-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI EUROPEAN OPEN: Risk Continues To Struggle In Asia

***This e-mail has been resent to correct the label on the chart***

EXECUTIVE SUMMARY

- SENATE OFFICIAL: $15 MINIMUM WAGE NOT ALLOWED IN BIDEN'S COVID RELIEF BILL (CNBC)

- KEY SENATORS FLOAT TAX ON BIG FIRMS TO ENABLE MINIMUM-WAGE HIKE (BBG)

- FED OFFICIALS VIEW RISING YIELDS AS BULLISH SIGN REFLECTING 2021 OPTIMISM (BBG)

- RBA STEPS IN WITH OFF SCHEDULE BOND PURCHASES BOJ REFRAINS

- CHINA STOCKS RECENT VOLATILITY DOESN'T CHANGE UPWARD TREND (SECURITIES NEWS)

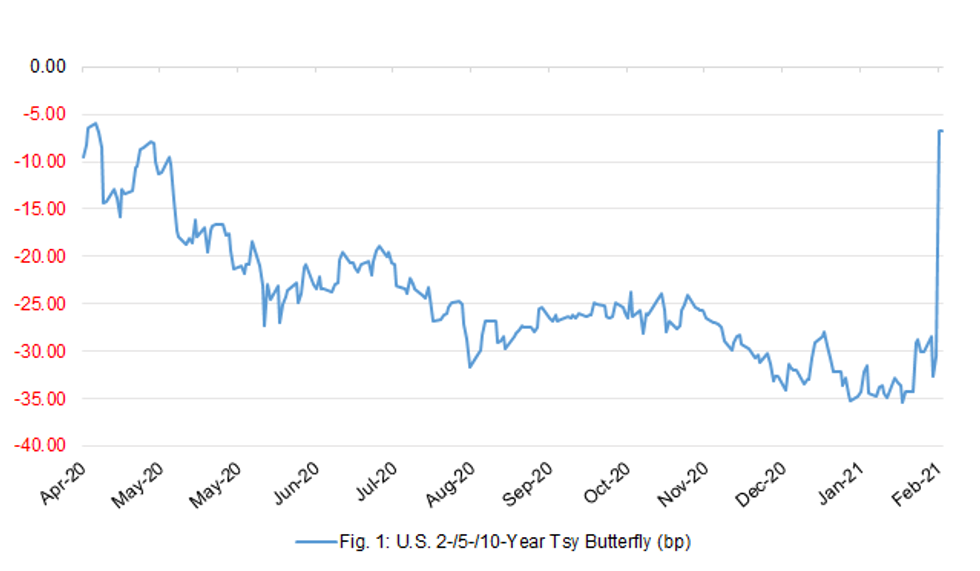

Fig. 1: U.S. 2-/5-/10-Year Tsy Butterfly (bp)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

FISCAL: Rishi Sunak will use the Budget next week to reveal a new UK state-guaranteed loan programme as ministers turn the taps off on the emergency coronavirus schemes which have so far allowed businesses to borrow £73bn. The three existing schemes will become the first main plank of the pandemic support programme to be pulled for new applicants by the chancellor. Companies will have until the end of March to apply for loans under those programmes, including the hugely popular bounce back loans. But Sunak will also use the Budget to extend a package of other Covid-19 support measures for business until June, including business rates and VAT relief, the furlough job support scheme and the stamp duty holiday. (FT)

FISCAL: Rishi Sunak will call for "honesty" about the need to eventually bring down wartime levels of spending in his Budget speech next week, as several Cabinet ministers – and David Cameron – warned him against tax rises. (Telegraph)

FISCAL: Rishi Sunak is drawing up plans for a new "stealth tax" on wealthy pensioners as he seeks to repair Britain's finances after the pandemic, The Times has learnt. The chancellor is expected to announce in his budget next week that the lifetime allowance, the amount people can build up in their pension pot before incurring punitive tax charges, will be frozen for the rest of this parliament at just over £1 million. (The Times)

FISCAL/POLITICS: Boris Johnson has been told not to raise business taxes in next week's Budget by Tory MPs in the North - as new Conservative MPs told Sky News they "won't be here in four years' time" if he doesn't deliver funding for major projects. Sky News can reveal Mr Johnson will come under intense pressure to adjust the party's agenda in favour of northern MPs after they secured fresh funding to lobby for their priorities up to the next election. (Sky)

BREXIT: The DUP leadership has held talks with the organisation which represents loyalist paramilitary groups, including the UDA and UVF. The party said the meeting in Belfast with the Loyalist Communities Council (LCC) discussed opposition to the Northern Ireland Protocol. Party leader Arlene Foster attended, along with her deputy Nigel Dodds and East Belfast MP Gavin Robinson. The party said the discussions had been "constructive and useful". "We listened to the views expressed and the need for political and constitutional methods to safeguard the UK single market and ensure there is unfettered flow of trade between Great Britain and Northern Ireland," a statement read. (BBC)

BREXIT: As the U.K. drifts further away from Europe, one of French President Emmanuel Macron's closest aides wants to convince people in Britain and France that the European Union is always the best option. That involves championing cities like Frankfurt, Amsterdam and, most of all, Paris as they try to seize as many of the jobs leaving the U.K. as possible. So far, the predicted flood of financial jobs hasn't materialized, although some banks have made a move. "We can do better," Clement Beaune, junior minister for EU affairs, said in an interview on Wednesday. "It's not over." (BBG)

ECONOMY: The number of cars built in the UK fell by 27% last month, the worst January figure for over a decade, as coronavirus shutdowns and post-Brexit border friction hampered production. The Society of Motor Manufacturers and Traders (SMMT) said just over 86,000 cars were built, a fall of 32,262 compared with January last year. Chief executive Mike Hawes said the numbers were cause for "grave concern". January marked the 17th consecutive month of decline in output. The trade industry body suggested that the ongoing impact of the coronavirus crisis, extended factory shutdowns, global supply chain problems, and friction in the new post-Brexit trading arrangements, had all contributed to the fall. (BBC)

EUROPE

CORONAVIRUS: European Union leaders inched toward establishing bloc-wide vaccine certificates to enable countries to reopen to travel as Commission President Ursula von der Leyen warned that unless they hurry Apple Inc. and Google will step into the vacuum. During a five-hour video call, the EU's 27 leaders focused on how to haul their nations back to a form of normalcy after a pandemic that's claimed more than 500,000 lives and shut down large parts of their economies. While there was broad support for certificates of some sort, leaders didn't agree on the type of privileges they would grant. (BBG)

CORONAVIRUS: Italian Prime Minister Mario Draghi told European Union leaders on Thursday that the bloc needed to accelerate its anti-COVID vaccination campaign and be tougher with companies that failed to meet supply commitments. "We have to go faster, much faster," Draghi said on the first day of a summit being held via video conference. (RTRS)

CORONAVIRUS: AstraZeneca Plc's Chief Executive Officer Pascal Soriot sought to deflect blame for a shortfall in Covid-19 vaccine deliveries to Europe this year, while reassuring lawmakers that his company is working to meet targets for the second quarter. Speaking remotely to a European Parliament hearing, Soriot said his company would deliver 40 million doses to the European Union in the first quarter, with the volume set to rise in the coming months. Soriot said employees are working around the clock to increase the amount of vaccines extracted in production, but that perfecting the process takes time and isn't without setbacks. (BBG)

FRANCE: French prime minister Jean Castex said 20 of the country's departments — a fifth of the total and including the entire Paris region — would be targeted for enhanced monitoring of Covid-19 infections and might face additional restrictions such as weekend lockdowns from March 6. The cities of Nice in the south and Dunkirk in the north are already subject to weekend lockdowns following a sharp rise in infections as a result of the rapid spread of highly infectious variants of the virus. (FT)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on Ireland (current rating: A+; Outlook Stable)

- Moody's on the EFSF (current rating: Aa1; Outlook Stable), ESM (current rating: Aa1; Outlook Stable) & France (current rating: Aa2; Outlook Stable)

- DBRS Morningstar on Portugal (current rating: BBB (high), Stable Trend) & Slovakia (current rating: A (high), Stable Trend)

U.S.

FED: MNI BRIEF: Fed's Williams Says Growth Could Be Best in Decades

- New York Fed President John Williams said Thursday the U.S. economy may be on track for its strongest performance in decades but added the central bank will remain patient about removing monetary support. "With strong federal fiscal support and continued progress on vaccination, GDP growth this year could be the strongest we've seen in decades," Williams said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Bostic Says Yields Still Low, QE Twist An Option

- Atlanta Fed President Raphael Bostic said Thursday that while "rates are still very low from historic perspective" the Fed could consider a QE twist style change to its bond program in the future but such changes do not appear imminent. "Yields have definitely moved at the higher end and the longer end. But right now I'm not worried about that," Bostic told reporters. "We're going to keep an eye out." Asked about moving to focus asset purchases on the long end of the yield curve, Bostic said "it's definitely something that we will keep in mind if this becomes an issue." "But, again, right now I don't see that as something that we're necessarily going to have to do," he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: "I think the rise in yields is probably a good sign so far because it does reflect better outlook for U.S. economic growth and inflation expectations which are closer to the committee's inflation target," says Federal Reserve Bank of St. Louis President James Bullard. "So far so good on the yields, I think." (BBG)

FISCAL: Democrats cannot include a $15 per hour minimum wage in their $1.9 trillion coronavirus relief package, a Senate official ruled Thursday, derailing for now a party priority and a raise for millions of Americans. Nonpartisan Senate parliamentarian Elizabeth MacDonough determined lawmakers could not include the policy under budget reconciliation, CNBC confirmed. She and her staff heard arguments from Democrats and Republicans about whether the proposal met strict standards for deficit effects needed to include it in the process. Reconciliation allows the Senate to pass bills with a simple majority — in this case with no Republicans who are wary of another massive rescue package. However, Democrats faced challenges in passing the pay hike regardless of whether the chamber's rules allowed it in the legislation. (CNBC)

FISCAL: Two Senate committee chiefs are looking at ways to raise taxes on companies paying workers less than $15 an hour, as part of a new strategy to include President Joe Biden's push to boost the minimum wage to that level in his Covid-19 aid bill. Senate Budget Committee Chairman Bernie Sanders and Senate Finance Committee Chair Ron Wyden said Thursday evening they were considering the strategy after prospects for making a wage increase part of the relief package were dealt a severe blow. (BBG)

CORONAVIRUS: US coronavirus cases rose on Thursday by the most in almost a fortnight, with some of the most populous states contributing many of the newest infections. States reported an additional 75,565 infections, according to Covid Tracking Project, up from 73,258 on Wednesday. It was the biggest one-day increase in cases since February 12, which was also the most recent instance the US reported at least 100,000 cases in a single day. (FT)

CORONAVIRUS: U.S. President Joe Biden said on Thursday his administration plans to launch a campaign to educate Americans about coronavirus vaccines in anticipation of a period later this year where supply may outstrip demand because of vaccine hesitancy. (RTRS)

CORONAVIRUS: Mayor Bill de Blasio and top New York City health officials have urged residents to remain calm following a media report that a more infectious variant of coronavirus that is more resilient to vaccines was spreading rapidly in the city. City officials were wary of a report in the New York Times on Wednesday that cited unpublished research papers from Columbia University and the California Institute of Technology that a new variant, known as B.1.526, appeared in late November and accounted for about 25 per cent of coronavirus genomes sequenced and deposited from New York during February. The studies have yet to be peer-reviewed. (FT)

OTHER

U.S./CHINA: Agriculture Secretary Tom Vilsack believes China is making good on promises it made as part of the landmark phase one trade deal it signed with the U.S. last year. Vilsack said that the deal allows for market conditions to dictate how much Beijing is required to purchase from U.S. farmers. The Covid pandemic, he added, would qualify as a material market condition that would impact how much China has to buy. (CNBC)

GLOBAL TRADE: Katherine Tai, President Joe Biden's top trade nominee, backed tariffs as a "legitimate tool" to counter China's state-driven economic model and vowed to hold Beijing to its prior commitments, while promising a sweeping new approach to U.S. trade. At her Senate confirmation hearing to become U.S. Trade Representative, Tai also called for a revamp of global trade rules to eliminate what she called "gray areas" exploited by China and end a "race to the bottom" that she said had hurt the interests of workers and the environment. (RTRS)

GLOBAL TRADE: U.S. President Joe Biden's nominee as top trade official, Katherine Tai, on Thursday said the United States and the European Union needed to come together to resolve a longstanding dispute over aircraft subsidies. Tai said the dispute had contributed to the collapse of the World Trade Organization's dispute settlement system, and she looked forward to working to resolve it, if confirmed as U.S. Trade Representative. (RTRS)

CORONAVIRUS: Dr. Scott Gottlieb, a member of Pfizer's board, told CNBC the company is taking a dual-track approach to boosting its Covid vaccine offering against new virus variants. The first approach is through a follow-up study that examines whether a third booster dose of its current vaccine formulation provides additional protection, Gottlieb said on "Squawk Box." While actual data is needed, Gottlieb said he expects one more dose would be helpful against the mutations. (CNBC)

CORONAVIRUS: An Oxford University biology laboratory researching Covid-19 has been hacked by a cyber gang amid fears they are trying to sell secrets to the highest bidder. (Telegraph)

CORONAVIRUS: French President Emmanuel Macron said on Thursday he would gladly accept being inoculated with the Oxford/AstraZeneca COVID-19 vaccine if it were offered when his turn comes. "In view of the latest scientific studies, the efficacy of the AstraZeneca vaccine has been proven," Macron told reporters after a virtual European Union summit. "My turn will come, but I've got time. If that's the vaccine that's offered to me, I will take it, of course." Macron had caused dismay in Britain after being quoted earlier this year as saying the shot appeared "quasi-ineffective" among those aged over 65. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Friday it was important now to keep the entire yield curve "stably low" as the fallout from the coronavirus pandemic weighs on the economy. "The BOJ has no intention of pushing up (10-year government bond yields) above its target of around 0%," Kuroda told parliament. (RTRS)

JAPAN: The important thing is that yields don't jump up and down, Japanese Finance Minister Taro Aso tells reporters Friday in Tokyo as climbing yields overnight sent stock markets tumbling. (BBG)

JAPAN: Japan is set to lift states of emergency in its western regions, underscoring progress against a coronavirus surge that has battered the economy and Prime Minister Yoshihide Suga's approval rating. Economy Minister Yasutoshi Nishimura told a panel on the virus Friday the government recommended lifting the order in six of the 10 areas under emergency restrictions, while leaving it in place in the Tokyo region. The current state of emergency is in place through March 7 and would be lifted at the end of February in areas including Osaka, Aichi and Fukuoka. A final decision was expected later Friday. The 10 areas under the state of emergency account for about 60% of the economy and an early lifting would free up businesses to operate at greater capacity. (BBG)

AUSTRALIA: Underlying cash deficit A$133.9bn in 7 months to Jan. 31. (BBG)

RBNZ: Reserve Bank Governor Adrian Orr has used his first opportunity to publicly comment on the central bank's remit tweak to stress this won't change the way it sets monetary policy. Speaking to the Canterbury Employers' Chamber of Commerce on Friday, Orr said: "Our Monetary Policy Committee remit targets remain unchanged. "We remain only focussed on maintaining low and stable consumer price inflation and contributing to maximum sustainable employment, as recently outlined in our Monetary Policy Statement." (Interest NZ)

SOUTH KOREA: South Korea reported 406 new coronavirus cases over the last 24 hours, versus 396 the previous day, according to data from the Korea Disease Control and Prevention Agency's website. The number of newly confirmed cases remained below 500 for a 7th day, while the total number of confirmed cases reached 88,922, the data showed. South Korea on Friday began utilizing AstraZeneca vaccines to inoculate patients and workers at nursing homes and related facilities who are younger than 65. Prime Minister Chung Sye-kyun says the nation will extend the current social distancing rules for another 2 weeks, and will also maintain current ban of gatherings of 5 or more people. (BBG)

SOUTH KOREA: Bank of Korea to Buy 5t-7t Won of Govt Bonds in 1H. Bank of Korea announces govt bond purchase plan as it expects bond market volatility to rise on increasing govt bond issuance. To take additional measures to stabilize markets if needed. (BBG)

MEXICO: Inflation risks, economic activity and financial markets pose challenges for monetary policy, according to a presentation by Mexico's central bank Governor Alejandro Diaz de Leon posted to Banxico's website. (BBG)

MEXICO: Mexico's central bank said on Thursday it stands ready to carry out government securities swap operations whenever it deems this necessary for the Mexican debt market to operate smoothly. In a statement updating the measures it takes to keep markets working well, the bank said it may carry out currency hedging operations in dollars with counterparties not domiciled in Mexico when so instructed by the currency commission. (RTRS)

BRAZIL: Brazil will give a monthly stipend of 250 reais in emergency aid for 4 months as of March, President Jair Bolsonaro said in his weekly live webcast, adding that he met with the Economy Minister Paulo Guedes and the proposal is currently under discussion at Congress. "Our indebtedness capacity is at the limit, so it will be (granted for) another 4 months to see if the economy picks up pace." (BBG)

BRAZIL: Brazil's government posted a primary budget surplus in January of 43.2 billion reais ($7.8 billion), Treasury figures showed on Thursday, down from the same month last year but still the second highest ever for that particular month. The surplus for the central government, which excludes interest payments, exceeded the 40.6 billion reais median forecast in a Reuters poll of economists. January is traditionally a month of surplus, due to strong personal income tax and corporate social contributions. The highest-ever January surplus was last year, at 44.1 billion reais. Despite the surplus, Treasury Secretary Bruno Funchal said the expected extension of emergency cash payments to millions of poor people must be accompanied with spending cuts elsewhere in the government's budget. (RTRS)

BRAZIL: Brazil is facing a new stage of the coronavirus pandemic with mutated variants of the virus that are three times more contagious, Health Minister Eduardo Pazuello said on Thursday, as the country hit a quarter of a million deaths. Pazuello said the government has distributed between 13 million and 14 million vaccine doses and plans to have inoculated half of the country's 210 million population by midyear. Brazil is negotiating to buy all the vaccines it can, and Congress is looking at legislation to allow the government to buy shots from Pfizer and Johnson & Johnson's Janssen subsidiary. (RTRS)

MIDDLE EAST: U.S. President Joe Biden on Thursday directed U.S. military airstrikes in eastern Syria against facilities belonging to what the Pentagon said were Iran-backed militia, in a calibrated response to rocket attacks against U.S. targets in Iraq. The strikes, which were first reported by Reuters, appeared to be limited in scope, potentially lowering the risk of escalation. (RTRS)

MIDDLE EAST: United States President Joe Biden spoke for the first time since becoming president with Saudi Arabia's King Salman bin Abdulaziz Al Saud on Thursday as the US prepares to release a report about the 2018 murder of Saudi journalist Jamal Khashoggi. Biden emphasised the US commitment to assuring Saudi Arabia security from threats from Iran and discussed renewed diplomatic efforts to end the war in Yemen, the White House said in a statement released by the communications office. (Al Jazeera)

OIL: ICE exchange, home of Brent oil futures trading, has put pressure on pricing agency Platts to postpone its physical Brent market reform, saying the market needs more time to consult and adjust the value of derivatives in line with the changes. (RTRS)

OIL: Norway on Thursday launched a consultation on a 2021 licensing round in mature areas in which it offered new blocks for petroleum exploration in the Arctic Barents Sea. The maps attached to a statement by the oil and energy ministry showed new blocks offered south east off Bear Island, roughly half way between the Arctic Svalbard Archipelago and mainland Europe. (RTRS)

OIL: Nigeria is losing an average of 200,000 b/d of its crude oil production to theft, state-owned Nigerian National Petroleum Corp. said Feb. 25, indicating a surge in pipeline sabotage in the West African country. (Platts)

CHINA

FISCAL: China may not be prepared to implement major tax and fee cuts in 2021 given its need to remain fiscal balance, wrote Han Yongwen, a former official with the National Development and Reform Committee, in a blog post for China Bond. About 60% of cities and 75% of counties across the country posted negative revenue growth in H1 2020 while spending is expected to rise, Han wrote. China will have CNY2.7 trillion in debt maturing this year, up CNY600 million from 2020, Han noted. The rate of increase in the money supply has surpassed economic growth, though liquidity hasn't been efficiently used, he said. (MNI)

FISCAL: Investments in public-private partnership projects may exceed CNY4.5 trillion this year, the Securities Times reported citing statistics from Ministry of Finance. As of Feb. 24th, 9,965 PPP projects have been registered totaling CNY15.4 trillion, comprising municipal engineering, transportation, environmental protection, and urban development, according to Ministry data. PPPs reduce local government debts and help private enterprises obtain financing, the report said. (MNI)

INFRASTRUCTURE: The world's largest high-speed rail network could nearly double in size over the next 15 years as part of China's ambitious new plan to expand public transport – signalling that the government will continue to splash out on large infrastructure projects as it pursues its goal of doubling the size of the economy by 2035. Beijing aims to increase the national high-speed railway network to 70,000km (43,500 miles) by 2035 – an 84 per cent increase from the estimated 38,000km at the end of last year, according to a blueprint jointly released on Wednesday by the Central Committee of the ruling Communist Party and the State Council, the country's cabinet. And the length of the nation's entire railway network is anticipated to grow to 200,000km in 15 years, an increase of 37 per cent from 146,000km at the end of 2020, the document said. (SCMP)

EQUITIES: China stocks recent volatility doesn't change upward trend. (Securities News)

CLIMATE: China's Newly appointed special envoy for climate change Xie Zhenhua Xie is expected to work closely with U.S. climate envoy John Kerry, the China Daily reported. Xie is expected to spearhead efforts for more meaningful co-operation on climate change amid a rift between the two countries, the Daily said. Xie, officially appointed by the Ministry of Ecology and Environment on Thursday, led the Chinese delegation in global climate negotiations from 2007 to 2018, which resulted in China joining the Paris Agreement on climate change. (MNI)

OVERNIGHT DATA

JAPAN JAN, P INDUSTRIAL OUTPUT -5.3% Y/Y; MEDIAN -5.4%; DEC -2.6%

JAPAN JAN, P INDUSTRIAL OUTPUT +4.2% M/M; MEDIAN +3.8%; DEC -1.0%

JAPAN JAN RETAIL SALES -2.4% Y/Y; MEDIAN -2.6%; DEC -0.2%

JAPAN JAN RETAIL SALES -0.5% M/M; MEDIAN -1.2%; DEC -0.7%

JAPAN JAN DEPT STORE, SUPERMARKET SALES -7.2% Y/Y; MEDIAN -7.4%; DEC -3.4%

JAPAN FEB TOKYO CPI -0.3% Y/Y; MEDIAN -0.4%; JAN -0.5%

JAPAN FEB TOKYO CORE CPI -0.3% Y/Y; MEDIAN -0.4%; JAN -0.5%

JAPAN FEB TOKYO CORE-CORE CPI +0.2% Y/Y; MEDIAN +0.2%; JAN +0.2%

JAPAN JAN HOUSING STARTS -3.1% Y/Y; MEDIAN -1.9%; DEC -9.0%

JAPAN JAN ANNUALIZED HOUSING STARTS 0.801MN; MEDIAN 0.799MN; DEC 0.784MN

JAPAN JAN CONSTRUCTION ORDERS +14.1% Y/Y; DEC -1.3%

AUSTRALIA JAN PRIVATE SECTOR CREDIT +1.7% Y/Y; MEDIAN +1.8%; DEC +1.8%

AUSTRALIA JAN PRIVATE SECTOR CREDIT +0.2% M/M; MEDIAN +0.3%; DEC +0.3%

NEW ZEALAND JAN TRADE BALANCE -NZ$626MN; MEDIAN -NZ$627MN; DEC +NZ$69MN

NEW ZEALAND JAN TRADE BALANCE 12 MTH YTD +NZ$2.745BN; MEDIAN +NZ$2.722BN; DEC +NZ$2.975BN

NEW ZEALAND JAN EXPORTS NZ$4.19BN; MEDIAN NZ$4.19BN; DEC NZ$5.38BN

NEW ZEALAND JAN IMPORTS NZ$4.82BN; MEDIAN NZ$4.82BN; DEC NZ$5.32BN

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE INDEX 113.1; JAN 113.8

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE -0.6% M/M; JAN +1.6%

The ANZ-Roy Morgan Consumer Confidence Index fell 1 point in February. Unlike business sentiment it has not had a full recovery, but it's not too far short of its historical average. (ANZ)

UK FEB LLOYDS BUSINESS BAROMETER 2; JAN -7

CHINA MARKETS

PBOC INJECTS CNY20BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged on Friday. The operations leave the liquidity unchanged given the maturity of CNY20 billion in reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2000% at 09:24 AM local time from the close of 2.2093% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 39 on Thursday vs 44 on Wednesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4713 FRI VS 6.4522

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4713 on Friday. This compares with the 6.4522 set on Thursday.

MARKETS

SNAPSHOT: Risk Continues To Struggle In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 977.14 points at 29144.69

- ASX 200 down 160.73 points at 6673.3

- Shanghai Comp. down 73.52 points at 3510.351

- JGB 10-Yr future down 37 ticks at 150.50, yield up 1.8bp at 0.171%

- Aussie 10-Yr future down 18 ticks at 98.09, yield up 18.4bp at 1.917%

- U.S. 10-Yr future +0-03 at 132-21+, yield down 1.9bp at 1.501%

- WTI crude down $0.9 at $62.65, Gold down $7.21 at $1762.6

- USD/JPY down 1 pip at Y106.2

- SENATE OFFICIAL: $15 MINIMUM WAGE NOT ALLOWED IN BIDEN'S COVID RELIEF BILL (CNBC)

- KEY SENATORS FLOAT TAX ON BIG FIRMS TO ENABLE MINIMUM-WAGE HIKE (BBG)

- FED OFFICIALS VIEW RISING YIELDS AS BULLISH SIGN REFLECTING 2021 OPTIMISM (BBG)

- RBA STEPS IN WITH OFF SCHEDULE BOND PURCHASES, BOJ REFRAINS

- CHINA STOCKS RECENT VOLATILITY DOESN'T CHANGE UPWARD TREND (SECURITIES NEWS)

BOND SUMMARY: Plenty Of Vol. In Asia

Core FI was subjected to some volatility during Asia-Pac hours, with news that U.S. Democrats cannot include a $15/hour minimum wage in their COVID relief package, per the ruling of a Senate official, allowing the space to unwind some early/overnight weakness, although trade continued to be choppy and active, with the space operating shy of best levels at typing.

- TYM1 last +0-03 at 132-21+, with the belly of the curve seeing some light outperformance after yesterday's dramatic cheapening. Activity was above average, with T-Note volume now topping 300K.

- JGB futures also followed the broader swings, and last print 30 ticks softer vs. yesterday's settlement, with 7s underperforming in cash trade, cheapening by a little over 2.0bp. The BoJ chose not to step in to protect the upside of its permitted trading band for 10-Year JGB yields (highs of ~0.18%, limit of ~0.20% ), despite some speculation that it may do so.

- Aussie bonds saw a light boost ahead of the aforementioned broader bid, with some fresh interest in establishing cross-market AUD longs seemingly apparent, although a repeat A$3.0bn round of RBA purchases covering ACGB Apr '23 & Apr '24 did little for the space, leaving participants to take cues from broader price action for much of the session.

JGBS AUCTION: Japanese MOF sells Y2.4564tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4564tn 2-Year JGBs:

- Average Yield -0.099% (prev. -0.127%)

- Average Price 100.399 (prev. 100.456)

- High Yield: -0.097% (prev. -0.124%)

- Low Price 100.395 (prev. 100.450)

- % Allotted At High Yield: 26.5444% (prev. 13.9251%)

- Bid/Cover: 4.275x (prev. 4.972x)

JGBS AUCTION: Japanese MOF sells Y5.4619tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y5.4619tn 3-Month Bills:

- Average Yield -0.1050% (prev. -0.1020%)

- Average Price 100.0282 (prev. 100.0274)

- High Yield: -0.1023% (prev. -0.0986%)

- Low Price 100.0275 (prev. 100.0265)

- % Allotted At High Yield: 69.9421% (prev. 18.2814%)

- Bid/Cover: 3.588x (prev. 3.702x)

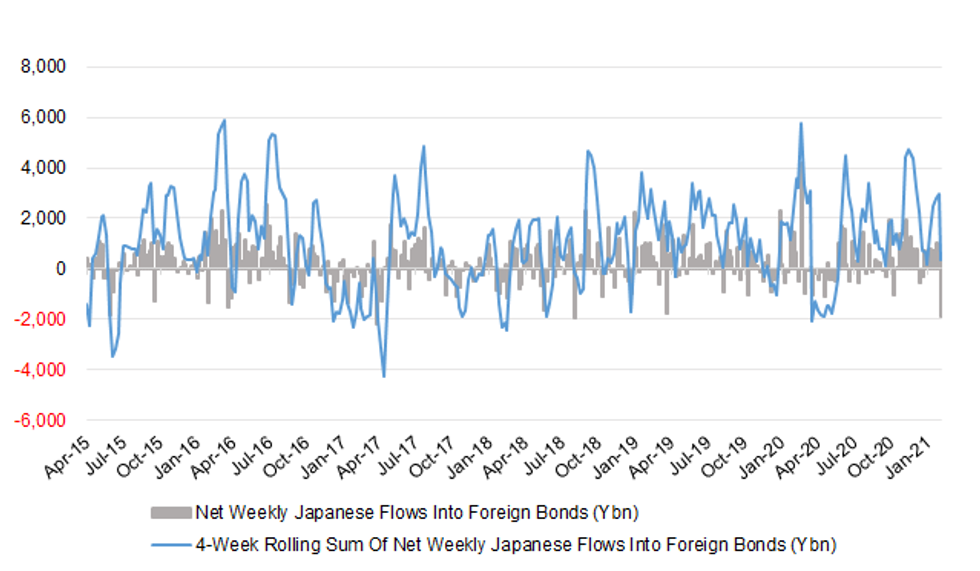

JAPAN: Heavy Selling Of Foreign Bonds In Most Recent Week

The standout round of flow in the weekly Japanese international security flow data came in the form of Japanese investors shedding the largest net amount of foreign bonds over a one-week period since August 2018. The data covers the period until February 19, so excludes the latest round of cheapening witnessed in global core bond markets and may have represented some caution ahead of the Japanese FY end (which falls at the end of March).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1893.0 | 478.2 | 341.6 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -394.8 | -23.8 | -1497.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 316.6 | -748.4 | 219.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 94.1 | 339.5 | 709.2 |

Source: MNI - Market News/Japanese Ministry Of Finance

Fig.1: Net Weekly Japanese Flows Into Foreign Bonds (Ybn)

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Thursday 4 March it plans to sell A$1.0bn of the 25 June 2021 Note & A$1.0bn of the 27 August 2021 Note.

- On Friday 5 March it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

EQUITIES: Red On The Screens

Asia-Pac equities hemorrhaged on Friday, taking a negative lead from the US after a day of heavy losses as US yields spiked. Most markets in Asia are off their worst levels but still seeing losses of between 2% - 3%, despite a calmer session for bonds.

- US futures are lower, the S&P 500 closed yesterday with a 2.5% with tech shares leading losses, this bled over into the Nasdaq 100 which tumbled 3.6%, the biggest one day drop since October, with market participants adjusting portfolios to favour companies poised to benefit from an end to lockdowns.

OIL: Crude On Track For Fourth Monthly Gain

Crude futures are lower in Asia, but still on track for a weekly gain – WTI is up around 6.5% on the week and 21.10% in February, on track for its fourth straight monthly gain. WTI is down $0.43 at $63.10, brent is down $0.26 at $66.62. Markets will look ahead to an OPEC+ meeting next week with chatter that Saudi Arabia and Russia are again heading into the meeting on opposite sides of the supply debate.

GOLD: Pressured By U.S. Real Yields, But Tech Support Remains Untouched

U.S. real yield dynamics (outside of the retracement in 30s), a firmer USD and another modest reduction in ETF holdings have combined over the last 24 hours, resulting in a weaker gold price, although bears haven't really been able to force a test of the Feb 19 low at $1,760.7/oz in spot, with $1,765/oz holding firm for now. Bullion last deals around $1,768/oz.

FOREX: Choppy End To The Week In Asia

Risk aversion lingered on as regional equity benchmarks tumbled on a negative lead from Wall Street. Commodity-tied FX traded on the back foot, with a bout of risk-off flows and broad-based greenback strength seen as USD/CNH had its first look above CNH6.5000 this lunar year. The rate swung to a loss but G10 FX space remained in a risk-off mode. The PBOC fixed its USD/CNY mid-point at CNY6.4713, just 5 pips above sell side estimates.

- NZD went offered as a spill-over from USD/CNH price action conspired with a speech from RBNZ Gov Orr, who sought to brush away any hawkish interpretations of this week's MPS/remit tweak. BBG trader sources flagged NZD sales by funds exiting core long positions as Orr reiterated the need for prolonged monetary stimulus, signalled potential for deploying a negative OCR if needed and noted that the RBNZ doesn't target house prices. The kiwi knee-jerked lower on the mention of negative interest rates.

- Reported AUD purchases by large exporters helped the currency move away from session lows before it turned its tail again. AUD is the worst G10 performer alongside NOK, with some sizeable AUD/USD option expiries coming up today. A$1.7bn of AUD puts with strikes at $0.7850 will expire at the NY cut, with a A$5.3bn put strike at $0.7900 rolling off as well.

- USD/JPY had a brief look above yesterday's multi-month high before reversing losses, but yesterday's low proved resilient. The pair bounced off there and returned toward neutral levels.

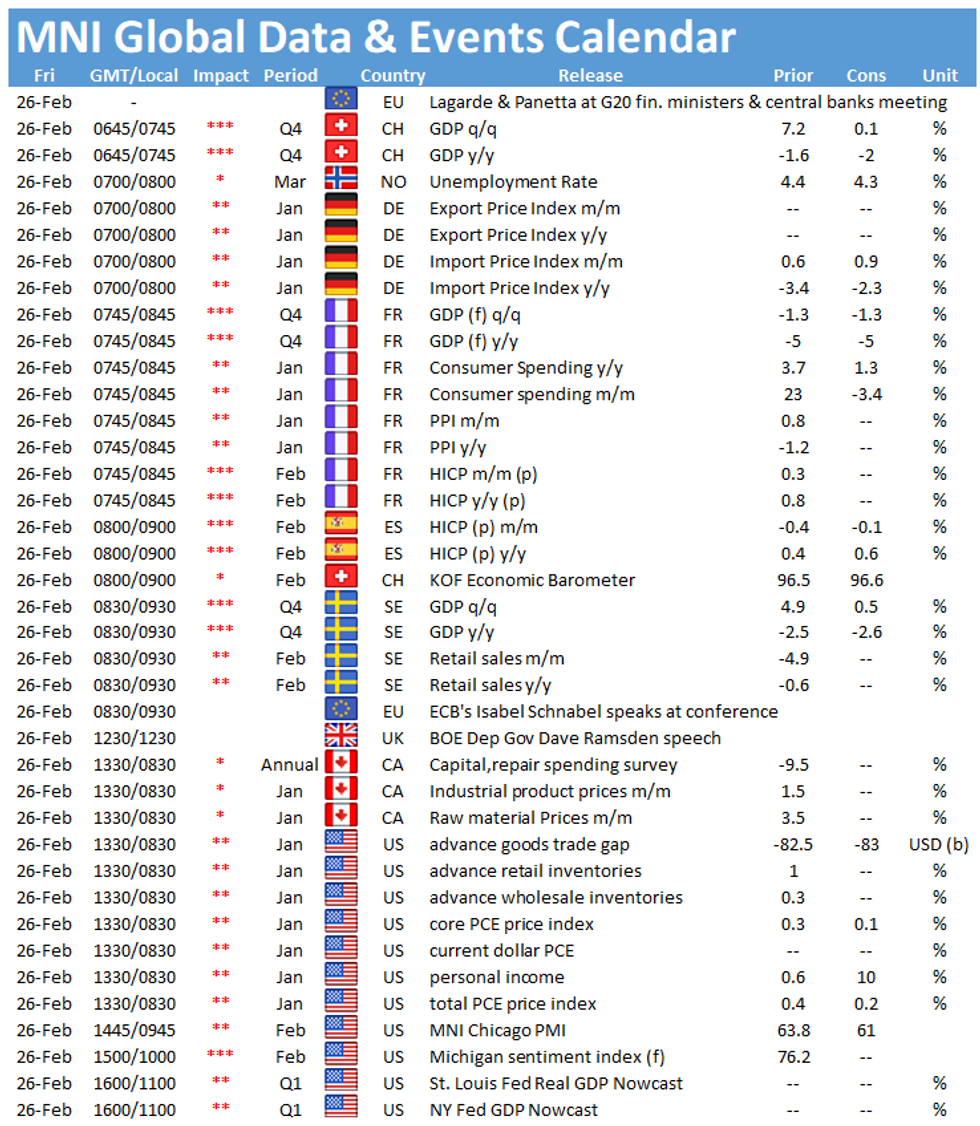

- U.S. personal income/spending, MNI Chicago PMI & final U. of Mich. Sentiment, French GDP (f) & CPI (p), Swedish GDP, trade balance & retail sales as well as Norwegian unemployment take focus on the data front. ECB's Schnabel & Visco and BoE's Haldane & Ramsden are set to speak.

FOREX OPTIONS: Expiries for Feb26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E682mln), $1.2150(E698mln), $1.2175(E1.6bln-EUR puts), $1.2200(E792mln), $1.2235-50(E694mln), $1.2275(E786mln)

- USD/JPY: Y105.25($750mln), Y105.80-00($1.2bln), Y106.25-35($602mln), Y106.50($655mln)

- GBP/USD: $1.3900(Gbp1.3bln), $1.3930(Gbp614mln), $1.4000(Gbp607mln), $1.4030(Gbp2.3bln-GBP puts), $1.4060(Gbp1.2bln-GBP puts), $1.4120(Gbp879mln)

- EUR/GBP: Gbp0.8600-20(E2.4bln), Gbp0.8650(E854mln), Gbp0.8665-75(E1.8bln-EUR puts), Gbp0.8750-65(E1.2bln-EUR puts)

- AUD/USD: $0.7590-0.7600(A$1.2bln), $0.7770-80(A$1.6bln-AUD puts), $0.7850(A$1.7bln-AUD puts), $0.7900(A$5.2bln-AUD puts), $0.7975(A$2.2bln-AUD puts)

- NZD/USD: $0.7400(N$676mln)

- USD/CAD: C$1.2500($1.9bln), C$1.2530($1.8bln), C$1.2630($1.5bln)

- USD/CNY: Cny6.41($550mln), Cny6.44($680mln). Cny6.45($1.1bln)

- USD/MXN: Mxn19.70($1.2bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.