-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese & HK Stocks Surge On COVID Hope

- Optimism surrounding the Chinese COVID situation biased Tsys lower in Tuesday’s Asia-Pac session, with a modest downtick in the number of new daily COVID cases in the country and speculation surrounding an impending press conference which will be held by the Chinese health authorities applying pressure.

- The CSI 300 is up close to 3%, while the Shanghai Composite is +2.20%. Early gains were supported by no escalation in onshore social unrest, while a slight downtick in covid cases also helped. Later this afternoon the National Health Commission holds a briefing (3pm local time), with the focus on Covid prevention and control measures. The other benefit for local equities has been further support for the property sector, as the authorities announced late yesterday, whereby developers will be allowed to raise funds through share listings (among other things). The Shanghai Property sub-index is up 7.23% so for the session.

- Coming up is the German CPI for November, while US house price data and November consumer confidence are also due. We will also get the latest round of ECB & BoE speak.

US TSYS: Hope Surrounding The Chinese COVID Situation Applies Light Pressure

TY futures deal a little off the base of their overnight range, while cash Tsys run 2-3bp cheaper as the curve bear flattens.

- Optimism surrounding the Chinese COVID situation biased Tsys lower in Tuesday’s Asia-Pac session, with a modest downtick in the number of new daily COVID cases in the country and speculation surrounding an impending press conference which will be held by the Chinese health authorities applying pressure.

- As we have noted elsewhere, speculation surrounding the potential for a complete re-opening of China seems a bit misplaced to us, although there may be further tweaks to China’s ZCS announced at the press conference.

- Richmond Fed President Barkin seemingly OK’d a slowdown to 50bp rate hike increments, although pointed to a longer hiking cycle with a potentially higher end point vs. previous expectations, as he stressed that the central bank will do what it needs to do, echoing the central Fed message.

- A block buy in TY futures (+1.3K) helped the space find a bit of a base after the China induced sell off.

- Looking ahead German state and national inflation data will provide interest in London hours, as will the aforementioned Chinese press conference re: COVID. Further out, NY hours will see the release of some of the house price metrics and Conference Board consumer confidence data.

JGBS: Mix Of Inputs Promotes Steepening Of Curve

The impetus derived from core global FI markets since Monday’s Tokyo close, firstly on hawkish ECB & Fed commentary, then on increased optimism surrounding the COVID situation in China (discussed elsewhere) biased JGBs lower on Tuesday.

- This allowed futures to extend through their overnight base, printing -26 ahead of the close, a little above worst levels of the day. Meanwhile, the major cash JGB benchmarks run 1bp richer to 4.5bp cheaper as the curve twist steepens

- 2s outperform on the back of a solid round of 2-Year JGB supply (the only benchmark running firmer on the day), while 10s are capped by their proximity to the upper boundary of the BoJ’s permitted YCC.

- Elsewhere, comments from Japanese Finance Minister Suzuki, pointing to defence spending that equates to 2% of Japanese GDP, may have provided additional bearish impetus, although this was in the range of spending outcomes that had been outlined by media source reports.

- Local data had no tangible impact on the space.

- Looking ahead, the release of the BoJ’s monthly Rinban outline will generate some attention after hours. This comes in the wake of tweaks to this month’s schedule as the BoJ looked to contain the latest meaningful challenge of its YCC settings, although there isn’t much speculation re: tweaks this time around.

- Flash industrial production data headlines the domestic docket on Wednesday.

AUSSIE BONDS: Chinese COVID Matters Front & Centre

A greater degree of optimism re: the Chinese COVID situation was evident on Tuesday, which biased the ACGB space lower.

- The run of fresh record daily new COVID cases in the country was halted, with speculation surrounding the potential content of an impending COVID-related press conference being held by the Chinese health authorities fuelling speculation of fresh movement in COVID restrictions.

- As we have noted elsewhere, speculation surrounding the potential for a complete re-opening seems a bit misplaced to us, although there may be further tweaks to China’s ZCS announced at the press conference.

- The space finished a little above its Sydney base after futures extended on their overnight downtick, leaving YM -4.0 & XM -9.0. Cash ACGBs were 4-9bp cheaper across the curve, with the 10- to 12-Year zone leading the weakness.

- EFPs were a touch narrower on the day, pointing to a bond-driven move.

- Bills saw some light bear steepening pressure, running flat to 3bp cheaper through the reds at the close

- Looking ahead, Wednesday’s domestic docket is bursting at the seams. It includes Q3 capex data, monthly CPI, building approvals & private sector credit, as well as A$700mn of ACGB Apr-33 supply and an address from RBA Head of Domestic Markets Kearns in front of the 2022 Australian Securitisation Conference.

NZGBS: Bear Flattening On Wider Impetus

The overnight, central bank rhetoric-driven moves in core global FI markets promoted bear flattening of the Aussie bond futures curve, although both YM and XM managed to finish post-Sydney dealing off of their respective overnight lows, with U.S. Tsys operating off of worst levels.

- The major contracts operate marginally below late overnight levels shortly after the re-open, with YM -7.5 and XM -4.5.

- Bills sit 5-11 ticks lower through the reds, with the front end of the IR strip leading the way lower, once again aided by hawkish global central bank rhetoric in post-Sydney dealing.

- Flash PMI data and the release of the weekly AOFM issuance slate headline the domestic docket on Friday, although participants will likely focus on headlines and wider macro flows when it comes to drivers of market activity.

FOREX: USD Unwinds Most Of Monday's Gains On China Optimism

The BBDXY has given up a good chunk of its gains from Monday's session. The index was last -0.50% and sitting just under 1274.50 (Monday saw a 0.63% gain). Risk appetite has been supported by strong gains across China/HK equities, which has weighed on the USDs safe haven appeal.

- A slight downtick in Covid cases, no escalation in social unrest and a press briefing later today from the China National Health Commission (NHC) is spurring re-opening hopes. Our first instinct is that today would be far too soon to announce anything like a mass re-opening in China, but markets are trading like there will be at least another tweak to the country’s COVID restrictions.

- High beta plays AUD, NZD and NOK lead the moves higher. AUD/USD is back above 0.6700, +0.80% for the session, while NZD has lagged somewhat this afternoon, last above 0.6200. Note CNH is up over 1%, with USD/CNH sub 7.1700.

- JPY is a lagged, with USD/JPY down 0.30% and the pair last around 138.50. EUR and GBP are up around 0.50% against the USD.

- Coming up is the German CPI for November, while in the US house price data and US November consumer confidence are due.

FOREX OPTIONS: Expiries for Nov29 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0450 (324mln).

- EURGBP: 0.8600 (500mln).

- USDJPY: 139 (435mln).139.70 (277mln), 140 (244mln).

- USDCAD: 1.3500 (295mln).

- USDCNY: 7.1992 (500mln), 7.20 (851mln).

ASIA FX: USD/CNH Dips 1% Amid Covid Optimism

USD/Asia pairs are mostly lower, with CNH and KRW leading the way. High yielders, INR and IDR are laggards, likewise for MYR. Still to come today is Taiwan Q3 GDP revisions, while tomorrow the focus will rest on the official China PMI prints and the BoT decision in Thailand (+25bps expected). Indian Q3 GDP also prints.

- USD/CNH is down over 1% from NY closing levels, last under 7.1650. The pair has unwound yesterday's gains and then some. Some slightly better domestic Covid case numbers and a press conference from the health commission later is spurring re-opening hopes. China/HK equities have rallied strongly today.

- USD/KRW 1 month is down over 1.2%, although is finding some buying interest ahead of 1320 (last 1325). The Kospi has steadily climbed during the session, last up over 1%. Offshore investors have bought $61.1mn of local shares so far.

- Spot USD/IDR is slightly higher, last 15732, with the pair seeing little benefit from lower USD/Asia levels elsewhere. We are close to recent cyclical highs around 15750. Equity market underperformance, coupled with higher US real yields are weighing.

- USD/THB is back above 35.60, but well down on early session highs above 35.80. Recent lows in the pair have come in around the 35.50 level. Tomorrow the BoT is expected to hike rates by 25bps to 1.25%.

- USD/MYR is back above 4.50 (last 4.5050, +0.50% for the session). Onshore equities are down around 1%. Some of the euphoria from Anwar's victory is coming out of markets, while Fitch notes that fiscal consolidation will be difficult for the new administration.

CHINA DATA: Official PMIs Due Tomorrow, Further Deterioration Expected

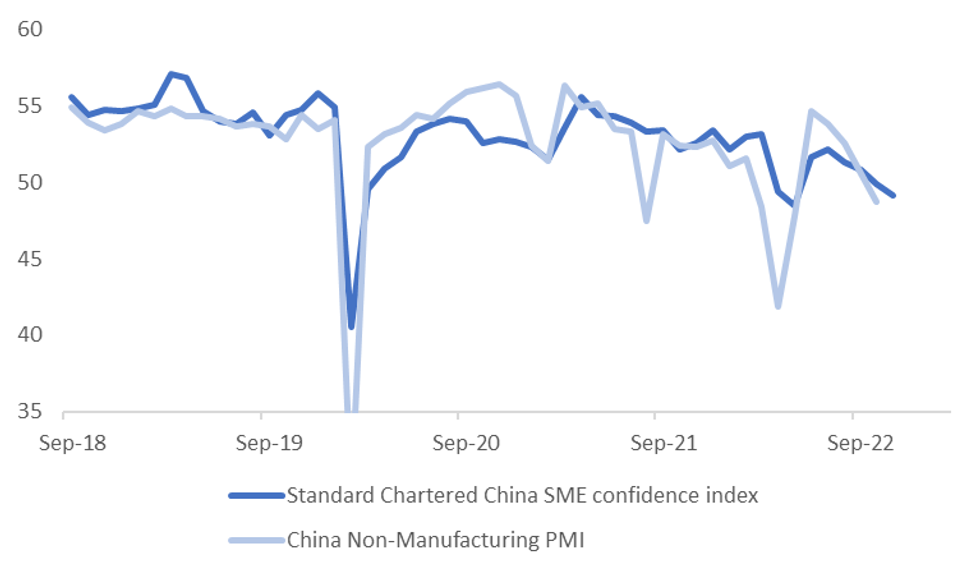

China official PMIs for November print tomorrow. Not surprisingly, the market expects further deterioration in both prints. Manufacturing is expected to moderate further to 49.0 from 49.2 last month (range of forecasts is 48.3 to 49.7), while non-manufacturing is forecast to print at 48.0 from 48.7 prior (range of forecasts is 46.3 to 49.2).

- The chart below overlays the Standard Chartered China SME index against the non-manufacturing PMI. The Standard Chartered Index slipped further in November to 49.16, although we remain above the May trough of 48.5.

- The data should confirm a further softening trend in China economic momentum, although this is well established theme in terms of the high frequency data.

Fig 1: China Non-Manufacturing PMI & Standard Chartered SME China Index

Source: Standard Chartered/MNI - Market News/Bloomberg

EQUITIES: China Covid Hopes & Property Stocks Drive Gains

Focus has rested on strong gains seen for China/HK bourses. These gains have dragged other parts of the region higher, while US futures are also firmer by 0.30%-0.45% at this stage, reversing some losses from the NY session.

- The CSI 300 is up close to 3%, while the Shanghai Composite is +2.20%. Early gains were supported by no escalation in onshore social unrest, while a slight downtick in covid cases also helped. Later this afternoon the National Health Commission holds a briefing (3pm local time), with the focus on Covid prevention and control measures.

- The other benefit for local equities has been further support for the property sector, as the authorities announced late yesterday, whereby developers will be allowed to raise funds through share listings (among other things). The Shanghai Property sub-index is up 7.23% so for the session.

- The HSI is slightly down from best levels, last up 3.85%, while the Kospi (+0.80%) and Taiex (+0.75%) have made gains as the session.

- Japan stocks are laggards, down 0.53% for the Nikkei 225, the firmer yen trend likely not helping.

- South East Asia has been more mixed, Philippines down 0.90%, following a recent strong run higher, while the JCI is off a touch (-0.15%).

GOLD: Prices Rise As Risk Sentiment Improves, China Covid Briefing Ahead

Gold prices are up 0.5% to around $1750/oz as the DXY has declined 0.4% since the NY close as risk appetite improved on sharply higher equity markets in Hong Kong and China. China is to hold a Covid press conference later today.

- Gold reached a low of $1741.36 early in today’s session and a high of $1750.60 recently. Any further improvement in risk sentiment that weighs on the USD could push bullion higher.

- Gold remains in a bullish trend and the latest pullback is seen as corrective. Today bullion moved away from the initial support at $1729.20, the 20-day EMA. The bull trigger is at $1786.50, the November 15 high.

- There is very little overnight except for some US house price data and US November consumer confidence. The focus of the week will be Friday’s payrolls.

OIL: Supply And Demand Reports Positive For Crude Prices

Supply and demand news has been positive for oil prices today, which are up over a percent. There are reports that OPEC+ will cut output at its December 4 meeting and China is to hold a press conference later regarding Covid prevention measures.

- WTI is currently trading close to its intraday high around $78.25/bbl after a low earlier of $76.29. Brent has been playing some catch up after diverging from WTI overnight and is also close to its intraday high at around $84.60. The USD weakened as risk sentiment improved and is now down 0.4%.

- Initial resistance for WTI is at $79.90/bbl, the November 25 high, and support at $73.38. It has been trading today in the upper part of this range.

- The EU price cap on shipments of Russian oil comes into effect on December 5, a day after the OPEC+ meeting. As of last night, the EU had not yet decided what the cap would be but a level as low as $62/bbl was discussed.

- There is very little overnight except for some US house price data and US November consumer confidence. The US API also publishes its latest inventory numbers. Last week it showed a drawdown of 4.8mn barrels.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/11/2022 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2022 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2022 | 0800/0900 | *** |  | CH | GDP |

| 29/11/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2022 | 0810/0910 |  | EU | ECB de Guindos Opens Encuentro Financiero Event | |

| 29/11/2022 | 0900/1000 | *** |  | DE | Hesse CPI |

| 29/11/2022 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2022 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/11/2022 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2022 | 1235/1235 |  | UK | BOE Mann Panels The Conference Board Conference | |

| 29/11/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2022 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/11/2022 | 1330/1430 |  | EU | ECB Schnabel Speech at Frankfurter Konjunkturgespraech | |

| 29/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/11/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/11/2022 | 1500/1500 |  | UK | BOE Bailey at Lords Economic Affairs Committee | |

| 29/11/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 30/11/2022 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.