-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Consecutive 25Bp Hikes Pricing In

- MNI INTERVIEW: Fed Could Hike Rates Three More Times-Kaplan

- MNI: Fed Can Expect Inflation Progress Without Hikes - Bostic

- MNI: Fed’s Powell Wants Stronger Bank Regulation, Supervision

- MNI: Canada Firms Plan Smallest Price Hikes In 2 Years- CFIB

- MNI: Initial Jobless Claims Surprise Albeit With Trend Still Higher

- MNI: Pending Home Sales Resist New Home Sales Surge

- MNI: Consumption and Exports Drive GDP Surprise, GDI Still Significantly Softer

US

FED: The Federal Reserve could be forced to raise interest rates three more times if services inflation remains stubborn, and then to keep borrowing costs elevated longer than many investors expect, former Dallas President Robert Kaplan told MNI.

- “It wouldn’t shock me that we got at least a couple more moves at the Fed and if this continues they may feel the need to do a little bit more,” Kaplan said in the latest episode of MNI’s Fedspeak Podcast.

- Ripple effects from fiscal policy such as post-Covid stimulus and the Inflation Reduction Act are acting as a countervailing force to the Fed’s aggressive monetary tightening, Kaplan said. That’s keeping employment high and giving consumers enough cash despite the inflation challenge to feel comfortable spending, particularly on services.

- “I was strongly in favor of a pause to assess these cross currents," Kaplan said. "However, as we get beyond this, services are going to stay strong. Even if I were at the FOMC when I got to the July meeting and the September meeting, I’d be starting to think we’re going to have to do more.” For more see MNI Policy main wire at 0836ET.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic argued Thursday the FOMC should expect progress on inflation to continue even absent additional interest-rate hikes.

- "It is wise to take a period to assess how monetary policy tightening is affecting the economy because, in my view, policy has been truly restrictive only for eight or nine months," he said in a speech delivered at the Irish Association of Investment Managers in Dublin.

- Bostic repeated his previous message that his baseline outlook sees the fed funds rate sitting at its current range of 5% to 5.25% but does not absolutely rule out the necessity of further hikes in coming months.

- "While my base case does not anticipate further rate hikes, it also does not have the federal funds rate coming down in 2023 or 2024," he added Thursday. Chair Jerome Powell has warned the Fed could raise rates further to bring inflation back to target. For more see MNI Policy main wire at 1440ET.

FED: Federal Reserve Chair Jerome Powell believes regulators need to learn lessons from the U.S. bank failures in March and sees the need for strengthened supervision and regulation of mid-sized banks. Speaking at a Bank of Spain conference on financial stability Thursday, Powell said the U.S. banking system overall is “sound and resilient,” with capital and liquidity at the largest U.S. banks more than doubling since the financial crisis.

- That doesn’t mean U.S. regulators can rest, he said. Recent developments in banking, including the failure of Silicon Valley Bank, "suggest a need to strengthen our supervision and regulation of institutions of the size of SVB," Powell said, also noting that bank runs that used to take days or weeks could now be "nearly instantaneous."

- "The bank runs and failures in 2023 were painful reminders that we cannot predict all of the stresses that will inevitably come with time and chance," he said. "We therefore must not grow complacent about the financial system’s resilience." For more see MNI Policy main wire at 0230ET.

CANADA

CANADA: Canadian firms plan their smallest price increases in two years, according to a survey by one of the country's biggest industry groups, in another sign the central bank may not need to raise interest rates again next month.

- The Canadian Federation of Independent Business said Thursday that expectations for price gains over the next year slipped 0.4 percentage point to 3.3%. Those views have topped the Bank of Canada's 1%-3% target band since April 2021, and peaked early last year at 4.9%.

- Wages are seen climbing 2.9% over the next year, down from the prior month's pace of 3.2% and the lowest since February of last year. Those gains peaked at 3.6% in June 2022. For more see MNI Policy main wire at 0700ET.

US TSYS: Hugging Session Lows After Economy Grows Faster Than Expected

- Treasury futures have moved sideways since marking session lows in midmorning trade, curves still flat (2s10s -1.536 at -102.364) but off deeper inverted levels (-106.695 low) as intermediates to long end led the sell-off.

- At the moment, front month 10Y futures trading 112-05 (-103) vs. 112-01 low, just above technical support of 112-00 (March 10 low) where a breach puts focus on 111-14+ (March 9 low) then key support of 110-27+ (March 2 Low).

- Morning data triggered new lows in Tsys as economy grew faster than anticipated GDP Annualized QoQ 2.0% vs. 1.4% est, 1.3% prior. Weekly claims recede (239k vs. 265k est, 264k prior) after showing stronger than expected gains the last few weeks. Latest pending home sales moderating, however, -2.7% MoM vs. -0.5% est.

- In turn, Secured Overnight Financing Rate 3M futures extending session lows as projected rate hike(s) gaining traction. Front month Sep'24 SOFR futures are currently trading -0.05 at 94.585 (3M SOFR settled -0.00443 to 5.53343% this morning); balance of Whites (SFRZ3-SFRM4) are trading -0.115-0.195, Reds-Golds (SFRU4-SFRM8) -0.195-0.140.

- Projected rate hikes gaining: July 26 FOMC has climbed to 84% w/ implied rate of +21bp to 5.283%. September fully pricing hike w/ cumulative of +28.7bp at 5.361%, November cumulative climbs to 35.1 at 5.425%, December cumulative 31.6 at 5.395%. Fed terminal at 5.42% in Nov'23 vs. 5.445% earlier.

OVERNIGHT DATA

- US JOBLESS CLAIMS -26K TO 239K IN JUN 24 WK

- US PREV JOBLESS CLAIMS REVISED TO 265K IN JUN 17 WK

- US CONTINUING CLAIMS -0.019M to 1.742M IN JUN 17 WK

- The -26k decline is the largest weekly drop since Jun’21 although week to week moves can be distorted by holiday affects. Looking through some of the noise, the four-week average ticked up 2k to 258k for a fresh high since Nov’21.

- After recent relative elevation of the NSA data compared to typical pre-pandemic years, the 18k decline to 233k stands out for a week when claims usually start drifting higher before a more notable move higher in coming weeks. 10k of the decline came from California.

- Continuing claims did however support the stronger than expected release, also falling from 1761k to 1742k for their lowest since February.

- US 1Q Final GDP +2.0% vs Prelim GDP +1.3%

- US 1Q GDP PRICE INDEX RISES AT A 4.1% ANNUAL RATE; EST. 4.2%

US DATA: Real GDP was surprisingly revised up to 2.0% (cons 1.4) in the third Q1 release from an initial 1.27%, after 2.57% in Q4.

- Importantly, consumption played a sizeable role, revised up from 3.76% to 4.16% for an even stronger acceleration from the 1.0% of Q4 and the strongest since 1H21. It helped lift final domestic demand 3.51% (initially 3.32%) from 0.64%.

- Net trade played an even larger role, led by exports now seen to have jumped 7.8% in Q1 (initially 5.2%) which surprisingly drags a larger net trade contribution of 0.58pp annualized from 0.42pp back in Q4.

- Looking away from GDP, real GDI also showed upward revisions (-1.8% Q/Q from the initial -2.3%) but it continues to paint a significantly different picture to GDP. Average GDP and GDI together and growth increased just 0.1% annualized in Q1 (albeit much better than the -0.5% after the second Q1 release) after -0.4% in Q4.

- US MAY PENDING HOME SALES FALL 2.7% M/M; EST. DOWN 0.5%

US DATA: Pending home sales were softer than expected in May, falling -2.7% M/M (cons -0.5) after -0.4% (initial 0.0%). It marks the third consecutive decline after some tentative lifting of sales at the turn of the year.

- The softer trend implies existing home sales are unlikely in the next couple months to show the same lurch higher as in Tuesday’s new home sales data, taking them back above pre-pandemic levels compared to pending home sales which are ~25% lower.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 204.61 points (0.6%) at 34059.19

- S&P E-Mini Future up 7.5 points (0.17%) at 4425.25

- Nasdaq down 30.8 points (-0.2%) at 13561.44

- US 10-Yr yield is up 14.8 bps at 3.856%

- US Sep 10-Yr futures are down 36.5/32 at 112-3.5

- EURUSD down 0.0046 (-0.42%) at 1.0867

- USDJPY up 0.39 (0.27%) at 144.87

- WTI Crude Oil (front-month) up $0.22 (0.32%) at $69.76

- Gold is up $0.19 (0.01%) at $1907.54

- EuroStoxx 50 up 9.94 points (0.23%) at 4354.69

- FTSE 100 down 28.8 points (-0.38%) at 7471.69

- German DAX down 2.28 points (-0.01%) at 15946.72

- French CAC 40 up 26.41 points (0.36%) at 7312.73

US TREASURY FUTURES CLOSE

- 3M10Y +15.482, -149.709 (L: -167.291 / H: -149.053)

- 2Y10Y -1.364, -102.192 (L: -106.695 / H: -100.468)

- 2Y30Y -5.13, -96.037 (L: -100.782 / H: -90.907)

- 5Y30Y -6.591, -22.763 (L: -24.509 / H: -16.52)

- Current futures levels:

- Sep 2-Yr futures down 10/32 at 101-22.125 (L: 101-21 / H: 102-00.625)

- Sep 5-Yr futures down 24/32 at 107-3 (L: 107-01 / H: 107-27.75)

- Sep 10-Yr futures down 36.5/32 at 112-3.5 (L: 112-01.00160000000005 / H: 113-08.5)

- Sep 30-Yr futures down 69/32 at 126-3 (L: 125-30 / H: 128-10)

- Sep Ultra futures down 88/32 at 134-27 (L: 134-22 / H: 137-18)

US 10Y FUTURE TECHS: (U3) Trades Through Support

- RES 4: 115-00 High Jun 1 and a key resistance

- RES 3: 114-06+/07 High Jun 6 / 50-day EMA

- RES 2: 114-00 High Jun 13

- RES 1: 113-18 High Jun 15 and a key short-term resistance

- PRICE: 112-05 @ 1410 ET Jun 29

- SUP 1: 112-01 Intraday low

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures are trading lower today and the contract has breached support at 112-12+, the Jun 14 low and bear trigger. This brings to an end a recent period of consolidation and confirms a resumption of the current downtrend. The focus is on the 112-00 handle next while further out, scope is seen for a move towards 110-27+, the Mar 2 low and key support. Initial firm resistance has been defined at 113-18, the Jun 15 high.

SOFR FUTURES CLOSE

- Sep 23 -0.055 at 94.580

- Dec 23 -0.120 at 94.605

- Mar 24 -0.165 at 94.865

- Jun 24 -0.190 at 95.250

- Red Pack (Sep 24-Jun 25) -0.21 to -0.20

- Green Pack (Sep 25-Jun 26) -0.20 to -0.175

- Blue Pack (Sep 26-Jun 27) -0.175 to -0.16

- Gold Pack (Sep 27-Jun 28) -0.155 to -0.145

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01051 to 5.11300 (+.02933/wk)

- 3M +0.00478 to 5.24665 (+.00795/wk)

- 6M +0.00918 to 5.34588 (+.01680/wk)

- 12M +0.00012 to 5.29945 (+.01585/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01485 to 5.05129%

- 1M +0.01200 to 5.20500%

- 3M -0.00443 to 5.53343% */**

- 6M +0.00857 to 5.73957%

- 12M +0.01685 to 5.96014%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $140B

- Daily Overnight Bank Funding Rate: 5.06% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.499T

- Broad General Collateral Rate (BGCR): 5.04%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $576B

- (rate, volume levels reflect prior session)

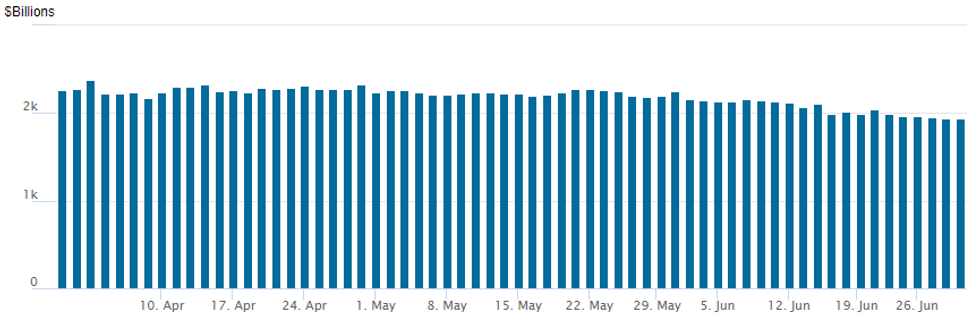

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to decline, latest at $1,934.684B w/ 102 counterparties, compared to $1,945.211B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B Mizuho 2Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/29 $2.5B #Mizuho $1.4B 6NC5 +165, $1.1B 11NC10 +190

EGBs-GILTS CASH CLOSE: Data Induces Selloff

Gilts and Bunds remained under pressure Thursday amid a combination of solid Eurozone inflation data and continued signs of US economic resilience.

- The German curve belly underperformed as national inflation came in slightly above expectations, following Spanish core coming in above survey - all but cementing a 25bp July ECB rate hike (90+% priced).

- The UK curve bear flattened as Wednesday's dovish central bank repricing was reversed (BoE terminal +7bp on the day), pushing up 2Y yields by 8bp.

- The selloff accelerated in the afternoon on US jobless claims coming in lower than expected and Q1 GDP revised higher, underpinning the "higher for longer" rate expectations theme of the week.

- We get the final major pieces of the Eurozone June inflation puzzle early Friday, with Dutch and French flash readings, ahead of the bloc-wide print later in the morning. We also get UK GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.2bps at 3.196%, 5-Yr is up 10.4bps at 2.568%, 10-Yr is up 10.1bps at 2.416%, and 30-Yr is up 6.6bps at 2.427%.

- UK: The 2-Yr yield is up 8.2bps at 5.228%, 5-Yr is up 5.6bps at 4.624%, 10-Yr is up 6.6bps at 4.382%, and 30-Yr is up 5.4bps at 4.433%.

- Italian BTP spread up 2bps at 168.3bps Spanish up 1.4bps at 99.1bps

FOREX: Greenback Maintains Upward Bias Following Stronger US GDP Revision

- The USD index has risen a further 0.4% on Thursday, extending on Wednesday’s firmer price action. The main impetus came from a strongly revised first quarter GDP figure from 1.3% to 2.0% Q/q. With markets not expecting a surprise, given it was the third reading for the data, the greenback surged in the immediate aftermath and has broadly consolidated at the week’s best levels approaching the close.

- The euro is one of the worst performers, with EURUSD down 0.42% approaching the APAC crossover. The pair was unable to hold onto moderate gains above the 1.09 handle following some marginally firmer Eurozone inflation figures and this may have exacerbated the reversal lower following US GDP. Price has narrowed the gap with key support at 1.0852, the 50-day EMA. A clear break of this average would strengthen a bearish threat and signal scope for a deeper corrective pullback.

- USDJPY maintained its string of positive trading sessions, making fresh trend highs in the process. Spot looks set to close right on session highs, very close to significant pivot resistance around the 145.00 mark. While topside momentum appears unwavering, with yield differentials continuing to be the dominant driver, market participants remain cautious as we approach historical levels where Japanese officials have decided to intervene to bolster the JPY.

- The focus overnight on Friday will be on China’s official PMI data for the latest signs regarding the health of the Chinese economy. Japanese Tokyo Core CPI will also cross. In Europe the focus will be on the latest flash estimate for Eurozone HICP inflation, which precedes US Core PCE Price Index and Canadian GDP.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 30/06/2023 | 2330/0830 | * |  | JP | labor forcer survey |

| 30/06/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/06/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/06/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/06/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 30/06/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2023 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 30/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 30/06/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 30/06/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/06/2023 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.