-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Bid, E-minis Struggle, Familiar Themes In Play

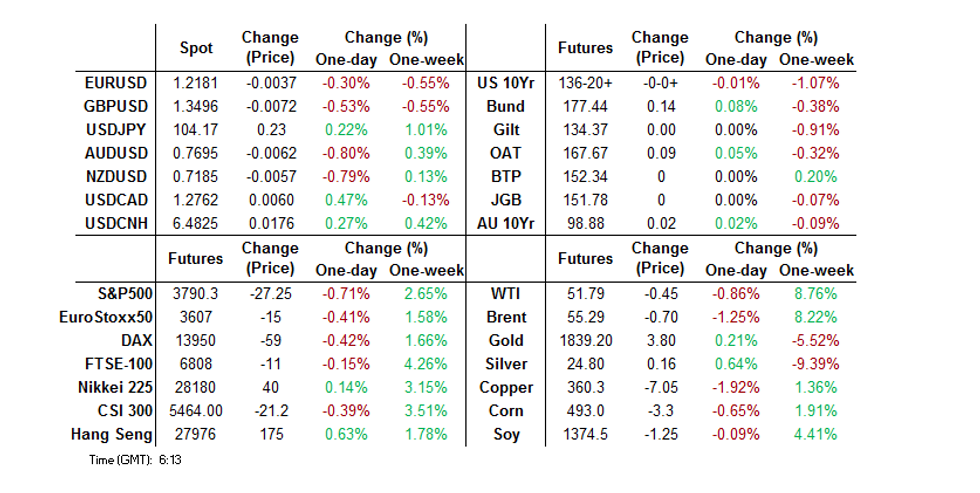

- USD edges further away from cycle lows in holiday thinned Asia-Pac trade, while T-Notes unwound early losses as e-minis ticked lower.

- The broader themes of U.S. fiscal matters, political worries, Sino-U.S. tension and COVID-19 angst remain at the fore

BOND SUMMARY: Aussie Bonds Firm, U.S. Tsys Active, Even With Japan Off

T-Notes corrected from worst levels of the Asia-Pac session after an initial flurry surrounding the U.S. fiscal dynamic and a breach of last week's lows (as well as a brief break below a level coinciding with the largest OI in TYH1 options, at 136.50) generated some pressure. That was before the ongoing political wrangling surrounding Trump impeachment matters, broader COVID-19 spread/mutation fears and simmering Sino-U.S. tensions (as well as softer e-minis) helped the contract back from early lows. The contract last trades at unchanged levels of 136-21, 0-06+ off intraday lows. Market conditions were a little thinner than usual owing to a Japanese holiday, which means that cash Tsys won't be open until London hours. Fedpseak from Bostic & Kaplan, as well as 3-Year Note supply will hit on Monday.

- The RBA's scheduled resumption of ACGB purchases (which met broader expectations in terms of size) and the bounce from lows in U.S.Tsys/light pressure on e-minis supported the Aussie bond space, with YM +0.5 and XM +2.0 at the close of Sydney trade. Participants looked through the final local retail sales print for November, which was marginally firmer than the strong flash reading, with the data reflective of the Victoria re-opening. Cash trade saw the ACGB curve flatten with swap spreads tightening a little across most of the curve.

FOREX: USD Kicks Off The Week With A Bid

The greenback caught a bid in early Asia, rising in the wake of some headlines that US House Speaker Pelosi would bring impeachment proceedings against US President Trump this week.

- US National Security Adviser O'Brien also said the US is considering an additional response to China over coronavirus and arrests made in Hong Kong, while the Trump administration said Saturday the US would remove its restrictions on diplomatic interactions with Taiwan.

- USD/JPY is higher, last up 25 pips at 104.19, JPY seeing some weakness after the discovery of a coronavirus variant similar to the UK strain. Japanese markets are shut for Coming of Age day which has impacted liquidity.

- AUD/USD down some 60 pips at 0.7696, breaking below Friday's low and through the 0.77 handle. There was chatter of sell stops offset against 0.7725 strikes with AUD 1.23bn rolling off today. An upbeat final reading of November retail sales failed to reverse sentiment. NZD/USD similarly under pressure having fallen below the 0.72 handle, last at 0.7189.

- GBP under some pressure on chatter of tighter lockdown measures in the UK, the Telegraph ran a piece saying the government are considering tightening restrictions on advice of scientists. GBP/USD last down 70 pips at 1.3499.

- The PBOC fixed USD/CNY midpoint at 6.4764, roughly in line with sell side estimates and around 56 pips higher than the previous fix as USD bounces and amid some renewed tensions between US and China. Inflation data was positive, both CPI and PPI printed above estimates, but the release did little to knock USD/CNH off its track higher.

FOREX OPTIONS: Expiries for Jan11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1960-70(E2.3bln-EUR puts), $1.2000(E864mln), $1.2095-1.2110(E1.6bln), $1.2125-35(E831mln), $1.2150(E669mln), $1.2200(E879mln), $1.2250-60(E1.1bln), $1.2295-1.2300(E3.8bln-EUR puts), $1.2310-15(E2.1bln-EUR puts)

- GBP/USD: $1.3150(Gbp597mln), $1.3290-1.3300(Gbp626mln), $1.3700-15(Gbp1.2bln-GBP puts)

- EUR/GBP: Gbp0.8950-65(E524mln-EUR puts), Gbp0.9000-04(E807mln-EUR puts), Gbp0.9105-10(E756mln-EUR puts), Gbp0.9300(E610mln)

- AUD/USD: $0.7625(A$1.2bln-AUD puts), $0.7724-25(A$1.3bln-AUD puts)

- USD/CAD: C$1.2550($550mln), C$1.2700($690mln-USD puts), C$1.2775-1.2800($905mln-USD puts)

- USD/CNY: Cny6.5000-20($580mln)

EQUITIES: Asia Mixed, E-Minis Pressured

The continued political tussling in the U.S., with the House set to bring impeachment articles against Trump to the floor in the coming days, a notable Boeing plane crash over the weekend, still simmering Sino-U.S. tensions and general worry re: COVID spread/mutations combined to weigh on the e-mini complex from the Sunday re-open, while Asia-Pac equity indices have seen mixed trade.

- Nikkei 225 closed, Hang Seng +0.1%, CSI 300 -0.4%, ASX 200 -0.9%.

- S&P 500 futures -25, DJIA futures -210, NASDAQ 100 futures -65.

GOLD: Offered On Firmer USD & DC Fiscal Expectations

Gold has struggled in Asia-Pac hours, with spot showing ~$8/oz lower, around the $1,840/oz mark at typing, once again printing below the 200-DMA in Asia-Pac hours, before reclaiming the threshold in recent dealing. Bears now look to the Dec 02 low at $1,807.5/oz. Focus has generally fallen on the broader USD strength seen in Asia-Pac hours and the prospect for higher U.S. yields surrounding the fiscal impulse that is expected to come to the fore in DC, although some of the more risk-negative news stories that crossed over the weekend have allowed bullion to move off lows. As a reminder, a Japanese market holiday has thinned out participation during Asia-Pac hours.

OIL: A Touch Lower To Start The Week

Asia-Pac hours have seen crude trade defensively, with WTI down ~$0.40, while Brent is closer to $0.70 worse off, as the defensive start to the week for e-minis (with some reasoning flagged elsewhere) and a stronger USD apply pressure to the space, allowing the benchmarks to tick away from their recent cycle highs.

- Crude-specific news flow has been fairly light, with the weekend seeing Iraq follow Saudi Arabia, as it nudged is OSPs to Asia higher.

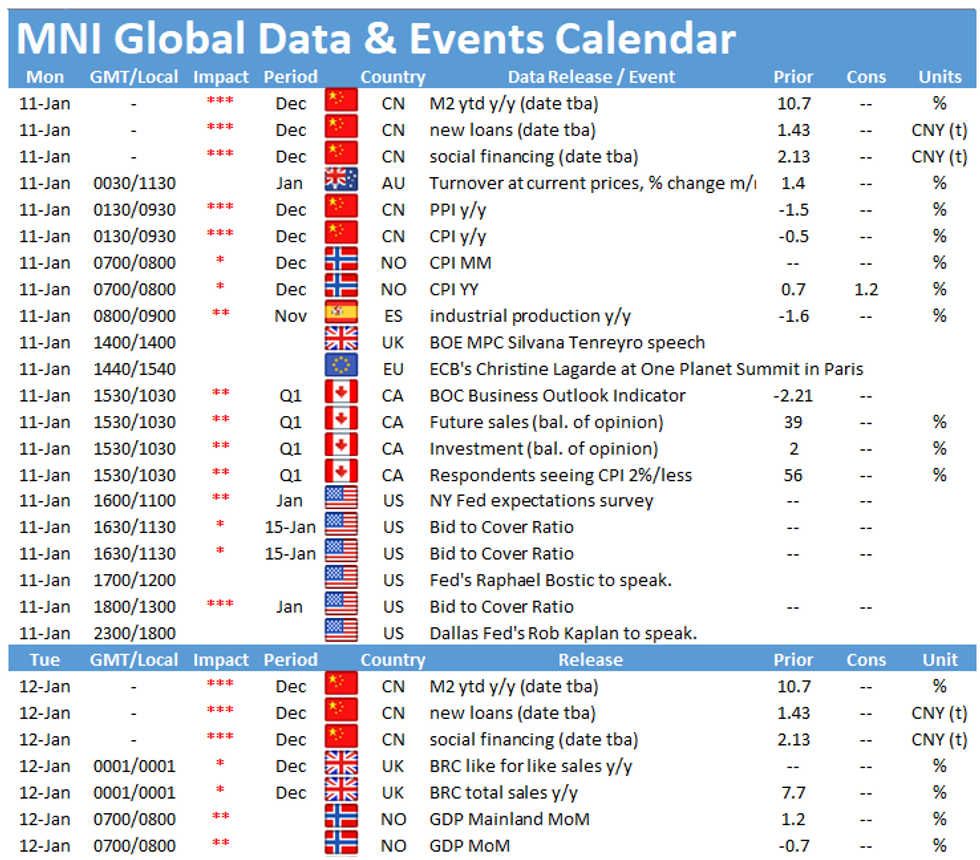

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.