-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Core FI A Touch Softer As E-Minis Bounce In Asia

US TSYS: E-Mini Bounce In Driving Seat

The major factor in Asia-Pac hours was E-minis pushing away from their Wednesday's trough. While there has been nothing in the way of overt triggers during Asia-Pac hours, at least on the broader wires, some positive musings re: COVID-19 treatment matters (albeit, developments that seemingly do not shift the vaccine timetable) during the NY- Asia crossover and the aforementioned FT story re: "the US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business," are the probable drivers here. T-Notes were offered but are recouping their modest losses, on decent volume of ~105K, last -0-00+ at 138-25, operating in a 0-04+ range, with cash yields unchanged to 1.7bp cheaper across the curve, bear steepening in play.

- As a reminder the early Tsy bid unwound on Wednesday, after the space initially drew support from the U.S. fiscal impasse and evolving COVID situation in Europe, with the lack of a sustained meaningful bid despite the selloff in equities leaving many pointing to risk parity funds as the culprits. This left cash Tsys little changed come the close. The pricing on the latest 5-Year Note auction was solid enough, stopping 0.5bp through WI, although the dealer takedown ticked higher vs. prev., to sit just above the recent average, while the cover ratio edged lower, to sub-average levels.

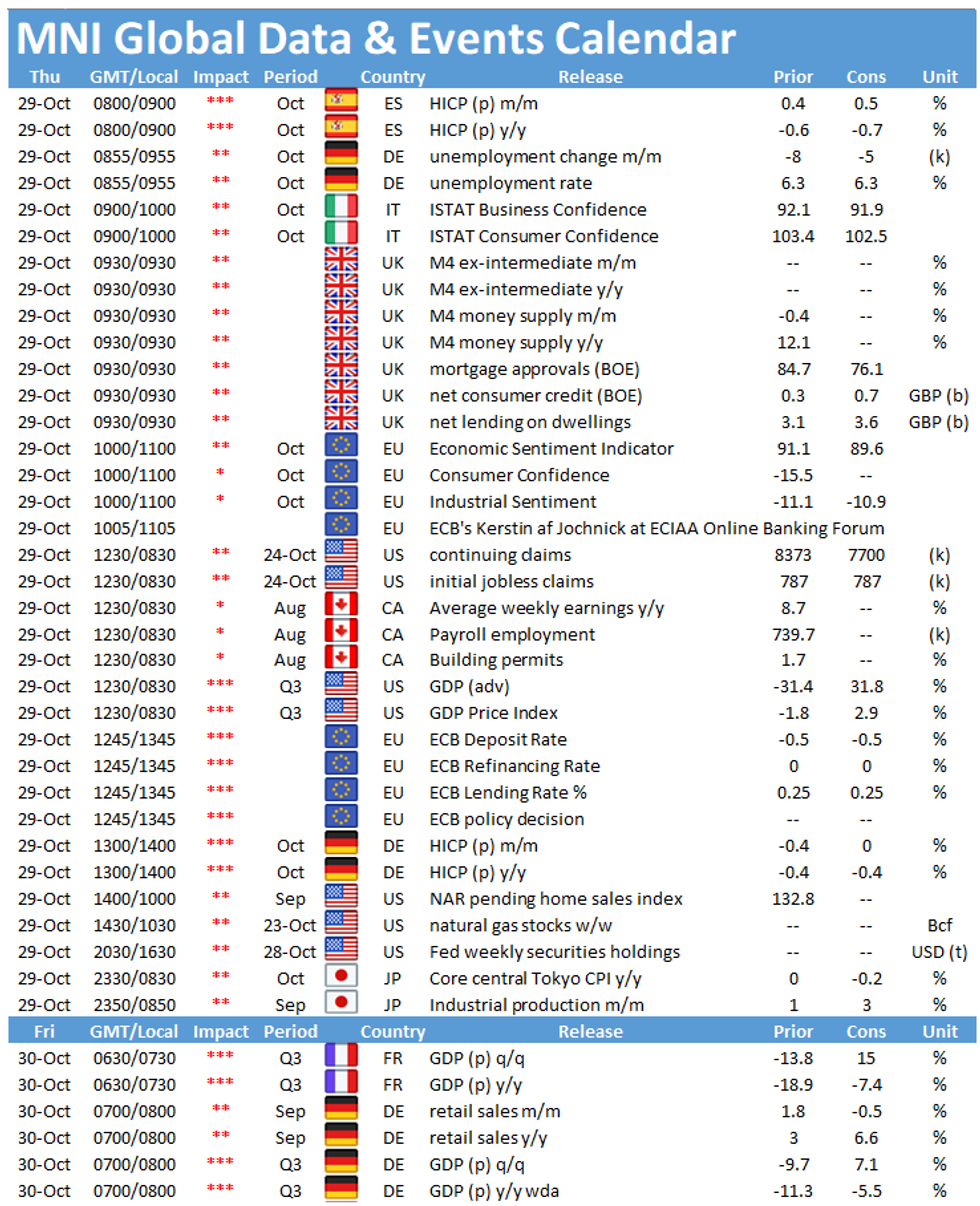

- Focus will fall on Thursday's ECB monetary policy decision, in addition to the weekly U.S. jobless claims data, Q3 GDP reading (which is well and truly in the rear view) and 7-Year Note supply.

JGBS: Futures Fade In Tokyo, Cash Mixed

JGB futures sit 8 ticks below settlement levels ahead of the bell, giving back overnight gains and more as onshore participants played catch up to U.S. Tsy movements in NY and early Asia-Pac hours. The longer end of the curve was lightly bid in cash JGB trade, with 1-10 Year paper a little more mixed as 7s underperformed. Swaps generally widened at the margin.

- The BoJ offered no surprises, leaving its monetary policy settings unchanged at its latest decision, while stressing that economic risks are tilted to the downside, we will publish a more in-depth review of the decision later in the day.

- Focus now moves to BoJ Governor Kuroda's post-decision press conference, ahead of the release of the BoJ's November Rinban outline, Tokyo CPI data, as well as September's prelim industrial production reading and labour market report. All of which are due over the next 24 hours or so.

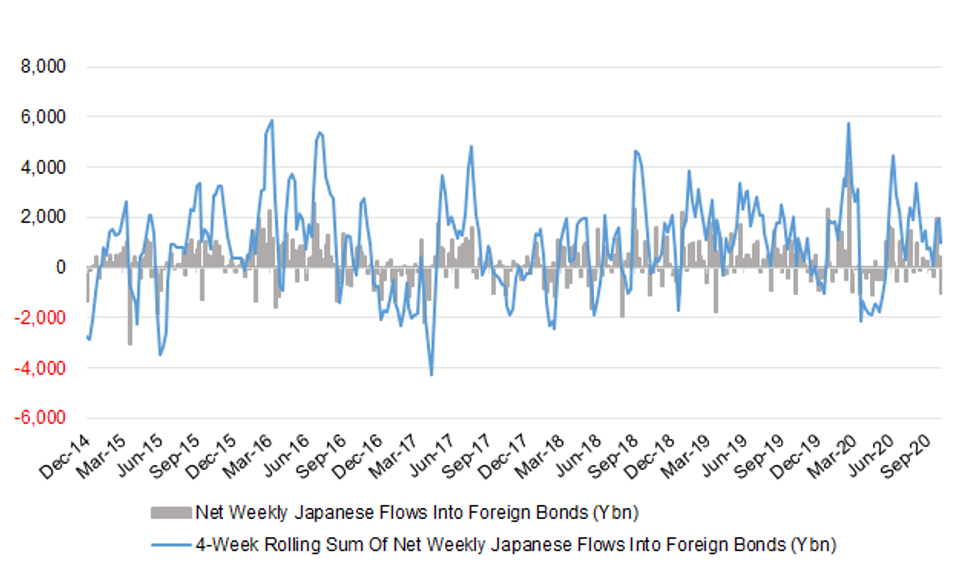

JAPAN: Weekly International Security Flows Point To Lifer Plans

MNI - Market News/Japanese Ministry of Finance

The most notable point in the latest round of weekly international security flow data out of Japan was the net sales of foreign bonds racked up by Japanese investors (Y1.0108tn), which could reflect what has been seen in some of the life insurer investment plans i.e. some interest in bringing bond exposure back onshore. This represented the largest round of weekly net sales of foreign bonds by Japanese investors since May.

- Elsewhere, the 4-week net rolling sum of foreign flows into Japanese bonds saw a notable jump, although that was a function of a chunky round of net weekly sales rolling out of the sample.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1010.8 | 422.3 | 1010.7 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -19.9 | -163.3 | 74.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 157.2 | 402.0 | 2247.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 228.4 | -93.9 | 2087.1 |

Source: Japanese Ministry of Finance

AUSSIE BONDS: Steeper On Broader Flow

Aussie Bonds saw little of note on the domestic front, with the curve steepening in Sydney hours on the back of the broader risk impulse (namely driven by U.S. Tsys and e-minis that we have discussed elsewhere). This left YM unch., XM -3.0 at the closing bell. Swaps tightened from 7-Years out.

- Some local focus fell on pre-RBA positioning, as some participants pointed to the light uptick in the AU/U.S. 10-Year yield spread in recent sessions.

- Tomorrow's points of interest include local private sector credit data, A$2.0bn of ACGB 1.50% 21 June 2031 supply and the release of the AOFM's weekly issuance schedule.

TECHS

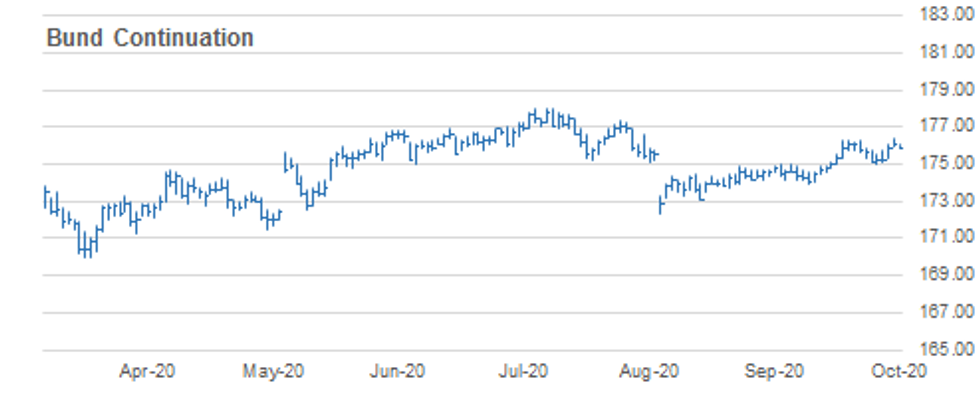

BUND TECHS: (Z0) Probes Key Resistance

- RES 4: 177.00 Round number resistance

- RES 3: 176.89 1.764 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.43 High Oct 28

- PRICE: 175.98 @ 05:02 GMT Oct 29

- SUP 1: 175.92 Intraday low

- SUP 2: 175.27 Low Oct 27 and a key support

- SUP 3: 175.00 Low Oct 23

- SUP 4: 174.90 Trendline support drawn off the Sep 1 low

Bunds traded higher again yesterday extending the recovery off 175.00, Oct 23 low. Futures traded above the key resistance at 176.29, Oct 16 high confirming a resumption of the underlying uptrend that opens 176.57 next, a Fibonacci projection. A concern for bulls however is yesterday's failure at the day's high and low close leading to a doji candle formation. A deeper pullback would expose initial support at 175.27, Oct 27 low.

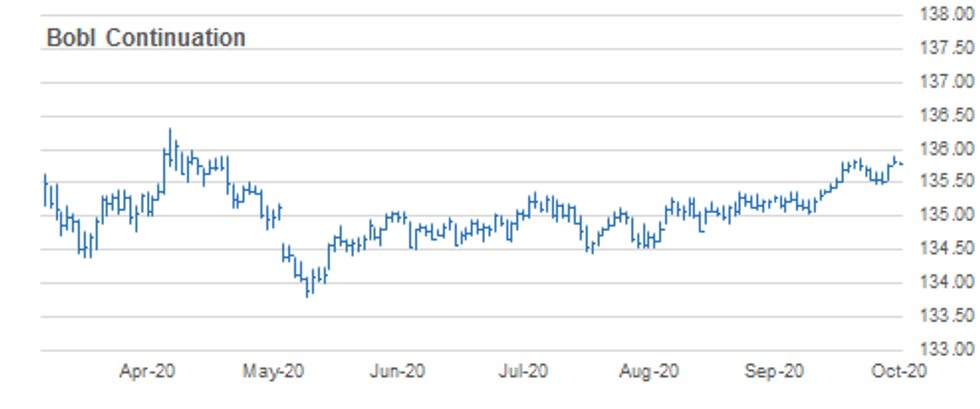

BOBL TECHS: Resumes Uptrend

- RES 4: 136.060 2.000 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 3: 136.000 Round number resistance

- RES 2: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 1: 135.900 High Oct 28

- PRICE: 135.810 @ 04:39 GMT Oct 29

- SUP 1: 135.770 Low Oct 28

- SUP 2: 135.530 Low Oct 27

- SUP 3: 135.470 Low Oct 23 and 26

- SUP 4: 135.318 50-day EMA

BOBL futures traded higher again yesterday, extending the recovery off 135.470, Oct 23 and 26 low. Price also traded above key resistance at 135.860, Oct 20 high confirming a resumption of the underlying uptrend. Scope is seen for gains towards 135.907 next, a Fibonacci projection ahead of 136.00. Initial support is 135.770, yesterday's low. A deeper pullback if seen would expose 135.530, Oct 27 low.

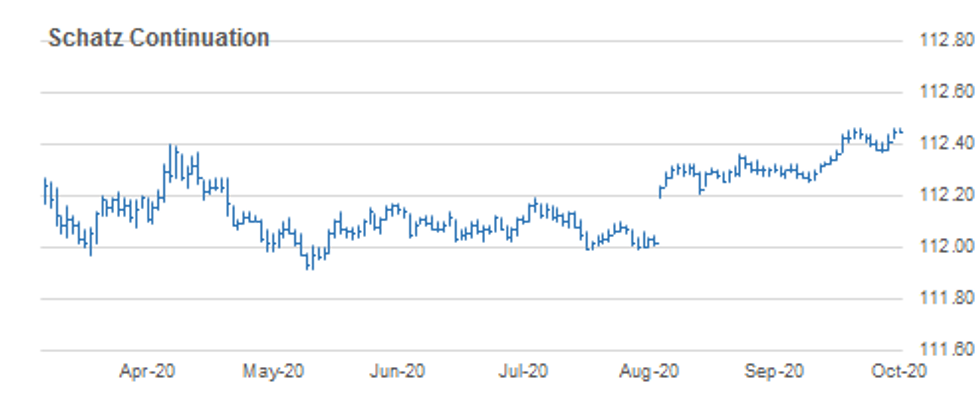

SCHATZ TECHS: (Z0) Tests Key Resistance

- RES 4: 112.523 2.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.505 61.8% retracement of the Mar - Jun sell-off (cont)

- RES 2: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 1: 112.460 High Oct 19 / 20 / 28 and intraday high

- PRICE: 112.455 @ 05:06 GMT Oct 29

- SUP 1: 112.425 Low Oct 27

- SUP 2: 112.377 20-day EMA

- SUP 3: 112.365 Low Oct 26 and key near-term support

- SUP 4: 112.360 High Sep 21 and the recent breakout level

Schatz futures traded higher yesterday resulting in a test of key resistance at 112.460, Oct 19 /20 high and this week's high thus far. A break of this hurdle would confirm a resumption of the underlying uptrend and pave the way for strength towards 112.490, a Fibonacci projection level. Key trend support has been defined at 112.365, Oct 26 low where a break is required to reverse the direction. Initial support lies at 112.425, yesterday's low.

GILT TECHS: (Z0) Recovery Extends

- RES 4: 137.04 High Sep 21 and a key resistance

- RES 3: 136.97 High Oct 16 and the bull trigger

- RES 2: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 1: 136.33 High Oct 28

- PRICE: 136.19 @ Close Oct 28

- SUP 1: 136.07 Low Oct 28

- SUP 2: 135.34 Low Oct 27

- SUP 3: 135.04 Low Oct 23 and the near-term bear trigger

- SUP 4: 134.59 Low Sep 1

Strong gains Tuesday in Gilt futures provided early evidence of a reversal. The climb has extended the recovery off 135.04, Oct 23 low and a key S/T support and yesterday futures edge higher trading above 136.27, Oct 21 high and a gap low on the daily chart. Attention is on 136.38 next, Oct 20 where a print would fill the recent gap. This would also expose key resistance at 136.97, Oct 16 high. Firm support lies at 135.34, Oct 27 low.

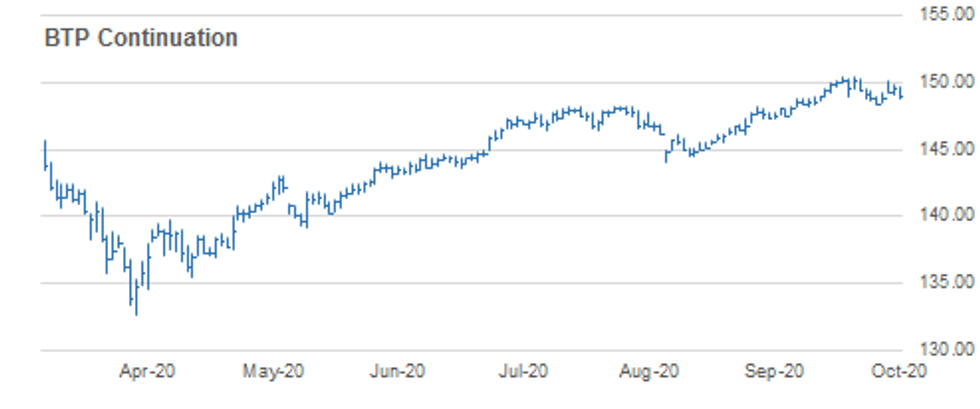

BTPS TECHS: (Z0) Corrective Phase

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.01 @ Close Oct 28

- SUP 1: 148.80 Low Oct 28

- SUP 2: 148.37 Low Oct 22 and key near-term support

- SUP 3: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 4: 147.46 Low Sep 30 and 50-day EMA

BTPS outlook remains bullish however futures are currently still trading in a corrective cycle and below recent highs. Monday's gap higher at the open failed to deliver a bullish extension and price traded lower to fill the gap. Key S/T support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Key resistance and the bull trigger is at 150.46.

EUROSTOXX50 TECHS: Clears Bear Channel Base

- RES 4: 3221.28 50-day EMA

- RES 3: 3217.96 High Oct 23 and the near term key resistance

- RES 2: 3135.48 Low Oct 22

- RES 1: 3062.38 Bear channel base drawn off the Jul 21 high

- PRICE: 2963.54 @ Close Oct 28

- SUP 1: 2932.95 Low Oct 28

- SUP 2: 2912.96 Low May 25

- SUP 3: 2877.00 50.0% retracement of the Mar - Jul uptrend

- SUP 4: 2854.07 Low May 22

A bearish EUROSTOXX 50 session dominated yesterday in line a general risk-off market mood. The index cleared a key support yesterday at 3064.10, the base of a bear channel drawn off the Jul 21 low. This follows a breach Tuesday of key support at 3097.67, Sep 25 low. The focus turns to 2877.00 next, the 50% retracement of the Mar - Jul rally. Initial resistance is at 3062.38, the former channel base. Heavy!

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.