-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: US Yields Lower Ahead Of Busy Fed Speak Schedule

- US Cash tsys are flat to 3bps richer across benchmarks in Asia-Pac dealings, with the curve steeper, as local participants extend the post-ADP employment data bull-steepening seen in yesterday's NY session.

- The USD has softened, the BBDXY down -0.20%, while equity sentiment has firmed. AUD and NZD are the strongest performers in the G10 FX space, although JPY has also rallied.

- In Asian markets, inflation prints were in focus, with South Korea and Philippines surprising on the upside, Thailand on the downside.

- Looking ahead, the Fed’s Mester, Kashkari, Barkin, Daly and Barr all speak. The ECB’s Lane and de Guindos also appear. Ahead of Friday’s payrolls US jobless claims and Challenger job cuts for September are released and there is also August trade data.

MARKETS

US TSYS: Richer In Asia-Pac Dealings, Bull Steepening Extended

TYZ3 is currently trading at 107-07+, +0-04 from NY closing levels.

- Cash tsys are flat to 3bps richer across benchmarks in Asia-Pac dealings, with the curve steeper, as local participants extend the post-ADP employment data bull-steepening seen in yesterday's NY session.

- There hasn’t been much in a way of meaningful newsflow in the Asian session so far.

- Later today sees Weekly Claims, Trade Balance, and various Fed speakers: Cleveland Fed Mester, MN Fed Kashkari, Richmond Fed Barkin, SF Fed Daly and Fed Vice Chair Barr.

JGBS: Futures Gains Pared After Poor Digestion Of 30Y Supply

In the Tokyo afternoon session, JGB futures are stronger, +18 compared to the settlement levels, but off the session’s best level. The paring of the morning’s gains can be attributed to the results from today’s 30-year JGB auction, which showed poor demand metrics. The low price failed to meet dealer expectations and the cover ratio ticked down versus last month’s auction. Moreover, the auction tail was significantly longer than the previous auction. Indeed, the tail was the longest since June 2019.

- Possibly limiting the damage from the poor digestion of 30-year supply elsewhere on the JGB curve has been the fact that US tsys are flat to 3bps richer across benchmarks in the Asia-Pac session. The curve is steeper as local participants extend the post-ADP employment data bull-steepening seen in yesterday's NY session.

- Cash JGBs are mixed, with yields 0.5bp lower (5-year) to 1.9bps higher (40-year). The benchmark 10-year yield is 0.4bp higher at 0.802%. It is slightly lower than the cycle high of 0.81%, set yesterday.

- The swaps curve has twist-steepened, pivoting at the 3s, with rates 0.3bp lower to 3.9bps higher. Swap spreads are wider across maturities beyond the 3-year.

- Tomorrow the local calendar sees Cash Earnings, Household Spending, and Leading and Coincident Indices.

AUSSIE BONDS: Richer, At Sydney Session Bests, Tracking US Tsys

ACGBs (YM +9.0 & XM +9.5) sit richer and at Sydney session highs. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined August trade balance. Considering that, the local market appears to have been guided by US tsys.

- Cash US tsys are flat to 3bps richer across benchmarks in the Asia-Pac session, with the curve steeper, as local participants extend the post-ADP employment data bull-steepening seen in yesterday's NY session.

- Cash ACGBs are 9-10bps richer, with the AU-US 10-year yield differential 3bps higher at -14bps.

- Swap rates are 6bps lower, with EFPs 2-4bps wider.

- The bills strip has bull flattened, with pricing +2 to +8.

- RBA-dated OIS pricing is 3-12bps softer across meetings beyond November, with Dec’24 leading. Terminal rate expectations have softened 5bps to 4.29%.

- Tomorrow the local calendar sees the release of the RBA’s Financial Stability Report.

AUSTRALIAN DATA: Surplus Widened, Soft Goods Imports In Line With Slowing Demand

The trade surplus widened more than expected in August to $9.64bn from a downwardly-revised $7.32bn. The move was driven by strong export growth of 4% m/m while imports fell 0.4%. The trade surplus remains elevated but has been trending lower over Q2 and Q3 with exports now down 2% y/y. Strong commodity exports have helped to boost federal government revenues.

Australia trade balance $mn

Source: MNI - Market News/Refinitiv

- Both goods and services exports were robust rising 4.5% m/m and 1.5% m/m respectively. The strength in merchandise is deceptive as it was driven by a 96.7% increase in non-monetary gold, rural fell 2.6% and non-rural rose only 0.5% with weakness in coal shipments weighing on the total. Tourism exports rose 2% m/m.

- Imports are now down 3.1% y/y and goods are -6.7% y/y, in line with softer domestic demand. While merchandise imports fell 1% m/m in August, services rose 1.6%. Consumer goods rose 1.7% m/m, due to a 3.4% rise in non-industrial transport, but are down 3.1% y/y. Capital goods fell 11.8% m/m with the weakness broad based but a 82.3% drop in the volatile aircraft component particularly weighed. Machinery & equipment fell 0.9%. Tourism imports rose 3.9%, outpacing exports.

- From the September trade release, the ABS will no longer publish monthly services statistics.

Source: MNI - Market News/ABS/Refinitiv

NZGBS: Richer But Underperforms The $-Bloc, NZ Budget Deficit Update Weighs

NZGBs closed 2-5bps richer but in the cheaper half of the local session’s trading range. The NZGB 10-year sharply underperformed its $-bloc counterparts, with the NZ-US and the NZ-AU yield differentials 10bps and 6bps wider respectively. At +81bp and +95bp respectively, the differentials are close to their widest levels for the year.

- The performance of NZGBs may have been influenced by news indicating that the NZ government's annual budget deficit contracted less than originally predicted in May. According to the NZ Treasury, the deficit for the year ended June 30 stood at NZ$9.45bn, which marked only a slight improvement from the NZ$9.69bn recorded in the previous year. In contrast, the government had projected a deficit of NZ$6.96bn in its May budget.

- Mixed results at weekly bond auctions also likely weighed, with the cover ratios for the May-28 and Apr-33 lines falling below 2.00x. In contrast, the May-41 bond saw a solid 3.34x.

- Swap rates are 3-5bps lower, with the 2s10s curve steeper.

- Following the RBNZ’s hint yesterday that they may opt to maintain a tight monetary policy for an extended period instead of pursuing further tightening, RBNZ-dated OIS rates have softened. They are now 3-9bps softer from pre-decision levels across meetings extending to August 2024.

- Tomorrow the local calendar is empty.

RBNZ: MNI RBNZ Review – October 2023: Extended Pause Rather Than Hike

- The RBNZ left rates at 5.5% at its October meeting where it has been since the last hike in May, and it reiterated its high-for-longer stance but didn’t imply that there may be more tightening. The NZ outlook “remained similar” to the last meeting. The statement suggests that while there may some near-term changes to the bank’s expectations, its focus, the medium-term, is unaltered.

- There was a tweak to the end of the statement saying that policy needs to remain restrictive for “a more sustained period of time” rather than “the foreseeable future”. This may be implying that rather than increase rates further, policy may stay tight for longer than is currently projected. Key data are released before the next meeting, including Q3 CPI & inflation expectations and employment/wages. The November 29 meeting will also include revised forecasts.

- At 5.76%, the market still has a 25bp hike priced by April 2024. Prior to the RBNZ decision, a 25bp hike had been fully priced by February 2024.

- See full review here.

FOREX: AUD & NZD Outperform Amid Continued USD Pull Back

The dollar correction, which commenced on Wednesday has continued through the first part of Thursday trade. The BBDXY is off a further ~0.25%, last near 1272.40. We are below Wednesday lows for the index, but still tracking higher for the week.

- A further decline in US yields has been a key driver of sentiment. US yields off 2.5bps for the 10yr to 4.71, with fairly consistent moves lower across the curve. Equity sentiment has improved, with all major regional Asia Pac indices higher, while US equity futures recouped earlier losses.

- AUD/USD has been the best performer, up 0.75% to 0.6375/80 in latest dealings. Commodity prices have been relatively steady, so this looks to be more of risk-on equity led move. A slight better trade surplus position for August, aided by higher exports has also helped.

- NZD/USD is back to 0.5950, up ~0.60%, the second best performer in the region.

- USD/JPY slumped through Wednesday lows, getting to 148.26, but sits higher now, last near 148.45/50. Exporter USD selling was cited as a positive, while Japan PM stated to local unions he will strive to make wage gains sustainable per wire reports (BBG, RTRS).

- EUR/USD is +0.20%, last near 1.0525.

- Looking ahead, the Fed’s Mester, Kashkari, Barkin, Daly and Barr all speak. The ECB’s Lane and de Guindos also appear. Ahead of Friday’s payrolls US jobless claims and Challenger job cuts for September are released and there is also August trade data.

JAPAN DATA: Offshore Selling Of Local Stocks & Bonds Stabilizes

Aggregate weekly investment flows were more modest in the final week of September. Foreign investors turned modest net buyers of local stocks, +¥71bn yen. This only modestly trimmed the monthly outflow though, which was -¥5384.7bn. Offshore purchases of local bonds also turned positive but were a very modest ¥25.8bn, a slight offset on the prior week outflow.

- In terms of Japan domestic outflows, purchases of offshore stocks picked up to ¥721bn. This was the strongest weekly outflow since late August/early September.

- Outbound flows to offshore bond markets were also positive, but at a more modest ¥297.1bn.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending September 29 | Prior Week |

| Foreign Buying Japan Stocks | 71.0 | -3025.5 |

| Foreign Buying Japan Bonds | 25.8 | -2020.6 |

| Japan Buying Foreign Bonds | 297.1 | -541.6 |

| Japan Buying Foreign Stocks | 721.0 | -23.1 |

Source: MNI - Market News/Bloomberg

EQUITIES: Asia Pac Markets Firm, US Equity Futures Recoup Early Losses

Equity sentiment is mostly positive in Asia Pac markets in Thursday trade to date. Sentiment has been aided by a further modest pull back in US yields (the 10yr yield is down ~2bps to 4.71%). US equity futures have recouped earlier losses as well, although are only marginally in positive territory. Eminis were last back near 4300, up from earlier lows at 4286. Wednesday highs just above 4304 remain intact for now. Nasdaq futures have followed a similar trajectory.

- Japan stocks have rebounded, the Topix +1.70%, the Nikkei 225 up 1.45%. Bellwether names in the transport and banking sector have led the rebound. Offshore investors halted sales of local shares last week. Japan PM told unions that he will make stronger wage gains sustainable, per news wire reports (see this BBG link).

- Hong Kong markets are also firmer, the HSI tracking around 0.80% higher at this stage. China Property Developer Sunac won approval for a debt restructuring plan, which has likely aided sentiment.

- Tech sensitive plays are higher, following positive leads in Wednesday US trade. The Taiex up 1.1%, the Kospi +0.80%.

- The ASX 200 has rebounded 0.65%, but is lagging other major indices. A softer commodity price backdrop likely weighing at the margins.

- In SEA most markets are higher, although Thailand and Philippine stocks are down. The stronger than expected Philippines CPI data a likely headwind.

OIL: Crude Consolidates After Sharp Fall, Waiting For Payrolls

Oil prices are holding most of Wednesday’s losses with WTI up 0.5% to $84.65/bbl and Brent +0.6% to $86.35, close to intraday highs. Yesterday prices collapsed over 5% falling through key levels driven by technical selling and market fears re the demand outlook. Crude is now in a corrective cycle. The USD index is 0.2% lower.

- US EIA crude inventories fell 2.22mn barrels with distillate down 1.27mn but gasoline up 6.48mn, adding to concerns of falling demand, but refinery utilisation fell. Last week showed the lowest gasoline demand for the time of year in 25 years, according to Bloomberg. Nerves re the economic outlook contained in higher bond yields have also driven the change in direction for crude.

- OPEC’s unchanged stance on production cuts was unable to support the market.

- Later the Fed’s Mester, Kashkari, Barkin, Daly and Barr all speak. The ECB’s Lane and de Guindos also appear. Ahead of Friday’s payrolls US jobless claims and Challenger job cuts for September are released and there is also August trade data. US employment will be important for giving direction to the oil market.

GOLD: Steady At The Lowest Level Since March

Gold is +0.4% in the Asia-Pac session, after it steadied near its lowest level since March on Wednesday, supported by lower Treasury yields. Over the past eight trading days, gold experienced its most extended losing streak since 2016, primarily driven by rising yields, fueled by expectations that the Federal Reserve will maintain higher interest rates for an extended period.

- The US Treasury 2-year yield finished 10bps lower at 5.05%. The 10-year yield finished down 6bps, after setting a fresh cycle high at 4.88%. At 4.73%, the 10-year yield remains 16bps higher over the week.

- US Treasury latched onto lower-than-expected ADP private employment data (+81k vs.150k est. and +177k prior). Also, the services PMI printed 50.1 (vs 50.2 flash; 50.5 prior), but the services new orders sub-index fell sharply from 57.5 to 51.8, the lowest level for the year. The decline was reportedly linked to weak domestic and foreign client demand.

- Later today the US calendar sees Weekly Claims, Trade Balance, and various Fed speakers: Cleveland Fed Mester, MN Fed Kashkari, Richmond Fed Barkin, SF Fed Daly and Fed Vice Chair Barr. The all-important Non-Farm Payrolls report is due for release on Friday.

RBI: MNI RBI Preview - October 2023: On Hold, 'Withdrawal Of Accommodation' To Remain

- The broad consensus is for no change in the RBI's policy rate tomorrow. This is also our strong bias. Inflation pressures have moved off recent highs, but risks remain around the outlook and it is likely to be too early for the central bank to declare comfort on the price backdrop.

- Growth appears to be holding up well, particularly compared to the rest of the region.

- The RBI is likely to maintains its bias around 'withdrawal of accommodation' in terms of language used to describe the policy bias.

- Full preview here:

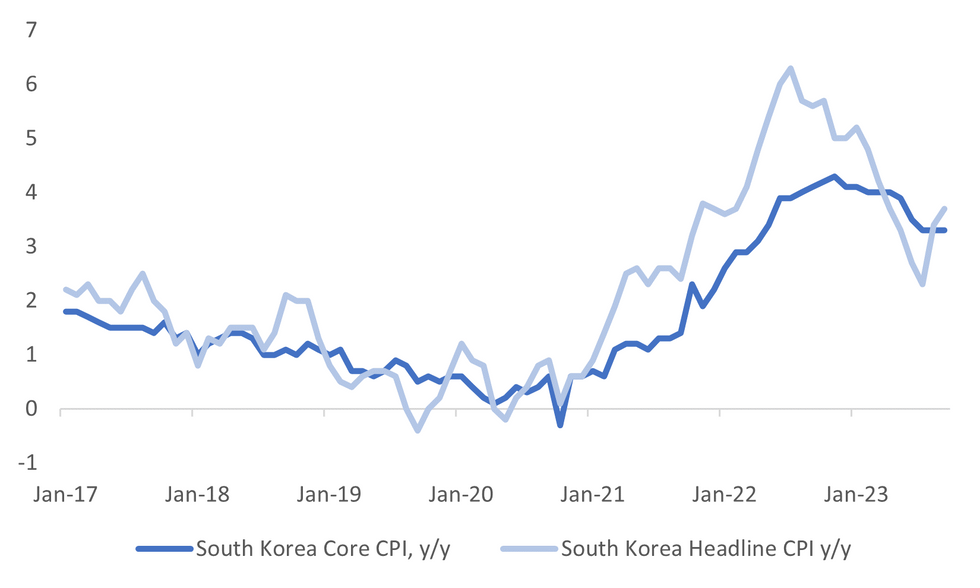

SOUTH KOREA: Headline Inflation Firms, Core Holds Steady

South Korea September CPI was stronger than expected. The m/m came in at 0.6%, versus 0.4% forecast and 1.0% prior. This left the headline y/y at 3.7% (3.5% forecast and 3.4% prior). Core (ex food and energy) rose 3.3% y/y, against a 3.3% forecast and 3.3% prior.

- Core inflation, based on this measure, has been steady around 3.3% for the third straight month, see the chart below.

- Looking at the detail, food inflation was 1.6% m/m, housing/utilities +1.3% m/m and transport +1.3% m/n. Working the other way, we saw modest falls in health (-0.1% m/m) and recreation and hotels (both -0.2% m/m).

- Of the 12 sub categories, 8 saw either the same y/y inflation pace or an acceleration versus August. Food, clothing, housing, furnishings and restaurants have y/y paces that are above headline inflation. Transport also moved back into a positive y/y pace (0.1%) after running negative for the past 6 months.

- Such a backdrop is likely to keep the BoK still cautious around the inflation backdrop. Note the next policy meeting is on the 19th of October. Finance Minister Choo stated that inflation is expected to stabilize again in October.

Fig 1: South Korea Inflation - Headline & Core Y/Y

Source: MNI - market News/Bloomberg

THAILAND: Inflation Falls Further Below Target & Suggests Rate Pause

Thailand CPI inflation for September printed lower than expected as it heads towards zero. Headline CPI eased to 0.3% y/y from 0.9% in August and core to 0.6% from 0.8%, the lowest since January 2022, and both well below the Bank of Thailand’s 1-3% target. These extremely low inflation prints are likely to confirm the signal from the BoT at its September meeting that it is ready to pause. USDTHB is off Wednesday high of 37.24 and is currently around 36.88. It fell on the weaker CPI data to 36.85.

- The ministry of commerce has cut its 2023 forecast moderately to 1-1.7% from 1-2% and it has said that there could be deflation in Q4.

- The cut in diesel and electricity taxes put downward pressure on inflation and should help to keep inflation low going forward.

- Food prices fell 0.1% y/y despite an increase in rice to 4.6% y/y from 2.5%. September global processed rice prices rose 7.1% m/m. Fruit & vegetable inflation was 0.5% y/y down from 5.9% and most of the other components were also lower.

- Non-food inflation eased to 0.6% from 1% in August driven by housing. Transportation rose though to 1.7% y/y from 0.3%.

Source: MNI - Market News/Refinitiv

PHILIPPINES: September Inflation Surprises On The Upside

Philippines September inflation surprised on the upside. M/M was +1.1%, versus 0.4% expected and 1.1% in August. This left y/y headline at 6.1% against a 5.3% expected and 5.3% prior. Note BSP had a forecast range estimate of 5.3-6.1%, so we were at the upper end of that.

- Core inflation was 5.9%, down slightly from the August 6.1% pace. This is still comfortably above the BSP's 2-4% target band.

- Looking at the detail, focus again was on food inflation, particularly rice. Rice inflation was nearly 18% y/y, which push overall food inflation to +9.7% y/y (from 8.1%y/y in August). This came despite the government placing a cap on rice prices.

- Elsewhere, there was a slight downtick in y/y momentum for some categories, but only housing/utilities, transport (which is rebounding), IT and education remain sub the top end of the BSPs 2-4% target band.

- Today's print will raise the risks around a further BSP interest rate hike. Recall, Governor Remolona recently stated an out of cycle policy move could be considered, ahead of the next policy meeting on November 16.

ASIA FX: USD/Asia Pairs Lower, Aided By Broader USD Pullback

USD/Asia pairs are lower in line with broader dollar trends/improved equity risk appetite. We sit slightly above session lows in latest dealings and overall gains (outside of the won) have been fairly modest. The main focus today has been CPI prints. South Korea and Philippines prints surprising on the upside, while Thailand's was to the downside. Still to come is Taiwan CPI. Tomorrow, we have the RBI decision in India (no change expected), along with a number of regional FX reserve prints.

- 1 Month USD/KRW last tracked near 1348, against earlier lows close to 1345. Equity sentiment has firmed (Kospi +0.40%), but offshore investors remain net sellers of local stocks (-$99.4mn). At the start of the session, the South Korean FinMin stated that the authorities will actively curb FX risks. CPI headline pressures were stronger than expected in September but core was steady.

- Spot USD/THB got to a low of 36.795 in early dealing, but we now sit slightly higher, last near 36.93. This is comfortably off recent highs above 37.20. Headline CPI eased to 0.3% y/y from 0.9% in August and core to 0.6% from 0.8%, the lowest since January 2022, and both well below the Bank of Thailand’s 1-3% target. These extremely low inflation prints are likely to confirm the signal from the BoT at its September meeting that it is ready to pause.

- USD/PHP sits slightly lower, last near 56.66, which is towards the bottom end of the recent range. We have only seen modest peso gains so far today, with the authorities likely curbing recent upside USD/PHP pressures against a stronger USD backdrop (which may be limiting follow through downside in the pair). September CPI was at the top end of the BSP's forecast range (6.1% y/y) and the central has stated it stands ready to resume the tightening cycle. Local equities are noticeably weaker, down close to 1% at this stage, a potentially more hawkish BSP backdrop not helping.

- USD/INR is very steady, last near 83.23, a touch below recent highs. The services PMI printed for September, rising to 61.0 from 60.1, underpinning a strong domestic growth backdrop. Tomorrow, the RBI is expected to hold rates steady, but retain a tightening bias.

- USD/IDR got to lows of 15575, but now sits back above 15600. Recent highs remain intact around the 15644 level.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/10/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/10/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/10/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/10/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 05/10/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/10/2023 | 0945/1145 |  | EU | ECB's Lane, BOE Broadbent and Riksbank Breman at ECB MP Conference | |

| 05/10/2023 | 0945/1045 |  | UK | BoE's Broadbent speaks at ECB conference | |

| 05/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 05/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/10/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/10/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2023 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 05/10/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/10/2023 | 1400/1600 |  | EU | ECB's de Guindos speaks at ECB MP Conference | |

| 05/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/10/2023 | 1440/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/10/2023 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 05/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 05/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/10/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2023 | 1615/1215 |  | US | Fed Vice Chair Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.