-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: MN Fed Kashkari Flexes Wings

EXECUTIVE SUMMARY

MNI BRIEF: Kashkari Says Need To Hike Creates Recession Risks

MNI FED: Bullard Looks Through CPI Miss, Supports 75bp Hike

MNI FED: George Strikes A Balanced Tone For Size Of Further Hikes

MNI INTERVIEW: BOC Must Remain Aggressive On Rate Hikes- Cross

US

FED: Minneapolis Federal Reserve President Neel Kashkari said Thursday the need for more interest-rate increases to slow inflation boosts recession risks.

- "We know we have more work to do in raising interest rates to bring inflation down," and that task is urgent, Kashkari said in a question-and-answer session. "I don't think we're in a recession right now," he said, adding that as interest rates climb "it should be tapping the brakes on the U.S. economy and that makes it more likely that we would end up in a recession."

FED: St Louis Fed's Bullard ('22 voter), seems to put little weight on last week's US CPI miss, speaking for the first time since the MNI Podcast just before the CPI release. He still sees the Fed needing to hike to 3.75-4% by year-end, but now also explicitly lends support to a third 75bp hike at the Sept FOMC. Below excerpts from WSJ headlines:

- Inflation is too high and it's too soon to say the inflation surge has peaked, with ways to go before the Fed gets inflation back under control.

- Jobs markets are strong and the outlook remains bright, with it possible unemployment can tick down further.

- Premature to worry about the economy falling into recession whilst it isn't clear that financial conditions have actually eased as stock prices can distort some measures.

- July CPI was encouraging but too soon for a victory lap, the case for continuing to raise rates remains strong whilst continuing to debate how fast to hike. It's not clear where the stopping point for rate hikes will be, but the Fed will need to be "completely convinced" inflation is coming down.

- The easing in financial conditions may have been based on optimism that Fed would slow down, but does not reflect how Fed is thinking about policy, but in a more dovish remark she notes the Fed has done a lot and must be mindful that policy acts with a lag whilst inflation expectations look to be pretty well anchored.

- Labor market commentary remains hawkish: it will take a while for tightness in the labor market to ease with businesses reporting they are still under pressure to raise wages to hire and falling productivity - which is currently seen as "abysmal" - makes the Fed's job harder.

CANADA

BOC: Canada's central bank must remain aggressive with rate hikes and move at least another 75 basis points next month to prevent price inflation from feeding through to wage demands, a former top economist at the federal statistics office told MNI.

- Philip Cross, former chief economic analyst at Statistics Canada and now senior fellow at the Macdonald-Laurier Institute, says Governor Tiff Macklem is still playing catch-up and every month of elevated price gains boosts the risk workers demand more too.

- "The battle will really play out in wages," Cross said Wednesday. “What everybody is worried about at this point is, will this initial upturn in inflation trigger a wage price spiral? The Bank of Canada has to be aware that's still a distinct possibility and they're going to have to continue to crack down, to raise interest rates and slow down the economy,” Cross said. For more see MNI Policy main wire at 0905ET Thursday.

US TSYS: Fledgling Hawk MN Fed Kashkari Flexes Wings

Tsy futures back near where they started the day, mildly higher - well off early session highs after Philly Fed Mfg moved the needle for once. Multiple Fed speakers had net effect of deflating rate rally through the second half.

- Tsy futures pared early gains after latest Philly Fed Mfg index topped estimate: +6.2 vs. -5.0 est (-12.3 prior read), while weekly claims come out at 250k vs. 264k est. Trading desks noted fast$, prop acct selling across the curve as Tsy futures receded to pre-open levels, 30YY slipped to 3.1029% low before rebounding to 3.1480% first half high.

- Limited reaction to slightly weaker than expected Existing Home Sales (4.81M vs 4.86M est, MoM much weaker than expected at - 5.9% vs. - 5.1%, while U.S. Leading Index stronger than expected at -0.4% vs -0.5% est, -0.8% prior.

- Mixed comments from SF Fed Daly on CNBC kicked things off: 50 or 75bp hike reasonable vs comments from Aug 11 (i.e. post US CPI miss) that 50bp was base case but open-minded on whether 75bp is needed should data evolve differently. Daly mirrored July minutes she didn't want to "overdo policy and find we've tightened the economy" more than needed. Daly effect less of a factor today then after CPI.

- MN Fed Kashkari, however, reiterated need for more interest-rate increases to slow inflation boosts recession risks.

- StL Fed Bullard: still sees the Fed needing to hike to 3.75-4% by year-end, but now also explicitly lends support to a third 75bp hike at the Sept FOMC.

- KC Fed's George ('22 voter), a 50bp dissenter at the June but not July FOMC, offers a balanced, open tone behind how much further the hiking cycle will go.

- Currently, 2-Yr yield is down 5.8bps at 3.2266%, 5-Yr is down 2.4bps at 3.0271%, 10-Yr is down 1.8bps at 2.8786%, and 30-Yr is down 1.3bps at 3.1381%.

OVERNIGHT DATA

- US JOBLESS CLAIMS -2K TO 250K IN AUG 13 WK

- US PREV JOBLESS CLAIMS REVISED TO 252K IN AUG 06 WK

- US CONTINUING CLAIMS +0.007M to 1.437M IN AUG 06 WK

- US AUG PHILADELPHIA FED MFG INDEX 6.2

- US JULY EXISTING HOME SALES FALL TO 4.81M SAAR

- JULY EXISTING HOME SALES LOWEST SINCE MAY'20, NOV'15 PRE-COVID

- CANADA JUL INDUSTRIAL PRICES -2.1% MOM; EX-ENERGY -0.4%

- CANADA JUL RAW MATERIALS PRICES -7.4% MOM; EX-ENERGY -5.0%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 4.48 points (-0.01%) at 33974.9

- S&P E-Mini Future up 10.75 points (0.25%) at 4287.25

- Nasdaq up 41.4 points (0.3%) at 12979.38

- US 10-Yr yield is down 1.8 bps at 2.8786%

- US Sep 10Y are up 2.5/32 at 118-27

- EURUSD down 0.0082 (-0.81%) at 1.0098

- USDJPY up 0.81 (0.6%) at 135.86

- WTI Crude Oil (front-month) up $2.44 (2.77%) at $90.55

- Gold is down $0.98 (-0.06%) at $1760.79

- EuroStoxx 50 up 21.32 points (0.57%) at 3777.38

- FTSE 100 up 26.1 points (0.35%) at 7541.85

- German DAX up 70.7 points (0.52%) at 13697.41

- French CAC 40 up 29.08 points (0.45%) at 6557.4

US TSY FUTURES CLOSE

- 3M10Y -3.343, 21.493 (L: 17.852 / H: 23.83)

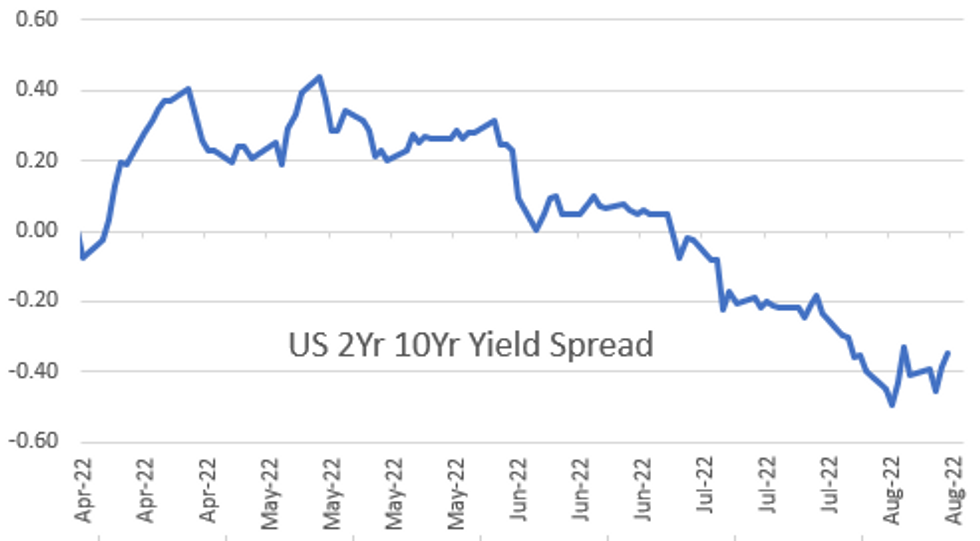

- 2Y10Y +3.372, -35.435 (L: -42.007 / H: -34.829)

- 2Y30Y +4.002, -9.56 (L: -17.164 / H: -7.824)

- 5Y30Y +0.829, 10.847 (L: 7.24 / H: 13.168)

- Current futures levels:

- Sep 2Y up 3.375/32 at 104-20.375 (L: 104-14.75 / H: 104-21.75)

- Sep 5Y up 3.5/32 at 112-1 (L: 111-24 / H: 112-09)

- Sep 10Y up 3/32 at 118-27.5 (L: 118-18 / H: 119-07.5)

- Sep 30Y up 5/32 at 140-15 (L: 139-31 / H: 141-05)

- Sep Ultra 30Y up 1/32 at 152-30 (L: 152-14 / H: 153-30)

(U2) Bear Cycle Still In Play

- RES 4: 122-29+ High Mar 31

- RES 3: 122-02 High Aug 2 and key resistance

- RES 2: 120-29 High Aug 4

- RES 1: 119-31/120-22 High Aug 15 / 10

- PRICE: 118-27+ @ 1500ET Aug 18

- SUP 1: 118-17+ Low Aug 18

- SUP 2: 118-05 50.0% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

Treasuries maintain a softer tone and the contract continues to trade at its recent lows. A continuation lower would pave the way for weakness towards 118-05, a Fibonacci retracement level. A break of this level would signal scope for weakness towards 117-14+, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 steady at 96.663

- Dec 22 +0.030 at 96.105

- Mar 23 +0.045 at 96.090

- Jun 23 +0.045 at 96.170

- Red Pack (Sep 23-Jun 24) +0.025 to +0.050

- Green Pack (Sep 24-Jun 25) +0.005 to +0.020

- Blue Pack (Sep 25-Jun 26) steady to +0.005

- Gold Pack (Sep 26-Jun 27) steady to +0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00429 to 2.31786% (+0.00300/wk)

- 1M +0.00257 to 2.36814% (-0.02386/wk)

- 3M +0.00743 to 2.98400% (+0.06243/wk) * / **

- 6M -0.00014 to 3.50757% (-0.00172/wk)

- 12M +0.00014 to 3.99571% (+0.03671/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.97657% on 8/17/22

- Daily Effective Fed Funds Rate: 2.33% volume: $92B

- Daily Overnight Bank Funding Rate: 2.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 2.29%, $966B

- Broad General Collateral Rate (BGCR): 2.26%, $400B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $388B

- (rate, volume levels reflect prior session)

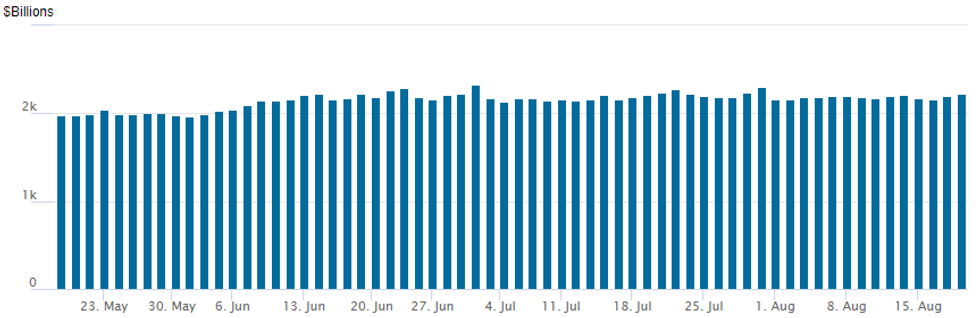

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,218.161B w/ 98 counterparties vs. $2,199.631B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $2.5B Credit Suisse 2Pt Launched

Credit Suisse dropped the 2Y SOFR leg announced earlier in the session

- Date $MM Issuer (Priced *, Launch #)

- 08/18 $2.5B #Credit Suisse $1.25B 2Y +155, $1.25B 5Y +205

- 08/18 $1.5B #Synchrony Bank $900M 3Y +220, $600M 5Y +260

- 08/18 $1.25B #MetLife $750M 3Y +83, $500M 7Y +135

- 08/18 $500M #Entergy Louisiana 30Y Green +162.5

- 08/18 $500M #Comerica 11NC10 +245

EGBs-GILTS CASH CLOSE: UK Short-End Once Again Underperforms

Gilts and EGB yields pulled back from morning highs, with both the German and UK curves closing Thursday a little flatter.

- UK inversion deepened as the short-end once again underperformed (2Y UK yield high topped Wednesday's high by 0.1bp). Early on, 10Y Bund yields hit the highest since Jul 22 (1.15%) and Gilt since Jun 30 (2.353%) before fading.

- September ECB hike pricing picked up a couple of basis points with a 50bp hike fully priced and then some after Schnabel suggested to Reuters interview that she favours another half-point raise next month.

- A relatively calm session for periphery EGBs as well; Greece underperformed.

- Final Eurozone CPI was in line and had little market impact. UK retail sales in focus Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.8bps at 0.749%, 5-Yr is up 2.7bps at 0.925%, 10-Yr is up 2bps at 1.103%, and 30-Yr is up 0.4bps at 1.296%.

- UK: The 2-Yr yield is up 5.2bps at 2.455%, 5-Yr is up 3.5bps at 2.183%, 10-Yr is up 2.3bps at 2.311%, and 30-Yr is up 0.2bps at 2.625%.

- Italian BTP spread down 0.4bps at 222.9bps / Greek up 1.6bps at 244.8bps

FOREX: Greenback Strength Extends, EURUSD Cracks Support

- The dollar index has made fresh three-week highs on Thursday, and has extending just shy of 1% to reach 1.0750 as we approach the APAC crossover. Greenback support was underpinned throughout the US session by stronger than expected Philly Fed data and lower initial jobless claims.

- Notable declines in EUR and GBP as price action has gained momentum following the breaks of short-term supports at 1.0123 and 1.2004 respectively. Both currencies trade with steep 1% losses on the day, extending their gaps lower from last Friday's close.

- 1.0007/0.9952 Low Jul 15 / 14 and the bear trigger remain the key levels for EURUSD on the downside.

- Despite the move lower in US yields, the bid for the dollar spread across the currency space in late US trade, prompting USDJPY to spike through resistance at 135.50/58, promptly rising to a high of 135.90. The first level on the topside is 135.96, 61.8% retracement of the Jul 14 - Aug 2 downleg which has held for now. Above here targets 136.58, the Jul 28 high.

- In emerging markets, the firmer greenback weighed on LatAm FX as well as the South African Rand. USDTRY looks set to close above 18.00 for the first time, following the CBRT’s surprise 100bp cut in the face off surging domestic inflation.

- UK and Canadian retail sales data round off the week. There is no US data on Friday which should keep any FedSpeak and geopolitical developments in focus.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/08/2022 | 2330/0830 |  | JP | Natl CPI | |

| 19/08/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/08/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/08/2022 | 0600/0800 | ** |  | DE | PPI |

| 19/08/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.