-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Curves Steeper, Fed Speak More Dovish Pre-NFP

- MNI BRIEF: Fed's Daly: Higher Yields Since Sep Equal To A Hike

- MNI US Payrolls Preview: AHE Seen Re-Accelerating, Troubling Fed Target

- MNI: Avoid Early Rate Easing As Soft Landing Emerges, IMF Says

US

FED: Federal Reserve Bank of San Francisco President Mary Daly said Thursday the Fed can hold interest rates steady because restrictive policy and tight financial conditions are working to slow the economy and inflation.

- "If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work," she told the The Economic Club of New York. "Importantly, even if we hold rates where they are today, policy will grow increasingly restrictive as inflation and inflation expectations fall. So, holding rates steady is an active policy action." (See MNI POLICY: Softer Underlying Inflation Boosts Case For Fed Pause)

- "The bond market has tightened quite considerably -- about 36 basis points -- since we met in September. Well, that is equivalent to about a rate hike," she said. However, if activity begins to reaccelerate or financial conditions loosen too much, "we can react to those data and raise rates further until we are confident that monetary policy is sufficiently restrictive to complete the job," she said. "In other words, rather than a prejudged path of what policy will be, we need an open mind and optionality."

US DATA: Consensus looks for payrolls growth of 170k in September. While industry-specific blips may occur, headline aggregates are not expected to be impacted by either the actors’ strike, or the walk-out of UAW workers currently impacting Ford, GM and Stellantis.

- While headline change in nonfarm payrolls should not be impacted by the cross-sector strikes, hours worked across the manufacturing sector could come under marginal pressure. Wages are seen re-accelerating to 0.3% M/M, a level that remains inconsistent with the Fed hitting their inflation target in the near-term.

- Unemployment rate expected to re-correct lower, after August’s 3.80% was largely down to technical factors.

- Markets continue to discuss the higher for longer narrative and assess odds of an economic soft landing. Terminal rate pricing is shy of recent hawkish extremes, operating a little above the 5.45% mark, equating to the market pricing 50/50 chances of one further hike in the current cycle.

EUROPE

IMF: Central banks must stick with "higher for longer" interest rates even amid glimmers of a soft landing for the global economy, IMF Managing Director Kristalina Georgieva said in a speech Thursday ahead of annual meetings in Morocco.

- "Fighting inflation is the number one priority," she said, echoing a message the Washington-based fund has given for most of this year. "It is paramount to avoid a premature easing of policy, given the risk of resurging inflation."

- Governments also need tight fiscal policy that rebuilds capacity to tackle future risks like climate change, sluggish global growth and a potential sharp tightening of financial conditions, she said during a speech in Abidjan, Cote D’Ivoire. (See: MNI INTERVIEW2: Ex-BOC Chief Says Neutral Rate Is Rising)

- "As you will see from our updated forecast next week, the current pace of global growth remains quite weak, well below the 3.8% average in the two decades before the pandemic. And looking ahead over the medium term, growth prospects have weakened further," she said. For more see MNI Policy main wire at 1300ET.

US TSYS Rates, Stocks Off Cycle Lows Ahead Friday's Sep Employment Data

- After paring gains in the lead-up to this morning's data, Treasury futures extended past late overnight lows after slightly lower than expected Initial Jobless Claims (207k vs. 210k est, 204k prior) and Continuing Claims (1.664M vs. 1.671M est, 1.670M prior). Meanwhile, Trade Balance reported -$58.3B vs. -$59.8B est vs. prior revised figure of -$64.7B.

- Futures extended lows post-data, TYZ3 tapped 106-28.5 (-7) -- well above Wednesday's low of 106-03.5, before rebounding over 107-00. Technicals held: Initial technical support at 106-00 (round number support), followed by 105-27+ (3.0% Lower Bollinger Band). Initial resistance is at 107-14 (High Oct 3).

- TYZ3 climbed to a session high of 107-12.5 high after dovish Fed speak from SF Fed President Daly said the Fed can hold interest rates steady because restrictive policy and tight financial conditions are working to slow the economy and inflation. "If we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work," she told the The Economic Club of NY.

- Meanwhile, focus turns to Friday's September employment data. Consensus looks for payrolls growth of 170k in September. While industry-specific blips may occur, headline aggregates are not expected to be impacted by either the actors’ strike, or the walk-out of UAW workers currently impacting Ford, GM and Stellantis.

OVERNIGHT DATA

- Jobless Claims (207k vs. 210k est, 204k prior),

- Continuing Claims (1.664M vs. 1.671M est, 1.670M prior)

- Trade Balance (-$58.3B vs. -$59.8B est)

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA up 2.51 points (0.01%) at 33134.95

- S&P E-Mini Future down 4.75 points (-0.11%) at 4293.25

- Nasdaq down 7.1 points (-0.1%) at 13230.26

- US 10-Yr yield is down 1.9 bps at 4.7144%

- US Dec 10-Yr futures are up 7/32 at 107-10.5

- EURUSD up 0.0044 (0.42%) at 1.0548

- USDJPY down 0.7 (-0.47%) at 148.42

- WTI Crude Oil (front-month) down $1.94 (-2.3%) at $82.27

- Gold is down $0.98 (-0.05%) at $1820.38

- European bourses closing levels:

- EuroStoxx 50 down 0.04 points (0%) at 4099.81

- FTSE 100 up 39.09 points (0.53%) at 7451.54

- German DAX down 29.7 points (-0.2%) at 15070.22

- French CAC 40 up 1.52 points (0.02%) at 6998.25

US TREASURY FUTURES CLOSE

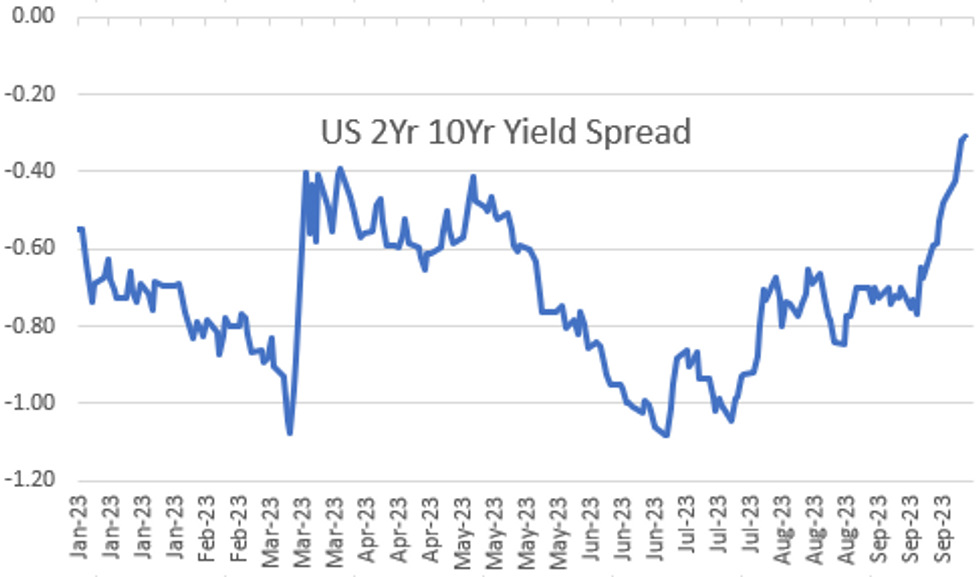

- 3M10Y -1.513, -78.808 (L: -82.281 / H: -73.224)

- 2Y10Y +1.287, -31.022 (L: -33.344 / H: -28.948)

- 2Y30Y +5.875, -14 (L: -20.356 / H: -12.475)

- 5Y30Y +7.003, 20.228 (L: 13.235 / H: 20.625)

- Current futures levels:

- Dec 2-Yr futures up 1.625/32 at 101-12.625 (L: 101-09.5 / H: 101-13.125)

- Dec 5-Yr futures up 4.75/32 at 105-2 (L: 104-26 / H: 105-04.25)

- Dec 10-Yr futures up 6.5/32 at 107-10 (L: 106-28.5 / H: 107-12.5)

- Dec 30-Yr futures down 4/32 at 111-12 (L: 110-23 / H: 111-29)

- Dec Ultra futures down 7/32 at 115-9 (L: 114-16 / H: 116-04)

US 10Y FUTURE TECHS: (Z3) Corrective Bounce

- RES 4: 109-28 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-15+ 20-day EMA

- RES 1: 107-14 High Oct 3

- PRICE: 107-10 @ 1230 ET Oct 5

- SUP 1: 106-00 Round number support

- SUP 2: 105-27+ 3.0% Lower Bollinger Band

- SUP 3: 105-27 2.0% lower 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

A bear trend in Treasuries remains intact and the contract traded to a fresh cycle low Wednesday. This confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Support at 107-07, the Sep 28 low, has been cleared this week signaling scope for the 106-00 handle next. Initial firm resistance is seen at 108-15+, the 20-day EMA. The recovery from Wednesday’s low is considered corrective.

SOFR FUTURES CLOSE

- Dec 23 +0.005 at 94.565

- Mar 24 +0.015 at 94.685

- Jun 24 +0.035 at 94.90

- Sep 24 +0.040 at 95.160

- Red Pack (Dec 24-Sep 25) +0.035 to +0.045

- Green Pack (Dec 25-Sep 26) +0.040 to +0.045

- Blue Pack (Dec 26-Sep 27) +0.030 to +0.040

- Gold Pack (Dec 27-Sep 28) +0.025 to +0.035

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00558 to 5.33598 (+0.01699/wk)

- 3M -0.01620 to 5.40620 (+0.01070/wk)

- 6M -0.03069 to 5.46263 (-0.00464/wk)

- 12M -0.05391 to 5.42975 (-0.03651/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% volume: $247B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.436T

- Broad General Collateral Rate (BGCR): 5.30%, $555B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $542B

- (rate, volume levels reflect prior session)

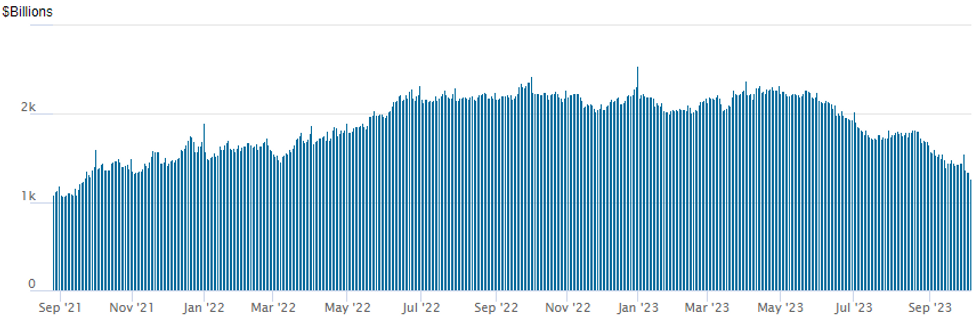

FED REVERSE REPO OPERATION: Lowest Since Sep'21

Repo operation usage slips to $1,265.132B - lowest since mid-September 2021 w/98 counterparties vs. $1,342.031B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.25B Fox Corp 10Y Priced

- Date $MM Issuer (Priced *, Launch #)

- 10/05 $1.25B *Fox Corp 10Y +190

- 10/05 $1.25B *MuniFin +3Y SOFR+38

- 10/05 $900M #Atmos Energy $400M 10Y +120, $500M 30Y +133

- 10/05 $Benchmark Federal Farm Credit Banks (FFCB) 2Y +10a (issued $1B 3Y +15 on Aug 9)

- 10/05 $Benchmark Uzbekistan 5Y 8.25%a

Late EGBs

- After pushing lower post US weekly claims beat, Bund and EGBs recovered amid short covering going into late European trade. Bund through initial resistance seen of 128.00 to 128.21, next resistance at 128.45.

- Focus in Peripheral spreads has been on the BTP/Bund spread, which sit 3.7bps wider and above the March high at the time of typing. Investors will be watching the Psychological 200.00bps, but initial resistance comes at 202.45bps.

- Gilt has mostly traded inline with the German Bund, translated in a flat Gilt/Bund spread.

- Comments from BoE’s Broadbent weren’t market moving. He pointed to clear signs that rate rises were having an impact, along with more resilient than expected demand and suggestions that the UK inflation profile is similar to that seen elsewhere (envisaging a move back to target in ~2 years).

- After leading EGBs and Gilt lower following the US Data, US Treasuries have also recovered from their intraday lows, with TYZ3 back in the green, although the 20yr and 30yr futures are still lagging the shorter end part of the curve, and still lean in the red

- Attention on Friday's USD NFP/AHE.

FOREX: Calmer Yield Curve Soothes Currency Markets

- The greenback traded softer on Thursday, edging lower against all others in G10 to tip the USD Index briefly back below the low to 106.338 (-.463). A negative close for the USD Index would be the third consecutive decline, however prices are still well clear of the recent low at last Friday's 105.658. Nonetheless, the medium-term uptrend posted off the July low remains intact for now, keeping pullbacks corrective for now.

- The US yield curve was considerably quieter Thursday, lending an element of consolidation to currency markets more broadly. This kept GBP, EUR and JPY within recent ranges and few fresh technical signals emerged in a relatively muted session.

- Oil tied currencies traded heavy, helping keep NOK and CAD toward the bottom half of the G10 table. Brent and WTI crude futures extended the recent decline, putting Brent over $10/bbl off the recent cycle high. Demand concerns evident in this week's EIA release, expectations of economic weakness and relentless CTA selling have variously been cited as the driver of oil's decline. USD/CAD printed a new cycle best at 1.3786, marking five consecutive sessions of higher highs.

- Focus Friday rests on the September nonfarm payrolls report, at which markets expected the US to have added 170k jobs over the month. Primary dealers are somewhat more positive, with a median view of 180k, with the unemployment rate expected to correct lower after an upside surprise in August. Average hourly earnings data is also forecast to re-accelerate to 0.3%, further marring any expectations of a swift return for inflation to target.

- Outside of nonfarm payrolls, German factory orders, Italian retail sales and the Canadian jobs report are also on the docket. Meanwhile, Fed's Waller is set to speak.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/10/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 06/10/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/10/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 06/10/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 06/10/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/10/2023 | 1230/0830 | *** |  | US | Employment Report |

| 06/10/2023 | 1600/1200 |  | US | Fed Governor Christopher Waller | |

| 06/10/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.