-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA OPEN - US Lawmakers Narrow in On Stimulus Deal

EXECUTIVE SUMMARY:

- US LAWMAKERS NARROW IN ON FISCAL DEAL, BUT SHUTDOWN POSSIBLE

- UK PM JOHNSON SAYS EU STANCE ON FISH 'NOT REASONABLE'

- STOCKS, OIL, YIELDS HIGHER, DOLLAR LOWER

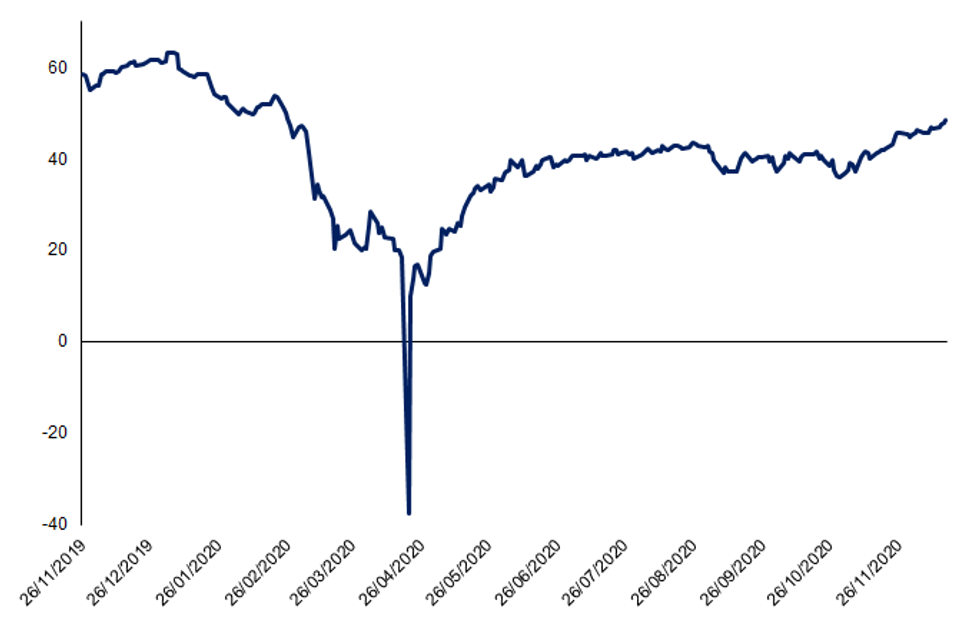

Source: MNI/Bloomberg

Source: MNI/Bloomberg

NEWS:

US:

MNI BRIEF: McConnell Says US Fiscal Relief Deal Appears Close

Senate Majority Leader Mitch MccConnell said Thursday a fiscal deal in Congress "appears close at hand," adding that negotiations could need another stopgap funding bill to allow further room for negotiations.

EU/UK:

MNI BRIEF: If Agreement Reached, EP Sits Dec 28/29: EU Source

A deal on future trading relations between the UK and EU could be reached at some unspecified point in coming days or weeks, European Union Chief Negotiator Michel Barnier told the European Parliament's Conference of Presidents Thursday, although he again underlined there may still be no deal this year, one EP source told MNI.

MNI BRIEF: Brexit Deal Likely Friday Or Saturday-Source

A deal between the UK and the European Union on future trade relations is likely "Friday or Saturday", an EU source told MNI, although no greater detail on the standing of the key problem areas was forthcoming

UK:

MNI REALITY CHECK: UK Nov Sales Lower, But Not All Bad News

Widespread lockdowns in the UK dampened non-essential retail sales in November, but early Christmas shopping and buoyant food sales may have prevented some of the nosedive in sales predicted by City forecasters, leading industry sources tell MNI.

MNI REVIEW: BOE Says Could Ease If Brexit Talks Fail

The Bank of England signalled it could ease if no trade deal with the European Union is greed before the United Kingdom's transition period finishes at the end of this year, but its Monetary Policy Committee was unanimous in leaving policy on hold at its December meeting.

Europe:

MNI REVIEW: Norges Bank Sees Three Rate Hikes From H1 2022

Norges Bank left its key policy rate on hold at zero percent on Thursday but projected that its first hike would come sooner, perhaps as early as the first half of 2022 and that the policy rate would then rise markedly more rapidly than it had previously projected.

DATA

MNI: US TREASURY GENERAL ACCOUNT $1.616T DEC 16 VS $1.621T PRIOR DAY

US CONTINUING CLAIMS -0.273M TO 5.508M IN DEC 05 WK

US CONTINUING CLAIMS -0.273M to 5.508M IN DEC 05 WK

MNI: US JOBLESS CLAIMS +23K TO 885K IN DEC 12 WK

US PREV JOBLESS CLAIMS REVISED TO 862K IN DEC 05 WK

US TSYS SUMMARY: Steeper Curve as Fiscal Details Awaited

The curve traded marginally steeper into the close Thursday, with markets awaiting the final details of the $900bln fiscal package from US lawmakers, on which the details are expected ahead of the Friday close. The price action wasn't one-way however, with March futures pushing lower at the end of the London session, moving swiftly from 137-29+ to 137-24 (last 137-25+) as the curve bear steepened on no material headline catalyst.

- 3M10Y +1.0, 84.3

- 1Y10Y +0.7, 84.6

- 2Y10Y +0.5, 81.2

- 2Y30Y +1.4, 156.0

- 5Y30Y +1.5, 130.6

EGBs-GILTS CASH CLOSE: Mixed Risk Reactions

Bunds outperformed for most of the session but came back to the pack, and it was a mixed risk picture overall with core FI in general doing fine and periphery spreads widening despite higher equities.

- BoE unch decision didn't have much of an impact. Brexit headlines continue to be mixed-to-positive, with most concerns cited today being of a procedural variety (ie when can bill passage be made).

- Late session brought news that the UK reported a record 35.6k COVID cases - but Gilts fell.

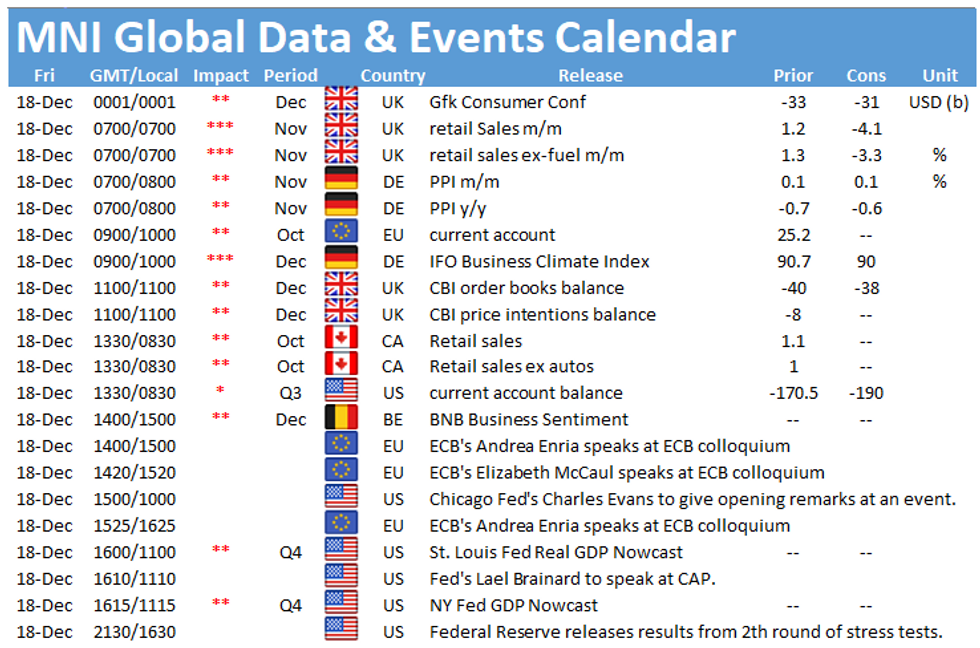

- On Friday, UK Nov retail sales is the clear data highlight, with German IFO following thereafter. No bond supply and no central bank speakers.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.725%, 5-Yr is down 0.2bps at -0.746%, 10-Yr is down 0.3bps at -0.57%, and 30-Yr is up 0.7bps at -0.155%.

- UK: The 2-Yr yield is up 2.6bps at -0.051%, 5-Yr is up 2.5bps at -0.006%, 10-Yr is up 1.5bps at 0.287%, and 30-Yr is up 1.3bps at 0.847%.

- Italian BTP spread up 0.7bps at 111bps

- Spanish bond spread up 0.9bps at 59.9bps

- Portuguese PGB spread up 2bps at 58.1bps

- Greek bond spread up 0.4bps at 115.4bps

FOREX: Dollar Dropped as Markets Hone In On Stimulus Prospects

The greenback was once again the poorest performer in G10, with decent risk appetite in equity space sapping the USD of any safe haven status. Market focus remains on US stimulus deal prospects, with reports suggesting that differences are continuing to narrow, with just the final details remaining in a package worth up to $900bln.

At the other end of the table, the NOK was stronger against all others Thursday following the Norges Bank rate decision. The Bank sharply steepened their rate path projections, bringing forward the timing of the first rate hike by around six months to mid-2022.

Despite recent outperformance, GBP was distinctly mid-table Thursday after solid gains were sold into the close after the conclusion of a phonecall between UK's Johnson and EU's von der Leyen. Both sides cautioned that no deal remained a real possibility, with distinct differences remaining between both sides.

Focus Friday turns to German IFO data and Canadian retail sales. The Russian central bank rate decision is also due.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.