-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: U.S. Nears Kicking Debt Can Down The Road

EXECUTIVE SUMMARY

- SENATE POISED TO STAVE OFF DEBT CRISIS, TALKS SPILL OVER INTO THURSDAY (Hill)

- BIDEN, XI TO HOLD VIRTUAL SUMMIT BY YEAR-END

- ECB SAID TO STUDY NEW BOND-BUYING PLAN FOR WHEN CRISIS TOOL ENDS (BBG)

- RUSSIA OFFERS TO STABILISE GAS PRICES (FT)

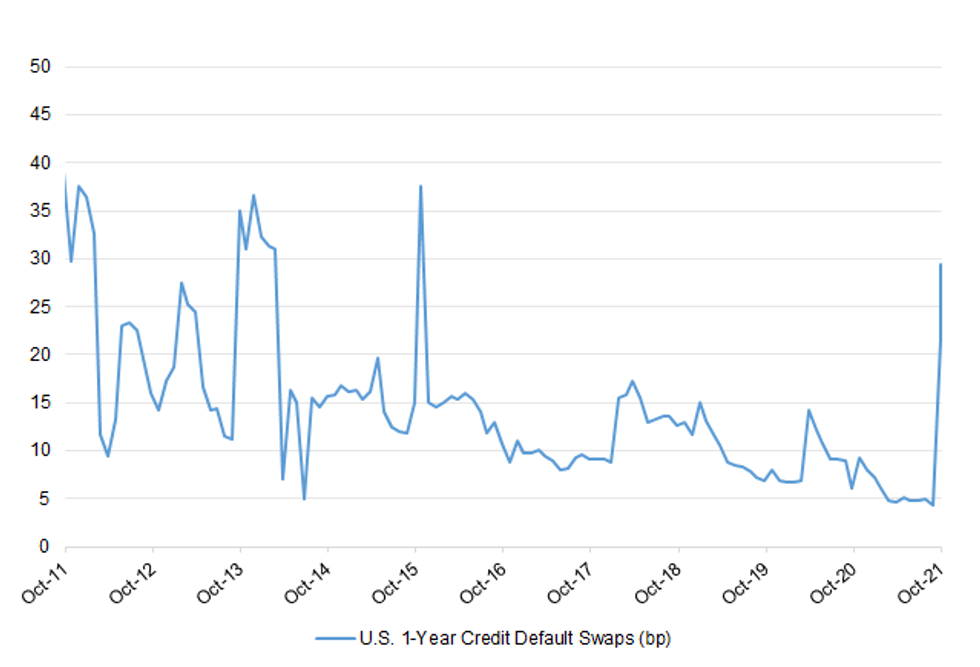

Fig. 1: U.S. 1-Year Credit Default Swaps (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/ECONOMY: Boris Johnson has promised to "get on with the job" of uniting and levelling up the UK, in a speech to the Conservative Party conference. In an upbeat address peppered with jokes, but light on new policy, the prime minister claimed a high-wage, high-skilled economy was being created in the wake of Brexit and the pandemic. He also defended tax rises to pay for the NHS and vowed to fix social care. The 45-minute speech was his first to a conference since the pandemic began. In it, the prime minister said the overwhelming Conservative general election victory in 2019 placed an onus on his government to deliver change demanded by voters. The main theme of his speech was "levelling up", with the PM saying that reducing gaps between regions would ease pressure on south-eastern England, while boosting places that felt left behind. (BBC)

ECONOMY: Business leaders rounded on Boris Johnson for lacking a coherent economic plan after he delivered a boosterish conference speech that made barely a mention of the supply chain crisis. The address was condemned as "bombastic but vacuous and economically illiterate" by the free market Adam Smith Institute, while the Conservative thinktank Bright Blue issued a stark warning. "The public will soon tire of Boris's banter if the government does not get a grip of mounting crises: price rises, tax rises, fuel shortages, labour shortages. There was nothing new in this speech, no inspiring new vision or policy," its chief executive, Ryan Shorthouse, said. (Guardian)

ECONOMY: Kwasi Kwarteng, the Business Secretary, has been criticised by fellow frontbenchers for failing to act more quickly to tackle the petrol crisis as a blame game erupted at the Tory conference. Critics in the Cabinet said Mr Kwarteng, who was made Business Secretary in January, should have reacted earlier to signs that petrol supplies were drying up. The Telegraph understands that Air Commodore Richard Pratley was sent from the Ministry of Defence to help tackle the emerging crisis amid criticism of how Mr Kwarteng's department was handling it. There is also wider disillusionment in parts of Downing Street about how the Department for Business, Energy and Industrial Strategy (BEIS) is performing. (Telegraph)

ECONOMY: Local councils in England face a funding crisis unless they significantly increase taxes and the government provides billions of pounds in extra funding, the Institute for Fiscal Studies said. The warning from the prominent research group tracking the public finances highlights the scale of the challenge facing municipal authorities to maintain services in the wake of the pandemic. (BBG)

POLITICS: Voters think Sir Keir Starmer came across more competent, in touch and agreeable in his conference speech than Boris Johnson managed today, an exclusive poll for Sky News reveals. The pollster Opinium showed 1,305 voters key sections of today's speech by the prime minister. It found more voters agreed with Mr Johnson than disagreed and more felt he was strong, caring and competent than not. But, his scores were less favourable than those for Sir Keir's speech at last week's Labour conference in Brighton. After watching Mr Johnson's speech, 51% said they agreed with what he had to say against 41% who did not. Some 53% said the prime minister came across as strong, while 30% said he came across as weak. And 49% said he was competent while 37% said incompetent, while 46% said he came across as if he cares about ordinary people while 42% said he did not care. Some 44% said he was in touch with people's concerns while 45% said out of touch. Also, 40% said Mr Johnson was interesting and 22% said boring. On most measures, Sir Keir scored higher, with 63% saying they agreed, 57% strong, 62% competent, 68% caring and 60% in touch. More people even thought Sir Keir was interesting, with 41% saying that about his speech. (Sky)

GAS: UK wholesale gas prices hit a record high before falling after Russia said it was boosting supplies to Europe. Russia President Vladimir Putin appeared to calm the market after gas prices had risen by 37% in 24 hours to trade at 400p per therm on Wednesday. (BBC)

EUROPE

ECB: The European Central Bank is studying a new bond-buying program to prevent any market turmoil when emergency purchases get phased out next year, according to officials familiar with the matter. The plan would both replace the existing crisis tool and complement an older, open-ended quantitative-easing scheme that's currently acquiring 20 billion euros ($23.1 billion) in debt every month, said the officials, who asked not to be identified because the discussions are confidential. No decisions have been made, they said. An ECB spokesperson declined to comment on the report, while noting that staff discuss a wide array of ideas that aren't necessarily presented to the Governing Council or the Executive Board. (BBG)

FRANCE: Emmanuel Macron made the case for a more assertive European Union foreign policy over a summit dinner on Tuesday and met with mixed reviews from the bloc's other leaders. The gathering near the Slovenian capital Ljubljana was the French president's first opportunity to let off steam with the EU's heads of government since the loss of a massive submarine deal to the U.S. last month. Macron told his colleagues that they need to remember that the EU has serious diplomatic leverage as one of the world's biggest trading blocs and a major investor in the fight against climate change, according to a person with knowledge of their discussions. He told his EU partners they should act with the confidence of a global power. (BBG)

AUSTRIA: Austrian authorities raided the offices and party headquarters of Chancellor Sebastian Kurz in Vienna on Wednesday amid suspicion that he and his inner circle conspired to embezzle public funds to bribe pollsters and prominent media figures in return for favorable coverage. The raids marked a significant escalation of prosecutors' corruption probe into Kurz, who already faces possible indictment in a separate case involving perjury allegations related to sworn testimony he gave before a parliamentary inquiry last year. Though some opposition leaders called on the conservative chancellor to resign, the head of Kurz's junior coalition partner, Greens leader Werner Kogler, signaled he would not abandon the alliance as long as it remained "capable of governing." Nonetheless, given the gravity of the accusations the chancellor faces — unprecedented in Austria's democratic history — a sudden collapse of Kurz's government remains a distinct possibility. It's clear from court filings published on Wednesday that the prosecutors' primary target is Kurz, whom they describe as the "central person" in the affair and the primary beneficiary of the alleged criminal behavior. (Politico)

DENMARK: Denmark's parliament begins hearings on Thursday on whether Prime Minister Mette Frederiksen knew she was issuing an illegal order last year when deciding to cull the country's entire mink population to prevent Covid-19 mutations. Frederiksen and several key ministers and government officials will be testifying in court in the coming months for the parliamentary probe, which seeks to establish if the minority government knowingly broke the law when it decided to cull 17 million mink in November. The move damaged the reputation of the government that otherwise is perceived to have handled the crisis well. (BBG)

US

FISCAL: The Senate appeared poised to stave off a debt ceiling crisis of its own making on Wednesday after Democrats said they could accept a surprise offer from Senate Minority Leader Mitch McConnell (R-Ky.) to raise the debt limit for two months. McConnell made the offer shortly before the Senate was prepared to hold another vote on extending the nation's borrowing limit just more than a week before a possible debt default. Republicans had been set to reject the measure. The vote was quickly canceled after Democrats emerged from a meeting saying they could agree to the McConnell offer. "In terms of a temporary lifting of the debt ceiling, we view that as a victory, a temporary victory with more work to do," Sen. Tammy Baldwin (D-Wis.) told CNN's Jake Tapper after the meeting. A key GOP centrist, Sen. Lisa Murkowski also embraced the proposal, saying it was "going to give us a way out of the woods, which is what we want." (Hill)

FISCAL: Negotiations over a short-term debt hike are spilling over into Thursday as Senate Majority Leader Charles Schumer (D-N.Y.) and Senate GOP Leader Mitch McConnell (R-Ky.) haggle over the size of the debt limit increase. McConnell announced after a closed-door GOP lunch that Republicans were offering to let Democrats pass a short-term debt limit increase that would last into December, and Democrats quickly signaled that they intended to accept the agreement. But behind-the-scenes talks then dragged on for hours, with the Senate remaining in limbo as lawmakers and staffers waited to see if the two leaders could hash out a deal to punt the debt fight closer to the end of the year. Schumer said on the Senate floor after midnight Thursday morning that he and McConnell had not yet reached a deal but that he hoped they could wrap up talks in a matter of hours. "We are making good progress, we're not there yet. But I hope we can come to an agreement tomorrow morning," Schumer said from the Senate floor. (Hill)

FISCAL: President Joe Biden enlisted financial and corporate leaders to help him pressure Republicans to stop blocking efforts to suspend the U.S. debt ceiling, warning that the government faces a first-ever default that would tank the economy. Biden hosted a mostly virtual meeting at the White House with several chief executive officers, whom he asked to explain how a default would impact their businesses, customers and the broader economy. "We're going to be defaulting on a debt that would lead to self-inflicted wounds that would risk the market tanking and wiping out retirement savings," he warned. "If they don't want to do the job, just get out of the way," he said of Republicans. (BBG)

POLITICS: A federal judge on Wednesday evening granted the Biden administration's request to temporarily block enforcement of Texas' controversial abortion ban. Why it matters: The ruling means that medical professionals can offer abortions in Texas even after about six weeks of pregnancy without fear of facing a lawsuit by members of the public, at least for the moment. (Axios)

POLITICS: The Biden administration is closing in on a nominee to lead the Food and Drug Administration, four people familiar with the process told POLITICO. The White House was nearing a final pick anyway, but National Institutes of Health Director Francis Collins' Tuesday announcement that he would step down accelerated the timeline, according to one person with knowledge of the matter. (Politico)

OTHER

U.S./CHINA: Joe Biden and his Chinese counterpart Xi Jinping have agreed to hold a virtual summit this year, in the first sign of improving relations between the countries since the US president took office. Jake Sullivan, US national security adviser, and Yang Jiechi, China's top foreign policy official, reached an agreement in Zurich on Wednesday to hold a virtual summit between the leaders following their two phone calls earlier this year. "We do have out of today's meeting an agreement in principle to hold a virtual bilateral meeting between the leaders before the end of the year," a US official said after Sullivan and Yang met for six hours. (FT)

U.S./CHINA/TAIWAN: U.S. Secretary of State Antony Blinken criticized China's recent military maneuvers around Taiwan, urging leaders in Beijing to stop such behavior for fear of a miscalculation. "The actions we've seen by China are provocative and potentially destabilizing," Blinken said Wednesday in an interview in Paris with Bloomberg Television. "What I hope is that these actions will cease because there's always the possibility of miscalculation, of miscommunication, and that's dangerous." China has ratcheted up tension around Taiwan in recent weeks, sending scores of warplanes into the island's airdefense- identification zone. At the same time, the U.S. and several allies, including Japan and the U.K., have been conducting naval drills in nearby waters. "It's very important that no one take unilateral actions that change the status quo by force," Blinken said in the interview, conducted on the sidelines of a meeting of the Organization for Economic Cooperation and Development. "We need to see China stop these actions." In a news conference later in the day, Blinken called the U.S.-Taiwan relationship "rock solid." His remarks on China's actions echoed those by White House Press Secretary Jen Psaki on Monday, comments that prompted Chinese Foreign Ministry spokeswoman Hua Chunying to criticize the U.S. for its "extremely erroneous and irresponsible" statements toward an island it considers its territory. (BBG)

TAIWAN: Taiwan will ensure regional peace and stability and seeks to work with other like-minded democracies, President Tsai Ing-wen told senior French and Australian dignitaries on Thursday, days after a dramatic spike in tensions with China. The trips by four French senators and former Australian prime minister Tony Abbott come after four straight days, beginning last Friday, of massed Chinese air force incursions into Taiwan's air defence zone, moves met with concern by Washington and its allies. (RTRS)

RUSSIA/NATO: Nato has expelled eight "undeclared intelligence officers" from the Russian delegation to the military alliance, and halved the total size of Moscow's representation, in a move that will further deteriorate relations between western militaries and the Kremlin. (FT)

RUSSIA/NATO: Russia will retaliate to the expulsion of diplomats from the Permanent Mission of the Russian Federation to NATO, and the organization's accusations are unfounded, the chairman of the 7th Duma's international affairs committee, Leonid Slutsky, told TASS on Wednesday. "Such moves are reciprocal in the diplomatic practice. I have no doubt that the leadership of the Russian Foreign Ministry will suggest adequate response measures, not necessarily symmetrical," the senior legislator said. (TASS)

IMF: Treasury Department officials are debating whether the U.S., the International Monetary Fund's largest shareholder, should ask Managing Director Kristalina Georgieva to resign amid an ethics scandal, people familiar with the situation said. The Treasury's deliberation continues as the Washington-based fund said its executive board met with Georgieva on Wednesday as part of its ongoing review of an investigation by law firm WilmerHale, commissioned by the World Bank. It alleged that she pressured bank staff to adjust data for a ranking in China's favor while working there previously. She took the helm of the IMF in 2019. The 24-member board "remains committed to a thorough, objective, and timely review and expects to meet again soon for further discussion," the IMF said in a statement. The people who spoke to Bloomberg News about the U.S.'s position declined to be identified because the discussions are private. Washington's stance is key in the matter because it has the biggest share of the fund's voting rights at 16.5%. (BBG)

WHO: The World Health Organization has recommended the widespread rollout of the first malaria vaccine, in a move experts hope could save tens of thousands of children's lives each year across Africa. Hailing "an historic day", the WHO's director general, Dr Tedros Adhanom Ghebreyesus, said that after a successful pilot programme in three African countries the RTS,S vaccine should be made available more widely. (Guardian)

CORONAVIRUS: Two real-world studies published Wednesday confirm that the immune protection offered by two doses of Pfizer's Covid-19 vaccine drops off after two months or so, although protection against severe disease, hospitalization and death remains strong. The studies, from Israel and from Qatar and published in the New England Journal of Medicine, support arguments that even fully vaccinated people need to maintain precautions against infection. (CNN)

JAPAN: Prime Minister Fumio Kishida will deliver his first policy speech to lawmakers on Friday. The NHK, Nikkei and Sankei have circulated snips from the draft version of Kishida's address. NHK noted that the new Premier will reiterate his commitment to "new capitalism," putting greater emphasis on distributional issues. In line with this approach, he will promise tax cuts for firms which have raised wages of their employees and a boost to social security spending. Furthermore, Kishida will point to a growth strategy based on bold investments in R&D and development of digital infrastructure. He will also outline plans to tackle the outbreak of Covid-19 by the implementation of oral therapeutic drugs within a year, actively utilising vaccine certificates and amending the law to secure medical resources. The Nikkei reported that the Premier is set to pledge relief to all businesses affected by the outbreak of Covid-19, regardless of their location or industry affiliation. The measure may target businesses which experienced a significant drop in sales. The Sankei suggested that Kishida will launch a review of the National Security Strategy (NSS), which defines the guiding principles of Japan's foreign and defence policy. The current NSS was adopted by the Abe Cabinet in 2013. The key revisions to the NSS will include emphasising economic security and focus on the ability to strike enemy bases. While announcing these changes, Kishida will underscore Japan's advocacy of a "free and open Indo-Pacific," while flagging bigger assertiveness towards China. In addition, Kishida is expected to unveil plans to revise the National Defence Programme Guidelines (NDPG) and the Medium-Term Defence Programme (MTDP). NDPG sets forth the basic policy for Japan's defence, while MTDP is a five-year defence spending plan based on NDPG. (MNI)

JAPAN: Tokyo's coronavirus monitoring panel plans to lower the warning level for strain on the capital's medical system one notch from the current highest level when it meets Thurs., NHK reports, without attribution. (BBG)

AUSTRALIA/FRANCE: Australia's Foreign Minister Marise Payne said on Thursday the return of France's ambassador to Canberra will help repair relations between the two countries which were damaged when Australia cancelled a $40 billion submarine contract. (RTRS)

NORTH KOREA: Recent commercial satellite imagery indicates continued construction activity at North Korea's Uranium Enrichment Plant (UEP) at the Yongbyon Nuclear Scientific Research Center. Imagery from October 1 indicates that previously reported construction in an area just north of the plant's Cascade Hall #2 has recently been covered, concealing details of the building's layout and construction. Prior to this concealment, the floor space measured roughly 42 meters by 15 meters (including walls), with six circles each approximately three meters in diameter observed at the east end of the building. The purpose of the building is still unknown and may be harder to determine via imagery going forward. There are several possible functions for such an extension. One option, assuming that North Korea is producing low-enriched uranium at two enrichment halls, is that the extension could also be used to enrich low-enriched uranium to weapons grade (high-enriched uranium) as it becomes available from those two cascade halls. (38North)

CANADA: Prime Minister Justin Trudeau unveiled his government's mandatory vaccine policy today — a mandate that will require public servants to either get their shots by month's end or be forced into an unpaid leave of absence. All would-be travellers must also be fully vaccinated by Oct. 30 before boarding planes, trains or marine vessels. To bolster stalled vaccination rates, the federal government will require all of its employees in the "core public administration" and the RCMP to be fully vaccinated or to apply for a medical or religious exemption by the end of the month. Federal contractors, like cleaning staff, must also be fully vaccinated to gain access to government buildings. The estimated 267,000 employees covered by this policy must report their vaccination status by Oct. 29. (CBC)

SAUDI ARABIA/UK: The ruler of one of the UK's closest Middle East allies faces a police investigation after a judge has concluded he ordered the hacking of a Tory peer's mobile phone using surveillance software. Sheikh Mohammed bin Rashid al-Maktoum of Dubai, a key member of the Queen's racing circle, is implicated in the use of the Pegasus spyware programme as part of a bitter custody battle with his ex-wife, a senior judge has ruled (Times)

TURKEY: Turkey's parliament ratified the Paris climate agreement on Wednesday, making it the last G20 country to do so, after holding off for years due to what it saw as injustices in its responsibilities as part of the agreement. (RTRS)

BRAZIL: A new right-wing party has emerged in Brazil as the country's conservative forces seek to gobble up the largest portion of public funds available for next year's elections while breaking free from the influence of President Jair Bolsonaro. Brazil Union, as the alliance officially launched on Wednesday is called, has among its ranks five state governors, two cabinet members and more than 80 lawmakers, including senate head Rodrigo Pacheco. As the largest party in congress, it will control about one-sixth of an electoral fund of 5.7 billion reais ($1 billion) set aside for next year. (BBG)

BANXICO: Banxico's three consecutive rate hikes have reinforced higher CPI expectations for next year, said Gerardo Esquivel, deputy governor of the central bank of Mexico, in an interview with Arena Publica. These consecutive rate hikes pose the risk of transmitting the idea of a more permanent inflationary pressure than the current one, Esquivel said. (BBG)

PERU: Peru's President Pedro Castillo replaced a prime minister accused of terrorist sympathies with a less controversial choice in a bid to improve his administration's sour relations with lawmakers. Former head of congress Mirtha Vasquez was sworn in as prime minister on Wednesday evening, replacing the outgoing Guido Bellido. The move is likely to be popular with investors, who ditched Peruvian assets when Bellido was named, but angered senior members of Castillo's own socialist Peru Libre party. Waldemar Cerron, party spokesman and a Peru Libre congressman, described the new cabinet appointments as an act of treachery. "Peru Libre members of congress don't support this cabinet, because we consider it to be a betrayal of all the majorities that have waited for many years to come to power to be attended to," Cerron told reporters in Lima. Vasquez, 46, represents the Frente Amplio, or Broad Front coalition, which includes socialists, environmentalists and center-left politicians. Castillo named six other new cabinet members, including ministers of mining, work, and interior. Finance Minister Pedro Francke, who is popular with investors, will stay on in the role. (BBG)

GAS: Gas markets swung sharply on Wednesday after Russia's president Vladimir Putin said his country was prepared to stabilise the soaring global energy prices that are threatening to curb industrial activity and sharply raise inflation. UK and European natural gas prices shot higher early in the day to trade at close to 10 times their level from the beginning of the year. But prices abruptly reversed course hours later when Putin hinted that Russia's state-backed monopoly pipeline exporter, Gazprom, may increase supplies to help Europe avoid a full-blown energy crisis. "Let's think through possibly increasing supply in the market, only we need to do it carefully. Settle with Gazprom and talk it over," Putin said. "This speculative craze doesn't do us any good." Gas traders say one of the drivers of the rally in prices is that Russia is limiting its European gas supplies to the levels in long-term contracts, and has let Gazprom's storage facilities in the continent fall to very low levels. Putin said Gazprom was exceeding its contractual obligations for gas supplies through Ukraine this year. (FT)

CHINA

CHINA/U.S.: China hopes the U.S. side could adopt a rational and pragmatic China policy, and, together with China, follow a path of mutual respect, peaceful coexistence and win-win cooperation, with respect for each other's core interests and major concerns. (Xinhua)

CHINA/TAIWAN: Chinese President Xi Jinping will talk about Taiwan policy on Saturday when commemorating the 110th anniversary of the Xinhai Revolution, Taipei-based United Daily News reported Wednesday, citing unidentified people. This will be Xi's most recent discourse regarding Taiwan after his speech in 2019 and this July when celebrating the Communist Party's 100-year anniversary. Xi's speech will reiterate China's wish for peaceful unification, resolute opposition to external forces interfering in the Taiwan Strait, and opposition to Taiwan independence. (BBG)

OVERNIGHT DATA

JAPAN SEP TOKYO AVG OFFICE VACANCIES 6.43; AUG 6.31

JAPAN AUG, P LEADING INDEX 101.8; MEDIAN 102.0; JUL 104.1

JAPAN AUG, P COINCIDENT INDEX 91.5; MEDIAN 91.5; JUL 94.4

SOUTH KOREA AUG BOP CURRENT ACCOUNT BALANCE +$7.5123BN; JUL +$8.2107BN

SOUTH KOREA AUG BOP GOODS BALANCE +$5.6357BN; JUL +$5.7264BN

MARKETS

SNAPSHOT: U.S. Nears Kicking Debt Can Down The Road

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 233.16 points at 27762.04

- ASX 200 up 49.955 points at 7256.5

- Shanghai Comp. is closed

- JGB 10-Yr future up 10 ticks at 151.4, yield down 0.8bp at 0.076%

- Aussie 10-Yr future up 2.5 ticks at 98.39, yield down 2.5bp at 1.585%

- U.S. 10-Yr future -0-03+ at 131-19+, yield up 1.57bp at 1.536%

- WTI crude down $0.72 at $76.7, Gold down $3.27 at $1759.47

- USD/JPY up 1 pip at Y111.42

- SENATE POISED TO STAVE OFF DEBT CRISIS (Hill)

- BIDEN, XI TO HOLD VIRTUAL SUMMIT BY YEAR-END

- ECB SAID TO STUDY NEW BOND-BUYING PLAN FOR WHEN CRISIS TOOL ENDS (BBG)

- RUSSIA OFFERS TO STABILISE GAS PRICES (FT)

BOND SUMMARY: Positive Risk Sentiment Limits Core FI But JGBs Manage To Eke Out Gains

The risk switch was flicked to on, which resulted in core FI coming under some modest pressure. Regional reaction to the compromise short-term offer on raising the debt ceiling extended by Senate minority leader McConnell to Democratic lawmakers likely underpinned positive risk sentiment. In addition, the White House confirmed plans to hold a virtual Biden/Xi summit by the year-end, providing some geopolitical respite.

- T-Notes edged lower amid an uptick in U.S. e-mini futures, last trade -0-03 at 131-20. The contract held a 0-05 range through the session. Cash U.S. Tsy yield sit 0.6-1.4bp higher across the curve. Eurodollars last seen +0.5 to -2.5 ticks through the reds. Domestic focus turns to weekly jobless claims, comments from Fed's Mester and any fresh developments on the fiscal front.

- JGB futures whipsawed, reversing their initial gains into the Tokyo lunch break. The contract caught a fresh bid in afternoon trade, rallying towards yesterday's highs amid lacklustre headline flow. It last trades at 151.43, 13 ticks above Wednesday's settlement. Cash JGB yields have eased off, with belly outperforming. The 5- to 15.5-Year liquidity enhancement auction saw average spread match high spread, with bid/cover ratio printing at 3.95x (prev. 4.06x).

- Selling pressure hit Aussie bond futures from the off. YM last trades -3.0, with XM +3.5, both off earlier lows. Cash ACGB yield curve twist flattened, with yields last seen +3.0bp to -4.0bp. Bills run 1-4 ticks through the reds.

JGBS AUCTION: Japanese MOF sells Y2.8058tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8058tn 6-Month Bills:

- Average Yield -0.1142% (prev. -0.1141%)

- Average Price 100.057 (prev. 100.056)

- High Yield: -0.1102% (prev. -0.1100%)

- Low Price 100.055 (prev. 100.054)

- % Allotted At High Yield: 81.3913% (prev. 73.8648%)

- Bid/Cover: 4.310x (prev. 4.955x)

JGBS AUCTION: Japanese MOF sells Y498.0bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.0bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.007% (prev. -0.002%)

- High Spread: -0.007% (prev. -0.001%)

- % Allotted At High Spread: 96.3700% (prev. 7.8033%)

- Bid/Cover: 3.948x (prev. 4.242x)

EQUITIES: Late US Rally Inspires Gains

Equity markets in the Asia-Pac region rose on Thursday after being under pressure for much of the week with several markets entering technical correction territory. Bourses took the baton from US stocks which closed with gains after a late rally amid signs of progress on the debt ceiling impasse. Hong Kong led the gains, the Hang Seng rising 2.5%, though liquidity remains thin with Chinese markets still on holiday returning to trade tomorrow. US futures rose, gains led by e-mini Nasdaq; US fiscal machinations will be watched after US Senator McConnell said a short-term debt ceiling vote is possible today.

OIL: Remains Under Pressure

Crude futures have extended their slide after retracing around half of the October rise during the session on Wednesday. Extra pressure was exerted after US DOE figures showed a far larger-than-expected build in crude inventories (+2.4mln bbls vs. Exp. +796k) compounded by a similarly sizeable build in gasoline stockpiles (+3.3mln bbls vs. Exp. -69k). WTI sees support at $76.67/75.32 - High Sep 28 / Low Oct 4 while Brent bears will target $79.95/78.75 - High Sep 28 / Low Oct 4.

GOLD: Slips From Closing Highs

Gold slipping lower in Asia-Pac trade, retreating from the day's highs hit near the close on Wednesday. Sentiment in the region has been mostly positive while e-minis have also held a decent bid through the session. Gold has moved in a range this week, this follows last week's move lower and extension of the bear phase that has been in place since Sep 3. A break of $1721.7, Sep 29 low would confirm a resumption of weakness and open key support at $1690.6, Aug 9 low. Markets await the key catalyst of US NFP data on Friday, while US fiscal machinations will be watched after US Senator McConnell said a short-term debt ceiling vote is possible today.

FOREX: Optimism Surrounding U.S. Debt Crisis Lends Modest Support To High-Betas

AUD took the lead in a tight Asia-Pac session, with liquidity limited by the ongoing holiday in China. Its commodity-tied peers followed suit, albeit their upticks were fairly modest, while safe haven currencies JPY and CHF lagged behind.

- The news that Senate minority leader McConnell offered Democrats a short-term deal to raise the debt ceiling generated a risk-on impulse, which provided the main driver of price action across G10 FX space.

- U.S. weekly jobless claims and German industrial output are set to take focus on the data front.

- Comments are due from no less than seven ECB speakers and Fed's Mester. PBOC Gov Yi will deliver an address on "China's experience with regulating big tech" ahead of a panel with several EM central bankers.

FOREX OPTIONS: Expiries for Oct07 NY cut 1000ET (Source DTCC)

- USD/JPY: Y111.00($835mln), Y111.50($707mln)

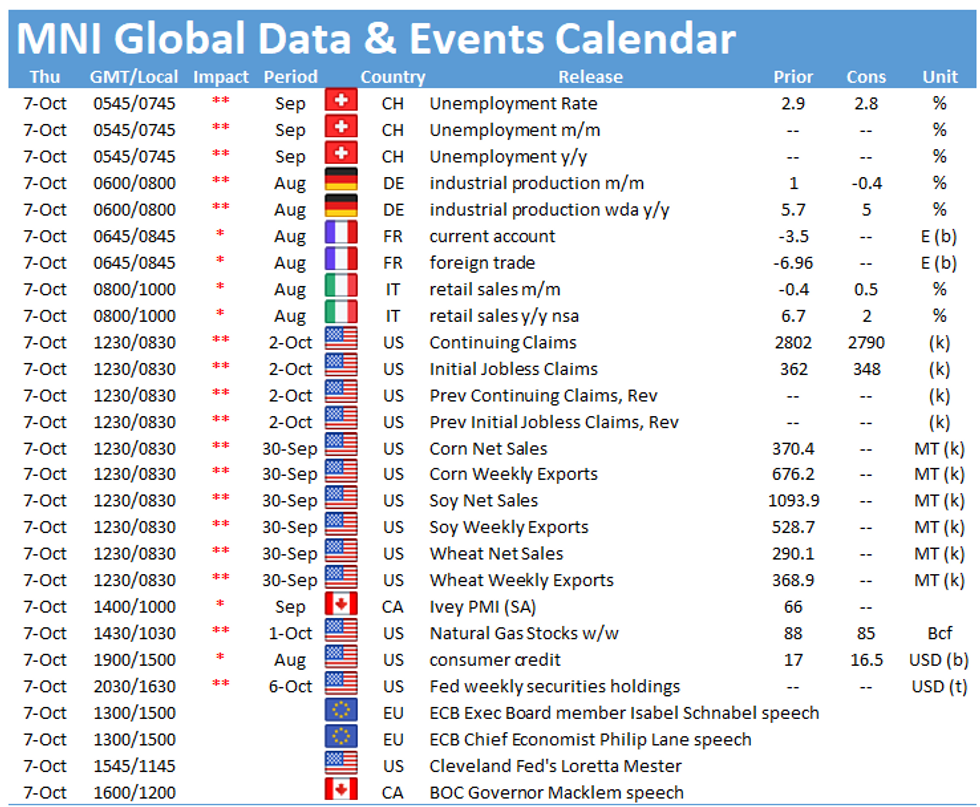

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.