-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Year-End In Sight

- Sino-U.S. tensions and what looked like some year-end profit taking in USD shorts shaped Asia-Pac trade.

- The Brexit & U.S. fiscal sagas continue to drag on, with impending (soft) deadlines eyed.

- Disjointed year-end rebalancing flows in focus owing to the holiday season, with money set to flow from equities into bonds.

BOND SUMMARY: Rebalancing, When & How Much?

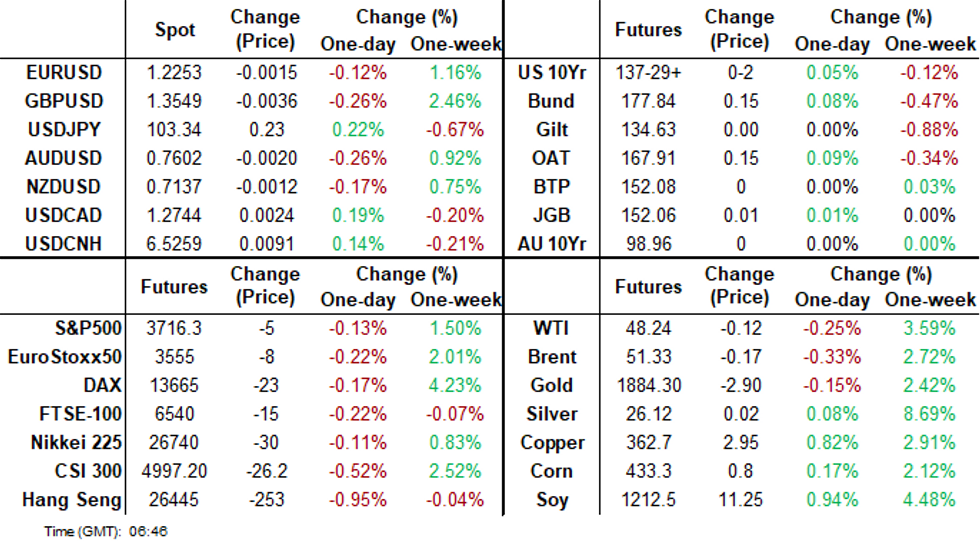

Cash Tsys are flatter as we head into London hours, with the space trading 0.2-2.7bp richer across the curve, as end-of-year focus remains zoomed in on fiscal developments in DC. T-Notes last +0-03 at 137-30+, sticking to a 0-05+ range thus far, recently firming on the back of a RTRS source piece which suggested that "the United States is set to add dozens of Chinese companies, including the country's top chipmaker SMIC, to a trade blacklist on Friday." There has also been some interest in rebalancing flows into year-end (which are seen as equity -ve, bond +ve), in addition to some worry re: the potential delay of a fiscal stimulus package in DC on the back of disagreement surrounding the re-appropriation of unused funds from the Federal Reserve's support schemes.

- JGB futures shrugged off the latest BoJ decision, with the upcoming assessment of the Bank's QQE with YCC scheme on the back of the sustained deviation from its inflation target flagged ahead of time by the Nikkei. There is little scope for major policy tweaks stemming from the assessment given the Bank's comments re: QQE with YCC i.e. there is no need to change the framework. The corporate liquidity provision extension was in line with broader expectations, at least in terms of time horizon (through the end of Sep '21), with the scheme made a little more generous overall (see earlier bullet for further details). Futures finished -1 on the day, with yields little changed across the JGB curve, although the short end was generally a touch firmer than the long end. The space also looked through the softest domestic headline CPI reading in a little over 10 years, with the dynamic providing no real shock vs. market and BoJ expectations.

- The Aussie bond space stuck to narrow ranges during Sydney hours, with YM & XM closing at unchanged levels. Focus remained on the domestic COVID-19 situation and guidance from the NSW government which advised residents in one of Sydney's suburbs to stay at home as much as possible over the next three days to fight the cluster that has emerged. The cash ACGB curve saw some light twist steepening, with some knock-on from Thursday's U.S. Tsy trade seen. Elsewhere, post-MYEFO issuance guidance from the AOFM was noted, in which it knocked its ACGB issuance target for the current fiscal year down to A$230bn vs. around A$240bn previously (A$153.5 billion has been completed YtD). The AOFM reiterated that "specific guidance on weekly tender volumes together with plans for new Treasury Bond lines will be provided on 15 January 2021."

FOREX: DXY Off Lows Amid Year End Flows; Thin Volumes Exacerbate Moves

A stronger US dollar was the main driver of price action in Asia, moves exacerbated by thin volumes heading into year end. The DXY has edged away from its newly minted cycle lows during Asia-Pac hours, which has applied some pressure to USD crosses. A pullback from intraday lows for U.S. real yields has allowed DXY to rise in Asia.

- AUD/USD down 25 pips at 0.7596 and dropping below the 0.76 handle. There is some concern in Australia around a mini resurgence of COVID-19 cases. Sydney reported 7 new cases in the past two days, which bought to an end around 5-weeks of virtually no cases and limited transmission in Australia's largest city.

- NZD/USD saw a similar move, down 23 pips at 0.7126. The December final ANZ Business Confidence rose to 9.4 from -6.9 previously, while the Activity Outlook rose to 21.7 from 9.1. The headline figure is at a 3-year high at these levels. The release had no effect on NZD.

- JPY saw some weakness heading into the BoJ decision. The bank kept rates on hold as expected, but tweaked its scheme focused on corporate liquidity provisions, extending its duration by 6 months, out to the end of September 2021 (meeting expectations), while noting that further extension will be considered if necessary. USD/JPY up 36 pips at 103.46, benefitting from a stronger greenback.

- GBP/USD fell, last down 60 pips at 1.3526. There has been no significant news flow, some of the weakness can be attributed to money coming off the table ahead of year end. There is still hope from some a Brexit deal can be reached, Ireland's Deputy Prime Minister Varadkar was the latest to weigh in saying both sides are edging towards a Brexit trade deal and he thinks both sides will want to get a deal by Christmas. However comments from UK Prime Minister Johnson were not so optimistic. He said the EU needs to substantially soften its stance on fisheries to secure a deal. European Commission President Ursula von der Leyen said there was progress big differences remain and noted fisheries as a sticking point. EU Chief Negotiator Barnier has proposed extending the deadline to Sunday.

- The PBOC strengthened the yuan by 47 pips at the fix, but this wasn't enough to stem the USD bid, USD/CNH up 90 pips at 6.5259 after brushing the 6.50 handle on Thursday.

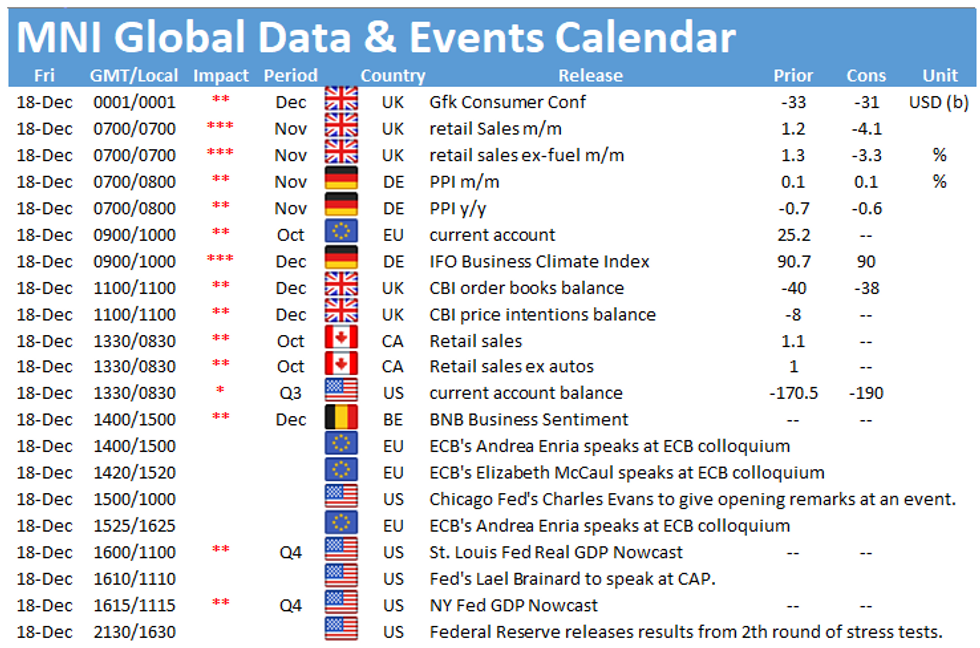

- A fairly thin economic docket to end the week. UK Retail Sales and German PPI are both at 0700GMT while ECB Current Account data and German IFO Survey at 0900GMT.

FOREX OPTIONS: Expiries for Dec18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850(E765mln), $1.1950(E608mln), $1.2000(E2.6bln), $1.2025(E896mln), $1.2100-05(E1.3bln), $1.2115-25(E1.3bln), $1.2150(E1.6bln), $1.2170-80(E870mln), $1.2200(E875mln), $1.2225-30(E668mln), $1.2250(E2.2bln), $1.2300-10(E880mln)

- USD/JPY: Y101.00($550mln), Y101.75($500mln), Y101.90-05($1.0bln), Y103.50-60($655mln), Y104.00($614mln), Y104.15-25($882mln), Y104.50($835mln), Y105.10-15($631mln), Y106.65($1.8bln)GBP/USD: $1.3450-65(Gbp530mln)

- EUR/GBP: Gbp0.9300(E500mln)

- USD/NOK: Nok8.50($400mln), Nok8.75($550mln)

- AUD/USD: $0.7485(A$526mln), $0.7500(A$1.45bln), $0.7550-70(A$798mln)

- USD/CAD: C$1.2675($520mln), C$1.2750-55($1.4bln mixed, $1.35bln USD puts), C$1.2825($605mln), C$1.2950($905mln), C$1.3000($856mln), C$1.3050($648mln), C$1.3150($1.0bln)

- USD/CNY: Cny6.50($555mln), Cny6.55($635mln), Cny6.58($760mln)

- USD/MXN: Mxn19.50($1.95bln-USD puts), Mxn20.00($2.4bln-USD puts), Mxn20.50($1.3bln)

EQUITIES: Headlines Light, Rebalancing Flows Eyed

A lack of headline flow (outside of those pointing to an increase in Sino-U.S. tension) and continued focus on the fiscal situation in DC made for a limited round of Asia-Pac trading on Friday, with the major regional indices unchanged to a touch lower.

- The ASX 200 underperformed vs. its major regional benchmarks as the financial and energy sectors struggled.

- E-minis also nudged lower against the headline-light backdrop.

- Month-, quarter- and year-end portfolio rebalancing flows are also be eyed and are seen as equity negative/bond positive. Note that these flows may be even more sporadic than normal, given the upcoming holiday schedule.

- Nikkei 225 -0.2%, Hang Seng -0.8%, CSI 300 -0.3., ASX 200 -1.2%.

- S&P 500 futures -5, DJIA futures -74, NASDAQ 100 futures -22.

GOLD: Looking To $1,900/oz

Gold is marginally softer on the day, last trading a touch above $1,880/oz.

- The DXY has edged away from its newly minted cycle lows during Asia-Pac hours, which has applied very modest pressure to bullion after spot failed to challenge $1,900/oz on Thursday. A reminder that the pullback from intraday lows for U.S. real yields allowed gold to move off best levels of the day on Thursday. A softer USD and lower U.S. real yields had provided support for bullion in early U.S. trade.

- Bulls now look to clear psychological resistance in the form of the $1,900/oz mark to open the way higher.

OIL: Little Changed In Asia

WTI & Brent sit $0.15-0.20 below their respective settlement levels after a softer USD supported crude on Thursday.

- Some light risk-negative flows and USD strength have been at the fore in Asia-Pac hours.

- It has been a quiet 24 hours or so for crude-specific news flow, although Thursday saw Saudi Arabia point to continued close management of the supply/demand mix for crude, as the country's Energy Minister looked to reassure markets.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.