-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE's Ramsden Flags Potential For Earlier Than Exp. Tightening, Familiar Themes Eyed In Asia

EXECUTIVE SUMMARY

- U.S. EXTENDS TRUMP-ERA HALT TO ECONOMIC DIALOGUE WITH CHINA (BBG)

- BOE'S RAMSDEN: TIGHTENING COULD COME EARLIER (MNI)

- BOE'S RAMSDEN: COULD END GBP150BN QE ROUND EARLY (MNI)

- CHINA MAY LOWER LPR BUT NOT CUT POLICY RATE (CSJ)

- TALK OF ANOTHER LOCKDOWN IN AUSTRALIAN STATE OF VICTORIA

- BANK OF KOREA ON TRACK FOR RATE HIKE AS VIRUS HIT PLAYED DOWN (BBG)

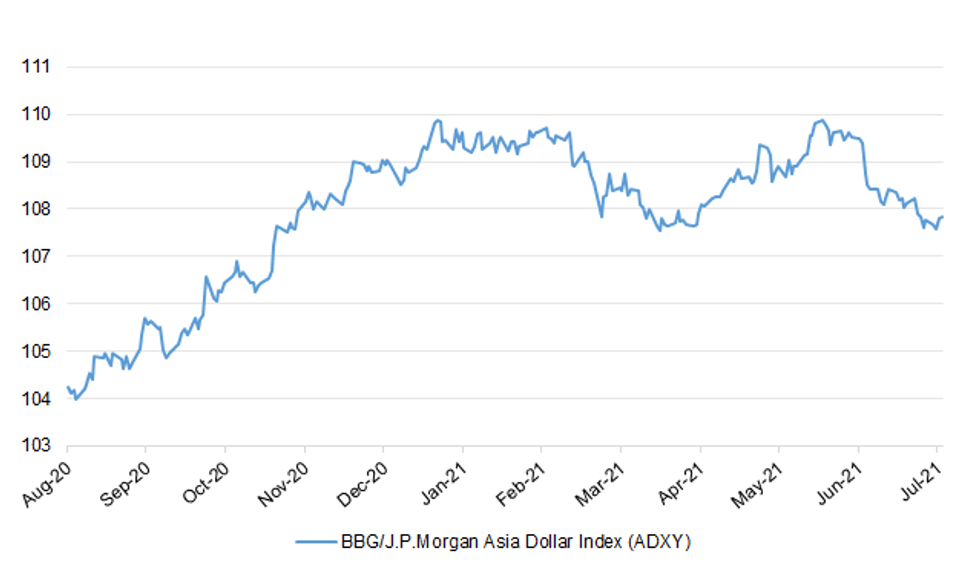

Fig. 1: BBG/J.P.Morgan Asia Dollar Index (ADXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Covid passports could be used in pubs, bars and restaurants as new government guidance for businesses urged their wider rollout. (Telegraph)

CORONAVIRUS: Most Covid rules in Wales - but not all - are set to be scrapped from 7 August. The Welsh government said all laws on the number of people who can meet will end but First Minister Mark Drakeford warned against "a free for all." Nightclubs would be able to reopen, but face masks will still be required in most indoor public places except in pubs, restaurants and schools. Some rules will change on Saturday, meaning six people can to meet in private homes and holiday homes. Despite the plan to ease many rules, people will be asked to continue working from home wherever possible. (BBC)

CORONAVIRUS: The Balearic Islands, which include the tourist hotspots of Ibiza, Majorca and Minorca, will be moved back to the amber travel list. Transport Secretary Grant Shapps said the measure will take effect in England from 4am on Monday, which will coincide with changes to the rules on quarantine for people arriving from amber destinations. The Scottish and Welsh government have announced they will make the same move, with Northern Ireland expected to put out a statement later. (Sky)

BOE: MNI BRIEF: BOE Ramsden: Tightening Could Come Earlier

- Bank of England Deputy Governor Dave Ramsden said Wednesday that the conditions "for considering tightening could be met somewhat sooner than I had previously expected," with activity accelerating and Covid restrictions being removed somewhat earlier than previously assumed. Speaking at a Strand Group event at King's College London, Ramsden said that he now put more weight on his inflationary than disinflationary scenario but he warned that it should not be taken for granted that "the recent strength in demand and inflation will be sustained." Ramsden's remarks show a centrist voter on the MPC edging towards earlier tightening, with the balance of risks shifting - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOE: MNI BRIEF: BOE Ramsden: Could End GBP150bn QE Round Early

- Bank of England Deputy Governor Dave Ramsden left the door open to ending the current GBP150 billion asset purchase programme early in comments Wednesday. The current round of bond buying is set to be completed by around the end of the year but Ramsden said that "it is conceivable we would not complete the current programme." Only Chief Economist Andy Haldane, who has since stepped down from both the BOE and the Monetary Policy Committee, voted to end the programme early at the June meeting but Ramsden made clear that early termination is a live option. Asked about other tools for tightening policy Ramsden said the MPC could opt to stop, in part or full, the reinvestment of maturing gilts or could move to outright sales of the government bonds it holds. The MPC is currently in the midst of a review of tightening policy, with an initial report expected at some point in Q3 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Chancellor Rishi Sunak is to warn ministers to prepare for a tough spending settlement for the rest of the parliament, as he seeks to rein in a £300bn deficit at a time of huge post-Covid pressures on public services. Sunak wants ministers running government departments to work over the summer to identify savings as well as spending priorities, while he tries to find more money for the NHS, schools, courts and promised reforms to social care, according to people briefed on his plan. The chancellor aims to set out the ground rules for his autumn comprehensive spending review, which is expected to outline budget totals for Whitehall departments for the last three years of the parliament, in a letter to ministers next week, although the timetable could slip. (FT)

POLICY: Boris Johnson will on Thursday promise voters in the South that his flagship strategy to "level up" the nation will not make them poorer. (Telegraph)

BREXIT: Increased cross-border trade in Ireland as a result of the Northern Ireland Protocol is "in many ways a problem", UK Brexit Minister Lord Frost has said. The protocol makes it harder for businesses in either part of Ireland to import goods from Great Britain. That has contributed to a surge in trade between Northern Ireland and the Republic. Lord Frost said this was a problem as it showed Northern Ireland firms cannot use their first choice suppliers. "I don't think it totally makes sense for us to encourage more of that development, rather than deal with the consequences of it," he told a House of Lords Committee. The protocol, which Lord Frost negotiated, keeps Northern Ireland in the EU's single market for goods, which means that products arriving from Great Britain are subject to new checks and controls. (BBC)

EUROPE

FISCAL: MNI: Eurozone Mulls Shift To Targeted Fiscal Stance-Source

- Eurozone finance ministers will monitor economic data and the development of the pandemic over the summer as they grow increasingly confident of being able to agree a withdrawal of blanket pandemic fiscal support measures in favour of a more selective approach targeting certain sectors towards the end of the year, a source close to the Eurogroup told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: The Serum Institute of India, which makes the version of the AstraZeneca Plc vaccine known as Covishield, said European approval of the jab is expected within a month, the Telegraph reported. (BBG)

IRELAND: Irish Debt Office says now guiding a narrower funding range, from previous guidance of EU16B to EU20B. Says already raised EU14.75b in long-term bond funding. Says "guidance takes account of our progress year to date and levels of prefunding entering 2021, along with additional funding from private placements with ultra-long maturities and continued retail inflows into State savings." (BBG)

U.S.

FED: MNI BRIEF: Fed's Powell Monitoring Inflation, Seen Temporary

- Federal Reserve Chairman Jerome Powell said Wednesday he's not worried about recent high readings on inflation because the spikes "are coming from a small group of goods and services that are tied to the reopening of the economy." "We are monitoring the situation very carefully. If we were to see that inflation was remaining high and was threatening to uproot inflation expectations then we would absolutely change our policy as appropriate," he said in response to questions from lawmakers - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Powell - MBS Not Main Fuel to Housing Prices

- Federal Reserve Chair Jerome Powell said Wednesday the central bank's agency mortgage-backed securities purchases are not the primary reason for the hot housing market but officials will debate pulling back on those purchases in the coming FOMC meeting - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: US Growth Strengthens Further, Fed Beige Book Says

- The U.S. economy strengthened further from late May to early July, displaying moderate to robust growth, and prices increased at an above-average pace, according to the Fed's anecdotal report on current conditions released Wednesday. Three-quarters of Fed districts reported slight or modest job gains and the remainder reported moderate or strong increases in employment, and there was "healthy labor demand" that was broad-based but seen as strongest for low-skilled positions, the report said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Senate Democrats revealed on Wednesday key details of their $3.5 trillion budget framework, a starting point for a Democrat-only bill for "human" infrastructure that would enhance federal safety net programs, expand Medicare and tackle climate change. The release of the FY2022 budget deal formally kicks off the process for getting a pair of infrastructure bills across the finish line. (Axios)

FISCAL: Sen. Joe Manchin, the Democrats' most pivotal swing vote, expressed his most serious concerns yet about a key element in their party's $3.5 trillion sweeping economic plan: Provisions dealing with climate change that have been sought by progressives. Manchin, who hails from coal-producing West Virginia, told CNN that he's "very, very disturbed" by provisions he believes would eliminate fossil fuels -- a warning sign for Democrats who need all 50 members of their caucus to sign off on the plan in order to get it through the Senate. But the climate provisions are key to getting support from liberals, particularly in the House. And how Democratic leaders keep both factions of their caucus will be key to determining if they can approve much of President Joe Biden's domestic agenda by the fall. (CNN)

CORONAVIRUS: Ohio says its public schools and universities can't require students or staff to be vaccinated against Covid-19, under a bill that bars institutions from requiring people to be vaccinated with shots that haven't received a full approval by the FDA. None of the Covid-19 vaccines have reached that stage so far. (BBG)

OTHER

MACRO: ECB to release Yellen, Lagarde podcast conversation 10:00 ET. (BBG)

GLOBAL TRADE: Ireland is set to abandon its long-held 12.5% corporation tax rate later this year, several senior Government sources have suggested. While no formal government decision has yet been made, several Government sources have told the Irish Examiner it is the expectation that our major tax incentive for large multi-national firms is set to be relinquished as part of a new OECD tax agreement in October. (Irish Examiner)

U.S./CHINA: Treasury Secretary Janet Yellen and her staff have no plans to resurrect the regular U.S.-China economic dialogue that governed ties between the two nations during the Bush and Obama administrations, continuing for now the suspension put in place under President Donald Trump. While Yellen's team, and those of other departments, are in touch with Chinese counterparts, the expectation for now is not to restart formal high-level talks, according to people familiar with the situation. A Treasury spokeswoman declined to comment. The disinterest in reopening channels active under President Barack Obama adds to evidence of President Joe Biden's toughening stance on China, which is pointing toward a continuing deterioration in ties between the world's two biggest economies. (BBG)

U.S./CHINA: The U.S. is pursuing "decoupling" with China using human rights issues as a pretext, and such measures as banning U.S. companies from supply chains involving Xinjiang will severely undermine bilateral cooperation on climate change and finance, the Global Times said citing Lv Xiang, a researcher at the state-run think tank Chinese Academy of Social Sciences. The Biden administration will open the stage for Chinese countermoves including the first use of China's entity list to punish unreliable supply chain partner companies and cause more boycotts of their goods by Chinese consumers, the newspaper said. Xinjiang accounts for around half of the world's polysilicon capacity, raw material for solar panels, so the measures will hurt U.S. efforts developing renewable energy, the newspaper said. (MNI)

GEOPOLITICS: Britain's top domestic spymaster cautioned citizens on Wednesday to treat the threat of spying from Russia, China and Iran with as much vigilance as terrorism, in a shift of focus back to counter-espionage nearly two decades after the 9/11 attacks. (RTRS)

CORONAVIRUS: Covid infections are rapidly rising again in the U.S. and Latin America as more contagious variants spread, putting the entire region at risk, World Health Organization officials said in a briefing Wednesday. Renewed spikes in infections are also exacerbating instability and violence across several countries in Latin America and the Caribbean, officials said, noting political upheaval in Haiti, Cuba and other nations as the delta variant takes hold in the Americas. "Many countries, including the United States, are seeing a resurgence of infections in North America, the U.S. and Mexico are reporting an increase in new infections across most states, many Central American nations are also seeing cases," Dr. Carissa Etienne, director of the Pan American Health Organization, WHO's regional bureau for the Americas, said Wednesday. (CNBC)

HONG KONG: Hong Kong will allow vaccinated residents and workers to return from nations it has deemed extremely high-risk, the South China Morning Post reported. Travelers will have to provide inoculation records and a negative Covid-19 test before boarding a flight to Hong Kong. Unvaccinated students stranded in the U.K. can also return home. (BBG)

JAPAN: Japan's health ministry will expand the approval of Moderna's Covid vaccine to those aged 12 and older, public broadcaster NHK reports, citing an unidentified person. (BBG)

JAPAN: Japan needs another extra budget of up to $270 billion to support economic growth while its battle with the coronavirus drags on, says an adviser to Prime Minister Yoshihide Suga. Economist Heizo Takenaka, in an interview this week, joined ruling party members calling for more spending as Japan muddles through a fourth virus emergency and voters prepare to head to the polls for elections by the fall. (BBG)

JAPAN: About two-thirds of Japanese firms are passing on rising raw materials costs to customers or planning to do so as surging global commodity markets drive up import costs and squeeze bottom lines amid the COVID-19 pandemic, a Reuters poll showed. Below are the questions and answers in the June 30-July 9 Corporate Survey, conducted for Reuters by Nikkei Research. Answers are denoted in percentages. The poll and reply totals are in absolute terms. Some 240 non-financial firms replied to the survey. (RTRS)

BOJ: The Bank of Japan is set to lower Japan's GDP growth outlook for this fiscal year from earlier prediction of 4% at its two-day policy meeting starting Thurs., public broadcaster NHK reports, without elaborating. BOJ will reflect the impact of the latest coronavirus state of emergency declared for Tokyo, NHK says, without citing anyone. The bank is expected to stand pat on its monetary easing policy and is looking to offer incentives to lenders in the climate scheme it said it would outline in the upcoming policy meeting; exploring possibility of adding interest to current account balances depending on outstanding loans and investments made in relation to climate change. (BBG)

AUSTRALIA: Victoria is expected to enter a snap lockdown tonight, with The Herald Sun reporting the decision is set to be announced later today. The lockdown is expected to start from midnight tonight,with health department sources telling the publication that the restrictions would be similar to the state's previous lockdown. This means there will likely be just five reasons to leave home, schools will close, with the lockdown expected to last for three or five days. (News AU)

AUSTRALIA: In response to the three new cases, Queensland will extend the mandatory mask rule for the greater Brisbane area for another week. They were due to ease tomorrow. The mask rule will lift for Townsville, which was part of the original restrictions, at 6am tomorrow. (Guardian)

BOK: Bank of Korea Governor Lee Ju-yeol said the central bank will discuss raising its key interest rate from its next meeting in August after playing down the likelihood that the latest virus surge will dent the economy's recovery. While the bank left rates unchanged at 0.5% at the end of its policy meeting Thursday morning, a call for a quarter percentage point hike from one member helped send Korea bond futures plunging and strengthened the won as investors boosted their hawkish bets the BOK to move early. "The need to deal with the issue of financial imbalances through the normalization of monetary policy has become greater than before," Lee said at a press briefing following the decision. (BBG)

CANADA: Canada is expected to announce government support for Pratt & Whitney to bring a hybrid engine to first flight, as the country eyes a broader role in developing new technologies to lower emissions, two people with knowledge of the matter told Reuters. The unspecified "co-investment" toward a demonstration flight of the hybrid engine for regional turboprops is part of a wider announcement for aerospace expected on Thursday, they said. (RTRS)

BRAZIL: Brazil is hoping to raise 100 billion reais ($19.64 billion) with a much-awaited income tax reform proposal, Economy Minister Paulo Guedes said on Wednesday, as the government sharply raised its economic growth forecast for 2021. Brazil's economy ministry on Wednesday said gross domestic product in Latin America's largest economy should grow 5.3% this year, up from its previous forecast of 3.5%. It also raised its 2021 inflation expectations to 5.90% from a previous forecast of 5.05%. Still, the central bank, which operates independently of the ministry, said earlier on Wednesday that Brazil's economy had shrunk in May, surprising economists who had expected it to grow. (RTRS)

BRAZIL: Brazil's Jair Bolsonaro was diagnosed with an intestinal obstruction and will be flown to Sao Paulo for additional exams that will tell whether he needs to undergo emergency surgery. The 66-year-old president had been hospitalized in Brasilia earlier on Wednesday with abdominal pain after more than 10 days of hiccups. Antonio Luiz Macedo, the surgeon who operated on Bolsonaro after his 2018 stabbing, was called to evaluate his situation and decided to transfer him to Sao Paulo, according to a statement from the presidential office. "He will have additional exams to determine whether or not an emergency surgery will be needed," the statement read. (BBG)

SOUTH AFRICA: Excess deaths, seen as a more precise way of measuring total fatalities from the coronavirus, rose for a fourth week in South Africa and hit pandemic-era records in two provinces as a third wave of infections continues to take hold in the country. In the week ended July 4, the country recorded 7,374 deaths compared with 2,631 official deaths from the virus, the South African Medical Research Council said in a report Wednesday. The number of deaths, which is measured against a historical average, exceeded the peak of a first wave of infections in July last year but was about half of that of the peak of the second in January. (BBG)

SOUTH AFRICA: ImmunityBio Inc.'s hAd5 T-cell Covid-19 vaccine won approval from South Africa's health products regulator for a trial as a booster shot in a study of 480,000 health workers in the country who have received Johnson & Johnson's inoculation. (BBG)

SOUTH AFRICA: South Africa's petroleum industry body SAPIA said on Wednesday supplies of petroleum products are "currently stable" after the country's main refinery in Durban shut down due to widespread looting. "SAPIA is actively engaging with the (government) to ensure that adequate supply to the market is maintained," the South African Petroleum Industry Association said in a statement. SAPIA represents major refinery operators, such as BP and Shell, in Africa's most advanced economy which is a net importer of petroleum products. (RTRS)

IRAN: Iran is not prepared to resume negotiations on coming back into compliance with the 2015 nuclear deal until Iranian President-elect Ebrahim Raisi's administration has begun, a diplomatic source said on Wednesday. The source, who spoke on condition of anonymity, said Iran had conveyed this to European officials acting as interlocutors in the indirect U.S.-Iranian negotiations and that the current thinking is the Vienna talks will not resume before mid-August. "They are not prepared to come back before the new government," said the source, saying it was not clear whether this meant until Raisi formally takes over on Aug. 5 or until his government is in place. "We are now talking probably not before mid-August," added the source. (RTRS)

IRAN: Outgoing Iranian Foreign Minister Mohammad Javad Zarif wrote in a report to parliament that the Biden administration has agreed to lift almost all U.S. sanctions on Iran to secure a mutual return to the 2015 nuclear deal. The report includes details that hadn't been made public before now and is the most official and comprehensive Iranian account of the status of the indirect talks with the U.S. The Farsi-language document also serves as Zarif's "political will" for the incoming hard-line administration. (Axios)

IRAN: Iran said on Wednesday it could enrich uranium up to 90% purity -- weapons grade -- if its nuclear reactors needed it, but added it still sought the revival of a 2015 deal that would limit its atomic programme in return for a lifting of sanctions. President Hassan Rouhani's remark is his second such public comment this year about 90% enrichment -- a level suitable for a nuclear bomb -- underlining Iran's resolve to keep breaching the deal in the absence of any accord to revive it. The biggest obstacle to producing nuclear weapons is obtaining enough fissile material - weapons-grade highly enriched uranium or plutonium - for the bomb's core. Iran says it has never sought nuclear weapons. (RTRS)

CHINA

PBOC: The People's Bank of China is likely to cut loan prime rates this month, but not lower policy rates soon as liquidity in the domestic financial markets looks ample in the third quarter, China Securities Journal cites analysts as saying. A recent investor survey by Huatai Securities shows 93% of respondents don't expect the PBOC to cut open market operation rates on July 15. But some analysts including CITIC Securities' Ming Ming expects a likely cut in LPR on July 20. (BBG)

LOCAL GOV'T BONDS: China's local governments are expected to significantly increase the selling of the so-called special-purpose bonds to invest more in infrastructure in the third quarter, the Securities Times reported citing industry insiders. As of July 12, disclosed offerings of Q3 special-purpose bonds totaled CNY1.3 trillion, compared with CNY1 trillion for the first half, the newspaper said citing Ministry of Finance data. The special-purpose bonds will provide the fiscal stimulus to prop up growth as the previous drivers of exports and real estate began to weaken, the newspaper said citing economists. (MNI)

COMMODITIES: China's State Council said authorities will severely punish and publicly shame those found profiting from illegal hoarding and reselling commodities and evade taxes, after a recent audit found such instances that disrupted market order and fair competition, according to a statement on Gov.cn following a Wednesday meeting chaired by Premier Li Keqiang. The cabinet also ordered officials to continue to be frugal and curb spending, carry out tax reductions and job creation policies that support small businesses, the statement read. Authorities should also further improve delivery services in rural regions that facilitate e-commerce and spending, according to the statement. (MNI)

OVERNIGHT DATA

CHINA Q2 GDP +7.9% Y/Y; MEDIAN +8.0%; Q1 +18.3%

CHINA Q2 GDP YTD +12.7% Y/Y; MEDIAN +12.7%; Q1 +18.3%

CHINA Q2 GDP +1.3% Q/Q; MEDIAN +1.0%; Q1 +0.4%

CHINA JUN INDUSTRIAL OUTPUT +8.3% Y/Y; MEDIAN +7.9%; MAY +8.8%

CHINA JUN INDUSTRIAL OUTPUT YTD +15.9% Y/Y; MEDIAN +16.0%; MAY +17.8%

CHINA JUN RETAIL SALES +12.1% Y/Y; MEDIAN +10.8%; MAY +12.4%

CHINA JUN RETAIL SALES YTD +23.0% Y/Y; MEDIAN +22.8%; MAY +25.7%

CHINA JUN FIXED ASSETS EX RURAL YTD +12.6% Y/Y; MEDIAN +12.0%; MAY 15.4%

CHINA JUN PROPERTY INVESTMENT YTD +15.0% Y/Y; MEDIAN +16.0%; MAY +18.3%

CHINA JUN UNEMPLOYMENT 5.0%; MEDIAN 5.0%; MAY 5.0%

CHINA JUN NEW HOME PRICES +0.41% M/M; MAY +0.52%

JAPAN MAY TERTIARY INDUSTRY INDEX -2.7% M/M; MEDIAN -0.9%; APR -0.8%

AUSTRALIA JUN UNEMPLOYMENT RATE 4.9%; MEDIAN 5.1%; MAY 5.1%

AUSTRALIA JUN EMPLOYMENT CHANGE +29.1K; MEDIAN +20.0K; MAY 115.2K

AUSTRALIA JUN FULL-TIME EMPLOYMENT CHANGE +51.6K; MAY +97.5K

AUSTRALIA JUN PART-TIME EMPLOYMENT CHANGE -22.5K; MAY +17.7K

AUSTRALIA JUN PARTICIPATION RATE 66.2%; MEDIAN 66.2%; MAY 66.2%

AUSTRALIA JUL CONSUMER INFLATION EXPECTATION +3.7% Y/Y; JUN +4.4%

AUSTRALIA JUN RBA FX TRANSACTIONS GOV'T -A$2.509BN; MAY -A$826MN

AUSTRALIA JUN RBA FX TRANSACTIONS MARKET +A$2.484BN; MAY +A$809MN

AUSTRALIA JUN RBA FX TRANSACTIONS OTHER +A$2.317BN; MAY -A$379MN

CHINA MARKETS

PBOC NET DRAINS CNY30BN VIA MLF THURSDAY

The People's Bank of China (PBOC) conducted CNY100 billion through one-year medium-term lending facility (MLF) with the rate unchanged at 2.95%and CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation drained net CNY30 billion from the market as CNY400 billion MLF and CNY10 billion matured today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample considering the demands for medium and long term funds at current tax payment period, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1690% at 10:17 am local time from the close of 2.1535% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Wednesday, unchanged from the previous trading day.

PBOC SETS YUAN CENTRAL PARITY AT 6.4640 THURS VS 6.4806

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4640 on Thursday, compared with the 6.4806 set on Wednesday.

MARKETS

SNAPSHOT: BoE's Ramsden Flags Potential For Earlier Than Exp. Tightening, Familiar Themes Eyed In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 327.53 points at 28280.46

- ASX 200 down 22.092 points at 7332.7

- Shanghai Comp. up 8.211 points at 3536.712

- JGB 10-Yr future up 3 ticks at 152.33, yield down 0.4bp at 0.015%

- Aussie 10-Yr future up 5.0 ticks at 98.705, yield down 5.1bp at 1.289%

- U.S. 10-Yr future +0-04+ at 133-19, yield down 1.35bp at 1.332%

- WTI crude down $0.61 at $72.52, Gold down $0.66 at $1826.80

- USD/JPY down 12 pips at Y109.85

- U.S. EXTENDS TRUMP-ERA HALT TO ECONOMIC DIALOGUE WITH CHINA (BBG)

- BOE'S RAMSDEN: TIGHTENING COULD COME EARLIER (MNI)

- BOE'S RAMSDEN: COULD END GBP150BN QE ROUND EARLY (MNI)

- CHINA MAY LOWER LPR BUT NOT CUT POLICY RATE (CSJ)

- TALK OF ANOTHER LOCKDOWN IN AUSTRALIAN STATE OF VICTORIA

- BANK OF KOREA ON TRACK FOR RATE HIKE AS VIRUS HIT PLAYED DOWN (BBG)

BOND SUMMARY: Core FI Generally Bid In Asia

U.S. Tsys showed little in the way of reaction to the Chinese data dump, with the quarterly GDP and monthly economic activity readings generally in line to a touch firmer vs. broader exp. T-Notes struggled to extend through the July 12 high overnight (133-20+), with the contract topping out at 133-21, last printing +0-05 on the day at 133-19+. The cash Tsy curve has seen some modest bull flattening, extending the move seen on Wednesday, with 2s little changed on the day, while the longer end of the cash Tsy curve runs as much as ~2.0bp richer. Weekly jobless claims and some of the regional Fed activity indices are due to be released during NY hours. Elsewhere, Fed Chair Powell will testify on the Hill for a second day, while Chicago Fed President Evans ('21 voter) will speak on the economy.

- JGB futures managed to add to their overnight gains at the Tokyo reopen, before pulling back to last print +4. Cash JGB trade has seen some outperformance for the 20- to 40-Year zone of the curve, which has richened by ~1.5-2.0bp given the overnight dynamic in U.S. Tsys, while the remaining benchmarks have richened by ~0.5bp. 10-Year JGB yields registered a new multi-month low of 0.01%. Broader headline flow has been a little light, with the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs having no real impact on the broader market. The latest BoJ decision headlines the local docket on Friday.

- Aussie bonds showed little in the way of net movement in the wake of the better than expected local labour market report (headline jobs and unemployment were better than exp., although underutilisation & underemployment ticked away from multi-year lows on the back of the lockdown in Victoria), with YM +3.0 & XM +5.5 at typing after a blip lower on the data. A reminder that the RBA's most recent SoMP did not look for a drop to 5.0% unemployment until Q421. Still, it will be wage growth and realised inflation that drives the medium-term evolution of the RBA's cash rate (at least based on Bank's current guidance), and the unemployment rate may not travel on a constant one-way trajectory given the local COVID situation. The release of the AOFM's weekly issuance schedule and A$700mn of ACGB 0.25% 21 November 2025 supply headline locally on Friday.

JGBS AUCTION: Japanese MOF sells Y4.3157tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.3157tn 3-Month Bills:- Average Yield -0.1070% (prev. -0.1038%)

- Average Price 100.0267 (prev. 100.0259)

- High Yield: -0.1062% (prev. -0.1002%)

- Low Price 100.0265 (prev. 100.0250)

- % Allotted At High Yield: 57.4459% (prev. 99.8122%)

- Bid/Cover: 4.882x (prev. 3.236x)

JGBS AUCTION: Japanese MOF sells Y399.3bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y399.3bn of 1-5 Year JGBs in a liquidity enhancement auction:- Average Spread: -0.005% (prev. -0.005%)

- High Spread: -0.002% (prev. -0.004%)

- % Allotted At High Spread: 26.2886% (prev. 93.2832%)

- Bid/Cover: 4.831x (prev. 4.533x)

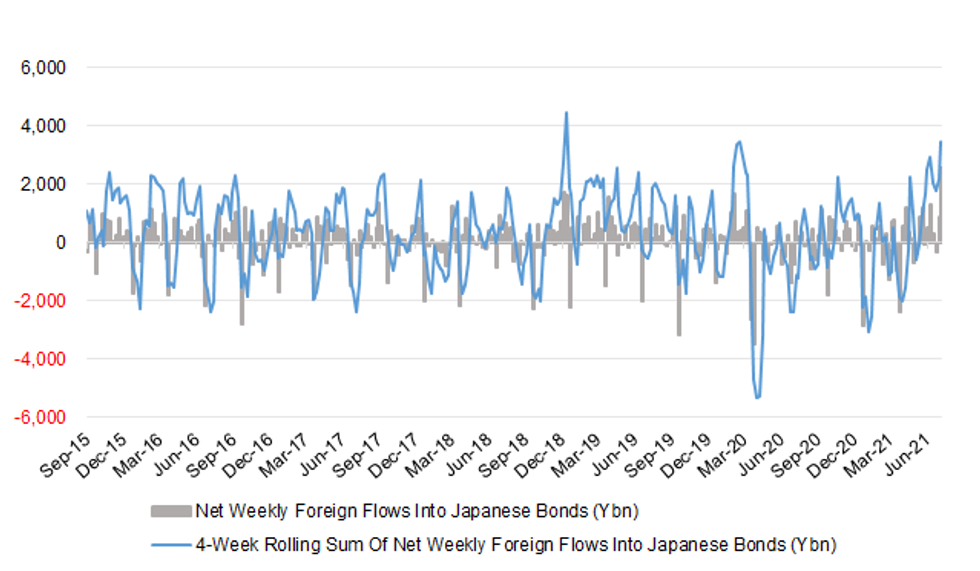

JAPAN: Foreigners Lodge Record Net Weekly Purchases Of Japanese Bonds

Bond flows dominated the latest round of weekly international security flow data:

- Foreign investors recorded the largest round of net weekly purchases of Japanese paper on record (a touch shy of Y2.6tn), in week which saw 10-Year JGB yields press to multi-month lows (0.02%), which have since been (marginally) extended on. The 4-week rolling sum of the measure moved to the highest level (largest amount of net buying) witnessed since early '20.

- Japanese investors sold foreign bonds for a 3rd straight week (~Y1.2tn).

- There were small net sales lodged in both of the equity flow metrics.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1217.8 | -191.4 | -1429.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -77.2 | -202.1 | -452.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 2567.8 | 887.1 | 3442.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -10.5 | -310.0 | -658.9 |

Fig. 1: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: China Gains After Partial MLF Rollover

Equity markets are mixed in the Asia-Pac region; in China markets are higher, the PBOC rolled over CNY 100bn of MLF funds, even after the 0.5ppt RRR cut last week. Elsewhere data slowed from last month and while GDP missed estimates retail sales and industrial production were both above consensus. Following the release the NBS said it saw the economy to keep recovering steadily in the second half of the year. In Japan markets are lower, local press reports have pointed to the BoJ adopting a lower GDP outlook for the current FY come the end of its 2-day meeting (which runs across today & tomorrow), which isn't a surprise given the local COVID situation. In South Korea markets are higher, the BoK kept rates on hold as expected and remained upbeat on the economy despite a surge in coronavirus cases. The Bank did note that next month would be time to start discussing removal of monetary accommodation. In the US futures are mixed again, e-mini Dow and e-mini S&P are lower, while e-mini Nasdaq is higher boosted by gains in the tech sector.

OIL: Crude Futures Slip As OPEC+ Deal Seems Closer

Oil is lower in Asia-Pac trade, on track for a second day of declines; WTI is down $0.70 from settlement at $72.42, Brent is down $0.69 at $74.08.

- Crude futures remain under pressure after the UAE and Saudi Arabia appear to have resolved a dispute over a demand by the UAE to raise its production quota that could pave the way for an extension of producer cooperation and enable substantial volumes of oil supply to come back to the market. What happens next will depend upon deliberations at a yet-to-be announced, OPEC+ ministerial meeting expected to take place this week ahead of the Islamic Eid on Jul. 19. The issue of the baseline change will also be discussed during the meeting by all members of the producer group. For reference, that meeting is not guaranteed to result in an agreement as other countries could raise similar requests on the back of the UAE's seeming success.

- Elsewhere, there were reports that the US-Iran nuclear talks will not resume until mid-August, which pushed the prospect of additional supply from Iran further down the road. According to Reuters sources Iran won't resume talks until its new president takes over which isn't expected to be until August.

GOLD: Bulls In Charge

Wednesday's downtick for U.S. real yields and an unwind of some of Tuesday's broader USD strength supported bullion, leaving spot to deal around the $1,825/oz mark during Asia-Pac hours. With the 50-day EMA & recent intraday highs now cleared, bulls look to some Fibonnaci levels related to June's decline ($1,833.7/oz & $1,853.3/oz) as the next areas of resistance. Further comments from Fed Chair Powell will likely garner most of the attention on Thursday.

FOREX: Weaker Oil, Heavier Yuan Weigh On G10 High-Betas

Offshore yuan went offered in Asia, with Chinese data front and centre today. Annual GDP growth slowed markedly in Q2, but only marginally undershot expectations, while the deterioration in most monthly activity indicators was less acute than projected. USD/CNH showed little reaction to the data after rising in the lead-up to the release. The PBOC set its central USD/CNY mid-point 14 pips above sell-side estimate, which may have lent some support to the pair.

- Weaker crude oil prices applied pressure to high-beta FX, with the Antipodeans pacing losses. Lingering angst surrounding the Covid-19 outbreak in NSW undermined the Aussie, even as local jobs report was stronger than forecast, with headline unemployment rate unexpectedly easing to 4.9% in June from 5.1% in May.

- Safe haven currencies outperformed, with JPY defying any potential impact of Gotobi Day flows and climbing to the top of the G10 scoreboard. USD/JPY extended losses past its 50-DMA.

- Focus turns to U.S. industrial output, Empire M'fing Survey and weekly jobless claims, UK labour market report and comments from Fed's Evans and BoE's Saunders, in addition to the second part of Fed Chair Powell's congressional testimony.

FOREX OPTIONS: Expiries for Jul14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E1.1bln), $1.1850(E513mln), $1.1865-85(E996mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

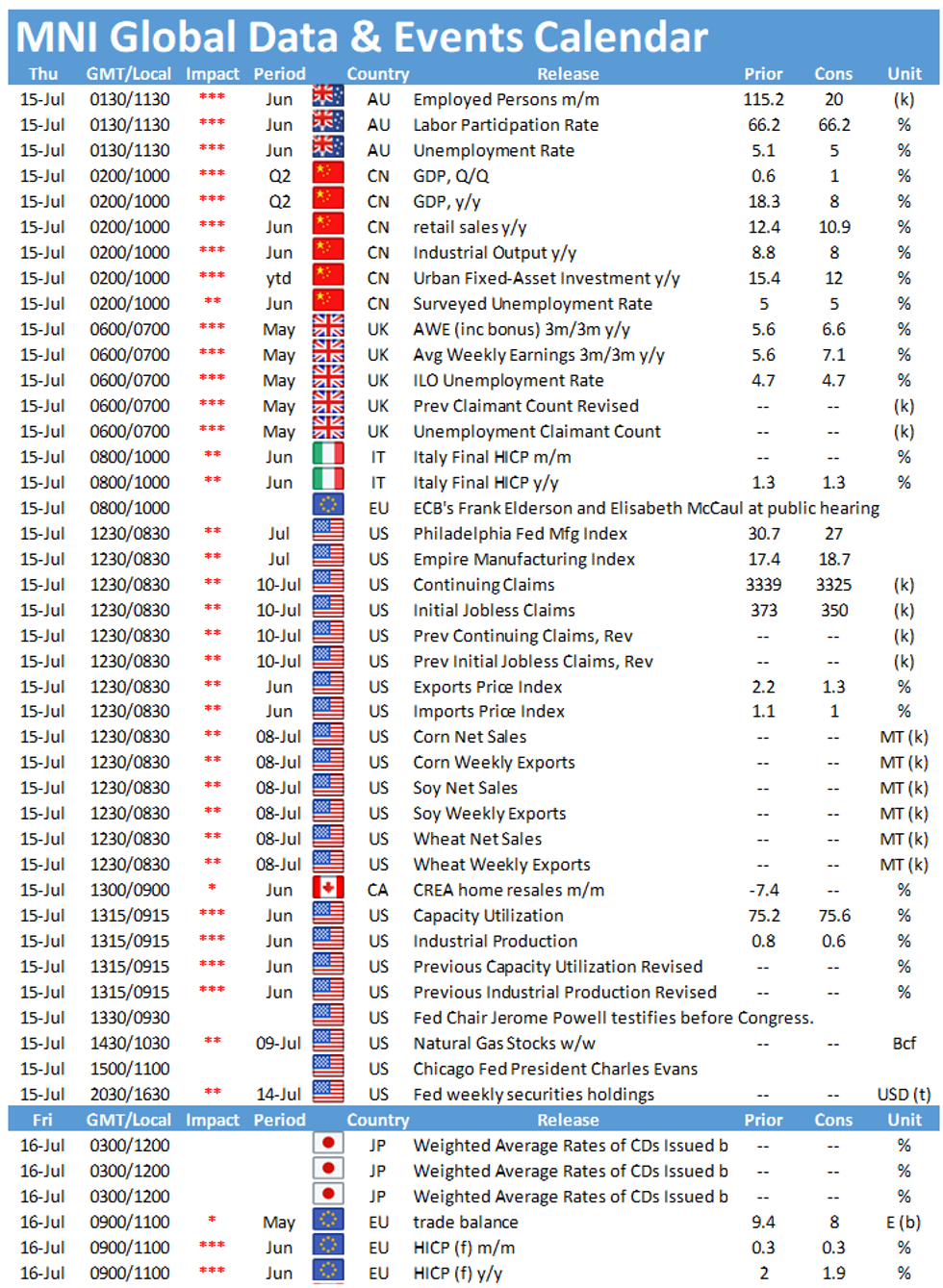

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.