-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Bid On Strong Earnings & Fed

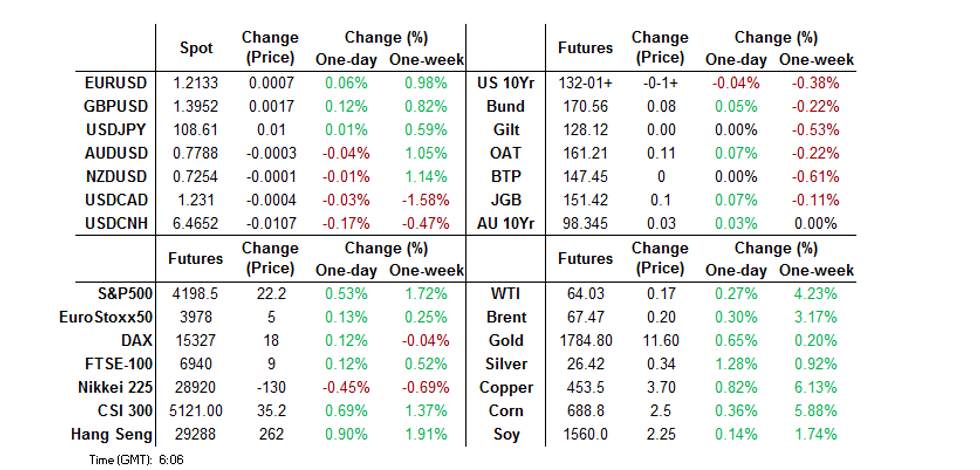

- FOMC messaging and strong earnings data from the likes of Apple & Facebook allowed the S&P e-mini contract to register another fresh all-time high, with the NASDAQ outperforming in Asia.

- The DXY initially softened during the Asia-Pac session with the post-Fed impetus spilling over, before the greenback recovered from worst levels.

- A Japanese holiday made for limited headline flow, with cash Tsys closed until the London open.

BOND SUMMARY: Fresh Highs For S&P E-Minis Apply Light Pressure

A bid in the equity space in the wake of quarterly earnings releases from some of the U.S. tech giants (Apple & Facebook) was evident in Asia-Pac hours, resulting in the S&P 500 e-mini contract hitting a fresh all-time high, with the NASDAQ 100 outperforming (the Fed's messaging also supported equities). The uptick in equities applied some light pressure to T-Notes, with nothing in the way of surprises provided in President Biden's latest address. T-Notes last -0-01 at 132-02, 0-01+ off lows, operating in a 0-04+ range, on ~45K lots, with liquidity thinned and cash Tsys closed until London hours on the back of a Japanese holiday. Q1 GDP and weekly jobless claims data headline locally on Thursday.

- JGBs were closed as Japan observed the aforementioned national holiday.

- YM +0.5, XM +3.0 in what has been relatively sedate Sydney trade. Very light pressure crept into XM on the back of the previously flagged uptick in U.S. equity index futures, although the negative RBA-adjusted net supply, month-end index extensions and spill over from yesterday's softer domestic CPI data seemingly continue to provide an underlying level of support, meaning the downtick was both short and modest. In local news, Treasurer Frydenberg noted that the country's jobless rate will "need to have a four in front of it" to generate the required level of wage growth and inflation, with the Treasury's estimate of NAIRU now between 4.5-5.0% (remember that RBA Governor Lowe couldn't discount the suggestion that NAIRU may start with a 3 when questioned on the matter during a recent appearance). Q1 PPI and the latest monthly round of private sector credit data headline the local docket on Friday. We will also see A$1.0bn of ACGB 1.50% 21 June 2031 supply and the release of the AOFM's weekly issuance slate.

FOREX: Moving On After FOMC

Familiar dynamics were in play in the early part of the Asia-Pac session, but started to peter out in the second half. Headline flow failed to provide any notable catalysts, while regional activity was limited by a market holiday in Japan. The latest speech from U.S. Pres Biden generated no tangible market reaction, as most details had been outlined/leaked earlier. The greenback continued its post-FOMC slide and the DXY printed two-month lows as a result, but trimmed the bulk of initial losses thereafter, even as the U.S. dollar remained among the worst G10 performers.

- USD/CNH went offered despite a marginally softer than expected PBOC fix. China's central bank set its USD/CNY mid-point at CNY6.4715, 8 pips above sell side estimates, but USD/CNH slipped through yesterday's low to its worst levels since the early days of March.

- The Antipodeans gave away their initial gains, which made NZD/USD fail to consolidate above broken resistance from Mar 18 high of $0.7269. Both AUD/USD & NZD/USD returned to respective opening levels.

- NOK remained resilient and topped the G10 pile, with SEK & GBP also holding up well.

- USD/CAD slipped to a fresh cycle low of C$1.2288, even though some suggested that C$1.2300 may have held some barrier options. The rate moved away from that trough as USD started chewing into its post-FOMC losses.

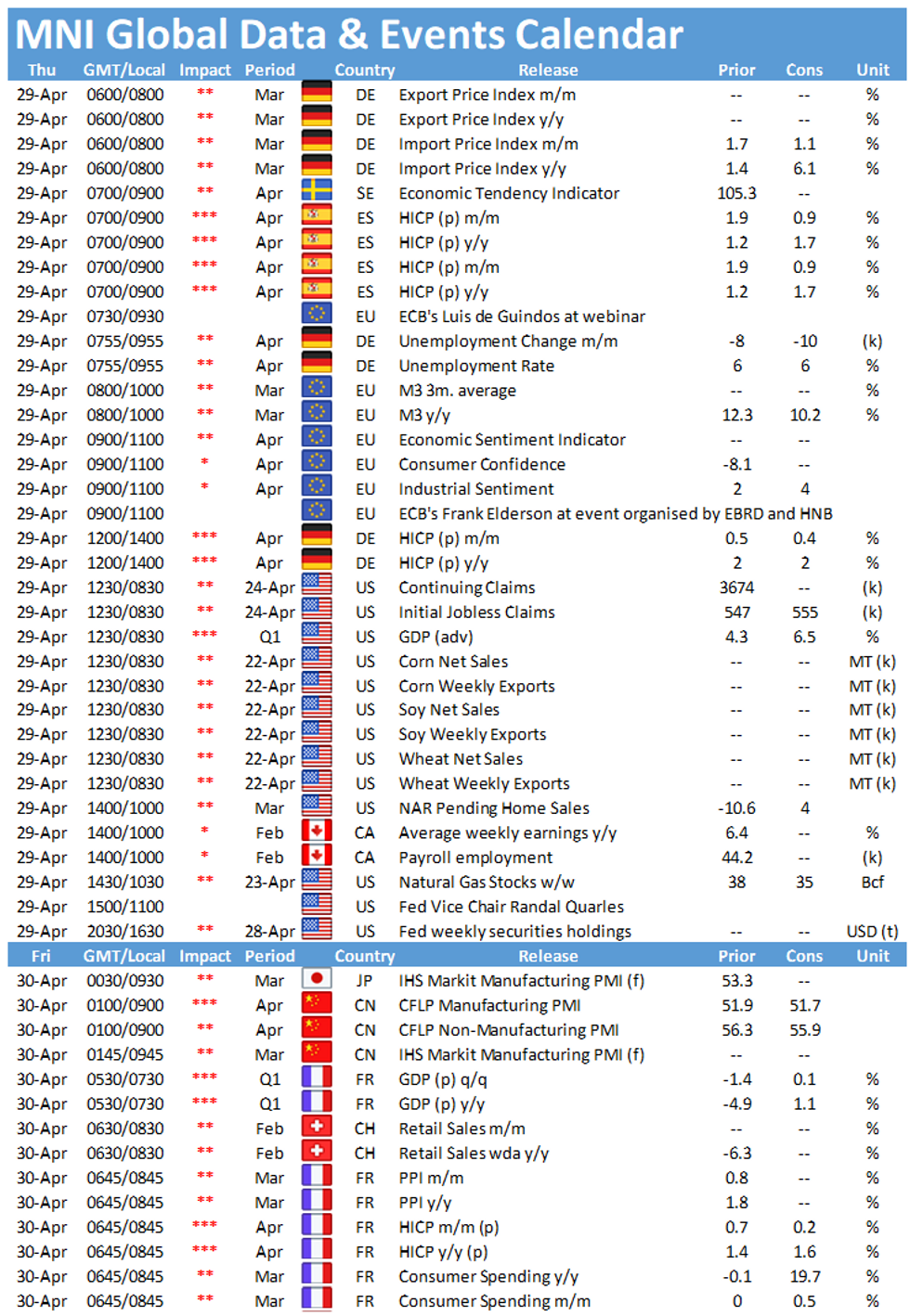

- The global data docket features U.S. GDP & initial jobless claims, German unemployment & flash CPI. Speeches are due from Fed's Quarles as well as ECB's de Guindos, Elderson, Weidmann & Holzmann.

FOREX OPTIONS: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-1.1905(E1.4bln-EUR puts), $1.1940-50(E589mln), $1.2095-1.2110(E1.3bln), $1.2135-40(E562mln), $1.2200(E625mln)

- USD/JPY: Y106.25($1.3bln), Y106.60-70($1.5bln-USD puts), Y106.85-107.00($1.5bln), Y108.00-15($822mln), Y108.45-50($1.2bln-USD puts), Y108.65-75($526mln), Y108.95-109.00($1.4bln-USD puts)

- EUR/JPY: Y129.85-95(E1.1bln-EUR puts)

- GBP/USD: $1.3500(Gbp613mln)

- EUR/GBP: Gbp0.8500-20(E777mln)

- USD/CHF: Chf0.9200($1.1bln-USD puts)

- EUR/CHF: Chf1.0950(E602mln-EUR puts)

- AUD/USD: $0.7600(A$925mln-AUD puts), $0.7650-60(A$842mln-AUD puts), $0.7740-50(A$514mln)

- AUD/JPY: Y81.00(A$1.1bln-AUD calls)

- EUR/AUD: A$1.5385-1.5400(E830mln-EUR puts)

- USD/CAD: C$1.2220-30($815mln), C$1.2400($615mln), C$1.2450($815mln-USD puts), C$1.2550($1.15bln-USD puts)

- USD/CNY: Cny6.4500($570mln)

- USD/MXN: Mxn9.80($470mln), Mxn20.00($505mln)USD/ZAR: Zar14.20($1.1bln-USD puts)

EQUITIES: Fed Guidance & Strong Earnings Support Equities

Equity markets have benefitted from the Fed's reiteration of guidance surrounding its future policy path and stronger than expected earnings from the likes of Apple, Facebook, Ford & Samsung. The NASDAQ outperformed given the tech focus of 2/3 of the aforementioned U.S. equity names. The S&P 500 e-mini contract registered another fresh all-time high, while the major Asia-Pac equity indices also ticked higher, with the Hang Seng leading. A reminder that Japanese markets were closed for the observance of a national holiday.

ASIA FX: Focus On All DMA Crosses That Glitter; KRW Outperforms On Samsung Earnings Beat

USD/Asia played catch-up with post-FOMC market moves and declined broadly, even as several of them saw golden crosses materialise, while greenback weakness moderated. KRW led gains on the back of local developments, while liquidity in the Asia-Pac region was sapped by market holidays in Japan & Malaysia.

- KRW: The combination of continued improvement in business confidence & Samsung profit beat was a shot in the arm for the won, giving it an edge over regional peers & pushing USD/KRW to two-month lows. Sentiment among manufacturers surged to a decade-high, nearing the 100 breakeven mark.

- CNH: Offshore yuan went bid despite a slightly softer than expected PBOC fix, which came 8 pips above sell-side estimates. USD/CNH slipped to its worst levels since early March.

- IDR: USD/IDR re-opened sharply lower, but trimmed losses thereafter. The rate found itself at technical crossroads, as it formed a head and shoulders pattern, but seemed poised to complete a golden cross within the coming sessions.

- PHP: USD/PHP did form a golden cross, but faltered nonetheless, despite Wednesday's decision from Pres Duterte to extend lockdown measures in the capital region through May 14, despite calls from local mayors to ease some restrictions.

- THB: Another golden cross was formed by USD/THB and yet the baht was among best performers in the region. Local coronavirus matters continued continued to take centre stage, with the national Covid-19 task force due to discuss fresh restrictions today.

- SGD: The Singdollar round tripped from fresh two-month lows vs. USD after MAS said Wednesday that Singapore's economy will likely grow more than 6% Y/Y this year. BBG reported that Singapore-based Olam Food Ingredients plans to buy U.S. spice manufacturer Olde Thompson for $950mn.

- HKD: HKMA issued its post-FOMC statement noting that HKD exchange rate & interest rates remain steady, while local money markets are operating smoothly.

GOLD: Firming Post FOMC

Gold has drawn support from the post-FOMC downtick in U.S. Tsy yields & USD weakness, after a brief showing below the 50-day EMA on Wednesday. Spot last deals $5/oz or so firmer, just above $1,785/oz with the bullish impetus still intact from a technical perspective. Bulls need to take out well defined resistance in the form of the April 22 high (1,797.9/oz) before turning their focus higher.

OIL: Crude A Touch Firmer Alongside Equities

The uptick in global equity indices supported crude in Asia-Pac trade, although WTI & Brent moved back from best levels of the day as the DXY recovered from worst levels, leaving the benchmarks $0.15 above their respective settlement levels at typing. The broader global COVID trends remain key re: the demand side of the equation. Elsewhere, Wednesday saw the release of the latest round of weekly DoE inventory data from the U.S., with crude and gasoline stocks registering surprise, albeit modest, builds while distillate stocks experienced a much sharper than expected drawdown.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.