-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Dirty Words

EXECUTIVE SUMMARY

- FED'S CLARIDA: U.S. ECONOMY ISN'T HEADED FOR STAGFLATION (BBG)

- FED'S BOSTIC: U.S. JOBS SLOWDOWN SHOULD NOT DELAY TAPER TIMELINE (FT)

- FED'S BOSTIC: TRANSITORY IS "DIRTY WORD" AS INFLATION LASTS (BBG)

- YELLEN STICKS WITH "TRANSITORY" VIEW OF U.S. INFLATION (BBG)

- HONG KONG STOCK TRADING SHUT BECAUSE OF TYPHOON

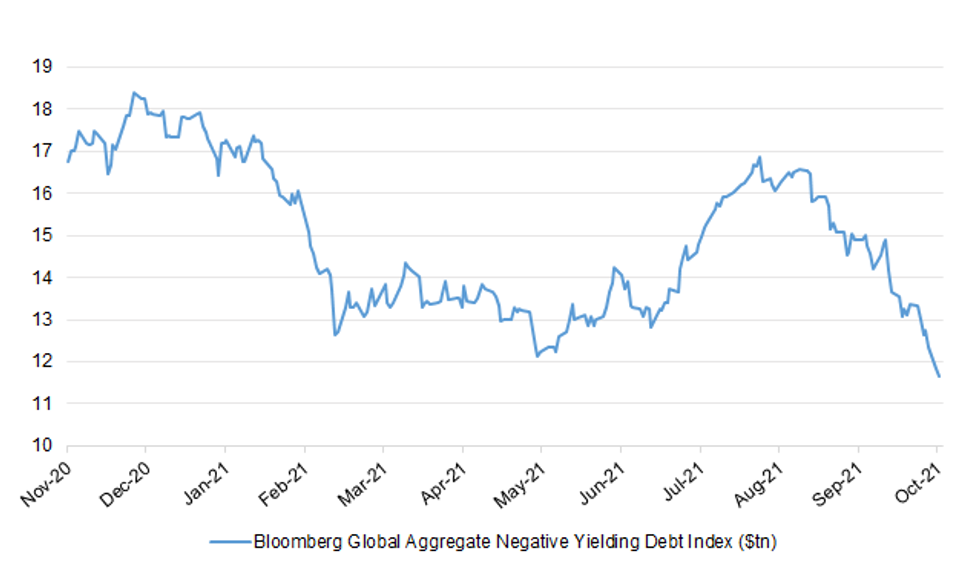

Fig. 1: Bloomberg Global Aggregate Negative Yielding Debt Index ($tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The guardians of the British economy are working to start reducing the supply of stimulus long before the fallout from the coronavirus crisis comes to an end. After winning widespread praise for a quick, bold and coordinated response to the pandemic last year, the U.K. Treasury and the Bank of England now are preparing to be among the first among industrial nations to whip away that support. "We're in a situation where both Rishi Sunak on the fiscal side and the BOE look like they are rushing to the exit," said James Smith, a former BOE senior economist now serving as research director at the Resolution Foundation. "There are signs that momentum is fading, and you're adding into that tightening from the chancellor and the bank, potentially." (BBG)

ECONOMY: Ofgem, the energy regulator, is braced for a fresh wave of supplier collapses this week as the crisis engulfing the industry continues to accelerate. Sky News understands that at least four suppliers were in talks with Ofgem on Tuesday about entering its Supplier of Last Resort (SOLR) system in a development expected to add several hundred thousand households to the toll of those impacted by soaring wholesale gas prices. Industry sources said the decision of at least some of those four companies to cease trading could be announced as early as Wednesday. (Sky)

ECONOMY: Shipping containers carrying Christmas gifts and vital supplies for industry are being diverted away from Britain's biggest port because it is full. Maersk, the world's largest container shipping company, is having to direct some of its biggest vessels away from Felixstowe to northern European ports. Felixstowe, on the Suffolk coast, normally handles about 36 per cent of the UK's container imports and exports. (Times)

ECONOMY: The coronavirus crisis is set to bring more longer-lasting damage to the UK economy than any other country in the G7, the IMF has warned. The fund on Tuesday said its global forecasts showed that while most advanced nations would return to the economic growth expected before the pandemic struck, Britain's economy would still be 3 per cent smaller in 2024. These large scars to the British economy, matched in recent days by forecasts from the Institute for Fiscal Studies and Citigroup, will force Rishi Sunak to use the new taxes he is raising to pay for the legacy of the pandemic rather than improving health and social care. (FT)

BREXIT: The UK government is on course for a diplomatic collision with Brussels as Brexit minister Lord Frost warned it would be a "historic misjudgement" for the bloc not to rewrite key parts of the agreement. Accusing the EU of being "disrespectful" to Britain, Lord Frost demanded leaders effectively tear up the Northern Ireland protocol he negotiated alongside Boris Johnson just two years ago and replace it with a new treaty. (Independent)

BREXIT: The EU will offer to remove a majority of post-Brexit checks on British goods entering Northern Ireland as it seeks to turn the page on the rancorous relationship with Boris Johnson. Up to 50% of customs checks on goods would be lifted and more than half the checks on meat and plants entering Northern Ireland would be abandoned under the bold offer from Brussels. The olive branch will be extended on Wednesday in defiance of the French government, which internally raised concerns about the proposed move by Maroš Šefčovič, the EU's Brexit commissioner. (Guardian)

EUROPE

ECB: Slovak central bank Governor and European Central Bank governing council member Peter Kazimir has been charged with bribery but denies wrongdoing and will defend himself against the charges, Kazimir and his lawyer said on Tuesday. (RTRS)

EU: The EU's top diplomat ignored the advice of his own staff in deciding to send observers to elections in Venezuela next month, over-ruling warnings that the mission will legitimise president Nicolás Maduro's regime and tarnish the reputation of the bloc's election observation missions. Josep Borrell, head of the European External Action Service, the EU's security and diplomatic arm, said last month he would send observers to Venezuela's regional and municipal polls in November, for the first time in 15 years. That decision came despite an internal report seen by the Financial Times, in which a team of EEAS officials sent to the country in July to assess the feasibility of deploying election monitors warned that such a move "may be contrary to the political line of the EU". (FT)

FRANCE: French president Emmanuel Macron has outlined a five-year, €30bn investment plan to boost the country's high-tech industries and reduce dependence on imported raw materials and electronic components such as microchips. Six months before a presidential election in which he is expected to seek a second term, Macron said the "France 2030" plan would direct government money to 10 targets, including the development of small "modular" nuclear reactors and of a "low-carbon" aircraft, green hydrogen production, the modernisation and decarbonisation of industry and the financing of start-ups. "We need to reinvest in a strategy of growth," Macron told a selected audience of 200 ministers, company bosses, politicians, scientists and students at the Elysée Palace. "If we don't reindustrialise the country, we cannot again become a nation of innovation and research." (FT)

CZECHIA: The Czech National Bank should refrain from raising interest rates for now, board members Oldrich Dedek and Ales Michl write in a joint opinion piece published by Mlada Fronta Dnes newspaper on Wednesday. The two central bankers, who opposed rate hikes adopted at the last three policy meetings, say Czech monetary tightening could hurt local businesses, but cannot curb an inflation surge caused mostly by a jump in global commodity prices and supply bottlenecks. To stabilize inflation expectations, the central bank instead needs to explain the transitory nature of the mostly imported price pressures. "We are not saying that interest rates should stay low forever. But we believe that it is not yet time for their normalization." (BBG)

US

FED: The U.S. isn't headed for the kind of "stagflation" that developed in the 1970s, when unemployment and inflation rose in tandem, Federal Reserve Vice Chair Richard Clarida said. "I actually lived through, as a college student, the 'Great Stagflation' of the 70s, and I think there are a lot of differences," Clarida said Tuesday while answering questions after a virtual speech at the 2021 Institute of International Finance Annual Membership Meeting. "First and foremost, the 1970s were a decade of pretty substantial policy mistakes, in monetary policy. And I think central bankers learned their lesson, and I would not see a repeat of those policy mistakes." (BBG)

FED: A sharp slowdown in jobs growth last month should not stop the US Federal Reserve from beginning to scale back its pandemic-era stimulus programme in November, a senior Fed official said on Tuesday. Atlanta Fed president Raphael Bostic told the Financial Times that the labour market had made sufficient gains to allow the central bank to reduce, or "taper", its $120bn a month asset purchase programme, which was put in place last year to shield the US economy and financial markets from the coronavirus-induced crisis. "I'd be comfortable starting in November," he said in an interview on Tuesday. "I think that the progress has been made, and the sooner we get moving on that the better." (FT)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said this year's inflation surge is lasting longer than policymakers expected, so it's not appropriate to refer to such price increases as transitory. "Transitory is a dirty word," Bostic said in a virtual speech to the Peterson Institute for International Economics on Tuesday. He spoke with a glass jar labeled "transitory" at his side, depositing $1 each time he used the "swear word," as it's become known to him and his staff over the past few months. "It is becoming increasingly clear that the feature of this episode that has animated price pressures — mainly the intense and widespread supply-chain disruptions — will not be brief," Bostic said. "By this definition, then, the forces are not transitory." (BBG)

FED: Federal Reserve Vice Chairman for Supervision Randal Quarles will be removed from his role as the main watchdog of Wall Street lenders after his title officially expires this week. The industry widely expected Quarles to effectively remain head of the central bank's supervisory committee, even without the vice chairman title. But the board has instead decided not to have a single governor take that position, according to a statement. (BBG)

ECONOMY: Treasury Secretary Janet Yellen stuck with her assessment that elevated U.S. inflation will prove "transitory," while acknowledging it will take longer for the pace of price gains to return to normal. "I believe it's transitory, but I don't mean to suggest these pressures will disappear in the next month or two," Yellen said in an interview on CBS Evening News with Norah O'Donnell that aired Tuesday evening. Yellen attributed the price spikes in many goods to the "huge disruption" from the Covid-19 pandemic to global supply chains, an effect that would slowly dissipate. "There's no reason for consumers to panic over the absence of goods they're going to want to acquire at Christmas," she added. (BBG)

FISCAL: Members of the House on Tuesday pushed through a short-term increase to the nation's debt limit, ensuring the federal government can continue fully paying its bills into December and temporarily averting an unprecedented default that would have decimated the economy. (AP)

FISCAL: Speaker Nancy Pelosi (D-Calif.) said Tuesday she thinks a bill that would transfer the authority to raise the debt limit from Congress to the Treasury secretary "has merit." Pelosi's support for shifting the near-annual responsibility of ensuring the U.S. doesn't default on its debts comes as a growing number of Democrats in recent weeks have endorsed abolishing the debt limit in its current form. (Hill)

FISCAL: U.S. Congress progressives on Tuesday signaled a new willingness to shrink the cost, but not the scope, of President Joe Biden's multi-trillion-dollar plan to broaden social programs and tackle climate change, as they struggle to reach a deal with party moderates. Centrist Democrats have balked at the plan's initial $3.5 trillion price tag. As a result, Biden faces a difficult balancing act in trying to bring down the cost but not alienate progressives who also are essential to passage. Following a meeting earlier this month on Capitol Hill with his fellow Democrats, Biden suggested the bill could cost around $2 trillion over 10 years. "We are prepared to negotiate," Senator Bernie Sanders, an independent who aligns with Democrats, told reporters on a Tuesday conference call. (RTRS)

EQUITIES: Apple Inc. is likely to slash its projected iPhone 13 production targets for 2021 by as many as 10 million units as prolonged chip shortages hit its flagship product, according to people with knowledge of the matter. The company had expected to produce 90 million new iPhone models in the last three months of the year, but it's now telling manufacturing partners that the total will be lower because Broadcom Inc. and Texas Instruments Inc. are struggling to deliver enough components, said the people, who asked not to be identified because the situation is private. (BBG)

CORONAVIRUS: Data collected by the National Institutes of Health show that people who received a shot of Johnson & Johnson's coronavirus vaccine have a stronger neutralizing antibody response if they receive an mRNA shot instead of a second J&J one, according to a person who has seen the data. Yes, but: J&J has asked the FDA to authorize a second shot of its own vaccine, which could make any attempt to authorize mix-and-matching vaccines confusing for the public. (Axios)

OTHER

G7: U.K. Chancellor of the Exchequer Rishi Sunak is using his first official visit to the U.S. in the role to urge major economies to collaborate over tackling the supply disruptions hampering global growth. Sunak will issue a plea to make supply chains more resilient when he chairs an in-person meeting of Group of Seven finance ministers in Washington, according to a statement released by his office in London. (BBG)

IMF: IMF chief Kristalina Georgieva is fully focused on global challenges, she said on Tuesday, after the fund's executive board cleared her of claims that she pressured World Bank staff to alter data to favor China in her previous job. "We have difficult problems to wrestle with and we need the strong standing of the institution to serve the membership," Georgieva, a Bulgarian economist, told Reuters in an interview. (RTRS)

GLOBAL TRADE: The U.S. has submitted a new proposal to the European Union to solve a Trump-era dispute on steel tariffs, offering more-generous terms, according to people familiar with the matter. The updated proposal involves so-called tariff-rate quotas that Bloomberg reported last month, but provides for a bigger quantity of steel to enter the U.S. before higher duties kick in, according to two of the people who asked not to be identified because the discussions are private. TRQs allow countries to export specified quantities of a product to other nations at lower duty rates, but subjects shipments above a pre-determined threshold to a higher tariffs. The EU will analyze the latest proposals, before U.S. Trade Representative Katherine Tai and European Commission Executive Vice President Valdis Dombrovskis -- who met on the sidelines of a Group of 20 trade gathering in Sorrento, Italy, on Tuesday -- meet again in Brussels next week, the people said. (BBG)

U.S./CHINA: China said it set up a group with the U.S. to discuss disputes, ahead of a video summit between President Joe Biden and his Chinese counterpart Xi Jinping planned for later this year. Chinese Vice Foreign Minister Le Yucheng said in an interview with state broadcaster CGTN that the group had already "made some progress," without specifying details. "Dialogue and cooperation are indispensable and confrontation and conflict will lead us nowhere," Le said. "We take seriously U.S. recent positive statements on China-U.S. relations," he added. (BBG)

CHINA/TAIWAN: Chinese military exercises near Taiwan are targeted at forces promoting the island's formal independence and are a "just" move to protect peace and stability, China's Taiwan Affairs Office said on Wednesday. It also said the exercises are aimed at interference by external forces. (RTRS)

U.S./CANADA/MEXICO: The US will reopen its land borders with Canada and Mexico to vaccinated travellers next month, ending restrictions put in place at the start of the pandemic and easing what was becoming a big strain on the Biden administration's relationships with its closest neighbours. The move, due to be announced on Wednesday, was confirmed by Democratic lawmakers from border areas and administration officials on Tuesday night. (FT)

AUSTRALIA: The Morrison government cut its economic outlook for the September quarter, saying the contraction will be 50 per cent larger than previously flagged. Treasurer Josh Frydenberg said he expected gross domestic product to fall by 3 per cent or more, up from his previous 2 per cent or more guidance. His comments came after the International Monetary Fund overnight downgraded its Australian growth forecast for 2021 from 5.3 per cent to 3.5 per cent. "That being said, there is now a light at the end of the tunnel," Mr Frydenberg told the Citi Australia and New Zealand investment conference this morning. He cited the IMF's upgrade to Australia's GDP forecast for 2022 from 3 per cent to 4.1 per cent. "The RBA has similarly made such a forecast and we'll be updating our numbers in the mid-year economic and fiscal outlook. Overall, I'm confident that the Australian economy will bounce back strongly, as it has done through this pandemic." (AFR)

AUSTRALIA: Australia has been on the end of some "pretty targeted measures" from China in respect to the two nations' trading relationship, Treasurer Josh Frydenberg says at Citigroup Inc. conference Wednesday. Important to remember China's actions have affected less than 6% of Australian exports and "our exporters have proven to be very resilient and innovative in the face of that economic coercion." Exporters have been able to identify new markets, for example barley that was otherwise going to China is now going to Saudi Arabia; wine that was going to China is now going to Singapore. The Treasurer also Reiterated that he's open to a review of the Reserve Bank of Australia, noting its been a while since one has been conducted. He expects Australia's economy to contract by at least 3% in the third quarter due to lockdowns in Sydney and Melbourne; sees recovery as rising vaccination rate allows businesses to reopen. (BBG)

SOUTH KOREA: South Korea will consider introducing a "vaccine pass" for people's gradual return to normal life, Prime Minister Kim Boo-kyum said Wednesday, as the country prepares to adopt a "living with COVID-19" scheme. Kim hinted at easing virus prevention measures under the new scheme, which is expected to begin Nov. 9, but he stressed that does not mean that the country should let its guard down against the virus. Under the scheme, COVID-19 will be treated as an infectious respiratory disease, like seasonal influenza. (Yonhap)

HONG KONG: Hong Kong suspended schools and the city's $6.3 trillion stock market canceled trading Wednesday as strong winds and rain from typhoon Kompasu lashed the financial hub. Hong Kong Exchanges and Clearing Ltd. canceled securities trading, including the Hong Kong-China stock connect and derivatives markets, for all of Wednesday after Kompasu halted after-hours trading the day before. The city raised the storm warning alert to No. 8, the third-highest on its scale, from No. 3 Tuesday afternoon. (BBG)

HONG KONG: Alibaba Group founder Jack Ma, largely out of public view since a regulatory clampdown started on his business empire late last year, is currently in Hong Kong and has met business associates in recent days, two sources told Reuters. The Chinese billionaire has been keeping a low profile since delivering a speech in October last year in Shanghai criticising China's financial regulators. That triggered a chain of events that resulted in the shelving of his Ant Group's mega IPO. While Ma made a limited number of public appearances in mainland China after that, as speculation swirled about his whereabouts, one of the sources said the visit marked his first trip to the Asian financial hub since last October. (RTRS)

PHILIPPINES: The Philippines peso trading at the 50 to 51 against the dollar isn't worrisome for the central bank, Governor Benjamin Diokno said citing the country's hefty reserves and inflation that remains manageable. Diokno, speaking Wednesday with Bloomberg TV's Kathleen Hays, also said the bank's current monetary policy settings, with the benchmark interest rate at a record low of 2%, remains appropriate as the country's economic recovery is nascent and price increases are expected to ease to its targeted range next year. "When you see the peso at 50-51, that's not worrisome on our part," Diokno said, adding that the peso-dollar level is within the government's foreign exchange assumption used for budget planning. The peso has weakened by more than 5% against the dollar so far this year. On monetary policy he said: "It's not that we don't want to move the rate, we just feel that the current policy rate is appropriate for the current situation." (BBG)

RUSSIA: Fresh from crowing over Europe's gas crisis, Russian President Vladimir Putin now sees a chance to capitalize on it. Putin wants to press the European Union to rewrite some of the rules of its gas market after years of ignoring Moscow's concerns, to tilt them away from spot-pricing toward long-term contracts favored by Russia's state run Gazprom, according to two people with knowledge of the matter. Russia's also seeking rapid certification of the controversial Nord Stream 2 pipeline to Germany to boost gas deliveries, they said. Putin is due to speak at the Russian Energy Week conference on Wednesday. Amid record daily swings of as much as 40% in European gas prices, he made a calculated intervention to cool the market last week by saying Gazprom can boost supplies to help ease shortages. Still, even as the Kremlin casts Putin as Europe's energy savior, Russia's under no illusion that it will gain political concessions from the EU or ease strained relations as a result of the crisis, according to a government official and a policy adviser close to the presidential administration. (BBG)

RUSSIA: Russia and the United States failed to make any major progress on Tuesday in resolving a row over the size and functioning of their embassies and there is a risk that relations could worsen further, Russia's Deputy Foreign Minister Sergei Ryabkov said. With ties already at post-Cold War lows, the two countries are in a dispute over the number of diplomats they can post to each other's capitals, though Moscow said it was willing to lift restrictions imposed in recent years. "I cannot say that we have achieved great progress," Interfax news agency quoted Ryabkov as saying after talks in Moscow with U.S. Under Secretary of State Victoria Nuland. "There is a risk of a further sharpening of tensions." (RTRS)

BRAZIL: Brazil's currency is being hit by investor uncertainty over next year's presidential election, even though the central bank is raising interest rates, economic growth is strong and the fiscal deficit is shrinking, Economy Minister Paulo Guedes said. The real has weakened 10% so far in the second half of the year, the worst performance in emerging markets after the Chilean peso. But the causes of this are political rather than economic, Guedes told Bloomberg Television's Shery Ahn in an interview Tuesday. "There's huge political noise," Guedes said. "We understand that. It's a very vibrant democracy." (BBG)

ARGENTINA: Argentina's President Alberto Fernandez told a group of eight top businessmen that a deal with the International Monetary Fund won't happen until 2022. The president spoke to a group of executives that represent top companies including MercadoLibre Inc, Pampa Energia SA and Pan American Energy LLC, according to a government official who asked not to be named discussing a private meeting. (BBG)

MIDDLE EAST: The United States is working to expand normalisation agreements between Israel and Arab nations, known as the Abraham Accords, and hopes restoring such ties can be leveraged to advance progress on the Israeli and Palestinian conflict, senior State Department officials said on Tuesday. In a briefing with reporters previewing U.S. Secretary of State Antony Blinken's meetings on Wednesday with his Israeli and Emirati counterparts, officials repeated that the Abraham Accords were not a substitute for the two-state solution between Israelis and Palestinians. "We continue to welcome the economic cooperation between Israel and all countries in the region. We hope that normalisation can be leveraged to advance progress on the Israeli-Palestinian tracks," a senior State Department official, speaking on the condition of anonymity said. (RTRS)

IRAN: The European Union envoy coordinating talks on reviving the Iran nuclear deal, Enrique Mora, will visit Tehran on Thursday, the Iranian foreign ministry said on Tuesday, as a date is still to be set to relaunch the stalled negotiations. "(Mora's) trip will take place on Thursday. It follows consultations between the two sides on issues of mutual interest, including relations between Iran and the Union, Afghanistan and the nuclear accord," ministry spokesman Saeed Khatibzadeh told Iranian state media. (RTRS)

AFGHANISTAN: The United States and the Taliban had "productive discussions" on the issue of humanitarian assistance for Afghanistan during meetings in Qatar over the weekend, State Department spokesperson Ned Price said on Tuesday, describing the talks as "largely positive." Officials discussed humanitarian access during the two days of meetings between Taliban representatives and U.S. officials including some from the intelligence community and the U.S. Agency for International Development. Price said the talks focused on security and terrorism concerns, safe passage for foreign nationals and Afghan allies of the United States to leave the country, as well as human rights. (RTRS)

ETHIOPIA: The United States is considering the full range of tools at its disposal, including the use of economic sanctions, to respond to the worsening crisis in northern Ethiopia, State Department spokesman Ned Price told reporters on Tuesday. Ethiopia's national army launched a ground offensive against forces from the northern region of Tigray on Monday, the region's ruling Tigray People's Liberation Front (TPLF) said. (RTRS)

ENERGY: The world is failing to invest in energy on the scale needed to escape catastrophic climate change and avoid sharp increases in fossil fuel prices, the International Energy Agency warned. In a report just weeks before a key climate change summit known as COP26, the agency said that investment in green energy like solar and wind is lagging what's needed to keep the planet from warming up significantly. At the same time, spending on fossil fuels is lower than needed if current demand growth for oil, natural gas and coal continues. "There is a looming risk of more turbulence for global energy markets," Fatih Birol, the head of the agency, said in a statement Wednesday. "We are not investing enough to meet for future energy needs." (BBG)

CHINA

ECONOMY: China will focus on stabilizing industrial production, expanding investment and promoting consumption to boost Q4 growth, as local authorities try to meet annual economic targets and counter slowdown, the Economic Information Daily reported. With the epidemic eased, consumer spending during the October holiday improved from previous holidays, and exports may hold up as the global supply chain recovers, which will stabilize industrial and manufacturing investment, the newspaper said citing Lin Zhiyuan, deputy director of Macroeconomic Research Center at Xiamen University. The accelerating issuance of local government special bonds will help boost infrastructure investment, Lin added. (MNI)

PROPERTY: China is likely to ease its "strictest and severest policies" on the property industry and instead seek to stabilize sentiment, Yicai.com said citing industry watchers. The authorities are likely to modify credit lending policies to developers and mortgage borrowers, Yicai said citing Bank of China Securities. Yicai commented following reports that the north-eastern city Harbin introduced bonuses and other incentives to entice buyers as the local authorities struggled to revive a slowdown. Lenders in other cities including Guangzhou and Foshan also cut mortgage rates for first and second-time buyers, Yicai said. (MNI)

COAL: China's energy shortage may not lead to a significant resumption in trade with Australia, the Global Times said in an editorial. The state-owned tabloid commented following western media reports that about 1 million tons of Australian coal were allowed to clear customs at Chinese ports, opening an opportunity for easing coal-focus trade dispute between the two countries. Without denying the reports, the newspaper said coal imports are not a major factor in China's energy supply and demand relationship, as the Asian country has ordered more coal-producing provinces to boost output. China significantly boosted imports from the U.S., South Africa and Canada in the first eight months, said the newspaper. (MNI)

CORONAVIRUS: China is preparing to test tens of thousands of blood bank samples from the city of Wuhan as part of a probe into the origins of Covid-19, according to a Chinese official. The move comes amid increasing calls for transparency over the emergence of the virus. The store of up to 200,000 samples, including those from the closing months of 2019 were pinpointed in February this year by the World Health Organization's panel of investigators as a possible source of key information that could help determine when and where the virus first crossed into humans. The samples are kept in the Wuhan Blood Center, and are thought to span 2019, providing real-time tissue samples from a wide swathe of the population in the Chinese city where SARS-CoV-2 is thought to have first infected humans. (CNN)

OVERNIGHT DATA

CHINA SEP TRADE BALANCE +$66.76BN; MEDIAN +$45.00BN; AUG +$58.33BN

CHINA SEP EXPORTS +28.1% Y/Y; MEDIAN +21.5%; AUG +25.6%

CHINA SEP IMPORTS +17.6% Y/Y; MEDIAN +20.9%; AUG +33.1%

JAPAN AUG CORE MACHINE ORDERS +17.0% Y/Y; MEDIAN +13.9%; JUL +11.1%

JAPAN AUG CORE MACHINE ORDERS -2.4% M/M; MEDIAN +1.4%; JUL +0.9%

JAPAN SEP MONEY STOCK M2 +4.2% Y/Y; MEDIAN +4.3%; AUG +4.7%

JAPAN SEP MONEY STOCK M3 +3.8% Y/Y; MEDIAN +3.9%; AUG +4.2%

AUSTRALIA OCT WESTPAC CONSUMER CONFIDENCE 104.6; SEP 106.2

AUSTRALIA OCT WESTPAC CONSUMER CONFIDENCE -1.5% M/M; SEP +2.0%

Despite both Sydney and Melbourne remaining in lock down throughout the last month consumers are relatively upbeat. At 104.6 there continues to be a clear majority of optimists nationally with little difference in the state readings – NSW (103.4); Victoria (105.4); Queensland (105.3) and Western Australia (105.4) all show similar majorities of optimists. This is despite a sharp contrast between the lock down status of NSW/ Victoria and Queensland/Western Australia. Consumers in NSW and Victoria are clearly looking towards their states' reopening as vaccine coverage reaches globally competitive rates. Just over 90% of the eligible population in NSW and 85% of the eligible population in Victoria have now received at least one vaccine dose, 15–20% ahead of Queensland and Western Australia. This theme is best exemplified by the contrast in confidence between respondents who are not vaccinated but intend to be vaccinated – with an index read of 122.0 – and those who are not vaccinated and do not intend to get vaccinated – with an index read of 84.8. (Westpac)

NEW ZEALAND OCT, P ANZ BUSINESS CONFIDENCE -8.6; SEP -7.2

NEW ZEALAND OCT, P ANZ ACTIVITY OUTLOOK 26.2; SEP 18.2

The preliminary ANZ Business Outlook data for October saw most forward-looking activity indicators hold up or improve. Business confidence eased but own activity expectations rose 6 points. Investment intentions jumped 5 points, while employment intentions eased 1 point. Expected profitability saw a 13pt bounce, with just a net 3% of firms expecting lower profits. That's despite extreme cost pressures, with a net 85% of firms reporting higher costs, similar to last month. Capacity utilisation, which normally correlates well with GDP, lifted from 17% to 20%. Only a net 4% of businesses reported lower activity than a year ago. A net 11% of firms are reporting higher employment than a year ago. Inflation pressures remain intense, with inflation expectations still above 3% and pricing intentions rising from 58% to a net 64% of firms expecting to lift their prices in coming months. Cost pressures are extreme, with a net 85% of firms expecting higher costs, up 1 point. (ANZ)

NEW ZEALAND SEP FOOD PRICE INDEX +0.5% M/M; AUG +0.3%

SOUTH KOREA SEP UNEMPLOYMENT 3.0%; MEDIAN 3.0%; AUG 2.8%

SOUTH KOREA SEP BANK LENDING TO HOUSEHOLDS TOTAL KRW1,052.7TN; AUG KRW1,046.3TN

SOUTH KOREA AUG MONEY SUPPLY L +0.9% M/M; JUL +0.9%

SOUTH KOREA AUG MONEY SUPPLY M2 +1.5% M/M; JUL +0.9%

CHINA MARKETS

PBOC NET DRAINS CNY90BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operations lead to a net drain of CNY90 billion after offsetting the maturity of CNY100 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2206% at 09:37 am local time from the close of 2.1592% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 40 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4612 WEDS VS 6.4447

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4612 on Wednesday, compared with the 6.4447 set on Tuesday.

MARKETS

SNAPSHOT: Dirty Words

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 63.03 points at 28167.58

- ASX 200 down 1.928 points at 7278.8

- Shanghai Comp. down 12.505 points at 3534.431

- JGB 10-Yr future up 3 ticks at 151.28, yield down 0.7bp at 0.086%

- Aussie 10-Yr future up 4 ticks at 98.29, yield down 3.7bp at 1.685%

- U.S. 10-Yr future -0-00+ at 131-04, yield up 0.17bp at 1.579%

- WTI crude down $0.15 at $80.49, Gold up $2.41 at $1762.59

- USD/JPY down 14 pips at Y113.47

- FED'S CLARIDA: U.S. ECONOMY ISN'T HEADED FOR STAGFLATION (BBG)

- FED'S BOSTIC: U.S. JOBS SLOWDOWN SHOULD NOT DELAY TAPER TIMELINE (FT)

- FED'S BOSTIC: TRANSITORY IS "DIRTY WORD" AS INFLATION LASTS (BBG)

- YELLEN STICKS WITH "TRANSITORY" VIEW OF U.S. INFLATION (BBG)

- HONG KONG STOCK TRADING SHUT BECAUSE OF TYPHOON

BOND SUMMARY: Initial Impetus Evaporates, ACGB Auction Attracts Strong Demand

Initial demand for core FI futures petered out, even as regional news flow did not add much new to the familiar macro-narrative. Participants prepared for an eventful NY session, including the start to the earnings season. China's monthly trade data provoked a muted market response, with the nation's trade surplus topping expectations on the back of stronger than expected exports growth.

- T-Notes rejected resistance from yesterday's high of 131-07+ and pulled back, swinging into a loss. The contract last changes hands -0-01 at 131-03+, hovering just above the session low of 131-02+. Cash Tsy yields trade unch. to +0.8bp, curve runs a tad flatter. Eurodollar futures last seen unch. to +0.5 tick through the reds. There is an eventful NY session ahead, with the FOMC due to release the minutes from their latest monetary policy meeting after the publication of U.S. CPI data, while policymaker Brainard will speak at a Fed Listens event in Oklahoma. On the supply front, focus turns to 30-Year debt auction.

- JGB futures reopened on a firmer footing but eased off gradually into the Tokyo lunch break. The contract last trades at 151.29, 4 ticks above previous settlement levels. Cash JGB yields sit lower across the curve, with the super-long end outperforming. The annual growth in Japan's core machine orders was faster than forecast, but came alongside an unexpected monthly contraction. The BoJ offered to buy 1-3 & 5-10 Year JGBs as part of their Rinban ops.

- The auction of ACGB May '32 attracted strong demand, drawing the highest bid/cover ratio (5.90x) since that tenor became available. Cash 10-Year ACGBs outperformed after the auction as other tenors ticked away from highs on the back of broader market impetus. Cash ACGB curve still runs flatter at typing, with yields last seen unch. to -3.8bp. Futures remain elevated, YM last +2.0 & XM +3.5. Bills run unch. to +3 ticks through the reds. Comments from Australian Treasurer Frydenberg were ignored, as the official said he expects a deeper Q3 GDP contraction than projected before, adding that it should be followed by a strong rebound.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y905bn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y30bn of floating rate JGBs

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 1.7305% (prev. 1.2041%)

- High Yield: 1.7325% (prev. 1.2050%)

- Bid/Cover: 5.9000x (prev. 5.2350x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 27.9% (prev. 53.6%)

- bidders 48 (prev. 50), successful 18 (prev. 16), allocated in full 10 (prev. 6)

EQUITIES: US Markets Remain Under Pressure

Equity markets are mixed in the Asia-Pac region, markets in Hong Kong are closed due to the typhoon which meant liquidity was slightly thinner than usual. Bourses in Japan led the way lower, while mainland China also saw indices struggle to get into positive territory. EM equity markets did fare better, rising after several days of declines with an extra boost from a weaker greenback. In the US e-minis are lower with the Nasdaq underperforming after reports that Apple is likely to cut its production targets for the year. Markets await the start of earnings season while CPI and FOMC minutes later today will be closely watched.

OIL: Uptrend Intact

Crude futures slightly softer in Asia but sticking to yesterday's range. WTI and Brent crude futures traded inside the week's range Tuesday, but importantly WTI held north of $80/bbl. This keeps the bullish case intact as markets continue to position for tighter winter supply in the coming months. This week's gains confirm an extension of the current bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $81.60, a Fibonacci projection. Note that inventory figures have been delayed by a day due to the US Columbus Day holiday while the IEA releases its World Energy Outlook later today.

GOLD: Rises As Greenback Softens

Gold crept higher in Asia on Wednesday as the greenback softened, but is below the previous day's high after retreating from intraday best levels in the US session. Near-term attention is on the 50-day EMA at $1777.0 and $1787.4,Sep 22 high and a key resistance. A resumption of strength would reinforce the bullish engulfing candle that signalled a reversal on Sep 30 and a break of $1787.4 would suggest scope for further upside.

FOREX: Aussie Loses Shine On Lead From Commodity Markets

The Aussie went offered across the board in a headline-light session, as iron ore and natural gas prices fell. The currency shrugged off comments from Australian Treasurer Frydenberg, who said he expects GDP contraction to be 3.0% Y/Y or more in Q3, adding that the economy should "bounce back strongly" thereafter. Frydenberg poured cold water on jitters surrounding Australia's tense relationship with China, noting that local exporters have identified alternative target markets.

- The yuan caught a bid despite a firmer than expected PBOC fix. The HKMA said that China will sell an additional CNH4.5bn of its 2.41% 2023 bonds and an additional CNH1.5bn of its 3.60% 2028 bonds in Hong Kong on Oct 20. USD/CNH faltered in the lead up to the release of China's trade data and extended losses as stronger than forecast exports growth underpinned a beat in trade surplus.

- The DXY slid in tandem with spot USD/CNH. The greenback lagged behind all of its G10 peers save for AUD. Its weakness allowed USD/JPY to extend its pullback from a three-year high.

- The minutes from FOMC's September monetary policy meeting and U.S. CPI headline the global economic docket today. Final German CPI & UK industrial output are also due. The speaker slate features BoE's Cunliffe, ECB's Visco & Fed's Brainard.

FOREX OPTIONS: Expiries for Oct13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500-15(E574mln), $1.1550-60(E703mln)

- EUR/GBP: Gbp0.8510-25(E1.2bln)

- USD/JPY: Y113.00($555mln)

- USD/CAD: C$1.2660-70($778mln)

- USD/CNY: Cny6.4200($1bln), Cny6.4500($1bln), Cny6.4800($1.3bln)

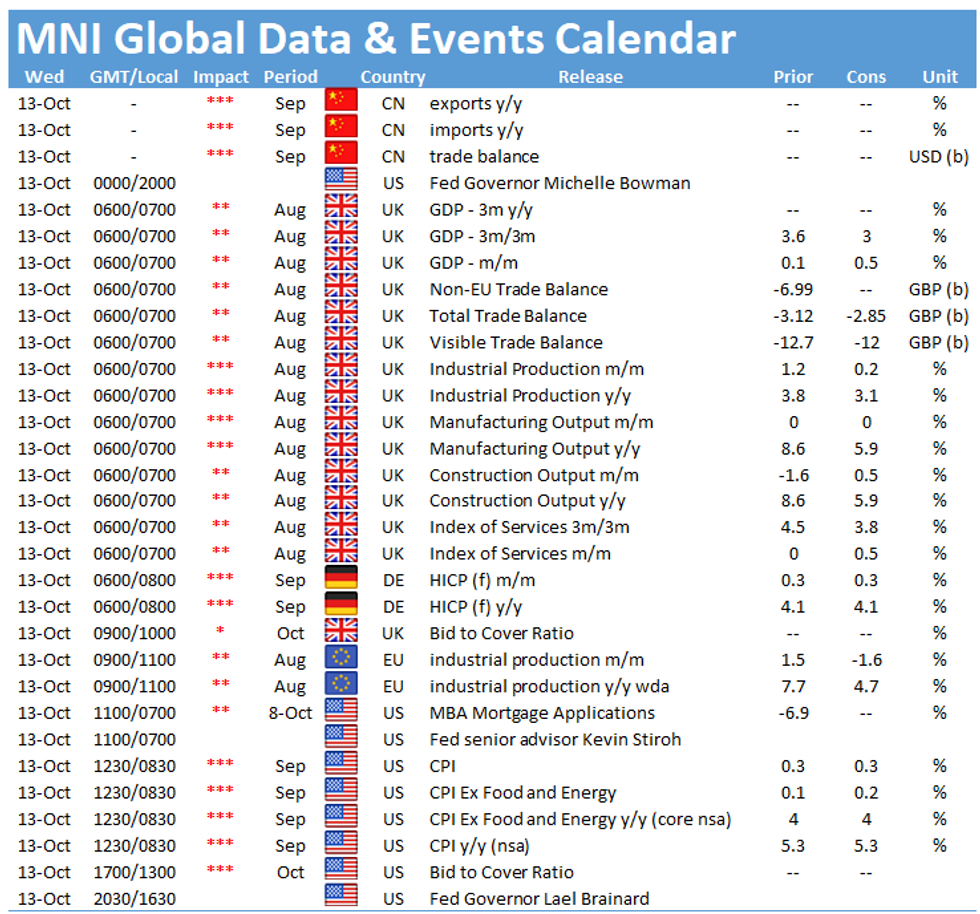

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.