-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk Aversion Eases, Familiar Themes In Play

EXECUTIVE SUMMARY

- FED'S EVANS WORRIED ABOUT SUB-2% INFLATION AFTER TEMPORARY BUMP (BBG)

- ECB'S VILLEROY: NO RISK OF INFLATION OVERHEATING IN EUROPE (BBG)

- BOE'S HALDANE: "RIP ROARING RECOVERY" IS POSSIBLE (BBG)

- UK AND EU MOVE TO CALM TENSIONS OVER ACCESS TO JABS (FT)

- ASTRA REPORTS LOWER EFFICACY FOR COVID VACCINE AFTER CRITICISM (BBG)

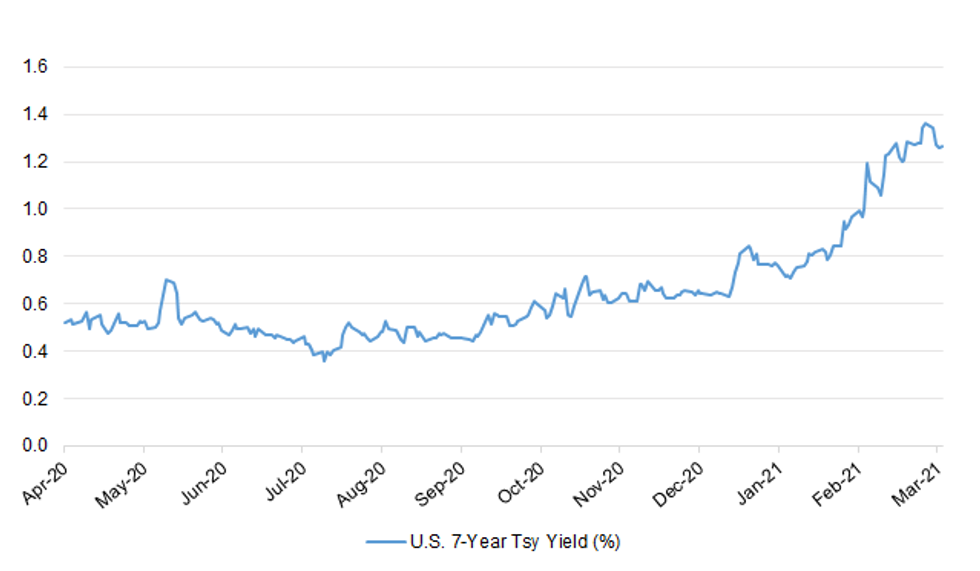

Fig. 1: U.S. 7-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The U.K. economy could see a "rip roaring" recovery even if consumers spend just a bit of the additional savings they accumulated during the Covid crisis, according to Bank of England Chief Economist Andy Haldane. Doubling down on his optimistic outlook for an economic resurgence, Haldane told ITV's Robert Peston show that he expects a sharp bounce back as restrictions on the economy are removed. He said about 150 billion pounds ($205 billion) has been saved over the past year, mostly by higher income households. "If some of those savings do get spent, even a small amount of them, we're talking abut a pretty rip roaring recovery," he said in an interview on Peston's show broadcast on Twitter. "When it comes, it will come fast, and it will be large." (BBG)

CORONAVIRUS: Pub landlords will be able to bar entry to people who have not been vaccinated, Boris Johnson has suggested. The prime minister said that it "may be up to the landlord" to decide whether to require proof of vaccination or a negative test from customers, in a significant change of heart after ruling out the idea last month. Johnson also said that he was considering adding France to the red list from which most travel was effectively banned but warned of "very serious disruption" to trade. He confirmed for the first time that tougher border rules were "something that we'll have to look at" but cast doubt on whether the danger from vaccine-resistant variants was worth the disruption. (Times)

CORONAVIRUS: Pubs could be allowed to ditch social distancing rules and allow people to crowd together as long as they check customers' Covid status on entry, the Guardian understands. Johnson said he believed Covid certification had the backing of the British people who understood the need for protective measures, and suggested he backed a more wide-ranging use for vaccine passports, which a committee led by Michael Gove is currently investigating. (Guardian)

CORONAVIRUS: Boris Johnson is facing a Tory rebellion on lockdown rules in the Commons, 24 hours after telling drinkers they may need a COVID vaccine or negative test to go to the pub. MPs are due to vote on extending emergency COVID legislation for six months until 25 September and current lockdown rules into July, but ending proxy voting in the Commons on 21 June. Senior Tory backbenchers have denounced the 2020 Coronavirus Act as "the most draconian detention powers in modern British legal history" and are threatening a rebellion by up to 60 Conservative MPs. (Sky)

ECONOMY: The British government has given a fresh signal of its ambition to ensure London becomes a leading center for green finance, telling the U.K.'s market watchdog that it should help the government's plans to grow the sector. Chancellor Rishi Sunak said in a letter to Financial Conduct Authority Chief Executive Officer Nikhil Rathi that helping London become a "hub for green finance" should be among the regulator's aims over the next few years, according to a letter published Wednesday on a government website. (BBG)

SCOTLAND: NHS staff in Scotland are being offered a pay rise of at least 4%, the Scottish government has said. It said the increase would benefit 154,000 NHS Agenda for Change employees - including nurses, paramedics, allied health professionals, as well as domestic, healthcare support staff, porters and other frontline health workers. The move is in recognition of their "service and dedication" during the coronavirus pandemic, Health Secretary Jeane Freeman said. (Sky)

EUROPE

ECB: Bank of France Governor Francois Villeroy de Galhau says the European Central Bank sees "no risk of inflation overheating." "That means we will keep interest rates low and very favorable financing conditions," Villeroy says onEurope 1 radio. (BBG)

EU/UK: The UK and EU have moved to calm tensions over access to coronavirus vaccinations despite a top Brussels policymaker accusing the UK of "vaccine nationalism" in its pandemic response. Britain and the European Commission on Wednesday issued a joint statement saying there had been discussions on developing a "reciprocally beneficial relationship" to tackle Covid-19. The statement committed both sides to work together "to create a win-win situation and expand vaccine supply for all our citizens". Boris Johnson, UK prime minister, insisted that he did not want to see a tit-for-tat vaccine war. Britain has offered to help boost production of the AstraZeneca vaccine at the Halix plant in the Dutch city of Leiden, and Downing Street has not ruled out the UK "giving up" some of the millions of doses it claims have been contracted to it. The EU also claims the vaccines. (FT)

EU: When military police entered an Italian factory at the EU's request over the weekend, they not only discovered 29 million COVID vaccine doses — they triggered ripples of anxiety around the world as countries feared being deprived of vital shots. The doses, an Italian official explained, were ready for shipment to Belgium. The plant is owned by Catalent, a company that helps drugmakers with the jab's fill-and-finish, and AstraZeneca sent doses there to be made ready for distribution. A spokesman for Catalent said that "at any one time there will be a balance of vaccine drug substance ready for filling, packaging, inspection and quality release, and packaged vials awaiting shipment to AstraZeneca's distribution facilities." The Italian police "found the company's records to be in order" and "their visit was not related to any manufacturing or quality issues," he added. According to an EU official, the visit was set in motion by Internal Market Commissioner Thierry Breton after he noticed that the numbers for the doses weren't adding up. Contacted by the Commission, Italian Prime Minister Mario Draghi then requested his health ministry to carry out an inspection, which took place Saturday and Sunday, according to the Italian official. (Politico)

EU: The fate of 29m AstraZeneca vaccine doses in Italy sparked finger pointing and recriminations on Wednesday as the EU warned that the company was far short of meeting its latest supply target. The European Commission called on AstraZeneca to explain the origin and intended destination of a stockpile identified by Italian authorities at the Anagni finishing plant, while some EU officials asked if the active ingredients in the doses had come from a Dutch facility as yet unlicensed to supply to the bloc. AstraZeneca said it was "incorrect" to describe it as a stockpile, adding that the doses were waiting for "quality control" processes to be completed before being released. (FT)

EU: Europe has started deploying the largest venture capital fund ever created in the region, in its latest attempt to create health and deep-tech startups that will rival the U.S. and Asia. The 3-billion-euro ($3.5 billion) fund run by the European Innovation Council, which formally launched last week, has invested in CorWave, a French startup that develops an implantable heart pump based on cutting-edge technology. Of the 35 million euros it raised in January, 15 million came from the EIC fund. Private investors in Europe typically don't have the lee-way to invest 15 million euros in a pre-clinical company, CorWave Chief Executive Officer Louis de Lillers said at the launch. "They keep their larger tickets for later-stage clinical phase or revenue phase," he said, referring to private investors. "The EIC fund is really filling a gap here." (BBG)

GERMANY: Angela Merkel reversed course on a controversial Easter shutdown and apologised for a policy she admitted had been a mistake, in a move that underlined growing doubts about Germany's management of the coronavirus pandemic. The U-turn came just 34 hours after authorities decided to extend the Easter holidays from three to five days, triggering a massive outcry. Opposition MPs said the affair risked undermining public confidence in the government's handling of the pandemic just as a third wave is driving up new infections and hospital ICUs are filling with Covid-19 patients. Three opposition parties even called on Merkel to hold a vote of confidence so as to ascertain whether her government still holds a majority in the Bundestag. (FT)

GERMANY: The German government said it is looking into the possibility of a temporary stop on foreign vacations. Confusion among people in Germany was high when trips to Spain's Mallorca were allowed but domestic travel wasn't. Beyond backing off the idea of an extra day of quiet over the Easter holiday weekend, leaders have reacted to intense backlash over a decision to allow Germans to vacation abroad while many here cannot travel at home. Now it seems that Berlin is looking at the legal possibility of reversing the original green light for foreign travel. The reversal was sparked by a run on booking sites offering travel to Mallorca, a favorite tourist destination for Germans, after the Spanish Balearic island registered a seven-day infection rate below 50 per 100,000 residents. (Deutsche Welle)

FRANCE: Xavier Bertrand, a former health minister and president of the working class northern region of Hauts-de-France, has announced he's running in the upcoming French presidential election. "I'm totally determined," 56-year-old Bertrand told right-wing magazine Le Point on Wednesday. The field of candidates set to run against incumbent President Emmanuel Macron is becoming increasingly crowded, with more than 10 figures so far, including Socialist Paris Mayor Anne Hidalgo. Macron has yet to officially confirm his candidacy, but his teams are already gearing up for his campaign. (BBG)

FRANCE: France's culture minister has been hospitalised with Covid-19 just as the country's employment minister was discharged after receiving treatment for the virus, French media reported, amid a rapidly escalating third wave of the pandemic. (France24)

FRANCE: European leaders failed to see that COVID-19 vaccines would be developed as soon as they were and this was why rollouts in the EU now lagged behind some other countries, French President Emmanuel Macron said in an interview broadcast on Wednesday. "Everybody, all the experts said: Never in the history of mankind was a vaccine developed in less than a year," Macron told Greek television channel ERT. "We didn't shoot for the stars. That should be a lesson for all of us. We were wrong to lack ambition, to lack the madness, I would say, to say: It's possible, let's do it," Macron said, in a rare admission of failure in the pandemic. (RTRS)

ITALY: MNI EXCLUSIVE: Italy Package To Total EUR30 Bln, More To Follow

- An additional fiscal package set to be announced by the Italian government in mid-April will add about EUR30 billion to the country's budget deficit, towards the top of end of previous reports, and will be followed later in the year by additional major spending plans, a senior Finance Ministry official told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ITALY: Premier Mario Draghi said Wednesday that his government is aiming to administer half a million COVID-19 vaccine doses a day in the near future. (Ansa)

SNB: MNI SNB Preview - March 2021: Calmer Outlook for CHF a Relief

- While the fall in CPI rates appear to have bottomed, inflation remains deep in negative territory, with prices continuing to decline at an annual rate of 0.5%. This is unlikely to phase the SNB, however, with the Bank likely satisfied with their current expansionary policy. Downside pressure on EUR/CHF has alleviated and EUR rates markets are signalling little chance of a further cut to the ECB's deposit rate, lessening the pressure on the SNB to take any near-term policy action to maintain the rate differential - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLAND: The country will probably decide against introducing full lockdown as part of stricter curbs it plans to announce on Thursday, Dziennik Gazeta Prawna reports. (BBG)

CYPRUS: The European Union should stay out of talks on the Cyprus problem as long as it recognizes only the Greek Cypriot government, the foreign minister of the northern breakaway republic said. Tahsin Ertuğruloğlu also told POLITICO in an interview that a two-state solution — or permanent split — was the only way forward for the divided Mediterranean island, a hardline position bound to further complicate efforts to resolve the decades-long dispute. (Politico)

U.S.

FED: MNI BRIEF: Williams Says Fed to Sustain Robust Support

- New York Fed President John Williams said Wednesday the U.S. central bank will "provide strong monetary policy support for a robust and full recovery over the next couple of years" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Daly Says Patience is Most Important Policy

- San Francisco Federal Reserve President Mary Daly said Wednesday that monetary policy must be given time to pull the economy out of the "substantial hole" created by the pandemic, and officials must look through any inflation blip later this year as vaccines allow for a major re-opening - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Atlanta Fed Model Revises US Q1 GDP Outlook Lower

- The Atlanta Fed has revised down it's Q1 GDP forecast to an annualized 5.4% from the 5.7% forecast last week, according to the Fed bank's latest weekly real-time GDPNow model - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: AstraZeneca Plc's Covid-19 vaccine, which faced a fresh onslaught of questions this week, was 76% effective in a U.S. study -- a slightly downgraded estimate based on the latest data collected from a contentious clinical trial. The company issued the new analysis in a statement on Thursday after an independent monitoring board expressed concern that the initial efficacy of 79% relied on outdated information. The earlier reading was based on data gathered through Feb. 17. The latest twist created another layer of uncertainty for a product already facing dwindling public support in Europe following months of confusion and missteps. The data glitch may delay the shot's ability to win U.S. regulatory clearance, although it will likely still play a crucial role in curbing the global pandemic. "The primary analysis is consistent with our previously released interim analysis, and confirms that our COVID-19 vaccine is highly effective in adults, including those aged 65 years and over," said Mene Pangalos, the company's executive vice president of BioPharmaceuticals research and development. "We look forward to filing our regulatory submission for Emergency Use Authorization in the U.S. and preparing for the rollout of millions of doses across America." (BBG)

ECONOMY: Banks have improved their capital positions and should be allowed to continue to buy back their own shares, Treasury Secretary Janet Yellen said Wednesday. Regulators restricted share repurchases in 2020 for the biggest institutions in the country as a precautionary measure after Covid-19 reached pandemic status. After those banks passed a pandemic-focused stress test in December, the Federal Reserve said it would allow buybacks to resume, though with some restrictions. Yellen, speaking before the Senate Banking Committee, Housing and Urban Affairs on Wednesday, said she agreed with allowing the share buybacks. (CNBC)

ECONOMY: Treasury Secretary Janet Yellen said on Wednesday it is important to "look carefully" at systemic risks posed by asset managers, including BlackRock Inc, but said designating them as systematically important financial institutions may not be the right approach. Yellen's remarks came in response to questions from Senator Elizabeth Warren, a longtime Wall Street critic, who demanded to know why BlackRock and other large asset managers had not been added to the list of designated institutions. (RTRS)

FISCAL: The Treasury Department said Wednesday that it has sent out another 37 million economic impact payments, bringing the total disbursed in the past two weeks to $325 billion. The second batch of payments sent out this week followed an initial 90 million payments made in the week after President Joe Biden signed the $1.9 trillion COVID relief measure on March 11. Treasury said the plan is to keep rolling out payments in batches over the coming weeks. Like the first round of payments, this latest group included direct deposits, as well as paper checks and debit cards mailed to households. (AP)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention is holding firm on a phased return to cruiseline operations, dashing the industry's hopes for a swift restart. (BBG)

POLITICS: Joe Biden campaigned on being a "transition" president during a pivotal time in the nation's history, saying he'd take the reins away from former President Trump and return the country to normal. But now more than ever, those around him say he'll make another bid for the presidency. "I don't think there's any reason to say that he won't," said one longtime adviser to the president. Another Biden ally added that Biden hasn't told associates that he wouldn't be running again. "So we all assume that he is," the ally said, "contrary to this sentiment that he'll be a one-term president because of his own volition." (Hill)

POLITICS: Donald Trump has been in talks with no-name app vendors as he contemplates partnering with an existing platform to create his own social media network, according to sources familiar with the private discussions. Driving the news: Among the social networking apps the former president and his digital adviser Dan Scavino have homed in on is a relatively unknown platform called FreeSpace, these sources told Axios. (Axios)

POLITICS: Senate Minority Leader Mitch McConnell (R-Ky.) said on Wednesday that he's barely spoken to President Biden since the Jan. 20 inauguration, accusing the White House of shifting to the "hard left." "I don't believe I've spoken with him since he was sworn in," McConnell said during an interview with Fox News, adding that he hadn't been invited to the White House either. Spokespeople for McConnell didn't immediately respond to a request for comment, but clarified to CNN that while they had spoken since the Jan. 20 inauguration, they haven't talked about the agenda. (Hill)

POLITICS: Rep. Ken Buck (R-Colo.), the lead Republican on the House Judiciary antitrust subcommittee, will stop accepting donations from Google, Facebook and Amazon, he said Wednesday. Why it matters: Buck (R-Co.) is declining Big Tech donations as regulatory scrutiny on tech companies heats up in Washington. (Axios)

POLITICS: Senate Minority Leader Mitch McConnell and Majority Leader Chuck Schumer Wednesday launched broadsides against each other in a hearing on S.1, the controversial Democratic-backed elections bill that would make sweeping changes to how Americans elect their leaders. The hearing also featured clashes between other senators over how fairly the hearing was being run, the validity of concerns about illegal aliens voting and multiple references to the Jan. 6 attack on the Capitol. "Our move to equality, our move to fairness has been inexorable. But it didn't happen on its own, it took mighty movements and decades of fraught" political fights, Schumer said. "I would like to ask my Republican colleagues, why are you so afraid of democracy?" McConnell shot back, saying it is Democrats who should be ashamed over how they've handled the voting bill. He cited a provision in the bill that would change the Federal Election Commission (FEC) from a body with three Republicans and three Democrats to one with two members from each party and a third unaffiliated member appointed by the president. (Fox)

POLITICS: Chris Coons was flying back from Ethiopia to Washington this week when a staffer showed him a revealing picture on the plane's radar: His aircraft and Secretary of State Antony Blinken's were about to cross paths over the Atlantic Ocean. The moment was a metaphor of sorts for Coons' current role for President Joe Biden. The Delaware Democrat's close friendship with Biden has already made Coons an unofficial White House envoy in the Senate, but he is now expanding his reach overseas, with the president dispatching the senator to Ethiopia over the weekend for an urgent diplomatic mission. The move showed that despite Coons' dashed hopes to serve as Biden's chief diplomat, he's emerging as what some sources called a "shadow" secretary of state for a president beset with foreign-policy challenges. (Politico)

POLITICS: President Biden is putting Vice President Harris in charge of addressing the migrant surge at the U.S.-Mexico border, senior administration officials announced on Wednesday. (Axios)

POLITICS: A number of senior Biden administration officials and members of Congress are taking a trip on Wednesday to a refugee resettlement facility along the U.S.-Mexico border in Texas, Axios has learned. (Axios)

EQUITIES: The United States is planning to impose sanctions on two conglomerates controlled by Myanmar's military over the generals Feb. 1 coup and a deadly crackdown, two sources familiar with the matter said on Wednesday. The move by the U.S. Treasury to blacklist Myanmar Economic Corporation (MEC) and Myanmar Economic Holdings Ltd (MEHL) and freeze any assets they hold in the United States could come as early as Thursday, sources said. The U.S. Securities and Exchange Commission (SEC) in recent days sent letters to Wall Street banks seeking information on their special purpose acquisition company, or SPAC, dealings, the four people said. (RTRS)

OTHER

GEOPOLITICS: China is quickly amassing weapons and systems to militarily overwhelm Taiwan, an action it could be poised to take within the next six years, the admiral chosen to be the next commander of US forces in the Pacific warned Tuesday. "My opinion is this problem is much closer to us than most think," Adm. John Aquilino said before the Senate Armed Services Committee, which was reviewing his nomination to lead the US military's Indo-Pacific Command. China considers establishing full control over Taiwan to be its "number one priority," added Aquilino. (CNN)

GEOPOLITICS: The United States and the European Union have agreed to relaunch a bilateral dialogue on China and work together to address Russia's "challenging behavior," according to a joint statement on Wednesday. U.S. Secretary of State Antony Blinken and the EU high representative for foreign affairs, Josep Borrell, "acknowledged a shared understanding that relations with China are multifaceted, comprising elements of cooperation, competition, and systemic rivalry." (RTRS)

U.S./CHINA: Secretary of State Antony Blinken issued a strong rebuke Wednesday of China's sweeping use of coercive measures and urged NATO allies to work with the U.S. in order to mount pushback on Beijing. Blinken, in an address at NATO headquarters in Brussels, said the U.S. wouldn't force its European allies into an "us or them choice." However, he made clear that Washington views China as an economic and security threat, particularly in the realm of technology, to NATO allies in Europe. (CNBC)

U.S./CHINA: U.S. securities regulator adopted measures that would kick foreign companies off American stock exchanges if they do not comply with U.S. auditing standards. The move by the Securities and Exchange Commission (SEC) adds to the unprecedented regulatory crackdown in China on domestic technology companies, citing concerns that they have built market power that stifles competition. (RTRS)

BOJ: The Bank of Japan's purchases of exchange-traded funds would be loss-making if the Nikkei 225fell below around 20,000, BOJ Governor Haruhiko Kuroda says Thursday. The central bank's ETF buys have so far generated sizable unrealized gains, Kuroda says in a response to a lawmaker's question in parliament. BOJ will continue flexible purchases of ETFs for some time. (BBG)

AUSTRALIA: Taiwan has begun mass production of a long-range missile and is developing three other models, a senior official said on Thursday, in a rare admission of efforts to develop strike capacity amid growing Chinese pressure. (RTRS)

CANADA: The federal government says it does not believe COVID-19 vaccine shipments to Canada would be affected by export restrictions being considered by the European Union. In an emailed statement, the press secretary for Mary Ng, minister of small business, export promotion and international trade, said Ng's counterparts have assured her that these measures will not affect vaccine shipments to Canada. (CBC)

CANADA: Canadian Prime Minister Justin Trudeau spoke with European Commission President Ursula Von der Leyen Wednesday after the European Union tightened vaccine export restrictions. "They agreed on the importance of rolling out safe and effective vaccines as quickly as possible, including with respect to continued close Canada-EU cooperation," according to a readout of the call issued by Trudeau's office Wednesday night. (BBG)

MEXICO: MNI BANXICO PREVIEW - March 2021: The Final Cut

- Global macro developments as well as domestic inflationary pressures have created trepidation in markets, prompting many analysts to adjust their calls for Thursday's decision. We believe, in a close split decision, Banxico are more likely to cut the overnight rate, one final time, by 25 basis points to a cycle low of 3.75% - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

TURKEY: Turkey's new central bank governor promised to stick to the single interest-rate framework adopted by his predecessor, state news agency Anadolu reported, citing a meeting between the monetary authority and commercial lenders on Wednesday. The monetary authority's new management led by Governor Sahap Kavcioglu pledged continuity in policy and to maintain the current operational framework, Anadolu said, citing banking executives without identifying them. The central bank declined to comment on what was discussed at the meeting. (BBG)

TURKEY: President Tayyip Erdogan said on Wednesday the text of a new constitution will be presented to the Turkish people for discussion next year, having overhauled the previous constitution in 2017 to grant his office sweeping powers. (RTRS)

TURKEY: Erdogan maintains that the economy is just fine, telling his ruling AK Party members in a speech Wednesday that this week's market volatility doesn't reflect Turkey's economic reality, according to a Reuters translation. In the same speech, however, he urged Turks to sell their foreign exchange assets and gold and buy lira-based financial instruments, in an effort to stabilize the beleaguered currency that's lost 10% of its value since Friday. (CNBC)

SOUTH KOREA: The National Assembly on Thursday approved an extra budget worth nearly 15 trillion-won (US$13.2 billion) to help prop up small merchants and the vulnerable hit hard by the yearlong COVID-19 pandemic. Nearly 10 trillion won of the approved extra budget will be financed by issuing government bonds, with the rest to be assigned from the national budget. (Yonhap)

NORTH KOREA: The Japanese government says North Korea launched two ballistic missiles on Thursday morning. Officials say the projectiles were launched around 7 a.m., Japan time and are believed to have fallen in waters outside Japan's exclusive economic zone. Prime Minister Suga Yoshihide said, "North Korea's missile launch is a threat to the peace and security of Japan and the region. Japan firmly protests the launch, which is a violation of UN Security Council resolutions." (NHK)

HONG KONG: Hong Kong suspended online bookings of the Covid-19 vaccines manufactured by BioNTech SE, soon after the government halted the roll-out because of packaging defects on the vials. According to the city's online vaccine booking system, reservations for the BioNTech/Fosun vaccine have suspended. Bookings for the Sinovac vaccine were still available. (Straits Times)

RUSSIA: Alexei Navalny has complained of a "sharp deterioration" in his health in prison and has been blocked from meeting lawyers, a senior aide to the Russian opposition leader has said. (Guardian)

RUSSIA: Russia may create a digital travel pass - a mobile application for international flights within the EAEU to accelerate the recovery of air transportation after the market collapse due to the pandemic. The Russian Ministry of Transport is discussing the measure with airlines, a source in one of the Russian airlines told TASS. At the same time, the issue of accelerating the implementation of the digital IATA Travel Pass, which is already operating on some air routes abroad, is also being discussed. (TASS)

INDIA: India will likely delay deliveries of AstraZeneca coronavirus vaccine doses to the GAVI/WHO-backed COVAX facility for March and April, the programme's procurement and distributing partner UNICEF told Reuters early on Thursday. "We understand that deliveries of COVID-19 vaccines to lower-income economies participating in the COVAX Facility will likely face delays following a setback in securing export licenses for further doses of COVID-19 vaccines produced by the Serum Institute of India (SII), expected to be shipped in March and April," UNICEF said in an email. "COVAX is in talks with the Government of India with a view to ensuring deliveries as quickly as possible." (RTRS)

PHILIPPINES: MNI BSP Preview - March 2021: Looking Through Inflation Overshoot

- Whilst the Philippines is waging an uphill battle against Covid-19, there is little that Bangko Sentral can do to shore up domestic economy. In January Governor Diokno promised a long pause in policy easing, at least through the first half of the year. Given persistently weak policy transmission and the recent CPI overshoot, BSP are set to leave interest rates unchanged - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA

ECONOMY: China is expected to review lenders later this month to decide on the scale of this year's inclusive finance, which lowers qualified banks' reserve ratio requirements to subsidize lending to farmers and small businesses, the 21st Century Business Herald said citing Wang Yifeng, chief banking analyst of Everbright Securities. The market expects up to only CNY100 billion, down from record CNY400 billion last year, the Herald reported. This year's program, the fourth since its launch in 2018, may come in April when liquidity is predicted to be tight due to local bond offerings, the newspaper said. (MNI)

PBOC: China's central bank may conduct annual review of reserve requirement ratio discount under the inclusive finance scheme today or on April 6, 21st Century Business Herald reports, citing its own forecast based on past review dates and reserve requirement payment dates. Liquidity unleashed from the RRR discount may be between 50b yuan and 100b yuan, the newspaper cites an analyst from Everbright Securities as saying. (BBG)

PBOC: MNI BRIEF: PBOC Asks Banks to Support Carbon Emission Cuts

- The People's Bank of China will encourage commercial banks to increase financial support for the country's drive to cut carbon emissions and request them to ensure consistency in real-estate lending by adjusting their credit structure, according to a statement published on the bank's website on Thursday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: China's program allowing SMEs to defer loan repayments was scheduled to end after the first quarter but will be extended to the end of the year, the State Council said on late Wednesday. The PBOC will continue to offer banks preferential financial support at 40% of the principals on loans lent to SMEs, the statement said. China will also extend CNY80 billion cuts in taxes and fees for manufacturers, the government said. (MNI)

PBOC: The PBOC may focus on reducing the cost of financing for small companies, wrote Hu Yuexiao, chief analyst at Shanghai Securities in a front-page commentary published in Securities Times. The PPI and CPI are at levels affording authorities room to push interest rates lower, Hu said. The surging property market boosted developers' demand for financing, raising competition for loans for SMEs, the Times said. (MNI)

EQUITIES: Tencent Holdings Ltd. played down the impact of Beijing's heightening scrutiny over China's biggest internet firms, saying a potential revamp of its $120 billion fintech wing should have little impact on its business. Its shares sank the most in two months. President Martin Lau acknowledged founder Pony Ma called on regulators recently but said that it was voluntary and part of a series of regular meetings. Executives reiterated that the company has always been cautious and compliant with fintech regulations and it will stick with its normal practice of acquiring minority stakes in Chinese startups, while regulators pore over past deals. (BBG)

OVERNIGHT DATA

NEW ZEALAND NON-RESIDENT BOND HOLDINGS 51.7%; JAN 51.0%

SOUTH KOREA FEB RETAIL SALES +10.0% Y/Y; JAN +6.1%

SOUTH KOREA FEB DISCOUNT STORE SALES +15.0% Y/Y; JAN -11.7%

SOUTH KOREA FEB DEPARTMENT STORE SALES +39.6% Y/Y; JAN -6.3%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:28 am local time from the close of 1.9399% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Wednesday vs 37 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5282 THURS VS 6.5228

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second day at 6.5282 on Thursday, compared with the 6.5228 set on Wednesday.

MARKETS

SNAPSHOT: Risk Aversion Eases, Familiar Themes In Play

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 383.23 points at 28790.45

- ASX 200 up 11.833 points at 6790.6

- Shanghai Comp. up 6.703 points at 3374.122

- JGB 10-Yr future down 11 ticks at 151.31, yield up 1.2bp at 0.085%

- Aussie 10-Yr future down 3 ticks at 98.285, yield up 2.7bp at 1.681%

- U.S. 10-Yr future -0-01+ at 132-01+, yield up 1.25bp at 1.621%

- WTI crude down $1.08 at $60.1, Gold up $2.7 at $1737.25

- USD/JPY up 21 pips at Y108.95

- FED'S EVANS WORRIED ABOUT SUB-2% INFLATION AFTER TEMPORARY BUMP (BBG)

- ECB'S VILLEROY: NO RISK OF INFLATION OVERHEATING IN EUROPE (BBG)

- BOE'S HALDANE: "RIP ROARING RECOVERY" IS POSSIBLE (BBG)

- UK AND EU MOVE TO CALM TENSIONS OVER ACCESS TO JABS (FT)

- ASTRA REPORTS LOWER EFFICACY FOR COVID VACCINE AFTER CRITICISM (BBG)

BOND SUMMARY: Bonds Wounded By Risk Recovery, JGBs Take Breather After 40-Year Auction

Risk appetite returned, despite the absence of any major headline catalysts in the Asia-Pac session, sapping strength from safe haven assets. T-Notes went offered, extending losses to the session low of 131-30 as the DXY had a look above the 200-DMA for the first time since May 2020. Subsequent recovery attempt proved shallow and T-Notes last sit -0-01+ at 132-01+. Cash Tsy curve runs steeper, yields are -0.2bp to +1.5bp. 7s underperformed in early trade but gradually caught up, with focus on today's seven-year auction. The previous offering of that maturity was particularly weak and triggered an immediate bond sell-off. Eurodollar futures run unch. to -1.0 tick through the reds. Today's U.S. docket features tertiary GDP report, initial jobless claims and plenty of Fedspeak.

- JGB futures softened as the broader market impetus outweighed the impact of a decent enough 40-Year JGB sale. The contract jumped after the auction as high yield (0.675%) missed BBG estimate of 0.690%, even as bid/cover ratio slipped to 2.800x from 2.865x seen previously. Futures then slid to a new session low of 151.24 but retraced the move and last trade at 151.31, -11 ticks vs. settlement. Meanwhile, 40-Year JGBs extended post-auction gains and comfortably outperform in the cash space.

- ACGBs tracked moves in U.S. Tsys, cash curve runs steeper with yields sitting -0.1bp to +3.5bp. YM wavered and sits -1.0 at typing, with XM last -3.0 & off earlier lows. Bills trade unch. to -2 ticks through the reds. The RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '28 to Nov '31.

JGBS AUCTION: Japanese MOF sells Y500.0bn of 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y500.0bn of 40-Year JGBs:- High Yield: 0.675% (prev. 0.685%)

- Low Price 94.01 (prev. 93.66)

- % Allotted At High Yield: 100.0000% (prev. 19.0130%)

- Bid/Cover: 2.800x (prev. 2.865x)

EQUITIES: Volatile

Markets are mixed in Asia. Chinese markets opened lower on concerns that Chinese companies they will be de-listed from US bourses after the SEC took initial steps to impose stricter regulation, while worries about a semiconductor shortage also engendered some caution. Mainland China did see indices moving into positive territory though, amid rumours that China's "national team" were again active in buying stocks. BOJ Governor Kuroda is putting wind in the sails of Japan stocks, saying the central bank will continue to buy ETFs as needed. In South Korea the KOSPI has eked out some gains after the National Pension Service's fund management committee announced it was to discuss increasing its target for local stock holdings.

- In Europe and the US have fluctuated between gains and losses. At the time of writing US futures are slightly higher, tech shares are the laggard after being hit hard yesterday in a rotation to cyclicals.

OIL: Recedes After Spike Higher

Oil has slipped slightly in Asia-Pac trade, retracing some of the rally yesterday. WTI is down $1.03 from settlement levels at $60.14/bbl, while Brent is down $0.89 at $63.51/bbl.

There is still a container ship blocking the Suez Canal, though a team of Dutch specialists will attempt to move the blockage today.

- Data yesterday showed crude inventory builds extended as refinery runs continued to see lingering effects from the mid-February polar vortex. Headline crude stocks climbed 1.91m bbls, taking stocks 6.4% above the five-year average. The build was concentrated on the US Gulf Coast, which saw inventories rise 5.39m bbls, while Cushing, OK saw a 1.94m bbl draw, the largest one-week slide since mid-February. It was the fifth consecutive week of crude inventory builds fueled in large part by a refiners struggling to reach full capacity after February's deep freeze.

GOLD: Struggling To Break Higher

The yellow metal is flat on the session, last trading at $1734.67/oz, retreating from session highs at $1739.27. There has been little in the way of macro catalysts during the Asia session, markets have shrugged off reports that North Korea conducted a missile test for the first time in a year. As such markets continue to digest comments from Fed speakers and consider US auctions. Demand at the 5-year auction yesterday was solid, markets await results of the 7-year auction today; a poor 7-year auction last month catalysed an initial sell off in US treasuries.

FOREX: Risk Appetite Recovers, JPY Dented By Gotobi Flows

Recent risk aversion evaporated and the Antipodeans got some reprieve after a poor showing in the first half of the week. BBG trader source cited demand for AUD/USD from exporters and fast money funds, while the kiwi crept higher alongside its cousin from across the Tasman. The Asia-Pac session provided little to rock the boat in the way of headline catalysts.

- JPY was the main laggard overnight amid speculation that Gotobi flows amplified pressure on the Japanese currency. However, USD/JPY struggled to push through the Y109.00 mark on both swings towards the level. Worth flagging today's expiry of $1.5bn worth of options with strikes at Y109.25-30.

- The PBOC fixed its USD/CNY mid-point at 6.5282, just 3 pips above sell side estimates. USD/CNH edged higher, extending its recent winning streak. 21st Century Business Herald reported that the PBoC could conduct the annual review of RRRs today or on Apr 6.

- Coming up today we have U.S. tertiary Q4 GDP and weekly initial jobless claims, while the central bank speaker slate is tightly packed with Fed, ECB, BoE & Riksbank members.

FOREX OPTIONS: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.2bln), $1.1800(E1.56bln), $1.1900(E610mln), $1.2000(E587mln)

- USD/JPY: Y108.00($615mln), Y108.80($560mln), Y109.25-30($1.5bln), Y109.40-50($688mln), Y110.00($691mln)

- EUR/GBP: Gbp0.8525(E525mln), Gbp0.8550(E800mln), Gbp0.8600(E1.1bln), Gbp0.8615(E589mln-EUR puts), Gbp0.8625-30(E816mln-EUR puts)

- AUD/USD: $0.7400(A$555mln)

- AUD/NZD: N$1.0745(A$576mln)

- USD/CAD: C$1.2505($700mln), C$1.2550($500mln)

- USD/MXN: Mxn20.83($480mln-USD puts)

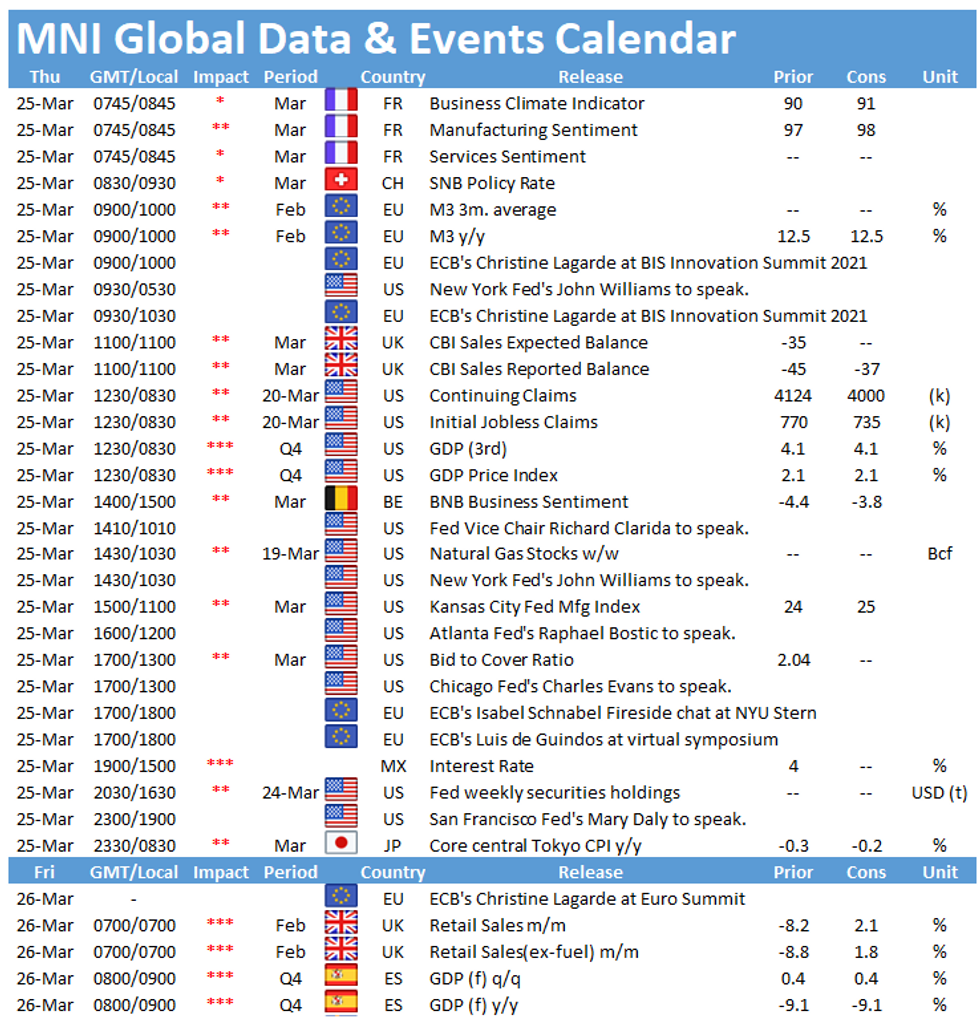

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.