-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Eyeing The Next Twist

- Little movement in G10 FX & global core FI markets overnight.

- Geopolitical tensions surrounding Israel & Iran ease.

- Flash PMIs headline the broader docket on Friday.

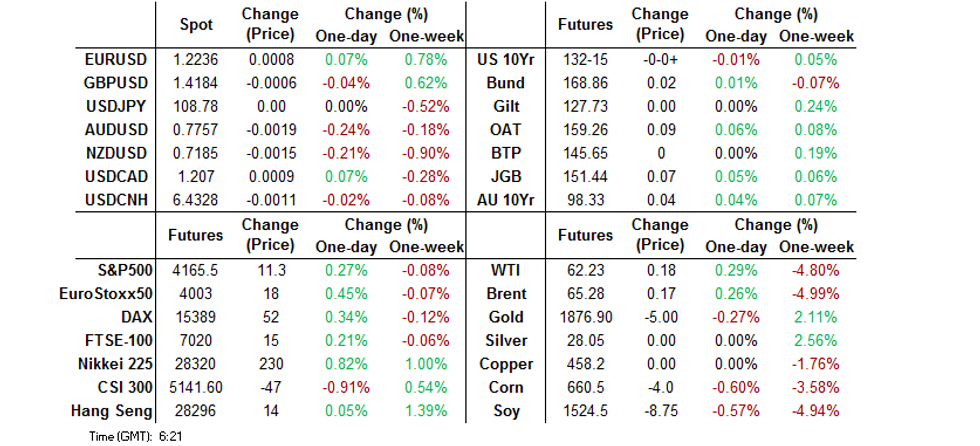

BOND SUMMARY: Core FI Little Changed To A Touch Firmer In Asia

T-Notes have stuck to a narrow 0-02+ range overnight, last -0-00+ at 132-15. The major Tsy benchmark yields are virtually unchanged across the cash curve. Headlines were light at best, although some block flow was observed, with the latter coming in the form of a TY/US flattener (-6.0K vs. +2.5K) and a 3,765 block buyer of TYM1 at 132-14+ European/UK flash PMI survey readings headline the broader economic docket ahead of NY hours on Friday, with existing home sales data due on the domestic slate. In terms of Fedspeak, we will hear from regional Fed Presidents Kaplan & Daly.

- The latest round of national Japanese CPI data was largely in line with exp., while some more details surrounding the impending state of emergency in Okinawa prefecture were given with speculation re: the extension of the state of emergency covering other regions of Japan still doing the rounds. The major cash benchmarks run little changed to ~1.0bp richer across the JGB curve, with the belly leading, while futures print +7 ticks vs. yesterday' settlement levels, operating within the confines of a narrow range. An average 20-Year JGB auction was witnessed, with the low price matching dealer expectations (per the BBG survey), tail widening and cover ratio nudging higher. Elsewhere, Indonesia priced Y100bn of Samurai paper. 40-Year JGB supply, the latest Tokyo CPI reading and the monthly labour market report headline next week's local docket.

- Some trans-Tasman impetus seemed to be at play in the Aussie bond space, with a rally in the NZGB space on the back of a well-received round of NZGB supply (building on early momentum stemming from light offer to covers in the latest round of RBNZ LSAP ops). These matters, coupled with short positioning, likely allowed the Aussie bond complex to firm. YM +2.0, XM +4.0 at typing, swaps lagging cash ACGBs, resulting in some swap spread widening across most of the curve. Today's ACGB Sep '26 supply was easily digested, with the weighted average yield printing 0.62bp through prevailing mids (per Yieldbroker pricing) as the cover ratio firmed vs. the prev. auction of the line (even when we account for the downtick in the notional on offer at today's auction). It would seem that the supportive factors we highlighted in our auction preview underscored demand. Domestic preliminary retail sales data for April was a touch firmer than exp. but didn't have any impact on the space. Q1 GDP partials, in the form of completed construction work and Private CapEx data, headline next week's local docket.

FOREX: Iron Ore Weakness Spills Over Into AUD

AUD retreated alongside iron ore futures, leading commodity-tied FX space lower, amid continued worry surrounding China's plans to reign in the recent surge in commodity prices. A beat in Australia's flash retail sales & the best M'fing PMI print on record failed to provide any support to the Aussie dollar. Commodity currencies have been the worst G10 performers this week.

- The PBOC set its central USD/CNY mid-point at CNY6.4300, 13 pips above sell-side estimates. Nonetheless, USD/CNH stuck to a tight range and last trades virtually unchanged.

- The greenback stabilised after yesterday's slide and the DXY wavered within a narrow range around Thursday's close.

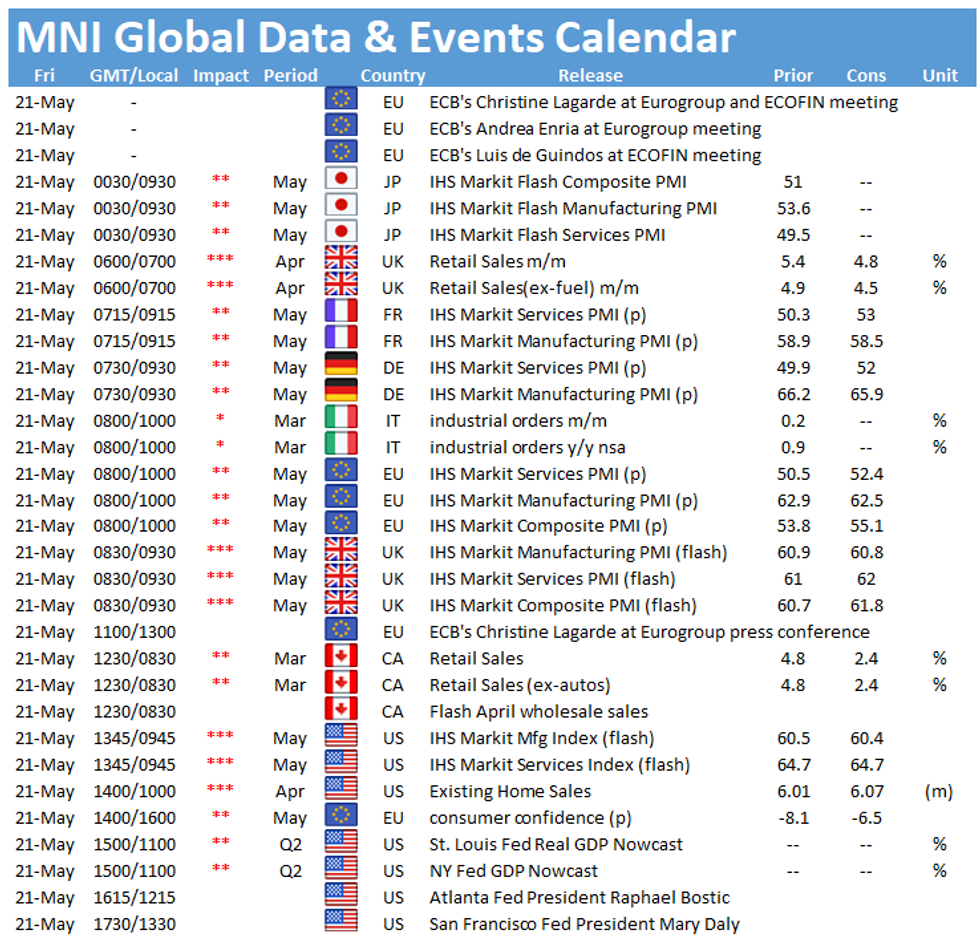

- Global flash PMI readings, UK & Canadian retail sales, U.S. existing home sales & EZ consumer confidence take focus from here. Speeches are due from Fed's Kaplan, Bostic, Barkin & Daly, ECB's Lagarde, BoE's Haused & Riksbank's Jansson.

FOREX OPTIONS: Expiries for May21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2080(E869mln), $1.2140-50(E1.0bln-EUR puts), $1.2160-70(E1.3bln-EUR puts), $1.2200(E1.0bln-EUR puts), $1.2225-50(E852mln-EUR puts)

- USD/JPY: Y108.45-60($1.1bln-USD puts), Y109.60-65($650mln-USD puts)

- GBP/USD: $1.4095-1.4100(Gbp477mln-Gbp puts), $1.4200-25(Gbp588mln-GBP puts)

- USD/CHF: Chf0.9000-20($648mln-USD puts)

- AUD/USD: $0.7690-0.7700(A$1.15bln-AUD puts), $0.7750-65(A$544mln-AUD puts)

- USD/CAD: C$1.2150-55($507mln-USD puts)

- USD/MXN: Mxn19.90($1.0bln-USD puts)

ASIA FX: Hugging Ranges

Most Asia EM FX sticking to narrow ranges amid broadly directionless trade and mixed risk sentiment.

- CNH: Offshore yuan is flat, the PBOC fixed USD/CNY at 6.4300, 13 pips above sell-side estimates. Elsewhere the PBOC will maintain the continuity and stability of its monetary policy to support the uneven recovery and manage external risks, said the Economic Daily in a commentary in an attempt to ease concerns of monetary tightening.

- SGD: Singapore dollar is flat, hugging a narrow range all session after testing support in US hours. Participants look ahead to CPI data on Monday and GDP data on Tuesday next week.

- TWD: Taiwan dollar is stronger, reversing a portion of yesterday's move. Taiwan lawmakers are expected to review a bill today to add a further TWD 210bn to help protect the economy from the pandemic after the latest developments

- KRW: The won is higher, the best performer in Asia. Data earlier showed PPI rose 5.6% Y/Y in April compared to the 3.9% rise in March, the April print denoted the biggest gain since 2011 and was attributed to higher commodity prices. Other data showed exports rose 53.3% in the first 20 days of May, compared to 45.4% in the April period. Imports rose 36.0%.

- MYR: Ringgit is stronger, PM Muhyiddin chairs a meeting today to discuss implementing a nationwide Movement Control Order (MCO), Bernama reported Thursday citing Law Min Takiyuddin. Meanwhile, Malaysia's fourth-largest city Ipoh was placed under a full lockdown for two weeks from Saturday.

- IDR: Rupiah is marginally stronger, data showed Indonesia's Q1 current account deficit widened more than expected to $1bn against an expected $0.73bn. Elsewhere Bank Indonesia intervened in FX spot & DNDF markets on Wednesday & Thursday and pledged to remain in the market to "smooth volatility".

- PHP: Peso is higher, BSP Gov Diokno said that the Philippines' piling debt should not affect sovereign credit ratings, as the nation's external debt-to-GDP ratio remains "well below" the threshold, which would put the central bank on alert. He added that the debt profile is balanced with regard to maturity, currency composition and creditor base.

- THB: Baht is flat, PM Prayuth will chair a meeting of the national Covid-19 task force today. The panel is expected to discuss extending Covid-19 state of emergency.

ASIA RATES: Indian Auctions In Focus After GSAP

South Korea futures higher alongside the earlier move in UST's even as exports continue to soar, market focus in India turns to today's auctions after a successful GSAP operation yesterday.

- INDIA: Yields lower in early trade. Bonds gained yesterday after the RBI conducted its second GSAP operation for INR 350bn, the market was reassured that the bank bought a decent chunk of total purchases in the 10-year sector, buying INR 83.5bn of the 5.85% 2030 issue at 5.9526%, the 10-year is seen as the anchor point for the yield curve. The operation also bodes well for today's auction, with cut off yields well below prevailing market level demand is expected to be boosted.

- SOUTH KOREA: Futures are higher, gapping up at the open following a similar move in UST's. Data earlier showed PPI rose 5.6% Y/Y in April compared to the 3.9% rise in March, the April print denoted the biggest gain since 2011 and was attributed to higher commodity prices. Other data showed exports rose 53.3% in the first 20 days of May, compared to 45.4% in the April period. On the coronavirus front South Korea will extend its current social distancing measures for another three weeks. "The number of new daily average patients as of late remains in the 500 level, not budging below that point, and infections are continuing from all quarters in our daily lives," Prime Minister Kim Boo-kyum said. South Korea reported 561 cases in the past 24 hours.

- CHINA: The PBOC matched maturities with injections today, the overnight repo rate down 9.8bps at 1.9812% while the seven day repo rate is up 10bps at 2.10% but off opening highs at 2.20%. Futures are higher as equity markets dip, the 10-year up around 11 ticks but a shade below yesterday's high of 98.425. Markets continue to digest comments from China's cabinet earlier this week that repeated warnings over commodity prices and attached inflation. The comments indicate the government will use administrative price caps and supply measures to curb commodity prices, rather than tightening monetary policy.

- INDONESIA: Yields lower across the curve with some flattening seen. Data showed Indonesia's Q1 current account deficit widened more than expected to $1bn against an expected $0.73bn. Indonesia's trade surplus unexpectedly swelled in April, yesterday's report showed. A larger than forecast jump in exports (and, indeed, the fastest increase in more than a decade) underpinned overall trade balance. Exports were boosted by buoyant commodity markets, with oil and gas, m'fing & mining exports seen as main contributors to the headline reading.

EQUITIES: Mixed Day In Asia; US Futures Build On Gains

A mixed day for equities in the Asia-Pac region. The Taiex is the top of the pile with gains of over 1%, but is off best levels. Taiwanese official has said that the chip industry will be protected if the US extends vaccine aid to Taiwan. Japan also higher, April core CPI fell less than expected at -0.1%, the headline Y/Y reading fell 0.4% against consensus for a 0.5% decline., while composite PMI dropped below 50 as both services and manufacturing softened. Markets in mainland China are lower, as is the Hang Seng. An overhaul of the Hang Seng is set to begin today after its quarterly review. In the US futures are higher, markets building on yesterday's gains.

GOLD: Where To Next?

Gold backed off a little in Asia-Pac hours, with spot trading ~$5/oz softer at typing, just above the $1,870/oz mark, well within the confines of the recent range. The technical backdrop hasn't changed since yesterday's update. U.S. real yields are a touch higher on net over the last 24 hours or so, while the DXY is softer over the same horizon.

OIL: Weekly Loss On The Cards

Oil is broadly flat in Asia-Pac trade, holding most of yesterday's losses. WTI is up $0.12 from settlement levels at $62.06/bbl, while Brent is down $0.02 at $65.09. For the week WTI is on track for declines of over 5%, the biggest drop since mid-March. Iran is readying a hike in its oil exports to "maximum capacity", approximately 2m bpd on top of current production, within months as talks with the US make progress. There is chatter a deal could be reached next week which could lead to sanctions lifted in around 3 months.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.