-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk-On In Asia Pre-Yellen

- Stock connect flows from China support the Hang Seng, although the index is off of best levels after bulls failed to test the 30,000 mark, with broader flows generally risk positive.

- Some pointed to perceptions re: Yellen being willing to run the U.S. economy hot as another supportive catalyst, she appears in front of the Senate Finance Committee later today.

- DXY a touch lower, while Tsy yields nudge higher after the long U.S. weekend.

BOND SUMMARY: Mixed Overnight Vs. A Positive Risk Backdrop

Technical breaks and supportive flows from China fed into an extension of the recent leg higher in the Hang Seng, fuelling broader risk-on flows across wider financial markets, although the broader risk positive mood has edged away from the overnight extremes ahead of European hours. Elsewhere, some looked with hope towards Janet Yellen's Tuesday testimony on the Hill, pointing to previous comments during her time as the FOMC Chair, suggesting that she will have no qualms re: running the economy hot for a time if deemed necessary (albeit from a fiscal standpoint this time around). Elsewhere, China's state planning body flagged no sharp turns in the nation's macro policies during '21.

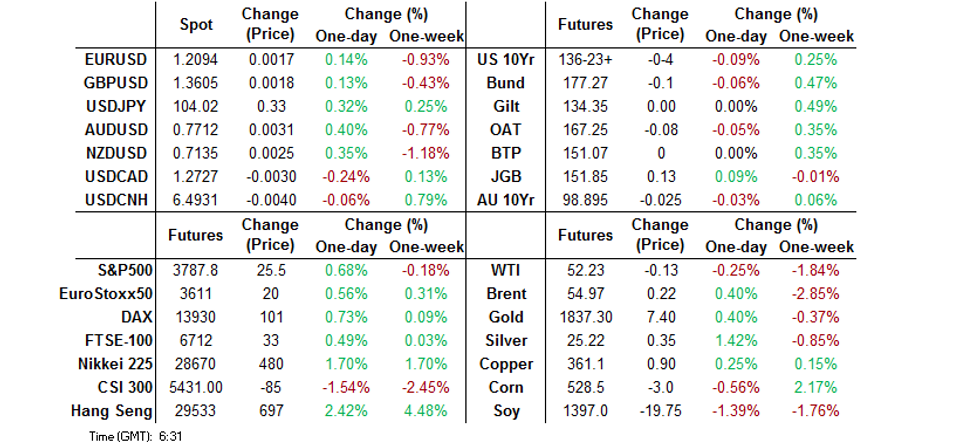

- This backdrop pressured Tsys during a session that was devoid of major macro headline flow, with 1.0-2.0K clip sellers of TYH1 futures at the fore on the flow front. T-Notes -0-04 at 136-23+ at typing, 0-02+ off lows, while the cash Tsy curve has bear steepened, with 30s sitting ~2.5bp cheaper on the day. Eurodollar futures sit unchanged to -1.0 through the reds, with a 5.0K lift of EDM4/Z4 providing the highlight on the flow front. Yellen's aforementioned address headlines locally on Tuesday.

- JGB futures held to a narrow range in morning trade, before extending higher during the Tokyo afternoon, closing at best levels of the day, +13, looking through the broader dynamic. 20s underperformed on the cash JGB curve, with auction dynamics at play. The latest round of 20-Year JGB supply wasn't as soft as December's 20-Year JGB auction, but wasn't strong by any stretch of the imagination, with some sources of worry (namely BoJ matters) likely facilitating a tentative bidding environment despite the recent outright and relative cheapening of 20s.

- The broader environment applied light pressure to the Aussie bond space, with YM -0.5 and XM -2.5 at the close of play, with A$ issuance dynamics likely adding further, albeit modest weight to the space. The 10- to 12-Year zone of the cash curve underperformed on the sell off.

FOREX: Risk Switch Flicked To On Ahead Of Yellen's Hearing

Markets switched into a risk-on mode ahead of the much awaited congressional testimony from Tsy Sec nominee Yellen. A market contact flagged speculation surrounding her upcoming address as a potential risk-supportive factor, with her 2016 comments re: running a "high-pressure economy" providing a point of reference. Firmer risk sentiment prompted participants to dump JPY, which landed at the bottom of the G10 pile. USD/JPY attacked the Y104.00 mark but failed to make much headway beyond that level. As a reminder, $1.1bn of options with strikes at Y103.90-104.00 expire at the NY cut, with $1.4bn of options with strikes at Y103.00 also due to roll off.

- The greenback was the second worst performer in the G10 basket, as markets have already discounted yesterday's WSJ piece suggesting that Yellen will advocate a market-determined FX rate.

- Commodity-tied FX gained on the back of better risk appetite. AUD outperformed its G10 peers but the rally in AUD/USD was limited by the imminent expiry of $1.2bn worth of options with strikes at $0.7700.

- USD/CNH edged away from session lows after NDRC head Yan poured cold water on chatter about a potential policy scale-back/exit this year, noting that there will be no sudden shift in monetary policy in 2021. Spot USD/CNH operated within a narrow range just shy of the CNH6.5000 figure.

- Focus turns to German ZEW Survey & final CPI report, as well as comments from BoE's Haldane, in addition to the aforementioned remarks from Janet Yellen.

FOREX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E575mln), $1.2000(E1.1bln), $1.2100(E567mln), $1.2150-60(E730mln-EUR puts), $1.2175-80(E769mln-EUR puts), $1.2190-1.2210(E4.7bln-EUR puts), $1.2250(E1.2bln-EUR puts), $1.2300(E1.4bln-EUR puts), $1.2350-55(E1.1bln-EUR puts)

- USD/JPY: Y102.50-55($568mln), Y103.00($1.4bln), Y103.25($735mln), Y103.50-55($787mln), Y103.65-75($775mln), Y103.90-104.00($1.1bln), Y105.00($638mln)

- GBP/USD: $1.3525-35(Gbp512mln), $1.3600-13(Gbp510mln)

- EUR/GBP: Gbp0.9020-25(E648mln)

- AUD/USD: $0.7450(A$1.2bln), $0.7625(A$573mln), $0.7650-55(A$618mln), $0.7700(A$1.2bln)

- AUD/NZD: N$1.0700(A$655mln)

ASIA FX: Most Asia FX Rebounds

Broad risk on sentiment has seen Asia FX bid as the greenback recedes. Volumes remain fairly thin with US participants slow to return after the Martin Luther King Jr holiday on Monday, while key risk events will likely keep traders on the sidelines. Yellen will testify to congress at 1000ET/1500GMT, while China report prime rates tomorrow, Malaysia and Indonesia announce rates later this week.

- The PBOC fixed USD/CNY at 6.4883, in line with sell side estimates and around 38 pips higher than yesterday. The bank also injected CNY 75bn, well above the CNY 5bn injections seen over the past week. However a weaker fixing for the yuan and a liquidity injection were not enough to dampen risk sentiment evident in the region, USD/CNH is last down 29 pips at 6.4940, but off worst levels of the day.

- USD/IDR has traded sideways, holding near neutral levels thus far. The pair last trades little changed at IDR14,065 & participants remain on the lookout for fresh catalysts.

- USD/THB has slipped and last deals down modestly at THB30.02, trading through yesterday's trough

- USD/SGD managed to break yesterday's low, down around 22 pips at 1.3291 having taken out the 1.33 handle which was challenged but not broken yesterday.

- USD/MYR has edged lower, but remains within yesterday's range amid lack of catalysts. Last 4.0490.

- USD/TWD has bucked the trend and ticked higher through the session, though the rate is still down on the day due to wild swings into the close on rumoured CB intervention. Last 27.992.

- USD/HKD last at 7.7525. HKD bid in Asia, hitting the highest levels in a week against the greenback as the Hang Seng soars and amid 19 consecutive sessions of inflows.

- USD/KRW heads into the close near session lows, down 2.35 at 1101.65 as the won rebounds from the lowest levels in 4 weeks, but still has some way to go to close the gap from Friday's close (close at 1099.75)

EQUITIES: Hang Seng Soars In Risk On Trade

Broad risk on sentiment in Asia has seen regional stock indices surge. The Hang Seng leads gains, last up over 2% (a fair way shy of intraday highs), morning trade saw southbound net inflows hit 82% of yesterday's record daily level. The bourse has seen inflows for 19 consecutive sessions (and is set to make it 20) as Chinese investors snap up stocks that were previously sold off as the US imposed restrictions on China.

- Chinese indices are the laggards in the region, CSI 300 down around 1.5%.

- In Australia the ASX 200 was up over 1% as latest testing data shows the latest coronavirus outbreak appears to be under control, consumer discretionary is the best performing sector.

- US stock futures have risen as yields have ticked lower, markets look ahead to an address from President-elect Biden's selection for Tsy Secretary, Janet Yellen, as she appears in front of the Senate Finance Committee in the wake of comments in the WSJ that the US would not pursue a soft dollar policy. European futures are also higher.

GOLD: We've Been Here Before

Bullion has coiled during Asia-Pac trade, with little to flag in the wake of Monday's recovery from the spike lower. The DXY sits a touch lower on net over that horizon, after unwinding the uptick that was seen during yesterday's holiday-thinned session, while U.S. real yields have edged higher, but remain within the confines of their respective recent ranges. That leaves spot bullion little changed on the day, just below $1,840/oz at typing.

OIL: Slight Divergence

WTI is ~$0.15 lower vs. Friday's settlement while Brent is ~$0.25 better off on the day. Broad risk on sentiment supported oil in Asia (there was no WTI settlement on Monday as U.S. markets were closed for a public holiday). Front-month February WTI futures expire on Wednesday.

- Data released yesterday showed China's refinery output rose 3% to a new record in 2020, painting a positive picture for the world's top crude oil importer.

- Global demand concerns are capping upside as Japan deals with the latest wave of infections and China reports a flurry of new Covid-19 cases. Data yesterday also showed nascent demand issues in India, sales of transport and cooking fuels over the first two weeks of 2021 declined M/M.

- Market participants will look ahead to the IEA monthly crude inventories report after market today.

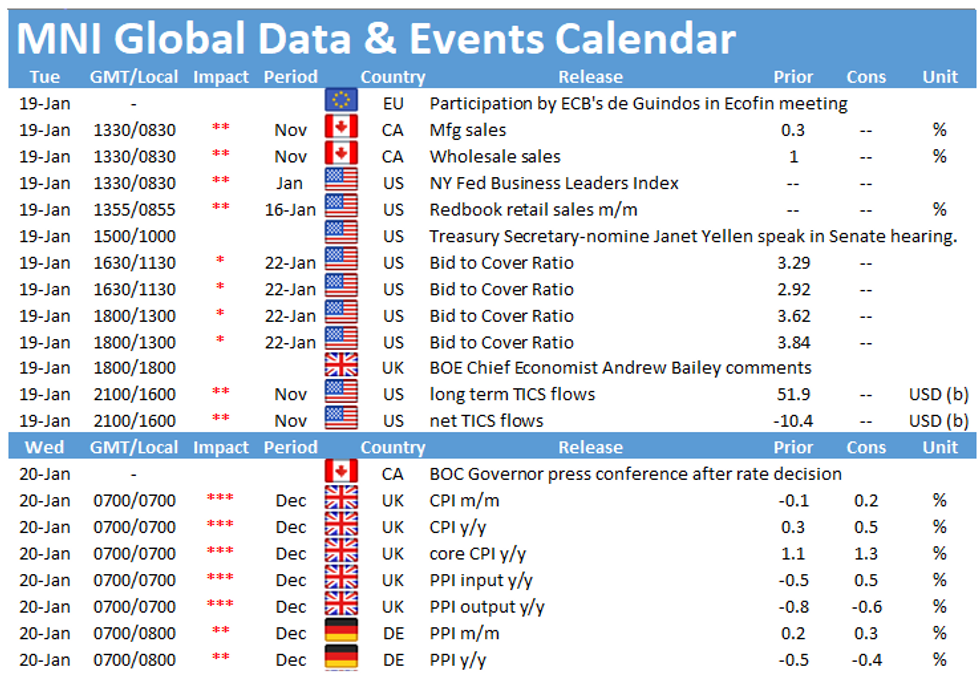

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.