-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ's August Meeting Now Deemed Live

EXECUTIVE SUMMARY

- FED'S KAPLAN UPS PCE OUTLOOK TO 3.9%, URGES TAPER TALK (MNI)

- SENATE DEMOCRATS AGREE TO $3.5 TRILLION TAX, SPENDING PLAN (BBG)

- FITCH AFFIRMED THE UNITED STATES AT AAA; OUTLOOK NEGATIVE

- RBNZ COMES DOWN ON THE HAWKISH SIDE, AUGUST MEETING NOW SEEN AS LIVE RE: OCR HIKE

- SYDNEY LOCKDOWN EXTENDED, COVID CASES IN MELBOURNE TICK HIGHER

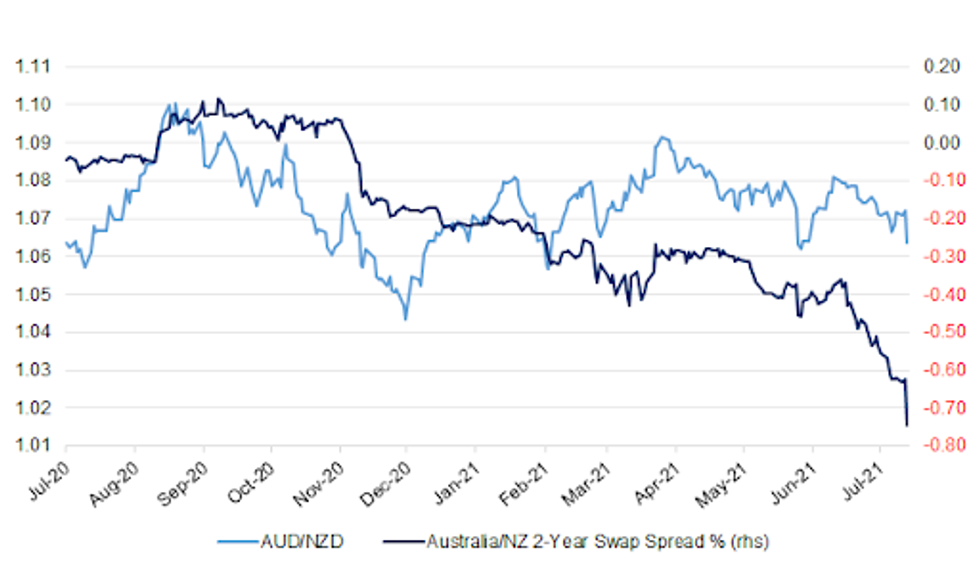

Fig. 1: AUD/NZD vs. Australia/NZ 2-Year Swap Spread % (rhs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Face coverings must be worn on London's transport network despite restrictions easing on 19 July, London's mayor says. Sadiq Khan said he was not prepared to put Tube, tram and other transport users at risk by relaxing the rules on face coverings. Face masks have been mandatory on public transport for the past year to reduce the spread of the virus. But those rules will be replaced with government guidance advising passengers to wear masks only on busy services. (BBC)

CORONAVIRUS: Ministers have pushed back the publication of new guidance on the return to the office as frustration from business leaders mounts over mixed messages just days before Covid restrictions end. (Telegraph)

CORONAVIRUS: Large businesses have said they will maintain a cautious approach to bringing staff back to the office despite the lifting of final Covid restrictions in England on Monday. The government announced yesterday that it will no longer instruct people to work at home from 19 July. But firms spoken to by the BBC said they did not plan to bring all staff back to the office. Many businesses said they will opt for a staggered approach for employees. Deloitte said it will increase the number of staff allowed to work in its offices to 50% capacity from next week. But the accountancy firm expects that level to stay in place until September. NatWest said that it will bring staff back to the office from 19 July but it will only be a small number of "priority workers". (BBC)

CORONAVIRUS: One in five workers in the hospitality and retail sectors are self-isolating as a result of COVID-19 rules, industry leaders have told MPs. The figures cited during a hearing of the Commons business select committee highlight growing concerns caused by people being alerted to stay at home after being in close contact with someone who has tested positive for the virus. Kate Nicholls, chief executive of UK Hospitality, said the problem was increasing - with worries that in some cases a third of staff could be affected. (Sky)

CORONAVIRUS: MPs have approved compulsory vaccinations for care home staff in England, but a number of Conservatives rebels voiced anger at the plans. From October, anyone working in a Care Quality Commission-registered care home in England must have two vaccine doses unless they have a medical exemption. The House of Commons approved the regulations by 319 votes to 246. But Tory MPs criticised the government for not publishing an impact assessment of the policy before the vote. Health minister Helen Whately told MPs the "impact assessment is being worked on". (BBC)

ECONOMY: Employers are planning the lowest number of job cuts for over six years, as the economy reopens after the pandemic. Redundancy figures for June from the Insolvency Service saw 15,661 positions put at risk in Great Britain. Last June saw nearly ten times that number, the worst on record. The reduction in expected redundancies comes despite the imminent end of the furlough scheme which was designed to protect jobs during the pandemic. Employers planning 20 or more redundancies have to file a form called HR1 notifying government at the start of the process. This data gives an early indication of moves in the labour market, months before they show up in the official unemployment figures. (BBC)

FISCAL/POLITICS: The government has won a Commons vote to lock in cuts to spending on overseas aid, despite a rebellion by Tory MPs. MPs voted by a majority of 35 to keep the budget for international development at 0.5% of national income. But 25 Conservatives joined Labour and other parties in an attempt to reinstate the 0.7% figure, which was in place until earlier this year. Prime Minister Boris Johnson said the cut was needed to keep public debt down during the pandemic. The government has faced cross-party criticism over the reduction - which amounts to almost £4bn - including from all the UK's living former prime ministers. (BBC)

COMPANIES: Treasury officials are examining private equity deals to see if they have benefited local regions as concerns grow over the pace of takeovers of British companies, The Times has learnt. Private equity takeovers of British companies this year have reached their highest level since 2007, and analysts believe that more than 60 companies are vulnerable in this quarter. Wm Morrison, the grocer, is at the centre of a bidding war between three US buyout companies, while in the past few days, Smiths Group, a FTSE 100 company, has received a takeover approach for its medical division and Tate & Lyle has agreed to sell a controlling stake in its bulk sweeteners and industrial starches division to private equity. A rush of deals, driven by depressed UK asset prices and the successful rollout of the vaccine programme, has increased fears of job losses and risks to the economy and national infrastructure from private equity ownership. (The Times)

EUROPE

SPAIN: Spain, Europe's second largest tourism market pre-pandemic, is still a safe destination, Tourism Minister Reyes Maroto said on Tuesday after Germany and France earlier warned citizens about the risks of heading there. Catalonia and Valencia, two of the most popular vacation spots, have both seen a surge in infections in recent days as restrictions are relaxed. (BBG)

GREECE: Greece reported 3,109 new cases Tuesday, the highest daily rise in just over two months. To combat the recent increase amid concerns for its tourism industry, authorities said customers of indoor restaurants and indoor areas at entertainment venues will need to show they've been vaccinated or have tested negative within the last three days. The requirement will remain in force until the end of August at the earliest, and doesn't concern outdoor areas. (BBG)

U.S.

FED: MNI INTERVIEW: Kaplan Ups PCE Outlook to 3.9%, Urges Taper Talk

- Dallas Fed President Robert Kaplan told MNI Tuesday he has raised his inflation forecast for the remainder of the year and into 2022 on a significant widening of price pressures, and urged more debate on pulling back asset purchases. "Our own view at the Dallas Fed is that PCE will end the year at approximately 3.9%, and that there's a second phase going on right now of a broadening or bleeding out of these initial extreme moves to a broader range of items," Kaplan said. The revised outlook is half a percentage point higher than Kaplan's previous estimate for this year and would mean no slowdown from the most recent report for May - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Richmond President Thomas Barkin said higher wages of lower-income workers in the U.S. are contributing to inflationary pressures, adding the outlook for more lasting changes should be clearer by September. "We see wages for lower-skilled workers rising as workforce participation stays stubbornly low," Barkin said in an essay on the bank's Website. "We also see price increases." "While other factors, such as supply bottlenecks, are contributing to inflationary pressures, businesses also point to wage pressure. For example, Chipotle linked its latest price hike to wage increases." (BBG)

FED: San Francisco Federal Reserve President Mary Daly told CNBC on Tuesday that a strong economic recovery will allow the central bank to slow its asset purchases, possibly near the end of 2021. Markets have been looking for clearer guidance from the Fed on when it will begin to reduce, or taper, the minimum $120 billion it is buying in Treasurys and mortgage-backed securities. While Daly did not give an exact timeline, she said the time for tapering is drawing near. "It is appropriate to start talking about tapering asset purchases, taking some of the accommodation that we have been providing to the economy down," she told CNBC's Steve Liesman. "We'll still be in a very accommodative position with a low funds rate, but we don't need all the tools we see the economy get its own footing." (CNBC)

FED: MNI INTERVIEW: Fed Model Sees 18 Months Of 2.4% Trend Inflation

- Trend U.S. inflation is set to stay elevated at around 2.4% over the next year and a half, levels not seen since before the financial crisis, according to economist Tyler Atkinson of the Dallas Fed, which publishes a "trimmed mean" PCE inflation measure widely followed within the Fed system - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve says directors at all 12 regional Fed banks supported holding the discount rate unchanged at 0.25% in light of the uncertainties associated with the economic outlook, according to minutes of discount rate meetings in May and June. "Overall, Federal Reserve Bank directors were positive about the economic outlook and continued to report strengthening activity across sectors and Districts," Fed says in minutes of meetings released Tuesday. "Directors noted high demand for housing and a broad range of products and services, including motor vehicles, leisure air travel, apparel, and other retail goods." "Directors also commented on the challenges posed by ongoing supply chain disruptions, rising input costs, and labor shortages. (BBG)

INFLATION: The White House expects supply chain pressures that are fueling higher inflation to abate in the "not-too-distant future," but cannot say exactly when, a senior official said on Tuesday after June consumer prices showed the biggest gain in 13 years. The official declined to repeat earlier forecasts that inflation would peak in the summer months, citing continued uncertainty about when the supply chain pressures would ease, and concerns over the emergence of new COVID-19 variants. Asked if the bump in prices for certain services reflected any price gouging, the official said, "that probably remains to be seen," and added that it was an issue worth investigating. "We expect that these things will work themselves out in the not-too-distant future, but I can't say exactly when," said one official. "We also can't say whether or not we really truly do have this pandemic under control." (RTRS)

INFLATION: Senate Minority Leader Mitch McConnell, R-Ky., warned that if Democrats push through a massive spending package via budget reconciliation, the current rise of inflation could be only the beginning. Speaking on the Senate floor Tuesday, McConnell blamed "Democrats' high-stakes spending spree from the springtime" for the nation's current woes, which include a 5.4% year-over-year increase in inflation. "And now they want an even more absurd, even more damaging summer sequel?" McConnell asked, referring to plans from Democratic lawmakers to push through a multitrillion package to go alongside a bipartisan infrastructure bill. The reconciliation bill, which would only require a simple majority because it cannot be filibustered, would cover Democratic agenda items including climate action, child care and paid leave. "What Democrats say they want to force through this summer through reconciliation would make our current inflationary mess look like small potatoes," McConnell said. (FOX Business)

FISCAL: Senate Democrats on the Budget Committee agreed to set a $3.5 trillion top-line spending level for a bill to carry most of President Joe Biden's economic agenda into law without Republican support. Democrats on the committee had been divided about the size and scope of the package, with Chairman Bernie Sanders initially pushing a $6 trillion measure that added an expansion of Medicare, immigration reform, more generous childcare benefits and more to Biden's proposal. The Budget Committee agreement includes the Medicare expansion, marking a significant win for Sanders. Senator Mark Warner of Virginia, a moderate, said the bill would be "fully paid for." (BBG)

FISCAL: A bipartisan group of senators and their staff are finalizing the language for a nearly $1 trillion bill that primarily addresses surface transportation and "traditional" infrastructure priorities, as well as some climate-related provisions on electric vehicles, a deal that has the support of President Biden. But some Republicans outside of the team of core negotiators have raised concerns about how the package will be paid for, expressing skepticism about the proposal to fund part of it through tax enforcement. Senate Majority Leader Chuck Schumer has said that he would like to bring the bipartisan deal to the Senate floor by the week of July 19, but it's unclear whether the language of the bill will be finalized by then. GOP Senator John Thune said Tuesday that he thought it was unlikely that the bipartisan group would be able to finish writing the bill and have it scored by the Congressional Budget Office by the end of this week. (CBS)

FISCAL: Sen. Joe Manchin (D-W.Va.) warned on Tuesday that he wants both a bipartisan infrastructure bill and a separate Democratic-only bill to be fully paid for. "I think everything should be paid for. We've put enough free money out," Manchin told reporters. Manchin's demand, if he sticks to it, could create real problems in Democratic negotiations. (The Hill)

FISCAL: The U.S. budget deficit narrowed to $2.2 trillion during the first nine months of the fiscal year from the same period a year earlier, with the gap between spending and revenue shrinking as the recovery from the pandemic-induced slump boosted tax collections. Outlays for the first three quarters of the government's budget year rose 6%, to $5.3 trillion, the Treasury Department said Tuesday. Spending has been boosted by pandemic-related costs that included tax credits, expanded unemployment compensation, emergency small-business loans and stimulus checks to households. Federal revenue during the period rose 35% when compared with the previous year, to $3.1 trillion, largely due to higher receipts from individual and corporate income taxes. (WSJ)

FISCAL: GOP discussing voting against debt limit increase. "Frankly, there is a fair bit of discussion about why would we help them do it at all at this point," Republican Sen. Kevin Cramer says. "The risk is default and nobody wants that on their hands, but at the same time, where we've just finished a year where we spent $4 trillion in addition to everything else we already do on a normal basis and we are already over $2 trillion in the new year and they're talking about $6 trillion more." "I mean fiscal responsibility arguments went out the window." (BBG)

FISCAL: Roughly 4 million refunds will be sent this week to people who overpaid taxes on their 2020 unemployment benefits, the IRS announced Tuesday. Due to the $1.9 trillion American Rescue Plan Act, which became law in March, up to $10,200 in 2020 unemployment compensation was excluded from taxable income for individuals and married couples with modified adjusted gross income under $150,000 last year. However, many taxpayers had already filed their tax returns before the legislation was approved by Congress and signed into law by President Joe Biden. (CNBC)

CORONAVIRUS: Top infectious disease specialists say the spread of the delta variant across unvaccinated pockets of the country is causing flare-ups and leading to an increase in hospitalizations as cases climb. Nationwide, cases are once again on the rise as the highly transmissible variant takes hold as the dominant strain in the U.S. The seven-day average of newly confirmed Covid cases has climbed to about 23,300 a day, almost double the average from a week ago, according to data compiled by Johns Hopkins University. Health officials and physicians have been hoping that high vaccination rates among the most vulnerable and oldest Americans would keep hospitalizations, which generally lag new cases by a few weeks, from also rising. But that hasn't materialized so far, doctors said on the call. (CNBC)

US/RATINGS: Fitch Affirmed The United States at AAA; Outlook Negative

MARKETS: MNI BRIEF: Investor Optimism Cools on Inflation Concern-Gallup

- Optimism among U.S. investors improved through Q2, with the Gallup Investor Optimism Index up 13 points to 39 from 26 in Q1, though researchers said the index would have been higher if not for "deteriorating views of inflation" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EQUITIES: Goldman Sachs CEO David Solomon said that China's recent moves boosting oversight of its technology industry surprised him and will likely delay "a large number" of companies from listing shares in the U.S. Last week, shares of riding hailing giant Didi Chuxing plunged after China declared that new users couldn't download the app amid a cybersecurity review. Didi had been advised by Chinese regulators to postpone its U.S. listing, but the tech firm went ahead with it last month, the Wall Street Journal has reported. (CNBC)

EQUITIES: Car House Holdings, based in Dongdong, China, withdrew its U.S. IPO registration statement, saying it has elected not to proceed with the public offering of ordinary shares. It had earlier planned an IPO of 3.85m shares at an estimated price of $6.50-$7.50 per share. (BBG)

EQUITIES: Apple Inc. has asked suppliers to build as many as 90 million next-generation iPhones this year, a sharp increase from its 2020 iPhone shipments, according to people with knowledge of the matter. The Cupertino, California-based tech giant has maintained a consistent level in recent years of roughly 75 million units for the initial run from a device's launch through the end of the year. The upgraded forecast for 2021 would suggest the company anticipates its first iPhone launch since the rollout of Covid-19 vaccines will unlock additional demand. The next iPhones will be Apple's second with 5G, a key enticement pushing users to upgrade. (BBG)

OTHER

U.S./CHINA: The Biden administration on Tuesday warned businesses with supply chain and investment ties to China's Xinjiang province that they could face legal consequences, citing growing evidence of genocide and other human rights abuses in the country's northwest region. The most-pointed line from the Xinjiang Supply Chain Business Advisory – published jointly by the State Department, Treasury, Commerce, Homeland Security, Labor and the Office of the U.S. Trade Representative – states that "businesses and individuals that do not exit supply chains, ventures, and/or investments connected to Xinjiang could run a high risk of violating U.S. law." The updated advisory strengthens previous warnings to companies by highlighting potential violations of U.S. law if their operations are linked even "indirectly" to the Chinese government in Xinjiang. (CNBC)

U.S./CHINA/HONG KONG: The U.S. will warn American companies this week of the increasing risks of operating in Hong Kong, three people familiar with the matter said, as Washington seeks to ramp up pressure over Beijing's crackdown on the financial center. Those risks include the Chinese government's ability to gain access to data that foreign companies store in Hong Kong, two of the people confirmed. The warning, first reported by the Financial Times, will come in the form of a business advisory, the people said. (BBG)

CORONAVIRUS: Vaccine safety and Guillain-Barré Syndrome will be the focus of an immunization advisory committee scheduled by the U.S. Centers for Disease Control and Prevention on July 22. The announcement comes after the fact sheet for Johnson & Johnson's Covid-19 shot was revised by federal regulators to warn about a "small possible risk" for the rare condition in which the immune system attacks the nerves. (BBG)

BOJ: With a Bank of Japan decision looming this week on possible green funding incentives, opinions within the central bank and the financial sector are split on whether lenders should be paid to support efforts to battle climate change. While economists are expecting the BOJ to pay commercial banks 0.1% on green lending, people familiar with the matter said that some financial institutions have told BOJ officials they don't want to earn interest from the central bank through the funding measure. In a series of meetings with the banking sector, some lenders said that approach could squeeze their profit margins if clients then demand lower borrowing rates, the people said. (BBG)

AUSTRALIA: Sydney extended its lockdown for a further two weeks as Australia's most-populous city battles an outbreak of the delta strain of the coronavirus that's already kept it isolated from the rest of the nation for three weeks. Stay-at-home orders will remain until at least July 30, New South Wales state premier Gladys Berejiklian told reporters Wednesday. The city recorded 97 new cases yesterday, including at least 24 who were infectious in the community despite being told to stay at home. (BBG)

AUSTRALIA: Victoria has recorded seven new local coronavirus cases. Four of those cases are in the Ariele Apartments complex in Maribyrnong in Melbourne's north-west, all on the third floor of the complex. The complex was visited by two removalists while infectious. One of the new cases is a man in his 60s, who visited the MCG on July 10 between 4pm and 8pm. (Sydney Morning Herald)

RBNZ: MNI STATE OF PLAY: RBNZ Toughens Up In A Hotter Than Expected Economy

- The Reserve Bank of New Zealand marked a significant change toward a tighter policy outlook in ending its quantitative easing programme in the face of an economy running hotter than expected, particularly in the housing market. The RBNZ's Monetary Policy Committee on Wednesday put a deadline on its Large Scale Asset Purchase (LSAP) program, well short of the original NZD100 billion limit (USD69.9 billion). Around NZD60 billion of bonds were purchased under the program, which will end on July 23. The central bank has maintained the Official Cash Rate at the record low 0.25%, and is continuing its Fund for Lending program which offers cheap funding to commercial banks - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: South Korea announced Wednesday it will elevate the social distancing scheme in regions outside the greater Seoul up one notch, as concerns of a fourth wave of new COVID-19 outbreaks over the summer grow stronger. The decision to implement Level 2 guidelines in regions outside Seoul, the western port city of Incheon and Gyeonggi Province on Thursday was announced in an interagency COVID-19 response meeting chaired by Prime Minister Kim Boo-kyum. Kim explained the decision was reached as the number of "newly confirmed patients outside of the capital area was also on the rise, amid the greater Seoul experiencing an extended COVID-19 emergency situation." Under Level 2 distancing, private gatherings of more than four people are banned. The central city of Sejong, the provinces of north and south Jeolla in the southwest and North Gyeongsang Province in the east, however, will be excluded. (Yonhap)

SOUTH KOREA: South Korea said Wednesday it plans to expand its investment in its signature New Deal policy projects in a bid to create more jobs and better prepare for the post-pandemic era. Under the "New Deal 2.0" initiative, the government will invest 220 trillion won (US$191 billion) in pushing for digital and green energy projects and promoting inclusive economic growth by 2025, up from its earlier investment plan of 160 trillion won. (Yonhap).

TURKEY: President Joe Biden is nominating former Republican Sen. Jeff Flake of Arizona as his ambassador to Turkey, whose alliance with the U.S. has in recent years been marked by major disagreements on key foreign policy issues. "I am honored and humbled by the trust President Biden has placed in me with this ambassadorial nomination," Flake wrote in a post on Medium. "This is a pivotal post at an important time for both of our countries," the former senator wrote. (CNBC)

BRAZIL: Brazil President Jair Bolsonaro announced the reduction of Pis/Cofins tax for diesel from 0.31 reais to 0.27 reais in a speech made during a ceremony in Brasilia. Economy Minister Paulo Guedes agrees with the decision, Bolsonaro said. President said that govt will eliminate a tax exemption for one sector, which he did not name. Bolsonaro said that his relationships with Lower House head Arthur Lira and Senate's Rodrigo Pacheco are "exceptional." Bolsonaro said that Brazil has seen no corruption since his administration began. (BBG)

BRAZIL: Rapporteur of Brazil's tax reform proposed cutting corporate income taxes by 12.5 percentage points to 2.5% by 2023, according to preliminary text of the bill seen by Bloomberg. Initial proposal by Economy Minister Paulo Guedes shaved off 10 p.p. off income taxes in coming years. Reduction of income tax will be made possible by slashing tax incentives that benefit 20,000 companies. Rapporteur also kept proposed dividend tax at 20%. Dividend tax targeted at investors, so levies paid between companies to holding firms are exempt. Rapporteur Celso Sabino tweeted some points of the text earlier, giving press conference on topic. (BBG)

BRAZIL: Exemption range for dividends may drop to 2,500 reais from 20,000 reais as govt proposed in tax reform bill and be valid for all companies, tax reform rapporteur in the lower house Celso Sabino said in an online event. Tax collections increase in the 2H21 may offset loss of revenue with the reform of the Income Tax, he said. Report likely to be voted in August. Report may change day trade taxation, which was reduced to 15% from 20% in tax reform, he said. (BBG)

SOUTH AFRICA: South Africa's biggest oil refinery, a joint venture between Royal Dutch Shell Plc and BP Plc known as Sapref, shut down because of safety concerns and logistical issues. The 180,000 barrel-a-day facility was closed "due to the ongoing civil unrest and disruption of delivery and supply routes in and out of the KwaZulu-Natal Province," the company said in an emailed response to questions. "This decision was taken after careful consideration of risks involved including the safety of our people" as well as operating without confirmed supply to the plant, it said. Widespread looting and violence in Africa's most industrialized nation has resulted in blocked roads and delays. Sasol Ltd., a chemical and fuel maker in South Africa reported disruptions to customer product deliveries, Sapref said. (BBG)

IRAN: The United States has been engaging in "indirect but active" discussions to secure the release of U.S. detainees in Iran, State Department spokesman Ned Price said on Tuesday, adding that Washington was treating those talks independently from the nuclear talks. (RTRS)

IRAN: An Iranian intelligence official and three others were charged with conspiring to kidnap a critic who was born in Iran but is now a U.S. citizen. Manhattan federal prosecutors on Tuesday said the intelligence official, Alireza Shavoroghi Farahani, and three members of his intelligence network planned to kidnap the unnamed U.S. citizen -- a journalist, author, and human rights activist who lives in Brooklyn -- as part of a government program to silence its critics. All four are in Iran, but a fifth person based in California was charged with providing financial services that aided the plot. (BBG)

METALS: There is a growing consensus that China needs to accelerate its iron ore diversification push, as at least 60% of its imports come from Australia, the Global Times said. In the first half, China's trade with South Africa and India both soared, and the iron ore trade was likely a big contribution, the newspaper said. Improving the utilization rate of steel scrap is also a necessary move to reduce dependency on iron ore imports, the newspaper said. China's iron ore imports reached 89.42 million tons in June, down 0.4 percent from May, while the value grew 7.43% to $16.78 billion, indicating urgent need for the diversification, the Times said. (MNI)

CHINA

ECONOMY: China needs countercyclical policies to keep growth in a reasonable range, help create immediate jobs and resolve cyclical downturn pressure, the Economic Information Daily said citing Liu Xiangdong, an economist with the China Center for International Economic Exchanges. While the economy is recovering, it faces uncertain global and domestic situations, long-standing issues and the pandemic, Liu was cited as saying. Liu commented after the newspaper reported Premier Li Keqiang's speech to a group of economists and businesspeople on Monday. Li repeated his mantra that China will keep monetary policies prudent, fiscal policies proactive, and won't resort to using excessive credit to achieve growth, according to the newspaper. (MNI)

POLICY: China should increase fiscal spending to further support its post-coronavirus recovery and help reach its economic growth target for the year, particularly after the central bank sent a signal that it expects slowing conditions ahead when it signalled last week that it would cut the reserve requirement ratio last week, analysts said. Calls for further monetary and fiscal policy stimulus have risen, with China's headline growth set to slow after an explosive rebound from the lows of a coronavirus-hit 2020 and in response to the likely fallout from continued tensions with major trading partners. A mainstream forecast of around 8 per cent year-on-year growth for the second quarter – impressive in comparison with major Western economies – analysts have expressed concerns of impending problems. These include a potential slowing of exports, weak consumption and rising bad loans. (SCMP)

PBOC: China has room to further cut banks' reserve requirement ratios to boost liquidity given the high RRRs held by most banks, the 21st Century Business Herald reported citing Lian Ping, the chief economist at Zhixin Investment Research Institute, who commented after the PBOC cut them by 50 bps across the board last week. For H2, manufacturing investment may become an important driver of economic recovery as industrial companies need to replenish inventories, while financial support to manufacturers will increase, Lian was cited as saying. On consumption, it may be difficult for retail sales to return to pre-pandemic levels due to the continued sparse domestic outbreaks of Covid-19 cases, with retail sales possibly growing 10% y/y in 2021, the newspaper cited Lian as saying. (MNI)

OVERNIGHT DATA

CHINA JUN FDI YTD CNY +28.7% Y/Y; MAY +35.4%

JAPAN MAY, F INDUSTRIAL OUTPUT +21.1% Y/Y; FLASH +22.0%

JAPAN MAY, F INDUSTRIAL OUTPUT -6.5% M/M; FLASH -5.9%

JAPAN MAY CAPACITY UTILISATION -6.8% M/M; APR +1.1%

AUSTRALIA JUL WESTPAC CONSUMER CONFIDENCE 108.8; JUN 107.2

AUSTRALIA JUL WESTPAC CONSUMER CONFIDENCE +1.5% M/M; JUN -5.2%

The survey was conducted over the week of July 5–9, during the lock-down in Sydney and restrictions in regional NSW but before the tightening of restrictions announced on July 9. Confidence has held up overall despite a sharp fall in NSW as other states – notably Victoria and Western Australia – recorded strong bounce-backs from COVID-related disruptions in June. The main takeaway is that concerns around the current virus outbreak and associated restrictions in NSW are not spilling over to the rest of the country. This contrasts with Victoria's 'second wave' outbreak in August last year which weighed heavily on sentiment across the rest of the country. The modest sentiment increase in July follows a 9.8% fall in the Index over the previous two months (April to June). That fall centred on weakness in Victoria (down 16%) and Western Australia (down 18%) with both states experiencing intermittent lock-downs as their governments sought to contain a lift in COVID cases. Confidence in NSW remained steady throughout the April to June period. This pattern reversed in July. The sharp rise in COVID cases and associated move to lock-down in Sydney hit NSW consumer confidence hard, the state index dropping 10.2%, including a 13.6% fall in Sydney. However, this was fully offset by strong recoveries in Victoria (up 10.5%) and Western Australia (up 15%) as both states came out of lock-down. The current fall in Sydney compares with a 7.3% fall in Sydney during the Northern Beaches lock down at the start of the year and the 18.7% fall in Melbourne heading into the 'second wave' lockdown in June-August last year. (Westpac)

NEW ZEALAND MAY NET MIGRATION +1,182; APR +832

SOUTH KOREA JUN UNEMPLOYMENT 3.7%; MEDIAN 3.8%; MAY 3.8%

SOUTH KOREA JUN EXPORT PRICE INDEX +12.7% Y/Y; MAY +12.6%

SOUTH KOREA JUN EXPORT PRICE INDEX +0.7% M/M; MAY +1.8%

SOUTH KOREA JUN IMPORT PRICE INDEX +14.0% Y/Y; MAY +14.2%

SOUTH KOREA JUN IMPORT PRICE INDEX +2.3% M/M; MAY +3.0%

SOUTH KOREA JUN BANK LENDING TO HOUSEHOLD TOTAL KRW1,030.4TN; MAY KRW1,024.1TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:27 am local time from the close of 2.1661% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4806 WEDS VS 6.4757

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4806 on Wednesday, compared with the 6.4757 set on Tuesday.

MARKETS

SNAPSHOT: RBNZ's August Meeting Now Deemed Live

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 90.5 points at 28627.59

- ASX 200 up 19.444 points at 7351.5

- Shanghai Comp. down 29.264 points at 3537.258

- JGB 10-Yr future up 1 tick at 152.26, yield down 0.5bp at 0.020%

- Aussie 10-Yr future down 2.5 ticks at 98.645, yield up 2.6bp at 1.353%

- U.S. 10-Yr future +0-04 at 133-03+, yield down 1.85bp at 1.398%

- WTI crude down $0.36 at $74.89, Gold up $4.04 at $1811.73

- USD/JPY down 13 pips at Y110.50

- FED'S KAPLAN UPS PCE OUTLOOK TO 3.9%, URGES TAPER TALK (MNI)

- SENATE DEMOCRATS AGREE TO $3.5 TRILLION TAX, SPENDING PLAN (BBG)

- FITCH AFFIRMED THE UNITED STATES AT AAA; OUTLOOK NEGATIVE

- RBNZ COMES DOWN ON THE HAWKISH SIDE, AUGUST MEETING NOW SEEN AS LIVE RE: OCR HIKE

- SYDNEY LOCKDOWN EXTENDED, COVID CASES IN MELBOURNE TICK HIGHER

BOND SUMMARY: U.S. Tsys Off Lows, JGBs Unwind Overnight Losses

The space has firmed after T-Notes had a brief and shallow look through Tuesday's low, with that particular contract now +0-04 on the day, printing 133-03+, a touch shy of best levels. The major cash Tsy benchmarks run unch. to 2.0bp richer across the curve. There was little in the way of overt headline flow to trigger the shunt higher. More recently, headlines have crossed the wires noting that Democrats on the Senate Budget Committee have reached an agreement on a $3.5tn fiscal plan, which aims to advance President Biden's Jobs & families initiative without support from the GOP. Overnight flow was dominated by the TYU1 133/132 1x2 put spread which saw ~15K lifted on screen.

- JGB futures have unwound their overnight losses alongside a modest bid in the U.S. Tsy space, with the contract now +2 on the day. Cash JGB trade sees the major benchmark yields print unchanged to 1.0bp lower. Local headline flow remains light. The latest round of BoJ Rinban operations (covering 1- to 10-Year and 25+ Year JGBs) saw steady to lower offer to cover ratios which will have offered some incremental support during afternoon trade. The BoJ's two-day policy meeting gets underway on Thursday. Elsewhere, Thursday will provide the latest liquidity enhancement auction covering off-the-run JGBS with 1- to 5-Years until maturity.

- There was nothing in the way of notable trans-Tasman impetus for ACGBs in the wake of the latest monetary policy decision from the RBNZ, with the stark divergence between the RBNZ & RBA punctuated by the RBNZ's move to declare a halt to its LSAP scheme come the end of next week, while the NZ OIS strip now prices a 65% chance of a rate hike at the end of the RBNZ's August meeting (given the Bank's new least regrets train of thought). Fresh multi-year lows for the Australia/NZ 2-Year swap spread were printed in the process. YM -3.5 & XM -2.5 at typing, with the contracts underwater for the entirety of the Sydney session after struggling overnight. In terms of local news, the Sydney lockdown was extended by 2 weeks, until at least July 30 (most expect a further extension to kick in then), while a handful of new COVID cases were detected in Melbourne. Thursday will bring the latest round scheduled ACGB purchases from the RBA, as well as the latest local monthly labour market report.

BOJ: Rinban Offers

The BoJ offers to buy a total of Y1.375tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$800mn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.25% 21 May 2032 Bond, issue #TB158:- Average Yield: 1.3878% (prev. 1.6120%)

- High Yield: 1.3900% (prev. 1.6150%)

- Bid/Cover: 5.3213x (prev. 3.8300x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 14.2% (prev. 34.7%)

- bidders 42 (prev. 43), successful 15 (prev. 22), allocated in full 6 (prev. 14)

EQUITIES: Mixed After Negative Lead From US

A broadly negative day for equity markets in the Asia-Pac region. Markets in mainland China are lower by around 1%, weighed on by simmering Sino-US tensions, while there were reports that Cathie Wood sold China tech stocks and warned of a valuation reset. Markets in Japan are down around 0.25% while the KOSPI also came under pressure on reports of a record increase in coronavirus cases. In Taiwan the Taiex managed to squeeze out some gains after reports that Apple is looking to increase iPhone production up to 20% in 2021. In the US futures are mixed, e-mini S&P and e-mini Dow Jones are both lower, extending losses from yesterday where the indices dropped for the first time in three sessions. Nasdaq futures are slightly higher.

OIL: Crude Futures Edge Lower

Crude futures are slightly lower in Asia, dropping after faltering ahead of the week's highs; WTI is down $0.26 from settlement levels at $74.99/bbl, Brent is down $0.20 at $76.31. Despite the drop both benchmarks continue to recover off last week's lows, with Brent (U1) key resistance defined at $77.84, Jul 6 high. Key support undercuts initially at $72.11, Jul 8 low. WTI (Q1) key resistance is at $76.98, Jul 6 high and the bull trigger. Initial firm support lies at $70.76, Jul 8 low. Focus Wednesday turns to the weekly DoE inventory data, with markets expecting another draw of over 4mln bbls for the headline crude numbers. If the print matches estimates it would be eight consecutive weekly decline in stocks. Inventory figures from API yesterday showed crude stocks fell 4.079m bbls, while stocks at Cushing, OK fell 1.59m bbls.

GOLD: Muted Reaction To U.S. CPI

Hotter than expected U.S. CPI data has failed to push the yellow metal out of its recent range, with spot last dealing ~$5/oz or so higher, a little above $1,810/oz. Ultimately, the spill over from the dip in U.S. real yields was countered by the firming of the broader USD, leaving the well-defined technical picture intact.

FOREX: Hawkish Surprise From RBNZ Sends Kiwi Flying

The RBNZ delivered a hawkish surprise, as it announced an imminent halt to its LSAP programme. The decision caught many off guard, given the RBNZ's aversion to tweak policy at non-MPS meetings, resulting in yet another round of hawkish repricing of future OCR path. A 25bp hike by the end of the November meeting is now fully priced in, with implied odds of an earlier hike in August sitting around 70% (as per BBG WIRP tool). In addition, ANZ and ASB brought forward their forecasts of the next hike to August, while Westpac flagged an increased risk of that scenario coming to fruition. The RBNZ's hawkish turn sent the NZD rallying across the board, with a usual degree of trans-Tasman spillover lending support to the AUD.

- NZD/USD pierced the round figure of $0.7000 and rose to a weekly high ($0.7023), with NZD/USD overnight volatility moving further away from a four-month peak printed on Wednesday.

- AUD/NZD tumbled to its lowest point in six weeks, as the Australia/New Zealand 2-Year swap spread tested levels not witnessed since early '16. A sense of concern about the virus situation in NSW continued to linger.

- The DXY ground lower from the off, trimming some of its post-CPI gains. The greenback was the worst G10 performer amid a mixed showing from U.S. e-minis.

- Sterling remained somewhat wobbly as UK PM Johnson's decision to lift remaining Covid-19 restrictions despite a surge in infections generated some angst.

- UK inflation data, EZ industrial output and remarks from ECB's Schnabel & BoE's Ramsden take focus in Europe. In America, Fed Chair Powell testifies to lawmakers, while the BoC deliver their MonPol decision.

FOREX OPTIONS: Expiries for Jul14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E1.1bln), $1.1850(E513mln), $1.1865-85(E996mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

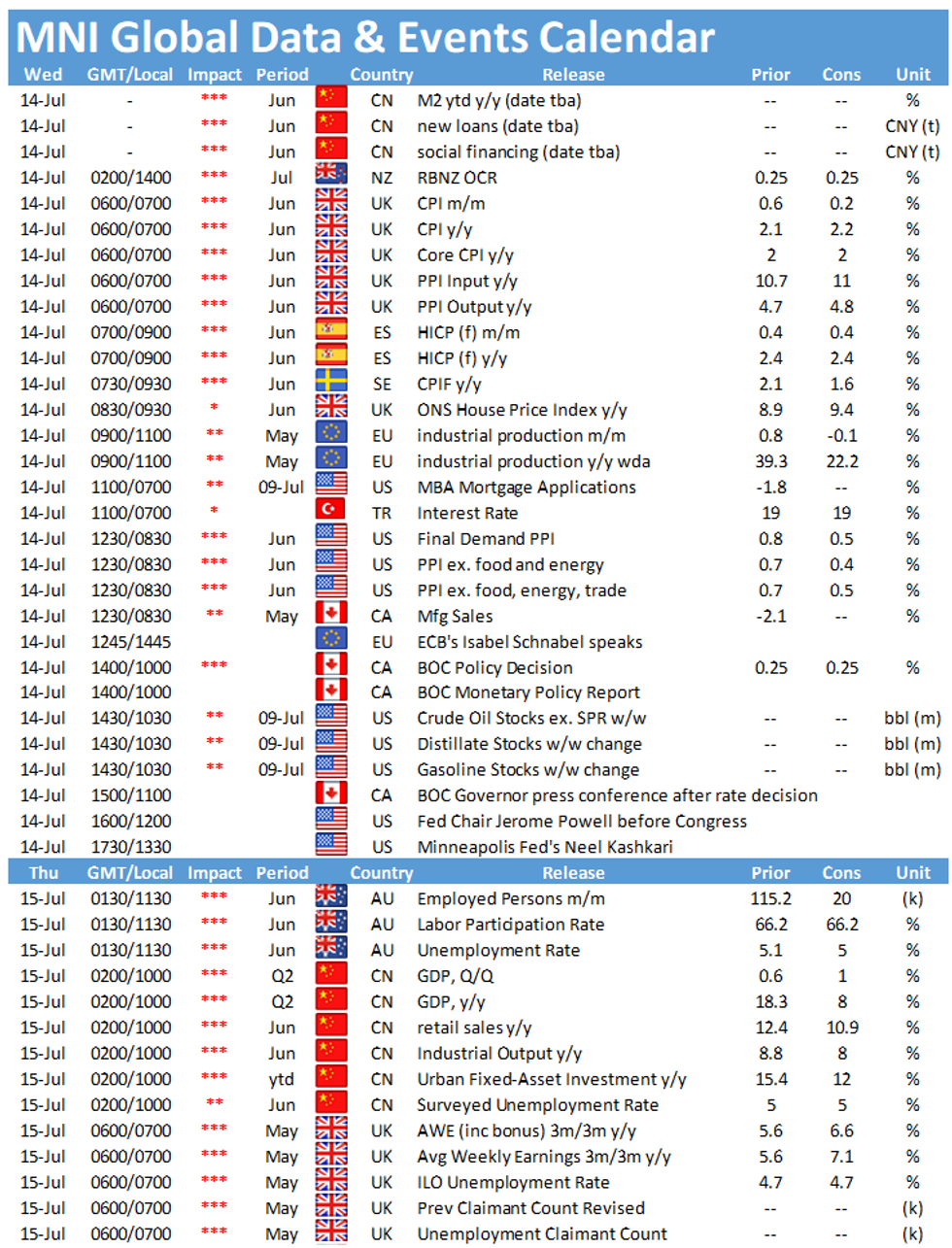

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.