MNI ASIA OPEN: PCE Elements Temper PPI Beat, Tariff Roadmap

EXECUTIVE SUMMARY

- MNI US: Trump Unveils Reciprocal Tariff Roadmap, Timeline Takes Shape

- MNI SECURITY: NATO Def Mins Meet As Ukraine & Europe Assess Trump's Push For Talks

- MNI MIDEAST: Hamas To Release 3 Hostages On 15 Feb, Risk Of Truce Ending Reduced

- MNI US DATA: Stronger-Than-Expected PPI, But PCE Elements Look Soft

- MNI US DATA: Soft PPI Details Could See Core PCE Estimates Round To 0.2%

- MNI US DATA: Steadying Claims Data Continue To Point To Solid Labor Market

US

MNI US: Trump Unveils Reciprocal Tariff Roadmap, Timeline Takes Shape

US President Trump has signed a measure ordering his administration (namely the USTR and Commerce Secretary) to propose country-by-country reciprocal tariffs. The tariff rates would be determined on a country-by-country basis, in what would appear to be a complex process.

- “We want a level playing field,” Trump told reporters in the Oval Office - and the tariffs could be designed not just to equal those levied on US-made products, but also to address non-tariff trade barriers, and VAT.

- Commerce Secretary Lutnick - who is taking a leading role in the reciprocal tariff plans - said that the studies on the issue would be complete by April 1 and the tariffs could start by April 2.

- More immediately, Trump said that tariffs on individual products such as cars, steel, aluminum, and pharmaceuticals were coming "soon" - and noted that tariffs would be stacked above the reciprocal tariffs.

- After an initial risk-off move with European currencies and equities falling, the move reversed on multiple factors including that the country-by-country approach appears to be the basis of a bargaining stance, as seen with Canada/Mexico, with nothing decided yet (and April 2 appears to be the earliest plausible date of implementation).

A couple of headlines that are getting missed that add a bit more color - press were briefed separately to the Oval Office press conference by an unnamed "White House official" who also ties in the fiscal impact of raising tariffs, and potential for a universal tariff plan despite what's just been announced:

- "WE DON'T RULE OUT ONE-SIZE-FITS-ALL FLAT TARIFF: US OFFICIAL" / "REPORT ON FISCAL IMPACT WITHIN 180 DAYS: US OFFICIAL" -bbg

NEWS

MNI SECURITY: NATO Def Mins Meet As Ukraine & Europe Assess Trump's Push For Talks

NATO defence ministers are meeting in Brussels as they grapple with a day that may represent the most significant shift in European geopolitics since Russia's full-scale invasion of Ukraine in Feb 2022. On 12 Feb US Secretary of Defense Pete Hegseth laid out in stark terms the future of European security, which will see a much less involved US and no NATO membership for Ukraine.

MNI UKRAINE: Foreign Min Cautious On Talks; Kremlin 'Impressed' By Trump Position

Speaking to France's Le Monde, Ukrainian Foreign Minister Andrii Sybiha says, in reaction to US President Donald Trump's announcement of talks with Russia on ending the war in Ukraine, that 'Nothing can be discussed on Ukraine without Ukraine or on Europe without Europe.' Sybiha: 'With Trump's leadership [and] strong European commitment we have a chance to give fresh impetus to this process'.

MNI MIDEAST: Hamas To Release 3 Hostages On 15 Feb, Risk Of Truce Ending Reduced

Hamas has confirmed in a statement that it intends to continue with the process of releasing Israeli hostages according to the schedule set out in the phase one ceasefire agreement with Israel. This would see a further three hostages freed on Saturday 15 Feb. Egypt's Al-Qahira Al-Akhbariya reports the Egyptian and Qatari gov'ts as saying that their mediators have 'succeded in bridging the gaps to continue implementing the Gaza ceasefire deal' adding that the 'parties in the deal are committed to continuing implementing it.'

MNI US TSYS: PPI/PCE Details, Reciprocal Tariff Implementation Delay

- Treasuries look to finish near late session highs Thursday, back near Wednesday's pre-CPI levels despite higher than expected PPI and up-revisions this morning, while a delay in implementing reciprocal tariffs to early April buoyed market sentiment.

- The PCE-relevant components of PPI have clearly set the tone with the market's dovish reaction to the release but the aggregate series were still notably stronger than expected. Overall PPI final demand inflation printed at 0.40% M/M sa (cons 0.3) after a heavy upward revision of 0.50% (initial 0.22) in Dec although that was partly offset by a downward revised 0.23% (initial 0.38) in Nov.

- US President Trump has signed a measure ordering his administration (namely the USTR and Commerce Secretary) to propose country-by-country reciprocal tariffs. The tariff rates would be determined on a country-by-country basis, in what would appear to be a complex process.

- Treasury Mar'25 10Y futures trade +21 at 108-29.5 after the bell vs 109-01 high, just below initial technical resistance at 109-08.5 (50-day EMA). 10Y yield -.0939 at 4.5269% while curves bull flattened: 2s10s -4.789 at 21.596, 5s30s -2.024 at 34.243.

- Cross asset update: extended late session lows (BBDXY -8.37 at 1292.82), stocks rallied back over last Friday's highs (SPX Eminis +57.25 at 6130.0) when talk of reciprocity weighed heavily on stocks.

OVERNIGHT DATA

MNI US DATA: Steadying Claims Data Continue To Point To Solid Labor Market

Weekly jobless claims data continue to point to labor market solidity. Initial claims in the Feb 8 week fell more than expected to 213k (216k expected, 220k prior rev from 219k), while continuing claims in the Feb 1 week fell sharply to 1,850k (1,882k expected, 1,886k prior unrevised). For initial, that largely reversed the prior week's rise (208k to 220k), nudging the 4-week moving average down to 216k from 217k prior.

- Continuing meanwhile saw a continuation of the recent pattern of a decline in claims following a weekly rise: this pattern has been observed in every 2-week period since mid-October 2024. And like initial claims, continuing claims have steadied out into a fairly predictable range, of roughly 1,850k-1,900k (the average since the start of October 2024 is 1,873k).

- On a state-by-state basis, California saw the biggest increase in initial claims (+1.7k), but this was outweighed by drops in New York (3k)and Pennsylvania (2.9k) . For continuing, outsized drops were seen in Texas (-15.3k), Pennsylvania (-7.8k), California (-7.1k) and Florida (-6.1k). These figures mainly point to continued erratic claims from California, probably related to the wildfires in January (initial claims unusually jumped 60k mid-month).

- The main conclusion is that the weekly claims reports continue to provide evidence that the labor market is in solid shape - or as Fed Chair Powell put it in his semi-annual Congressional testimony, "very strong".

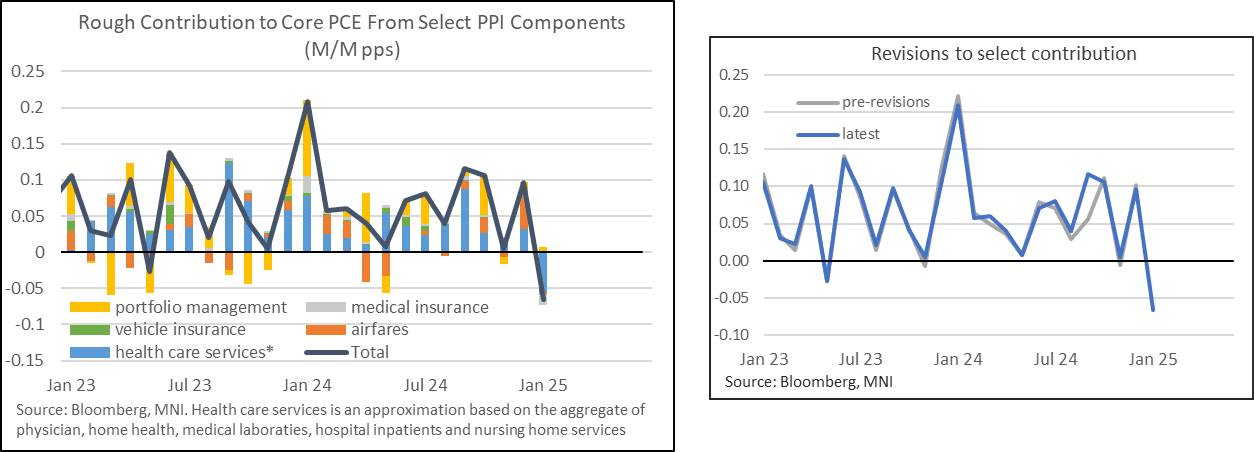

MNI US DATA: Stronger-Than-Expected PPI, But PCE Elements Look Soft

Lots to get through on this PPI report but we note upward revisions to sequential December producer prices, and pay special attention to the beats on the Y/Y figures - these are not just the result of seasonal factor revisions, they are just straight-up beats (ex-food/energy/trade 3.4% Y/Y vs 3.1% expected, 3.5% prior rev up from 3.3%). PPI momentum thus looks stronger overall at the moment.

- BUT a few standouts in the details for PCE that at first glance make it look soft for the translation: airline passenger services fell 0.3% M/M (after +5.0%), portfolio management decelerated to 0.4% (after 0.6%), health/medical insurance fell 1.1% (after 0.1%), and indeed the broad set of medical services categories decelerated/were deflationary in January.

MNI US DATA: Soft PPI Details Could See Core PCE Estimates Round To 0.2%

- Our proxy for core PCE relevant components sees a negative M/M contribution of -0.07pps in January for a large swing from the +0.10pp back in December.

- Recent months for this proxy are little changed after the annual revisions, with that +0.10pp coming as a smaller than first thought boost from airfares saw offset by a larger boost from portfolio management and the array of healthcare services.

- Post-CPI rough analyst consensus was for somewhere in the mid-0.30s for % M/M core PCE in January. The extent to which this will be revised lower of course depends on particular analyst assumptions for the PCE relevant components, but it’s possible these could be closer to rounding to 0.2%.

- Core PCE will be released Feb 28.

MNI US DATA: PPI Aggregates Further Boosted By Robust Revisions

- The PCE-relevant components of PPI have clearly set the tone with the market's dovish reaction to the release but the aggregate series were still notably stronger than expected. Overall PPI final demand inflation printed at 0.40% M/M sa (cons 0.3) after a heavy upward revision of 0.50% (initial 0.22) in Dec although that was partly offset by a downward revised 0.23% (initial 0.38) in Nov.

- Our preferred core PPI series, ex food, energy & trade services painted a slightly stronger picture again, surprising with 0.32% M/M (cons 0.2) after an upward revised 0.35% (initial 0.07) with much smaller near-term downward revisions.

- The NSA-based Y/Y calculations weren't subject to annual seasonal adjustment revisions and were still clearly stronger than expected as we pointed to earlier with core PPI at 3.4% Y/Y vs cons 3.1%.

- Recent momentum also looks stronger, with the three-month accelerating to 3.3% annualized from 3.1% in Dec (revised up from 1.9%) whilst the six-month eased to 3.1% but only after an upward revised 3.2% (initial 2.4%).

- See the revisions table and trend charts below:

MNI US DATA: Delinquency Rates Pause Climb In Q4, Some Sectors Still Of Concern

- Within the NY Fed’s household and credit report, aggregate delinquency rates increased slightly in Q4 with 3.6% (+0.1pp) of outstanding debt in some stage of delinquency for a new high since 2020. The transition into delinquency (30+ days) meanwhile was near unchanged, with 4.14% in Q4 vs 4.13% in Q3, a break from having steadily climbed ever since 1.9% in 2Q21.

- This rate remains low historically though, below the 2019 average of 4.65%, although the difference is almost entirely down to the adjustment lower in student loan delinquencies following the Biden administration forbearance.

- Indeed, all other major sectors see higher delinquency rates than immediately before the pandemic, most notably credit cards (+2.2pts at 9.0%) and auto loans (+1.1pts at 8.1%) – that said, both of those have seen broadly steady transition rates in latest quarters rather than a continued increase.

- As for the transition into serious delinquency (90+ days), the 1.7% in Q4 was also near unchanged from the 1.68% in Q3 as the increased from 0.7% in 2021 has plateaued.

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA up 334.81 points (0.75%) at 44703.29

S&P E-Mini Future up 57.75 points (0.95%) at 6130.5

Nasdaq up 262.8 points (1.3%) at 19912.48

US 10-Yr yield is down 9.4 bps at 4.5269%

US Mar 10-Yr futures are up 21/32 at 108-29.5

EURUSD up 0.0079 (0.76%) at 1.0461

USDJPY down 1.66 (-1.08%) at 152.78

WTI Crude Oil (front-month) up $0.07 (0.1%) at $71.44

Gold is up $22.66 (0.78%) at $2926.92

European bourses closing levels:

EuroStoxx 50 up 94.85 points (1.75%) at 5500.5

FTSE 100 down 42.72 points (-0.49%) at 8764.72

German DAX up 463.99 points (2.09%) at 22612.02

French CAC 40 up 121.92 points (1.52%) at 8164.11

US TREASURY FUTURES CLOSE

3M10Y -8.304, 20.006 (L: 18.64 / H: 28.113)

2Y10Y -4.578, 21.807 (L: 20.831 / H: 27.5)

2Y30Y -5.007, 42.506 (L: 41.395 / H: 49.18)

5Y30Y -1.822, 34.445 (L: 33.701 / H: 37.243)

Current futures levels:

Mar 2-Yr futures up 3.5/32 at 102-21.25 (L: 102-18 / H: 102-21.75)

Mar 5-Yr futures up 11.75/32 at 106-7.75 (L: 105-29.25 / H: 106-09.75)

Mar 10-Yr futures up 21.5/32 at 108-30 (L: 108-10 / H: 109-01)

Mar 30-Yr futures up 1-14/32 at 114-27 (L: 113-15 / H: 115-03)

Mar Ultra futures up 1-29/32 at 120-0 (L: 118-03 / H: 120-09)

MNI US 10YR FUTURE TECHS: (H5) Maintains A Softer Tone

- RES 4: 110-25 High Dec 12

- RES 3: 110-19 76.4% retracement of the Dec 6 - Jan 13 bear leg

- RES 2: 110-14 High Dec 14

- RES 1: 109-08+/110-00 50-day EMA / High Feb 7 and the bull trigger

- PRICE: 109-00 @ 1500 ET Feb 13

- SUP 1: 108-00 Low Jan 16

- SUP 2: 107-06 Low Jan 13 and the bear trigger

- SUP 3: 107-04 Low Apr 25 ‘24 and a key support

- SUP 4: 106-11 2.00 proj of the Oct 1 - 14 - 16 price swing

Treasury futures remain soft. The contract traded sharply lower on Wednesday’s CPI print, resulting in a break of 108-20+, the Feb 4 low. The breach highlights a stronger reversal and most likely the end of the corrective cycle between Jan 13 - Feb 7. A continuation lower would open 108-00, the Jan 16 low, and expose 107-06, the Jan 13 low and bear trigger. Key resistance and the bull trigger has been defined at 110-00, Feb 7 high.

SOFR FUTURES CLOSE

Mar 25 steady00 at 95.685

Jun 25 +0.030 at 95.780

Sep 25 +0.050 at 95.875

Dec 25 +0.065 at 95.945

Red Pack (Mar 26-Dec 26) +0.075 to +0.095

Green Pack (Mar 27-Dec 27) +0.10 to +0.115

Blue Pack (Mar 28-Dec 28) +0.110 to +0.115

Gold Pack (Mar 29-Dec 29) +0.110 to +0.115

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00253 to 4.31186 (-0.00333/wk)

- 3M +0.00496 to 4.32298 (+0.01908/wk)

- 6M +0.02268 to 4.31501 (+0.05729/wk)

- 12M +0.04755 to 4.29153 (+0.11242/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.32% (-0.02), volume: $2.313T

- Broad General Collateral Rate (BGCR): 4.31% (-0.01), volume: $922B

- Tri-Party General Collateral Rate (TCR): 4.31% (-0.01), volume: $902B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $285B

FED Reverse Repo Operation

RRP usage gains slightly to $67.820B this afternoon after falling to the lowest level since mid-April 2021 yesterday: $67.670B. The number of counterparties at 28 from 27 prior.

MNI PIPELINE: Corporate Bond Issuance Update: $1B Leidos 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/13 $1.25B #Sysco $700M +5Y +70, $550M 10Y +87

- 02/13 $1.1B Gen Digital 8NC3 guidance TBA

- 02/13 $1B #Leidos $500M 7Y +93, $500M 10Y +103

- 02/13 $1B #Exelon 30NC10 6.5%

MNI BONDS: EGBs-GILTS CASH CLOSE: Bull Flattening On US PPI And Tariff Rhetoric

European curves bull flattened Thursday as US inflation data and tariff threats continued to set the tone.

- Having already pared much of Wednesday's post-US CPI rise, helped this morning by further reciprocal tariff bluster from US President Trump and softer energy prices, Bund and Gilt yields pushed lower in the afternoon on US data.

- With the US PPI report signalling lower PCE price pressures than feared after the CPI data, global bonds rallied led by Treasuries.

- The UK curve continued to bull flatten after the data, with the move in Germany stalling out somewhat.

- On the day, German instruments outperformed UK counterparts across the respective curves, with the short-end outperformance particularly pronounced.

- The latter can be attributed to ECB 2025 implied cut pricing extending 4bp to just over 81bp amid lower European gas prices and the EU considered particularly vulnerable to Trump tariff threats, contrasted with the BOE equivalent relatively flat at 58bp.

- UK quarterly and monthly GDP data surprised to the upside, but it is unlikely to change the narrative for the BOE in the near-term.

- Periphery EGB spreads tightened, but French OATs stood out in the semi-core space with 10Y spreads falling 3bp vs Bund.

- Friday's scheduled data highlight is Eurozone prelim Q4 GDP, along with a variety of price measures.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.9bps at 2.088%, 5-Yr is down 6bps at 2.207%, 10-Yr is down 5.9bps at 2.418%, and 30-Yr is down 5.3bps at 2.672%.

- UK: The 2-Yr yield is down 1.8bps at 4.179%, 5-Yr is down 2.6bps at 4.196%, 10-Yr is down 5.3bps at 4.49%, and 30-Yr is down 5.9bps at 5.076%.

- Italian BTP spread down 1.2bps at 107.2bps / French OAT down 2.9bps at 73.5bps

MNI FOREX: Greenback Loses Ground, USDCHF Extends Intra-Day Decline to 1%

- The USD index has weakened around 0.5% on Thursday, as a multitude of factors produced further questions over the greenback’s dominant uptrend in the aftermath of the US election. The market analysed some notably soft details within the PPI data report, translating that into a more negative read for the Fed’s preferred measure of inflation (PCE).

- With this dynamic weighing on US treasury yields, the USD remained marginally on the back foot. Dollar weakness then picked up momentum as headlines crossed from CNBC suggesting that new reciprocal tariffs to be announced by President Trump would not go into effect today. With a possible start date of April 1 being proposed, risk sentiment was boosted as equity indices extended higher which in turn weighed broadly on the dollar.

- EURUSD has made a bullish development today by breaching the 50-day EMA, rising to a high of 1.0445. A clear breach of the average would strengthen a bullish condition and signal scope for stronger recovery and open 1.0533, the Jan 27 high.

- USDJPY is down 0.80% on the session, and although this is a sizeable daily adjustment, the pair has only pulled back to around mid-range for the week following the significant recovery seen on Wednesday.

- Lower core yields, a softer greenback and the hotter-than-expected core CPI print in Switzerland are all contributing to the ongoing weakness for USDCHF on Thursday. The pair has traded as low as 0.9036, extending session losses to ~1% and narrowing the gap to an area of key support. USDCHF has continually failed to close below the 50-day EMA, which currently intersects at 0.9024. Below here, the January low resides at 0.8965.

- China loans data and the second estimate of Eurozone GDP will be released on Friday, before the focus turns to the January US retail sales report.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 14/02/2025 | 0800/0900 | *** | HICP (f) | |

| 14/02/2025 | 1000/1100 | *** | GDP (p) | |

| 14/02/2025 | - | *** | Money Supply | |

| 14/02/2025 | - | *** | New Loans | |

| 14/02/2025 | - | *** | Social Financing | |

| 14/02/2025 | 1330/0830 | ** | Monthly Survey of Manufacturing | |

| 14/02/2025 | 1330/0830 | ** | Wholesale Trade | |

| 14/02/2025 | 1330/0830 | *** | Retail Sales | |

| 14/02/2025 | 1330/0830 | ** | Import/Export Price Index | |

| 14/02/2025 | 1415/0915 | *** | Industrial Production | |

| 14/02/2025 | 1500/1000 | * | Business Inventories | |

| 14/02/2025 | 1800/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 14/02/2025 | 2000/1500 | Dallas Fed's Lorie Logan |