July 10, 2024 07:37 GMT

Contrasting Momentum Dynamics Underscore Need For July Data

NORWAY

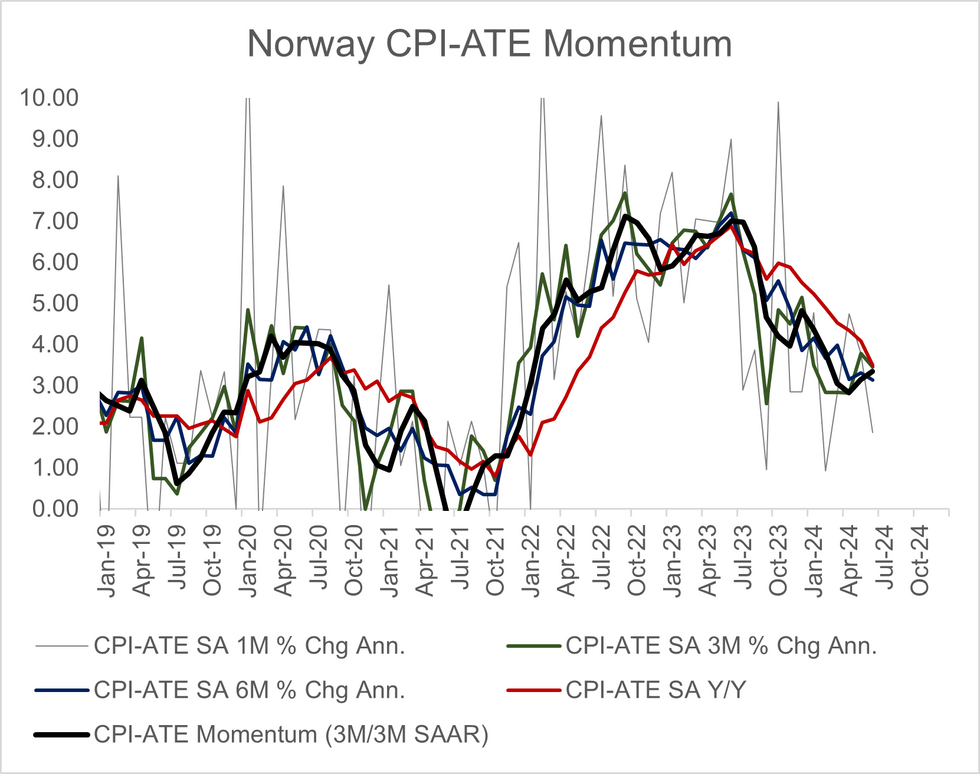

Norwegian underlying inflation momentum ticked up in June, though Norges Bank will have expected a larger increase given the below-consensus NSA reading.

- Measured as a 3m/3m SAAR using data from Statistics Norway, inflation momentum rose to 3.35% (vs 3.15% prior), up from a low of 2.84% in April.

- In contrast, annualised SA growth rates from 1-month, 3-month and 6-month changes ticked lower on the month (see chart).

- These contrasting dynamics underscore the need to assess the June inflation data alongside the July prints (due in August), in order to better gauge the trends in underlying inflation at the start of H2 2024.

- CPI-ATE inflation has trended below the Norges Bank’s forecasts ahead of every monetary policy meeting in 2024, but that has not stopped the bank from consistently delivering hawkish surprises, with high wage growth and an uncertain krone keeping the stance cautious.

153 words