-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Georgia Eyed

- USD dips & equities chop around in generally narrow ranges during Asia-Pac hours. Focus remains on Georgia Senate run-offs.

- GBP shrugs off the declaration of another lockdown in the UK.

- OPEC+ meeting extended to Tuesday as Russia pushes for uptick in group production.

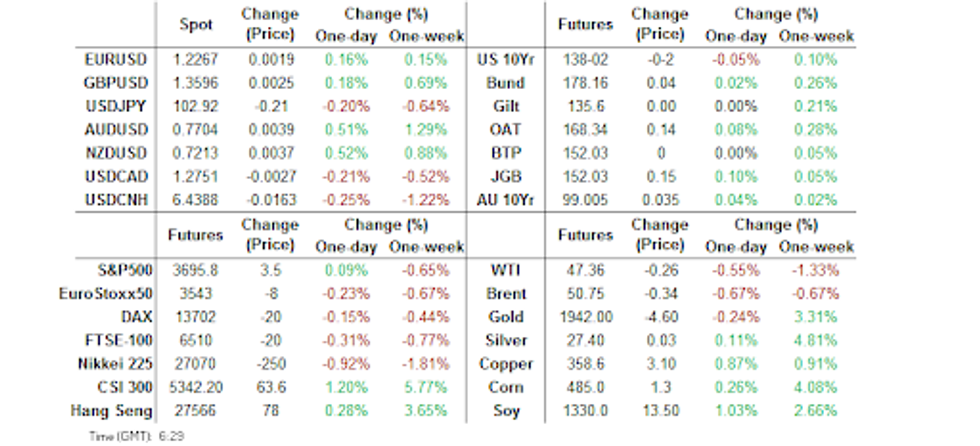

BOND SUMMARY: Core FI Sees Tight Ranges Prevail In Asia

Core FI has looked through the latest round of headlines re: Sino-U.S. tensions, which represented at least a marginal de-escalation as the NYSE walked back its previously declared intentions re: the de-listing of 3 large Chinese telecoms firms. T-Notes stuck to a narrow 0-03+range, last -0-01+ at 138-02+, while the cash Tsy curve saw some light bear steepening, with 30s cheapening by ~1.0bp in Asia-Pac hours. Indonesia's marketing of 10-, 30- & 50-Year USD bonds caught some attention, while light instances of downside screen interest via TYG1 136.00 puts and EDU2/U4 steepeners dominated on the flow side, as participants await the results of Tuesday's Georgia Senate run-offs (although most have suggested that we may not see conclusive results in Georgia for a few days).

- JGB futures reclaimed the 152.00 level, closing +15 on the day, just shy of best levels of the session, as participants looked to local COVID-19 worry (with growing chances of a state of emergency being declared in the coming days) and steady to softer offer/cover ratios in the latest round of BoJ 1-10 Year Rinban ops for support (even as the Bank bought Y50bn less of 1-3 Year paper vs. prev., in a move which was at least partially telegraphed by the tweaks to the limits of the relevant purchase band in the Bank's January Rinban outline). Bonds generally firmed by ~1.0bp across the JGB curve.

- The Australian curve bull flattened in the wake of the move seen in U.S. Tsys after Sydney closed on Monday, with little in the way of idiosyncratic headline flow noted, outside of a handful of cases of the UK's more aggressive COVID strain being detected in one of Western Australia's travel quarantine hotels. This came after Australian PM Morrison expressed hope that border restrictions between Victoria and NSW could be eased soon. YM closed +0.5, while XM was +3.5 at the bell, with the latter back from best levels, finishing just above 99.000. The latest round of ANZ job ads data was firm but had little impact on the broader space.

FOREX: NYSE Announcement Bolsters Yuan, Chinese State Banks Buy USD

The yuan picked up a bid after the NYSE said it ditched plans to delist three Chinese telecom giants and USD/CNH dipped to CNH6.4118, a level not seen since mid-2018. Recovery came quickly thereafter amid chatter that Chinese state banks bought the greenback at CNY6.43. USD/CNH wiped out the bulk of its earlier losses as a result, but remained below neutral levels.

- Yuan strength added strain to the greenback, which underperformed in G10 FX space amid reduced demand for safe havens & ahead of Georgia runoff elections. JPY and CHF also struggled for any meaningful impetus, with the former limited by Gotobi day flows.

- The Antipodeans topped the G10 pile, drawing support from the NYSE's announcement. AUD/USD staged a foray above the $0.7700 mark and NZD/USD crossed above the $0.7200 figure.

- TWD surged in sync with CNY, with USD/TWD dropping below the TWD28.00 level for the first time since 1997.

- KRW underperformed in the Asia EM basket after USD/KRW failed to make substantial headway beyond its cycle low yesterday.

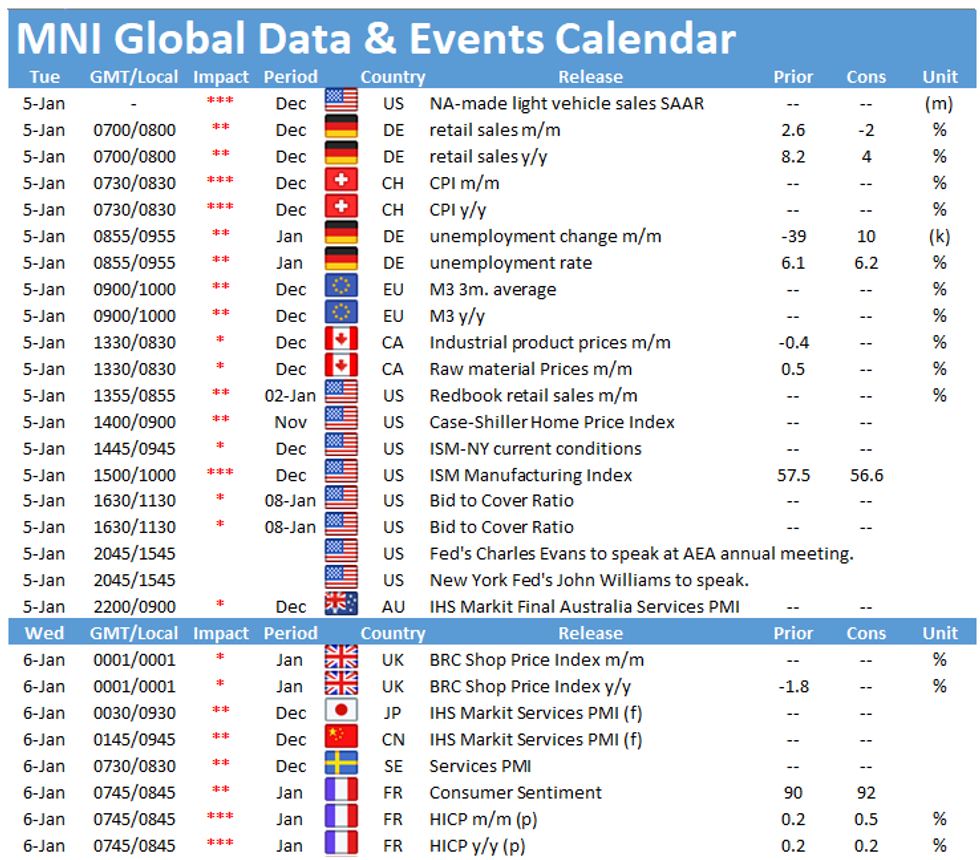

- Coming up today we have U.S. ISM M'fing, German retail sales & unemployment, flash French CPI and comments from Fed's Evans & Williams.

FOREX OPTIONS: Expiries for Jan05 NY cut 1000ET (Source DTCC)

- AUD/JPY: Y79.10-20(A$569mln-AUD puts)

- AUD/NZD: N$1.0485(A$960mln-AUD puts), N$1.0665(A$480mln-AUD puts)

- USD/CAD: C$1.2965-75($519mln)

EQUITIES: Little Cohesion Overnight

The major Asia-Pac equity indices exhibited little in the way of a cohesive sense of direction on Tuesday.

- The Chinese telecom sector was supported by headlines noting that the NYSE no longer plans to de-list the three major Chinese TelCos previously outlined. This came after earlier headlines run on RTRS re: guidance issued by the U.S. Treasury noted that President Trump's executive order forbidding investment into Chinese "military-controlled" companies does not require a divestment of current holdings.

- E-minis initially nudged higher after Monday's round of pressure, before pulling back from best levels of the session with Tuesday's Georgia Senate run-off elections eyed.

- Nikkei 225 -0.4%, Hang Seng +0.4%, CSI 300 +1.4%, ASX 200 unch.

- S&P 500 futures +4, DJIA futures +15, NASDAQ 100 futures +17.

GOLD: The Road To Georgia

The pull lower in U.S. real yields as 10-Year breakevens topped 2.00% for the first time since 2018 allowed bullion to firm in early dealing this week, as did a cautious start to broader trade in '21, with COVID-19 matters remaining front & centre. Spot last deals around the $1,940/oz mark, little changed vs. Monday's closing levels.

- Tuesday's Senate run-offs in the state of Georgia will likely provide the key short-term input for bullion, with the outcome key to the U.S. fiscal trajectory.

- From a technical perspective, key resistance is located at the Nov 9 high of $1,965.6/oz, while initial support comes in at the Dec 31 high of $1,900.9/oz.

OIL: Respecting Monday's Ranges

WTI & Brent last deal ~$0.30 below settlement levels, although the benchmarks have stuck to the confines of the respective ranges established on Monday.

- To recap, Monday ultimately saw broader COVID jitters and OPEC+ squabbling pressure crude, outweighing geopolitical tension surrounding Iran.

- Re: OPEC+, Russia is pushing for a 500K bpd increase for cumulative group production in February, while most of the group supported a rollover of the current production levels, per source reports. The disagreement means that participants reconvene on Tuesday with focus on the aforementioned divide as Russia looks for OPEC+ to regain market share, while others remain wary of the impact of increased supply in a fragile, COVID-hampered environment. This highlights the impact that OPEC+ fractures can have, which has been magnified by the now monthly meeting schedule for production pact participants.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.