-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA Kicks Can To July

- RBA highlights July as staging post for 3-Year yield target & QE decisions, delivers more upbeat assessment of economy.

- DXY pares some of Monday's losses.

- Ongoing Japanese & Chinese holidays sap liquidity from Asia-Pac trade.

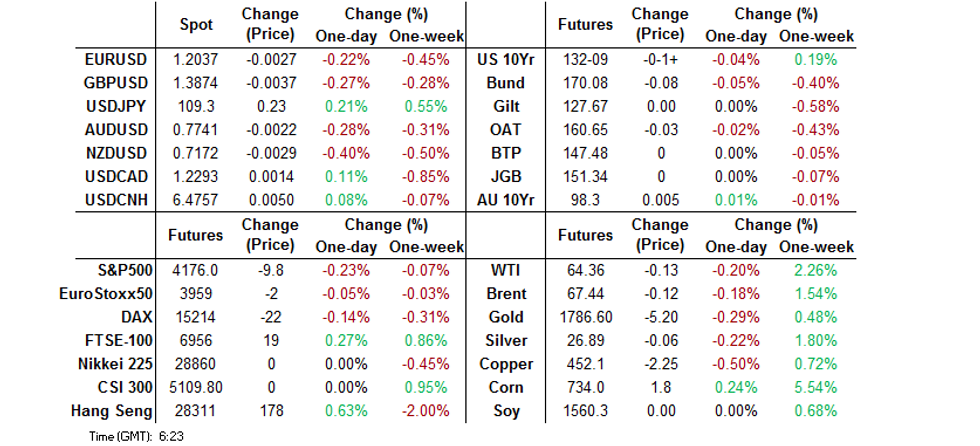

BOND SUMMARY: Narrow Ranges, RBA Has Little Overall Impact

T-Notes stuck to a very narrow 0-02+ range in Asia-Pac hours, with a lack of headline flow compounded by the observance of holidays in both Japan & China (the former keeps cash Tsys closed until London hours). The contract last deals -0-01+ at 132-09, at lows of the day, on very limited volume of ~28K. This comes after a rally on Monday, but the contract ultimately finished a little shy of best levels. Final durable goods and March's factory orders readings headline the local economic docket on Tuesday. Elsewhere, Fedspeak will come from Kaplan & Daly.

- YM -1.5, XM +1.0. A more upbeat economic assessment from the RBA (better short-term GDP outlook, lower unemployment track and uptick in underlying inflation expectations) did little for the space, outside of applying some mild pressure, as the movement in the Bank's forecasts was more of a mark to market exercise given the recent dynamics in the local economy. The assessment came alongside the Bank leaving its broader monetary policy settings unchanged, as expected. The Bank revealed that "at its July meeting, the Board will consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond. The Board is not considering a change to the target of 10 basis points." The Bank also stressed that "the Board is prepared to undertake further bond purchases to assist with progress towards the goals of full employment and inflation. The Board places a high priority on a return to full employment." The highlight of its priority in the final sentence of that passage is a new inclusion to the statement but isn't particularly shocking. The Bank concluded with "the Board is committed to maintaining highly supportive monetary conditions to support a return to full employment in Australia and inflation consistent with the target. It will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest." The final sentence previously read "the Board does not expect these conditions to be met until 2024 at the earliest." This tweak was likely a product of the aforementioned updated projections surrounding inflation and unemployment.

FOREX: USD Outperforms, AUD Knee-Jerks Higher Post-RBA

Another holiday-thinned Asia-Pac session amid market closures in Japan & China saw G10 FX crosses stick to familiar ranges. The latest monetary policy decision from the RBA provided the main point of note, but reaction in the AUD was limited to a marginal knee-jerk higher. The Reserve Bank left its policy settings unchanged and revised its growth forecasts higher.

- The greenback topped the G10 pile, with DXY gradually chewing into yesterday's losses, as all three main e-mini contracts faltered.

- A wider cautious feel was evident through the bulk of the session, limiting commodity-tied FX. CAD bucked the trend and firmed despite marginally softer oil prices, while CHF was among the worst G10 performers.

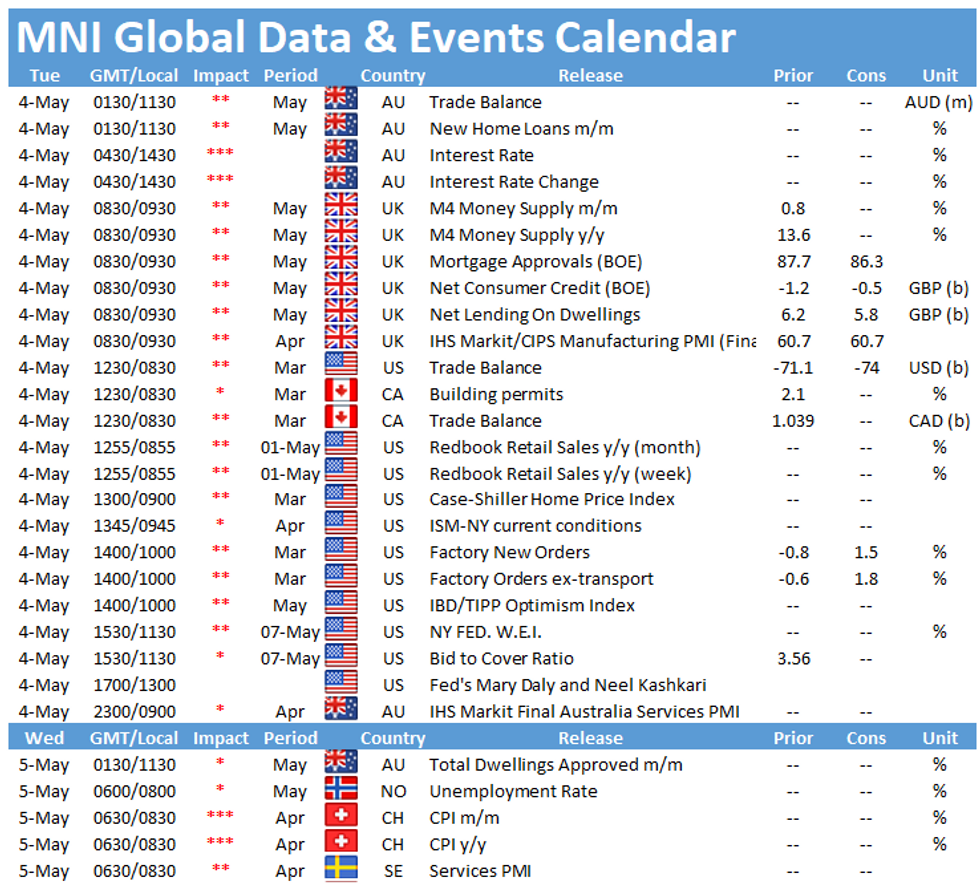

- U.S. trade balance, durable goods orders & factory orders, Canadian trade balance & building permits as well as comments from Fed's Kaplan & Daly, BoC's Macklem & ECB's Villeroy take focus from here.

FOREX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E1.0bln)

- GBP/USD: $1.3800(Gbp896mln)

- AUD/USD: $0.8000(A$1.1bln)

- AUD/NZD: N$1.0855-65(A$2.0bln-AUD puts)

ASIA RATES: Indian Coronavirus Concerns Continue To Dominate Narrative

An uneventful session with liquidity sapped as Chinese markets remain closed for an ongoing holiday.

- INDIA: Yields mixed in India in early trade. Focus today falls on an INR 149bn state debt sale for clues of demand ahead of an INR 320bn government securities sale on May 7. Elsewhere, concerns over the coronavirus situation in India remain elevated, Indian PM Modi is still resisting pressure to declare a country wide lockdown despite please from international leaders. Two weeks ago Modi asked states to use lockdowns only as a last resort in order to maintain the economic recovery

- SOUTH KOREA: Futures in South Korea are higher, moving sharply higher at the open in sympathy with US Tsys. Futures are off session highs, retracing the move as markets digest CPI data earlier in the session. South Korean CPI rose at the fastest pace since 2017 in April, rising 2.3% Y/Y against estimates of a 2.1% gain and faster than the 1.5% rise in March. Core CPI rose 1.4% against estimates of 1.2%. Tracking subcomponents, the increase was driven by commodity and energy prices thanks to a low base effect, while agricultural products also rose. At the April meeting BoK Governor Lee noted that inflation would hover around the bank's 2% target with the possibility of an overshoot, before slipping later in the year.

- INDONESIA: Yields mixed across the curve in Indonesia, the belly seeing buying wile the long end endures selling. Market participants await an IDR 10tn sukuk auction. Data yesterday showed Indonesian CPI rose less than expected in April, the Y/Y print came in at 1.42% against expectations of 1.5%, while core prices rose 1.18% against estimates of 1.24%.

ASIA FX: CPI Data Helps Boost Won While Others Struggle

A stronger greenback has seen some pressure on Asia EM FX, will equity outflows have also seen some currencies sustain losses. Overall mixed performance in quiet trade with several markets, including mainland China, closed today.

- SGD: Singapore dollar weakened, USD/SGD meeting resistance at yesterday's highs. Markets look ahead to PMI and retail sales data tomorrow.

- TWD: Taiwan dollar strengthened, but is off best levels due to heavy outflows from the Taiex as the tech sector sees selling.

- KRW: The won is stronger, rising after inflation data showed prices rose at the fastest pace since 2017 and above the BoK's 2% target. The increases were driven by a low base effect for commodities and agricultural prices.

- IDR: Rupiah is stronger, with little in the way of headline flow technical drivers remain in focus, after rate failed to consolidate above the neckline of a head & shoulders pattern, despite recently forming a golden cross.

- MYR: Ringgit is lower, Federal Territories Min Annuar said that several state gov'ts have asked central authorities to reimpose MCOs to arrest the spread of new Covid-19 infections. Annuar said that the gov't will study these requests before making decisions, while it sees targeted MCOs as an appropriate measure for several localisations across Kuala Lumpur.

- PHP: Peso has fallen slightly and hovers near 2.5 month lows, President Duterte was joined by vaccine czar Galvez, who said the gov't is in talks for the delivery of 4mn doses of the Sinovac jab & 2mn Sputniks this month.

EQUITIES: Tech Sector Bears Brunt Of Selling

A mixed session with cash markets in Japan and mainland China closed for holidays. The Hang Seng has squeezed out some gains along with markets in Australia, while in Taiwan the Taiex is seeing its second day of heavy losses, and South Korean bourses also seeing selling. The tech sector is being hit particularly hard thanks to a sell off in the US yesterday. US futures are lower as the greenback gains, the Nasdaq bearing the brunt of the selling.

GOLD: $1,800/oz Still Holding

The combination of a softer DXY and lower U.S. real yields put a bid under bullion on Monday, although the DXY's bounce from Monday's lows and continued uptick in Asia-Pac hours has prevented bullion from challenging $1,800/oz overnight, pinning spot to the $1,790/oz area during Asia-Pac hours. A break through yesterday's high ($1,798/oz) and $1,800/oz would open the path to the Feb 25 high ($1,805.7/oz).

OIL: Crude Futures Hold Near Top Of Range

Oil is slightly higher on Tuesday; WTI last up $0.05 from settlement levels at $64.54, while Brent is up $0.05 at $67.61. Crude futures have moved in a narrow range so far during the session after rising into the US morning as the greenback weakened yesterday. Markets are hoping for improved demand on the back easing restrictions for travelers in Europe and several states in the US.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.