-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: Asia Ends Week With Risk Switch Turned To On

- Core FI fade initial gains but ACGBs remain afloat after Westpac say they now expect the RBA to extend its QE programme by A$100bn in mid-Oct (prev. forecast: A$50bn)

- FX space sees risk-on flows at the end to the week in Asia as regional equity benchmarks register gains

BOND SUMMARY: Core FI Ebb Off Session Highs, But RBA Chatter Keeps ACGBs Afloat

ACGBs extended gains to fresh session highs after Westpac revised their RBA call and said they now expect the Reserve Bank to extend its QE programme by a further A$100bn in mid-Oct rather than by A$50bn. Core FI crept higher before the release of Westpac's research note, which provided a shot in the arm for ACGBs. XM pulled back from highs but held onto the bulk of earlier gains and last trades +2.0 ticks, with YM last seen -0.5. Cash ACGB yields trade lower across the curve, with belly outperforming as 10s lead the way. Bills trade unch. to -1 tick through the reds. The AOFM tapped ACGB 0.25% 21 Nov '24, amid speculation that this bond might be included in the RBA's YCC purchases. The A$800mn auction was small by historical standards and saw a tighter price tail vs. the previous auction & a slightly smaller bid/to cover ratio, which nonetheless held above 4.00x. Elsewhere, the AOFM released a relatively light issuance slate for next week. Across the Tasman, the RBNZ trimmed its LSAP purchase target for next week, which was expected after NZ Tsy said it will reduce bond issuance in Apr.

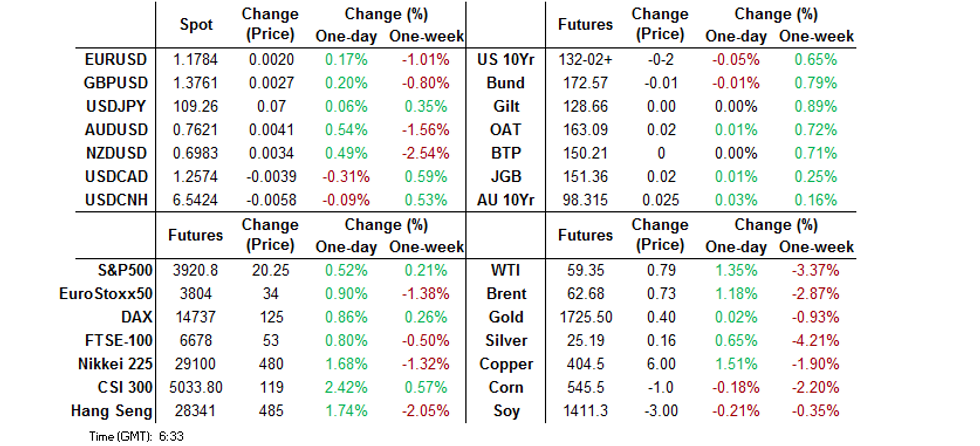

- U.S. Tsys were capped after U.S. Pres Biden doubled his Covid-19 vaccination target & the Fed signalled imminent termination of dividend curbs for banks. T-Notes popped higher to the session high of 132-04 in early Tokyo trade as reaction bid in ACGBs spilled over. The contract ebbed off best levels as broader sentiment remained positive, before posting another uptick with little in the way of headline catalysts crossing the wires. T-Notes last trade -0-02+ at 132-02. Cash Tsy yields sit a touch lower across the curve, with the 5-7 Year sector outperforming despite yesterday's weak 7-Year Note sale. Eurodollar futures last sit +0.5 to -0.5 tick through the reds. Focus in the U.S. turns to personal income/spending & PCE data.

- Despite a softer re-open, JGB futures rallied through Thursday's peak before the Tokyo lunch break, printing their session high of 151.41 as the BoJ left the sizes of its 1-3 & 5-10 Year JGBs unch. Futures trimmed gains thereafter and last sit at 151.37, +3 tick vs. settlement. Cash JGB yields sit lower across the curve, with 2s outperforming. Tokyo CPI, a bellwether of national inflation, showed a marginal slowdown in headline & core deflation in March.

BONDS: Draghi Tells EU Leaders To Kickstart European Bonds

The EU needs to start the journey towards a common European bond, Italy's Prime Minister Mario Draghi told bloc leaders Thursday, MNI understands. Accepting it was a long-term goal, Draghi, formerly President of the ECB, said 'it's important to have a political goal' in place. A veteran of the GFC and the following eurozone debt crisis, Draghi also said a top priority for all leaders was to ensure no mistakes were made during the economic recovery from Covid-19.

- He pointed to the U.S. as an example of the fiscal framework needed, where there is a capital markets union, a complete banking union and a safe asset, a source noted. Draghi, who once famously said the ECB would do 'whatever it takes' to maintain the euro, said these three things underpinned the dollar's international role.

- EU leaders had earlier reaffirmed their calls for a strengthening of the international role of the euro, looking to enhanced 'strategic autonomy' - although current ECB head Christine Lagarde said this did not mean currency competition or protectionism.

FOREX: Antipodeans Trim Weekly Losses, Yen Lags On Firmer Sentiment

The Antipodeans led high-beta FX higher amid a broader pick-up in risk sentiment, with regional equity benchmarks posting gains amid light news and data flow. Some saw U.S. Pres Biden's pledge to double his Covid-19 vaccination target & German Cll'r Merkel's decision to abandon her plan to implement a five-day lockdown over Easter. AUD/USD crossed above the $0.7600 mark and approached its 100-DMA after charting a Doji candlestick yesterday. The Aussia looked through a research note from Westpac, who now expect the RBA to extend its QE programme by a further A$100bn rather than by A$50bn.

- USD/JPY extended gains after completing a bullish flag pattern. The rate was bought into the Tokyo fix but eased off highs later on, while the yen remained the worst G10 performer.

- The PBOC fixed its USD/CNY mid-point at CNY6.5376, 8 pips below sell side estimates. USD/CNH extended its pullback from Thursday's high, despite China's tensions with a number of Western countries.

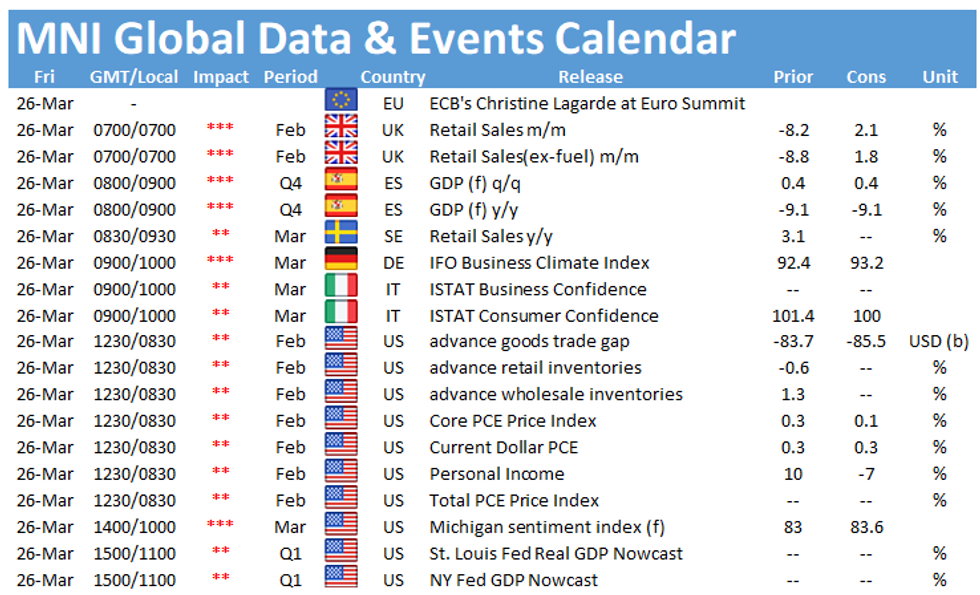

- Focus turns to U.S. personal income/spending & PCE data, German Ifo survey, Italian sentiment gauges, Swedish retail sales & Norwegian unemployment as well as comments from ECB's Rehn, BoE's Saunders & Tenreyro.

FOREX OPTIONS: Expiries for Mar26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E487mln-EUR puts), $1.1900(E749mln)

- USD/JPY: Y108.75-80($680mln)

- EUR/GBP: Gbp0.8600(E416mln-EUR puts)

- AUD/USD: $0.7500(A$539mln), $0.7765(A$1.7bln)

- USD/CAD: C$1.2900($520mln)

- USD/CNY: Cny6.40($1.1bln)

ASIA FX: Mixed As Greenback Rally Pauses

The greenback paused its rally on Friday, moves were mixed.

- CNH: Offshore yuan is weaker, the World Bank upgraded China's growth forecast to 8.1%, but PBOC research predicted 5%-5.7% from now until 2025.

- SGD: Further gains in the greenback saw USD/SGD higher, on track for the fourth straight day of gains. The rate now sits just below the 2021 high of 1.3531. It was reported yesterday that Singapore and Indonesia would both gradually allow more tourism in their respective countries.

- TWD: The Taiwanese dollar has declined again, consolidating above 28.50. TWD has been pressured by foreign equity sales, so far this week there has been $2.25bn worth of sales of Taiwan equities by foreign funds. Former board members have petitioned the CBC to change its currency regime.

- KRW: The won is stronger, consumer confidence rose to the highest in over a year, while the IMF are positive on South Korea's economy, the body now forecasts the South Korean economy to grow 3.6% this year, up from its estimate in January of 3.1%.

- MYR: Ringgit is flat, Director-General of Health Noor Hisham urged Malaysians to show "strong social responsibility" as the country's R rate rose to 1.0.

- IDR: Rupiah is slightly lower, Indonesia's banking loans fell 2.15% Y/Y in Feb, according to the latest update from the FSA.

- PHP: Peso strengthened, BSP left its benchmark interest rate at the record low of 2.0% yesterday and increased inflation forecasts.

- THB: Baht weakened, Thailand's Covid-19 economic panel will consider steps to attract FDI & allow vaccinated foreign tourists to travel to Phuket without having to quarantine from Jul 1.

ASIA RATES: Bonds Under Pressure In Risk On Trade

INDIA: Yields are higher across the curve as bonds come under pressure globally, but moves more muted than regional counterparts. Reasons for this include pledged support from the RBI, auction cancellation and additional liquidity operations.

INDONESIA: Cash curve is mixed, belly seeing yields rise, short end yields fall while long end is flat. The finance ministry announced IDR 30tn of bond sales next week after a disappointing sale this week.

CHINA: The PBOC matched maturities with injections again today, the fifteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. The market appears sanguine about liquidity, the overnight repo rate is 24bps lower today at 1.7592%, while the 7 day repo rate has averaged 2.054% since the return from LNY, below the 2.20% prevailing rate at the PBOC. Futures are under pressure as stocks rise after declining for the past three sessions. Cash yields are higher, steepening seen with 30-year supply on the docket today.

SOUTH KOREA: A risk on tone has seen bonds pressured in South Korea; data earlier in the session showed consumer confidence rose to 100.5 in March, up from 97.4 previously. This is the highest reading since January last year. Elsewhere, the IMF upgraded South Korea's growth forecast.

EQUITIES: Green To Finish The Week

Major Asia-Pac bourses are in the green on Friday, large gains reversing some of the declines seen earlier this week. The technology sector is driving gains, TSMC has helped the Taiex higher. Major benchmarks in China are up around 2%, the biggest single day advance in two weeks. In South Korea Samsung Heavy helped buoy the index after winning a KRW 2.81tn order, while Samsung Display reported a 50% share in the smartphone panel market.

- Futures in Europe and the US are higher, Nasdaq futures are the outperformer on the tech rally. Positive sentiment has been further boosted by US President Biden's declaration that he wants to double the target for vaccinations administered.

GOLD: Hovers Near Week's Low

The yellow metal is lower, losing ground for the second straight session and the fourth day this week, on track for its first weekly decline since March 5. Markets are still assessing the weak 7-year US auction which briefly saw yields spike. A broad risk on tone has pressured gold, with equity markets recouping some of their recent losses. Gold last trades down $2.69 at $1724.32/oz, touching the lowest level this week, a break of $1720 brings $1700 into focus before looking at the 2021 low around $1680.

OIL: Higher On The Day, Lower On The Week

Crude futures have risen on Friday, WTI is last up $0.61 at $59.17/bbl, while Brent is up $0.49 at $62.44/bbl. On a weekly basis oil is on track for a third weekly decline.

- Markets are still weighing the implications of the trapped container ship in the Suez canal, reflation efforts have so far failed, which has raised the prospect that the ship could continue to block the route for days. The route facilitates almost 10% of total seaborne oil trade.

- Upside could be tempered by renewed COVID-19 concerns as infection numbers in Europe rise, which has forced countries to extend their mobility restrictions, dampening the demand outlook for oil. Markets look ahead to the next OPEC+ meeting on April 1 where the coalition is expected to roll over production cuts.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.