-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Central Bank Speak Eyed

- Local COVID worries dominated regional Asia-Pac news flow on Monday, with the PBoC continuing to drip in liquidity via OMOs.

- Core global markets lacked a strong sense of direction/purpose.

- Central bank speak will dominate the global docket on Monday.

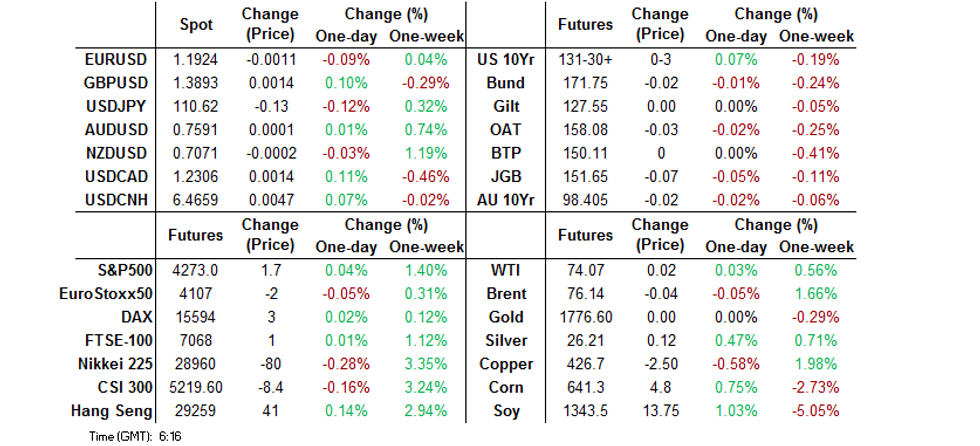

BOND SUMMARY: Tight Ranges For Core FI, ACGB Front End Bid On COVID Matters

News flow and broader market flow was generally light in Asia. T-Notes have stuck to a 0-02+ range, last +0-02+ at 131-30, while cash Tsys trade unchanged to ~0.5bp cheaper across the curve at typing. A recently published FT interview with Boston Fed President Rosengren saw him issuea warning that "the U.S. cannot afford a "boom and bust cycle" in the housing market that would threaten financial stability, in a sign of growing concern over rising property prices at the central bank." The weekend saw U.S. President Biden stress that he doesn't plan to veto the bipartisan infrastructure bill if it is presented without a reconciliation package, despite previous accusations to the contrary from the GOP in the wake of some of Biden's comments on Thursday The latest round of Fedspeak will headline the local docket in NY hours. Still, participants are already looking to Friday's NFP release.

- JGB trade was relatively muted, with futures 7 ticks below Tokyo settlement levels at typing, adding to the modest overnight session dip, while the major cash benchmarks trade little changed to 1.0bp cheaper across the JGB curve. An uptick in the cover ratio witnessed at the latest round of 25+ Year BoJ Rinban ops applied some marginal pressure to the longer end during the Tokyo afternoon. News flow was light, with the summary of the latest BoJ monetary policy revealing nothing in the way of surprises, while PM Suga pointed to the government's "high alert" re: the slight rise in Tokyo's COVID case count, while underlining the government's desire to implement a nimble response to the virus. Tuesday will bring the release of the latest local labour market report, retail sales data & 2-Year JGB supply.

- The local COVID situation supported the front end of the Australian bond curve in early trade this week, leaving YM +2.5 and XM -2.5 at typing, as the former unwound its modest overnight cheapening and more. Cash ACGB trade has also seen some twist steepening, with 3s representing the firmest point on the curve, while the long end has cheapened by ~2.5bp vs. Friday's closing levels. As a reminder, the weekend saw the scope of Sydney's lockdown broadened to cover the entire Sydney area, with the length of the lockdown increased to 2 weeks. Elsewhere, the city of Darwin implemented a "hard" two-day stay-at-home order after the discovery of a handful of COVID cases. The NSW premier hopes to announce a support package for business tomorrow/Wednesday. The latest round of scheduled ACGB purchases covering maturities of Nov '24 to May '28 will have also provided support for the front end/belly of the curve. Today's A$300mn ACGB Jun '51 supply saw the weighted average yield price a comfortable 0.94bp through prevailing mids at the time of supply (per Yieldbroker), with takedown likely supported by the more than palatable DV01 on offer and recent demand for long end ACGBs. The cover ratio printed at a healthy enough ~3.52x.

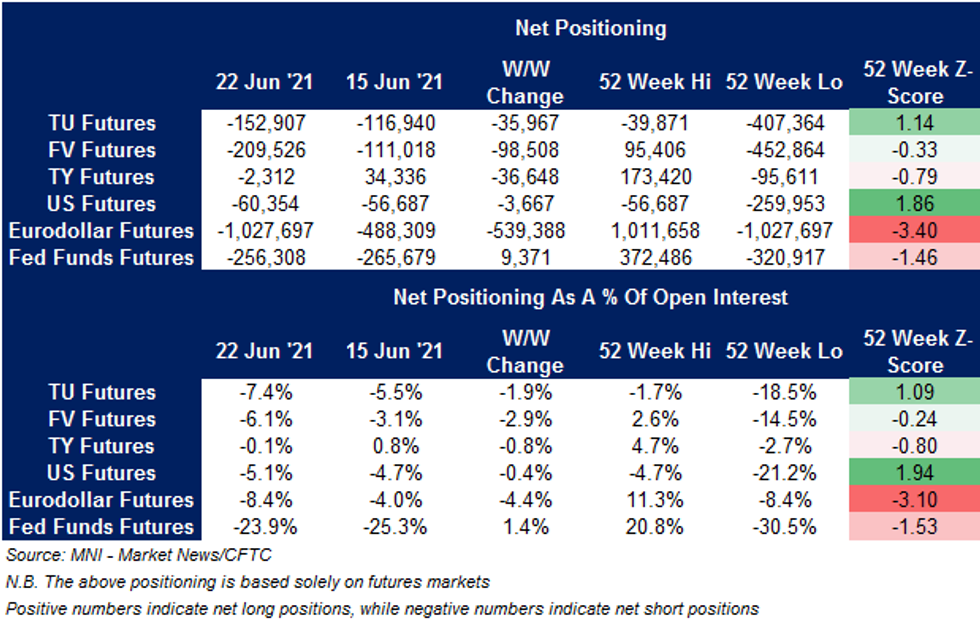

US TSY FUTURES: Eurodollar Positioning Steals The Show In Latest CFTC CoT

TU, FV & US futures saw net short non-commercial exposure swell in the latest weekly CFTC CoT report which covered the week ending 22 June (capturing the post-FOMC adjustments), while TY positioning swung back into net short territory for the first time since early May. FV saw the most aggressive net positioning adjustment out of the major bond contracts, although the net short positioning registered across the board sits some way off the recent respective extremes witnessed in each contract.

- Eurodollar positioning stole the show, with non-commercials extending their net shorts by ~539K contracts. Non-commercial net short positioning in Eurodollar futures is now at the most extreme since Feb '19 (in outright terms), but remains some way shy of the ~4mn net short position amassed at one point in '18. Non-commercials trimmed their net shorts in Fed Funds futures during the same week.

FOREX: Covid Talk Front And Centre

Coronavirus concerns dominated at the start to the week. The USD and JPY gained on the back of resultant safe haven demand, but CHF failed to follow suit. USD/JPY slipped into the Tokyo fix, while remaining within the confines of last Friday's range. The DXY inched higher, having a look above the prior trading day's range.

- The broadening of lockdown measures in Sydney and the extension to Wellington restrictions applied some pressure to the Antipodeans early on, but both currencies shook off their initial weakness. Their commodity-tied peers CAD and NOK traded on a softer footing.

- The PBOC set the central USD/CNY mid-point at CNY6.4578, virtually in line with sell-side estimate. Spot USD/CNH edged higher, recouping Friday's losses.

- Sterling caught a light bid, after new Health Sec Javid announced that "to see that we can return to normal as soon and as quickly as possible" will be his "most immediate priority".

- With the global data docket offering little of note today, focus turns to plenty of speeches from Fed, ECB & BoE policymakers.

FOREX OPTIONS: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-08(E508mln-EUR puts), $1.1915-25(E994mln-EUR puts), $1.1950(E1.1bln-EUR puts), $1.2000(E1.2bln)

- USD/JPY: Y108.50($660mln), Y110.00($481mln), Y110.50($1.5bln, $1.47bln-USD puts), Y111.75($500mln), Y112.00-05($890mln)

- EUR/GBP: Gbp0.8500(E710mln-EUR puts)

- AUD/NZD: NZ$1.0740(A$400mln-AUD puts)

- USD/MXN: Mxn19.85($911mln)

ASIA FX: Coronavirus Concerns Weigh

Mostly weaker across Asia with coronavirus concerns sapping risk appetite.

- CNH: The PBOC set the central USD/CNY mid-point at CNY6.4578, virtually in line with sell-side estimate. Spot USD/CNH edged higher, recouping Friday's losses.

- SGD: Singapore dollar is weaker, USD/SGD grinding higher throughout the session and currently bumping up against resistance at a 23.6% retracement level.

- KRW: The won is weaker; Health authorities brace for revamped social distancing rules while pushing to accelerate vaccinations.

- TWD: Taiwan dollar is slightly stronger, the central bank said over the weekend that the economy and financial system were healthy, pushing back against a note in which Nomura says Taiwan could be vulnerable to a crisis.

- MYR: Ringgit is stronger, PM Muhyiddin announced an extension of the nationwide lockdown until the daily Covid-19 case count falls below 4,000.

- IDR: Rupiah is weaker, Health Min Sadikin confirmed that the gov't has met the target of administering 1mn vaccinations per day and has enough supply of jabs to maintain the current rate of 1.3mn jabs/day.

- PHP: Peso has fallen, Senator Richard Gordon is considering running for president in 2022 and admitted that he is looking for a suitable running mate.

- THB: Baht dropped, Thailand ordered restaurants in Bangkok and neighbouring regions to halt dine-in services for a month.

ASIA RATES: Indian Bonds Under Pressure After Weak Auctions

- INDIA: Yields higher in early trade. Auctions were poorly received on Friday, the RBI didn't accept any bids for the 10-year auction and the sale of shorter maturity bonds was rescued by underwriters. In total investors bought INR 91.5bn of bonds, compared to an initial RBI target of INR 260bn. There was upward pressure on yields in the second half of June as retail inflation remains above the top of the RBI's target band and oil prices continue to rally.

- SOUTH KOREA: Futures lower in South Korea after hawkish comments from the BoK Governor last week saw markets reprice the chances of a rate hike. Lee said it would be time for orderly normalization in the coming months. The MOF sold 30-Year debt, the sale was taken in line with the previous auction and saw futures come off their lows.

- CHINA: The PBOC conducted net injections of CNY 20bn today in a move to stabilize liquidity heading into month and quarter end, the third straight session of injections. Repo rates are slightly higher but the overnight repo rate is some 85bps lower than last week's peak. Futures are lower, 10-year future down 6.5 ticks and breaking out of Friday's range.

- INDONESIA: Curve twist steepens. Health Min Sadikin confirmed that the gov't has met the target of administering 1mn vaccinations per day and has enough supply of jabs to maintain the current rate of 1.3mn jabs/day. This comes after Indonesia expanded loosened vaccination eligibility criteria and allowed all adults to register. Officials are scrambling to secure swift distribution of vaccines after the country declared a record increase in new Covid-19 cases (21,342) on Sunday.

EQUITIES: Mixed

A mixed day for equity markets in the Asia-Pac region, there were reports that US forces conducted airstrikes on Iranian-backed militia groups blamed for drone attacks on American facilities in Iraq. Bourses in Japan have struggled and in minor negative territory. Japan's Covid-19 response czar Nishimura signalled that the central gov't stands ready to declare a fresh state of emergency amid a deteriorating virus situation in Tokyo. In Australia the ASX 200 is negative, again coronavirus concerns weigh after of Sydney's lockdown broadened to cover the entire Sydney area, with the length of the lockdown increased to 2 weeks. In China markets are just about in positive territory but have failed to make much ground. Futures in the US are higher.

GOLD: Blip Lower Unwound

Gold is little changed on the day after paring early losses, with spot last dealing just shy of $1,780/oz. There was nothing in the way of news drivers/fundamental inputs from U.S. Tsys & the USD to drive the downtick in bullion early on (with silver also tracing out a similar path). Bears didn't manage to get anywhere near forcing a test of initial support (in the form of the Jun 18 low at $1,761.1/oz).

OIL: Pulls Back Slightly

Oil is lower to kick off the week, snapping a three-day winning streak, although Brent & WTI futures are only a handful of cents below their respective settlement levels at typing. At these levels oil is still hovering near a two-year high. There were reports that US forces conducted airstrikes on Iranian-backed militia groups blamed for drone attacks on American facilities in Iraq, the strikes could prove a stumbling block in negotiations on the nuclear accord. Focus turns to the next OPEC+ meeting on July 1 after a leak that an increase of 500k bpd is being considered.

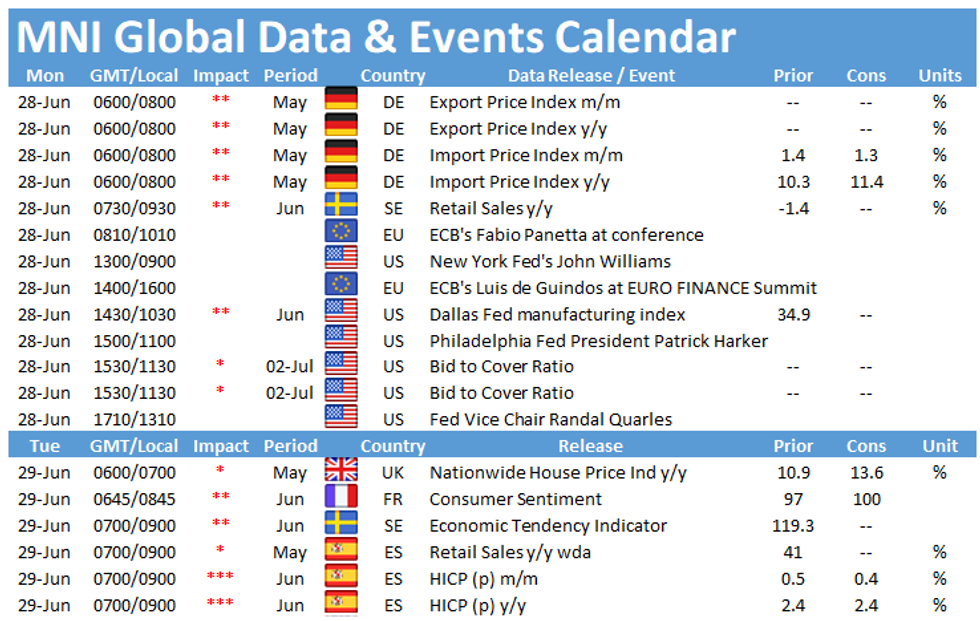

UP TODAY (Times GMT/Local):

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.