-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI EUROPEAN OPEN: Biden's Spending Push Takes Shape, Germany To Lock Down For Easter

EXECUTIVE SUMMARY

- POWELL: RECOVERY FAR FROM COMPLETE (MNI)

- YELLEN: STIMULUS BILL WILL HELP U.S. "REACH THE OTHER SIDE" (BBG)

- BIDEN INFRASTRUCTURE, JOBS SPENDING PUSH COULD HIT $4 TRILLION (RTRS)

- GERMANY TO IMPOSE DRASTIC 5-DAY LOCKDOWN OVER EASTER (BBG)

- MERKEL: EU SHOULD NOT IMPOSE A GENERAL VACCINE EXPORT BAN (BBG)

- NEW ZEALAND UNVEILS A SUITE OF MEASURES TO REIGN IN SURGING HOUSING PRICES

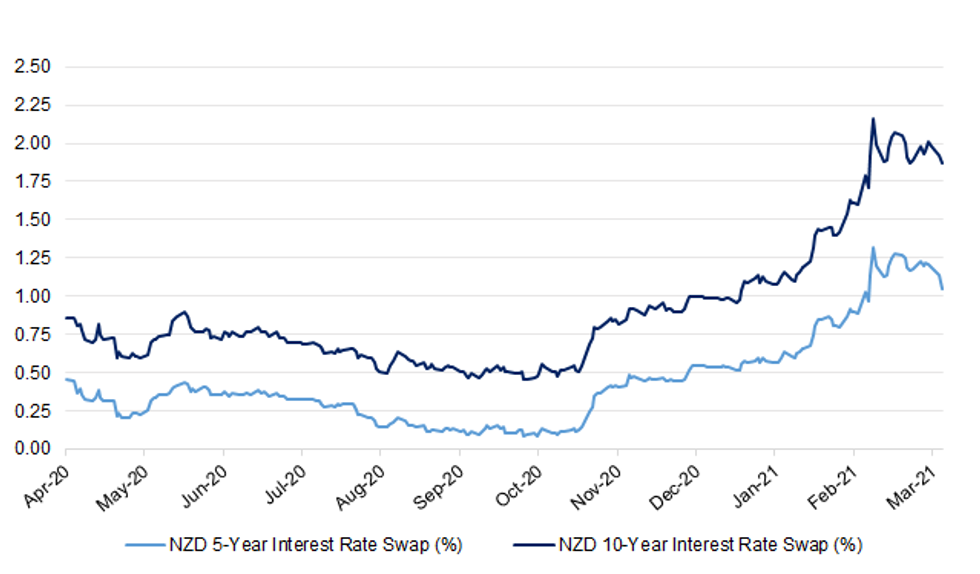

Fig. 1: NZD 5-Year/10-Year Interest Rate Swaps (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has warned the effects of a third wave of coronavirus will "wash up on our shores" from Europe. The PM said the UK should be "under no illusion" we will "feel effects" of growing cases on the continent. One of his ministers, Lord Bethell, also warned the UK might put "all our European neighbours" on the red list of countries, where arrivals are either banned or put in quarantine hotels. (BBC)

CORONAVIRUS: Within the latest spat between Brussels and AstraZeneca, and by extension Boris Johnson's government, lies the potential for a new period of vaccine collaboration between Britain and the EU, however unlikely that might look at the moment. The issue highlighted by EU officials in recent days is that AstraZeneca has a plant in the Netherlands' Leiden Bio Science Park, producing vaccines. The plant, run by the subcontractor Halix, has not exported any jabs to the EU as yet as the facility is yet to be given approval by the European Medicines Agency. Neither has it exported a significant number of completed doses to the UK. No exports have been made to the UK in the last two months and if any were sent before that they were only samples or doses for use in clinical trials. AstraZeneca's production for the UK market is largely covered by production in Oxford and Staffordshire, with input also expected from a manufacturing partner in India in the event of yields in Britain being lower than expected. But the Dutch plant is building up something of a stockpile now – and both the EU and the UK want them. More to the point the both believe they have a claim to them. (Guardian)

SCOTLAND: Nicola Sturgeon has been accused of indulging in a "reckless distraction" from the pandemic after her government unveiled a draft bill for another independence referendum by the end of 2023. The SNP plans to table the legislation after May's Holyrood election if they win a majority themselves, or in conjunction with the pro-separation Scottish Greens. Ms Sturgeon then plans to make a formal request to Boris Johnson for the requisite powers for a legal referendum and, if he refuses, pass the bill anyway and challenge the UK Government to take her to court. (Telegraph)

SCOTLAND: Nicola Sturgeon has been comprehensively cleared of breaching the ministerial code over her dealings with Alex Salmond in a major blow to her opponents. James Hamilton QC, a former Irish prosecutor, has rejected a series of allegations that the first minister deliberately misled Holyrood about when she knew about sexual harassment allegations against Salmond being investigated by Scottish government civil servants. In a detailed report published on Monday, Hamilton said he accepted Sturgeon's evidence she had never sought to mislead the Scottish parliament and had tried to avoid any appearance of interfering in the government's internal inquiry. (Guardian)

BREXIT: Whisky, cheese and chocolate producers have suffered the biggest post-Brexit export losses in the food and drink sector, new figures from HMRC have shown. Analysis of the figures by the Food and Drink Federation (FDF) shows that cheese exports in January plummeted from £45m to £7m year on year, while whisky exports nosedived from £105m to £40m. Chocolate exports went from £41.4m to just £13m, a decline of 68%. They put the collapse in trade down to a combination of Brexit and weaker demand in Europe, where restaurants, hotels and other hospitality outlets remain closed. (Guardian)

BREXIT: Britain's business groups have yet to lose the Brexit debate and can build on an EU-U.K. trade agreement, according to one of the country's top lobbyists. Adam Marshall, who is stepping down later this month as director-general of the British Chambers of Commerce, said businesses have so far struggled to get ministers "to focus on the practicalities of Brexit rather than the politics" in the years since Britain's referendum. The U.K.'s trade bodies had mounted a concerted push for a close relationship with the EU in the aftermath of the 2016 Brexit referendum. But Downing Street prioritized sovereignty over industry calls for seamless trade flows and chose a more distant relationship with Brussels than many British firms had hoped for. There's still time, though, Marshall argued in an interview with POLITICO. He said firms will continue to make the case for cooperation now that Britain has signed its Trade and Cooperation Agreement with the EU. (Politico)

EUROPE

ECB: The European Central Bank finally delivered on its promise to boost the pace of emergency bond-buying to combat the economic threat from higher yields. Net purchases settled last week climbed by 21.1 billion euros ($25.2 billion), the most since the start of December. That figure is reduced by redemptions -- the gross value of purchases will be disclosed on Tuesday. (BBG)

EU: Vaccine diplomacy between London and Brussels is edging toward a path to break their deadlock over AstraZeneca Plc's coronavirus doses. Seeking to avoid an escalation that could see exports to the U.K. blocked from AstraZeneca's plant in the Netherlands, European Union officials have floated sharing the facility's output, according to diplomats familiar with the matter. The appeal stems from the EU's view that the drugmaker had double booked its production and that both Brussels and London have valid claims. The diplomats said the U.K had dispatched a former ambassador as a special representative to negotiate with the European Commission. The Financial Times reported that Britain had sent Tim Barrow, its former envoy to the EU, to lead the talks. (BBG)

EU/GERMANY: "We must be very careful with general export bans at this stage," German Chancellor Angela Merkel says at press briefing in Berlin. "Instead we will have to look very closely at supply chains." (BBG)

GERMANY: Chancellor Angela Merkel and regional leaders agreed to put Germany into hard lockdown over Easter to try to reverse a "third wave" of Covid-19 infections fueled by faster-spreading mutations. Under the radical plan, all stores will be shuttered from April 1 for five days, except for food stores which will open on April 3, Merkel said after a video call with the country's 16 state premiers that lasted more than 11 hours. Citizens will be encouraged to remain at home, and private gatherings limited to one other household and a maximum of five people. "We are now in a very, very serious situation," Merkel said at a news conference that started just after 2:30 a.m. in Berlin. "The case numbers are rising exponentially and intensive-care beds are filling up again,"she said, adding that the number of infections must come down to allow the country's vaccination campaign to start taking effect. Germany's Covid-19 incidence rate has nearly doubled in the past month, threatening to overwhelm hospitals and highlighting Europe's struggles to contain the pandemic. Merkel and the regional leaders also agreed to extend Germany's current lockdown measures until April 18. These include the partial closing of nonessential stores and the shutdown of hotels, restaurants, gyms and cultural venues. A plan to push ahead with a cautious reopening of Europe's biggest economy, agreed at the start of this month, was postponed. They agreed to meet again on April 12 to decide on how to proceed with the partial lockdown, which has effectively been in place for about four months. (BBG)

GERMANY: Germany is likely living through the most dangerous phase of the COVID-19 pandemic as new coronavirus variants spread faster and affect more people than just the elderly, Bavarian premier Markus Soeder said early on Tuesday. (RTRS)

GERMANY: Germany's western state of North Rhine-Westphalia (NRW) on Monday extended coronavirus restrictions on shops after a court ruled the existing measures on retail businesses were unfair. The court's decision meant that mandatory visitor appointments and limitations of customers per square meter in stores would be dropped with immediate effect. In response, the state has stretched the customer booking requirement and limitations to include shops that were initially exempt. NRW Health Minister Karl-Josef Laumann said his government was "consistently implementing" the court's decision. (Deutsche Welle)

FRANCE: France is trying to beat back skepticism and kickstart its Oxford/AstraZeneca vaccination campaign after days of confusing statements about the safety of the jab. Figures from the health authority, Santé Publique France, show that the uptake of the AstraZeneca vaccine dropped to just over 66,000 and 62,000 doses on Friday and Saturday. That's down from an average of over 90,000 doses injected every day during the previous week. "It's not a collapse, we'll have to watch the figures this week," said Jérôme Marty, president of the UFML doctors trade union. Marty said half his vaccination slots for this week have been booked and he is confident the vaccinations will get back on track. "It's part mistrust, part logistics. We've got to restart the vaccinations. We need to call up patients, organize vaccination days, etc. You can't switch it back on overnight." (Politico)

SPAIN: The Spanish government should "rapidly and uniformly" execute the 11 billion-euro fiscal package it approved in mid-March to channel funds to companies, says European Central Bank policy maker and Bank of Spain Governor Pablo Hernandez de Cos. The distribution of the funds should be targeted to "companies that are viable but have solvency problems," he says in Madrid. "Flexibility in the volume of funds that have been pledged is also necessary and should be adapted to the trajectory of the pandemic." Authorities should focus on "streamlining liquidation processes" to ensure non-viable companies don't consume resources that would be better spent elsewhere. (BBG)

NETHERLANDS: The Netherlands is ready to block shipments of AstraZeneca's coronavirus vaccine if the United Kingdom does not agree to a deal to share vaccines more fairly with the EU, Dutch government officials told POLITICO. "If such an [EU-UK] agreement on sharing the delay proves impossible and the Commission were to decide to block an export request, the Dutch government can be expected to follow the Commission in its verdict," said a Dutch diplomat. While the Netherlands "in principle" remained in favor of maintaining a free flow of vaccines across borders, it also was keen to make sure that AstraZeneca didn't abuse that openness to fulfil only its contract with the United Kingdom, they said. (Politico)

IRELAND: Restricting vaccine exports from Europe would trigger retaliation from other countries and disrupt the global production of jabs, Irish Prime Minister Micheál Martin warned Monday. "Once you start putting up barriers, other people start putting up barriers globally," Martin told RTÉ radio in Dublin. "We'd all lose in that situation, notwithstanding the frustrations with AstraZeneca." (Politico)

NORWAY: Norway has got the go-ahead to construct what's being billed as the world's first ship tunnel, designed to help vessels navigate the treacherous Stadhavet Sea. First announced a few years ago by the Norwegian Coastal Administration, this mile-long, 118-feet-wide tunnel will burrow through the mountainous Stadhavet peninsula in northwestern Norway. (CNN)

HUNGARY: An appeal went out on Monday for volunteers to join hospital staff treating coronavirus patients in northwestern Hungary, as doctors said COVID-19 wards were overwhelmed, with the pressure only set to mount during the next few weeks. New infections are surging in Hungary, hard-hit by the third wave of the pandemic, despite vaccination rates at the top of European Union nations, as a proportion of population. (RTRS)

KOSOVO: Albin Kurti returned as government leader in Kosovo on Monday, a year after being ousted over mishandling the Covid-19 crisis, this time pledging a fast vaccination rollout and reiterating demands for Serbia's recognition of his state. Lawmakers approved an 18-member cabinet led by Kurti whose Self-Determination party won February's elections on promises to fight graft, poverty and to win full international recognition for Kosovo. The landlocked Balkan state of 1.8 million people declared independence in 2008 when it seceded from Serbia, almost a decade after a war that ended with NATO bombing. (BBG)

U.S.

FED: MNI BRIEF: Powell Tells Congress Recovery Far From Complete

- The economic situation is "much improved" relative to a year ago, but the recovery is far from complete and the Federal Reserve will "continue to provide the economy the support that it needs for as long as it takes," Chair Jay Powell wrote in testimony to Congress - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Treasury Secretary Janet Yellen, in delivering testimony before lawmakers Tuesday, will stress the impact of recently-passed pandemic-relief legislation in helping Americans weather the Covid-19 pandemic. "With the passage of the Rescue Plan, I am confident that people will reach the other side of this pandemic with the foundations of their lives intact," Yellen says in prepared remarks she is scheduled to deliver tomorrow. "While we're seeing signs of recovery, we should be clear-eyed about the hole we're digging out of: The country is still down nearly 10 million jobs from its pre-pandemic peak." (BBG)

FISCAL: President Joe Biden will be briefed by advisers this week on infrastructure, climate and jobs proposals being considered by the White House that could collectively cost as much as $4 trillion, according to people familiar with discussions. Biden advisers are weighing a price tag of between $3 trillion and $4 trillion for new legislative action, including repairing the country's crumbling infrastructure and tackling climate change, one source said. A second source said Biden advisers have a package of proposals totaling up to $3 trillion for infrastructure and other priorities they are discussing with the president this week. White House spokeswoman Jen Psaki said on Twitter on Monday that Biden would not unveil a proposal this week but that the "focus will be on jobs and making life better for Americans. "He is considering a range of options, scopes and sizes of plans and will discuss with his policy team in days ahead, but speculation is premature," she added. (RTRS)

FISCAL: President Biden's economic advisers are preparing to recommend spending as much as $3 trillion on a sweeping set of efforts aimed at boosting the economy, reducing carbon emissions and narrowing economic inequality, beginning with a giant infrastructure plan that may be financed in part through tax increases on corporations and the rich. After months of internal debate, Mr. Biden's advisers are expected to present a proposal to the president this week that recommends carving his economic agenda into separate legislative pieces, rather than trying to push a mammoth package through Congress, according to people familiar with the plans and documents obtained by The New York Times. The total new spending in the plans would likely be $3 trillion, a person familiar with them said. That figure does not include the cost of extending new temporary tax cuts meant to fight poverty, which could reach hundreds of billions of dollars, according to estimates prepared by administration officials. Officials have not yet determined the exact breakdown in cost between the two packages. (NYT)

FISCAL: The White House said on Monday that a New York Times report that President Joe Biden will consider spending $3 trillion for infrastructure and other priorities was premature and did not reflect administration thinking. The Times reported that Biden advisers were preparing to recommend he spend as much as $3 trillion on boosting the economy, reducing carbon emissions and narrowing economic inequality, beginning with a giant infrastructure plan. (RTRS)

FISCAL: The White House will consider various options to pass an estimated $3 trillion economic recovery proposal, including splitting it into two bills, NBC News reported Monday. (CNBC)

FISCAL: The next batch of direct payments from the $1.9 trillion COVID-19 relief package will be sent this week, and Americans who don't receive a direct deposit by March 24 will get the money via a check or a prepaid debit card in the mail, the Treasury Department announced in an update Monday. (Axios)

CORONAVIRUS: Biden administration officials are increasingly concerned Johnson & Johnson may not deliver the 20 million doses of coronavirus vaccine it promised would be available by the end of this month, according to three senior administration officials. The full tranche of vaccine Johnson & Johnson committed in February to delivering may not be ready to ship until the second or third week of April, the officials said, potentially complicating preparations for states expecting millions of J&J shots. (Politico)

POLITICS: The White House has withdrawn its nomination of Elizabeth Klein to become the Interior Department's deputy secretary, as the Biden administration faced push back from Alaska Sen. Lisa Murkowski, sources familiar with the situation said Monday. (Politico)

POLITICS: Former President Trump warned the GOP that removing the filibuster would be "catastrophic for the Republican Party" during an interview on the podcast "The Truth with Lisa Boothe." Flashback: Trump told Republican lawmakers in 2018 that keeping the filibuster would be "the end of the party," insisting that Senate Democratic Leader Chuck Schumer (D-N.Y.) would eliminate it as soon as Democrats took the majority, Politico reported at the time. (Axios)

POLITICS: Republicans who voted to impeach former President Donald Trump in the U.S. House of Representatives are warning Democrats not to set a "dangerous precedent" by challenging the certified results of a disputed House election in Iowa. Republican Representative Mariannette Miller-Meeks defeated Democrat Rita Hart in Iowa's 2nd Congressional District by only six votes out of nearly 400,000 cast. State election officials certified the results and Miller-Meeks was sworn into office in January. But Hart has petitioned the Democratic-controlled House to intervene, claiming that 22 votes were improperly excluded. The House Administration Committee, where Democrats outnumber Republicans by six to three, has launched an investigation. Nine of the 10 Republicans who voted in January to impeach Trump on a charge of inciting insurrection drew a strong parallel between the Iowa election and the certified presidential election results that Trump contested in the weeks leading up to the deadly Jan. 6 Capitol riot. (RTRS)

POLITICS: U.S. President Joe Biden intends to nominate Lina Khan, a former counsel to the House of Representatives Judiciary Committee's antitrust subcommittee, to be a commissioner of the Federal Trade Commission, the White House said on Monday. (RTRS)

OTHER

GLOBAL TRADE: President Joe Biden's trade representative held her first meetings with counterparts from the European Union and U.K. on Monday, with all sides expressing desire to resolve a dispute over subsidies to manufacturers Boeing Co. and Airbus SE. USTR Katherine Tai, who was sworn in last week, and European Commission Executive Vice President Valdis Dombrovskis discussed "their strong interest" in resolving the aircraft dispute, her office said in a statement following the virtual meeting. In a separate meeting with U.K. Trade Secretary Liz Truss, Tai agreed to partner with the nation toward the same goal. Tai also discussed her ongoing review of the Trump administration's work to reach a free-trade agreement with the U.K., and spoke with both officials about shared work to address challenges including issues related to China and climate change. Tai said that she and Truss will continue discussions at a Group of Seven trade ministers' meeting this month. (BBG)

GEOPOLITICS: The United States, the European Union, Britain and Canada imposed sanctions on Chinese officials on Monday for human rights abuses in Xinjiang, in the first such coordinated Western action against Beijing under new U.S President Joe Biden. Beijing hit back immediately with punitive measures against the EU that appeared to be broader, blacklisting European lawmakers, diplomats and think tanks, including families, and banning their businesses from trading with China. (RTRS)

CORONAVIRUS: AstraZeneca Plc may have released outdated information about its Covid-19 vaccine trial, giving an "incomplete" view of the efficacy of the shot, said the leading U.S. agency on infectious diseases. The Data and Safety Monitoring Board, charged with ensuring the safety and accuracy of the trial, has "expressed concern that AstraZeneca may have included outdated information from that trial, which may have provided an incomplete view of the efficacy data," said the National Institute for Allergy and Infectious Diseases in a statement early Tuesday. "We urge the company to work with the DSMB to review the efficacy data and ensure the most accurate, up-todate efficacy data be made public as quickly as possible," said the statement from the group headed by Anthony Fauci, the top U.S. infectious disease official. The disclosure comes as a setback to AstraZeneca, who earlier Monday said its vaccine was found 79% effective in preventing Covid-19 in a U.S. clinical trial of more than 30,000 volunteers. (BBG)

WHO: More producers of COVID-19 vaccines should follow AstraZeneca's lead and license technology to other manufacturers, the World Health Organization's head said on Monday, as he described continuing vaccine inequity as "grotesque". (RTRS)

CORONAVIRUS: The coronavirus vaccine developed by AstraZeneca and the University of Oxford was found to be 79% effective at preventing symptomatic COVID-19 and 100% effective against severe disease and hospitalization, according to results from its Phase III trial in the U.S. announced Monday. (Axios)

JAPAN: Maintaining Japan's fiscal health continues to be an important issue, but dealing with Covid is the first priority now, Finance Minister Taro Aso tells reporters on Tuesday in Tokyo. Govt is keeping its goal of balancing the budget, excluding debt payments, in the year ending in March 2026. (BBG)

NEW ZEALAND: New Zealand's government took aim at property speculators with a suite of new measures to tackle runaway house prices and prevent the formation of a "dangerous" bubble. The government will remove tax incentives for investors to make speculation less lucrative and unlock more land to increase housing supply, Prime Minister Jacinda Ardern said Tuesday in Wellington. The moves come as surging house prices keep first-time buyers and people on lower incomes out of the market, raising concerns about growing societal inequality. "The last thing home owners need right now is a dangerous housing bubble, but a number of indicators point towards that risk," Ardern told a news conference. "Property investors are now the biggest share of buyers, with the highest amount of purchases on record. Last year, 15,000 people bought homes who already owned five or more." [Finance Minister Robertson] said extending to 10 years the so-called "bright-line" test -- effectively a capital gains tax on investment property sales -- and removing interest deductibility for investors "will dampen speculative demand and tilt the balance towards first home buyers." From Oct. 1, investors won't be able to deduct mortgage interest as an expense on properties acquired from March 27. For existing property owners, mortgage interest deductibility will be phased out over the coming four years so that it can't be claimed at all by the 2025-26 tax year. New builds are expected to be exempted from this change. The government is trying to curb housing demand while also increasing supply, which has been constrained by a raft of factors including planning rules and high construction costs. It said today it will establish a NZ$3.8 billion fund to unlock more land for housing development, and also make first home grants available to more people. (BBG)

NEW ZEALAND: Both Treasury and Inland Revenue (IR) advised the Government against removing the ability for investors to deduct interest on their mortgages from their rental incomes. Treasury said, in a Regulatory Impact Assessment on the Government's proposed housing policy changes, it didn't have enough time to do the analysis on the change. It didn't include any commentary on interest deductibility in the Assessment and said the Government should hold fire until the work is done. IR, in the same Assessment, simply said it opposed denying interest deductibility. Revenue Minister David Parker couldn't put a figure on what the change would likely cost investors/how much additional tax revenue would be generated. He said it would depend on how the rule was phased in. As for extending the bright-line test from five to 10 years, Treasury didn't have time to form a view on this. Rather, it recommended the test be extended to 20 years. (interest.co.nz)

SOUTH KOREA: Ex-Seoul Mayor Oh Se-hoon beat software mogul-turned-politician Ahn Cheol-soo Tuesday to become the single opposition candidate for the upcoming Seoul mayoral by-election, as opinion polls project a possible election victory for the opposition bloc. Oh, who is running on the ticket of the main opposition People Power Party (PPP), was declared the winner of a bipartisan primary against Ahn, the leader of the conservative minor People's Party (PP), according to the primary results. (Yonhap)

CANADA: Alberta will not be further easing its COVID-19 restrictions at this time due to rising hospitalizations, Health Minister Tyler Shandro said on Monday. "This is the safe move. It's the smart move to make for our province right now, and it's absolutely necessary to help us avoid a third wave that would take more lives and once again put more pressure on the hospital system," Shandro said at a news conference that followed a meeting of the province's COVID-19 committee. (CBC)

BRAZIL: The governor of Sao Paulo state has called Jair Bolsonaro a "psychopathic leader," in a sharp rebuke over the Brazilian President's response to the coronavirus pandemic. "We are in one of those tragic moments in history when millions of people pay a high price for having an unprepared and psychopathic leader in charge of a nation," Joao Doria said in an interview with CNN on Monday. Doria said much of the deaths from the virus in Brazil could have been avoided if Bolsonaro had "acted with the responsibility that the position gives him." He added that Bolsonaro made "unbelievable mistakes, the biggest one was having a political dispute with the governors who are trying to protect the population." (CNN)

MEXICO: Mexico's economy "could easily" grow more than 5% in 2021, the finance ministry said on Monday, adding that the government aims to come up with ways to reduce tax evasion before discussing potential tax reform. The COVID-19 vaccine rollout and the impact of the United States' $1.9 trillion stimulus package should boost the economy, Finance Minister Arturo Herrera told students at the National Autonomous University of Mexico (UNAM). In view of all those factors, the economy "could easily grow above 5.0%," Herrera said in a presentation. He also expected to see higher tax revenues and crude oil prices, as well as for debt levels to start falling. Separately, Deputy Finance Minister Gabriel Yorio told UNAM students the government wants to "close the (tax) evasion gap" before discussing a potential tax overhaul. "I think there's room to reconfigure the structure without the need to increase taxes, and to make the country's tax structure more progressive," said Yorio. (RTRS)

THAILAND: Global funds will continue to have unfettered access to Thai bonds even when a rule on registration takes effect, the central bank said as it sought to allay concern the regulation could be used to curb speculative flows. The proposal, which will kick off in October, requires foreign funds to open segregated onshore accounts instead of relying on omnibus facilities from international clearing firms such as Euroclear Ltd. This would enable officials to identify the ultimate holder of the nation's bonds, doing away with the anonymity provided by global depositories which tend to combine transactions. The regulation will help officials understand investors' behavior, and isn't intended to limit trading and speculation, Bank of Thailand Assistant Governor Vachira Arromdee said in a March 22 email interview. Policy makers don't have a target for foreign ownership of Thai bonds as it's crucial to have a diversified investor base, she added. (BBG)

RUSSIA/EU: The entire infrastructure of relations with the European Union has been destroyed by unilateral steps taken by Brussels, so Moscow has no relations with that organization now, Russian Foreign Minister Sergey Lavrov told reporters on Tuesday at a joint news conference with his Chinese counterpart Wang Yi. (TASS)

ISRAEL: Israelis vote on Tuesday on Prime Minister Benjamin Netanyahu's political survival in a fourth election in two years, with the veteran leader hoping his role in a rapid COVID-19 vaccine campaign will win him another term. Opinion polls show the race too close to call. (RTRS)

SAUDI ARABIA: Saudi Arabia has proposed a ceasefire deal to end the fighting in Yemen's six-year conflict that would include Riyadh lifting its blockade on rebel-controlled ports in the war-torn country. The initiative announced on Monday by Prince Faisal bin Farhan, the foreign minister, comes as Iran-aligned Houthi rebels have stepped up missile and drone attacks on Saudi cities and oil infrastructure. (FT)

OIL: Saudi Arabia is seeking more help from the U.S. to defend its oil facilities, underscoring the kingdom's concern about recent missile and drone strikes that it's linked to arch-rival Iran. The requests were put to President Joe Biden's administration since January, according to a Saudi official, who asked not to be named as the matter is private. Saudi Arabia is also asking other allies for support to thwart almost daily attacks on cities and towns, the official said. (BBG)

GAS: Brussels is considering classifying gas as a partially sustainable technology under its landmark green labelling system for investors who want to plough their money into sustainable finance. In a draft legal text, seen by the Financial Times, the European Commission has paved the way for controversial technologies such as gas generated by fossil fuels to be recognised in its "taxonomy for sustainable finance", raising fears that Brussels is engaging in "greenwashing". The EU's taxonomy is designed to be the world's first classification system for green financial products by establishing science-based criteria on what should count as truly sustainable economic activity. (FT)

ALUMINUM: Aluminum slumped, with futures in Shanghai falling by the daily limit on speculation that China may release some of its state reserves. (BBG)

CHINA

ECONOMY: China's five-year Loan Prime Rate, a benchmark for residential mortgages, may rise this year if the property market continues to heat up, the Shanghai Securities News said citing Wang Qing, chief macro analyst of Golden Credit Rating. The one-year LPR for corporate loans is likely to remain stable with an interest rate of 3.85%, Wang said. The PBOC is likely keeping a cap on lenders' LPR quotes after having recently tightened banks' deposit rates and reduced competition for deposits, the newspaper said. On Monday, the central bank for the 11th month kept its published benchmark 1Y and 5Y LPRs, which are decided based on quotes submitted by lenders. (MNI)

ECONOMY: China is likely to beat the "above 6%" government-set growth target this year, but it will seek to curb energy consumption and pollution, Premier Li Keqiang said in a speech to the China Development Forum on Monday night. China must balance growth, income and employment, and strive to create 11 million new jobs this year, Li said. China must also urge urbanization to expand domestic demand and let consumption be a bigger growth driver, Li said. (MNI)

ECONOMY: drives investors out of emerging markets, according to a former adviser to China's central bank. The potential for a reversal in capital inflows and a possible wave of bond defaults are two of the biggest risks facing the economy this year, Li Daokui, a former member of the People's Bank of China's monetary policy committee, said in an interview. The instability is being fueled by the U.S.'s $1.9 trillion pandemic relief, which will benefit China by boosting exports, but also add to risks, he said. "It's just like drinking alcohol: you feel comfortable, but people worry about the after-effect," he said. "When the stimulus is gone and the U.S. is back to normal, the aftermath will be very damaging to emerging market economies." The U.S. stimulus is boosting the outlook for growth and inflation, driving up bond yields and prompting investors to sell riskier, emerging market assets. That's a worry for global policy makers as they brace for more volatility in their currencies and financial markets. (BBG)

CHINA/RUSSIA: China and Russia won't form a western-style alliance or bloc as they did during the Cold War despite closer partnerships in the face of increasing sanctions from the U.S. and its western allies, the Global Times said in an editorial on Tuesday as Russian Foreign Minister Sergei Lavrov visits China. However, observing the non-interference principle, the two nations will be determined to co-operate in all spheres possible, and take care of each other's core interests wherever and whenever it is necessary to do so, the newspaper said.

OVERNIGHT DATA

JAPAN FEB SUPERMARKET SALES -2.1% Y/Y; JAN +1.2%

JAPAN FEB NATIONWIDE DEPT STORE SALES -10.7% Y/Y; JAN -29.7%

JAPAN FEB TOKYO DEPT STORE SALES -13.5% Y/Y; JAN -33.8%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 110.4; PREV. 110.9

NEW ZEALAND FEB CREDIT CARD SPENDING -12.4% Y/Y; JAN -10.6%

NEW ZEALAND FEB CREDIT CARD SPENDING -1.9% M/M; JAN -0.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:28 am local time from the close of 2.1064% on Monday.

- The CFETS-NEX money-market sentiment index closed at 37 on Monday vs 39 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5036 TUE VS 6.5191

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5036 on Tuesday, compared with the 6.5191 set on Monday.

MARKETS

SNAPSHOT: Biden's Spending Push Takes Shape, Germany To Lock Down For Easter

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 117.64 points at 29055.69- ASX 200 down 7.058 points at 6745.4

- Shanghai Comp. down 40.554 points at 3402.749

- JGB 10-Yr future down 2 ticks at 151.28, yield down 0.3bp at 0.080%

- Aussie 10-Yr future up 3 ticks at 98.235, yield down 2.9bp at 1.732%

- U.S. 10-Yr future +0-02+ at 131-20, yield down 2.46bp at 1.67%

- WTI crude down $0.64 at $60.92, Gold down $3.51 at $1735.61

- USD/JPY down 9 pips at Y108.76

- POWELL: RECOVERY FAR FROM COMPLETE (MNI)

- YELLEN: STIMULUS BILL WILL HELP U.S. "REACH THE OTHER SIDE" (BBG)

- BIDEN INFRASTRUCTURE, JOBS SPENDING PUSH COULD HIT $4 TRILLION (RTRS)

- GERMANY TO IMPOSE DRASTIC 5-DAY LOCKDOWN OVER EASTER (BBG)

- MERKEL: EU SHOULD NOT IMPOSE A GENERAL VACCINE EXPORT BAN (BBG)

- NEW ZEALAND UNVEILS A SUITE OF MEASURES TO REIGN IN SURGING HOUSING PRICES

BOND SUMMARY: Core FI Catch Bid On Risk Aversion, ACGBs Rally On Coattails Of NZ Peers

After a broadly lacklustre start for core FI space outside of the Antipodeans, participants grew cautious as German Cll'r Merkel announced that Germany will go into a radical lockdown for five days over the Easter period. Merkel's comments helped T-Notes move away from their session low of 131-14 and the contract last sits +0-03+ at 131-21. Cash Tsy curve bull flattened, yields last seen 0.2-3.5bp lower. Eurodollar futures trade unch. to -0.5 tick through the reds. Snips from Fed Chair Powell's & U.S. Tsy Sec Yellen's upcoming testimony did the rounds, but provided little in the way of fresh insights. Fed's Bowman reiterated familiar lines from Powell's recent addresses, stressing that the Fed is "likely to continue supporting the economy for some time," as it is "still a long way" from meeting its employment & inflation goals.

- Slightly erratic price action in JGB futures saw the contract re-open at a session high of 151.38 after the Tokyo lunch break, before paring gains. JGB futures last trade at 151.27, -3 ticks vs. settlement. Cash JGB yields sit lower across a flatter curve, with 20s outperforming again. Japan's FinMin Aso noted that the gov't doesn't plan to raise taxes anytime soon, but remains committed to its goal of balancing the budget in FY2025. The MoF held an enhanced liquidity auction for off-the-run JGBs with 1-5 years until maturity.

- ACGB space found itself under the influence from across the Tasman, as NZGBs picked up a bid after NZ gov't announced a slew of measured designed to curb house prices. The broader risk-off impetus provided a fresh tailwind for ACGBs, helping them extend gains later in the session. YM +1.0 & XM +4.0 as we type, with 10-year futures printing session highs. Cash ACGB curve bull flattened, with yields sitting 0.2-3.9bp lower, albeit belly still outperforms on a lead from NZ, where 5s lead the way. Bills trade unch. to +2 ticks through the reds. The AOFM auctioned A$150mn of the 0.75% 21 Nov '27 linker.

JGBS AUCTION: Japanese MOF sells Y399.1bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y399.1bn of 1-5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.003% (prev. -0.002%)

- High Spread: -0.002% (prev. +0.002%)

- % Allotted At High Spread: 73.4497% (prev. 80.7621%)

- Bid/Cover: 3.999x (prev. 4.781x)

AUSSIE BONDS: The AOFM sells A$150mn of the 0.75% 21 Nov '27 I/L Bond, issue #CAIN414:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 0.75% 21 November 2027 I/L Bond, issue #CAIN414:- Average Yield: -0.7882% (prev. -0.8026%)

- High Yield: -0.7850% (prev. -0.7900%)

- Bid/Cover: 5.1667x (prev. 3.8133x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 85.7% (prev. 8.6%)

- bidders 40 (prev. 34), successful 12 (prev. 9), allocated in full 8 (prev. 7)

EQUITIES: Decline After Shaking Off Positive Lead

Most Asia-Pac equities lower on Tuesday, taking out early gains as risk sentiment took a hit after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter. Bourses in China and Hong Kong lead the way lower as markets digest stricter regulations on e-cigarette makers. Markets in Japan took a hit on reports that the government is planning to extend lockdown measures that are currently slated to expire at month-end. Taiwan is managing to squeeze out small gains, buoyed by strong export data after market yesterday, while markets in South Korea have also managed to limit downside as the tech sector remains resilient.

- Futures in Europe and the US are lower, markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while US bond auctions will also provide direction.

OIL: Demand Concerns Weigh

Crude futures are lower again on Tuesday, casualties of the broad risk off theme. WTI is $0.64 lower at $60.93/bbl, Brent is $0.64 lower at $63.98/bbl.

- Demand concerns weigh on oil after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter. France and Poland have already announced new lockdown measures to combat rising COVID-19 infections, while UK PM Johnson warned the UK was at risk of a third wave. There are also demand concerns emanating from an increase in cases in India, while demand in South East Asia is said to have plateaued as lockdowns drag on and vaccination programmes proceed slower than expected.

- Markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while participants will also look to API inventory figures later on Tuesday

GOLD: Lower, But Off Worst Levels

The yellow metal has added to its declines on Tuesday, erasing the recovery from yesterday's lows. Last trades at $1734.73/oz, down $4.28, it has come off lows at $1731.79 after German Chancellor Merkel announced stricter lockdown measures to be in place over Easter which saw a bid in safe haven assets. Markets await comments from Fed Governor Powell and US Tsy Secretary Yellen in a Fed heavy week, while US bond auctions will also provide direction.

FOREX: Kiwi Shot Down By New Zealand's Salvo Against Housing Bubble

The kiwi fell prey to New Zealand gov't's bold plan for tackling the "dangerous" housing market bubble, with some steps due to take effect as soon as this weekend. NZD/USD pierced several key support levels, including its 100-DMA & Mar 5 low of $0.7100, as it slid smoothly towards worst levels since the final days of 2020. The rate printed a session low after punching through the $0.7100 mark, with some pointing to the execution of sell-stops upon the breach of that level, which triggered broad-based NZD sales.

- The suite of measures unveiled by PM Ardern included the removal of tax incentives for investors, an extension to the "bright-line" test (an effective capital gains tax on investment property), more accessible support for first home buyers, and NZ$3.8bn for new infrastructure around new housing developments.

- NZD weakness spilled over into AUD, with further headwinds emerging for the broader high-beta FX space as risk aversion took hold. A bout of risk-off flows was seen as German Cll'r Merkel & German regional leaders agreed to impose a radical five-day lockdown over Easter, but EUR remained relatively buoyant.

- AUD/NZD hit best levels sine early Oct, despite today's expiry of A$2.2bn worth of options (mostly AUD puts) with strikes at NZ$1.0785-90.

- JPY was the best G10 performer amid safe haven demand, while the DXY advanced but held yesterday's range.

- The PBOC fixed the USD/CNY mid-point at CNY6.5036, around 10 pips below sell side estimates. USD/CNH wobbled around neutral levels, as participants scrutinised a piece in China's financial press opined that the PBOC unlikely to tighten policy quickly.

- Focus turns to the House testimony from the Powell/Yellen duo, as well as comments from around a dozen G10 central bank members. The data docket features UK labour market report & U.S. new home sales.

FOREX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1895-1.1900(E638mln), $1.2000-05(E617mln)

- USD/JPY: Y107.95-108.05($2.45bln), Y108.12($1.8bln)

- EUR/GBP: Gbp0.8600(E556mln-EUR puts), Gbp0.8620-30(E887mln-EUR puts)

- EUR/CHF: Chf1.0978-80(E780mln-EUR puts)

- AUD/USD: $0.7750(A$1.3bln)

- AUD/JPY: Y83.10-15(A$587mln)

- AUD/NZD: N$1.0785-90(A$2.2bln - A$2.1bln of AUD puts)

- NZD/USD: $0.6850(N$759mln-NZD calls)

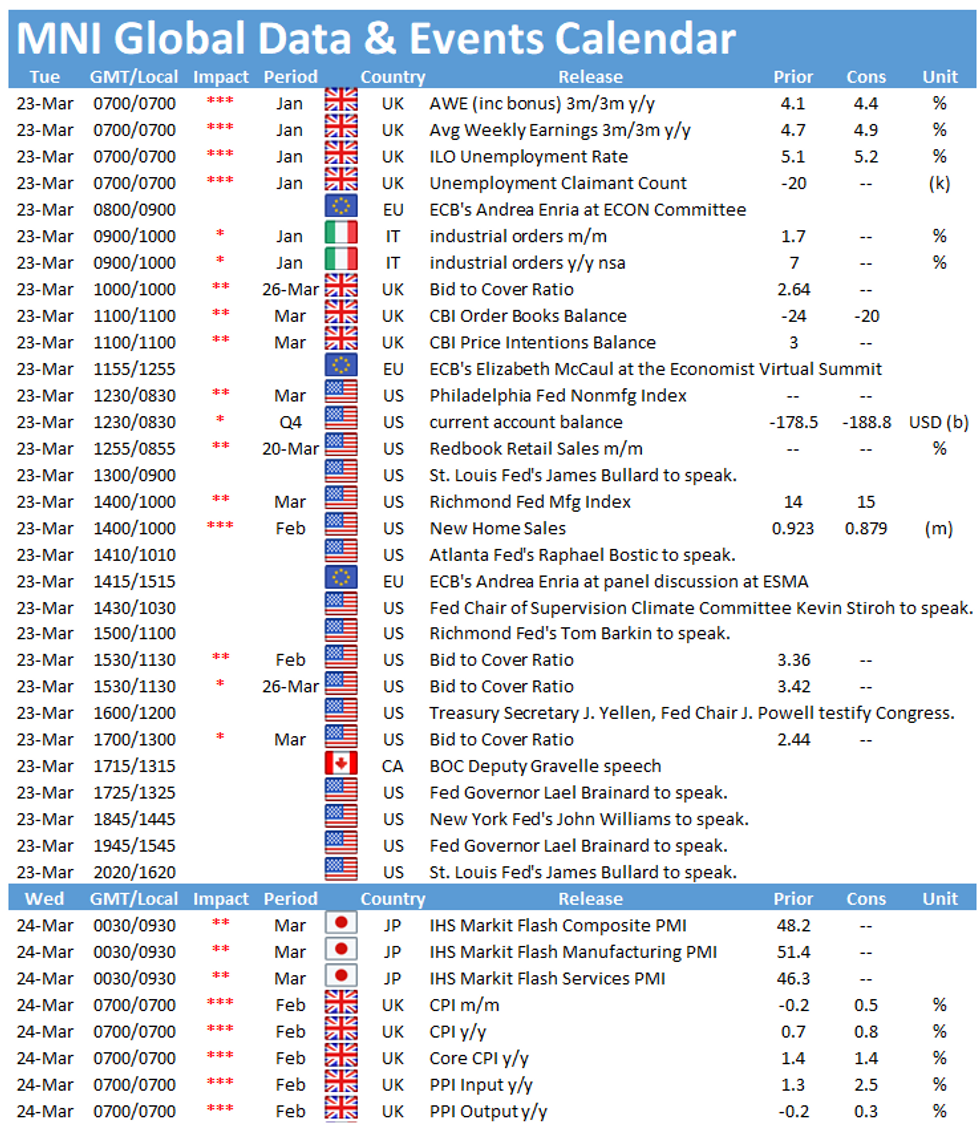

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.