-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Tsy 2Y Yield Tops 5% Post Powell Testimony

EXECUTIVE SUMMARY

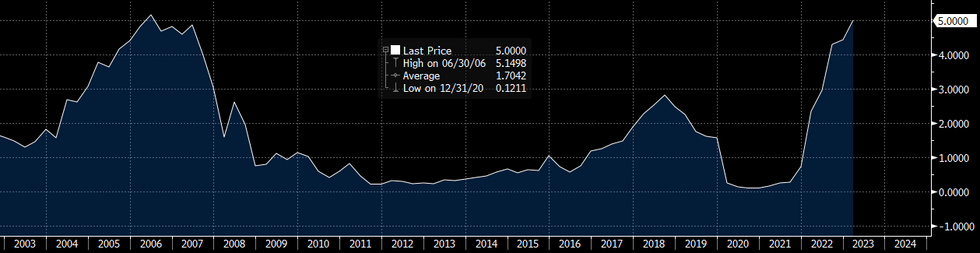

Tsy 2Y Yield Tops 5%

BBG/MNI

Hawkish Chairman Powell comments on potential to raising rates higher, faster in the near term continues to weigh on short end, resulting in 2YY topping 5% for first time since 2006. 2s10s curve new inverted low of -103.723 last seen 1981.

US

FED: The Federal Reserve will need to keep raising interest rates more than markets expect because the inflation views that matter most – those of consumers and businesses – are not particularly well-anchored, San Francisco Fed visiting scholar Yuriy Gorodnichenko told MNI.

- A streak of hot economic data from jobs to inflation have forced investors to readjust their expectations for the federal funds rate to peak around 5.5%, but Gorodnichenko thinks that’s still too low.

- “They will have to keep increasing it – maybe 6%, maybe higher,” said the Berkeley economist, also a research consultant at the European Central Bank, in an interview. Gorodnichenko worries the Fed is playing with fire by allowing the one-year horizon price expectations of consumers and businesses to far exceed their 2% inflation goal. For more see MNI Policy main wire at 1242ET.

- "The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," he said in written testimony to Congress.

- Powell also opened the door to potentially larger rate hikes. "If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," he said, also repeating that the Fed anticipates ongoing increases in the target range for the federal funds rate will be appropriate.

- "We have covered a lot of ground, and the full effects of our tightening so far are yet to be felt. Even so, we have more work to do." For more see MNI Policy main wire at 1001ET.

US TSYS: Fed Chair Powell Opens Door to 50Bp Hike and Then Some

Tsys reversed gains, yield curves extended inversion to 1981 levels (2s10s -105.513) after this mornings hawkish comments from Chairman Powell: possibility of larger, faster hikes and higher terminal rate spurred heavy selling in short end.

- Salient short end metrics: 2Y yield climbed over 5% to 5.0168% high, March'23 Eurodollar futures traded 94.785 (-0.1325)

- Fed funds implied hike for Mar'23 up to 40.3bp vs. 30.5bp this morning, May'23 cumulative 74.1bp (+14.3) to 5.315%, Jun'23 96.0bp (+18.5) to 5.535%.

- Terminal rate via Fed Funds at 5.635% in Oct'23.

- Focus turns to private ADP employment data at 0815ET Wednesday, Nonfarm Payrolls this Friday at 0830ET.

- Fed enters media blackout in regards to policy this Friday at midnight.

OVERNIGHT DATA

- US JAN WHOLESALE INV -0.4%; SALES 1%

- US JAN CONSUMER CREDIT +$14.8B

- US JAN REVOLVING CREDIT +$11.2B

- US JAN NONREVOLVING CREDIT +$3.6B

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 531.08 points (-1.59%) at 32899.07

- S&P E-Mini Future down 61.75 points (-1.52%) at 3990.75

- Nasdaq down 144 points (-1.2%) at 11530.93

- US 10-Yr yield is up 1.2 bps at 3.9696%

- US Jun 10-Yr futures are steady at at 110-31.5 at 110-31.5

- EURUSD down 0.0127 (-1.19%) at 1.0554

- USDJPY up 1.18 (0.87%) at 137.1

- WTI Crude Oil (front-month) down $3.3 (-4.1%) at $77.15

- Gold is down $32.06 (-1.74%) at $1814.82

- EuroStoxx 50 down 34.82 points (-0.81%) at 4278.96

- FTSE 100 down 10.31 points (-0.13%) at 7919.48

- German DAX down 94.05 points (-0.6%) at 15559.53

- French CAC 40 down 33.94 points (-0.46%) at 7339.27

US TREASURY FUTURES CLOSE

- 3M10Y -10.832, -101.928 (L: -104.021 / H: -90.501)

- 2Y10Y -10.616, -104.082 (L: -104.169 / H: -90.976)

- 2Y30Y -13.373, -113.082 (L: -113.523 / H: -96.767)

- 5Y30Y -7.061, -43.028 (L: -43.801 / H: -34.243)

- Current futures levels:

- Jun 2-Yr futures down 6.75/32 at 101-14.125 (L: 101-13.25 / H: 101-23.625)

- Jun 5-Yr futures down 5.75/32 at 106-13 (L: 106-10 / H: 106-26.5)

- Jun 10-Yr futures up 0.5/32 at 111-0 (L: 110-23.5 / H: 111-13)

- Jun 30-Yr futures up 17/32 at 125-5 (L: 124-16 / H: 125-23)

- Jun Ultra futures up 18/32 at 135-26 (L: 134-26 / H: 136-22)

US 10YR FUTURE TECHS: (M3) Powell Knocks Prices, But Support Untroubled

- RES 4: 113-07 50-day EMA

- RES 3: 112-28 High Feb 16

- RES 2: 112-07 20-day EMA

- RES 1: 111-23+/112-03 High Feb 28 / 24

- PRICE: 111-01 @ 16:50 GMT Mar 7

- SUP 1: 110-12+ Low Mar 02 and the bear trigger

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-04+ Lower 2.0% Bollinger Band

- SUP 4: 109-22 3.236 proj of the Jan 19 - Jan 30 - Feb 2 price swing

Treasury futures took a knock on a hawkish Powell appearance Tuesday, however prices remain above last week’s low of 110-12+ (Mar 2). Recent gains are considered corrective and note that a move higher would allow an oversold trend condition to unwind. Key short-term resistance is seen at 112-07, the 20-day EMA. On the downside, the bear trigger lies at 110-12+, the Mar 2 low. A break would confirm a resumption of the downtrend and open 110-06, a Fibonacci projection.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.115 at 94.803

- Jun 23 -0.175 at 94.255

- Sep 23 -0.180 at 94.095

- Dec 23 -0.175 at 94.245

- Red Pack (Mar 24-Dec 24) -0.14 to -0.06

- Green Pack (Mar 25-Dec 25) -0.05 to +0.010

- Blue Pack (Mar 26-Dec 26) +0.030 to +0.050

- Gold Pack (Mar 27-Dec 27) +0.060 to +0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 4.56229% (+0.00272/wk)

- 1M +0.00771 to 4.71900% (+0.00986/wk)

- 3M +0.01771 to 5.02571% (+0.04171/wk)*/**

- 6M +0.01814 to 5.34614% (+0.02943/wk)

- 12M +0.02614 to 5.71671% (+0.02228/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.02571% on 3/7/23

- Daily Effective Fed Funds Rate: 4.57% volume: $114B

- Daily Overnight Bank Funding Rate: 4.57% volume: $310B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.129T

- Broad General Collateral Rate (BGCR): 4.51%, $460B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $449B

- (rate, volume levels reflect prior session)

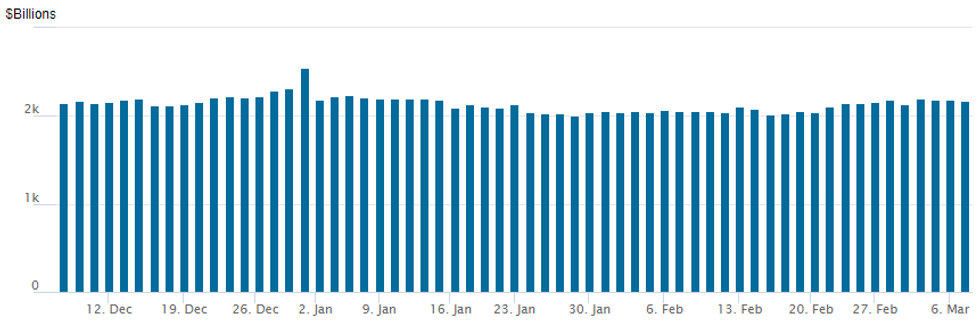

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,170.195B w/ 101 counterparties vs. prior session's $2,190.793B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $3B Nestle 4Pt Launched

$15.7B high-grade corporate debt to price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 03/07 $3B #Nestle $1B 3Y +55, $850M 5Y +70, $500M 7Y +80, $650M 10Y +90

- 03/07 $2B *African Development Bank (AFDB) 5Y SOFR+33

- 03/07 $2B #Islamic Development Bank (ISDB) 5Y Sukuk SOFR+55

- 03/07 $1.7B #HP Enterprise $1.3B 1.5Y +95, $400M 3NC1 +140

- 03/07 $1.5B *Nordic Inv Bank (NIB) 5Y SOFR+30

- 03/07 $1.4B #Texas Instruments $750M 10Y +95, $650M 30Y +115

- 03/07 $1.25B #TransCanada Pipelines $850M 3NC1 +150, $400M 3NC1 SOFR+152

- 03/07 $800M #Magna Int, $300M 3NC1 +125, $500M 10Y +155

- 03/07 $750M #CCDJ 5Y +140

- 03/07 $700M #Harley-Davidson 5Y +225

- 03/07 $600M #Caterpillar Fncl 2Y +40 (drops 2Y SOFR leg)

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 08/03/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/03/2023 | 0930/0930 |  | UK | BOE Dhingra at Resolution Foundation | |

| 08/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2023 | 1000/1100 | * |  | EU | Employment |

| 08/03/2023 | 1000/1100 |  | EU | ECB Lagarde at Women's Day WTO Event | |

| 08/03/2023 | 1000/1100 |  | EU | ECB Panetta Intro at Euro Cyber Resilience Board | |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.