-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

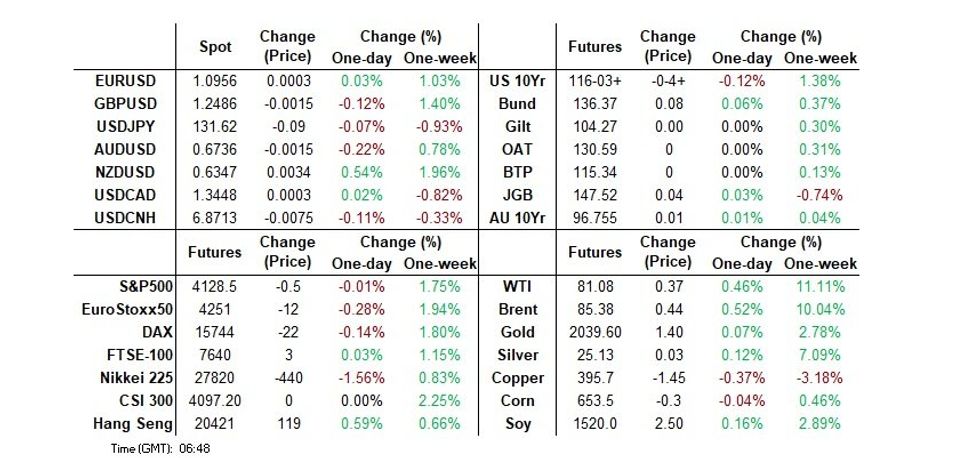

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Kiwi Soars On Shock From Orr

- NZD is the strongest performer in the G-10 space, bouncing after the RBNZ raised the OCR by 50bps to 5.25%. Markets had priced in a 25bp hike with only 1 economist of the 22 surveyed by Bloomberg looking for a 50bp hike.

- Cash Tsys sit 3bp cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 20s.

- The final prints of EU, German and French Services PMI headline in Europe today. Further out there is a slew of US data including ADP Employment, Trade Balance, Services PMI and ISM Services survey.

US TSYS: Curve Flattens In Asia

TYM3 deals at 116-03, -0-05, with a narrow 0-05 range on volume of ~96k.

- Cash tsys sit 3 bps cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 20s.

- Tsys were marginally cheaper in early dealing, there was no overt headline driver, Asia-Pac participants perhaps using yesterday's richening as an opportunity to exit long positions.

- Pressure moderately extended as the RBNZ hiked rates 50bps raising the OCR to 5.25%. Markets had priced in a 25bp hike with only 1 economist of the 22 surveyed by Bloomberg looking for a 50bp hike. Screen flow added to the pressure, ~3.3k lots of TY given post RBNZ decision over a couple of clips.

- Ranges were tight with little follow through on moves for the remainder of the session.

- Fedspeak from Cleveland Fed President Mester crossed early in today's Asian. She noted that the Fed will weigh credit conditions as it ponders further hikes, also noting she sees the Fed Funds rate above 5% and holding there for some time.

- There is a slew of US data due today including ADP Employment, Trade Balance, Services PMI and ISM Services survey.

JGBS: Futures Pare Overnight Gains

JGB futures initially spiked through their overnight high as Tokyo reacted to the impulse derived from the softer than expected U.S. JOLTS data released Tuesday, before paring the bulk of those gains to sit +9 ahead of the close. Cash JGBs run 1.5bp richer to 0.5bp cheaper, with the 7- to 10-Year zone outperforming on the bid in futures. Swap rates are a touch lower on the day, fading from session extremes alongside JGBs.

- Subdued to average offer/cover ratios in today’s BoJ Rinban operations (covering 1- to 5- & 10- to 25-Year JGBs) and U.S. Tsys finding a bit of an intraday base (within tight ranges) helped stabilise JGBs in the Tokyo afternoon, with futures off worst levels. Note that today’s Rinban was the first round of purchases after the BoJ’s well-documented tweak to the Q2 purchase bands, with 10- to 25-Year paper receiving a Y50bn uptick in purchases today (after the reduction seen in purchase sizes covering that bucket during March)

- LDP Secretary General Motegi noted that Japan doesn’t intend to lift taxes or issue debt to facilitate PM Kishida’s measures aimed at supporting families.

- On the corporate issuance side Berkshire Hathaway has mandated banks for JPY issuance, with the deal reportedly set to follow in “the near future,” as Warren Buffett’s company returns to the JPY debt market.

- Weekly international security flow data from the MoF and 30-Year JGB supply headline tomorrow.

AUSSIE BONDS: Stronger, Off Bests After Gov. Lowe’s Speech

ACGBs are richer on the day (YM +2.0 & XM +2.0) but slightly weaker after RBA Governor Lowe’s speech and Q&A at the National Press Club in Sydney. Cash ACGBs are 2-3bp richer with the AU/US 10-year yield differential +6bp at -11bp.

- In his speech, Lowe stated that the decision to hold rates steady this month did not imply rate increases are over. Pausing to “assess how the various influences on the economy balance out” was consistent with practice in earlier interest rate cycles, according to Lowe. He also said the board will benefit from an updated set of forecasts at the May meeting.

- During the Q&A session, Governor Lowe emphasised that it's premature to discuss interest rate cuts since the balance of risks is currently tilted towards more rate hikes. However, he noted that any decision would depend on the data.

- Swaps are 6-7bp stronger on the day with EFPs 4bp tighter.

- RBA-dated OIS pricing is 1-3bp firmer for meetings to September and 4-5bp softer beyond. May meeting has a 21% chance of a 25bp hike priced. There is 32bp of easing priced by February 2024.

- Further afield, the global calendar is relatively light with the highlights being European PMIs and US ISM Services.

NZGBS: Weaker, Led by 2-Year As RBNZ Surprises

The NZGB cash curve had twist flattened 18bp by the close with the 2-year benchmark yield 12bp higher and the 10-year 6bp lower after the RBNZ surprised the market with a 50bp rate hike. The 10-year benchmark yield had spiked 12bp higher on the decision but quickly recouped those losses. At the close, the cash 2/10 curve was -69bp, the most inverted since 2009.

- The 2s10s swap curve closed 12bp flatter at -94bp, a new low for this cycle and the most inverted since 2008.

- RBNZ dated OIS shunted firmer with pricing +18-24bp across meetings with 20bp of tightening priced for May. Terminal OCR expectations increased 21bp to 5.49%.

- The market pricing and BBG consensus had been expecting a stepped-down 25bp increase today after the 50bp hike in February. The bank had considered both a 25bp and a 50bp hike at today’s meeting but believed that a larger tightening was needed to return inflation to its 1-3% target band.

- The RBNZ revised up its estimates of the inflationary impact of the cyclone rebuild and noted upside risks to the fiscal outlook.

- Further afield, the global calendar is relatively light today with the highlights being European PMIs and German Factory Orders ahead of US ISM Services.

FOREX: Kiwi Outperforms After RBNZ Raises OCR 50bps

NZD is the strongest performer in the G-10 space, bouncing after the RBNZ raised the OCR by 50bps to 5.25%. Markets had priced in a 25bp hike with only 1 economist of the 22 surveyed by Bloomberg looking for a 50bp hike.

- NZD/USD firmed to $0.6380 in the immediate aftermath of the decision being paring gains to sit ~0.5% higher at $0.6345/50. ANZ revised their terminal rate call up to 5.5% with a 25bp hike in May expected. Westpac also look for a 25bp hike in May noting that the RBNZ seems intent on getting the OCR to 5.5% the level they saw as sufficiently contractionary in February.

- AUD/USD dragged higher by the RBNZ and comments for RBA Gov Lowe noting that the tightening cycle isn't over, however the pair couldn't hold gains and now trades little changed.

- Yen has observed relatively narrow ranges, USD/JPY prints at ¥131.65/75. The final March print of Jibun Bank Services PMI printed this morning at 55.0 rising from 54.2. The Composite measure rose to 52.9 from 51.9 in March.

- Elsewhere in G-10 moves have had little follow through with ranges respected for the most part.

- Cross asset wise; 2 Year US Treasury Yields are ~+3bps and BBDXY is little changed as are E-minis.

- The final prints of EU, German and French Services PMI headline in Europe today. Further out there is a slew of US data including ADP Employment, Trade Balance, Services PMI and ISM Services survey.

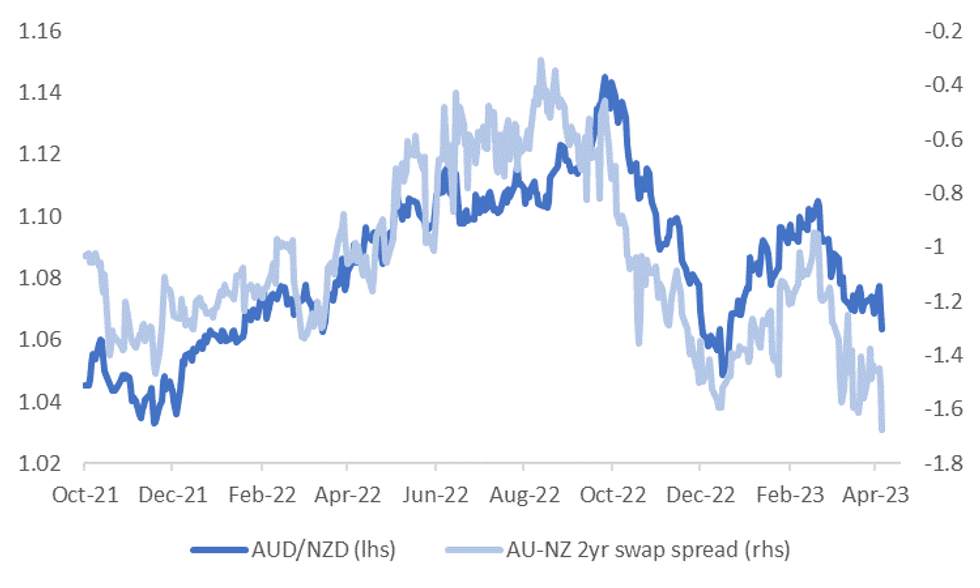

AUDNZD: AUD/NZD Can Still Play Catch Up To The Downside, On Fresh AU-NZ 2yr Wides

The AUD/NZD cross sits slightly off session lows, last around 1.0630/35. We got close to 1.0620 earlier post the RBNZ's surprise +50bps hike. The chart below points to further downside risks for the cross from a near term standpoint. The AU-NZ 2yr swap spread is at fresh wides -168bps, yet the AUD/NZD is still above lows that prevailed from late 2022.

- Markets are generally expecting a further +25bps from the RBNZ at the next policy meeting, while the RBA is more data dependent, with RBA Governor Lowe stating this isn't necessarily the end of the tightening cycle, but further moves look to be very much data dependent.

- The technical backdrop remains skewed to the downside for the AUD/NZD cross, with the 2022 low at 1.0471 a likely focus point.

- We likely need to see noticeably improvement in the AU terms of trade backdrop to turn the tide more positive for the A$.

- On the upside, bulls first look to sustain a break of the 20-Day EMA (1.0746) to target the 200-Day EMA (1.0880).

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

ASIA FX: USD/THB Breaks To Fresh Multi-Week Lows, Mixed Trends Elsewhere

USD/Asia pairs are mixed today, with liquidity lighter due to China and Hong Kong holidays. USD/THB broke lower through 34.00 to fresh multi week lows. Moves were more modest elsewhere, with some USD support evident on dips. Tomorrow, the RBI decision is out, with +25bps expected. Also due is the Caixin services PMI in China.

- USD/CNH has mostly been range bound in lighter liquidity conditions. The pair got briefly to 6.8625/30, but it wasn't sustained. We last sit around 6.8710/20 now, slightly down for the session, but still underperforming broader USD trends.

- 1 month USD/KRW was generally supported on dips. We saw a low of 1307, but now sit back at 1310. Onshore equities are firmer, but aren't providing much positive spill over. The financial regulator announced this afternoon that local currency lending rules would be eased for foreign bank branches. This is designed to boost lending. March FX reserves ticked modestly higher.

- Spot USD/INR is lower, last sub 82.20, this is up slightly from earlier lows. Bears look to target the 200-Day EMA at 82.04. Bulls look to target the 83 handle, however they will first need to clear the 20-Day EMA (82.35). The services PMI printed at 57.8, versus 59.4 prior. The RBI is expected to hike +25bps tomorrow.

- The SGD NEER (per Goldman Sachs estimates) is little changed from yesterday's closing level this morning, we remain well within recent ranges and below cycle highs seen in March. We sit ~0.7% off the upper end of the band. USD/SGD softened yesterday as broader USD trends continue to dominate. The pair is a touch off its lowest level since 23 March, after failing to break the 20-Day EMA early in the week, last printing 1.3255. Better than expected retail sales data, +12.7% y/y, (+2.0% forecast), hasn't shifted the NEER materially.

- USD/THB sits close to session lows, last under 33.98, so through downside support at 34.00. March CPI was weaker than expected, y/y dipping to 1.7%, while core fell to 2.83%. 33.75 could be eyed on the downside, while beyond that is mid-February lows around 33.40. Note on the topside the 20 and 50-day EMAs are in the 34.30/35 region. Buoyant tourism sentiment continues to drive Baht.

- USD/PHP is down modestly, last near 54.45, up from session lows sub 54.40. Out earlier was March inflation figures, which came in below expectations. The headline y/y printed at 7.6%, versus 8.0% expected. The prior read was 8.6% y/y. Note for March headline prices fell 0.2% m/m, aided by lower food and transport costs. Core inflation still firmed to 8% y/y, fresh highs back to 1999. The headline CPI print was at the bottom end of the BSP's range, but still firm core pressures may prompt BSP to tighten further (note the next BSP meeting is May 18).

MNI RBI Preview: April 2023: +25bps Likely, Focus Again On RBI Policy Stance

EXECUTIVE SUMMARY

- The main rationale for a further rate hike is India’s inflation backdrop. The early 2023 trends have been titled to renewed upside pressures. For February inflation, the headline printed at 6.44% y/y, so still above the RBI’s 2-6% target band. After dipping briefly through 6% y/y at the end of 2022, inflation pressures have recovered. A Bloomberg core CPI measure also remains elevated, printing at 6.23% y/y for February. This is down from 2022 highs, but is not showing a definitive downtrend, which is likely to factor into RBI thinking. Inflation is also running above RBI’s projections for the first part of 2023. Base effects should help ease headline momentum as we progress through Q2 though.

- Recent global banking turmoil, coupled with signs of slowing momentum in the US economy, could also factor into RBI thinking. External headwinds look set to grow for India, although we have already seen a sharp slowdown in export growth (last at -8.8% y/y for February). These concerns may be more of a headwind for further RBI action if domestic indicators of growth weren’t holding up, but they are.

- A number of sell-side analysts also expect this to the be the final hike of the cycle, or at least a pause post this meeting. The next policy meeting will be on June 8. This will leave the focus, tomorrow, on whether the RBI statement shifts to a more neutral stance, as opposed to continuing to focus on withdrawal of policy accommodation. In this respect the RBI faces a delicate balancing act.

- Click here for full preview.

EQUITIES: Japan Stocks Sink, South Korea Does Better In Holiday Affected Markets

Japan stocks are off sharply, the Topix down by nearly 1.9%, as global recession fears edge higher. Moves elsewhere have been more muted though, with South Korean stocks outperforming. Note also lighter liquidity with China and Hong Kong markets closed today for local holidays. US futures are close to flat presently.

- Japan stocks have been weighed by Toyota, which has contributed the most to lower index levels, while the electric appliances sector is also weaker. Such sectors are exposed to global demand, with softer US data outcomes raising recession fears in recent sessions. The firmer yen backdrop could also be weighing at the margins.

- In contrast such fears haven't weighed on South Korean shares, the Kospi is +0.55% higher, with the Kosdaq +1.35%. Samsung SDI has rallied strongly. The company will reportedly invest $3.1bn in advanced OLED panels, which has likely helped local sentiment. Offshore investors are still sellers of local equities (-$80.6mn so far today).

- Moves are more muted elsewhere. Indian shares are playing catch up after onshore markets were shut yesterday. The Nifty +0.50%. Philippines shares are higher, +0.55%, after the CPI miss gave hope the BSP can turn less hawkish.

- Australian shares are close to flat, while NZ shares are down 0.55%, as the RBNZ surprised with a +50bps hike.

GOLD: Bullion Supported By Lower USD And US Yields, Watch Wednesday’s US Data

Gold prices have held above $2000/oz during APAC trading and are up 0.2% following a 1.8% increase on Tuesday. It is currently trading around $2023.54. It reached an intraday high of $2025.37, which exceeded Tuesday’s high of $2025.04. Bullion has been supported by a lower dollar and US yields following weak US data. There is an increasing belief that Fed rates are close to peaking. The USD index has been flat on Wednesday.

- Gold broke through the bull trigger of $2009.70, the March 20 high, on Tuesday. It also rose past $2024.85, opening $2034 as a level to watch, but is now back below.

- There are no Fed officials scheduled to speak later today. But there is some important data with US ADP March employment forecast to rise 210k, and the trade deficit for February expected to widen slightly to $68.8bn. March ISM services is projected to ease to 54.4 from 55.1 and the prices paid component is likely to be watched closely, while the S&P Global services and composite PMIs are forecast to be stable at February levels.

OIL: Crude Continues Moving Higher, WTI Holds Above $81

Oil prices continued their march higher during APAC trading following Sunday’s OPEC+ output cut announcement. They are now about 7% higher than Friday’s close but are off this week’s highs. Brent is up 0.5% today to $85.36/bbl and WTI +0.4% to $81.06. Brent reached a high of $86.44 early on Monday and WTI of $81.81 on Tuesday. The USD index has been flat on Wednesday.

- Both Brent and WTI are now above their 200-day moving averages and up 17.3% and 21% from their March lows. The move was driven by a weaker dollar, stabilisation in the banking sector, supply measures and continued optimism on China demand. Watch resistance at $81.74 for WTI and $86.44 for Brent.

- The market has also been supported by the API reporting a crude drawdown of 4.3mn barrels in the latest week, according to Bloomberg citing people familiar with the data. A reduction in US stocks would be another factor weighing on supply. EIA data is published later.

- There are no Fed officials scheduled to speak today. But there is some important data with US ADP March employment forecast to rise 210k, and the trade deficit for February expected to widen slightly to $68.8bn. March ISM services is projected to ease to 54.4 from 55.1 and the prices paid component is likely to be watched closely, while the S&P Global services and composite PMIs are forecast to be stable at February levels.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/04/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/04/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/04/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/04/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.