-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Month-End, Soft E-Minis & Risk Events Eyed

US TSYS: Looking To The Weakness In Tech

T-Notes registered fresh session highs during the Asia/Europe crossover, last +0-05+ at 138-18+, with yields across the cash curve unchanged to 1.7bp richer, as the curve bull flattens. Little to note on the headline front in Asia-Pac hours, with the space drawing support from the dip in e-minis, which came on the back of big tech earnings (the NASDAQ contract broke through Thursday lows, which seemed to be the driving force behind the latest leg), allowing Tsys to move away from their respective Thursday lows. Eurodollar futures sit unchanged to +1.0 through the reds, with a ~20K sale of EDU1 triggering a brief burst activity across the front end of the strip during Asia-Pac hours.

- To recap, the space was under pressure on Thursday, as the bear steepening witnessed in Asia-Pac hours extended, aided by the firming of chances of a Biden election victory/Blue Wave in some quarters (although betting market pricing remains more hesitant than the likes of FiveThirtyEight's election model re: the pricing of a Blue Wave), with reports suggesting the COVID-19 situation was providing headwinds for the incumbent President in several of the battleground states. 10s and 20s provided the weak points on the curve, with both closing almost 5.0bp cheaper. Firmer than expected Q3 U.S. GDP data and more favourable than expected weekly jobless claims also helped to pressure the space. The record sized 7-Year Note also fed into the dynamic later in the day, tailing by over 1.0bp, with the cover ratio easing to sub average levels and dealer takedown ticking up, coming in above the recent averages. On the flow side, a WNZ0 block sale was seen during the NY morning.

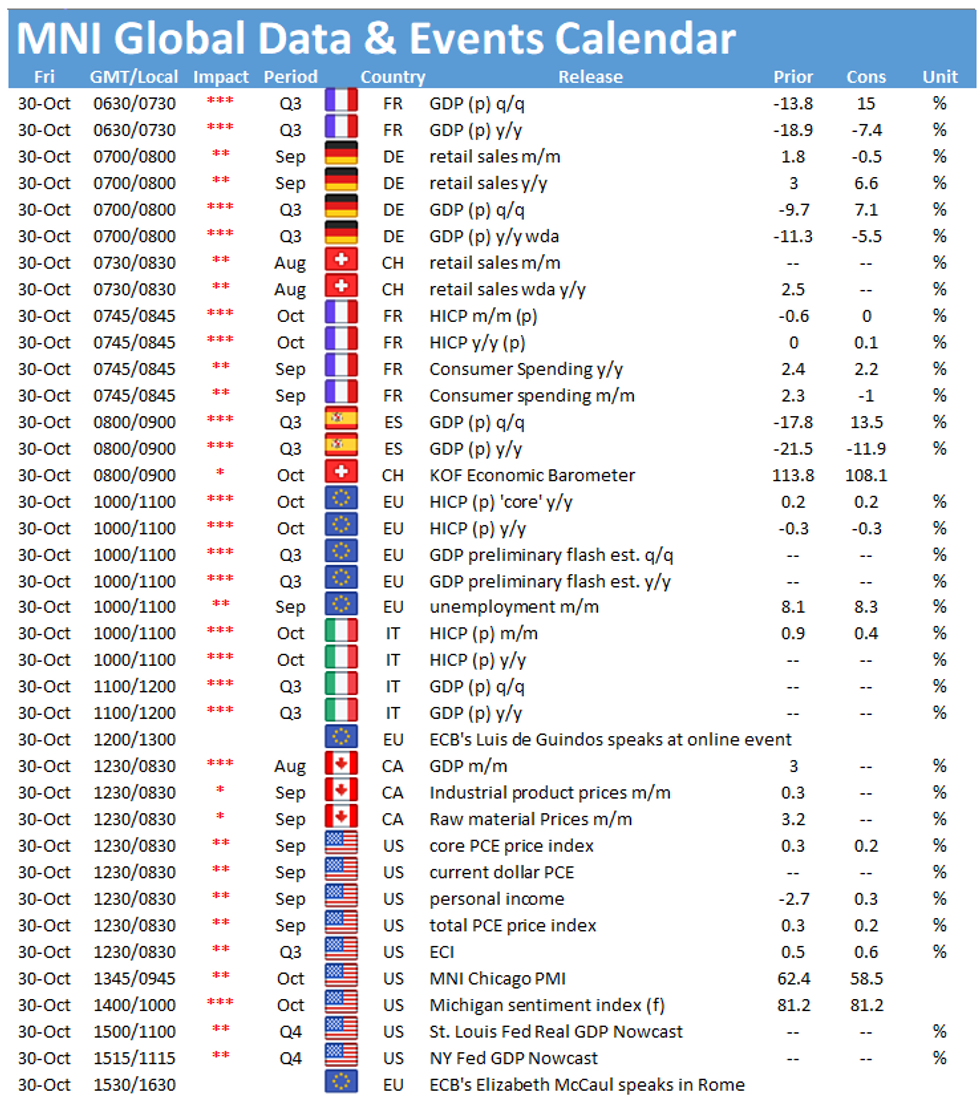

- The MNI Chicago PMI print and PCE data headline locally on Friday.

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Finland (current rating: AA+; Outlook Stable)

- Moody's on the Netherlands (current rating: Aaa; Outlook Stable)

- DBRS Morningstar on Italy (current rating: BBB (high), Negative Trend)

JGBS: Weaker Into The Close

JGBs were offered in Tokyo, owing to the New York impetus in U.S. Tsys, with futures last -15 vs. settlement, easing to worst levels into the close. The shorter end of the cash curve outperformed, with 5-Year+ plus paper cheapening, resulting in twist steepening, as 7s and 40s represented the weak points on the curve.

- The latest round of BoJ Rinban operations saw the purchase sizes of the buckets covering 1-10 Year paper left as was, with offer/cover ratios as follows: 1-3 Year: 2.75x (prev. 1.56x), 3-5 Year: 3.23x (prev. 3.48x), 5-10 Year: 2.66x (prev. 3.17x).

- Local data was inconsequential for price action, as the core Tokyo CPI readings met expectations, softening vs. the previous month, labour market details showed no real deviation vs. expectations and industrial production provided a modest beat.

- Focus now moves to the BoJ's November Rinban plan, due to be released after hours.

AUSSIE BONDS: Steeper, But Sources Of Support May Have Limited Long End Losses

Aussie bonds have looked through ACGB supply matters and an in line with exp. local private sector credit release, with focus well and truly on next week's headline risk events, namely the RBA decision and U.S. election. Curve was steeper vs. settlement come the close, YM unch., XM -1.5, with the cash space twist steepening. Swaps were wider vs. ACGBs. Larger than usual ACGB month-end extensions & the proximity to the RBA decision may have cushioned the long end, promoting some outperformance vs. Tsys since yesterday's Sydney close.

- On next week's RBA decision, a recent AFR article has suggested that the cash rate target will be cut to 0.10%, alongside the 3-Year ACGB yield target and interest rate applied to the TFF being trimmed to the same level. The piece also suggested that the interest paid on E/S surplus funds lodged at the RBA will fall to 0.01%. Finally, the piece noted that the Bank will buy "billions of dollars of longer-dated Commonwealth and state government bonds with tenors of between five and 10 years." The piece also played down the idea of the Bank adopting a 5-Year ACGB yield target.

- Bills unchanged at settlement, with a seller of the IRZ0/M1 spread seen early in Sydney.

- M'fing PMIs, CoreLogic house price data and A$1.5bn of ACGB 0.25% 21 November 2025 headline locally on Monday.

AUCTIONS/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y6.1679tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1679tn 3-Month Bills:

- Average Yield -0.0845% (prev. -0.0793%)

- Average Price 100.0227 (prev. 100.0213)

- High Yield: -0.0800% (prev. -0.0744%)

- Low Price 100.0215 (prev. 100.0200)

- % Allotted At High Yield: 33.9886% (prev. 54.9827%)

- Bid/Cover: 3.230x (prev. 3.228x)

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGB's from the market, sizes unchanged from previous operations:

- Y420bn worth of JGBs with 1-3 Years until maturity

- Y350bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.50% 21 Jun '31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:- Average Yield: 0.8498% (prev. 0.9395%)

- High Yield: 0.8525% (prev. 0.9400%)

- Bid/Cover: 4.7175x (prev. 4.9275x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 10.6% (prev. 90.6%)

- bidders 54 (prev. 45), successful 28 (prev. 13), allocated in full 17 (prev. 4)

AUSSIE BONDS: Nothing Of Note On Next Week's AOFM Issuance Schedule

The AOFM has released its weekly issuance schedule:

- On Monday 2 November October it plans to sell A$1.5bn of the 0.25% 21 November 2025 Bond.

- On Thursday 5 November it plans to sell A$1.0bn of the 26 February 2021 Note & A$1.0bn of the 21 May 2021 Note.

- On Friday 6 November it plans to sell A$2.0bn of the 1.00% 21 December 2030 Bond.

TECHS

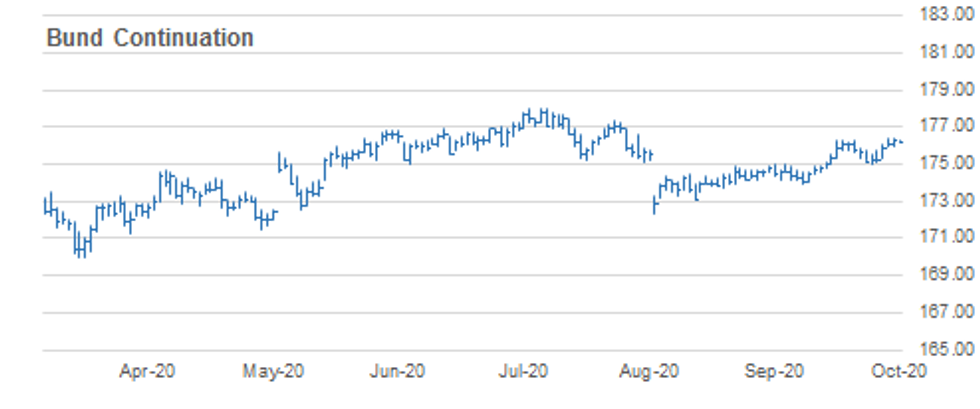

BUND TECHS: (Z0) Needle Points North

- RES 4: 177.00 Round number resistance

- RES 3: 176.89 1.764 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.44 High Oct 29

- PRICE: 179.29 @ 04:56 GMT Oct 30

- SUP 1: 175.92 Low Oct 29

- SUP 2: 175.27 Low Oct 27 and a key support

- SUP 3: 175.38 20-day EMA

- SUP 4: 174.96 Trendline support drawn off the Sep 1 low

Bunds maintain a positive tone following this week's gains. Futures have traded above the key resistance at 176.29, Oct 16 high confirming a resumption of the underlying uptrend that opens 176.57 next, a Fibonacci projection. Yesterday's push higher negates the recent doji candle formation that highlighted the risk of a potential near-term top. Initial support lies at yesterday's low of 175.92. Bullish!

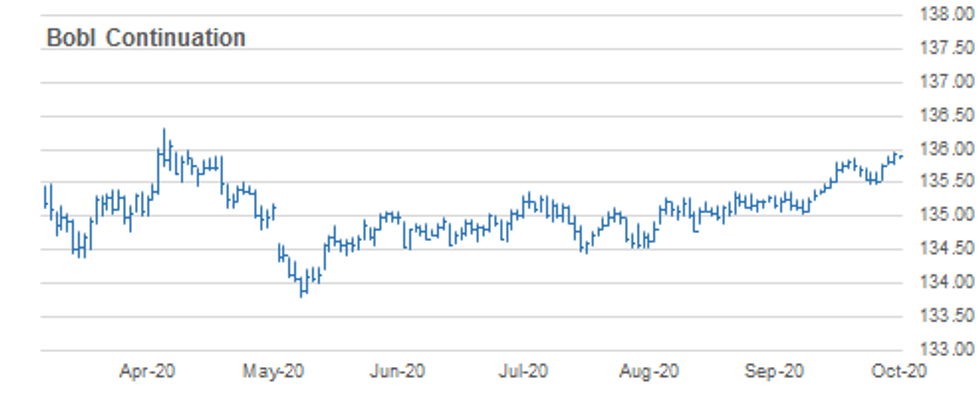

BOBL TECHS: (Z0) Uptrend Intact

- RES 4: 136.14 High May 5 (cont)

- RES 3: 136.060 2.000 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 136.000 Round number resistance

- RES 1: 135.960 High Oct 29

- PRICE: 135.920 @ 05:03 GMT Oct 30

- SUP 1: 135.770 Low Oct 28

- SUP 2: 135.567 20-day EMA

- SUP 3: 135.530 Low Oct 27

- SUP 4: 135.470 Low Oct 23 and 26

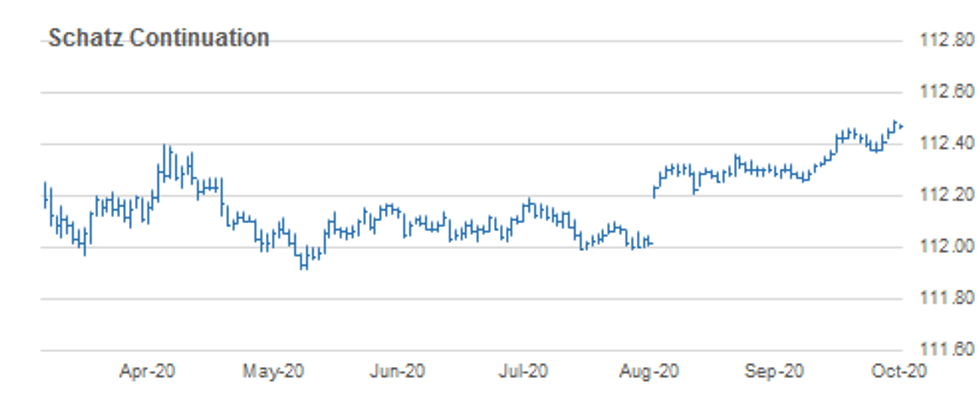

SCHATZ TECHS: (Z0) Clears Key Resistance

- RES 4: 112.543 2.382 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.523 2.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.505 61.8% retracement of the Mar - Jun sell-off (cont)

- RES 1: 112.95 High Oct 29

- PRICE: 112.480 @ 04:57 GMT Oct 30

- SUP 1: 112.445 Low Oct 29

- SUP 2: 112.425 Low Oct 27

- SUP 3: 112.387 20-day EMA

- SUP 4: 112.365 Low Oct 26 and key near-term support

Schatz futures traded higher once again yesterday resulting in a convincing break of key resistance at 112.460, Oct 19 /20 and 28 high. The break confirms a resumption of the underlying uptrend and paves the way for strength towards 112.505, a Fibonacci retracement and 112.523, a Fibonacci projection. Key trend support has been defined at 112.365, Oct 26 low where a break is required to reverse the direction. Initial support lies at 112.445.

GILT TECHS: (Z0) Bullish Focus

- RES 4: 137.04 High Sep 21 and a key resistance

- RES 3: 136.97 High Oct 16 and the bull trigger

- RES 2: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 1: 136.37 High Oct 29

- PRICE: 136.17 @ Close Oct 29

- SUP 1: 135.97 Low Oct 29

- SUP 2: 135.34 Low Oct 27

- SUP 3: 135.04 Low Oct 23 and the near-term bear trigger

- SUP 4: 134.59 Low Sep 1

Strong gains Tuesday in Gilt futures provided early evidence of a reversal. The contract has pushed higher since although with less of an impulsive drive. The outlook nevertheless remains bullish and futures are holding onto recent gains. Attention is on 136.38, Oct 20 low where a print would fill a gap in the chart. This would also expose key resistance at 136.97, Oct 16 high. Firm support lies at 135.34, Oct 27 low.

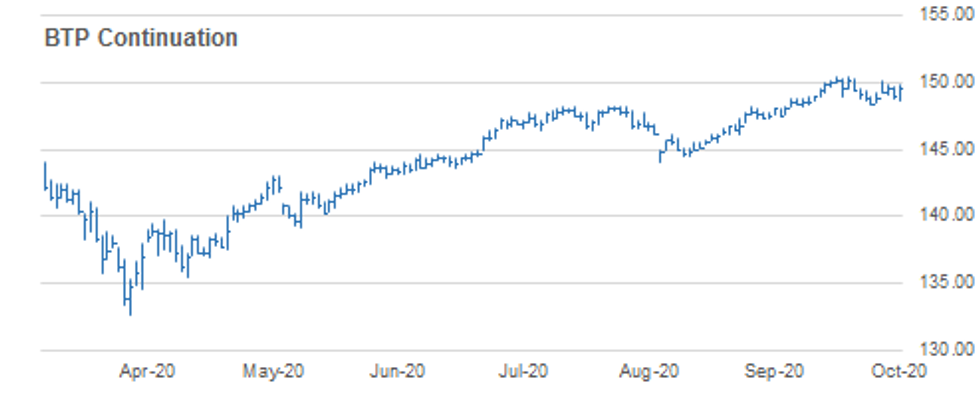

BTPS TECHS: (Z0) Trading Below Recent Highs

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.63 @ Close Oct 29

- SUP 1: 148.68 Low Oct 29

- SUP 2: 148.37 Low Oct 22 and key near-term support

- SUP 3: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 4: 147.60 50-day EMA

BTPS outlook remains bullish however futures remain in a corrective cycle and below recent highs. Monday's gap higher at the open failed to deliver a bullish extension and price traded lower to fill the gap. Key S/T support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Key resistance and the bull trigger is at 150.46.

EUROSTOXX50 TECHS: Remains Heavy

- RES 4: 3217.96 High Oct 23 and the near term key resistance

- RES 3: 3211.03 50-day EMA

- RES 2: 3135.48 Low Oct 22

- RES 1: 3060.65 Bear channel base drawn off the Jul 21 high

- PRICE: 2960.03 @ Close Oct 29

- SUP 1: 2920.87 Low Oct 29

- SUP 2: 2912.96 Low May 25

- SUP 3: 2877.00 50.0% retracement of the Mar - Jul uptrend

- SUP 4: 2854.07 Low May 22

A bearish EUROSTOXX 50 session has dominated this week in line with a general risk-off mood in markets. The index cleared a key support Wednesday at 3064.10, the base of a bear channel drawn off the Jul 21 low. This follows a breach Tuesday of key support at 3097.67, Sep 25 low. The focus turns to 2877.00 next, the 50% retracement of the Mar - Jul rally. Initial resistance is at 3062.38, the former channel base. Heavy!

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.