-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI EUROPEAN OPEN: BoJ Makes Green Tweaks, NZ CPI Leads To Further Hawkish RBNZ Repricing

EXECUTIVE SUMMARY

- BIDEN: CHINA NOT KEEPING COMMITTMENTS ON HONG KONG (BBG)

- CHINA SNUBS SENIOR US OFFICIAL IN WORSENING STAND-OFF (FT)

- CHINA PLANS TO EXEMPT HONG KONG IPOS FROM CYBERSECURITY REVIEWS (BBG)

- BOJ ACTS TO BOOST GREEN LOANS, HOLDS RATES ON UNCERTAIN OUTLOOK (BBG)

- HOT NZ CPI PRINT LEADS TO EVEN MORE HAWKISH RBNZ CALLS & MARKET PRICING

- PBOC'S LIQUIDITY OPERATIONS SEND STABLE SIGNAL (CSJ)

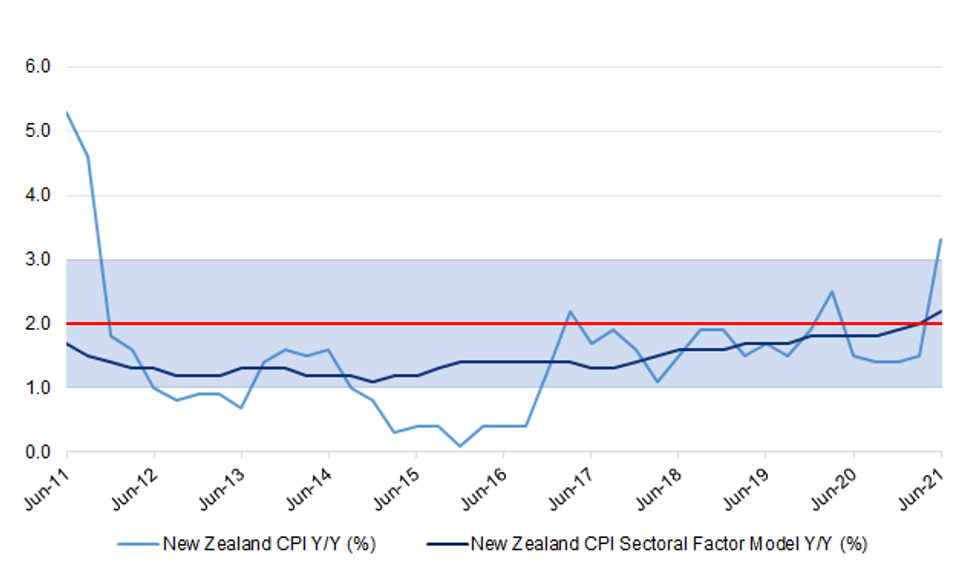

Fig. 1: New Zealand CPI Y/Y (%) vs. CPI Sectoral Factor Model Y/Y (%)

Shaded region represents the RBNZ's target range, with midpoint marked by the red line.Source: MNI - Market News/Bloomberg

Shaded region represents the RBNZ's target range, with midpoint marked by the red line.Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has claimed it is "highly probable" the worst of the coronavirus pandemic is over - on the day the UK recorded its highest number of daily cases for six months. The prime minister urged people not to "throw caution to the winds" when most legal restrictions in England end on Monday, as he acknowledged there would be more hospital admissions and deaths in the "difficult days and weeks ahead". Latest figures show there had been a further 48,553 cases of COVID-19 as of 9am on Thursday. (Sky)

CORONAVIRUS: The UK is "not out of the woods yet" when it comes to coronavirus and people should approach the end of most restrictions on Monday with caution, England's chief medical officer has warned. Professor Chris Whitty said the number of people in hospital with COVID-19 is doubling around every three weeks and could hit "quite scary numbers" if that trend is sustained. "I don't think we should underestimate the fact that we could get into trouble again surprisingly fast," he told a webinar hosted by the Science Museum. (Sky)

CORONAVIRUS: Pubs, restaurants and nightclubs have said they do not have the technology to scan Covid vaccine passports as the scheme threatens to descend into chaos next week. (Telegraph)

FISCAL: Boris Johnson is backing proposals for a new tax to pay for reforms to Britain's social care system under plans that could be agreed within weeks. A government source said Downing Street was "comfortable with some sort of tax" to fund universal social care and reduce the burden on families. The plan is also likely to include a cap on the amount people have to pay towards their own care, as well as additional funding to ensure more people get help and staff are better paid. Plans put forward by Sir Andrew Dilnot, who carried out a review of social care ten years ago, suggested a cap of about £50,000. It is understood that the Treasury wants a higher limit, however, to minimise costs to the taxpayer. (The Times)

FISCAL: Rishi Sunak has been urged to tweak a key metric used for the pensions triple lock under a proposal that could see pensioners lose out on £200 a year. (Telegraph)

BOE: MNI INTERVIEW: Tightening To Test BOE Independence-Lord Bridges

- The withdrawal of monetary stimulus will pose a key test for the independence of the Bank of England and it should be as transparent as possible about its strategy and the likely impact of quantitative tightening, a member of the Lords Economic Affairs Committee told MNI after it released a report on the BOE's bond-buying operations. The Bank could find itself in the political firing line if it drives up government debt servicing costs at a time of increased public spending, Lord Bridges said in an interview. The BOE could come under pressure to reduce remuneration on central bank reserves, said Bridges, also noting the Treasury's refusal to release a key legal document setting out the indemnity it is supposed to pay if the BOE runs up losses from its asset purchases as rates rise - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BREXIT: The UK's estimate of its Brexit divorce bill is £3 billion lower than the European Union's, the government has said, paving the way for another dispute between the two sides. Steve Barclay, the chief secretary to the Treasury, told MPs yesterday that the present value of the financial settlement was £37.3 billion. But the EU's accounts last week showed that Brussels put the figure at €47.5 billion (£40.5 billion). Barclay said the UK was already in the process of paying its first invoice of €3.7 billion (£3.2 billion). Each side has different figures because in the Brexit deal they agreed a method for calculating the divorce bill, rather than a specific sum of money. Last week Downing Street said it did not accept the EU's sum. "We don't recognise that figure, it's an estimate produced by the EU for its own internal accounting purposes," a spokesman said. "For example, it doesn't reflect all the money owed back to the UK, which reduces the amount we pay." (The Times)

BREXIT: The so-called "sausage war" trade dispute between the UK and EU was "not even handbags at dawn", MPs have been told. Aodhan Connolly from the NI Retail Consortium told the Northern Ireland Affairs Committee that the row over chilled meats was "peripheral" and that bigger problems for traders are coming. The committee heard from a number of business, retail and manufacturing figures during a hearing on the impact of the Northern Ireland Protocol. (Sky)

EUROPE

ECB: The European Central Bank is likely to limit changes to its monetary policy to words at next week's meeting, leaving decisions on future bond-buying until the economic outlook clears, according to a Bloomberg survey of economists. Policy makers will have to adapt their language on interest rates, asset purchases and other tools to a new inflation strategy that allows prices to grow moderately faster than 2% -- the goal going forward -- for some time. Economists including ING's Carsten Brzeski and Rabobank's Bas van Geffen expect a signal that substantial monetary stimulus may remain in place for longer. The implementation of the ECB's new strategy "should confirm that an exit from unconventional policies is still very distant," said Kristian Toedtmann, an economist at DekaBank. (BBG)

IRELAND: Ireland is heading into a "difficult couple of weeks" where Covid cases will spike and hospitalizations will increase, Deputy Prime Minister Leo Varadkar warned, as the country saw its most new cases in five months. There's concern that unvaccinated people could "overwhelm our hospitals" if they take risks with the virus, Varadkar told lawmakers in Dublin. Hospitalizations rose to their highest level in five weeks, although well below the previous peak in January. Despite the rise in cases, the government has set a target to reopen indoor dining for July 26. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled after hours on Friday include:

- Fitch on the EFSF (current rating: AA), ESM (current rating: AAA; Outlook Stable) & Greece (current rating: BB; Outlook Stable)

- Moody's on Finland (current rating: Aa1; Outlook Stable)

- DBRS Morningstar on Ireland (current rating: A (high), Stable Trend) & the Netherlands (current rating: AAA, Stable Trend)

BANKS: Deutsche Bank may have mis-sold foreign exchange derivatives to more than 50 companies in Spain, suggesting the scope of a scandal that has already led to the exit of two senior bankers is wider than previously thought, according to people familiar with the matter. Germany's biggest bank launched an internal probe last year after clients complained they were sold complex derivative products they did not understand. The investigation, known within Deutsche Bank as Project Teal, was first revealed by the Financial Times earlier this year. At the time, the bank said that "a limited number of clients" were affected. (FT)

U.S.

FED: Treasury Secretary Janet Yellen on Thursday offered high marks for the Federal Reserve and how central bank officials navigated the U.S. economy throughout the coronavirus pandemic. Yellen told CNBC that the Fed has "done a good job" in recent months under the direction of Chairman Jerome Powell. Yellen led the central bank until her term expired in 2018, when former President Donald Trump opted to appoint Powell, a Republican. Asked whether she would support Powell for a second term as Fed chairman in the midst of rising inflation, Yellen deflected. "That's a discussion I'm going to have with the president," Yellen said during an interview that aired on CNBC's "Closing Bell." (CNBC)

FED: MNI BRIEF: Evans Sees Substantial Progress Later This Year

- Chicago Fed President Charles Evans said Thursday the U.S. economy could make substantial further progress later this year -- a threshold for potential tapering of asset purchases -- and he said interest rates could rise in early 2024 or a little sooner if inflation runs hot. Evans told the Rocky Mountain Economic Summit hosted by the Global Interdependence Center he thought unemployment "should be about 4.5% by the end of this year" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Signs of 'More Durable' US Inflation Pressures

- Rising inflationary pressures in the cost of housing and dining out could be a hint that the spike in U.S. inflation over the past few months will prove more lasting than the Federal Reserve expects, Atlanta Fed economist and policy adviser Brent Meyer said in an interview - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

INFLATION: Treasury Secretary Janet Yellen cautioned Thursday that prices could continue to rise for several more months, though she expects the recent startling inflation run to ease over time. In a CNBC interview, the Cabinet official added that she worries about the problems inflation could pose for lower-income families looking to buy homes at a time when real estate values are surging. "We will have several more months of rapid inflation," Yellen told Sarah Eisen during a "Closing Bell" interview. "So I'm not saying that this is a one-month phenomenon. But I think over the medium term, we'll see inflation decline back toward normal levels. But, of course, we have to keep a careful eye on it." (CNBC)

ECONOMY: MNI REALITY CHECK: June Sales Seen Slower as Spending Cools

- The pace of U.S. retail sales slowed in June as spending cooled after a stimulus-fueled spike in the spring, industry experts told MNI, though spending was still abundant as consumers were still unlikely to be deterred by higher prices for goods. Overall sales growth "remains on solid footing," said Jack Kleinhenz, chief economist at the National Retail Federation, though the pace "is perhaps slowing." Still, business and consumer optimism was elevated through June, he said, and total sales are likely to get a slight boost from 'Amazon Prime Day' event, which took place from June 21 – 23 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The White House on Thursday said it would support efforts to include a pathway to U.S. citizenship in a separate reconciliation bill being pushed by Senate Democrats, saying it was up to lawmakers to hammer out the final package. Asked if the White House was on board with including the immigration provision, White House spokeswoman Jen Psaki told reporters at a news briefing yes. She added President Joe Biden would do "whatever is needed" to help the budget measure pass Congress. The proposed $3.5 trillion budget reconciliation bill is separate from a planned $1.2 trillion bipartisan infrastructure measure. (RTRS)

FISCAL: Speaker Nancy Pelosi on Thursday said the House will "realign" some of the priorities in a $3.5 trillion Senate Democrat budget blueprint to expand the proposal's social and environmental programs. "Many of the priorities of the House are already in the bill. The question is the top line -- how we stay under the top line, as we perhaps realign some of those priorities," Pelosi said at an event Thursday in Los Angeles. Progressives in the House, whose votes Pelosi needs to pass the budget measure that carries the bulk of President Joe Biden's agenda, are pressing to add more climate and social spending provisions to the outline developed by Senate Budget Committee Democrats. But that risks the support from moderate Democrats in both chambers. The party will have to be united to overcome solid Republican opposition. (BBG)

FISCAL: Treasury Secretary Janet Yellen is calling for the child tax credit to be made permanent as the first installment of the monthly allowance was delivered to parents' bank accounts this week. Under the Biden administration's American Rescue Plan passed by Congress in March, parents are set to receive $250 to $300 per child every month for the rest of this year. The first of those monthly payments, totaling $15 billion, were delivered on Thursday. "I think this is something that's very important to continue," Yellen told Morning Edition host Noel King in an interview with NPR on Thursday. (NPR)

FISCAL: The Senate confirmed former Federal Reserve economist Nellie Liang as the Treasury Department's undersecretary for domestic finance, putting her at the forefront of efforts to manage the soaring federal debt. Ms. Liang, who specialized in financial stability issues at the Fed, was confirmed by a vote of 72-27. She will oversee U.S. fiscal policy at a time when the Biden administration is proposing trillions of dollars in new spending on infrastructure and antipoverty programs. The Congressional Budget Office projects a budget deficit of $3 trillion this fiscal year—more than it forecast in February, but less than the $3.2 trillion deficit in fiscal year 2020. The non-partisan agency expects the federal debt to grow to 103% of gross domestic product at the end of 2021. (WSJ)

CORONAVIRUS: Most vaccinated Americans are unlikely to need Covid-19 booster shots for months, or even years, despite the rise of highly infectious variants and the continued spread of the virus, according to top scientists. Pfizer Inc. has been touting a plan to apply for clearance this summer for a third shot of its messenger RNA vaccine. But vaccine experts and health officials in both the U.S. and Europe say that while a booster may eventually be needed, existing shots remain highly effective in preventing severe disease, including against all known variants. (BBG)

CORONAVIRUS: Los Angeles County told its residents they must wear masks indoors -- even the vaccinated -- following a surge in Covid-19 cases and the spread of the highly contagious delta variant. The county of 10 million people added more than 1,000 new cases for a seventh straight day, with the transmission rate reaching close to a "high" level after hitting a "substantial" pace in a short period of time, Muntu Davis, the county's health officer, said in a briefing. "We have to get these numbers down," he said. "Masking by all makes it a lot easier for this to happen. And it adds that layer of protection for fully vaccinated people." (BBG)

CORONAVIRUS: President Joe Biden said his Covid-19 advisers are weighing when to lift prohibitions on travel from Europe, after German Chancellor Angela Merkel raised the issue in a White House meeting on Thursday. "It's in process now," Biden said at a news conference with Merkel following their meeting. "I'm waiting to hear from our folks, our Covid team, as to when that should be done." He said to expect an answer "within the next several days." European travel to the U.S. in May was still 95% below its 2019 level, according to the U.S. Travel Association. European governments are growing increasingly frustrated with the Biden administration for refusing to lift restrictions that prevent most of their citizens from traveling to the U.S., with officials citing inconsistent rules, economic costs and an outdated strategy for halting the coronavirus. (BBG)

PROPERTY: The White House will hold a meeting with representatives from across the homebuilding industry on Friday as President Joe Biden seeks to address a housing supply shortage that's spurring a record increase in home prices. Top Biden administration officials will sit down with representatives from across the supply chain, including builders, housing advocates, lumber companies, real estate firms, loggers and labor unions, according to White House officials. Builders cite high materials prices, scarce supplies and a dearth of skilled workers as ongoing challenges in the race to complete new homes. (BBG)

MARKETS: Democratic Senator Chris Van Hollen and Representative Carolyn Maloney introduced a bill they say would close an insider trading loophole by preventing executives from trading on information contained in a form 8-K disclosure, such as bankruptcy or an acquisition, ahead of filing. "Corporate executives shouldn't be allowed to trade on significant information ahead of the public and investors, but that's exactly what's happening because of this legal loophole," New York's Maloney says in a statement. (BBG)

EQUITIES: Several Chinese companies have suspended plans to list in the U.S., including Keep, an exercise App, Himalaya, a Chinese music/podcast host, and LinkDoc, a medical technology service provider, after the State Council released stricter scrutiny over listing Chinese shares in overseas markets, as well as draft regulations by the cybersecurity watchdog requiring reviews over data confidentiality, the 21st Century Business Herald reported. There won't likely be any new shares getting listed in H2 after 37 companies succeeded in H1, the newspaper said. There were also rumors that regulators will begin to require approvals for listings through the so-called Variable Interest Equity structure, a way for Chinese domestic companies to obtain overseas listing through registering first in another country, the newspaper said. (MNI)

EQUITIES: Chinese social media and e-commerce startup Xiaohongshu, or "Little Red Book," is putting its U.S. initial public offering plans on hold after China tightened rules on overseas listings, according to people with knowledge of the matter. The online platform, backed by Tencent Holdings Ltd. and Alibaba Group Holding Ltd., is discussing with advisers on alternatives as the company would likely be subject to a cybersecurity review under Beijing's proposed policy for firms listing abroad, said the people. A listing in Hong Kong could be an option, the people said, who asked not to be identified as the information is private. Xiaohongshu, which had filed confidentially for a U.S. IPO earlier this year, was aiming to raise more than $500 million, one of the people said. Chinese on-demand logistics and delivery firm Lalamove is weighing an IPO venue switch from the U.S. to Hong Kong, Bloomberg news reported this week. (BBG)

OTHER

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen said on Thursday that it was not certain that Amazon.com will reach the profitability threshold for a new global tax deal that would allow more countries to tax large multinational firms. "It depends on whether or not they reach the threshold of profitability and I'm not certain of that," Yellen told CNBC in an interview when asked whether the 132-country agreement would reallocate taxing rights for Amazon. (RTRS)

GLOBAL TRADE: The World Trade Organization said Thursday that a trade minister meeting aimed at jump-starting negotiations towards banning subsidies that favour overfishing had been "successful", signalling a deal could be possible. "I believe that the answers today have given us the ingredients to reach a successful conclusion," Colombian ambassador Santiago Wills, who chairs the WTO fisheries subsidies negotiations, told reporters in Geneva. (Barron's)

U.S./CHINA: Beijing has snubbed the US by refusing to grant Wendy Sherman, deputy secretary of state, a meeting with her counterpart during a proposed visit to China that would have been the first top-level engagement since acrimonious talks in Alaska. The US halted plans for Sherman to travel to Tianjin after China refused to agree to a meeting with Le Yucheng, her counterpart, according to four people familiar with the decision. China offered a meeting with Xie Feng, the number five foreign ministry official who is responsible for US affairs. The Biden administration had been negotiating what would have been the first high-level engagement since their first meeting in Alaska, which erupted into a public spat between Antony Blinken, US secretary of state, and Yang Jiechi, the top Chinese foreign policy official. (FT)

U.S./CHINA: The largest bloc of House conservatives has drafted a 300-page counterproposal to the Senate's sprawling bipartisan China bill, planning to circulate it to members Friday, Axios has learned. Senate Majority Leader Chuck Schumer (D-N.Y.) won approval for his China bill, the U.S. Innovation and Competition Act, with the support of 18 Republicans last month. While the GOP doesn't control the House, the proposal is an attempt to peel away Republican support for Schumer's bill and attract support from House members opposing it. (Axios)

U.S./CHINA/HONG KONG: President Joe Biden says the situation in Hong Kong is deteriorating as the Chinese government is not keeping the commitments it has made to the city. Biden adds his administration is issuing an advisory warning businesses of the risks of operating in Hong Kong. (BBG)

U.S./CHINA/HONG KONG: The United States is preparing to impose sanctions on Friday on a number of Chinese officials over Beijing's crackdown on democracy in Hong Kong, as well as a warning to international businesses operating there about deteriorating conditions, two people with knowledge of the situation told Reuters. (RTRS)

EU/CHINA: China and the EU should work together to broaden the scope of cooperation, stick to the principle of mutual benefit, properly manage differences and refrain from imposing one's own will on others, according to a MOFA statement, citing Wang's comment made at a meeting in Tashkent with EU's High Representative for Foreign Affairs and Security Policy Josep Borrell. China and the EU share a lot of common ground. The two sides can complement each other and work together to promote connectivity among countries and accelerate development of the Eurasian continent. (BBG)

JAPAN: Tokyo's neighboring Kanagawa prefecture is considering asking the central government to declare a state of emergency in the area as infections rise, the Yomiuri newspaper reports, citing an unidentified person. As the Tokyo Olympics kick off next week, officials reckon tougher measures are needed in anticipation of an increase in flow of people. Daily cases in the prefecture on Thursday surpassed 400 for the first time since Jan. 28. (BBG)

BOJ: The Bank of Japan offered lenders incentives to go green as it outlined details of its climate-linked funding measure and left its main policy settings unchanged. The BOJ, in a statement Friday, said it will give banks more exemptions from its negative interest rate when they make loans or investments toward a greener economy. A majority of economists had expected the central bank to go further than that, by offering to pay a small amount of interest. (BBG)

BOK: The level of Bank of Korea's key rate needs to be normalized as the economy recovers, Governor Lee Ju-yeol says in parliament. Lee says he communicated with the market that BOK will hike rates this year; while Covid-19 has worsened recently and poses uncertainty, he still expects the increase to take place this year. (BBG)

CANADA: Prime Minister Justin Trudeau said on Thursday Canada could start allowing fully vaccinated Americans into Canada as of mid-August for non-essential travel and should be in a position to welcome fully vaccinated travelers from all countries by early September. Trudeau spoke with leaders of Canada's provinces and his office released a readout of the call. He noted that if Canada's current positive path of vaccination rate and public health conditions continue the border can open. "Canada would be in a position to welcome fully vaccinated travelers from all countries by early September," the readout said. "He noted the ongoing discussions with the United States on reopening plans, and indicated that we could expect to start allowing fully vaccinated U.S. citizens and permanent residents into Canada as of mid-August for non-essential travel." (AP)

CANADA: Canada will allow cruise ships to operate in its waters starting Nov. 1 if operators comply fully with public health requirements, the country's minister of transport announced on Thursday. Earlier this year, the Canadian government had extended its ban on cruises until the end of February 2022. (CNBC)

BRAZIL: Brazil's Congress approved the budget guidelines for 2022, paving the way for a parliamentary recess from July 18. Text approved, which sets the framework for next year's budget, forecasts that the 2022 fiscal target will be a primary deficit of 170.5b reais, or 1.9% of the country's GDP. Brazil's 2022 GDP growth estimate was kept at 2.5%. Minimum wage next year seen at 1,147 reais. 2022 inflation forecast at 3.5%. (BBG)

BRAZIL: Brazil's Jair Bolsonaro is unlikely to need surgery to solve partial intestinal obstruction after responding well to treatment, but will remain hospitalized for the time being. The president gave an interview to a local TV station on Thursday evening, his first comments on video since being admitted to the hospital the day before. Bolsonaro was seen in a bed flanked by his doctor and appeared to be in good spirits, saying he had progressed well. The president still had a nasogastric tube, which carries food and medicine to the stomach through the nose. "When I arrived there was a very high chance surgery was needed, but I'm doing much better," Bolsonaro said. He apologized to supporters for not being able to attend a planned rally this weekend in Manaus. (BBG)

BRAZIL: Brazil tax reform rapporteur mulls progressive dividend tax. (BBG)

RUSSIA: U.S. President Joe Biden said he and German Chancellor Angela Merkel agreed they wouldn't allow Russia to use the contentious Nord Stream 2 pipeline to threaten its neighbors amid a push to limit the Kremlin's geopolitical clout. But the leaders acknowledged that difference remain over the project, which critics say could burnish Russian leverage and hurt Ukraine by reducing transit fees it collects on gas flowing to Europe. "We've come to different assessments as to what this project entails," Merkel said Thursday though an interpreter. "But let me say very clearly: Our idea is and remains that Ukraine remains a transit country for natural gas, that Ukraine remains -- just as any other country in the world -- has a right to territorial sovereignty, which is why we've become engaged." (BBG)

RUSSIA/RATINGS: Potential sovereign rating reviews of note scheduled after hours on Friday include:

- S&P on Russia (current rating: BBB-; Outlook Stable)

SOUTH AFRICA: South Africa's death toll from days of riots rose to 117 even as the worst of the violence appeared to ease, with the deployment of thousands of soldiers starting to take effect. Authorities have arrested almost 1,500 people, including 12 who allegedly instigated the unrest, resulting in rampant looting and the destruction of businesses in two key provinces, acting Minister in the Presidency Khumbudzo Ntshavheni told reporters in Pretoria, the capital, on Thursday. The situation remains volatile in KwaZulu-Natal, the heart of the violence, while the economic hub of Gauteng should stabilize by Friday, she said. About 10,000 troops are now on the streets, leading to a drop in the number of incidents. (BBG)

EQUITIES: China plans to exempt companies going public in Hong Kong from first seeking the approval of the country's cybersecurity regulator, removing one hurdle for businesses that list in the Asian financial hub instead of the U.S., according to people familiar with the matter. The exemption was outlined by officials in recent meetings with bankers, after a government statement on Saturday announcing a new review process for foreign listings prompted questions over whether it would apply to Hong Kong, the people said, asking not to be identified as the discussions are private. The Cyberspace Administration of China will vet companies to ensure they comply with local laws, but only those headed to other countries such as the U.S. will undergo a formal review, the people said. All listings, including those in Hong Kong, will require a sign-off from the China Securities Regulatory Commission under the new framework, the people said. (BBG)

METALS: Rio Tinto Group flagged its iron ore shipments this year are likely to be at the low end of its forecast as the world's top producer and rivals struggle to meet buoyant demand from steelmakers in China. The London-based miner said Friday guidance for annual ore shipments of 325 million to 340 million tons was subject to a range of risks, including Covid-19 disruptions as well as the management of cultural heritage issues and replacement mines. Its second-quarter cargoes fell 2% on the previous quarter. This comes as China's steel demand rose 5% in the first half of 2021, driven by strong growth in the country's construction and automotive sectors, according to Rio's June report. It said supply had "struggled to keep pace" with the surge in ore demand as the big producers lag expectations. (BBG)

OIL: India's new oil minister Hardeep Singh Puri vowed to work with oil producers Saudi Arabia and United Arab Emirates to reduce volatility in oil markets and make crude prices affordable. Veteran diplomat Puri, who took charge of India's oil ministry last week, on Thursday spoke to Saudi oil minister Prince Abdulaziz bin Salman, a day after his conversation with Ahmed Al Jaber, UAE's minister of Industry and chief executive of Abu Dhabi National Oil Co (ADNOC). (RTRS)

CHINA

PBOC: The unchanged interest rate in MLF, reverse repo operations Thursday shows that the direction of monetary policy is unchanged, China Securities Journal reports, citing an unidentified bond investment manager. Last week's reserve requirement ratio cut was a normal operation and should not be understood as start of policy easing. PBOC is likely to continue using multiple liquidity tools to maintain reasonably ample liquidity in coming months because there'll be large demand for medium and long-term liquidity with 3.75t yuan of MLF maturing before year-end and acceleration of government bond issuance. (BBG)

PBOC: The People's Bank of China may keep its policy interest rates, including the rate of MLFs, stable in H2 to manage the market's inflation expectations, Yicai.com reported citing analysts. After cutting banks' required reserve ratios last week, the PBOC renewed the maturing MLFs on Thursday without changing the rate, signaling it is keeping a prudent monetary policy stance and not attempting to loosen, the newspaper said citing analysts. Still, the RRR cuts may lead to 5 bps drop in LPR to be announced by the PBOC on July 20, the newspaper cited analysts as saying. (MNI)

INVESTMENT: China's investment will continue to grow steadily in H2 with manufacturing likely to be the main driving force, the Shanghai Securities News reported citing analysts. Manufacturing investment, helped by higher corporate profits and private companies' growing confidence, may reach an 11% annualized growth, the newspaper said citing Tang Jianwei, chief researcher with Bank of Communications. Infrastructure investment may slow quarterly due to the higher comparison base from last year, still at a relatively high level of about 7%, the newspaper said citing Wang Jun, chief economist of Zhongyuan Bank. (MNI)

PROPERTY: Chinese regulators want property developers to disclose details of rapidly growing commercial paper issuance in their monthly reports, said three sources, as part of Beijing's move to rein in ballooning debt in the property sector as the economy slows. (RTRS)

OVERNIGHT DATA

NEW ZEALAND Q2 CPI +3.3% Y/Y; MEDIAN +2.7%; Q1 +1.5%

NEW ZEALAND Q2 CPI +1.3% Q/Q; MEDIAN +0.7%; Q1 +0.8%

NEW ZEALAND Q2 SECTORAL FACTOR MODEL INFLATION INDEX +2.2% Y/Y; Q1 +2.0%

NEW ZEALAND JUN BUSINESSNZ M'FING PMI 60.7; MAY 58.6

NEW ZEALAND JUN NON-RESIDENT BOND HOLDINGS 51.1%; MAY 50.3%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:45 am local time from the close of 2.1646% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 40 on Thursday vs 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4705 FRI VS 6.4640

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4705 on Friday, compared with the 6.4640 set on Thursday.

MARKETS

SNAPSHOT: BoJ Makes Green Tweaks, NZ CPI Leads To Further Hawkish RBNZ Repricing

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 173.72 points at 28103.08

- ASX 200 up 0.481 points at 7336.8

- Shanghai Comp. down 0.805 points at 3563.785

- JGB 10-Yr future down 11 ticks at 152.22, yield up 0.7bp at 0.021%

- Aussie 10-Yr future down 0.5 ticks at 98.705, yield up 0.3bp at 1.290%

- U.S. 10-Yr future -0-05 at 133-20+, yield up 2.01bp at 1.319%

- WTI crude up $0.02 at $71.67, Gold down $3.01 at $1826.56

- USD/JPY up 18 pips at Y110.01

- BIDEN: CHINA NOT KEEPING COMMITTMENTS ON HONG KONG (BBG)

- CHINA SNUBS SENIOR US OFFICIAL IN WORSENING STAND-OFF (FT)

- CHINA PLANS TO EXEMPT HONG KONG IPOS FROM CYBERSECURITY REVIEWS (BBG)

- BOJ ACTS TO BOOST GREEN LOANS, HOLDS RATES ON UNCERTAIN OUTLOOK (BBG)

- HOT NZ CPI PRINT LEADS TO EVEN MORE HAWKISH RBNZ CALLS & MARKET PRICING

- PBOC'S LIQUIDITY OPERATIONS SEND STABLE SIGNAL (CSJ)

BOND SUMMARY: Core FI Lower Overnight

The modest weakness across the bulk of the JGB curve may have applied some pressure to U.S. Tsys during Asia-Pac hours. T-Notes last print -0-04+ at 133-21, with cash Tsys running 0.5-2.5bp cheaper across the curve, bear steepening in play. Most of the macro headline flow has been centred on Sino-U.S. tensions, while sell-side calls & market pricing re: the RBNZ hiking cycle are becoming more aggressive in the wake of the firmer than expected NZ CPI print for Q2. Flow was dominated by a 5.0K lift of the TYQ1 134.25/135.00 1x2 call spread via block. Retail sales data and the latest UoM sentiment survey will headline the local docket during NY hours. We also note that NY Fed President Williams will speak, but the topic is "culture in the workplace" which limits the scope for market impact.

- JGB futures have extended their drift lower during the early part of the Tokyo afternoon, with the contract now -13 on the day, with little movement in the cash JGB space in the afternoon. The 5- to 20-Year zone of the curve has cheapened by 0.5-1.5bp, with the wings seeing some modest richening. The BoJ offered little in the way of notable surprises in its latest decision, leaving its broader monetary policy settings unchanged and unveiling its green strategy (there will be more on this matter in our full review).

- Aussie bond futures nudged a touch lower in the wake of the blowout Q2 CPI print from across the Tasman, with YM -1.5 and XM at unchanged levels at typing. We have flagged some of the potential hurdles for a break higher in XM i.e. technical resistance and the addition of longs yesterday, although we do reiterate that the post-NZ data dip has been shallow, with the RBNZ-RBA tightening divergence now well-defined. The AU/NZ 2-Year swap spread has moved to fresh cycle lows in the wake of the data release. Elsewhere, a firm round of ACGB Nov '25 supply was seen, likely driven by the supportive matters we identified pre-auction (levels of liquidity in the system, relative international appeal & RBA-adjusted net supply), with the outright richness (at least from a short-term perspective) discounted. The weighted average yield printed 0.97bp through prevailing mids (per Yieldbroker). The reduced auction size (A$700mn) provided artificial support for the cover ratio (would have been around 4.6x if auction size was consistent with the previous auction, all else equal).

AUSSIE BONDS: The AOFM sells A$700mn of the 0.25% 21 Nov '25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 0.25% 21 November 2025 Bond, issue #TB161:- Average Yield: 0.5080% (prev. 0.6217%)

- High Yield: 0.5100% (prev. 0.6250%)

- Bid/Cover: 6.5743x (prev. 4.1700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 67.8% (prev. 3.3%)

- bidders 47 (prev. 44), successful 8 (prev. 18), allocated in full 4 (prev. 10)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 21 July it plans to sell A$800mn of the 1.00% 21 December 2030 Bond.

- On Thursday 22 July it plans to sell A$1.5bn of the 22 October 2021 Note & A$500mn of the 21 January 2022 Note.

- On Friday 23 July it plans to sell A$700mn of the 4.25% 21 April 2026 Bond.

EQUITIES: Mild Risk Aversion

A negative day for equity markets in the Asia-Pac region amid some mild risk aversion as markets digest recent comments from FOMC Chair Powell and US Tsy Sec Yellen as well as contemplate elevated coronavirus numbers with the delta variant a particular cause of concern. Bourses in mainland China are lower, the CSI 300 down around 0.6%, US President Biden earlier said the Hong Kong situation was deteriorating and said the US are to sanction Chinese officials and give US companies an advisory. In Japan markets are lower, the BoJ kept rates on hold as expected and kept forecasts broadly in line with expectations. Markets in Australia and New Zealand are slightly lower, the NZX 50 coming under pressure after a bumper CPI print added fuel to the hawkish RBNZ narrative. Futures are lower in the US, markets look ahead to retail sales data and a speech from Fed's Williams later today.

OIL: Set For Worst Week Since March

Oil is flat in Asia-Pac trade after declining for a third session on Thursday; WTI is down $0.02 from settlement at $71.63, Brent is down $0.04 at $73.44. Both benchmarks are on track for their worst week since mid-March as OPEC+ members near a deal that would allow the group to increase output. There is also demand concern as the delta variant of coronavirus picks up steam leading to renewed restrictions. From a technical perspective WTI sees support at $70.76, July 8 low and key support, while Brent bears target $72.11 the July 8 low and key near-term support.

GOLD: Bulls Looking Higher Still

A firmer DXY has nullified the downtick in U.S. real yields over the last 24 hours (based on our weighted U.S. real yield monitor), allowing bullion to retrace from Thursday's highs. Spot is little changed at typing, just above the $1,825/oz mark. The 61.8% retracement of the June decline now provides the main point of resistance after a show above the 50-day EMA & 50% retracement of the same move.

FOREX: Inflation Overshoot Sends Kiwi Flying

The kiwi received some further support from hawkish OCR-hike wagers toward the end of a week marked by aggressive RBNZ repricing. Upbeat inflation data provided a catalyst this time, as headline CPI inflation (+3.3% Y/Y) surged past the upper bound of the RBNZ's target range (+1.0%-3.0%) and topped estimates of all economists surveyed by Bloomberg. The kiwi slowly ground off its reaction highs, when the release of the RBNZ's sectoral factor model of core inflation prompted another leap higher. The Reserve Bank's preferred metric of core inflation registered at +2.2% Y/Y in Q2, exceeding the midpoint of the target range.

- NZD/USD jumped to $0.7029 after the release of the initial inflation report. AUD/NZD dipped to its lowest point since Feb 4, piercing support from May 27 low of NZ$1.0601 in the process, as the AU/NZ 2-Year swap spread moved to fresh cycle lows.

- Broader commodity-tied FX space traded on a firmer footing, with BBG Commodity Index seen ticking marginally higher. Safe haven currencies went offered, despite negative showing from most regional equity benchmarks. JPY paced losses, shrugging off the latest monetary policy decision from the BoJ.

- USD/CNH extended gains as the PBOC fixed its USD/CNY midpoint at CNY6.4605, 19 pips above sell-side estimate.

- Final EZ CPI takes focus in Europe. Highlights of the U.S. session include retail sales, flash U. of Mich. Survey & comments from Fed's Williams.

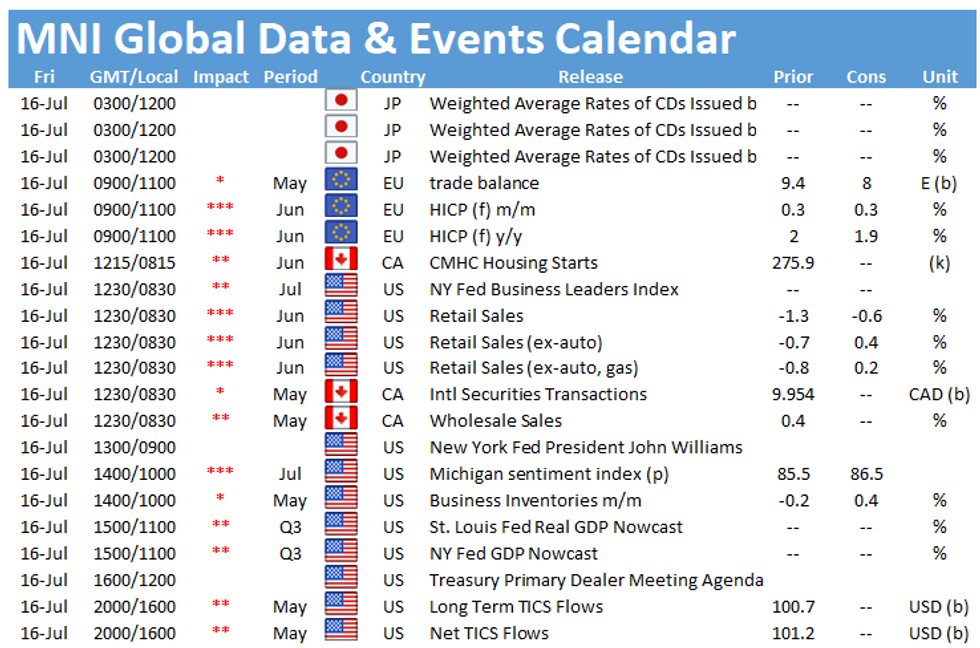

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.