-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Growth Worries & NSW COVID Cases Dominate In Asia

- COVID cases in Australia caught the eye, while several well-known voices in Chinese policymaking circles cautioned on growth prospects over the weekend.

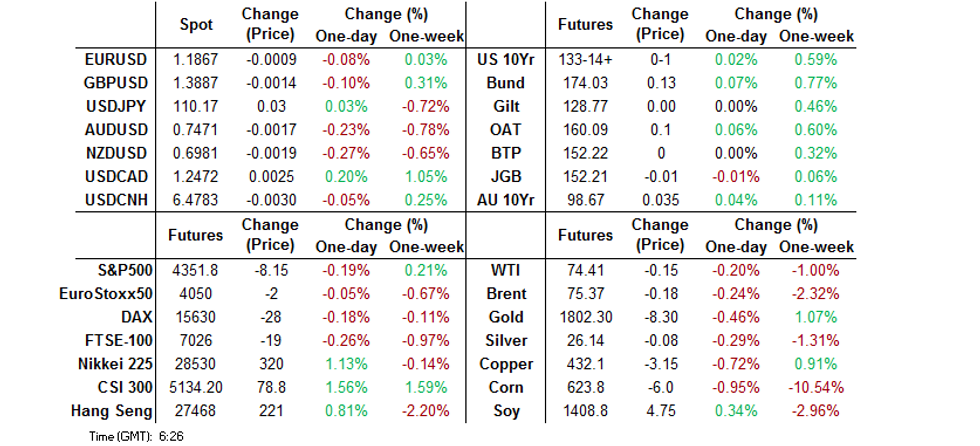

- USD nudges higher with e-minis a touch weaker as a result.

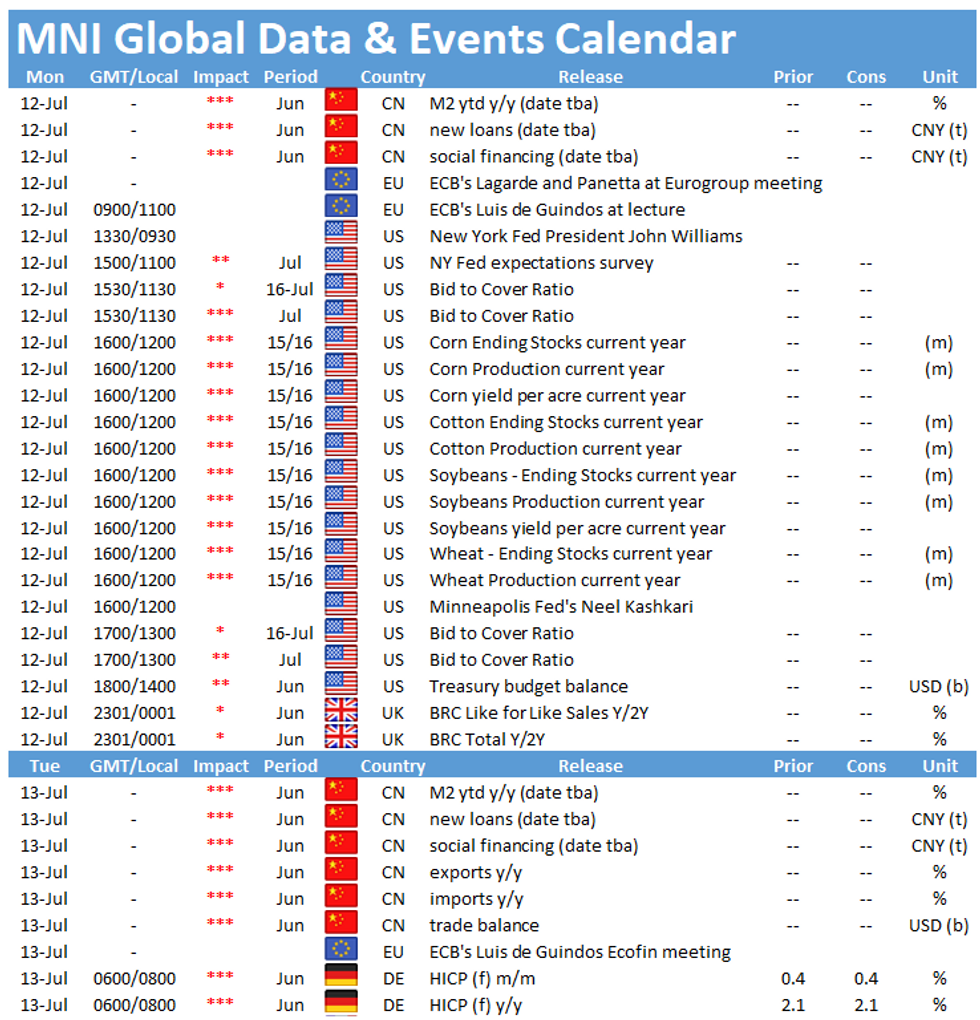

- Central bank speak from de Guindos headlines a limited Monday docket, with London liquidity potentially thinned on the back of the Euro 2020 final.

BOND SUMMARY: ACGB Matters Dominate

The first Asia-Pac session of the week was a little lacking in terms of meaningful macro headline news. A downtick for e-minis (after Friday saw a fresh all-time high for the S&P 500), coupled with some caution in Australia re: COVID was enough to generate some modest support for T-Notes, with that contract last dealing +0-01+ at 133-15, within the confines of a 0-04+ range. Cash Tsys saw some very modest twist flattening. Participants now look to Monday's "double supply" (in the form of 3- and 10-Year Notes) and an address from Minneapolis Fed President Kashkari.

- JGB futures trade 2 ticks lower on the day at typing, with the contract paring modest overnight losses, likely on the back of the light bid in broader core FI markets during regional trade (U.S. Tsys/ACGBs), given the lack of local news flow. The major cash JGB benchmarks mostly deal a little firmer on the day, but within the -/+1.0bp boundaries when compared to Friday's closing levels. Local PPI data (for June) revealed a slightly higher than expected uptick in both M/M & Y/Y terms, although both prints were a touch lower than the readings witnessed in May (which saw upward revisions). Core machine tool orders data provided healthy beats in both M/M & Y/Y terms. Note that 20s showed no sign of concession ahead of tomorrow's 20-Year JGB supply.

- The longer end of the curve has played catch up during Sydney trade, seemingly on the confirmation of 112 new local COVID cases in NSW (after such a number was touted by local reporters ahead of the release). Speculation re: deeper fiscal support packages and harder/longer lockdowns in NSW continues to intensify, which has underpinned the space today. YM +3.5, XM +4.0, with the long end now leading the way in cash ACGB trade, richening by a little over 5.5bp on the day. The monthly NAB business survey headlines the local docket on Tuesday.

FOREX: Not Too Much Appetite For Risk

Sentiment turned sour and the initial risk-on impulse dissipated, driving high-beta G10 FX lower. Covid-19 matters remained front and central, with the Sydney outbreak sapping some strength from the Aussie. AUD went offered as Sydney daily case count topped 100, while NSW Premier Berejiklian suggested an imminent extension to regional lockdown measures. NZD turned heavy in sync with its Antipodean cousin, while AUD/NZD operated below the previous close.

- Safe havens attracted demand, as U.S. e-minis gave away their initial modest gains and slipped into negative territory. USD/JPY tested last Friday's high of Y110.26, but failed to clear the level and backed off.

- USD/CNH lost some altitude, despite a slightly weaker than expected PBOC fix, which came in at CNY6.4785, 19 pips above sell-side estimate. China's moves against tech companies also failed to undermine the redback.

- It is a slow start to the week in terms of global data releases, while today's central bank speaker slate features Fed's Kashkari & ECB's de Guindos.

FOREX OPTIONS: Expiries for Jul12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1930-35(E528mln)

- USD/JPY: Y109.00($500mln), Y109.30-50($669mln), Y110.00($705mln)

- AUD/USD: $0.7400(A$627mln), $0.7500(A$758mln)

- USD/CAD: C$1.2360-68($870mln), C$1.2500($610mln), C$1.2505-25($1.5bln), C$1.2575($500mln), C$1.2695-05($1.1bln)

- USD/CNY: Cny6.4530($560mln)

ASIA: IDR Leads Gains In Asia Despite Below-Forecast GDP Print

Spot USD/IDR sank at the re-open of onshore trade, punched by overnight impact of U.S. presidential race, which pushed offshore yuan to its best levels against the greenback in 28 months. As for USD/IDR, it registered at lows not seen since Jul 15 this morning, before moving away from this trough as data confirmed Indonesia's first recession since the Asian financial crisis.

- The nation released its Q3 GDP figures today. The economy shrank more than expected in Y/Y terms, confirming that Indonesia has entered recession. A Q/Q rebound in GDP could be a reason for some cautious optimism, but it was slower than forecast. Yet, head of the statistics office said that officials are hoping for a continued improvement in Q4 owing to the relaxation of wide-ranging social restrictions.

- Bank Indonesia's Hendersah commented that consecutive trade surplus over the recent months signals that the rupiah has some room for appreciation.

- Spot USD/IDR sits -130 pips at 14,435 as we type. Next support coming up at IDR14,355, which limited losses on Jul 9 & 14. Below there would open the 61.8% retracement of the Jun 8 - Sep 11 rally at IDR14,284. Bulls need a move through the 100-DMA at IDR14,593 to get some reprieve.

- Indonesia's Danareksa Consumer Confidence should be released at some point later this week, before next Monday's print compiled by Bank Indonesia.

EQUITIES: Asia-Pac Equities Higher, E-Minis Lower

The positive lead from Wall St. made for a buoyant start to the week for the major Asia-Pac equity indices. The Nikkei 225 led the way higher, aided by the broader theme, some modest JPY weakness vs. G10 FX since Friday's Tokyo close and firmer than expected core machine orders data out of Japan. Meanwhile, Chinese bourses drew support from Friday's after hours RRR cut from the PBoC, although the increased regulatory oversight evident in China perhaps limited the bid. The ASX 200 lagged on the back of the COVID situation in NSW, with worry re: a deeper and longer lockdown evident. E-Minis nudged lower after Friday saw fresh all-time highs for the S&P 500.

GOLD: Still Tethered To $1,800/oz

Bullion ultimately remains tethered to the $1,800/oz mark, with little in the way of meaningful macro headline flow evident at the start of a new week. An unchanged technical backdrop remains in play as gold takes a bit of a breather after the recent uptick.

OIL: A Touch Lower

A slightly firmer USD and downtick for e-minis leaves WTI & Brent $0.20 below settlement levels into London hours. Participants continue to weigh up the demand side of the equation (which is potentially clouded a little by the spread of the delta strain of COVID-19. Although that should at least be partially mitigated by the wider vaccine rollout that has been seen/is underway), while OPEC+ will continue to shape supply side issues over the coming months.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.