-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Evergrande Sheds Bank Equity Holdings

EXECUTIVE SUMMARY

- FED: BULLARD STRIKES USUAL HAWKISH TONE (BBG)

- CHINA EVERGRANDE PLANS TO RAISE $1.55B FROM SHENGJING BANK STAKE SALE (DJ)

- GPIF WON'T BUY CHINESE SOVEREIGN DEBT (BBG)

- JAPANESE ELECTION SET FOR KONO-KISHIDA RUNOFF

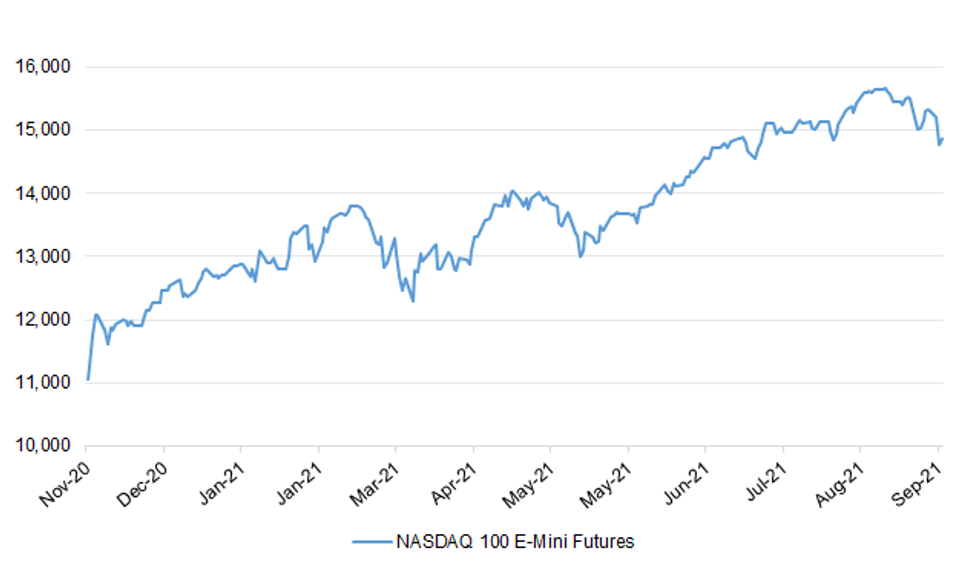

Fig. 1: NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: The fuel situation in the UK is starting to improve, PM Boris Johnson has said - as he urged motorists to fill up their cars in the "normal way". He said the situation at fuel stations was "stabilising" and people should be "confident" to go about their business, after days of queues and pump closures. Labour said the government had let the country "crash from crisis to crisis". Defence Secretary Ben Wallace has approved a request for 150 military tanker drivers to help deliver fuel. Training the drivers to use civilian fuel company tankers is expected to take place over the next three days, so the first deliveries could take place by the end of the week. With some drivers continuing to face difficulties in refuelling, there have been calls for key workers, such as health and social care staff, to receive priority at the pumps. (BBC)

ENERGY: Petrol stations will face disruption for up to a month even if people stop panic buying, industry figures have warned, despite "tentative" signs that the situation is starting to improve. Boris Johnson said yesterday that the government was putting preparations in place to deal with a shortage of HGV drivers and ensure that Britain could get "through to Christmas and beyond". In his first public comments on the fuel crisis, the prime minister said that the situation was "stabilising". He urged people to stop panic buying and to behave "in a normal way". However, industry sources told The Times that the disruption could continue for weeks even if panic buying subsided because it would take time to restock petrol stations. (The Times)

BREXIT: The U.K. and European Union are seeking to cool tensions over a thorny Brexit dispute related to Northern Ireland as they prepare to engage in weeks of intensive negotiations over how to resolve it, according to people familiar with the discussions on both sides. The negotiations are reducing the imminent threat of drastic action, such as trying to pull out of the Northern Ireland protocol that is in place to maintain an open border between Ireland and Northern Ireland. The EU is planning to offer a set of proposals next month aimed at addressing British complaints about the Northern Ireland protocol, according to a person familiar with the planning, who added that the details would be presented first to the U.K. That is expected to trigger intensive talks that could last until December. (BBG)

BREXIT: The U.K. limited the access of small EU boats to fish in its territorial waters, a move that risks stirring up a bitter post-Brexit dispute. Out of 47 applications to fish in British waters made by small vessels, 12 licenses have been granted, the U.K.'s Department for Environment, Food and Rural Affairs said in a statement. The other licenses weren't granted because the boats weren't able to show sufficient evidence of having fished in the waters historically, the department said. The U.K. decision risks inflaming one of the most contentious and emotive elements of the post-Brexit relationship. Earlier this year, Britain and France deployed warships to the isle of Jersey amid protests about curtailing the ability of French boats to fish in British seas. (BBG)

POLITICS: Sir Keir Starmer will vow today to end the Jeremy Corbyn era as he says that winning is more important than maintaining unity in his party. In his first in-person speech to his party conference as leader, Starmer will say that he is putting Labour "back in business". He will draw a line under the Corbyn years and the manifesto that Labour presented to voters in 2019. A party source said his speech would demonstrate that it "will never again go into an election with a manifesto that isn't a serious plan for government". (The Times)

FISCAL: A minority stake in a new £20bn nuclear power station on England's east coast will be sold to institutional investors or floated on the stock market under UK government plans to oust China's CGN from the project. The government is closing in on a deal which would force state-owned CGN to give up its 20 per cent stake in the proposed Sizewell C nuclear plant in Suffolk. Under the plans, the government would hold the stake until it could be sold on to institutional investors, according to people briefed on the situation. Another option to float the stake on the stock market through an initial public offering is also being examined, said these people. (FT)

EUROPE

GERMANY: Armin Laschet appeared to be losing his grip on Angela Merkel's conservative bloc, as the fallout from Sunday's crushing election defeat risked boiling over into an open power struggle. Laschet agreed to step aside as premier of Germany's most populous state, pressured to commit early by regional lawmakers. He also faced resistance to a plan to install a caucus leader temporarily in case he wanted to take the job himself later on, but managed to fend it off for the time being. Laschet is struggling to maintain authority after the conservative bloc tumbled to its worst-ever election result. While the 60-year-old CDU chief continues to hold out hopes of forming a coalition, he's under growing pressure from allies and is losing room to maneuver. (BBG)

ITALY: Italy's government forecasts that the economy will grow by 6% this year, two government sources said on Tuesday, while the budget deficit will come in at 9.5% of gross domestic product (GDP). The 6% GDP growth forecast is an upward revision from a projection of 4.5% set in April, while the new deficit forecast of 9.5% is a sharp reduction from the previous 11.8% estimate. The new forecasts were agreed at a meeting of key coalition figures on Tuesday and will be formalised in the government's Economic and Financial Document (DEF) to be approved by the cabinet on Wednesday. (RTRS)

U.S.

FED: MNI BRIEF: Fed's Bostic Sees Tapering And Steeper Yield Curve

- Atlanta Fed President Raphael Bostic Tuesday said if trends continue it would be warranted for the central bank to begin pulling back asset purchases, and the yield curve will steepen as the economy heals. "I'm confident that the yield curve will steepen once again and get us back to more normal conditions," he said. "If things continue, the taper will be warranted, we'll start doing that, and then we'll see how the economy responds to that." "The trajectory of this economy is solid," said Bostic at a Mid-Size Bank Coalition of America event. "My models, and from the data that I'm seeing, suggest that we are on firm footing towards a full recovery and momentum is going to continue strong even in the midst of the rise of delta" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: St. Louis Fed President Bullard ('22 voter) reaffirmed his now accustomed hawkish tone in his latest round of comments, pointing to a U.S. economy that has now fully recovered from COVID (he expects 5.8% GDP growth in '21, followed by 4.5% in '22). Bullard highlighted the tight labour market situation, going on to underscore the need for the Fed to be ready to act if high inflation persists (he also flagged upside risks to prices). In terms of the tapering dynamic, Bullard reaffirmed his previous comments re: his belief that tapering will be announced come the end of the November FOMC, while he suggested that the Fed is now past the point of any sort of taper tantrum. (BBG)

FED: Sen. Elizabeth Warren charged Tuesday that Federal Reserve Chairman Jerome Powell has led an effort to weaken the nation's banking system, and she vowed to oppose his renomination. In remarks made during a hearing before the Senate Banking Committee, the Massachusetts Democrat cited several instances where she said the Powell Fed has watered down post-financial crisis bank regulations. (CNBC)

FED: The Federal Reserve is examining the trades done by regional bank presidents to make sure they were in compliance with the central bank's rules, Fed Chair Jerome Powell said on Tuesday, adding that the rules will be reviewed and improved. "We're also looking carefully at the trading that was done to make sure it's in compliance with our rules and with the law," Powell said during a U.S. Senate Banking Committee hearing in response to a question from Demographic Senator Raphael Warnock. "And even if it appears to be the case that these trades were in compliance with existing rules, that just tells you the problem is the rules and the practices and the disclosure needs to be improved." (RTRS)

FISCAL: The Senate is expected to vote as early as Wednesday on a revamped spending bill that would forestall a government shutdown at the end of the week after Democrats ditched action on the debt limit amid staunch Republican resistance. The standalone continuing resolution comes after Senate Republicans refused to fast-track a package on Tuesday that pairs government funding with suspension of the debt ceiling through the midterms next year. Several GOP senators have said they will support a bill to prevent a shutdown and deliver disaster aid to storm-battered states, as long as the package does not lift the cap on how much the government can borrow. Senate leaders circulated the legislation on Tuesday night, launching an expedited process to check for last-minute opposition. The House could also take up the stopgap spending bill on Wednesday, once it clears the upper chamber. The bill would fund the government through Dec. 3, according to a copy obtained by POLITICO. (POLITICO)

FISCAL: Progressive leaders on Tuesday declared that a majority of their 100-member caucus still plans to tank President Joe Biden's infrastructure bill this week without a firm commitment that party leaders can finish another huge agenda item. And time is running out before that vote. Liberal Democrats in the House are demanding details about what the Senate's most vocal centrists will support, ratcheting up the pressure on Biden for a pair of high-stakes meetings with Sens. Joe Manchin of West Virginia and Kyrsten Sinema of Arizona on Tuesday. Without more clarification, Congressional Progressive Caucus Chair Pramila Jayapal said most of her members still plan to oppose Thursday's infrastructure vote. "As our members have made clear for three months, the two are integrally tied together, and we will only vote for the infrastructure bill after passing the reconciliation bill," Jayapal said in a statement, capping an hourlong meeting of progressive members. (POLITICO)

FISCAL: On Tuesday, Senate Minority Leader Mitch McConnell rejected Majority Leader Chuck Schumer's request for a vote to suspend the debt limit, leaving the government closer to a debt default and shutdown. "Democrats won't get bipartisan help paving a path to partisan recklessness," McConnell wrote on Twitter. (Insider)

CORONAVIRUS: The U.S. Food and Drug Administration is leaning toward authorizing half-dose booster shots of the Moderna Inc. coronavirus vaccine, satisfied that it's effective in shoring up protection, people familiar with the matter said. The authorization would set the stage to further widen the U.S. booster campaign after earlier authorization of the Pfizer Inc.-BioNTech SE shot. About 170 million fully vaccinated people in the U.S. received the Moderna or Pfizer shots, or 92% of the total inoculated so far. The people spoke on the condition of anonymity, before a potential announcement. It's not clear when an announcement will come. (BBG)

CORONAVIRUS: White House chief medical advisor Dr. Anthony Fauci said Tuesday that safety and efficacy data could be available within the next two weeks on pairing a primary regimen of Covid vaccines from one manufacturer with boosters from another. (CNBC)

CORONAVIRUS: New York City Mayor Bill de Blasio hailed vaccine mandates following a court panel decision on Monday that the city could proceed with a vaccine requirement for teachers and other education workers. Workers at the largest U.S. school district have until Friday at 5 p.m. to get their first Covid shot or get placed on unpaid leave. Principals will have the weekend to find substitute teachers so that "by Monday morning, 100% of staff will be vaccinated," de Blasio said during a briefing. (BBG)

BANKS: Federal Reserve officials have questioned several big U.S. banks about their exposure to China Evergrande Group, joining other global regulators in examining the potential fallout Powell, Lagarde, Bailey, from the property developer's debt crisis. Troubles at Evergrande, with more than $300 billion of liabilities, spurred the Fed to seek information to head off any risks to financial stability, according to people familiar with the matter. Hong Kong's central bank also asked lenders there to report risks tied to Evergrande, China's largest issuer of high-yield, dollar-denominated bonds. (BBG)

OTHER

GLOBAL TRADE: U.S. Commerce Secretary Gina Raimondo said on Tuesday the Chinese government is preventing its domestic airlines from buying "tens of billions of dollars" of U.S.-manufactured airplanes. (RTRS)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai and her European Union counterpart discussed common challenges posed by non-market economies, including China, during a meeting in Washington on Tuesday, Tai's office said in a statement. (RTRS)

GLOBAL TRADE: U.S. Treasury Secretary Janet Yellen said on Tuesday she is looking for G20 countries to reach a political agreement on a global minimum tax deal at the G20 summit in October and has not ruled out a rate higher than 15%. Yellen, speaking to the National Association for Business Economics, said that the Senate Finance Committee is looking at a "slightly higher" overseas minimum corporate tax rate than the 16.5% passed by the House Ways and Means Committee. "We'll see where it all shakes out, but my hope is that when reconciliation (legislation) passes, we will come into compliance with this regime, and we're looking for political agreement to be achieved at the G20 summit at the end of October, and then countries will quickly put this into place," Yellen said. (RTRS)

GLOBAL TRADE: Switzerland won't be able to meet the implementation deadline of 2023 for the global minimum corporate tax, according to Finance Minister Ueli Maurer. Switzerland has a federal system and its lawmaking process is at-time cumbersome. Maurer told a conference in Bern that the Swiss would be informing their counterparts of the need for more time later this year and hoped to meet with understanding. (BBG)

U.S./CHINA: The Biden administration dispatched a top Treasury Department official to a meeting with Chinese regulators and Wall Street executives this month as the administration navigates its approach toward the Asian rival. David Lipton, senior counselor to Treasury Secretary Janet Yellen and a former top International Monetary Fund official, participated virtually in the September meeting where Chinese officials talked with top U.S. investors, according to people familiar with the attendees. (BBG)

GEOPOLITICS: The United States has reached out to China diplomatically about reducing its purchases of Iranian crude oil, U.S. and European officials said on Tuesday, as Washington seeks to persuade Tehran to resume talks about reviving the 2015 nuclear deal. Purchases of Iranian oil by Chinese companies are believed to have helped keep Iran's economy afloat despite U.S. sanctions that are designed to choke off such sales to put pressure on Iran to curb its nuclear program. "We are aware of the purchases that Chinese companies are making of Iranian oil," said a senior U.S. official who spoke on condition of anonymity because of the sensitivity of the matter. "We have used our sanctions authorities to respond to Iranian sanctions evasion, including those doing business with China, and will continue to do so if necessary," he added. (RTRS)

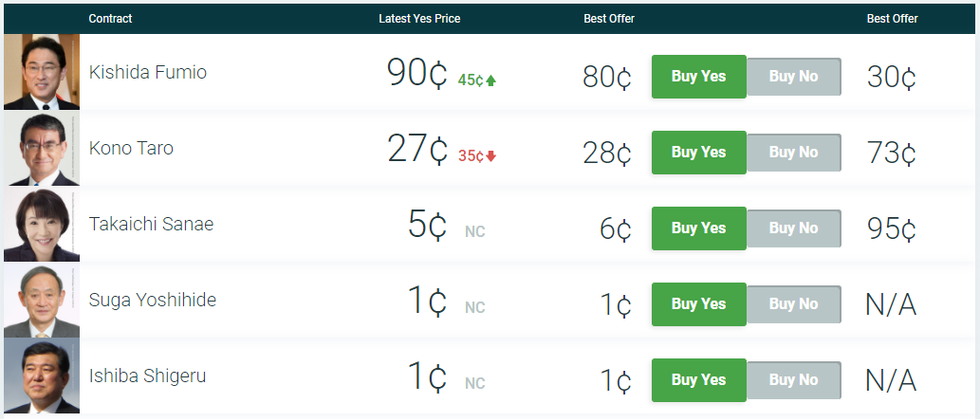

JAPAN: Fumio Kishida garnered 256 votes in the first round of LDP leadership race, with Taro Kono ranking second with 255 votes. The result sets the scene for the expected Kono-Kishida runoff. Sanae Takaichi came third with 188 votes, while Seiko Noda brought up the rear with 63 votes. Solid result in the first round is a boon to Kishida's leadership bid, as the former Foreign Minister has solid backing among lawmakers, whose votes will have a greater weight in the runoff. As a reminder, in the second round of the election each of the 382 LDP lawmakers and each of the 47 local party chapters will get one vote. The gap between Kishida's vs. Kono's odds of being Japan's Prime Minister come the year-end has widened, as implied by betting markets. (MNI)

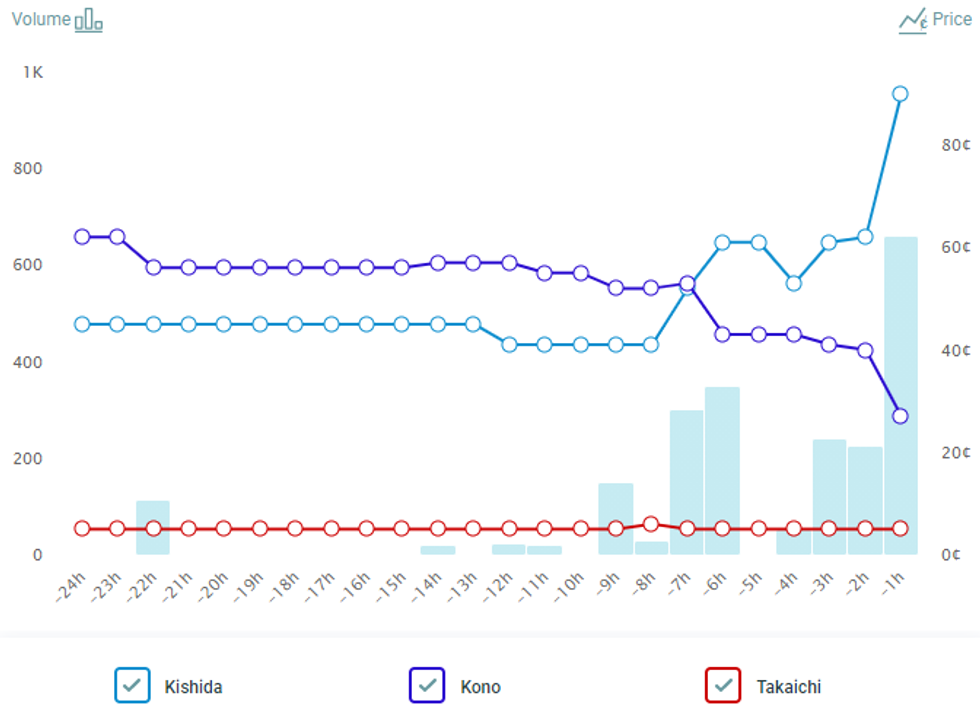

JAPAN: It appears that the Sankei piece flagged in the previous bullet has provided a boost to market pricing of a Kishida win in today's LDP leadership election, putting him ahead of main contender Kono.

- The Sankei report pointed to a deal struck by Kishida and Takaichi camps, which would make them join forces if any of the two candidates faces Kono in the second round of the election.

- Kono relies on his popularity among rank-and-file LDP members, while Kishida is expected to score the most votes of LDP lawmakers.

- The race is unlikely to be concluded in the first round, where half of the voting power lies with rank-and-file party members. The backing from party heavyweights will be critical in deciding the outcome of the second round, which is why the Kishida-Takaichi deal may tip the balance in the potential runoff.

- Note the increase in implied odds of Kishida being the Prime Minister come the end of the year around the time the Sankei piece was released (Fig. 2). The winner of LDP leadership race is virtually certain to become the next Premier.

Source: PredictIT

Source: PredictIT

Fig. 2: Who Will Be The Prime Minister Of Japan On Dec 31? PredictIt "Yes" Share Price/Volume By Candidate In The Last 24 Hours.

Source: PredictIt

Source: PredictIt

BOJ: MNI INSIGHT: Capex Trend A Concern For BOJ Rebound Outlook

- Bank of Japan officials are focused on whether capital investment plans will remain solid in the September Tankan for automobile makers and related firms that continue to grapple with supply chain disruptions, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's federal government will start to withdraw support from the Covid-19 Disaster Payment when vaccination thresholds are reached, Treasurer Josh Frydenberg said in an emailed statement. The temporary payment for those who have lost work will begin to transition once a state or territory reaches 70% full vaccination of its population who are 16 years and older. At 80% vaccination rate, the temporary payment will step down over a period of two weeks before ending. The program has supported about 2 million Australians with over A$9 billion payments made since it was announced in June. (BBG)

AUSTRALIA: Regulators are looking at measures to deal with the growing risk of household debt outpacing incomes. New home loans where debt is at least six times greater than income rose to a record 22 per cent in the June quarter - up from 16 per cent a year earlier. Australia's four financial regulators said in a statement on Wednesday they were "mindful that a period of credit growth materially outpacing growth in household income would add to the medium-term risks facing the economy, notwithstanding that lending standards remain sound". "Against this background, the council discussed possible macroprudential policy responses," the Council of Financial Regulators said in their quarterly statement. "(The Australian Prudential Regulation Authority) will continue to consult with the council on the implementation of any particular measure. "Over the next couple of months, APRA also plans to publish an information paper on its framework for implementing macroprudential policy." (The West Australian)

NORTH KOREA: North Korea opened a session of its rubber-stamp legislature without leader Kim Jong-un in attendance and dealt with economic and other domestic issues without issuing any message to South Korea or the United States, according to state media Wednesday. The Supreme People's Assembly (SPA) meeting held Tuesday drew attention as it came just days after the sister of leader Kim Jong-un issued a conciliatory message to South Korea, including the prospect of an inter-Korean summit, if Seoul drops its "double standards." (Yonhap)

NORTH KOREA: North Korea said Wednesday that it tested a newly developed hypersonic missile a day earlier. The North's Academy of Defence Science test-fired the Hwasong-8 missile from Toyang-ri, Ryongrim County of Jagang Province, the official Korean Central News Agency (KCNA) said. "The development of the hypersonic missile, one of 5 top-priority tasks of the five-year plan facing the field of strategic weapon for the development of defence science and weapon system set forth at the 8th Congress of the Party, has been pushed forward according to a sequential, scientific and reliable development process," the KCNA said.

CANADA: MNI BRIEF: Canada July GDP Seen Down Less Than Govt Flash

- Canada on Friday will likely report that July GDP shrank 0.2% according to a market consensus, a decline half as much as the government statistics office's flash estimate, on resilience in the job market and retailing - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's financial stability council updated its balance of risks, with Pemex's credit rating remaining an internal risk. Economic and financial environment continues to be influenced by the pandemic, according to a statement from the stability council. Risks and vulnerabilities that increased during lockdowns have diminished, but uncertainty remains, particularly with less dynamism in internal demand and effects on the sovereign and Pemex premiums, as well as the state oil company's credit rating. External risks include restrictive and volatile global financial markets. Mexico's banking system continues to show resiliency with solid liquidity and capital positions. Council aware of Accendo Banco's situation, which resulted from non-compliance with regulations. (BBG)

BRAZIL: Brazil's fuel prices are currently at a high level due to state-level taxes, Lower House speaker Arthur Lira said during an event in Alagoas state alongside President Jair Bolsonaro. Lower house has fulfilled its role and helped the government's reforms agenda. Senate now needs to speed up the analysis of bills, he added. Brazil's Lower House to discuss a fixed ICMS tax rate for fuels in states, according to Lira. (BBG)

BRAZIL: To give special fiscal treatment for social spending, including the Covid emergency aid, is not appropriate, Treasury Secretary Jeferson Bittencourt said in an online press conference. Social problems must be fixed properly, he said. There is no possibility of a new social program without fiscal compensation, secretary said. Brazil's new social program will only start if the income tax reform is approved, Bittencourt said. (BBG)

BRAZIL: Brazil's lower house approved a bill to extend for up to 15 years the exemption of state-level ICMS tax on commerce, including incentives and fiscal or financial-tax benefits aimed at fostering commercial activities. There were 416 votes in favor and 22 against. Bill now goes to the Senate. (BBG)

SOUTH AFRICA: The Constitutional Court upheld a ruling of a lower court that South Africa's largest power utility's decision to disconnect electricity to two defaulting municipalities was irrational, Business Day reports. Decision setback to Eskom's bid to recover unpaid bills from municipalities. Power utility owed about 36 billion rand by municipalities. (BBG)

EQUITIES: Hong Kong is studying with Chinese authorities to expand the use of yuan in stock trading in Hong Kong, Hong Kong Monetary Authority Chief Executive Eddie Yue says at the de-facto central bank-organized Treasury Market Summit. Further studies needed on how to drive demand from issuers and investors as well as reducing market fragmentation. He hopes to come up with practical solutions "very soon." Hong Kong and China are mutually beneficial in fostering yuan internationalization like "bee and flower." (BBG)

OIL: The White House is staying in communication with OPEC about oil prices and looking at every tool to address its cost, White House press secretary Jenn Psaki said on Tuesday after Brent crude topped $80 per barrel for the first time in nearly three years. (RTRS)

CHINA

PBOC: China's central bank is shifting its monetary policies to prevent a further slowdown as the authorities recognize that the real economy is faltering and growth drivers weaken in H2, Yicai.com reported citing analysts including Citic Securities Ming Ming, who is a former central bank official. The PBOC is likely to ensure the growth of M2 and social supplies meet the nominal GDP growth needs, and will continue to support small businesses, employment and consumption, Yicai said citing analyst Zhou Maohua of Everbright Bank. The economy faces greater pressure characterized by a lack of infrastructure investments, persistently high commodity prices, logistical bottlenecks and shortage of parts, property curbs, electricity shortages and the global pandemic, Zhou was cited saying. (MNI)

CREDIT: China Evergrande Group is planning to raise nearly 10 billion yuan ($1.55 billion) by selling part of its stake in Shengjing Bank to a state-owned enterprise as part of efforts by the debt-laden conglomerate to meet its financial obligations. Evergrande has entered into an agreement to sell a 19.93% stake in the bank to Shenyang Shengjing Finance Investment Group Co., it said Wednesday. The conglomerate, which has businesses spanning from property to finance to electric vehicles, will sell a total of 1.75 billion non-publicly traded domestic shares in the bank for CNY5.70 per share. The transaction is subject to approval from the China Banking and Insurance Regulatory Commission and the Assets Supervision and Administration Commission. Evergrande said that its liquidity crunch had adversely affected Shengjing Bank in a material way. "The introduction of the purchaser, being a state-owned enterprise, will help stabilise the operations of Shengjing Bank," Evergrande said. (Dow Jones)

CREDIT: Creditors of HNA Group and 320 related companies will vote on a debt restructuring plan at a second creditor meeting Wednesday, according to the proposal seen by Bloomberg News. The conglomerate has proposed full cash repayment for the first 30,000 yuan of claims involving unsecured debt. The remainder would be repaid as interests in a new trust established to hold assets including equity of some HNA units and receivables. (BBG)

PROPERTY: China is likely to gradually relax the current tight financing environment for the real estate sector, focusing on meeting the loan demand of developers and first-time homebuyers and increasing financial support for the housing rental market, wrote Yin Zhongli, director of the Real Estate Finance Research Center of the Chinese Academy of Social Sciences in an article published by 21st Century Business Herald. In an unusual move, the central bank emphasized the healthy development of the property market and safeguarding the legitimate rights of home consumers in its Q3 MPC meeting, hinting a relaxation, said Yin. The release of mortgage loans may be sped up as the PBOC also proposed to allow some of next year's loan quotas to be used this year to offset the recent decline in credit growth, said Yin. But such relaxation should be carried out through window guidance to banks, so to avoid stoking the real estate market, according to Yin. (MNI)

BONDS: Japan's Government Pension Investment Fund, the world's largest pension fund, said it won't include yuan- denominated Chinese sovereign debt in its portfolio. The decision comes as FTSE Russell is set to start adding Chinese debt to its benchmark global bond index, which the GPIF follows, from October. The pension fund will instead use a version of the World Government Bond Index that excludes Chinese government bonds, Hiroshi Nagaoka, an official at the pension fund, told Bloomberg News. Minutes from a July meeting of the pension fund's board of governors released on Wednesday showed that the members were in favor of avoiding Chinese bonds, citing issues surrounding settlement, liquidity and stability. The management board made a final decision on September 22, Nagaoka said. The decision was not related to the issues surrounding China Evergrande Group, he added. The Nikkei, which earlier reported the decision, had said that the debt crisis at the Chinese firm weighed on the fund's decision. "Investors have been forced to rethink the risks of investing in Chinese assets," said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. in Tokyo. He cited U.S.-China tensions and recent government curbs on the private sector, as well as Evergrande. (BBG)

ENERGY: China's top economic planner said on Wednesday that railway companies and local authorities should strengthen coal transportation in key areas including the northeast region and ensure stable supply for power generation. The National Development and Reform Commission (NDRC) sent local economic planners, energy administrations and railway companies a notice urging them to reinforce coal transportation to secure enough supply to meet residents' heating demand during the winter season. Local economic planning departments should encourage medium- to long-term supply contracts of thermal coal that have a guarantee of transport capacity, the NDRC said. (RTRS)

R&D: China will achieve "large-scale" increase in research and development spending by 2025 and raise the number of top-level scientists as well as achieving self-sufficiency in training domestic talents, President Xi Jinping said at a top-level government forum on talents, according to a readout by Xinhua News Agency. By 2030, the country will install a system that attracts top foreign talents and become a world leader in science and technology, Xi said. The government will strategically support the building of global talent pools, including setting up talent bases in Beijing, Shanghai and Guangdong-Hong Kong region, Xi said. (MNI)

CORONAVIRUS: China supports waiver of intellectual property rights for Covid-19 vaccines, and calls upon competent countries to play an "active" role in international cooperation, official Xinhua reports, citing Chen Xu, head of the Chinese Mission to the UN Office at Geneva. Speaking at a session of the UN Human Rights Council Tuesday, Chen called upon all member nations to expand vaccine production, upgrade production capabilities of developing countries through exports, donation, joint research and development and franchised production. (BBG)

OVERNIGHT DATA

UK SEP BRC SHOP PRICE INDEX -0.5% Y/Y; AUG -0.8%

CHINA MARKETS

PBOC INJECTS NET CNY40BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY100 billion via 14-day reverse repos with the rate unchanged at 2.35% on Wednesday. The operations lead to a net injection of CNY40 billion after offsetting the maturity of CNY60billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3694% at 09:29 am local time from the close of 2.1889% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Tuesday vs 52 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4662 WEDS VS 6.4608

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4662 on Wednesday, compared with the 6.4608 set on Tuesday.

MARKETS

SNAPSHOT: Evergrande Sheds Bank Equity Holdings

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 676.29 points at 29507.67

- ASX 200 down 67.353 points at 7208.2

- Shanghai Comp. down 64.62 points at 3537.599

- JGB 10-Yr future up 4 ticks at 151.41, yield down 1.5bp at 0.070%

- Aussie 10-Yr future down 2.0 ticks at 98.475, yield up 1.5bp at 1.495%

- U.S. 10-Yr future +0-01+ at 131-16+, yield down 0.52bp at 1.532%

- WTI crude down $1.01 at $74.28, Gold up $3.48 at $1737.46

- USD/JPY unch. at Y111.50

- FED: BULLARD STRIKES USUAL HAWKISH TONE (BBG)

- CHINA EVERGRANDE PLANS TO RAISE $1.55B FROM SHENGJING BANK STAKE SALE (DJ)

- GPIF WON'T BUY CHINESE SOVEREIGN DEBT (BBG)

- JAPANESE ELECTION SET FOR KONO-KISHIDA RUNOFF

BOND SUMMARY: Latest Dip Bought In Asia

Dip buying has kicked into U.S. Tsys after some initial weakness in early Asia-Pac trade, with Chinese equity markets on the defensive as concerns surrounding the well-documented headwinds for Chinese economic activity weigh on mainland and Hong Kong equity indices ahead of the week-long Chinese holiday, which gets underway on Friday. The earlier disclosed liquidation of some of Evergrande's private shareholdings is providing a relief rally for the name, although questions remain whether the move will provide much in the way of meaningful medium-term reprieve for the firm (as we discussed earlier). T-Notes last +0-02+ at 131-17+, a little shy of their peak, running on ~185K volume. Cash Tsys now sit little changed to ~1.5bp richer across the curve, with the belly leading the rally.

- To recap, the Tsys were subjected to further cheapening pressure on Tuesday, with the curve running steeper as 30s cheapened by ~9bp on the day. The space finished off of cheapest levels with 10s failing to test their mid-June highs in yield terms after various account types stepped in to fade the latest bout of cheapening during early NY hours. Equities came under notable selling pressure on the uptick in yields, with tech leading the weakness. Uncertainty surrounding the debt ceiling/government funding also remained in the mix with Republicans and Democrats still at loggerheads when it comes to avoiding a looming government shutdown. 7-Year supply helped soothe the nerves a little, with the bidding metrics on the solid side (modest downtick to sub-average levels in cover, with dealer takedown holding below the recent average), even as the sale tailed by 0.8bp.

- A raft of Fedspeak headlines Wednesday's NY docket.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y935bn of JGBs from the market:

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y60bn worth of JGBis

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov ‘31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 1.4956% (prev. 1.2319%)

- High Yield: 1.4975% (prev. 1.2325%)

- Bid/Cover: 5.3400x (prev. 5.0700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 21.6% (prev. 69.4%)

- Bidders 45 (prev. 55), successful 19 (prev. 17), allocated in full 8 (prev. 4)

EQUITIES: Asia-Pac Markets Slide

A negative day for equity markets in the Asia-Pac time zone, taking a negative lead from the US where major indices saw sharp declines. Markets in Japan lead the way lower with a slide of around 2.5%, the ruling party's leadership election steals the limelight today. Markets in China also lower, Evergrande is in focus with a coupon payment coming due today. In South Korea the KOSPI saw heavy losses after positive reopening comments from a minister sparked speculation that the October BoK meeting could be live. In the US futures have bounced slightly, coming off the back of the worst one-day loss since May, upside is tempered by concerns over the debt ceiling impasse. participants can look forward to UK lending data, Eurozone consumer confidence and a speech from Fed's Harker. Later in the day a raft of Central Bank speakers will appear on a policy panel discussion at ECB Forum on Central Banking.

OIL: Rally On Pause

Crude futures are lower in Asia-Pac trade on Wednesday, adding to Tuesday's losses as the greenback holds most of its gains while a broad risk off tone has weighed on the commodity complex. Data from API yesterday was bearish for oil, with gains in headline crude stocks to the tune of 4.127m bbls and builds in downstream products. If official DoE inventory figures confirm the build it will be the first lift in stockpiles for eight weeks. The modest correction lower in both WTI and Brent prices has done little to deter the near-term uptrend in oil prices, however, with the technical picture still very much bullish. The White House further voiced their view on energy markets, stating that they continue to speak with OPEC on pricing matters, and is looking at every means they have to address the cost of oil.

GOLD: Nudging Away From Tuesday's Lows

A slight richening in U.S. Tsys has allowed bullion to form a base in Asia-Pac hours, with spot last dealing +$6/oz at $1,740/oz. This comes after an aggressive round of Tsy cheapening and an uptick in the broader DXY weighed on gold on Tuesday, with the sell off halting just below $1,730/oz. Bears failed to force a test of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Fedspeak and the latest round of U.S. PCE data as well as the m'fing ISM survey present the main event risks during the remainder of the week.

FOREX: Return Of Covid Jitters Clips Kiwi's Wings

Selling pressure hit the kiwi after New Zealand reported a spike in daily Covid-19 case count. Officials detected 45 new infections, the most since September 2, after recording just 8 yesterday. This resulted in some dovish RBNZ repricing, with the OIS strip pricing an ~81% chance of a 25bp OCR hike when the MPC convene next week, down 9pp from what was seen before headlines surrounding New Zealand's Covid-19 caseload hit the wires.

- The NZD remained the worst G10 performer, while NZD/USD probed the water below the 61.8% retracement of its Aug - Sep rally, as it registered a fresh one-month low.

- NZD/USD 1-week implied volatility spiked higher, reaching levels not seen since July 9. It last sits at 11.15%, with participants assessing RBNZ outlook ahead of next Wednesday's monetary policy meeting.

- AUD/NZD caught a bid and BBG cited a trader source pointing to the trimming of existing short positions following the release of New Zealand's latest Covid-19 case count. The rate narrowed in on its 50-DMA, while AUD topped the G10 scoreboard.

- Most G10 crosses were happy to tread water, while the DXY ground away from a multi-month peak reached yesterday. USD/JPY touched its highest point since Mar 26, 2020 before erasing gains, with Japan watchers awaiting the outcome of ruling party leadership contest.

- There is central bank speak galore to digest today, with several notable appearances due as part of the ECB's annual Forum on Central Banking, including a panel discussion with Fed, ECB, BoE & BoJ chiefs.

FOREX OPTIONS: Expiries for Sep29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700($994mln), $1.1750(E1.2bln), $1.1800-15(E709mln)

- USD/JPY: Y109.90-00($1.3bln), Y111.00-05($558mln)

- GBP/USD: $1.3680(Gbp997mln)

- USD/CAD: C$1.2620($1.4bln), C$1.2630-40($531mln), C$1.2900($2.0bln)

- USD/CNY: Cny6.4400($1bln), Cny6.4965($700mln)

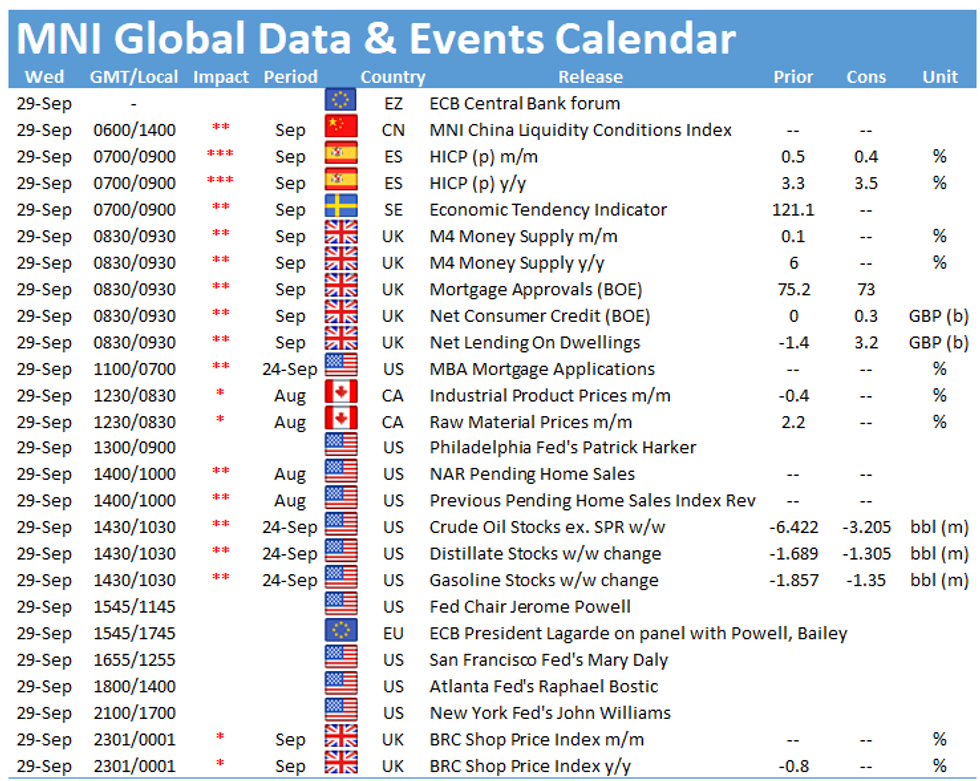

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.