-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ Provides Hawkish Surprise, PBoC Doesn't Prohibit USD/CNY Downtick

EXECUTIVE SUMMARY

- FED'S CLARIDA: FED MAY BE ABLE TO TALK TAPER IN UPCOMING MEETINGS (YAHOO)

- FED'S DALY: ECONOMY IS STRONG, BUT IT'S 'WAY TOO EARLY' TO TIGHTEN POLICY (CNBC)

- RBNZ RATE TRACK PROVIDES HAWKISH SURPRISE, POLICY ON HOLD

- USD/CNY BREAKS BELOW CNY6.4000

- XIAOMI SAYS U.S. COURT ISSUES FINAL ORDER ON BLACKLIST REMOVAL (BBG)

- SHANGHAI FUTURES EXCHANGE VOWS TO CURB UNREASONABLE PRICE MOVES (BBG)

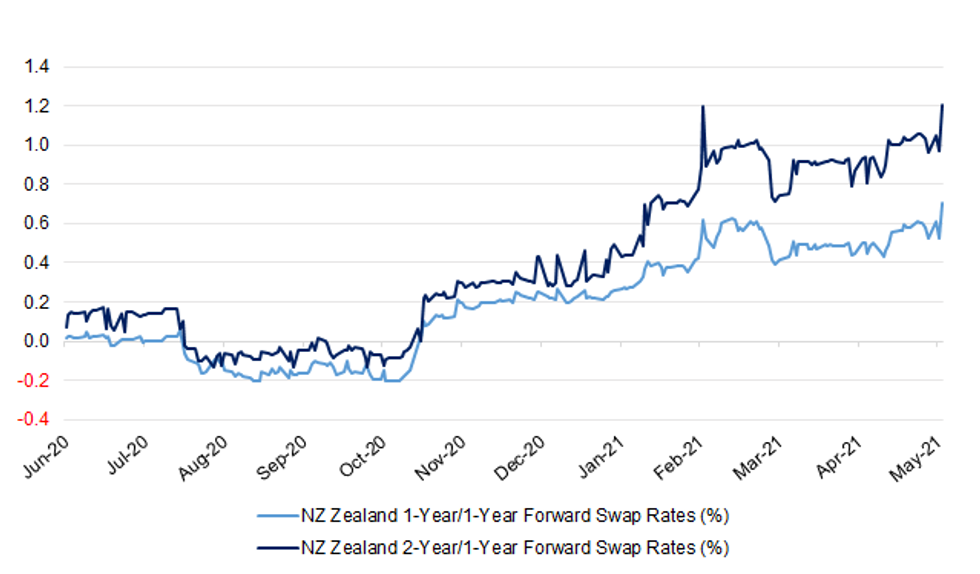

Fig. 1: NZ Zealand 1-Year/1-Year & 2-Year/1-Year Forward Swap Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Advice for eight areas in England worst-hit by the Indian coronavirus variant has been updated after the government clarified that it was not imposing local restrictions. There was confusion after guidance was published earlier covering Bolton, Blackburn, Kirklees, Bedford, Burnley, Leicester, Hounslow and North Tyneside. It had asked people not to meet indoors or travel unnecessarily. The updated advice asks people to minimise, rather than avoid, travel. A government spokesperson said it wanted to "make it clearer we are not imposing local restrictions" in areas where the new variant is spreading. (BBC)

CORONAVIRUS: Britain is heading for two "big" weeks of vaccination, boosting hopes that immunisation can stay ahead of the Indian variant and allow restrictions to end next month. Vaccination rates are approaching all-time highs and the coming weeks will bring record-breaking numbers as jabs are opened up today to everyone aged over 30. More than four million doses have been given in a week for the first time since March and ministers hope that the number will rise to more than 4.5 million, adding to optimism that restrictions can end as planned. Nadhim Zahawi, the vaccines minister, said that he was "cautiously optimistic that we are in a good place" to open up completely on June 21, with increasing evidence that two vaccine doses protect against B.1.617.2, the Indian variant. (The Times)

CORONAVIRUS/POLITICS: The prime minister's former aide, Dominic Cummings, will be questioned by MPs at a joint meeting of Parliament's health and science committees on Wednesday. Mr Cummings - who has been increasingly critical of the government in recent months - will be asked about ministers' handling of the pandemic. He says "secrecy" had "contributed greatly to the catastrophe". Downing Street says it is getting on with the "huge task" of recovery. The joint session of the health and social care and the science and technology select committees is part of an ongoing inquiry into "lessons learnt" about coronavirus. Mr Cummings - who gave evidence to one committee in March - will be grilled by MPs at 09:30 BST for around four hours. (BBC)

ECONOMY: Businesses are at their most confident about taking on more staff since 2016. A survey by the Recruitment & Employment Confederation has found that business confidence in making hiring and investment decisions rose by 15 percentage points between February and April to a net balance of 28 per cent. Employers' confidence in the economy also increased significantly to a net balance of -10 per cent, the highest level since August 2018. Neil Carberry, chief executive of the confederation, said: "Job creation is taking off. Currently recruiters are more likely to say their key challenge is candidate shortages in sectors like IT and driving, rather than the effects of the Covid recession." (The Times)

BOE: MNI BRIEF: BOE Tenreyro: Financial Conditions To Stay Loose

- Bank of England Monetary Policy Committee member Silvana Tenreyro downplayed the likelihood of any swift tightening led by the US Federal Reserve in response to higher inflation and said that she expected financial conditions to remain loose. Speaking at an Oxford Latin American Society event Tenreyro said that she shared the Fed's perception that increases in inflation will be "temporary, mostly driven by ... energy prices and base effects" and that policymakers would look through them. "For now I expect financial conditions to remain accommodative," she said, adding that when any rate hikes did come they would only be "mild" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PROPERTY: The total value of homes sold in the UK is expected to reach £461bn this year, a jump of 46% on 2020, indicating the current housing market boom is likely to continue, according to a new prediction. The property website Zoopla said its projections indicated the property market in 2021 was on course to be the busiest for 14 years. Its figures come on the back of data showing that the sector has defied expectations over the past year to notch up double-digit price growth. (Guardian)

MARKETS: Chancellor Rishi Sunak is to set out plans to block companies from listing on the London Stock Exchange on national security grounds as government concerns mount about "dirty money" in British financial markets. Sunak will launch a consultation within the next fortnight setting out proposals for a tougher regime governing flotations on the LSE, the Treasury said. Decisions over the eligibility of companies to list in London are currently made by the UK Listing Authority, part of the Financial Conduct Authority. (FT)

EUROPE

CORONAVIRUS: The European Union will ask judges to order AstraZeneca Plc to supply millions more vaccine doses to the 27-nation bloc in the latest round of a bitter legal dispute. A Belgian court will weigh EU claims that there's an emergency situation that merits an order for the drug maker to deliver the shots. The same court will examine later this year whether AstraZeneca violated the terms of its contract. "Given the urgent need of vaccine doses to continue the vaccination in the member states, the European Commission asked the court to require the company to deliver a sufficient number of doses," Stefan De Keersmaecker, a spokesman for the EU's executive arm, said by email. (BBG)

FISCAL: MNI: EU To Signal Return Of Debt Rules After Fresh Suspension

- The European Commission will officially confirm next week the extension of the escape clause from the Stability and Growth Pact until the end of 2022, but stronger data and forecasts as the economy recovers from Covid may prompt it to stress that the European Union's rules on public debt and deficits will eventually have to return, officials told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ITALY/BTPS: Italy plans to sell up to 3 billion euros ($3.7 billion) of 0 percent bonds due Apr 1, 2026 in an auction on May 28. Italy plans to sell up to 3.5 billion euros ($4.3 billion) of 0.6 percent bonds due Aug 1, 2031 in an auction on May 28. Italy plans to sell up to 2 billion euros ($2.4 billion) of floating bonds due Apr 15, 2026 in an auction on May 28. (BBG)

PORTUGAL: Portugal aims to administer at least one Covid-19 vaccine dose to 70% of the adult population by Aug. 8, Prime Minister Antonio Costa tells reporters in Brussels. (BBG)

GREECE/RATINGS: Greece's stable credit profile balances the growth accelerating reforms implemented by the government over the past few years and its high public debt, which remains the key challenge to the country's creditworthiness, Moody's Investors Service said in a report published today. The country's credit profile reflects its relatively high wealth levels, set against the economy's moderate size and equally moderate economic diversification. The current government has improved Greece's institutions and governance in several areas. Thus, the country benefits from a favourable debt structure, a substantial cash buffer and strong debt affordability. "Greece's rating would come under upward pressure if further progress on structural reforms yielded tangible results in the form of stronger investment and further lifted and solidified medium-term growth prospects," says Steffen Dyck, a VP - Senior Credit Officer at Moody's and the author of the report. "Conversely, the rating would come under downward pressure if progress in reforming Greece's institutions were to be reversed, putting at risk the agreement with the euro area creditors." The coronavirus pandemic interrupted Greece's economic recovery and led to a sharp contraction in 2020, but substantial EU funds will be vital to bolstering investment and growth in the coming years. However, Greece's credit profile's main challenge remains its elevated debt burden, which was 205.6% of GDP in 2020 and is the second-highest among Moody's rated sovereigns. (Moody's)

SNB: Swiss National Bank Chairman Thomas Jordan sees no reason to change the bank's ultra-loose monetary policy, he said in a TV interview, describing the central bank's use of the world's lowest interest rates as "absolutely necessary." "We really don't have any reason right now to change monetary policy," he told TeleZurich's TalkTaeglich program. "Our monetary policy is appropriate because we still have very low inflation, the franc is very strong and that tends to put pressure on inflation," Jordan said in the interview to be broadcast on Tuesday. (RTRS)

U.S.

FED: U.S. central bank officials may be able to begin discussing the appropriate timing of scaling back their bond-buying program at upcoming policy meetings, Federal Reserve Vice Chair Richard Clarida said. "It may well be" that "in upcoming meetings, we'll be at the point where we can begin discuss scaling back the pace of asset purchases," Clarida said Tuesday in a Yahoo! Finance interview. "I think it's going to depend on the flow of data that we get." (BBG)

FED: While she's encouraged by the economic progress, San Francisco Federal Reserve President Mary Daly told CNBC on Tuesday that it's still not time to change policy. "We haven't seen substantial further progress just yet. We're still looking for substantial further progress," Daly said during a live "Closing Bell" interview. "What we've seen is some really bright spots, some very encouraging news. It gives me hope, and I am bullish for the future. But it's too early to say that the job is done." Fed officials have used "substantial further progress" as a benchmark for when they'll start considering first reducing the pace of their monthly asset purchases then, ultimately, raising interest rates. (CNBC)

FED: With only months left on their current terms, Federal Reserve vice chairs Randal Quarles and Richard Clarida were reminded on Tuesday that their time in office may be drawing short. Quarles's tenure as the Fed's top banking supervisor expires Oct. 13 while Clarida's term ends Jan. 31, a few weeks before Chair Jerome Powell's own tenure at the helm is up. President Joe Biden, who can reshape the leadership of the U.S. central bank if he wants by replacing any of them, is under explicit pressure from some Democrats to dump Quarles. Senator Elizabeth Warren, during a tart exchange over banking oversight, pointed out to Quarles that his term as vice chair for supervision was up in five months. "Our financial system will be safer when you are gone," she told a hearing before the Senate Banking Committee. "I urge President Biden to fill your role with someone who'll actually keep our financial system safe." Quarles is also serving a term as a Fed governor that doesn't expire until 2032, but Fed officials step down by tradition if not reappointed to their leadership roles.

FISCAL: A group of Senate Republicans plans to send President Joe Biden an infrastructure counteroffer this week as the sides consider whether they can bridge an ideological gulf to craft a bipartisan bill. The proposal could cost nearly $1 trillion, and Republicans aim to offset the spending without increasing taxes. The group of GOP lawmakers aims to deliver the plan as soon as Thursday morning. (CNBC)

FISCAL: A small bipartisan group of senators is privately sketching out the contours of a new infrastructure package — and fresh ways to pay for it — that the lawmakers hope to sell to colleagues after negotiations between Republican senators and the White House stalled in recent days. The nascent plan is being drafted by more than a half-dozen lawmakers, including Republican Sens. Mitt Romney (Utah), Susan Collins (Maine) and Rob Portman (Ohio) and Sen. Joe Manchin III (D-W.Va.). On Tuesday, Romney said the group, which is divided equally between Democrats and Republicans, has come to a "pretty close consensus" on key elements of a blueprint that focuses largely on traditional infrastructure, such as roads, bridges, trains and broadband Internet. (Washington Post)

CORONAVIRUS: The rebound in U.S. travel is gaining steam, according to the country's three biggest airlines. The pace of the recovery has been faster than expected, Delta Air Lines Inc. President Glen Hauenstein said Tuesday. United Airlines Holdings Inc. predicted it would turn a profit before certain items next quarter, while American Airlines Group Inc. said corporate trips and long overseas flights -- the worst-hit segments during the pandemic -- are poised for improvement. (BBG)

POLITICS: Manhattan's district attorney has convened the grand jury that is expected to decide whether to indict former president Donald Trump, other executives at his company or the business itself should prosecutors present the panel with criminal charges, according to two people familiar with the development. (Washington Post)

PROPERTY: The Biden administration is monitoring rising U.S. home prices, which it is concerned are increasingly making housing unaffordable, a White House spokeswoman said on Tuesday. "The increase in housing prices we've seen does raise concerns for us about housing affordability and access to the housing market," White House press secretary Jen Psaki told reporters. "We recognize there is a need for new housing supply, particularly on the affordable end of the market." (RTRS)

OTHER

GLOBAL TRADE: China should overcome U.S. trade barriers on semiconductors by opening up its market and avoid working "alone behind closed doors," the China Daily said commenting on South Korea's announcement to invest USD39.4 billion in the U.S. as well as Japan and other major economies' stated investments as the global shortage has disrupted supply chains. The U.S. administration is trying to move Asia's assembling and testing capacity to the U.S. soil, and relocate factories away from China to shovel China out of the global semiconductor industry, said the official English-language newspaper. It is absolutely necessary for China to stress its independence in semiconductors and core technologies, while using its strengths as the supplier of final products to try to overcome U.S. trade barriers, the daily said. (MNI)

GLOBAL TRADE: Commerce Secretary Gina Raimondo on Tuesday expressed confidence around the Biden administration's efforts to increase semiconductor manufacturing in the U.S. In an interview on CNBC's "Mad Money," Raimondo said the global chip shortage that's rattled a range of industries demonstrates the need for America to boost domestic production capacity and once again become a leader. Asian countries, particularly Taiwan, have come to dominate the industry. "We are going to get it done. There's no option," Raimondo told host Jim Cramer. "When the semiconductor supply chain is disrupted, the economy is disrupted." (CNBC)

GLOBAL TRADE: European governments are increasingly confident a deal will soon be struck with the U.S. on a minimum global corporate tax and related measures to make multinationals pay more to the coffers of the countries they operate in, according to people familiar with the matter. President Joe Biden's administration last week floated a global minimum tax of at least 15%, less than the 21% rate it has proposed for the overseas earnings of U.S. businesses -- a level that countries including the U.K. regarded as too high. While European nations warmly received that offer, they've also been pushing the U.S. to focus on measures to ensure multinationals -- especially big technology firms such as Amazon.com Inc. and Facebook Inc. -- pay more of their tax in the countries where they operate. U.S. officials have opposed any efforts to target specific industries for taxation, such as tech. (BBG)

GLOBAL TRADE: Ireland has "significant reservations" over a plan by US President Joe Biden for a global minimum corporate tax of at least 15 percent, Dublin's finance minister Paschal Donohoe told Sky News on Tuesday. "We do have really significant reservations regarding a global minimum effective tax rate status at such a level that it means only certain countries, and certain size economies can benefit from that base -- we have a really significant concern about that," Donohoe said. According to Sky News, Donohoe said that Ireland intends to hold its corporate tax rate at 12.5 percent for a few more years. (AFP)

GLOBAL TRADE: Japan's Ministry of Economy, Trade and Industry is considering brokering a venture between Sony and TSMC for a chip plant in the nation's Kumamoto prefecture, Nikkan Kogyo reports, citing an unidentified government official. (BBG)

U.S./CHINA: The U.S. District Court for the District of Columbia issued a order vacating the U.S. Department of Defense's designation of Xiaomi as a Communist Chinese Military company, Xiaomi says in an exchange filing. The court formally lifted all restrictions on U.S. persons' ability to purchase or hold Xiaomi's securities. The order was issued at 4:09pm U.S. Eastern Standard Time on May 25. (BBG)

U.S./CHINA: Majority Leader Chuck Schumer says the Senate's China competition bill is bipartisan, and he's confident it will pass this week. (BBG)

U.S/CHINA/CORONAVIRUS: White House officials told reporters Tuesday that China hasn't been "completely transparent" in the global investigation into the origins of Covid-19, and that a full investigation is needed to determine whether the virus that's killed almost 3.5 million people came from nature or a lab. "We need to get to the bottom of this, whatever the answer may be," White House senior Covid-19 advisor Andy Slavitt told reporters at a Covid briefing Tuesday. "We need a completely transparent process from China, we need the [World Health Organization] to assist in that matter and we don't feel like we have that now." (CNBC)

GEOPOLITICS: President Joe Biden said on Tuesday that U.S. sanctions against Belarus are in play, but declined to offer more details. Biden made the remark to reporters as he was leaving the White House en route to his home state of Delaware amid international outrage over Belarus' forcing down of a jetliner and arrest of a dissident journalist on board. "Well, that's in play. I don't want to speculate until we get it done," Biden said when asked what the United States was considering in terms of a sanctions response. (RTRS)

HONG KONG: Hong Kong's opposition-free legislature is expected to approve sweeping changes to the city's electoral system ordered by the Chinese leadership, dramatically curtailing the ability of dissenting voices to participate in government. The amendments poised to be approved on Wednesday by the Legislative Council would create a review committee to vet candidates for elected office to ensure they are patriotic to China. All candidates must also be approved by national security officials in the Hong Kong police force to determine whether they can be trusted to uphold local laws. The bill's passage will mark the culmination of Beijing's efforts to take control of how the former British colony chooses its leaders, and give China the ability to veto any candidate for office following historic and sometimes violent unrest in 2019. (BBG)

JAPAN: Japan preparing to extend virus emergency to June 20. (TV Asahi)

JAPAN: The Tokyo Metropolitan Government is considering asking the central government to extend a coronavirus state of emergency in the capital that's due to expire May 31, public broadcaster NHK reports, without attribution. The number of cases is on the decline but officials are concerned about a resurgence if the emergency is lifted too soon. (BBG)

JAPAN: Japan's Asahi Shimbun, an official partner of the Tokyo 2020 Olympics, called for the Summer Games to be cancelled in an editorial on Wednesday, citing risks to public safety and strains on the medical system from the COVID-19 pandemic. (RTRS)

JAPAN: Japan is likely to proceed with the Tokyo Olympic Games as planned this summer even if there are no spectators, senior ruling party official Kozo Yamamoto said on Wednesday. "Japan will hold the Games," Yamamoto, who is close to former Prime Minister Shinzo Abe, told Reuters in an interview. "Holding the Games as scheduled is good for the economy." Yamamoto, who heads the Liberal Democratic Party's (LDP) financial research committee, also said the government should compile an extra budget worth around 26 trillion yen ($239 billion) in October or November to cushion the economic blow from the COVID-19 pandemic. (RTRS)

JAPAN: JSDA to relax rules on investment into unlisted stocks. (Nikkei)

BOJ: MNI INSIGHT: BOJ Kuroda To Resist Four Reflationists On Easing

- With just four reflation-minded members on the Bank of Japan's nine-strong board, Governor Haruhiko Kuroda will be able to resist any pressure for additional policy easing and stick to his view, which is to act only in the event of a considerable economic shock, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI BRIEF: BOJ Suzuki Warns of Bigger Downside Risks

- Bank of Japan board member Hitoshi Suzuki has warned of bigger downside risks to the economy and prices amid high uncertainties over the pace of the vaccine rollout and its effectiveness - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI BRIEF: BOJ Suzuki: Must Assess Policy Side-Effects

- Bank of Japan board member Hitoshi Suzuki says the BOJ must minutely assess not only the positive effects of monetary easing but also its side effects - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Victoria has recorded another six local COVID-19 cases, bringing the cluster in Melbourne's north to 15. The Department of Health had reported 10 new local cases in the 24 hours to midnight, and Acting Premier James Merlino revealed another case had been identifed this morning. Mr Merlino said all of the new cases were close contacts of the cases that have already been identified as part of the City of Whittlesea cluster. "It's good that everyone is linked at this stage, but we are concerned about the number and also about the kind of exposure sites and the next 24 hours are going to be critical," he said. Mr Merlino said he could not rule out further restrictions in response to the outbreak. (ABC)

AUSTRALIA/NEW ZEALAND: New Zealand Ministry of Health comments in emailed statement. Says officials remain in close contact with their counterparts in Victoria over the Covid-19 outbreak in Melbourne. "Given the length of time between the first case in Melbourne on 11 May and the most recent cases, now numbering 15 in this cluster, it is possible that people from the Whittlesea local government area in Melbourne may have been exposed to the virus and may now be in New Zealand." (BBG)

RBNZ: MNI BRIEF: No Rate Cuts at RBNZ, QE Unchanged

- The Reserve Bank of New Zealand kept its Official Cash Rate unchanged at the record low 0.25% and agreed to continue its NZD100 billion bond buying program at today's meeting of the Monetary Policy Committee. The RBNZ said that while the economic outlook continued to improve, "current stimulatory monetary policy settings" needed to continue until key targets were met around full employment and with inflation - currently running at 1.5% - sustainably near 2% - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBNZ: The decision around whether the Reserve Bank (RBNZ) will be given additional tools to restrict mortgage lending now rests with Finance Minister Grant Robertson. The RBNZ confirms it has advised Robertson on new measures, like debt-to-income (DTI) restrictions, that could be used to regulate mortgage lending. It intends to publish this analysis once Robertson responds to it. However, Robertson says a timeframe around the matter hasn't been decided upon yet. Robertson's office confirmed an announcement definitely wouldn't be made this week, as Robertson is visiting different parts of the country to talk about the Budget. Asked whether she could provide any initial thoughts on the RBNZ's analysis, Prime Minister Jacinda Ardern on Monday gave interest.co.nz a blunt answer: "No." (Interest NZ)

NEW ZEALAND: RBNZ published new residential mortgage lending data for April on website. Lending to all borrowers falls 19% m/m to NZ$8.5b from record NZ$10.5b in March. Lending to first home buyers drops by ~NZ$200m. Lending to owner occupiers falls by NZ$1.11b. Lending to investors drops by ~NZ$650m. Lending to all borrowers at LVR of more than 80% falls to NZ$718m of which NZ$566m is to first home buyers. (BBG)

NEW ZEALAND: Fonterra forecast a higher milk price to farmers for next season, underpinned by an improving global economy, and strong demand for dairy relative to supply. The co-operative announced an opening forecast for the 2021/22 season of between $7.25 per kilogram of milk solids to $8.75 per kgMS, with a mid-point of $8 per kgMS. That would see the co-operative contributing more than $12 billion to the economy next season. Whole milk powder prices on the global dairy trade platform are 54 per cent higher than a year ago and analysts say they are likely to stay elevated as farmers are constrained from increasing supply by environmental factors and high feed prices. Demand for dairy products is being driven by China, where a wealthier population and an increased focus on health and wellbeing after the Covid-19 pandemic is stoking demand for better nutrition. (Stuff NZ)

USMCA: The Biden administration on Tuesday escalated a simmering trade dispute with Canada over dairy import quotas, requesting that the first dispute settlement panel under the U.S.-Mexico-Canada Agreement be formed to review the matter. (RTRS)

MEXICO: Mexican Deputy Finance Minister Gabriel Yorio said in an interview posted online by the finance ministry on Tuesday that upcoming midterm elections in Mexico may cause "noise" but the peso exchange rate was expected to remain stable in the range of 19.9 to 20.1 to the dollar. On June 6, Mexicans will elect 500 lawmakers, 15 governors and more than 20,000 local officials. (RTRS)

MEXICO: The Federal Aviation Administration on Tuesday said it has downgraded its air safety rating for Mexico, prohibiting that country's carriers from adding service to the U.S. The decision is a new headache for both U.S. and Mexican carriers that have been operating from the U.S. to Mexico, popular routes during the coronavirus pandemic as Mexico didn't issue travel restrictions like many other countries did. (CNBC)

BRAZIL: Brazil's economic reforms can give the current government a chance to win the upcoming presidential elections in 2022, Economy Minister Paulo Guedes said at an online event organized by BTG Pactual. "Who knows, we might speed up privatizations and end up reducing our social inequalities," he added. Brazil's tax reform will be a simple and doable one, Guedes said, noting that raising taxes is not the goal. Govt will not drive the country's debt-to GDP ratio to 100% and there will be no lack of funding for Covid-19 vaccines. "We have a dual commitment, with our health but also with future generations." (BBG)

BRAZIL: The heads of Brazil's lower house and senate agreed on a strategy to speed up the approval of a long-delayed overhaul of the country's tax code, a cornerstone of Economy Minister Paulo Guedes's market-friendly agenda. The lower house will start voting next week on proposals to change the income tax and to merge two federal levies on consumption, the so-called PIS and Cofins, into a 12% valued- added tax, Speaker Arthur Lira said on Tuesday. At the same time, the senate will begin discussing a new debt renegotiation program to help companies amid the pandemic, he added. "Unity is necessary to approve reforms in Brazil," Lira said during an event organized by BTG Pactual, criticizing an ongoing probe into the federal government's handling of the virus carried out by the senate. "The probe at this moment, during the pandemic, is a waste of time." (BBG)

RUSSIA: President Joe Biden will meet with Russian President Vladimir Putin in Geneva, Switzerland, on June 16, the White House said Tuesday, in their first face-to-face encounter since Biden took office. "The leaders will discuss the full range of pressing issues, as we seek to restore predictability and stability to the U.S.-Russia relationship," White House press secretary Jen Psaki said of Biden's goals for the summit. The Kremlin also confirmed the date for the much-anticipated meeting. On the heels of the announcement, Psaki confirmed there were no preconditions. (ABC)

RUSSIA: President Joe Biden says he backed off from new U.S. sanctions against the Nord Stream 2 pipeline project because it's nearly completed, and the move would have hurt relations with Europe. "It's almost completely finished," Biden told reporters on Tuesday as he left the White House for a funeral in Wilmington, Delaware. "To go ahead and impose sanctions now, I think is counter-productive in terms of our European relations." The Biden administration said last week that Nord Stream 2 and its chief executive Matthia Warnig are engaged in sanctionable activity under U.S. law but that it would waive the penalties for national security reasons. German Chancellor Angela Merkel has applauded the decision and said she'll discuss the project with Biden at the G-7 summit in the U.K. next month. (BBG)

RUSSIA: The unemployment rate in Russia in April fell to 5.2% from 5.4% in March, the Russian Federal State Statistics Service (Rosstat) said on Tuesday. "The unemployment rate (the ratio of the number of unemployed to the number of labor force) in April 2021 amounted to 5.2%," the Federal State Statistics Service said. According to the agency, in April, the total number of unemployed in Russia amounted to 3.9 million people. (TASS)

COMMODITIES: Shanghai Futures Exchange will target abnormal trading and "malicious speculation" in oversight and curb "unreasonable" price fluctuations, exchange chairman Jiang Yan says at a forum in Shanghai. Crude oil options trading will start on June 21, Jiang says. (BBG)

COMMODITIES: China must strictly curb hoarding commodities or speculating in futures while boosting supply to tame surging prices of industrial commodities such as iron ore and coal, said the 21st Century Business Herald in an editorial. Ensuring sufficient coal supply is critical to avoiding power outages as consumption peaks in the summer, the newspaper said. China should also maintain a safety margin with thermal or nuclear power amid its push for carbon neutrality, it said. Green energy supply, easily affected by weather, can be unstable and used by speculators, which can trigger inflation expectation, the newspaper said. (MNI)

COPPER: Workers at BHP Group's remote operations center in top copper producer Chile rejected the company's latest wage offer and will begin a strike on Wednesday, according to a union leader. Members voted against the proposal after government-mediated talks ended on Tuesday, Union President Jessica Orellana said in text messages. The strike is scheduled to begin at 8 a.m. local time. About 200 BHP Chile employees provide control services to the giant Escondida and Spence copper mines from a center set up two years ago in Santiago, several hundred miles away. BHP may be able to continue production during a stoppage at the center, although not at full capacity, Orellana said. (BBG)

OIL: The Biden administration is working with pipeline companies to strengthen protections against cyberattacks following the Colonial Pipeline hack and will announce actions in coming days, the Department of Homeland Security (DHS) said on Tuesday. (RTRS)

CHINA

YUAN: Analysts expect yuan to rise further against the U.S. dollar in the short term, citing weakness of the greenback, domestic economic recovery, trade surplus and capital inflow, China Securities Journal says in a front-page report. The yuan breached 6.4 per dollar level Tuesday due to a sharp drop in the dollar index and strong performance of China's stock market, Wang Youxin, senior analyst at a research institute of Bank of China. But conditions for the Chinese currency's two-way fluctuation remain unchanged. (BBG)

YUAN: The yuan may gain past 6.2 on the U.S. dollar in the current round of rally supported by the weakening dollar index and strong domestic economic recovery, the Shanghai Securities News reported citing analysts. The Chinese currency may however continue to fluctuate given the increased internationalization and China's opening up of its financial markets, the newspaper said citing Ming Ming, the deputy research director at CITIC Securities. The yuan may fluctuate between 6.3 to 6.7 against the dollar in 2021, the newspaper said citing Tang Jianwei, chief researcher of Bank of Communications. The onshore yuan rose by nearly 200 basis points against the dollar on Monday, hitting an intraday high of 6.4016, near the strongest in three years. (MNI)

OVERNIGHT DATA

JAPAN APR PPI SERVICES +1.0% Y/Y; MEDIAN +0.9%; MAR +0.7%

JAPAN APR SUPERMARKET SALES +6.0% Y/Y; MAR +1.3%

JAPAN MAR, F LEADING INDEX 102.5; FLASH 103.2

JAPAN MAR, F COINCIDENT INDEX 93.0; FLASH 93.1

AUSTRALIA Q1 CONSTRUCTION WORK DONE +2.4% Q/Q; MEDIAN +2.0%; Q4 -1.5%

AUSTRALIA APR WESTPAC LEADING INDEX +0.20% M/M; MAR +0.45%

The Leading Index growth rate continues to point to strong above trend growth momentum carrying through the second half of 2021 and into early 2022. While the pace of gains has moderated, this is coming from an extremely strong starting point after the Index growth rate hit record highs late last year. April's read may be down on those peaks, but it is still above all other growth rates recorded since the early 1980s. The signal is consistent with Westpac's growth forecasts for the Australian economy: we expect GDP to post a very strong 4.5% gain in 2021, growth moderating only marginally to a 4% pace in the first half of 2022. The moderation mainly reflects the cycling of a very strong initial bounce coming out of last year's COVID lockdowns. With initial reopening rebounds now largely complete, other drivers are set to take over with upbeat, cashed-up households and booming housing markets setting what will still be a strong pace for growth. That shift is evident in the Leading Index component detail. (Westpac)

NEW ZEALAND APR TRADE BALANCE +NZ$388MN; MAR +NZ$39MN

NEW ZEALAND APR TRADE BALANCE 12 MTH YTD +NZ$733MN; MAR +NZ$1.696BN

NEW ZEALAND APR EXPORTS NZ$5.37BN; MAR NZ$5.69BN

NEW ZEALAND APR IMPORTS NZ$4.98BN; MAR NZ$5.66BN

SOUTH KOREA JUN BUSINESS SURVEY M'FING 97; MAY 98

SOUTH KOREA JUN BUSINESS SURVEY NON-M'FING 81; MAY 82

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2336% at 09:24 am local time from the close of 2.2575% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 38 on Tuesday vs 53 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4099 WEDS VS 6.4283

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.4099 on Wednesday, compared with the 6.4283 set on Tuesday.

MARKETS

SNAPSHOT: RBNZ Provides Hawkish Surprise, PBoC Doesn't Prohibit USD/CNY Downtick

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 96.74 points at 28650.14

- ASX 200 down 5.586 points at 7109.6

- Shanghai Comp. up 13.279 points at 3594.191

- JGB 10-Yr future up 3 ticks at 151.53, yield down 0.3bp at 0.075%

- Aussie 10-Yr future unch. at 98.375, yield down 0.4bp at 1.682%

- U.S. 10-Yr future -0-03+ at 132-27+, yield up 1.69bp at 1.576%

- WTI crude down $0.04 at $66.03, Gold up $6.78 at $1905.99

- USD/JPY unch. at Y108.78

- FED'S CLARIDA: FED MAY BE ABLE TO TALK TAPER IN UPCOMING MEETINGS (YAHOO)

- FED'S DALY: ECONOMY IS STRONG, BUT IT'S 'WAY TOO EARLY' TO TIGHTEN POLICY (CNBC)

- RBNZ RATE TRACK PROVIDES HAWKISH SURPRISE, POLICY ON HOLD

- USD/CNY BREAKS BELOW CNY6.4000

- XIAOMI SAYS U.S. COURT ISSUES FINAL ORDER ON BLACKLIST REMOVAL (BBG)

- SHANGHAI FUTURES EXCHANGE VOWS TO CURB UNREASONABLE PRICE MOVES (BBG)

BOND SUMMARY: RBNZ Applies Some Pressure To Core FI Markets

T-Notes traded a touch cheaper during Asia-Pac trade, although there was a lack of notable news flow outside of the hawkish surprise provided by the OCR track that accompanied the RBNZ monetary policy decision. T-Notes last -0-02+ at 132-28+, while cash Tsys saw some modest bear steepening as 20s provided the weak point on the curve, cheapening by ~1.5bp as of typing. T-Note volume hovers around 280K, although ~175K of that has come via the roll, with the latest estimates pointing to ~65% of the TY roll being completed at present. Overnight flow was headlined by a 5.0K block sale of the TYN1 132.50 calls.

- JGB futures last +3, sticking to a tight range during Tokyo hours, but backing off from best levels given the pressure seen elsewhere in the core global FI complex. The major cash JGB benchmarks trade little changed to 1.0bp richer on the day at typing, off best levels. Speculation re: the elongation of the states of emergency in play in Tokyo/wider afield continue to do the rounds. Re: the Olympics, Asahi Shimbun, an official partner of the Tokyo games, called for the cancellation of the event, although ruling party lawmaker Yamamoto told RTRS that Japan will hold the games and the event will be "good for the economy." Yamamoto also noted that the government is expected to compile an extra budget in October/November, with the aim of cushioning the economic blow from the COVID-19 pandemic.

- Aussie bond futures trickled lower in the wake of the latest RBNZ monetary policy decision across the Tasman, with the previously outlined hawkish inferences from the contents of the resumed publication of the RBNZ's OCR track and tweaks to its forward guidance weighing on NZGBs, creating some trans-Tasman spill over. Still, cash ACGBs comfortably outperform their NZ equivalents on the day. YM -1.0, XM +1.0 last, with the wider cash curve seeing a similar degree of twist flattening, although operating off of early session flats. Local data (in the form of stronger than expected completed construction work data for Q1 & another uptick in the Westpac leading index) did little for the space.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May '32 Bond, issue #TB158

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:- Average Yield: 1.6838% (prev. 1.7834%)

- High Yield: 1.6850% (prev. 1.7850%)

- Bid/Cover: 3.6600x (prev. 4.2167x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 54.7% (prev. 76.5%)

- bidders 36 (prev. 47), successful 13 (prev. 20), allocated in full 6 (prev. 11)

EQUITIES: Mixed

Mixed performance in Asia with markets oscillating between minor positive and minor negative territory. Mainland China is higher after a robust rally yesterday, Tuesday saw Chinese mainland equities benefit from record daily net inflows via the northbound legs of the Hong Kong-China Stock Connect schemes, totalling a net CNY21.7233bn. In Japan the Nikkei is around 0.2% higher, while the TOPIX is slightly lower, the NHK has suggested that the Tokyo Metropolitan Government is considering asking the central government to extend a coronavirus state of emergency in the capital that's due to expire May 31. In South Korea markets are mixed with the KOSPI marginally lower as coronavirus cases rise above 700. Several markets in Asia are closed for public holiday's; Singapore, Indonesia, Thailand, Malaysia and India are all closed today. US futures are higher after dropping yesterday with the Nasdaq outperforming.

OIL: Crude Futures Under Pressure

Oil is lower in Asia on Wednesday but still inside yesterday's range after a flat finish on Tuesday; WTI is down $0.21 from settlement levels at $65.86/bbl, Brent is down $0.17 at $68.48/bbl. Data late yesterday from API showed headline US crude stocks fell by 439k bbls, while gasoline stocks fell 2m bbls, and crude stocks at Cushing fell 1.2m bbls. Talks between Iran and world powers continue in Vienna, E.A. Gibson Shipbrokers estimate Iran could have up to 69m bbls of crude in tankers at sea. Elsewhere Nigeria signed a deal for investment in an offshore oil field with Shell, Exxon, Total and Eni for a production sharing contract which could take capacity at the field to around 350k bpd from 200k bpd currently.

GOLD: $1,900/oz Breached, RSI Eyed

Tuesday's move lower in U.S. real yields and the latest leg of weakness for the USD (as measured by the broad DXY index) coupled to propel spot gold above $1,900/oz for the first time since early January (although the move was not sustained on a closing basis), with further gains lodged during Asia-Pac hours. Spot currently sits just above $1,905/oz, with bulls now eying resistance in the form of the Jan 8 high, which is located at $1,917.6/oz, although the RSI is starting to show worrying signals, topping 75 for the first time August (a swing in the measure back below 70 will trigger a technical sell signal for some).

FOREX: Hawkish RBNZ Sends Kiwi Flying, Risk-On Sentiment Takes Hold

RBNZ monetary policy decision sent the kiwi rallying across the board, as the Reserve Bank left its monetary policy settings unchanged and signalled that the tightening cycle is in sight. The reinstated OCR projection included in the Monetary Policy Statement suggested that the OCR could start rising in mid-2022, slightly earlier than most had expected. Meanwhile, the MPC dropped reference to being "prepared to lower the OCR if required" from its statement, while the summary of the meeting only mentioned that "the OCR is the preferred tool to respond to future economic developments in either direction".

- NZD/USD pierced the $0.7300 figure and attacked key resistance area at $0.7305/07, which represent May 10/Mar 2 highs. The rate managed to take out these levels and trades just above there at typing. NZD/JPY surged to its best levels since Apr 2018, after breaching its YtD peak. Key resistance levels gave way as NZD extended gains during RBNZ Gov Orr's press conference.

- The bid in NZD spilled over into AUD, which was the second best performer in the G10 pack, as well as into the broader commodity FX space. AUD/NZD slid sharply after the RBNZ's announcement and narrowed in on key support from Feb 26 low of NZ$1.0640.

- The PBOC set the central USD/CNY mid-point at CNY6.4099, just 2 pips shy of sell-side estimate. USD/CNH extended losses after the in-line fixing, printing worst levels since Jun 2018.

- Safe haven currencies came under additional pressure as e-minis crept higher. USD and JPY were comfortably the worst performers in G10 FX space.

- Focus turns to French sentiment gauges, Swedish unemployment as well as comments from Fed's Quarles, ECB's Villeroy & BoC's Lane.

FOREX OPTIONS: Expiries for May26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E628mln), $1.2075-90(E1.4bln-EUR puts), $1.2195-10(E1.0bln), $1.2215-30(E746mln-EUR puts)

- USD/JPY: Y108.00($1.0bln), Y108.25-35($534mln), Y108.50-60($558mln), Y108.80($604mln), Y109.25($725mln), Y109.50($879mln), Y110.50($717mln)

- GBP/USD: $1.4220(Gbp422mln-GBP puts)

- EUR/GBP: Gbp0.8600-15(E1.1bln)

- EUR/CHF: Chf1.1000(E741mln-EUR puts)

- USD/SEK: Sek8.2650($642mln-USD puts)

- AUD/USD: $0.7600-10(A$648mln), $0.7740-50(A$1.2bln-AUD puts), $0.7770-85(A$1.1bln-AUD puts)

- NZD/USD: $0.7215-17(N$599mln)

- USD/CNY: Cny6.35($650mln), Cny6.4445($500mln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.