-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Chunky Bank Issuance Anchored Tsys

EXECUTIVE SUMMARY

- MNI INTERVIEW: Stein–Troubled Treasury Market Needs Reform

- MNI: Fiscal Conditions For ECB Tool Prompt EU Disquiet

- SCHUMER: SENATE WILL HOLD PROCEDURAL VOTE ON CHIPS BILL TUESDAY, Bbg

US

FED: The Federal Reserve should relax banks’ supplemental leverage ratio as well as significantly expand eligibility for participation in its standing repo facility in order to ease the Treasury market’s liquidity troubles, former Fed governor Jeremy Stein told MNI.

- Stein said well-intended rules that require banks to hold capital against their Treasury reserves have become an undue burden, making institutions reluctant market makers in times of stress.

- “You want to defang the leverage ratio, you don’t want it to be the primary binding constraint,” said Stein, a member of the G30 Group of financiers and academics which recently released a report recommending key Treasury market reforms. For more see MNI Policy main wire at 0911ET.

EUROPE

UK: Sunak, Mordaunt Lead Latest Vote As Tugendhat Eliminated.

- Rishi Sunak and Penny Mordaunt remain on course to contest the final run-off to be the next Conservative party leader and UK PM after topping a third ballot of the party's MPs on Monday.

- Sunak received 115 votes, ahead of Mordaunt with 82. Foreign Secretary Liz Truss was third with 71. Former equalities minister Kemi Badenoch secured fourth place to stay in the race, however, Tom Tugendhat was eliminated.

- As a reminder, further votes are scheduled for Tuesday and Wednesday, as the field gets narrowed down to a final two, with the grassroots Tory members making the final decision.For reference the winner will be announced Sept. 5.

EU: Eurogroup and European Commission officials are concerned that the European Central Bank’s proposed anti-fragmentation tool, which would cap member states’ bond spreads on condition they make efforts towards improving their finances, could undermine other European institutions’ role in monitoring fiscal policy, sources told MNI.

- “If we have an anti-fragmentation tool, the entire European Semester and the SGP may become obsolete,” said one senior eurozone finance ministry official, referring to Stability and Growth Pact rules which govern borrowing in the bloc.

- Conditionality for the new tool, which investors speculate might be announced at the ECB’s meeting on Thursday, could be based on the annual economic and fiscal policy guidance to EU states. Another possibility might be for the ECB to follow the Commission’s assessments as to whether EU states are meeting commitments under the NextGenerationEU programme for long-term structural, fiscal and growth-enhancing reforms. For more see MNI Policy main wire at 1344ET.

US TSYS: Risk-On Evaporates

Tsys trading weaker after the bell, off midday lows where 30YY tapped 3.1771% high, yield curves inching steeper on the day: 2s10s +1.084 at -20.257, 5s10s +1.040 at -11.349, amid light summer volumes (TYU2 <835k after the bell).

- Rates appeared to draw at least some short cover support as stocks reversed gains early in the second half. The reversal in stocks coincided with headlines that Apple plans to slow hiring expenditures for some teams next year.

- No reaction to the weaker than expected homebuilder sentiment report, NAHB July housing index of 55 vs. 65 est is the largest monthly decline in the index this side of the pandemic and prior to the pandemic is the lowest level since May'15.

- Light FI option related hedging in the first half while incoming corporate issuance generated some early rate lock hedging on the following:

- $7B #JP Morgan $3.5B 6NC5 +175, $3.5B 11NC10 +193

- $6.5B #Wells Fargo $3B 6NC5 +175, $3.5B 11NC10 +195

- $4B #Morgan Stanley $2B 4NC3 +152, $2B 11NC10 +192

- $2.5B *Bank of Montreal 3Y SOFR+79

- On tap for Tuesday:

- Housing Starts (1.549M, 1.580M); MoM (-14.0%, 2.0%)

- Jul-19 0830 Building Permits (1.695M, 1.650M); MoM (-7.0%, -2.7%)

PIPELINE: $7B JPM 2Pt Launched

Terms of JP Morgan two-part nearly match that of Wells Fargo

- Date $MM Issuer (Priced *, Launch #)

- 07/18 $7B #JP Morgan $3.5B 6NC5 +175, $3.5B 11NC10 +193

- 07/18 $6.5B #Wells Fargo $3B 6NC5 +175, $3.5B 11NC10 +195

- 07/18 $4B *Morgan Stanley $2B 4NC3 +152, $2B 11NC10 +192

- 07/18 $2.5B *Bank of Montreal 3Y SOFR+79

- 07/18 $Benchmark American Movil SAB 10Y +195a

- 07/18 $Benchmark Lenovo multi-tranche investor calls

OVERNIGHT DATA

- US NAHB HOUSING MARKET INDEX 55 IN JUL

- US NAHB JUL SINGLE FAMILY SALES INDEX 64; NEXT 6-MO 50

- "Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home," said NAHB Chairman Jerry Konter.

- Tsy yields continued to climb across the curve through the release after a volatile past 90 minutes sitting circa 1bp higher, with a surprising lack of a move richer at the longer end on the potential implications for softer growth ahead (2Y +5bps on the day, 10YY +6.5bps).

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 85.58 points (-0.27%) at 31203.11

- S&P E-Mini Future down 16 points (-0.41%) at 3851.75

- Nasdaq down 57.8 points (-0.5%) at 11415.08

- US 10-Yr yield is up 4.4 bps at 2.9596%

- US Sep 10Y are down 6/32 at 118-14.5

- EURUSD up 0.0075 (0.74%) at 1.0159

- USDJPY down 0.56 (-0.4%) at 138.01

- WTI Crude Oil (front-month) up $4.93 (5.05%) at $102.58

- Gold is down $0.12 (-0.01%) at $1710.33

- EuroStoxx 50 up 34.66 points (1%) at 3511.86

- FTSE 100 up 64.23 points (0.9%) at 7223.24

- German DAX up 95.09 points (0.74%) at 12959.81

- French CAC 40 up 55.91 points (0.93%) at 6091.91

US TSY FUTURES CLOSE

- 3M10Y +6.246, 58.142 (L: 54.155 / H: 62.618)

- 2Y10Y +0.899, -20.442 (L: -21.467 / H: -17.285)

- 2Y30Y +2.469, -2.986 (L: -5.694 / H: -1.122)

- 5Y30Y +2.765, 6.262 (L: 2.659 / H: 6.433)

- Current futures levels:

- Sep 2Y down 1/32 at 104-21.75 (L: 104-19.75 / H: 104-25.125)

- Sep 5Y down 1.75/32 at 111-30.75 (L: 111-21.25 / H: 112-06.5)

- Sep 10Y down 6/32 at 118-14.5 (L: 118-00 / H: 118-29.5)

- Sep 30Y down 28/32 at 139-5 (L: 138-12 / H: 140-14)

- Sep Ultra 30Y down 1-11/32 at 153-24 (L: 152-17 / H: 155-24)

US 10YR FUTURES TECHS: (U2) Bullish Focus

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-06/120-16+ High Jul 13 / High Jul 6 and the bull trigger

- PRICE: 118-14 @ 1415 ET Jul 18

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries continue to consolidate - quickly reverting after any periods of intraday strength/weakness. The outlook remains bullish and the recent pullback is considered corrective. Key short-term support is at 116-11, Jun 28 low where a break would strengthen a bearish threat and signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break resumes the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 steady at 96.560

- Dec 22 +0.015 at 96.140

- Mar 23 +0.020 at 96.30

- Jun 23 steady at 96.465

- Red Pack (Sep 23-Jun 24) -0.035 to -0.015

- Green Pack (Sep 24-Jun 25) -0.04 to -0.03

- Blue Pack (Sep 25-Jun 26) -0.03 to -0.02

- Gold Pack (Sep 26-Jun 27) -0.03 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00500 to 1.57014% (+0.00457 total last wk)

- 1M +0.00614 to 2.12643% (+0.22058 total last wk)

- 3M -0.02771 to 2.70986% (+0.31457 total last wk) * / **

- 6M -0.04386 to 3.26743% (+.26286 total last wk)

- 12M -0.03343 to 3.86300% (+0.25157 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $97B

- Daily Overnight Bank Funding Rate: 1.57% volume: $276B

- Secured Overnight Financing Rate (SOFR): 1.54%, $950B

- Broad General Collateral Rate (BGCR): 1.51%, $368B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $359B

- (rate, volume levels reflect prior session)

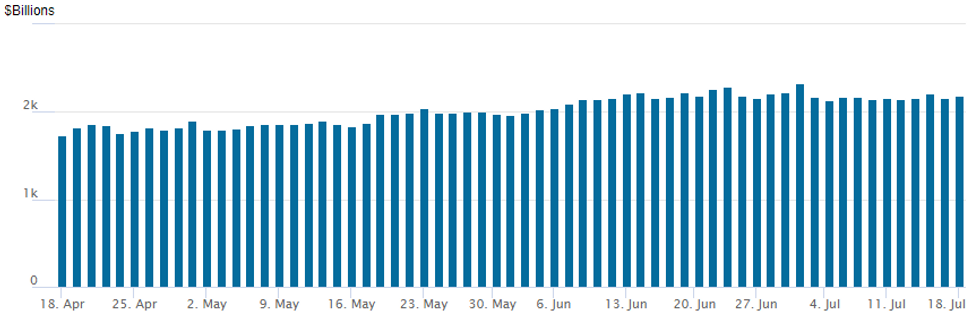

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,190.375B w/ 98 counterparties vs. $2,153.750B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EGBs-GILTS CASH CLOSE: BTP Relief

Core European FI retraced most Friday's gains on Monday, with the German and UK curves bear steepening amid a broader risk-on move.

- Yields gained alongside a softer US dollar and stronger equities / commodity prices, with volumes light and no important data.

- Buffered by speculation that Italy PM Draghi's resignation could be averted this week, BTPs pared recent losses, with spreads vs Germany falling for the first session in 7.

- The key central bank commentary (with the ECB and Fed in blackout) came from BoE's Saunders, who said 2+% rates were not implausible.

- Attention turns to the next round of the UK Tory leadership contest after hours, and of course the ECB later this week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.8bps at 0.525%, 5-Yr is up 7.8bps at 0.91%, 10-Yr is up 8.3bps at 1.216%, and 30-Yr is up 8.3bps at 1.443%.

- UK: The 2-Yr yield is up 6.2bps at 1.986%, 5-Yr is up 6.5bps at 1.87%, 10-Yr is up 6.8bps at 2.159%, and 30-Yr is up 5.1bps at 2.636%.

- Italian BTP spread down 7.5bps at 206.8bps / Spanish up 7.1bps at 122.9bps

FOREX: Greenback Weakness To Start Week, USD Index Off Session Lows

- Initial strength across equity and commodity markets bolstered risk sentiment in currency markets on Monday, weighing on the US dollar. The weakness put the USD Index well through last Wednesday's lows, extending the pullback from the Thursday high to around 2.20% at its lowest point.

- Overall, the USD index remains in negative territory on Monday, although a late reversal lower for major equity benchmarks has seen the greenback climb around 0.5% off its worst levels ahead of the APAC crossover.

- One of the main beneficiaries today was the single currency. EUR/USD now trades just ahead of 1.0150 having topped out at 1.0201 shortly before the WMR fix.

- Following the break of 1.0122, the Jul 13 high, this may highlight the possibility of a short-term correction from the base of the bear channel. Focus on the topside now turns to 1.0270, the 20-day EMA. Thursday's ECB rate decision remains the focus going forward, with any hawkish turn from the central bank likely to bolster the short-term bullish potential.

- Another outperformer was GBP ahead of key political and data risks later this week. Today’s price action marks an extension of the corrective bounce in the pair, but markets need to top 1.2049, the 20-day EMA to secure any further move higher. For now, however, the outlook remains bearish, with the downtrend still initially targeting 1.1673, the 1.00 projection of the May 27 - Jun 14 - 16 price swing.

- CAD, AUD and JPY all rising around half a percent, with NZD the notable underperformer despite the stronger CPI data from New Zealand published shortly after the open.

- RBA minutes are scheduled to be published overnight before UK employment data at the start of the European session. Final Eurozone CPI readings for June will also hit the wires. On the speaker slate, BOE Governor Bailey is due to speak at the Mansion House Financial and Professional Services Dinner. Also there may be comments from Fed’s Brainard.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 19/07/2022 | 0800/1000 |  | EU | ECB Bank Lending Survey | |

| 19/07/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner | |

| 19/07/2022 | 1835/1435 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.