-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI DAILY TECHNICAL ANALYSIS - Trend Direction In The FI Space Remains Down

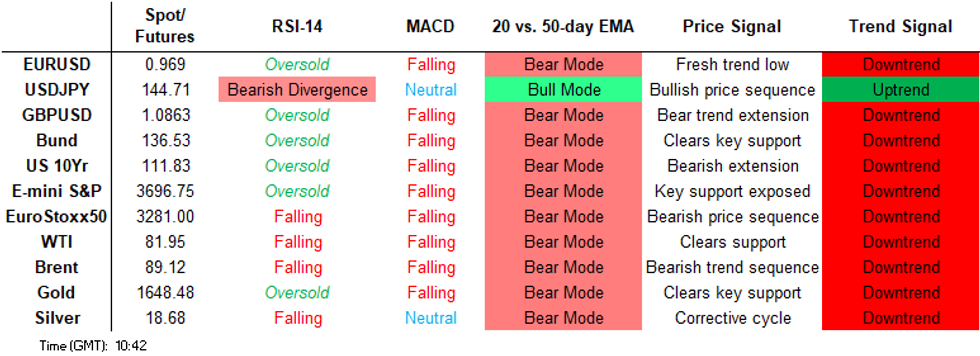

Price Signal Summary - FI Space Remains Bearish And S/T Gains Are Considered Corrective

- In the equity space, S&P E-Minis trend conditions remain bearish despite yesterday's recovery. Last week’s extension of the trend and this week’s follow through, strengthens bearish conditions and note that a key support at 3657.00, Jun 17 low and an important medium-term bear trigger, has been cleared. The break confirms a resumption of the broader downtrend. The focus is on 3600.00 next. EUROSTOXX 50 futures remain soft following the reversal on Sep 13, from 3678.00, the Jun 13 high and this week’s follow through. Key short-term support at 3341.00, the Jul 5 low, has been breached. The focus is on 3229.00 next, the Nov 9 2020 low (cont).

- In FX, the EURUSD remains vulnerable despite yesterday’s gains. The break lower this week, confirms a resumption of the primary downtrend - reinforced too by last week’s breach of 0.9864, the Sep 6 low. The move lower maintains the bearish price sequence of lower lows and lower highs. Price is also trending down inside a bear channel drawn from the Feb 10 high. The channel base intersects at 0.9495. Bearish trend conditions in GBPUSD remain intact. An important short-term support has been defined at 1.0350, Monday’s low. The trend is down and a break of this support would confirm a resumption of bearish activity. Monday’s close also highlights an important candle pattern - a hammer and potential reversal signal. A break above Monday’s 1.0931 high is required to strengthen this signal and highlight a short-term base. USDJPY is holding on to the recovery from 140.36, the Sep 22 low and a key short-term support, where a break is required to highlight a top and the potential for a deeper retracement. The uptrend remains intact and attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, 2.764 projection of the Aug 2 - 8 - 11 price swing.

- On the commodity front, Gold remains in a downtrend and Wednesday’s bounce is considered corrective. Fresh trend lows this week confirm a resumption of the downtrend and this opens $1610.5, the 1.00 projection of the Jun 13 - Jul 21 - Aug 10 swing. In the Oil space, a bearish threat in WTI futures remains present and the recovery from Monday’s low is considered corrective. The recent break of support at $84.25, the Jul 14 low, confirmed a resumption of the downtrend that started Jun 8. Attention is on $76.11, 1.618 projection of the Jul 29 - Aug 16 - 30 price swing.

- In the FI space, Bund futures remain in a clear downtrend and the extension lower last week and this week, confirms a resumption of the bear leg that started early August. The focus is on 135.27, the Mar 2012 low (cont). Gilts have traded in an extremely volatile manner, however, trend signals remain bearish. A resumption of weakness would refocus attention on 90.99, Wednesday low and the bear trigger. Note that in pattern terms, yesterday’s session is a bullish engulfing candle. However, additional reinforcing price evidence is required to validate this signal and confirm a short-term shift in market sentiment.

FOREIGN EXCHANGE

EURUSD TECHS: Remains Bearish Inside Its Bear Channel

- RES 4: 1.0034 Bear channel top drawn from the Feb 10 high

- RES 3: 0.9892 20-day EMA

- RES 2: 0.9852 High Sep 23

- RES 1: 0.9751 High Sep 28

- PRICE: 0.9681 @ 06:20 BST Sep 29

- SUP 1: 0.9536 Low Sep 28

- SUP 2: 0.9501 1.382 projection of the Aug 10 - Sep 6 - 12 price swing

- SUP 3: 0.9495 Bear channel base drawn from the Feb 10 high

- SUP 4: 0.9442 1.50 projection of the Aug 10 - Sep 6 - 12 price swing

EURUSD short-term gains are considered corrective and trend signals continue to point south. Fresh trend lows this week reinforce bearish conditions, signalling scope for a continuation. The move lower also maintains the bearish price sequence of lower lows and lower highs. Price is approaching the base of a bear channel drawn from the Feb 10 high. The channel intersects at 0.9495 and represents a key support.

GBPUSD TECHS: Monitoring The Hammer Candle Pattern

- RES 4: 1.1287 20-day EMA

- RES 3: 1.1274 High Sep 23

- RES 2: 1.1000 Round number resistance

- RES 1: 1.0931 High Sep 26

- PRICE: 1.0799 @ 06:27 BST Sep 29

- SUP 1: 1.0541/0350 Low Sep 28 / All Time Low

- SUP 2: 1.0203 3.236 proj of the Jun 16 - Jul 14 - Aug 1 price swing

- SUP 3: 1.0108 3.382 proj of the Jun 16 - Jul 14 - Aug 1 price swing

- SUP 4: 1.0032 3.50 proj of the Jun 16 - Jul 14 - Aug 1 price swing

Bearish trend conditions in GBPUSD remain intact although activity is likely to stay volatile near-term. Monday’s low of 1.0350 is a key short-term support. The primary trend is down and a break of this level would confirm a resumption of bearish activity. Note that Monday’s price pattern is a hammer candle and a potential reversal signal. A break of Monday’s 1.0931 high is required to strengthen this signal and this would highlight a short-term base.

EURGBP TECHS: Remains Above Support

- RES 4: 0.9501 High Mar 19 2020 and major resistance

- RES 3: 0.9388 High Mar 23 2020

- RES 2: 0.9292 High Sep 11 2020

- RES 1: 0.9108/9266 61.8% of Monday’s range / High Sep 26

- PRICE: 0.8973 @ 06:43 BST Sep 29

- SUP 1: 0.8853 Low Sep 26

- SUP 2: 0.8788 High Sep 19

- SUP 3: 0.8692 Low Sep 22 and a key short-term support

- SUP 4: 0.8636 50-day EMA

EURGBP remains below Monday’s high of 0.9266 - a key short-term resistance. The rally Monday reinforced bullish conditions and has maintained the positive price sequence of higher highs and higher lows. This has exposed the top of a broad multi-year range at the 0.9300 handle and a key medium-term resistance area. Short-term weakness is considered corrective - for now. 0.8692 marks a key short-term support.

USDJPY TECHS: Holding On To Its Recent Gains

- RES 4: 146.52 1.236 proj of the May 24 - Jul 14 - Aug 2 price swing

- RES 3: 146.03 2.764 proj of the Aug 2 - 8 - 11 price swing

- RES 2: 145.90 High Sep 22

- RES 1: 144.90 High Sep 27

- PRICE: 144.61 @ 06:49 BST Sep 29

- SUP 1: 142.59/141.77 20-day EMA / Low Sep 23

- SUP 2: 140.36 Low Sep 22 and key short-term support

- SUP 3: 139.87 Low Sep 2

- SUP 4: 139.47 50-day EMA

USDJPY is holding on to the recovery from last 140.36, the Sep 22 low. This level has been defined as a key short-term support where a break is required to highlight a top and the potential for a deeper retracement. The uptrend remains intact and attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, a Fibonacci projection.

EURJPY TECHS: Corrective Cycle Still In Play

- RES 4: 146.23 2.236 proj of the Aug 2- 10 - 16 price swing

- RES 3: 145.64 High Sep 12 and the bull trigger

- RES 2: 142.30/144.04 Low Sep 14 / High Sep 20

- RES 1: 140.82 20-day EMA

- PRICE: 139.72 @ 06:56 BST Sep 29

- SUP 1: 137.40 Low Sep 26

- SUP 2: 136.02 Low Aug 25

- SUP 3: 135.52 Low Aug 24

- SUP 4: 134.95 Low Aug 16 and a key support

A recent sharp reversal lower in EURJPY has resulted in a break of the 50-day EMA and the cross continues to trade closer to its recent lows. The latest move lower is considered corrective, despite a deep retracement and technical trend signals continue to highlight a bull cycle. Initial firm support has been defined at 137.40, the Sep 26 low. Resistance to watch is 140.82, the 20-day EMA.

AUDUSD TECHS: Trend Direction Remains Down

- RES 4: 0.6747 High Sep 20

- RES 3: 0.6673 20-day EMA

- RES 2: 0.6656 High Sep 23

- RES 1: 0.6550 High Sep 26

- PRICE: 0.6456 @ 08:05 BST Sep 29

- SUP 1: 0.6363 Low Sep 28

- SUP 2: 0.6337 Low Apr 24 2020

- SUP 3: 0.6283 Low Apr 23 2020

- SUP 4: 0.6255 1.236 proj of the Apr 5 - May 12 - Jun 3 price swing

AUDUSD remains in a downtrend and yesterday's climb is considered corrective. The outlook is bearish. Recent weakness has resulted in the break of support at 0.6682, the Jul 14 low and a bear trigger. This strengthens bearish conditions and maintains the broader bearish price sequence of lower lows and lower highs. The focus is on 0.6337 next, the Apr 24 2020 low. Initial firm resistance has been defined at 0.6673, the 20-day EMA.

USDCAD TECHS: Bullish Trend Conditions Intact

- RES 4: 1.4000 Psychological round number

- RES 3: 1.3970 3.236 proj of the Aug 25 - Sep 7 - 13 price swing

- RES 2: 1.3896 3.00 proj of the Aug 25 - Sep 7 - 13 price swing

- RES 1: 1.3833 High Sep 28

- PRICE: 1.3720 @ 08:11 BST Sep 29

- SUP 1: 1.3560/3468 Low Sep 26 / 23

- SUP 2: 1.3349 20-day EMA

- SUP 3: 1.3148 50-day EMA

- SUP 4: 1.2954 Low Sep 13 and a key support

USDCAD traded higher Wednesday but pulled back from the session high. A bullish theme remains intact. The recent extension reinforces the uptrend and maintains the positive price sequence of higher highs and higher lows. Moving average studies are in a bull mode position, highlighting current market sentiment. Sights are set on 1.3896 next, a Fibonacci projection. On the downside, initial firm support is at 1.3349, the 20-day EMA.

FIXED INCOME

BUND TECHS: (Z2) Gains Considered Corrective

- RES 4: 142.58 High Sep 20

- RES 3: 142.17 20-day EMA

- RES 2: 142.02 High Sep 22

- RES 1: 139.29/140.99 High Sep 27 / 23

- PRICE: 138.34 @ 05:02 BST Sep 29

- SUP 1: 135.41 4.236 proj of the Aug 2 - 12 - 15 price swing

- SUP 2: 135.27 Low Mar 2012 (cont)

- SUP 3: 134.76 4.382 proj of the Aug 2 - 12 - 15 price swing

- SUP 4: 134.24 4.50 proj of the Aug 2 - 12 - 15 price swing

Bund futures remain in a downtrend despite yesterday’s bounce. The extension lower this week again confirms a continuation of the bear cycle that started early August. A major support at 140.67, Jun 16 low (cont), has been cleared. The break strengthens the broader bearish outlook and confirms a resumption of the primary downtrend. Attention is on 135.27 next, the Mar 2012 low (cont). The 20-day EMA, at 142.17 is a firm resistance.

BOBL TECHS: (Z2) Outlook Remains Bearish

- RES 4: 121.570 High Sep 19

- RES 3: 121.036 20-day EMA

- RES 2: 120.940 High Sep 21

- RES 1: 119.630/120.150 High Sep 28 / 23

- PRICE: 119.270 @ 05:10 BST Sep 29

- SUP 1: 118.020 Low Sep 28

- SUP 2: 117.918 2.382 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 3: 117.630 2.50 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 4: 117.342 2.618 proj of the Aug 25 - Sep 1 - Sep 6 price swing

The trend needle in Bobl futures still points south despite yesterday’s bounce. This week’s fresh cycle lows reinforce bearish conditions. A key support at 119.940, the Jun 16 low (cont) and the bear trigger, has recently been cleared. The break of this level confirms a resumption of the broader downtrend and opens 117.918 next, a Fibonacci projection. Firm resistance is seen at 121.036, the 20-day EMA.

SCHATZ TECHS: (Z2) Bear Trend Intact Despite Bounce

- RES 4: 107.585 High Sep 19

- RES 3: 107.461 20-day EMA

- RES 2: 107.380 High Sep 20

- RES 1: 107.035 High Sep 22

- PRICE: 106.895 @ 05:20 BST Sep 29

- SUP 1: 106.513 2.236 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 2: 106.379 2.382 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 3: 106.000 Round number support

- SUP 4: 105.800 Low Nov 2008 (cont)

The Schatz futures trend direction is unchanged and remains down despite yesterday’s recovery. Recent fresh trend lows confirm an extension of the bear cycle. This also maintains the current bearish price sequence of lower lows and lower highs with moving average studies in a bear mode position. The focus is on 106.513 next, a Fibonacci projection. On the upside, initial firm resistance is seen at 107.461, the 20-day EMA.

GILT TECHS: (Z2) Bullish Engulfing Candle?

- RES 4: 102.98 20-day EMA

- RES 3: 100.00/102.45 Round number resistance / High Sep 23

- RES 2: 98.68 Low Sep 23 and gap high on the daily chart

- RES 1: 97.43 High Sep 27

- PRICE: 97.17 @ Close Sep 28

- SUP 1: 90.99 Low Sep 28 and the bear trigger

- SUP 2: 90.57 2.618 proj of the May 12 - Jun 16 - Aug 2 swing (cont)

- SUP 3: 90.00 Psychological round number

- SUP 4: 88.94 2.764 proj of the May 12 - Jun 16 - Aug 2 swing (cont)

A strong rally yesterday in Gilt futures has led to a short-term reversal. In pattern terms, yesterday’s bounce is a bullish engulfing candle. However, additional reinforcing price evidence is required to validate this signal and confirm a short-term shift in market sentiment. An extension higher would be positive and signal potential for a climb towards the 100.00 handle initially. Key support and the bear trigger has been defined at 90.99, yesterday’s low.

BTP TECHS: (Z2) Bearish Extension

- RES 4: 118.51 High Sep 13

- RES 3: 117.05 High Sep 22

- RES 2: 115.60 20-day EMA

- RES 1: 113.46/114.67 High Sep 26 / Low Sep 20

- PRICE: 111.27 @ Close Sep 28

- SUP 1: 107.99 2.236 proj of the Aug 25 - Sep 1 - 8 price swing

- SUP 2: 107.27 2.382 proj of the Aug 25 - Sep 1 - 8 price swing

- SUP 3: 107.00 round number support

- SUP 4: 106.68 2.618 proj of the Aug 25 - Sep 1 - 8 price swing

BTP futures remain bearish despite yesterday’s volatile price action and recovery from the session low. Fresh trend lows this week have confirmed a resumption of the bear cycle. Moving averages are in a bear mode too, highlighting the current market sentiment. A return lower would refocus attention on 107.27, a Fibonacci projection. On the upside, initial firm resistance is seen at 115.60, the 20-day EMA.

US 10YR FUTURE TECHS: (Z2) Trend Signals Remain Bearish

- RES 4: 116-11+ 50 day EMA values

- RES 3: 115-06+ High Sep 14

- RES 2: 114-14+ 20-day EMA

- RES 1: 112-30+/114-00 High Sep 23 / 22

- PRICE: 112-11 @ 16:30 BST Sep 28

- SUP 1: 110-19 Low Sep 28

- SUP 2: 110-01 3.0% 10-dma envelope

- SUP 3: 110-00 Psychological Support

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries remain soft despite the latest rally. Last week’s extension of the downtrend and this week’s move lower has reinforced current conditions. A bearish price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's current bearish sentiment. The focus is on 110-01 a lower moving average band value. Initial resistance is Friday’s high of 112-30+.

EQUITIES

EUROSTOXX50 TECHS: (Z2) Trend Needle Still Points South

- RES 4: 3753.00 High Aug 19

- RES 3: 3692.00 High Aug 26

- RES 2: 3678.00 High Sep 13 and bull trigger

- RES 1: 3467.00/3537.70 20-day EMA / 50-day EMA

- PRICE: 3354.00 @ 05:43 BST Sep 29

- SUP 1: 3229.00 Low Nov 9 2020 (cont)

- SUP 2: 3163.00 Low Nov 6 2020

- SUP 3: 3143.20 1.382 proj of the Aug 17 - Sep 5 - 13 price swing

- SUP 4: 3100.00 Round number support

EUROSTOXX 50 futures trend conditions remain bearish despite yesterday’s recovery - gains are considered corrective. This week’s fresh cycle lows mark an extension of the reversal on Sep 13 from 3678.00. Key short-term support at 3423.00, the Sep 5 low, has been cleared, The break strengthens bearish conditions and has led to a breach of 3341.00, the Jul 5 low, The focus is on 3229.00 next, the Nov 9 2020 low (cont). Resistance is at 3467.00.

E-MINI S&P (Z2): Short-Term Gains Considered Corrective

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 3983.16/4175.00 50-day EMA / High Sep 13

- RES 1: 3783.25/3936.25 High Sep 23 / 20

- PRICE: 3720.75 @ 06:58 BST Sep 29

- SUP 1: 3600.00 Round number support

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish following last week’s extension lower and the bearish follow through this week. Short-term gains are considered corrective. The move lower strengthens bearish conditions and attention is on key support at 3657.00, the Jun 17 low. This support has been pierced. A clear break would confirm a resumption of the broader downtrend and opens 3600.00 next. Initial firm resistance is at 3936.25, Sep 20 high.

COMMODITIES

BRENT TECHS: (X2) Extends Corrective Bounce

- RES 4: $107.30 - High Jul 5

- RES 3: $96.99/103.86 - High Sep 5 / High Jul 29 and key resistance

- RES 2: $94.04 - 50-day EMA

- RES 1: $90.73 - 20-day EMA

- PRICE: $88.68 @ 06:54 BST Sep 29

- SUP 1: $83.65 - Low Sep 26 and the bear trigger

- SUP 2: $82.59 - 1.618 proj of the Jul 29 - Aug 17 - 30 price swing

- SUP 3: $80.71 - 1.764 proj of the Jul 29 - Aug 17 - 30 price swing

- SUP 4: $79.12 - Low Jan 24

Brent futures traded higher yesterday, extending the bounce from Monday’s low of $83.65. Short-term gains are considered corrective. The contract traded lower Monday, confirming a resumption of the broader downtrend. The move lower strengthens bearish conditions and maintains the price sequence of lower lows and lower highs. This paves the way for $82.59 next, a Fibonacci projection. Firm trend resistance is at the 50-day EMA, at $94.04.

WTI TECHS: (X2) Corrective Bounce

- RES 4: $97.91 - High Jul 29 and a reversal trigger

- RES 3: $92.26/96.82 - High Aug 30 / 31 and key resistance

- RES 2: $87.84 - 50-day EMA

- RES 1: $83.98 - 20-day EMA

- PRICE: $81.41 @ 07:10 BST Sep 29

- SUP 1: $76.11 - 1.618 proj of the Jul 29 - Aug 16 - 30 price swing

- SUP 2: $75.70 - Low Jan 24

- SUP 3: $71.22 - 2.00 proj of the Jul 29 - Aug 16 - 30 price swing

- SUP 4: $68.20 - 2.236 proj of the Jul 29 - Aug 16 - 30 price swing

WTI futures traded higher Wednesday. Bearish conditions remain intact though and the climb from Monday’s low is considered corrective. The contract has recently cleared support at $80.89, Sep 8 low. This marks a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. The focus is on $76.11 next, a Fibonacci projection. Key short-term resistance is at $87.84 the 50-day EMA.

GOLD TECHS: Gains Highlight A Pause In The Downtrend

- RES 4: $1765.5 - High Aug 25 and a key resistance

- RES 3: $1718.8/35.1 - 50-day EMA / High Sep 12

- RES 2: $1688.0/1707.1 - High Sep 21 / High Sep 14

- RES 1: $1662.7 - High Sep 28

- PRICE: $1643.0 @ 07:15 BST Sep 29

- SUP 1: $1615.0 - Low Sep 28

- SUP 2: $1610.5 - 1.00 proj of the Jun 13 - Jul 21 - Aug 10 swing

- SUP 3: $1569.1 - Low Apr 1 2020

- SUP 4: $1563.9 - 1.236 proj of the Jun 13 - Jul 21 - Aug 10 swing

Gold bounced yesterday but has already started retracing the recovery. The trend outlook remains bearish. This week’s extension of the bear cycle confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies are in a bear mode position, clearly highlighting current market sentiment. The focus is on $1610.5, a Fibonacci projection. Initial firm resistance is at $1688.0.

SILVER TECHS: Support Remains Exposed

- RES 4: $21.967 - High Jun 17

- RES 3: $21.540 - High Jun 27

- RES 2: $20.876 - High Aug 15 and the bull trigger

- RES 1: $20.014 - High Sep 12

- PRICE: $18.633 @ 07:23 BST Sep 29

- SUP 1: $17.562 - Low Sep 1 and bear trigger

- SUP 2: $16.955 - Low Jun 15 2020

- SUP 3: $16.473 - 1.00 proj of the Jun 6 - Jul 14 - Aug 10 price swing

- SUP 4: $15.998 - 76.4% retracement of the 2020 - 2021 bull leg

Silver maintains a softer tone despite yesterday’s gains. The recent break of $18.845, Sep 12 low, confirms the end of the recent corrective recovery between Sep 1 - 12. A continuation lower would pave the way for a move towards the key support and bear trigger at $17.562, the Sep 1 low. Clearance of this level would confirm a resumption of the broader downtrend. On the upside, key resistance is unchanged at $20.014, Sep 12 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.