-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: The Transitory Debate Is Set To Continue

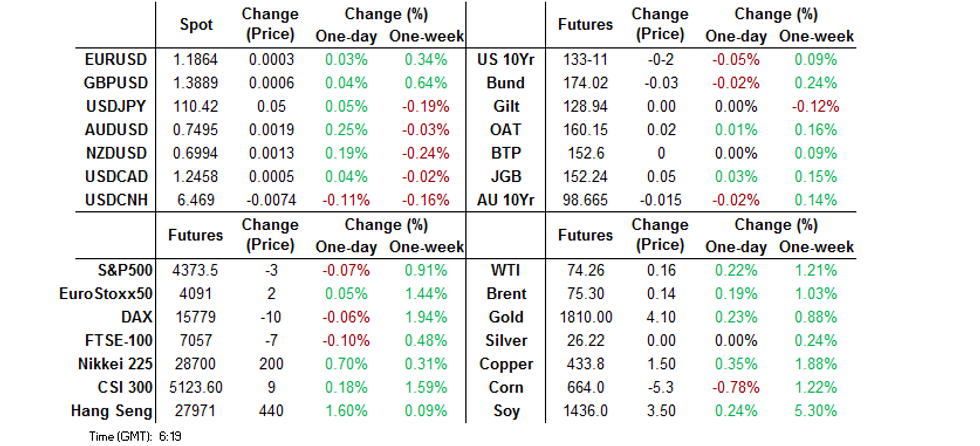

- A lack of major news flow was evident in Asia, leaving the Antipodeans atop the G10 FX pile, while e-minis traded either side of unchanged.

- Core fixed income markets had little to latch onto, with some modest relative outperformance for JGBs.

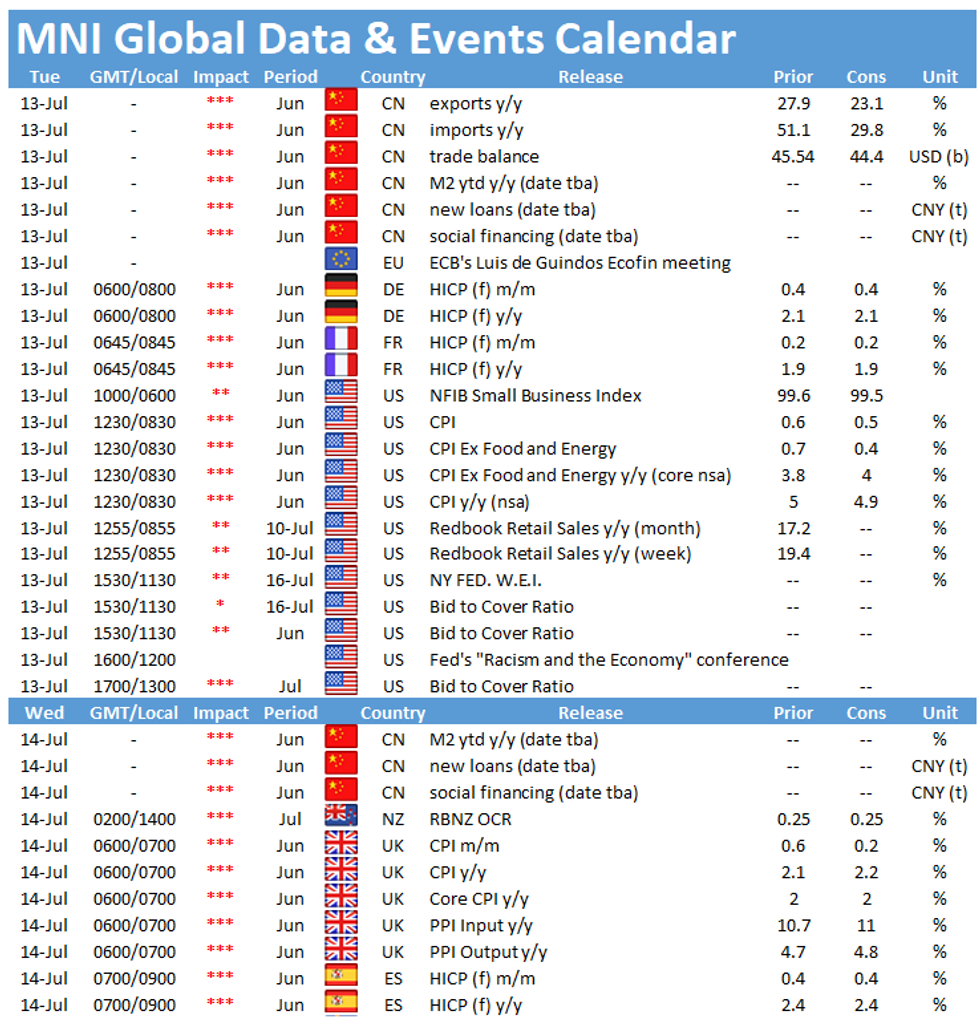

- U.S. CPI data headlines the global docket on Tuesday.

BOND SUMMARY: Relative Outperformance For JGBs, Aus Fiscal Support Matters Eyed

T-Notes held to a very narrow 0-03 range overnight, last dealing -0-02+ at 133-10+ on volume of ~40K. Cash Tsys are unchanged to ~0.5bp cheaper across the curve. There has been little in the way of notable macro news flow during Asia-Pac hours, outside of a BBG report pointing to early discussions surrounding a Biden-led digital trade deal re: countering the influence of China in Asia (which would include the likes of Canada, Japan & Chile). Market flow has been dominated by the previously flagged ~31K screen lift of FFU1, with a total of ~46K lots trading at the same price in that contract overnight.

- Tokyo trade has seen JGB futures respect the range established during the previous after-hours session. The major cash JGB benchmarks trade little changed to ~1.0bp richer on the day. 20s have outperformed in the wake of supply, with the latest round of 20-Year JGB supply seeing the low price print comfortably above broader dealer expectations (proxied by the BBG dealer poll), while the cover ratio edged ever so slightly lower and the price tail saw an incremental widening vs. prev. auction.

- It has been a mundane session for ACGBs, with the latest NAB business survey showing a slight moderation from very upbeat levels (in terms of both confidence and conditions), with the risk seemingly for a lower print next month given the lockdown situation in Sydney. Still, NAB noted that "overall, the survey points to a solid outcome in the June quarter for economic activity - and continues to reflect the support of both fiscal and monetary policy. The experience of lockdowns to date, is that there is a fairly rapid rebound in activity as restrictions are removed - and with most survey indicators still at high levels, the hope is that there is no material easing in hiring and investment intentions which have been critical to the recovery. However, as the economy passes through the rebound phase and into a new period of growth, we would expect some normalisation across the survey variables." YM unch., XM -1.5. The 10+-Year zone of the cash ACGB curve is seeing the largest degree of cheapening on the day, with yields in that zone ~1.5bp higher vs. closing levels. Elsewhere, the Guardian noted that "a new commonwealth financial support package for locked-down greater Sydney is to be announced after the federal government signed off on a cash boost for affected businesses and households. The new Covid assistance package, which was approved by the federal government's expenditure review committee on Monday, was finalised by the federal and New South Wales Treasuries before a joint announcement expected on Tuesday."

FOREX: Risk Tone Improves, Chinese Trade Data Support Yuan

Today's fairly lacklustre Asia-Pac session saw the Antipodeans take a narrow lead in the G10 pack, as most regional equity benchmarks eked out some gains. AUD/USD flirted with the round figure of $0.7500, while NZD/USD returned above the $0.7000 mark. AUD/NZD shed a handful of pips as Australia's NAB Business Confidence deteriorated.

- Better risk tone reduced demand for safe haven assets, leaving JPY and USD at the bottom of the pile. The DXY faltered ahead of the release of monthly U.S. CPI.

- An uptick in crude oil prices failed to shield the NOK, which was among the worst G10 performers.

- USD/CNH traded on a softer footing, as China reported a wider than expected trade surplus for the month of June, underpinned by considerable beats in both exports and imports. The PBOC fix came in 10 pips above sell-side estimate, provoking virtually no reaction.

- Focus turns to inflation data from the U.S., Germany & France, while BoE Gov Bailey is set to speak on the Financial Stability Report.

FOREX OPTIONS: Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740-45(E1.2bln), $1.1875(E605mln), $1.1900-15(E1.3bln)

- USD/JPY: Y109.70-85($883mln), Y110.30($545mln)

- EUR/JPY: Y132.85(E536mln)

ASIA FX: Most EM Currencies Gain

Most EM currencies gained in a supportive risk environment.

- CNH: Offshore yuan gained as China reported a wider than expected trade surplus for the month of June, underpinned by considerable beats in both exports and imports. The PBOC fix came in 10 pips above sell-side estimate, provoking virtually no reaction.

- SGD: Singapore dollar is higher, yesterday the government eased restrictions on groups of people dining and plans to further reopen the economy when 50% of the population is vaccinated later this month.

- TWD: Taiwan dollar gained, USD/TWD retreating further from the 28.00 handle. On the vaccine front the government has plans to purchase 15 million doses of Moderna's vaccine in 2022 and another 15 million in 2023. There were reports yesterday that Foxconn and TSMC had reached deals to purchase 10 million doses of the BioNTech vaccine

- KRW: The won strengthened, there were some comments from Vice FinMin lee earlier who noted that volatility was rising in South Korean markets due to the latest wave of coronavirus, adding that the government would strengthen monitoring on markets and risk factors.

- MYR: Ringgit is stronger, FinMin Zafrul said that the gov't may lower its 2021 growth forecast to around +4.0% Y/Y from the current +6.0%-7.5%, adding that he would propose raising the legal debt ceiling to 65% of GDP from 60%, as fiscal deficit may prove wider than projected this year.

- IDR: Rupiah is flat, Indonesia declared another record-breaking increase in new Covid-19 infections, adding 40,427 new cases on Monday. The number of deaths rose by 891, amid shortages of oxygen and other critical supplies.

- PHP: Peso bucked the trend and declined, hitting the lowest in over a year. Fitch affirmed Philippines at BBB (second-lowest investment grade score), but revised its outlook to negative from stable, citing "increasing risks to the credit profile from the impact of the pandemic and its aftermath on policy-making as well as on economic and fiscal out-turns."

- THB: Baht is stronger, Thai cabinet may consider additional economic assistance measures for those affected by Covid-19 restrictions during its weekly meeting today.

ASIA RATES: Indian Bonds Supported By CPI Miss

- INDIA: Yields lower in early trade after data late yesterday showed CPI grew at a slower-than-estimated pace. CPI rose at 6.26% Y/Y in June, below estimates of 6.59%, however this is still above the top end of the RBI's target band. Other data showed industrial production rose 29.3% in May, below estimates of 32%. As a reminder, RBI Governor Das said last week that recent higher inflation was 'transitory' and an early exit from pandemic stimulus may hurt the recovery.

- SOUTH KOREA: Futures lower, the 10-year giving back some of yesterday's gain. There were some comments from Vice FinMin lee earlier who noted that volatility was rising in South Korean markets due to the latest wave of coronavirus, adding that the government would strengthen monitoring on markets and risk factors. South Korea reported 1,150 new cases in the past 24 hours, above 1,000 for the seventh day. South Korea set a record high for daily cases Saturday with 1,378. Tighter restrictions in Seoul and the surrounding areas were started on Monday, authorities have warned that daily cases could exceed 2,000 later this month amid a spike in the number of delta variant cases.

- CHINA: Futures are higher in China, data showed the trade surplus widened more than expected as exports and imports both rose at a robust pace. The trade surplus widened to CNY 332.8bn, exports rose 20.2% while imports rose 24.2%, both above estimates. Markets now look ahead to GDP data later in the week.

- INDONESIA: Yields lower across the curve. Indonesia declared another record-breaking increase in new Covid-19 infections, adding 40,427 new cases on Monday. The number of deaths rose by 891, amid shortages of oxygen and other critical supplies. Investment Min Luhut, who's in charge of Indonesia's emergency Covid-19 measures, said that the gov't expects situation in Java and Bali to improve within days, once additional supplies of oxygen arrive.

EQUITIES: Higher Across The Board

Equity markets are higher in Asia as risk assets find favour in a quiet session after taking a positive lead from the US where bourses hit another set of record highs. Markets in China are in positive territory, data showed the trade balance widened more than expected as exports and imports both continue robust gains. Markets in Australia are higher, though moves are muted compared to peers; demand concerns around the Delta-variant of coronavirus abound, but the drop in case numbers in Sydney helped underpin prices. Gains were solid in tech shares, the Hang Seng seeing gains of around 1.5% while in Taiwan markets hit an intraday record high. In the US futures are mixed, tech shares continue to outperform and have moved higher while e-mini S&P and e-mini Dow Jones are slightly lower.

GOLD: Little Net Movement

Gold isn't going anywhere fast at present after dealing either side of $1,800/oz on Monday. Spot last deals little changed around $1,810/oz. The well-defined technical overlay remains in play after the recent consolidation, with U.S. CPI data (due for release on Tuesday) and Fed Chair Powell's semi-annual testimony on the Hill set to provide the major fundamental inputs over the coming sessions.

OIL: Prices Drift Higher

Crude futures have drifted higher in Asia-Pac trade on Tuesday; with WTI & Brent sitting ~$0.15 above settlement levels. Demand concerns around the Delta-variant of coronavirus abound, but the drop in case numbers in Sydney helped underpin prices. This keeps the technical outlook unchanged, with Brent still vulnerable following last week's downleg. The focus is on $71.24, the Jun 17 low. Gains are considered corrective. WTI has also cleared its 20-day EMA last week and attention turns to $69.54, Jun 17 low.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.