-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A Calm Start To April After Biden Delivers Infra Plan

EXECUTIVE SUMMARY

- BIDEN UNVEILS $2.25T INFRASTRUCTURE PLAN, TAX RISE (MNI)

- FED'S BARKIN SEES 'POWERFUL' DISINFLATION FORCES (MNI)

- EXPANSION IN CHINESE CAIXIN M'FING PMI SLOWS IN MARCH

- FRANCE & ITALY EXTEND VIRUS CURBS

- UK TOLD 'ZERO' JABS COMING FROM EU UNTIL ASTRAZENECA MEETS BLOC'S TARGETS (FT)

- SEC OPENS PROBE INTO ARCHEGOS TRADES THAT TRIGGERED ROUT (BBG)

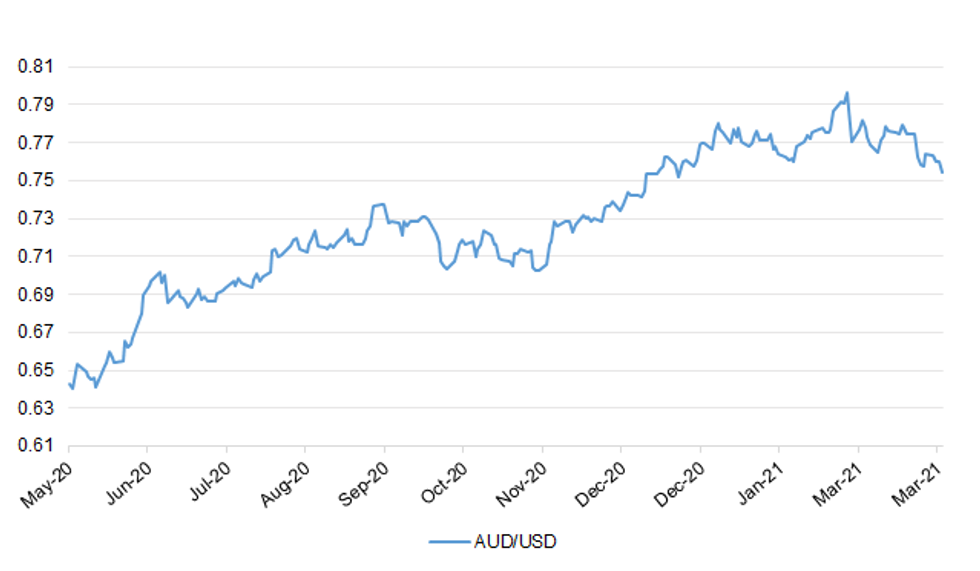

Fig. 1: AUD/USD

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

BREXIT: The UK has delivered its "road map" for implementing the Northern Ireland Protocol to the EU. Lord Frost, the UK's lead Brexit Minister, and EU Commission Vice-President Maroš Šefčovič spoke on Wednesday. The protocol is the part of the Brexit withdrawal deal that created the Irish Sea border. Earlier this month, the UK government changed how the protocol was being implemented without EU agreement. It delayed the introduction of new sea border checks on food, parcels and pets. It also moved unilaterally to ease the trade in horticultural products across from Great Britain to Northern Ireland. The EU has begun legal action as a consequence. (BBC)

EUROPE

FRANCE: French President Emmanuel Macron announced a nationwide four-week lockdown, shutting down schools and business. "We did everything we could to make these decisions as late as possible, until they became strictly necessary, which is now," Macron warned in an address to the nation on Wednesday. "The virus is more contagious and deadlier." He implored people to make an extra effort as the lockdown begins to come into force on Saturday. Restrictions will be flexible this weekend, during the Easter holidays, to allow people to relocate. (BBG)

FRANCE: Macron said existing support to businesses and employees affected by the pandemic would be maintained, while the finance ministry said 150,000 non-essential shops and businesses would now be closed across the country, with the total cost of emergency support running at €11bn a month. (FT)

ITALY: Italy has seen a resurgence in coronavirus infections and deaths over the last month and the government has tightened restrictions on businesses and movements to contain the virus. (RTRS)

ITALY: All health workers in Italy must have coronavirus jabs, the government said on Wednesday, in a potentially controversial move aimed at protecting vulnerable patients and pushing back against 'no-vax' sentiment. Curbs are calibrated in the country's 20 regions according to a four-tier, colour-coded system (white, yellow, orange and red) and are normally based on local infection levels. Wednesday's decree said everywhere would remain a tougher red or orange zone until April 30, giving time for the vaccines to work. This means that restaurants, bars and gyms will remain closed and much regional travel will be banned. However, in a concession to coalition parties that have complained about the lengthy restrictions, the decree said it will be possible to loosen some curbs in those areas which have a high vaccination rate and low infections. (RTRS)

ITALY: Italy's state-backed lender Cassa Depositi e Prestiti SpA agreed on a revised bid for a controlling stake in Atlantia SpA's highway unit, in an effort to seal the acquisition after months of acrimonious talks. Cassa Depositi, which is bidding for the assets with funds Macquarie Group Ltd. and Blackstone Group Inc., submitted the "final offer" for Atlantia's 88% stake in Autostrade per l'Italia SpA, the bidders said in an emailed statement late Wednesday. The statement didn't disclose the value of the offer, saying the offer includes "certain refinements" on the previous proposal made Feb. 24. (BBG)

GREECE: Greece will ease certain lockdown measures even as new cases surge. The country will allow non-essential shops to reopen from April 5 but only with online ordering and pickup, and appointment-only in-store shopping, Deputy Citizen Protection Minister Nikos Hardalias said Wednesday. At weekends only, starting April 3, a maximum of three citizens or families will be allowed to move outside the municipality where they live for personal exercise. Greece reported 3,616 new Covid-19 cases Wednesday, the second-highest daily increase since the start of the pandemic. That followed Tuesday's record 4,340 new cases. (BBG)

IRELAND: Irish economy forecast to grow 5.9% in 2021 compared to 3.8% previously as outlook for exports improved, Irish central bank says in quarterly report. GDP now forecast to grow 4.7% in 2022 versus 4.6% previously. Says economic prospects "deteriorated" in near term amid virus resurgence, recovery may accelerate in 2H21. (BBG)

FINLAND: Finland's government has withdrawn a proposal to confine people largely to their own homes in several cities to help curb the spread of the COVID-19 pandemic, Prime Minister Sanna Marin said on Wednesday. The decision followed a statement from a constitutional law committee that deemed the proposal too vague and not in compliance with the constitution. "Because of the statement from the committee the government has decided we have to withdraw the proposal," Marin said on Twitter. (RTRS)

EQUITIES: Deutsche Bank AG sold about $4 billion of holdings seized in the implosion of Archegos Capital Management in a private deal Friday, helping it emerge unscathed from a scramble that may cost some rivals billions of dollars. (BBG)

U.S.

FED: MNI INTERVIEW: Fed's Barkin Sees 'Powerful' Disinflation Forces

- Richmond Fed President Tom Barkin said in an interview Wednesday that long-term inflation expectations have remained stable through the start of an economic boom triggered by Covid-19 vaccines, and there's still lots of slack in the economy to hold down prices overall. "What I'm hearing is a real reluctance to use short-term supply chain issues to change the long-term price structure," said Barkin, a voter on the FOMC this year. "Part of that is firms haven't changed their expectations, and part of that is some of the disinflationary forces that are out there are still very powerful," such as online price transparency, he said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Infrastructure investment helps foster higher long-term growth, Federal Reserve Bank of Dallas President Robert Kaplan said Wednesday as the Biden administration laid out an ambitious infrastructure plan. "The nice thing, and the desirable thing for me about infrastructure spending -- it's a long-term investment," Kaplan said in a Bloomberg Television interview with Mike McKee. "It's an investment you make today or over the years, and it should help in future create higher potential GDP growth, higher sustainable growth, better productivity." (BBG)

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "An expected temporary rise in inflation poses little risk. But leaving 10 million workers on the sidelines leaves lasting damage. Let's remember the dual mandate is price stability AND full employment." (MNI)

FED: The popularity of one Federal Reserve overnight deposit facility has surged as investors look for shelter from negative rates in short-term markets, which are under unusual pressure over quarter-end thanks to the flood of cash in the system. The rate on overnight repurchase agreements -- or loans collateralized with Treasuries -- opened at 0% Wednesday after trading at negative levels in the past week. The bid-ask spread was 0.02%/0% after the central bank's operation. Usage of the Fed's overnight reverse repurchase facility rose to $134.3 billion Wednesday, which was still the highest level since April. It exceeded Tuesday's takeup of $104.7 billion. The facility pays an overnight rate of 0%, helping to temporarily reduce the quantity of reserve balances in the banking system. (BBG)

FISCAL: MNI POLICY: Biden Unveils $2.25T Infrastructure Plan, Tax Rise

- U.S. President Joe Biden on Wednesday proposed USD2.25 trillion of infrastructure spending matched by higher taxes including higher corporate rates, measures that could reshape the economic recovery and how much stimulus the Fed needs to provide. The package would spread project costs over eight years and aims to pay for it all over 15 years. Coming just weeks after Congress passed a USD1.9 trillion fiscal stimulus plan, Biden's investment proposal will set the stage for months of delicate negotiations on Capitol Hill - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: While the White House is still pushing for Republican support to pass the infrastructure package, there's widespread expectation on Capitol Hill that it will only make it through Congress if Democrats pass it on their own through reconciliation — and they might only have one more shot this year to use that tactic. That has amped up pressure among some lawmakers to ensure their priorities are addressed in this bill. (POLITICO)

FISCAL: Senate Minority Leader Mitch McConnell (R-Ky.) on Wednesday panned President Biden's infrastructure package, calling it a "major missed opportunity" amid growing criticism from members of his caucus. "Our nation could use a serious, targeted infrastructure plan. There would be bipartisan support for a smart proposal. Unfortunately, the latest liberal wish-list the White House has decided to label 'infrastructure' is a major missed opportunity by this Administration," McConnell said in a statement. (The Hill)

FISCAL: The Business Roundtable, the U.S. Chamber of Commerce and the National Association of Manufacturers all welcomed the idea of pumping money into repairing and building the nation's infrastructure, but recoiled at raising corporate taxes to do so. (BBG)

FISCAL: The IRS will start issuing tax refunds in May to Americans who filed their returns without claiming a new break on unemployment benefits, the federal agency said Wednesday. The American Rescue Plan waived federal tax on up to $10,200 of unemployment benefits, per person, received in 2020. Households with $150,000 or more in income are not eligible for the tax cut. (CNBC)

CORONAVIRUS: The highly contagious coronavirus variant first identified in the U.K. is starting to become the predominant strain in many regions of the U.S., the head of the Centers for Disease Control and Prevention said Wednesday. The variant, known as B.1.1.7, now accounts for 26% of Covid-19 cases circulating across the nation, CDC Director Dr. Rochelle Walensky told reporters during a White House news briefing on the pandemic. It is the predominant strain in at least five regions, she added. (CNBC)

CORONAVIRUS: New Jersey presented moderate and high-case model scenarios for Covid-19, both of which predict cases will increase in April. Under the moderate scenario, cases and hospitalizations will reach a high in mid-April. Cases wouldn't drop below 3,000 until June, while hospitalizations wouldn't be less than 1,000 until August. The high-case model assumes that the vaccines are far less effective against variants, and that people will relax their adherence to social distancing and masks, Governor Phil Murphy said Wednesday at a press briefing. If this occurs, New Jersey sees daily cases of more than 8,000 in mid-May and again in mid- June, and hospitalizations reaching December and January's high levels in August. (BBG)

CORONAVIRUS: Pennsylvania health officials announced on Wednesday that beginning April 19, all residents will be able to schedule a COVID-19 vaccine appointment. (ABC)

CORONAVIRUS: All Kentucky residents who can safely take a COVID-19 vaccine will have access to set up appointments starting Monday. (Courier Journal)

US: Major U.S. exchange holiday schedules covering the Easter weekend period can be found below:

MARKETS: Treasury Secretary Janet Yellen convened a council of regulators tasked with monitoring the stability of the financial system, homing in on risks that emerged during the market turmoil of a year ago when the coronavirus pandemic hit the U.S. economy. Ms. Yellen led her first meeting Wednesday as head of the Financial Stability Oversight Council, focusing on a variety of issues, including activities of open-end mutual funds and hedge funds and their roles in the market turbulence last year. (WSJ)

TSYS: A U.S. judge on Wednesday dismissed long-running litigation accusing 10 large banks of conspiring to suppress competition in the now $21.2 trillion market for U.S. Treasury securities. (RTRS)

EQUITIES: The U.S. Securities and Exchange Commission opened a preliminary investigation into Bill Hwang over his leveraged trades that have roiled Wall Street. The SEC started the civil probe in recent days after Hwang's Archegos Capital Management made a series of wrong-way wagers that prompted brokers to liquidate his positions, said a person familiar with the matter, who asked not to be named because the inquiry isn't public. The examination is in its early stages and is being led by the asset-management group in the SEC's enforcement division. It's fairly routine after a major market blowup for the SEC to launch a review. The probe may not lead to any allegations of wrongdoing. (BBG)

EQUITIES: Sen. Sherrod Brown, the Democratic chairman of the powerful Senate Banking Committee, is setting his sights on Archegos Capital Management after the fund's recent losses sent shockwaves through markets. "Once again, investment banks put profits first and enabled risky derivatives trading that resulted in billions of dollars in losses," Brown said in a statement to CNBC on Wednesday. "We must make sure our financial watchdogs work together to protect the financial system and our economy. I expect the SEC and other regulators to take a closer look." (CNBC)

EQUITIES: Some of the banks that collectively had more than $50bn of exposure to Archegos Capital are conducting internal inquiries over whether Bill Hwang, the former hedge fund manager who ran the family office, concealed his other positions from them. Executives within the prime brokerage divisions of at least two banks are being quizzed by risk managers over why they offered a business as small as Archegos tens of billions of dollars of leverage on trades in volatile equities through swaps contracts, according to people with knowledge of the discussions. (FT)

AIRLINES: United Airlines CEO: Domestic leisure demand 'has almost entirely recovered' (BBG)

OTHER

U.S./CHINA: More than a third of multinational firms in Shanghai are considering moving all or part of their operation out of China or to another Chinese city when tax exemptions on allowances for foreign employees expire next year, a survey released by a US business lobby group on Thursday showed. At the end of 2018, Beijing said tax breaks for expat allowances, including those available for language training, housing, and children's education would be phased out at the beginning of 2022 after a three-year transition period. The change was introduced partly to equalise benefits between local and foreign workers after the government introduced tax deductible items as part of personal income tax reform. But as the deadline has approached, many foreign companies have become increasingly worried.

GEOPOLITICS: Propaganda officials quietly celebrated in Beijing two days after a Chinese social-media post helped ignite a frenzy of outrage against Western clothing brands, according to people familiar with the matter, in what they saw as a victory in a new effort to inoculate China against criticisms from the West. The furor that scorched Hennes & Mauritz AB's H&M , Nike Inc., Adidas AG and other boldface names of global retail, threatening them with lost revenues in one of the world's most lucrative consumer markets, began with a message from a blogger on China's Twitter -like Weibo service on March 23, according to an analysis by Doublethink Lab, a Taipei-based nonprofit that has researched online Chinese state disinformation. China fanned the flames the next day through state-media outlets and Communist Party-affiliated social-media accounts. (WSJ)

GEOPOLITICS: Canada needs to adopt a united front with its Five Eyes allies on China, according to one of Justin Trudeau's top ministers who handled trade, foreign affairs and is now in charge of industry. Francois-Philippe Champagne helped craft the northern nation's policy toward Beijing and just revamped the rules for conducting national-security reviews of foreign investment. (BBG)

GEOPOLITICS: Chinese lenders have used legal contracts to give them a hidden advantage over other creditors when lending to low-income countries, in a trend which threatens to undermine global debt relief efforts, according to research. Many of the contract terms were unusually strict and gave Chinese loans priority for repayment while prohibiting borrowers from restructuring their Chinese debts in co-ordination with other creditors, the report published on Wednesday said. (FT)

JAPAN/CHINA: China's defence ministry has urged Japan to stop making provocative moves and refrain from attacking China over disputed uninhabited islands in the East China Sea. "China's defence department stressed the fact that the Diaoyu Islands and its affiliated islets are all China's inherent territory," defence ministry spokesman Wu Qian said. "Japan should stop all provocative moves involving the Diaoyu problem … The Chinese side also expressed strong dissatisfaction and serious concern over its recent series of negative moves against China and asked Japan to abide by international relations criteria, stop smearing China and take practical actions to maintain China-Japan relations." (SCMP)

CORONAVIRUS: The World Health Organization warned of a steady rise in Covid-19 cases and deaths in recent weeks, urging people Wednesday to stick with mask mandates and social distancing rules as the world enters a critical phase of the pandemic. "We're into our second year of the pandemic. There is a lot of frustration and fatigue out there wanting this pandemic to be over, but with transmission increasing, it's going in the wrong direction," Dr. Maria Van Kerkhove, the WHO's Covid-19 technical lead, said during a Q&A at the organization's headquarters in Geneva. "This is far from over. We're not talking about a handful of cases here and there. We are still in the acute phase of the pandemic." (CNBC)

CORONAVIRUS: A senior Brussels policymaker has sought to quash British hopes of obtaining AstraZeneca vaccines manufactured in the EU, saying "zero" jabs would be shipped across the Channel if the company failed to meet its commitments to the bloc. Thierry Breton, internal market commissioner, played down the likely outcome of talks that have been ongoing between Brussels and London over vaccine production, saying "there is nothing to negotiate" between the two parties. Production from the Seneffe plant in Belgium and the Halix factory in the Netherlands "more or less" matches AstraZeneca's commitments to Brussels, and so must be reserved for the EU, he said. (FT)

CORONAVIRUS: The National Institutes of Health has started testing a new coronavirus vaccine from Moderna designed to protect against a problematic variant first found in South Africa, the agency said Wednesday. The phase one trial, led and funded by the NIH's National Institute of Allergy and Infectious Diseases, will test how safe and effective the new shot is against the variant — known as B.1.351 — in roughly 210 healthy adults, according to the agency. (CNBC)

GLOBAL TRADE: The U.S. government on Wednesday vowed to continue battling what it sees as significant trade barriers that are harming American companies and farmers, and singled out China as the "world's leading offender" in creating overcapacities in several sectors. (RTRS)

GLOBAL TRADE: The White House's infrastructure plan will put the U.S. on more equal footing with China as it bolsters the American semiconductor industry, Commerce Secretary Gina Raimondo said Wednesday. "This is about out-competing China," Raimondo told CNBC's Jim Cramer in a "Mad Money" interview. "If we act now … we will compete with China. There is time to do that, to rebuild, to build in semiconductors in particular, but we have to get to the business of doing it." (CNBC)

GLOBAL TRADE: Ford Motor is significantly cutting production at six plants in North America due to an ongoing global shortage of semiconductor chips, including facilities that produce highly profitable pickup trucks. (CNBC)

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co Ltd (TSMC) said on Thursday it plans to invest $100 billion over the next three years to keep up with demand. "TSMC is working closely with our customers to address their needs in a sustainable manner," the world's largest contract chip manufacturer said in a statement to Reuters. (RTRS)

JAPAN: The Japanese government is seeking to place Osaka and two other regions under new measures to control the coronavirus, Economy Minister Yasutoshi Nishimura said Thursday. (BBG)

AUSTRALIA: Australia increases superannuation contribution caps. (BBG)

AUSTRALIA: Australia ended a lockdown of its third- biggest city Brisbane on Thursday, just in time for Easter holidays, as only one new locally transmitted COVID-19 case in Queensland state eased fears of a widespread outbreak. Video and photos on social media showed people wearing masks checking in at cafes and restaurants for lunch or having beer at bars as Brisbane emerged from its three-day snap lockdown at noon local time (0200 GMT). Residents are, however, still required to wear masks in public and some social distancing restrictions will remain in place, Queensland Premier Annastacia Palaszczuk said earlier in the day as she announced the easing of curbs. (RTRS)

NEW ZEALAND: Statistics New Zealand reports experimental weekly series based on payday filing to the Inland Revenue, on website. Paid job numbers fall 7,280 in week ended Feb. 21 to 2,240,340. Numbers rise 34,950 since start of 2021 after slumping 64,010 during December. (BBG)

NEW ZEALAND: New Zealand Treasury publishes financial statements for eight months ended Feb. 28. Operating deficit before gains, losses is NZ$4.51b. Deficit is NZ$3.66b smaller than the NZ$8.17b projected in the half-year fiscal update. (BBG)

NORTH KOREA: North Korea has likely developed the ability to mount nuclear warheads onto its intercontinental ballistic missiles, a United Nations panel warned in a Wednesday report, as the country continues to advance its weapons program funded by cryptocurrency heists, smuggling operations and more. "It is highly likely that a nuclear device can be mounted on the intercontinental ballistic missiles, and it is also likely that a nuclear device can be mounted on the medium-range ballistic missiles and short-range ballistic missiles," concluded the panel, which reports to the U.N. Security Council. (Nikkei)

NORTH KOREA: Hackers backed by North Korea who targeted security researchers in January returned in March to set up a fake website and social media profiles, Google says in a post. New site claims a fake company called SecuriElite is an security company in Turkey. Google says it has not seen the new attacker site serve malicious content but has added it to Google Safebrowsing as a precaution. (BBG)

CANADA: The Canadian province of Ontario, the country's most populous, will enter another lockdown on the weekend for 28 days, local media reported, as it grapples with rising COVID-19 cases and intensive care hospitalization rates. The Canadian Broadcasting Corporation (CBC), citing unnamed sources, said the province's premier would announce the new lockdown measures on Thursday. The new steps would still allow both essential and non-essential retailers to remain open, albeit with occupancy limits and schools would not be closed ahead of a spring break slated for April 12, the CBC said. (RTRS)

BOC: The Bank of Canada is seeing "worrying" signs that some Canadians are taking on too much debt to buy into the nation's hot housing market. In an interview with the Financial Post, Governor Tiff Macklem said there is evidence that loan levels relative to home values are growing -- an indication that some borrowers could be overextending. He also warned people have begun to make purchases based on the belief prices will continue rising. "Canadians are stretching and that is worrying." Macklem said. "If Canadians are basing their decisions on the kinds of price increases that we've seen recently are going to continue indefinitely, that would be a mistake. They're not sustainable." (BBG)

BOC: Most Canadians prefer the Bank of Canada's existing inflation targeting mandate to any other alternative frameworks, even though there appears to be an appetite for flexibility. That's one of the conclusions from a report released Wednesday by the country's central bank that summarized findings of public consultations ahead of its mandate review this year. "Generally, when given the choice between the Bank's current inflation-targeting approach and an alternative framework, most opted for our existing approach," the Bank of Canada said. "Participants perceived it to be easy to understand and the most achievable option, given the Bank's tools." (BBG)

TURKEY: Turkey extended a cut in withholding tax on bank deposits until the end of May, a decision published on the official gazette said on Thursday. Turkey announced a cut on the withholding tax on longer-term bank deposits last year. (RTRS)

MEXICO: Mexico's Finance Ministry increased its growth forecast for this year and next, as the Covid-19 vaccine roll-out and a stronger U.S. economy drive the recovery. Latin America's second-largest economy will grow 5.3% in 2021, compared to a previous projection of 4.6%, and 3.6% in 2022, higher than the 2.6% estimated before, the Finance Ministry wrote in a preliminary budget proposal published Wednesday. (BBG)

MEXICO: Mexico's balance of inflation risks is now tilted upwards after months of uncertainty, Deputy Governor Irene Espinosa said in a interview with Banorte's Norte Economico podcast. (BBG)

MEXICO: Mexico still faces the threat of a slow economic recovery, increasing recomposition of international capital to lower risk assets and potential adjustments to Pemex and the sovereign's credit rating, according to updated risks posted by the Financial Stability Council. Mexico's financial system is confronting the Covid-19 pandemic from a solid position, according to the council. (BBG)

BRAZIL: Brazil hit a record number of Covid-19 deaths for the second day in a row, with 3,869 fatalities in the last 24 hours, the Health Ministry reported. Total deaths rose to 321,515 and the country reported 90,638 new cases, pushing the total to 12.7 million, the second highest tally globally. The health care system in the Latin American country is collapsing with 18 of 27 states reporting over 90% intensive- care beds occupied, the Fiocruz foundation reported. President Jair Bolsonaro said that "only without a lockdown policy it is possible to return to normality." Brazil also detected a new variant of the virus Wednesday in Sorocaba, near Sao Paulo, according to the local government. The new strain is said to be similar to one found in South Africa, according to authorities. (BBG)

IRAN: The European Union will target eight Iranian militia and police commanders and three state entities with sanctions next week over a deadly crackdown in November 2019 by Iranian authorities, three diplomats said on Wednesday. (RTRS)

EQUITIES: Trading in more than 50 Hong Kong-listed companies was suspended on Thursday, with some attributing the move to their failure report earnings in time. The mass suspensions come as March 31 was the last day to report annual results for Hong Kong-listed companies. (BBG)

OIL: On Wednesday, the JMMC made no formal recommendation, three OPEC+ sources said. Options, which the ministers are set to consider on Thursday, include an output roll-over and a gradual increase, two OPEC+ sources said. (RTRS)

OIL: OPEC's top official warned that oil demand remains fragile as the cartel and its partners headed for talks on whether to prolong their vast production curbs. "We should not be out smelling the flowers just yet," Secretary-General Mohammad Barkindo told a committee of ministers that lays the ground for their main meeting, scheduled for Thursday. The oil market is "surrounded by uncertainties, including the prevalence of Covid-19 variants, the uneven rollout of vaccines, further lockdowns and third waves in several countries," Barkindo said. (BBG)

OIL: Saudi Arabia and Iraq are keen to accelerate the restoration of balance to oil markets by committing to the implementation of the OPEC+ agreement, Saudi state news agency (SPA) said on Wednesday. The statement came during an official visit by Iraqi Prime Minister Mustafa al-Kadhimi to Riyadh. (RTRS)

OIL: Iraq's lawmakers approved a revised budget for this year that's smaller than initially envisaged to help narrow the deficit and reduce borrowing. OPEC's second-largest producer assumed oil prices would average 65,250 Iraqi dinar ($45) per barrel in the budget statement. The country's total exports, including from the autonomous region of Kurdistan, would be 3.25 million barrels a day, the parliament's press department said via WhatsApp messages. Expected revenues are 101.3 trillion dinars ($69.4 billion), while projected spending is 129.9 trillion dinars, according to calculations based on the official exchange rate. The fiscal shortfall is expected to be 28.6 trillion dinars, and officials said the deficit would be covered via the difference in oil prices set in the budget and the real prices at which barrels are sold. (BBG)

CHINA

POLICY: China should avoid withdrawing too soon from policies of fiscal and monetary easing, and should stay on a course of promoting economic growth rather than stabilizing leverage, said Yu Yongding, a researcher at the Chinese Academy of Social Sciences, according to a CF40 Forum blog post. The government has other measures to rein in asset prices other than pulling back easing, said Yu. Consumption is still lagging because people tend to increase savings in times of uncertainties, he said. (MNI)

FISCAL: China will cut taxes by over CNY550 billion to further support small and micro enterprises, individual businesses and advanced manufacturing, Xinhua News Agency said citing the State Council. Measures would include halving tax rates on small businesses' first CNY1 million of income and raising the threshold of VAT from CNY100,000 monthly sales to CNY150,000, the report said. The government will refund the incremental retention tax credit monthly to advanced manufacturing businesses, including those working in the transportation equipment, electrical machinery, instruments and meters, medicine, and chemical fiber sectors, Xinhua said. (MNI)

YUAN: The yuan exchange rate is likely to be stable in the long term despite losing 1.5% to the dollar in March, the PBOC-owned Financial News reported. The depreciation of the CNY is modest compared with the 2.3% rise in the USD Index, and the yuan has stayed strong against a basket of currencies, the newspaper said citing Zhou Maohua, an analyst with the China Everbright Bank Financial Market Department. The CNY exchange rate is predicted to show a two-way volatility pattern despite recent drastic fluctuations in the overseas market, Zhou said. (MNI)

CORONAVIRUS: China must increase the rate of its vaccination to boost its defence against the Covid-19 virus or it would lose its early advantage and risk falling behind other nations in terms of group immunity, China Central Television reported citing Shao Yiming, an immunologist at the Chinese Center for Disease Control and Prevention. China administered 114 million doses of the vaccines in the week through March 30, and its goal is to vaccinate 10 million per day with production reaching 5 billion doses by the end of this year, Shao said. (MNI)

OVERNIGHT DATA

CHINA MAR CAIXIN M'FING PMI 50.6; MEDIAN 51.4; FEB 50.9

Overall, the manufacturing sector continued to recover in March, but the momentum of both supply and demand weakened. Overseas demand largely improved. The sector remained under employment pressure. Manufacturing enterprises were still confident that the economy will continue to recover and that the pandemic will be brought under control, with the gauge for future output expectations exceeding the long-term average. We should pay attention to inflation in future as the gauges for input and output prices have been rising for several months. The growing inflationary pressure limits the room for future policies and is not a good thing for sustaining an economic recovery in the postepidemic period. (Caixin)

JAPAN Q1 TANKAN LARGE M'FING INDEX 5; MEDIAN -1; Q4 -10

JAPAN Q1 TANKAN LARGE M'FING OUTLOOK 4; MEDIAN 4; Q4 -8

JAPAN Q1 TANKAN LARGE NON-M'FING INDEX -1; MEDIAN -4; Q4 -5

JAPAN Q1 TANKAN LARGE NON-M'FING OUTLOOK -1; MEDIAN -1; Q4 -6

JAPAN Q1 TANKAN LARGE ALL INDUSTRY CAPEX +3.0%; MEDIAN -1.4%; Q4 -1.2%

JAPAN Q1 TANKAN SMALL M'FING INDEX -13; MEDIAN -20; Q4 -27

JAPAN Q1 TANKAN SMALL M'FING OUTLOOK -12; MEDIAN -17; Q4 -26

JAPAN Q1 TANKAN SMALL NON-M'FING INDEX -11; MEDIAN -14; Q4 -12

JAPAN Q1 TANKAN SMALL NON-M'FING OUTLOOK -16; MEDIAN -14; Q4 -20

MNI DATA IMPACT: BOJ Mar Tankan Shows Improved Outlook

Both short and long-term inflation expectations at Japanese firms rose slightly in the three months to March, easing the Bank of Japan's concern over a weaker view of inflation among corporates, the latest Bank of Japan Tankan survey showed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN MAR, F JIBUN BANK M'FING PMI 52.7; FLASH 52.0

The Japanese manufacturing sector continued to gather some positive momentum at the end of the first quarter of 2021, as March PMI data pointed to a second successive improvement in operating conditions. Moreover, the pace of the expansion quickened and was moderate overall, as firms recorded stronger growth in output and new orders. Employment levels also returned to stabilisation in March, with manufacturers taking on additional capacity to fulfil increasing orders. However, this was offset by a significant number of voluntary retirements. Beyond the immediate future, Japanese manufacturers were confident that output would continue to rise over the coming 12 months, as expectations for growth remained at a high level. Firms cited hopes that a successful vaccination rollout which began in March would help to bring a quicker end to the pandemic and allow for a broad-based recovery in demand. Currently, IHS Markit estimates that industrial production in Japan will grow 7.7% in 2021, yet this does not fully recover the output lost in 2020. (IHS Markit)

JAPAN MAR VEHICLE SALES +2.4% Y/Y; FEB -2.2%

AUSTRALIA FEB, F RETAIL SALES -0.8% M/M; MEDIAN -1.1%; FLASH +0.3%

AUSTRALIA FEB TRADE BALANCE +A$7.529BN; MEDIAN +A$9.872BN; JAN +A$9.616BN

AUSTRALIA FEB EXPORTS -1% M/M; MEDIAN +1%; JAN +4%

AUSTRALIA FEB IMPORTS +5% M/M; MEDIAN +4%; JAN -2%

AUSTRALIA FEB JOB VACANCIES +13.7% Q/Q; JAN +23.3%

AUSTRALIA MAR AIG M'FING PMI 59.9; FEB 58.8

The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) increased by a further 1.1 points to 59.9 points (seasonally adjusted), indicating a stronger pace of expansion in March 2021. This was the highest monthly result for the Australian PMI® since March 2018 and a sixth consecutive month of strong recovery, after the severe disruptions of COVID-19 in Q2 of 2020. Results above 50 points indicate expansion, with higher results indicating a faster rate of expansion. All six manufacturing sectors included in the Australian PMI® reported positive trading conditions (results over 50 points, trend) during March, with especially buoyant conditions reported by manufacturers in machinery & equipment and 'textiles clothing, footwear, paper & printing products'. (AiG)

AUSTRALIA MAR, F MARKIT M'FING PMI 56.8; FLASH 57.0

The PMI slipped slightly again in March but was still strong enough to round off the best quarter for manufacturing since the survey began almost five years ago. Given the headwinds of supply shortages, shipping delays, rising prices and ongoing COVID-19 restrictions in many markets, the strong performance is even more impressive. Both global trade should improve in coming months as lockdowns become increasingly less severe in many overseas markets, which should help not only boost exports but also alleviate the supply constraints. This will in turn help reduce some of the inflationary pressures we are seeing at the moment. (IHS Markit)

AUSTRALIA FEB HOME LOANS VALUE -0.4% M/M; MEDIAN +2.5%; JAN +10.5%

AUSTRALIA FEB OWNER-OCCUPIER LOAN VALUE -1.8% M/M; JAN +10.9%

AUSTRALIA FEB INVESTOR LOAN VALUE +4.5% M/M; JAN +9.4%

AUSTRALIA MAR CORELOGIC HOUSE PRICE INDEX +2.8% M/M; FEB +2.0%

NEW ZEALAND MAR ANZ CONSUMER CONGIDENCE 110.8; FEB 113.1

NEW ZEALAND MAR ANZ CONSUMER CONFIDENCE -2.0% M/M; FEB -0.6%

NEW ZEALAND MAR CORELOGIC HOUSE PRICE INDEX +16.1% Y/Y; FEB +14.5%

SOUTH KOREA MAR TRADE BALANCE +$4.175BN; MEDIAN +$4.295BN; FEB +$2.616BN

SOUTH KOREA MAR EXPORTS +16.6% Y/Y; MEDIAN +16.6%; FEB +9.5%

SOUTH KOREA MAR IMPORTS +18.8% Y/Y; MEDIAN +19.1%; FEB +14.1%

SOUTH KOREA MAR MARKIT M'FING PMI 55.3; FEB 55.3

South Korean manufacturers continued to report a sustained improvement in operating conditions in March, continuing the trend seen throughout the first quarter of 2021. The latest Manufacturing PMI signalled a further improvement in the health of the sector, driven by strong, albeit softer, growth in output and new orders. Firms also reported that new business inflows from external clients in particular increased further in March, and at the fastest pace since November 2020. That said, South Korean goods producers signalled that price pressures had continued to intensify throughout March as supply-chain disruption remained widespread. Average cost burdens increased at the second-sharpest pace on record as firms widely reported higher raw material costs. Manufacturers looked to partially pass the increased costs to clients, resulting in the steepest rise in output prices since the survey began in April 2004. South Korean manufacturers continued to signal strong optimism as the rollout of COVID-19 vaccinations began and demand for new products accelerated. IHS Markit currently estimates industrial production will expand 2.7% in 2021. (IHS Markit)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:33 am local time from the close of 2.2855% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 58 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5584 THURS VS 6.5713

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5584 on Thursday, compared with the 6.5713 set on Wednesday.

MARKETS

SNAPSHOT: A Calm Start To April After Biden Delivers Infra Plan

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 209.53 points at 29385.25

- ASX 200 up 24.532 points at 6814.6

- Shanghai Comp. up 8.447 points at 3450.359

- JGB 10-Yr future down 16 ticks at 151.01, yield up 0.9bp at 0.104%

- Aussie 10-Yr future up 1 tick at 98.19, yield up 5.4bp at 1.839%

- U.S. 10-Yr future +0-03 at 131-01, yield down 1.24bp at 1.728%

- WTI crude up $0.3 at $59.45, Gold up $3.98 at $1711.78

- USD/JPY down 5 pips at Y110.67

- BIDEN UNVEILS $2.25T INFRASTRUCTURE PLAN, TAX RISE (MNI)

- FED'S BARKIN SEES 'POWERFUL' DISINFLATION FORCES (MNI)

- EXPANSION IN CHINESE CAIXIN M'FING PMI SLOWS IN MARCH

- FRANCE & ITALY EXTEND VIRUS CURBS

- UK TOLD 'ZERO' JABS COMING FROM EU UNTIL ASTRAZENECA MEETS BLOC'S TARGETS (FT)

- SEC OPENS PROBE INTO ARCHEGOS TRADES THAT TRIGGERED ROUT (BBG)

BOND SUMMARY: Core FI Mixed In Asia, BoJ Related Matters Steal The Headlines

Cash Tsys sit unchanged to a touch firmer as we move into European hours, with the curve seeing some light bull flattening (30s sit 2.0bp richer on the day). The first round of U.S. President Biden's infrastructure plan held nothing in the way of meaningful surprises, while late Wednesday trade saw a contained round of month-end related vol. There has been very little of note on the headline front in Asia, outside of a softer than expected Chinese Caixin m'fing PMI print and some production issues for the J&J COVID vaccine at one plant, although the company has noted that it doesn't expect any interruptions to its delivery schedule. T-Notes in a narrow 0-04+ range, last +0-03 at 132-01. The ISM m'fing survey headlines the local economic docket on Thursday.

- The JGB space played catch up to the BoJ's April Rinban plan in early Tokyo trade, after the Bank noted that it will remove Y550bn of conventional JGB purchases in April vs. March, with some pre-auction concession also built in. There was some respite in the wake of the latest 10-Year JGB auction, which saw the low price top dealer estimates, with the tail narrowing and cover ratio moving higher, although the latter continues to operate within the lower end of its recent range, with the metric observed at last month's auction providing a low bar to hurdle given the fact that it represented a multi-year low. JGB futures -14 on the day, with the cash curve a little steeper (30s provide the weak point, cheapening by 2.0bp on the day).

- The Aussie bond space reversed its overnight losses, aided by the light firming in the longer end of the Tsy curve. YM +1.0, XM +0.5 at typing, while cash ACGBs sit unchanged to 1.0bp firmer on the day. There has been nothing in the way of a meaningful reaction to a relatively packed local data docket and vanilla weekly issuance slate from the AOFM.

JGBS AUCTION: Japanese MOF sells Y2.1005tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1005tn 10-Year JGBs:- Average Yield 0.123% (prev. 0.131%)

- Average Price 99.77 (prev. 99.70)

- High Yield: 0.124% (prev. 0.134%)

- Low Price 99.76 (prev. 99.67)

- % Allotted At High Yield: 82.7380% (prev. 30.8194%)

- Bid/Cover: 3.543x (prev. 3.140x)

JAPAN: Foreign Investors Shed Japanese Assets Last Week

Net foreign selling of Japanese bonds and equities dominated within the latest round of weekly international security flow data, with foreign investors shedding exposure to Japanese assets in the wake of the well-documented tweaks to BoJ monetary policy (and also ahead of the end of the Japanese FY). The metrics both experienced multi-month highs in terms of net sales.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 200.7 | 554.4 | 440.5 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -368.0 | -274.7 | -773.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -2393.1 | -943.1 | -1816.0 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -852.4 | -79.0 | -1118.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 7 April it plans to sell A$1.2bn of the 1.00% 21 December 2030 Bond.

- On Thursday 8 April it plans to sell A$500mn of the 23 July 2021 Note & A$500mn of the 24 September 2021 Note

- On Friday 9 April it plans to sell A$800mn of the 0.25% 21 November 2025 Bond.

EQUITIES: April Off To A Green Start

The new quarter kicks off with gains in Asia-Pac equity markets, taking a positive lead from the US and boosted by robust data in the region. US President Biden unveiled the latest spending plan late yesterday, which also helped engender a positive tone. Markets in Hong Kong rose, despite reports of around 50 companies suspended from trading on the Hang Seng, with speculation among traders that the restriction is due to a failure by the companies to report earnings on time. Chip makers were buoyed by TSMC's announcement to spend $100bn expanding capacity over the next three years, while Micron and Western Digital are said to be each exploring a potential $30bn deal for Kioxia. Futures in the US are mixed, S&P and Dow Jones in negative territory, while the Nasdaq ekes out some small gains.

OIL: Halts Decline, OPEC+ Eyed

Crude futures are marginally higher in Asia, recouping some of yesterday's losses.WTI is $0.19 above settlement levels at $59.35/bbl, Brent is $0.16 higher at $62.90. Data yesterday showed a draw in crude and gasoline inventories, with the market gleaning further support from expectations that OPEC+ will roll over its production quotas into May. US DOE inventory data showed headline stockpiles fell 880k bbls, while refinery utilisation reached 83.9% of total capacity, up 2.3 percentage points from the week prior. There are lingering demand concerns though, with France the latest European country to declare a 4-week lockdown while Italy extended restrictions, Ontario in Canada will also impost a lockdown. Markets look ahead to the conclusion of the OPEC+ meeting after a panel meeting finished on Wednesday without reaching a recommendation.

GOLD: Key Support Holds

A pullback in the DXY and stable U.S. real yields (on net) allowed gold to move away from its recent trough on Wednesday. Bullion has stuck to a tight range in Asia-Pac hours, with spot last dealing +$5/oz at $1,713/oz. From a technical perspective bears failed to force their way through key support in the form of the Mar 8 low on Wednesday, with the subsequent rebound allowing bulls to refocus on the 20-Day EMA.

FOREX: Antipodeans Sag Ahead Of Easter

The Antipodeans led high-beta currencies lower, with liquidity in Australia and New Zealand likely thinned ahead of the Easter holidays. AUD faltered amid chatter about the liquidation of AUD longs during the release of Australian retail sales data and accelerated losses as AUD/USD slid through its YtD lows into the London morning. The latest round of AUD sales coincided with a spell of broader demand for the greenback and spilled over into the NZD to a degree, helping the Antipodeans cement their position as worst G10 performers.

- CAD was hurt by a CBC source report noting that Ontario will be placed under a 28-day lockdown from Saturday.

- JPY led gains in the G10 basket despite a round of sales into the Tokyo fix. USD/JPY jumped to its session high of Y110.82 around that time, but gave up all earlier gains thereafter.

- The PBOC set its USD/CNY mid-point at CNY6.5584, just 3 pips shy of sell-side estimates. USD/CNH rallied past yesterday's high on a surprise deterioration in China's Caixin M'fing PMI, which printed at 50.6.

- Global PMI data, U.S. construction spending & initial jobless claims, Canadian building permits & German retail sales take focus on the data front. Fed's Harker will speak at a fintech symposium.

FOREX OPTIONS: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E468mln-EUR puts), $1.1850(E1.1bln-EUR puts)

- USD/JPY: Y108.00($969mln), Y108.50($655mln), Y108.90-109.00($660mln), Y109.35($585mln), Y110.00($532mln), Y111.00($790mln-USD puts)

- GBP/USD: $1.3800(Gbp399mln)

- AUD/JPY: Y85.85(A$664mln)

- USD/CAD: C$1.2350-55($750mln), C$1.2450($1.5bln), C$1.2600-10($1.5bln-USD puts), C$1.2630-45($1.2bln-USD puts), C$1.2660-75($1.3bln), C$1.2875($502mln)

- USD/CNY: Cny6.5475($750mln)

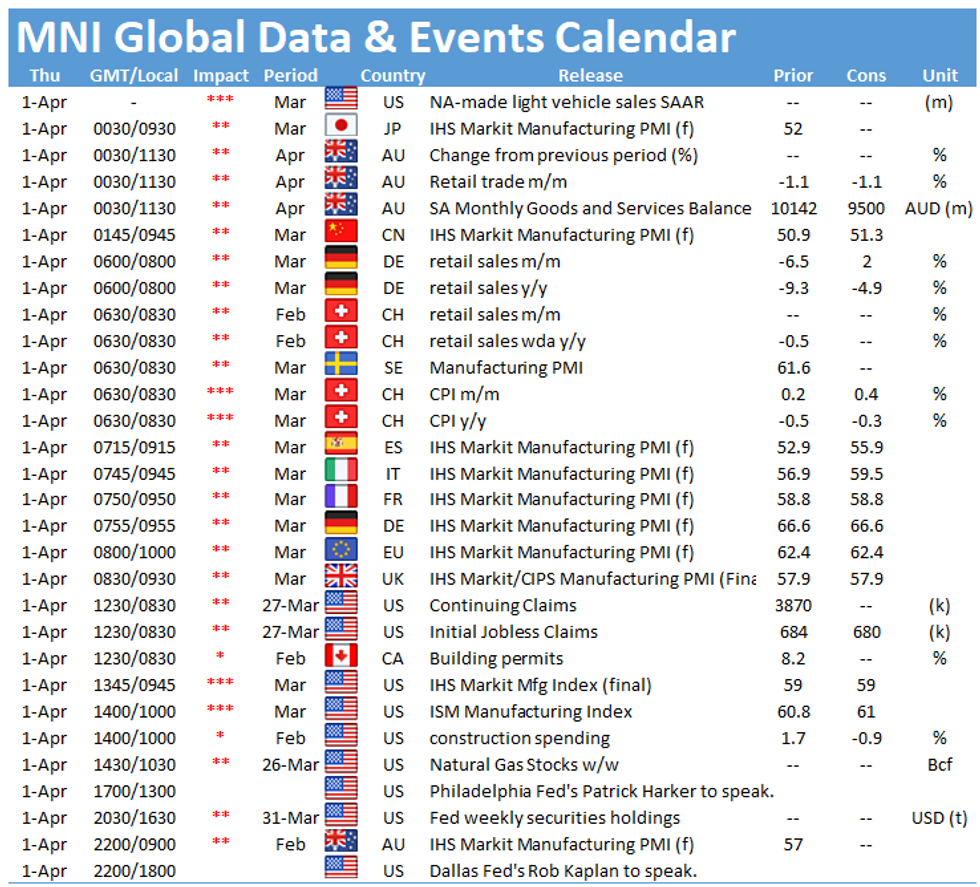

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.