-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Gilt Rally Reverses After BoE

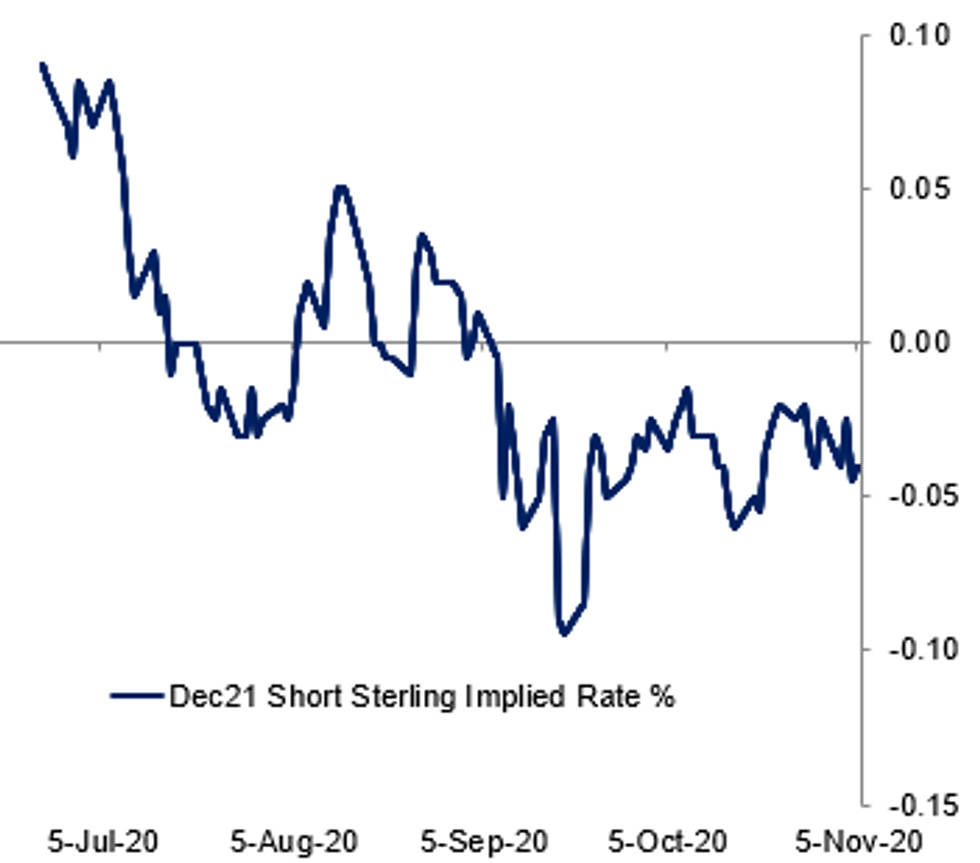

Fig. 1: BoE Doesn't Move Needle Much On Rate Expectations

BBG, MNI

BBG, MNI

GILT SUMMARY: Reversing Yesterday's Bull Flattening

Following yesterday's bull flattening move, the gilt rally lost momentum today with the curve now bear steepening.

- Gilt cash yields are 2-4bp higher on the day. The 2s30s spread is 1bp wider. Last yields: 2-year -0.0595%, 5-year -0.0598%, 10-year 0.2245%, 30-year 0.7908%.

- The Dec-20 gilt future trades at 136.04, towards the bottom end of the day's range (L: 135.89 / H: 136.69)

- The BoE announced an additional GBP150bn of QE purchases to shore up the recovery as the economy contends with the second national lockdown. The QE announcement exceeded the GBP100bn consensus estimate.

- Alongside the BoE stimulus, Chancellor of the Exchequer Rishi Sunak announced an extension of the furlough scheme until March.

- There will be no further UK data releases until next week.

EGB SUMMARY: Core stays better offered

Core EGB have traded heavy today and this afternoon, taking their cue from the risk on tone, as Biden edges closer to a potential win.

- In turn, this has helped the German curve bear steepened today.

- Peripherals have outperformed, and trading tighter on the session, with Greece leading at 3bps tighter, while Spain and Portugal sits close to flat on the day.

- Looking ahead, focus turns to the FOMC, and continued polling results from the US election.

- Dec Bund futures (RX) down 19 ticks at 176.21 (L: 176.09 / H: 176.65)Germany: The 2-Yr yield is up 1.2bps at -0.781%, 5-Yr is up 1.2bps at -0.805%, 10-Yr is up 0.9bps at -0.629%, and 30-Yr is up 1.3bps at -0.218%.

- BTP futures (IK) up 32 ticks at 150.53 (L: 150.36 / H: 150.89)

- Italy / German 10-Yr spread 2.9bps tighter at 129.6bps

- Dec OAT futures (OA) down 9 ticks at 170.35 (L: 170.23 / H: 170.7)

- 10Yrs:Spanish bond spread down 0.7bps at 72.3bps

- Portuguese PGB spread down 0.3bps at 70bps

- Greek bond spread down 2.9bps at 146.5bps

DEBT FUTURES/OPTIONS:

- DUZ0 112.20/112.30/112.50/112.60 c condor vs 112.10/112ps, sold the condor at 7.5 in 7k

- DUF1 112.30/20ps, bought for 1.5 in 10k

- RXF0 181 call, sold at 27.5 in 5k

- 0RZ0 100.62/75cs vs 100.50p, bought for half in 2.5k

- 0RZ0 100.625/100.75cs, bought for 1.25 in 2.5k (ref 100.585, 10 del)

- LH1 100.12/100.25/100.37c fly, bought for 1 in 2k

- 0LH1 100c vs 2lH1 100c, bought the 1yr and receive 0.25 in total 9k

- LF1 99.87/100/100.125c fly, sold at 6.5 in 4k

- LM1 100.125/100.25/100.375c fly, bought for 1.5 in 6k

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.