-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Safety Concerns

EXECUTIVE SUMMARY

- GERMANY, FRANCE HALT ASTRA SHOT THAT REGULATOR DECLARES SAFE (BBG)

- EU EXECUTIVE TO LAY OUT PLAN FOR MANAGED REOPENING OF ECONOMIES (BBG)

- UK PLANS TIGHTER SECURITY TO ALLOW TRADE WITH "BIGGEST THREAT" CHINA (Times)

- RBA EMPHASIZES NEED FOR HIGHER WAGES GROWTH IN SUBTLE SHIFT (BBG)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Many of Britain's workers will remain at home at least part of the time after the coronavirus pandemic passes, Bank of England Governor Andrew Bailey said in comments that put him at odds with one of his fellow policy makers. The U.K. central bank's chief expects a "hybrid" model to prevail where employees spend some time in the office, but not as much as before Covid-19. His remarks have huge implications for real estate investors and city-center restaurants built up on the assumption that offices would only grow. (BBG)

POLITICS: Britain is lifting the cap on the number of Trident nuclear warheads it can stockpile by more than 40%, Boris Johnson will announce on Tuesday, ending 30 years of gradual disarmament since the collapse of the Soviet Union. The increased limit, from 180 to 260 warheads, is contained in a leaked copy of the integrated review of defence and foreign policy, seen by the Guardian. It paves the way for a controversial £10bn rearmament in response to perceived threats from Russia and China. The review also warns of the "realistic possibility" that a terrorist group will "launch a successful CBRN [chemical, biological, radiological or nuclear] attack by 2030", although there is little extra detail to back up this assessment. It includes a personal commitment from Johnson, as a last-minute addition in the foreword, to restore foreign aid spending to 0.7% of national income "when the fiscal situation allows", after fierce criticism of cuts in relief to Yemen and elsewhere. (Guardian)

POLITICS: Priti Patel insisted on Monday that the UK government was committed to preventing violence against women as she tried to dispel concerns that proposed legislation will fail to tackle the issue adequately. In a statement to MPs, the home secretary said the murder of 33-year-old Sarah Everard had "rightly ignited anger" among the public and served as a stark reminder of the everyday harassment faced by women. (FT)

BREXIT: The European Commission Monday launched twin-track legal action against the British government over its decision to unilaterally delay the introduction of post-Brexit checks on goods entering Northern Ireland from Great Britain. The EU executive body said in a statement that it had sent two letters to the U.K. government, which contain threats of two different paths for legal proceedings against London should the British government not be willing to settle the dispute via negotiations in the coming weeks. The U.K. said the waivers remained "lawful and part of a progressive and good faith implementation of the Northern Ireland Protocol." (Politico)

CORONAVIRUS: Cabinet ministers and senior officials have told the BBC the government should have brought in tougher restrictions in the early autumn to tackle the "inevitable" second wave of coronavirus. In the run up to the anniversary of the lockdown, BBC News has spoken off the record to more than 20 senior politicians, officials and former officials about the key moments of the last 12 months. The investigation revealed significant frustration in government about Boris Johnson's unwillingness to tighten restrictions in September, as cases again began to rise. (BBC)

SCOTLAND: Scottish Conservative leader Douglas Ross on Monday accused the governing Scottish National party of abuses of power while setting out a policy stall for crucial elections in May that includes a universal £500-a-year retraining grant for workers. (FT)

U.S./CHINA: Sensitive sites and technology will be made more secure to allow Britain to trade with an increasingly powerful China, a landmark defence, security and foreign policy review says today. China poses the "biggest state-based threat" to the UK's economic security and presents a "systemic challenge" to British prosperity and values, according to a copy of the report that was leaked before publication to The Times. (Times)

DATA: Loungewear, hand weights and sanitizer fluid have all been added to the list used to gauge living costs, the Office for National Statistics said on Monday. It's part of an annual review of the basket of goods tracking consumer prices and gives an insight into the country's changing lifestyles. (BBG)

EUROPE

CORONAVIRUS: The European Medicines Agency said in a statement that "many thousands of people develop blood clots annually in the EU for different reasons" and that the number of incidents in vaccinated people "seems not to be higher than that seen in the general population". It said it was working closely with AstraZeneca and national health regulators, including the MHRA in the UK, where 11 million people have received the shot, to analyse all available data and establish whether the vaccine might have contributed. (Guardian)

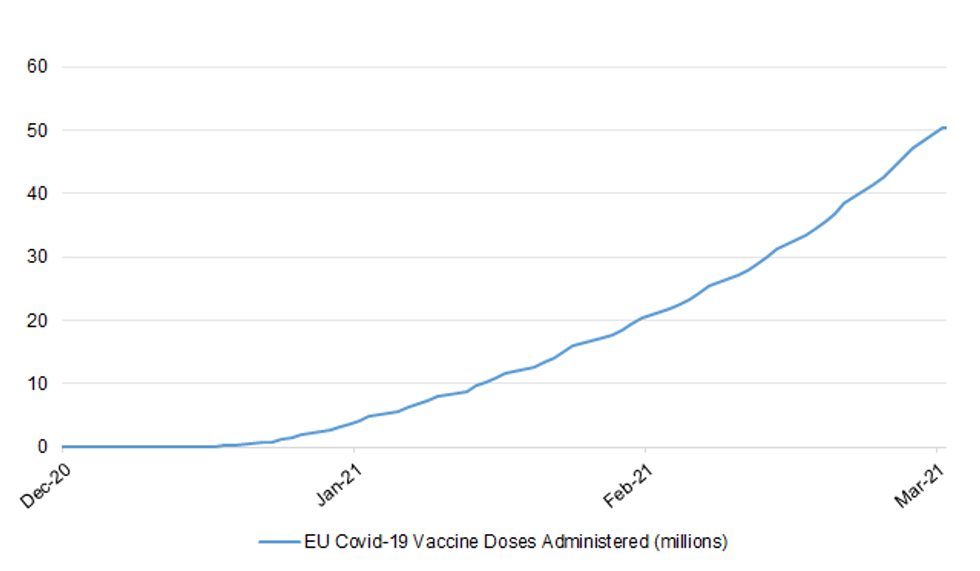

EU: Europe's biggest countries, including Germany and France, suspended use of AstraZeneca Plc's Covid-19 vaccine amid a growing health scare that's creating yet another delay for the European Union's inoculation campaign. Governments across the continent halted the distribution of the shots following reports of serious blood clotting, even as the EU drugs regulator reiterated its support for the vaccine. The suspensions mark a U-turn for some countries that had previously said inoculations should continue while the issue was investigated. Italy, Spain and Portugal also suspended use of the shot. EU health ministers are due to hold a video conference on Tuesday, where the latest concerns will probably dominate proceedings. In its statement on Monday, Germany cited additional cases of serious thrombotic events in recent days as the reason for the temporary suspension. (BBG)

EU: The European Union will start plotting its strategy to gradually lift coronavirus lockdowns, even as an AstraZeneca Plc. vaccine health scare risks causing additional delays to the bloc's botched immunization campaign. "There is reason to look forward to a substantial reduction in the prevalence of the virus, raising the prospect of a lifting of the restrictions weighing on citizens and the economy alike," the European Commission will say in a policy document due to be unveiled Wednesday. "EU citizens have good reason to expect the situation to improve," it will say, according to a draft seen by Bloomberg. The coordinated lifting of lockdowns will be based on a tier "system reflecting the epidemiological situation in each member state," the Commission will say. The document's publication is coming as a surge in contagion across the continent is forcing governments to prolong or reimpose restrictions. The tier system, due to be proposed by the European Centre for Disease Prevention and Control, will simulate how much latitude each government has to lighten the measures "without risking a reversal in the spread of the virus." The ECDC will aim to launch the system next month, the draft says. (BBG)

EU: The EU is seeking to expand domestic production of giant plastic bags crucial to vaccine-making, as part of a response to threat of shortages and US controls on critical raw material exports. Merck, the German drugs giant, is planning to boost EU output of the disposable vessels to ease the threat of supply squeezes and boost Brussels' attempts to improve sluggish jab deliveries. The EU initiative highlights growing concerns about a threat to European vaccine manufacturing if supplies of vital items from the US are squeezed by Washington's efforts to maximise domestic US jab availability. Efforts by the EU to convince the US to release unused batches of AstraZeneca vaccine made in the country have so far failed to bear fruit. (FT)

EU: The European Union is working to create a digital contact-tracing system to let member states better track Covid-19 outbreaks as people travel across borders. The Passenger Locator Form project adds to signs the EU wants to gradually restore travel after the pandemic brought it to a standstill and as economies including Greece and Spain prepare to welcome visitors with the summer holiday season approaching. On Wednesday, the bloc's executive arm will present a proposal for the introduction of digital certificates that will offer proof their holders have been vaccinated, tested negative or recovered from Covid and can thus travel without the need to be quarantined. (BBG)

EU/RUSSIA: The European Commission can move to strike a joint European contract with the Russian Direct Investment Fund (RDIF) to supply Russia's Sputnik V COVID-19 jabs to take the deliveries of the Russian shot to EU members under its control, a diplomatic source in Brussels told TASS Monday, underlining that "the European Commission is yet to engage in talks with the Russian side." (TASS)

GERMANY: The leaders of Germany's ruling conservative parties on Monday said Angela Merkel's government had to up its game in handling the coronavirus, following heavy defeats in regional elections just months before the country chooses a new chancellor. Markus Söder, leader of Bavaria's Christian Social Union (CSU), described Sunday's election losses as "a wake-up call." Armin Laschet, head of Merkel's Christian Democratic Union (CDU), declared at a press conference in Berlin: "I expect the federal government to do a good job." Laschet tried to push the blame for the government's woes onto the junior coalition partner, the center-left Social Democrats (SPD). He lashed out at Finance Minister Olaf Scholz, the SPD candidate for chancellor, who made headlines earlier this month by suggesting as many as 10 million Germans could be vaccinated per week by the end of March, a claim the government later refuted. (Politico)

GERMANY: The CDU has drafted a ethical rules for all members to follow. DW obtained a copy of the paper, "Strengthen Trust, Follow Rules, Sanction Infractions," before it was officially adapted by the party Monday afternoon. The code of conduct paper begins by reminding party members, especially elected officials, of their responsibilities as "role models in society." The paper comes as three members of Merkel's political bloc were forced to step down after taking hundreds of thousands of euros in payments from mask-producing companies with business before the government. News of the scandal only worsened anger over the government's perceived poor performance in dealing with the coronavirus and vaccinating citizens. (DW)

FRANCE: The French economy is weathering the Covid pandemic and government restrictions better than previously forecast, putting it on a path to stronger growth this year, the Bank of France said. Activity fell less than the central bank initially expected at the end of 2020 as household and business investment held up despite the lockdown in November. The central bank expects stronger growth in the second half of this year as health restrictions are lifted and vaccines slow the pandemic. "The economy will be pulled by a rebound of consumer spending, public support for demand and the resilience of investment," the Bank of France said in its quarterly economic forecasts Tuesday. (BBG)

ITALY: League leader Matteo Salvini said Monday that new Democratic Party (PD) leader Enrico Letta was putting Premier Mario Draghi's broadly backed government in danger with talk of granting automatic Italian citizenship to children born in Italy to migrant parents. A Ius Soli law giving citizenship to the children of migrants was among the points raised by ex-premier Letta after he was voted the PD's new leader by a party assembly on Sunday. (Ansa)

ITALY: Steve Bannon, the former adviser to ex-U.S. President Donald Trump, has lost a legal battle to set up a right-wing Catholic political academy in an abbey in Italy. (RTRS)

SPAIN: The leader of the junior party in Spain's coalition government announced Monday he is leaving the Cabinet to run for regional office. Pablo Iglesias, who took the left-wing Unidas Podemos (United We Can) party into government 15 months ago with the Socialist party, said he is proposing Yolanda Díaz, currently Spain's Labor Minister, to take his place as deputy prime minister in charge of social rights. Iglesias said he had informed Socialist Prime Minister Pedro Sánchez of his decision to stand in the May election for the Madrid regional government. He said his political efforts would be "most useful" fighting right-of-center opponents in the Spanish capital. (AP)

CZECHIA: The Czech economy has been "surprisingly resilient" against one of the world's worst coronavirus outbreaks, but market expectations of an interest-rate increase this summer may be premature, a central banker said. With most shops and services closed since late December under a virus lockdown, private savings have surged and are likely to help fuel a robust recovery once restrictions are lifted, Ales Michl said in an interview. While investors are betting that rate hikes will start in August, he cautioned against tightening monetary conditions before the pandemic recedes. (BBG)

ESTONIA: Estonian Prime Minister Kaja Kallas has tested positive for COVID-19 and says she will self-quarantine until she has recovered from the virus. (AP)

US

FISCAL: President Joe Biden is planning the first major federal tax hike since 1993 to help pay for the long-term economic program designed as a follow-up to his pandemic-relief bill, according to people familiar with the matter. Unlike the $1.9 trillion Covid-19 stimulus act, the next initiative, which is expected to be even bigger, won't rely just on government debt as a funding source. While it's been increasingly clear that tax hikes will be a component -- Treasury Secretary Janet Yellen has said at least part of the next bill will have to be paid for, and pointed to higher rates -- key advisers are now making preparations for a package of measures that could include an increase in both the corporate tax rate and the individual rate for high earners. (BBG)

POLITICS: President Biden said in a speech from the White House Monday that his administration will reach two "giant goals" in the next 10 days: 100 million coronavirus vaccine doses and 100 million relief checks distributed to the public. Why it matters: The speech kicks off the administration's "Help is Here" campaign, which will see Biden and Vice President Harris travel the country to sell the benefits of the $1.9 trillion COVID relief package to the American public. (Axios)

POLITICS: The Senate voted 51-40 on Monday to confirm Rep. Deb Haaland (D-N.M.) as President Biden's secretary of the Interior Department. Why it matters: Haaland, a member of the Laguna Pueblo tribe, is the first Native American to lead a Cabinet agency. (Axios)

POLITICS: Senate Majority Leader Chuck Schumer, D-N.Y., on Monday renewed calls for President Biden to cancel $50,000 worth of student loan debt just days after the president signed the $1.9 trillion American Rescue Plan into law. Schumer said that he believes Biden has the authority to forgive up to $50,000 in federal student loan debt during a speech on the Senate floor, which he said would be a "life-changing policy decision." (Fox)

POLITICS: Illinois Sen. Dick Durbin, the No. 2 Democrat in the upper chamber, torched the legislative filibuster on Monday, arguing that it is undermining democracy. Durbin's floor speech comes as intense pressure builds from outside groups and within the Senate Democratic caucus for nixing the 60-vote legislative filibuster. Democrats don't currently have the votes to invoke the "nuclear option," which would take every member of their 50-seat caucus. (Hill)

CORONAVIRUS: The Biden administration issued new internal guidance Monday saying it would reduce daily coronavirus testing for White House staff to once a week, Axios has learned. (Axios)

CORONAVIRUS: Ocugen Inc plans to sell 100 million doses of India's state-backed COVID-19 vaccine in the United States this year, the U.S. firm's chief executive Shankar Musunuri told Reuters on Monday. Musunuri said Ocugen, a Pennsylvania-based biopharmaceutical firm, was aiming to launch the Indian-developed vaccine in the United States in the second quarter of 2021, initially with imported shots before beginning production there. (RTRS)

OTHER

WHO: The World Health Organization (WHO) has urged countries not to pause Covid vaccinations, as several major EU member states halted their rollouts of the Oxford-AstraZeneca jab. It said there was no evidence of a link between the vaccine and blood clots. The WHO's vaccine safety experts are meeting on Tuesday to discuss the jab. (BBC)

IMF: The Executive Board of the International Monetary Fund (IMF) approved an extension of the current Special Drawing Right (SDR) valuation basket by ten months from September 30, 2021 to July 31, 2022. (IMF)

U.S./UK: British finance minister Rishi Sunak and U.S. Treasury Secretary Janet Yellen spoke on the phone on Monday to discuss a possible new allocation of Special Drawing Rights (SDRs), the UK treasury department said in a statement. Both agreed that a new SDR allocation could form an important part of a package of support for low-income countries and could be vital for securing a truly global recovery, the statement added. (RTRS)

U.S./CHINA/AUSTRALIA: The US will not grant China any improvement in relations until Beijing stops its economic coercion of Australia, a senior White House official said. The administration of President Joe Biden has told the Chinese government that "we are not going to leave Australia alone on the field", according to the President's Indo-Pacific Coordinator, Kurt Campbell. "We have made clear that the US is not prepared to improve relations in a bilateral and separate context at the same time that a close and dear ally is being subjected to a form of economic coercion," he told The Sydney Morning Herald and The Age in in the first interview a senior Biden official has given to any Australian media. (Age)

U.S./CHINA: The White House is quietly supporting Sen. Chuck Schumer's forthcoming legislation to curb China's global influence to prove Democrats can still work with Republicans despite the GOP voting unanimously against the $1.9 trillion coronavirus relief package. (Axios)

ASIA: Thai Prime Minister Prayuth Chan-ocha became the first person to be inoculated with the AstraZeneca Covid-19 vaccine in the Southeast Asian country on Tuesday after the roll-out had been temporarily put on hold over safety concerns. Prayuth and other cabinet members were initially due to get their vaccine shots on Friday, before Thailand suspended use of the AstraZeneca vaccine after reports it could cause blood clots prompted a number of European countries to hit pause. "Today I'm boosting confidence for the general public," Prayuth told reporters at Government House, before he received a shot in his left arm. (SCMP)

BOJ: MNI BRIEF: BOJ To Begin CBDC Experiment in Spring, says Kuroda

- The advent of the digital society is creating significant change in the way central banks provide money, and the Bank of Japan is taking an opportunity to carefully consider its response to these changes, Bank of Japan Governor Haruhiko Kuroda said on Tuesday

BOJ: MNI BRIEF: Forex Rates Stable, Eye Impact Of Moves: Kuroda

- All the leading forex pairs including the yen, dollar and euro, are set in stable ranges as central banks all aim at achieving a 2% price target, Bank of Japan Governor Haruhiko Kuroda told lawmakers Tuesday. However, he said the central bank continues to monitor rates, as adverse moves affect both prices and the wider economy

JAPAN: Japan's Cabinet has approved cash handouts for low-income families as part of new aid amid the pandemic, Finance Minister Taro Aso tells reporters in Tokyo on Tuesday. Govt is also putting together a package to support people dealing with depression amid the isolation of the pandemic. (BBG)

JAPAN: Defense and foreign ministers from the U.S. and Japan are to discuss their concern over China's growing influence in the Indo-Pacific region as the Biden administration tries to reaffirm engagement with its key regional allies. U.S. Defense Secretary Lloyd Austin and Secretary of State Antony Blinken are to hold so-called "two plus two" security talks on Tuesday with their Japanese counterparts, Foreign Minister Toshimitsu Motegi and Defense Minister Nobuo Kishi. The U.S. ministers arrived in Tokyo late Monday. (AP)

RBA: The Reserve Bank of Australia highlighted the importance of stronger wages growth before considering any rise in interest rates, providing itself with a little extra room by emphasizing a traditionally lagging indicator. "It was likely that wages growth would need to be sustainably above 3%," the RBA said in minutes of its March policy meeting in Sydney Tuesday, noting overseas experience suggested Australia would need a tight labor market and considerable time for this to occur. "Wages growth would be unlikely to be consistent with the inflation target earlier than 2024." (BBG)

AUSTRALIA: Australia won't follow European countries pausing rollouts of the AstraZeneca COVID-19 vaccine, with federal health authorities describing the drug as safe and necessary to protect the public. Chief Medical Officer Paul Kelly said the drug was safe and no evidence existed showing it caused blood clots. (AFR)

AUSTRALIA: Facebook Inc. reached a multiyear deal with News Corp. in Australia, agreeing to pay Rupert Murdoch's publishing arm for access to additional stories. The agreement resolves a dispute in the country between publishers and tech giants over payments for news articles. The deal includes content from News Corp.'s national newspaper, The Australian, as well as the Daily Telegraph in New South Wales, the Herald Sun in Victoria and the Courier-Mail in Queensland, the publishing company said in a statement Monday. Sky News Australia also reached a parallel accord with Facebook. (BBG)

CANADA: The National Advisory Committee on Immunization (NACI) is expected to change its stance on the AstraZeneca COVID-19 vaccine to now recommend its use for Canadians over the age of 65, a senior government source tells CTV News. The source added that there will be a news conference Tuesday morning to confirm the details of the change. (CTV)

BRAZIL: President Jair Bolsonaro replaced General Eduardo Pazuello at the helm of the health ministry as daily records of infections and deaths add pressure on Brazil to get the coronavirus pandemic under control. Cardiologist Marcelo Queiroga accepted an offer to become the country's new health chief, the president told supporters in front of the residential palace on Monday. "I had an excellent conversation with him this afternoon," Bolsonaro said. "In my understanding he has everything to do a good job, continuing everything that Pazuello has done so far." Queiroga will be the fourth person in charge of the health ministry since the coronavirus arrived in the country a little over a year ago. Luiz Henrique Mandetta and Nelson Teich, who both had medical background, left after disagreements with Bolsonaro over social distancing and unproven treatments against Covid-19. Pazuello had been in the post since May. (BBG)

MEXICO: Mexico has asked the United States to share doses of AstraZeneca's COVID-19 vaccine it has in stock, a senior diplomat said, following up on a request made by President Andres Manuel Lopez Obrador to his counterpart Joe Biden. Deputy foreign minister for multilateral affairs Martha Delgado said that since the United States had not yet approved the AstraZeneca vaccine it would be a good candidate to offer to Mexico, which has started using it already. "The possibility exists of being able to have access to some AstraZeneca batches they have," Delgado said in an interview with Reuters late last week, saying Mexico had made the request in diplomatic conversations since Lopez Obrador spoke to Biden on March 1. (RTRS)

VENEZUELA: Venezuela said it won't allow the use of the AstraZeneca Plc's Covid-19 vaccine for the country'simmunization process due to health complications following the application of the shot, Vice President DelcyRodriguez said on state TV. (BBG)

INDIA: India reported 24,492 new coronavirus cases on Tuesday, the sixth straight day of more than 20,000 infections, as curbs to try to stop the spread of COVID-19 were expanded in parts of the country that have recorded a surge. (RTRS)

MALAYSIA: Malaysia's opposition leader Anwar Ibrahim is expected to hold a press conference at 4.30pm on Tuesday (March 16) amid talks about the collaboration between his Parti Keadilan Rakyat (PKR) and its supposed rival Umno in the next election. Invitations to the press conference were sent to the media on Tuesday morning on WhatsApp groups by his press secretary, following a report by the Mingguan Malaysia newspaper on Sunday, where Datuk Seri Anwar confirmed that there have been informal discussions between both parties. (Straits Times)

RUSSIA: The Bank of Russia is considering moving faster than previously signaled to tighten monetary policy and may bring its key interest rate up by 125 basis points or more before the end of the year, according to a person with knowledge of the discussions. (BBG)

OIL: The UK oil and gas industry has the potential to approve new North Sea projects holding a combined 700 million barrels of oil equivalent by the end of 2022, but requires both a stable market, and regulatory and governmental support, industry group Oil & Gas UK said March 16. (Platt's)

CHINA

ECONOMY: China's top leader warned that Beijing will go after so-called "platform" companies that have amassed data and market power, a sign that the months-long crackdown on the country's internet sector is only just beginning. President Xi Jinping on Monday chaired a meeting of the communist party's top financial advisory and coordination committee, ordering regulators to step up oversight of internet companies, crack down on monopolies, promote fair competition and prevent the disorderly expansion of capital, according to state broadcaster CCTV. Internet companies need to enhance data security and financial activities need to come under regulatory supervision, CCTV also reported. (BBG)

ECONOMY: Liquidity in China's money market in the second half of March is likely to remain plentiful as fiscal expenditure rises, driving rates lower, the Shanghai Securities News reported citing Ming Ming, deputy director of CITIC Securities Research Institute. The PBOC is likely to continue to prioritize stability after injecting CNY100 billion by MLF on March 15, which replaces the same amount of MLF expiring on Tuesday, while leaving rates unchanged at 2.95%, the newspaper said. The MLF rate is likely to remain unchanged in Q2, the report said. (MNI)

ECONOMY: China should include asset prices when considering its inflation levels, as the CPI and PPI may not reflect the whole picture of the economy and the well-being of residents, said Xu Zhong, former director of the Research Bureau of the People's Bank of China in a blog post published by China Finance 40. Higher asset prices and valuations could mean the future investment income of pensions may not be high and more pensions may need to be paid today, Xu said. (MNI)

ECONOMY: China will promote low-carbon energy by curbing the use of fossil fuels, promote carbon emission rights trading and actively develop green finance in the next five years, CCTV News reported citing a meeting of the Central Committee for Financial and Economic Affairs. China will improve policies on taxation, finance, land and government procurement conducive to green development, and promote new green and low-carbon technologies, CCTV said. The moves are part of government plans to reach peak carbon emissions by 2030 and achieve net-zero by 2060. (MNI)

EQUITIES: China Mobile Ltd. is considering an A-share listing after the country's largest wireless carrier was removed from the New York Stock Exchange under a Donald Trump-era investment ban, according to people familiar with the matter. The state-owned firm has discussed the potential offering with advisers as it looks for new avenues to fund its 5G network development, said the people, who asked not to be identified as the discussions are private. Deliberations are at an early stage and China Mobile hasn't decided the size and timeline of the listing, the people said. (BBG)

OVERNIGHT DATA

JAPAN JAN, F INDUSTRIAL OUTPUT -5.2% Y/Y; FLASH -5.3%

JAPAN JAN, F INDUSTRIAL OUTPUT +4.3% M/M; FLASH +4.2%

AUSTRALIA Q4 HOUSE PRICE INDEX +3.6% Y/Y; MEDIAN +2.9%; Q3 +4.5%

AUSTRALIA Q4 HOUSE PRICE INDEX +3.0% M/M; MEDIAN +1.8%; Q3 +0.8%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 110.9; PREV. 111.9

NEW ZEALAND JAN CREDIT CARD SPENDING -10.6% Y/Y; DEC -6.7%

NEW ZEALAND JAN CREDIT CARD SPENDING -0.1% M/M; DEC -2.0%

SOUTH KOREA FEB EXPORT PRICE INDEX +0.2% Y/Y; JAN -1.9%

SOUTH KOREA FEB EXPORT PRICE INDEX +3.1% M/M; JAN +2.2%

SOUTH KOREA FEB IMPORT PRICE INDEX -0.8% Y/Y; JAN -5.8%

SOUTH KOREA FEB IMPORT PRICE INDEX +3.8% M/M; JAN +3.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2144% at 09:38 am local time from the close of 2.2957% on Monday.

- The CFETS-NEX money-market sentiment index closed at 36 on Monday vs 55 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5029 TUES VS 6.5010

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second day at 6.5029 on Tuesday, compared with the 6.5010 set on Monday.

MARKETS

SNAPSHOT: Safety Concerns

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 153.59 points at 29920.56

- ASX 200 up 54.089 points at 6827.1

- Shanghai Comp. up 14.596 points at 3434.325

- JGB 10-Yr future up 11 ticks at 151.18, yield down 1.0bp at 0.101%

- Aussie 10-Yr future up 9.9 ticks at 98.27, yield down 9.7bp at 1.692%

- U.S. 10-Yr future +0-04+ at 132-03, yield down 1.21bp at 1.593%

- WTI crude down $0.43 at $64.96, Gold up $3.15 at $1734.78

- USD/JPY up 5 pips at Y109.18

- GERMANY, FRANCE HALT ASTRA SHOT THAT REGULATOR DECLARES SAFE (BBG)

- EU EXECUTIVE TO LAY OUT PLAN FOR MANAGED REOPENING OF ECONOMIES (BBG)

- UK PLANS TIGHTER SECURITY TO ALLOW TRADE WITH "BIGGEST THREAT" CHINA (Times)

- RBA EMPHASIZES NEED FOR HIGHER WAGES GROWTH IN SUBTLE SHIFT (BBG)

BOND SUMMARY: Tsys Firm Ahead Of FOMC, ACGBs Shrug Off RBA Minutes

T-Notes extended yesterday's gains and trade +0-05 at 132-03+ as we type, amid little in the way of headline flow to drive the move. Cash curve bull flattened, though the 7-10 sector outperformed, while 10-year Tsy yield pulled back under 1.600%. Eurodollar futures run -0.5 to +1.0 tick through the reds. U.S. highlights today include industrial output & retail sales data, as well as 20-Year Tsy supply. The Fed is in its blackout period, with all eyes on Wednesday's MonPol decision.

- JGB futures took their cue from T-Notes and crept higher, printing best levels in a week. The contract sits at 151.16, 9 ticks above last settlement. Cash JGB yields trade lower across a slightly flatter curve. Final industrial output figures reported by Japan were revised marginally higher. The MoF conducted a liquidity enhancement auction for off-the-run 5-15.5 Year JGBs, with bid/cover ratio easing to 3.664x from 5.060x seen at the prev. auction. MoF off'ls revealed that there is Y3.8tn left in Japan's Covid-19 reserve fund, while FinMin Aso said that the cabinet has approved cash handouts for low income families. Aso added that the decision on U.S. beef imports has not been taken yet, after local media flagged an imminent tariff hike.

- Aussie bond futures firmed, YM last sits +3.5 & XM +9.4 ticks, in close proximity to session highs. Cash ACGB curve flattened, yields trade +0.1bp to -10.1bp at typing. Bills trade unch. to +3 ticks through the reds. The space showed little reaction to the latest RBA MonPol meeting minutes and local data, which included a beat in Q4 house price index & slight deterioration in the ANZ/Roy Morgan weekly consumer confidence gauge. Following the release of the RBA minutes, CBA said they now see the RBA keeping its YCC policy in place until the maturity of the Apr '24 bonds (without switching to Nov '24), while Westpac confirmed their call that the RBA will extend the YCC to the Nov '24 bond.

JGBS AUCTION: The MOF sells Y498.2bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.2bn of 5-15.5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.008% (prev. 0.000%)

- High Spread: -0.007% (prev. +0.002%)

- % Allotted At High Spread: 67.5905% (prev. 36.3391%)

- Bid/Cover: 3.664x (prev. 5.060x)

EQUITIES: Tech Rallies

Equities are higher in Asia-Pac on Tuesday, having overcome an earlier mid-session drop. Chinese markets ventured into negative territory after the PBOC refrained from injecting liquidity for the seventh straight day, which saw repo rates jump and sapped equity markets. This negative sentiment spilled over into other Asia-Pac markets, before a rally in tech stocks helped markets regain footing. Markets in Australia are the biggest gainer today, led higher by a 3% rally in the tech sector. Futures in Europe and the US are mixed, the tech rally is supporting a move higher in Nasdaq futures, while e-mini Dow Jones has slipped around 0.125% at time of writing. Elsewhere, the VIX has returned to its pre-pandemic levels as equity markets in the US hover around record highs.

OIL: Slips For Third Day

Crude futures are lower in Asia, on track for a third day of loses. WTI is $0.50 lower than settlement at $64.89/bbl, Brent is down $0.54 at $68.34/bbl. A stronger greenback is hurting oil prices, as is over supply, which has seen WTI's front time spread drop to the deepest levels of contango since early January. Markets look ahead to API data later in the day for indications as to the extent of oversupply, with analysts estimating headline US crude stocks are around 6.5% above five-year averages.

GOLD: Creeps Towards Resistance

The yellow metal is higher in Asia-Pac trade, creeping towards last week's high at $1,740 which also held earlier in March. Gold is on track for two straight days of gains with markets looking ahead to the FOMC meeting later this week, where markets appear to expect Fed Chair Powell to affirm the board's dovish stance. Also helping underpin gold is the prospect of higher taxes from the Biden administration, which historically sees shifts into bullion.

FOREX: RBA Minutes Sap Some Strength From Aussie, Sterling Underperforms

Price action across G10 FX space was relatively subdued in the lead up to Wednesday's FOMC decision. AUD went offered, extending losses to fresh session lows after the minutes from the RBA's latest MonPol meeting noted that "wages growth would be unlikely to be consistent with the inflation target earlier than 2024" and warned against potential hiccups related to the imminent termination of the JobKeeper wage subsidy scheme.

- Sterling lagged behind as more EU nations suspended vaccinations with the AstraZeneca jabs, while Brussels launched legal action against the UK over alleged breach of the Brexit deal.

- USD/JPY struggled to advance towards the fresh cycle high printed on Monday, even as a "golden cross" formation materialised on the daily chart.

- The PBOC fixed its USD/CNY mid-point at CNY6.5029, just 3 pips below sell side estimates.

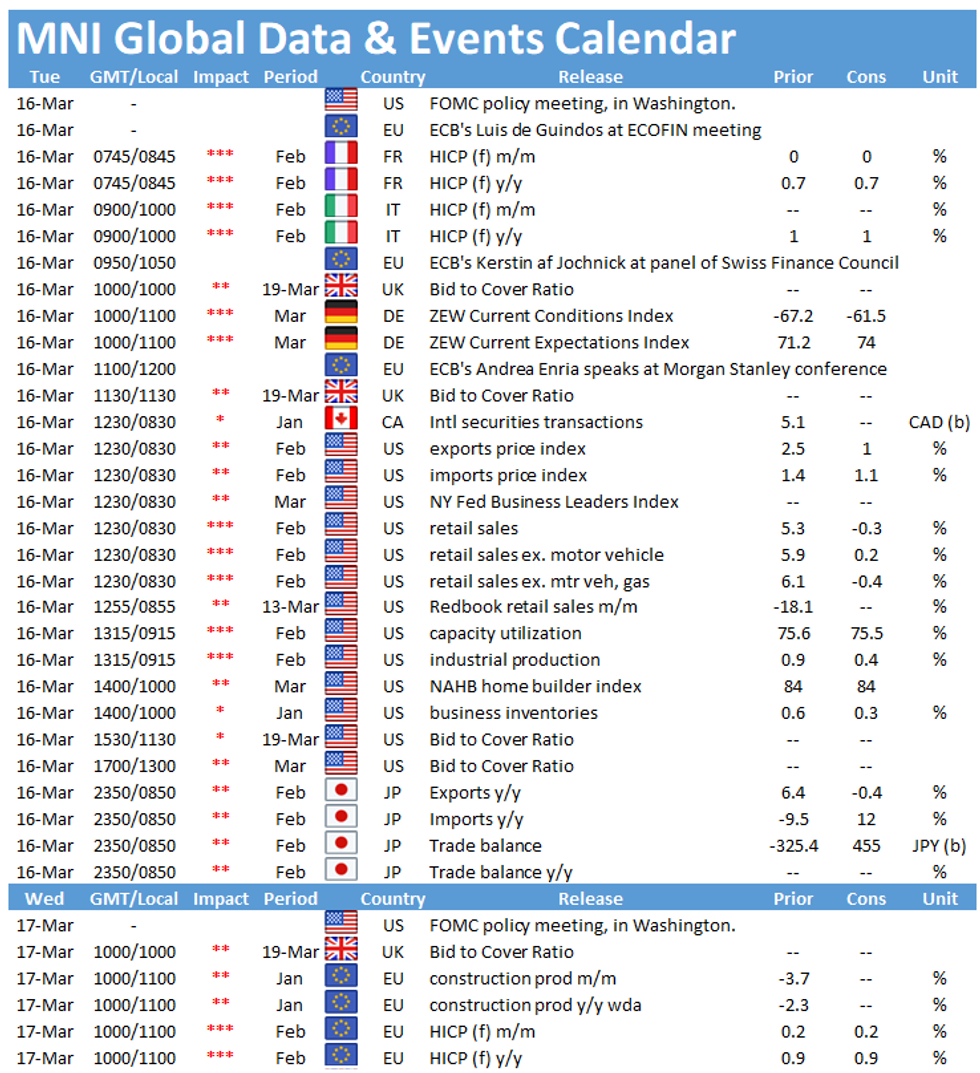

- Today's data docket features German ZEW Survey, final French & Italian CPIs as well as U.S. retail sales & industrial output. Riksbank's Ingves & Jansson take part in an open hearing, while ECB's Elderson holds a Q&A session.

FOREX OPTIONS: Expiries for Mar16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-1.1900(E1.1bln-EUR puts), $1.2050(E662mln), $1.2175(E652mln)

- USD/JPY: Y106.00($1.6bln), Y107.00($1.45bln), Y107.85-00($996mln), Y109.00-15($1.1bln-USD puts)

- GBP/USD: $1.3650(Gbp432mln), $1.3750(Gbp797mln-GBP puts)

- EUR/GBP: Gbp0.8545-50(E621mln)

- USD/CHF: Chf0.9220($720mln)

- AUD/USD: $0.7500(A$1.2bln), $0.7650(A$1.4bln), $0.7670(A$532mln), $0.7695-00(A$649mln), $0.7770(A$755mln), $0.7800-05(A$518mln), $0.7825-30(A$617mln)

- AUD/JPY: Y82.50(A$650mln)

- USD/CAD: C$1.2530-50($970mln), C$1.2800($1.15bln)

- USD/ZAR: Zar14.85($512mln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.