-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI EUROPEAN OPEN: European COVID Worries Linger

EXECUTIVE SUMMARY

- CHINA FX PANEL URGES BANKS TO CAP SPECULATION AS YUAN SURGES (BBG)

- PBOC ADVISER WARNS ABOUT 'QUASI-STAGFLATION' RISK (BBG)

- BOE GOVERNOR WARNS RISKS TO INFLATION FORECASTS 'TWO-SIDED' (FT)

- ANTI LOCKDOWN PROTESTS OBSERVED IN SEVERAL EUROPEAN CAPITALS

- U.S. INTELLIGENCE SHOWS MASS RUSSIA TROOP BUILDUP NEAR UKRAINE (BBG)

- JAPAN PREPARES TO RELEASE OIL RESERVES IN JOINT PLAN (TV ASAHI)

Fig. 1: U.S. 5-Year/30-Year Treasury Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: There's no need yet for the U.K. to implement "Plan B" to clamp down on persistently high Covid infection levels, said U.K. Health Minister Sajid Javid. (BBG)

BOE: In an interview with the Sunday Times newspaper, Bailey said the key issue for the BoE would be whether a tight labour market led to higher wage demands that could keep inflation persistently above target. "A, activity in the economy is slowing. B, the proximate cause of many of these inflation issues is on the supply side, and monetary policy isn't going to solve these directly . . . It doesn't get more gas, more computer chips, more lorry drivers", he said, in reference to surging energy prices and supply chain shortages. He continued: "And C, however the concern for us is what they classically call 'second-round effects', particularly in wage bargaining and the labour market . . . If the economy evolves in the way the forecasts and reports suggest, we'll have to raise rates." But Bailey also warned said that even if the BoE had persistently underestimated the strength of inflation over the past year, the risks to its forecasts were now "two-sided", adding: "You're in a fairly febrile world . . . There are risks both ways. Obviously, our concern would be that if it gets into second-round effects, it [inflation] could be elevated for longer." (FT)

FISCAL: The head of the UK's HM Revenue & Customs has said it will struggle to recoup more than half of the estimated £5.8bn it paid out in error or due to fraud from three Covid-19 state support schemes it administered. HMRC played a pivotal role in providing financial support during the pandemic, paying out just over £81bn in total through the Coronavirus Job Retention Scheme, the Self-Employment Income Support Scheme and Eat Out to Help Out scheme. Jim Harra told the Financial Times the dedicated taskforce set up by the tax authority to claw back the money expected to recoup just £2.3bn over the next 18 months. (FT)

FISCAL: Road pricing has moved a step closer as government infrastructure chiefs say charging drivers could help deal with congestion and hit net-zero targets. The National Infrastructure Commission has launched a major review of pay-to-drive schemes, which could lead to congestion charging forming part of the next official assessment of the country's transport needs. Sir John Armitt, head of the commission, said an "open public debate" was needed about road pricing, which has long been politically toxic but is gaining support in government. Ministers have begun preliminary talks about road pricing as the Treasury looks for ways of replacing the £30 billion a year brought in by fuel duties, which is under threat from the switch to electric cars. (The Times)

FISCAL: The Treasury plans to clamp down on risky local authority borrowing by offering lower-cost public loans to councils if they pass the vetting of Britain's new infrastructure bank. Chris Grigg, chairman of the UK Infrastructure Bank, told The Times there was "a desire to dodge some of the problems" caused by the "Spelthorne effect", referring to the council in Surrey that borrowed £1 billion in public money to fund a commercial property buying spree for rental income. (The Times)

ECONOMY: The government's economic growth targets and policies on skills, investment and productivity are "nowhere near bold enough", the head of Britain's biggest business lobby group will tell ministers next week. Tony Danker, director-general of the CBI, will use its annual conference to urge the government to be more ambitious with its growth targets and to deal with a dearth of policies needed to achieve Boris Johnson's ambition for a "high-wage, high-skill, high-growth" economy. (The Times)

BREXIT: Britain will once again become a "dealmaking nation" as it prepares to join the trans-pacific partnership and launch four more negotiations next year, Anne-Marie Trevelyan has declared. (Telegraph)

BREXIT: The European Commission Vice-President Maroš Šefčovič has accused the UK's Brexit Minister, Lord David Frost, of "political posturing". Writing in The Mail on Sunday Lord Frost said "urgency" was needed from the EU to resolve the issues in the Northern Ireland Protocol. The protocol is the deal between the EU and UK agreed as a way to avoid a hardening of the Irish land border. Mr Šefčovič was speaking on Sunday on the BBC's The Andrew Marr Show. He said that in his meetings with stakeholders in Northern Ireland the message had been to "focus on the key priorities and problems we have to solve". (BBC)

BREXIT: France will continue supporting its fishermen as talks with the U.K. on post-Brexit fish licenses drag on, according to Gabriel Attal, the spokesman for the French government. "As long as the talks go on and our fishermen aren't given all the licenses requested and that they are owed, it's clear we need to accompany them," Attal said in an interview on Europe 1 radio on Sunday. (BBG)

BREXIT: Brussels plans to crack down on a patchwork of national arrangements that allow banks outside the EU to sell services into the bloc, dealing a blow to lenders in London that rely on the arrangements to cushion the impact of Brexit. The proposal would stop almost all cross-border selling from non-EU countries into the bloc's single market. Banks are keen on cross-border access to the EU because it is cheaper and simpler to do some trade from their main international centres rather than moving capital and staff. The cross border clampdown is part of an attempt to streamline how global banks operate in the EU, with Brussels also wanting to give regulators more power to make banks turn some branches into more closely supervised subsidiaries. (FT)

POLITICS: Previously loyal Conservative MPs have told Mark Spencer, the chief whip, that they will vote against the government for the first time when the plans are brought before parliament this week. After the changes were slipped out last week, the prime minister was accused of breaking a promise that no one would have to sell their home to pay for care. (Sunday Times)

POLITICS: Boris Johnson has been warned the migrant crisis could "destroy" the Conservative Party, as a Telegraph poll showed the overwhelming majority of Tory voters believe the Government's approach to Channel crossings is "too soft". On Saturday, a prominent party donor declared ministers must do "far more" to tackle the problem, warning that immigration is "going to destroy us and there is going to be a [Nigel] Farage-style party". The Telegraph can reveal Mr Johnson's own MPs erupted in anger over the issue when he appeared at the powerful backbench 1922 committee last week. (Telegraph)

POLITICS: MPs have channelled hundreds of thousands of pounds in private consultancy work through personal companies in a move that may have significantly reduced their tax bills. An investigation by The Times has found that at least ten MPs have taken on outside work via their personal companies. (The Times)

EUROPE

GERMANY: A debate in Germany over whether to impose compulsory vaccinations is picking up steam after Austria last week became the first European country to take the controversial step. Schleswig-Holstein Premier Daniel Guenther said he'd be open to the measure if Germany can't manage to escape the pandemic without it, according to an interview with Die Welt. Tilman Kuban, head of the youth wing of Chancellor Angela Merkel's conservative bloc, wrote in the same newspaper that he's in favor of "de facto" mandatory vaccinations. The country's association of pediatricians also urged compulsory shots for all adults. Other politicians have said they're skeptical that the move would be possible. Members of the Social Democrats will discuss the option in an internal call with medical experts on Monday, Die Welt said. (BBG)

GERMANY: The German state of Saxony, one of the worst hit by the latest wave of infections, announced tighter curbs on public life. Starting Monday, many culture venues as well as bars and nightclubs will have to close, Christmas markets are cancelled and people who aren't vaccinated face a curfew in hotspot areas. The measures come after the state of Bavaria introduced a lockdown for districts with high levels of infection. (BBG)

GERMANY: Germany's Free Democrats (FDP) leader Christian Lindner, who is pushing to become finance minister in the next government of Europe's largest economy, told a German newspaper that fears he was a fiscal hawk were overblown. (RTRS)

FRANCE: The French government will discuss the possibility of widening the Covid-19 booster campaign to more adults as soon as this week, government spokesman Gabrial Attal said in an interview on Europe 1 on Sunday. France's health authority on Friday advised giving a third Covid-19 jab to people aged 40 or more, six months after the previous shot. The French government has always followed the advice of health authorities, Attal said, noting the recent spike in coronavirus cases and reiterating a call for all eligible citizens to get a booster as soon as they can. (BBG)

ITALY: Italy's government acknowledges and welcomes the interest from KKR in Telecom Italia, says this is "good news" for the country, according to a statement released Sunday evening. (BBG)

BELGIUM/NETHERLANDS: Violence erupted at demonstrations in Belgium and the Netherlands over the weekend as tougher Covid-19 restrictions to curb the resurgent pandemic led to angry protests in several European countries. Ten of thousands of people marched through central Brussels on Sunday to protest against reinforced restrictions imposed by the Belgian government to counter the latest rise in coronavirus cases. The march, which police estimated involved 35,000 people, began peacefully but descended into violence as several hundred people started pelting officers, smashing cars and setting rubbish bins on fire. Police responded with teargas and water cannon. (Guardian)

AUSTRIA: Tens of thousands gathered in Vienna on Saturday to protest the Austrian government's new vaccine mandate and a national lockdown to contain record coronavirus cases. The demonstration came as unrest is on the rise in Europe, where governments, desperate to end the pandemic and its damage to their economies and health care systems, are increasingly focusing on the unvaccinated. (BBG)

SWITZERLAND: Several thousand people took part in rallies in Zurich and Lausanne on Saturday to protest against government measures to curb the Covid-19 pandemic. They took place one week ahead of a nationwide vote on November 28 on the use of the Swiss Covid certificate. (Swiss Info)

SWITZERLAND: Many Swiss cantonal health services won't be able to offer Covid booster shots to those under 65 until January, newspaper SonntagsZeitung reported, citing Gundekar Giebel, a spokesman for the cantonal health department in Bern. The federal government had previously said it hoped to make booster shots available to those under 65 beginning in December. (BBG)

U.S.

FED: MNI BRIEF: Faster Fed Taper Debate in Dec Appropriate-

- Federal Reserve Vice Chair Richard Clarida said Friday that it could be appropriate for the FOMC to discuss speeding up the central bank's slowing of asset purchases at its next meeting December 14-15. "Speaking for myself, I'll be looking at the data between now and the December meeting, and it may well be appropriate to have a discussion about increasing the pace at which we're reducing our balance sheet," he said in Q&A at a San Francisco Fed virtual event - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Waller Prefers Avoiding Taper, Hike Overlap

- Federal Reserve Governor Christopher Waller said Friday that if inflation does remain higher for longer his preferred response would be a faster taper, possibly in January, to bring forward rate hikes, and not hiking rates in a way that would suddenly abruptly stop the taper or overlap with continued asset purchases - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: At a briefing on Friday, Jen Psaki, the White House press secretary, said Biden "intends to make a decision" on the Fed chair nominee and said there would be "more to report early next week". (FT)

FED: A senior Senate Democrat suggested that uncertainty over who will run the Federal Reserve has limited action to rein in U.S. inflation and urged President Joe Biden to renominate Fed Chair Jerome Powell for another term. "I think we've got issues revolving around inflation that he can't do much about as long as he's not confirmed," Montana Senator Jon Tester said on NBC's "Meet the Press" on Sunday. Powell "needs to be appointed," said Tester. "We need to confirm him. I think he would be confirmed by a large margin if the president appointed him. And then he can get to work as chairman of the Fed and do a good job as he's done in the past." (BBG)

ECONOMY: Biden will deliver remarks on the economy and "lowering prices for the American people" on Tuesday, according to his weekly schedule. (BBG)

FISCAL: Chuck Schumer wants the Senate to pass President Joe Biden's social spending plan before Christmas. Standing in his way is the chamber's long to-do list, its rules referee and — more likely than not — Joe Manchin. The House on Friday morning passed $1.7 trillion in new funding to expand the social safety net, sending it to the upper chamber after months of infighting. In a statement soon after, Schumer said that the Senate will consider the legislation "as soon as the necessary technical and procedural work with the Senate parliamentarian has been completed." (POLITICO)

FISCAL: Rep. Rashida Tlaib (D-Mich.) told "Axios on HBO" she's "fearful" of what will happen to President Biden's big social spending bill in the Senate because "corporate Democrats" — including Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) — are serving special interests. "I know that they've been influenced and guided by folks that don't have the best interests of the American people in mind," the Squad member said. (Axios)

CORONAVIRUS: The CDC's independent panel of vaccine scientists unanimously endorsed Pfizer and Moderna's boosters for all adults, one of the final regulatory steps before the U.S. can officially start distributing the doses. (CNCB)

CORONAVIRUS: Anthony Fauci urged vaccinated adults to get booster shots now that health regulators have approved them for everyone 18 years and older, as U.S. infections trend upward and the holidays near. (BBG)

CORONAVIRUS: Michigan issued a mask advisory on Friday to combat the steepest rise in new cases in the U.S. State health officials are recommending that anyone over the age of two should wear a mask indoors regardless of vaccination status. With the holiday season nearing, the advisory also advises all establishments to require masks of customers and employees. (BBG)

CORONAVIRUS: All adults in the U.S. are now eligible to receive Pfizer's and Moderna's Covid vaccine boosters, after the Centers for Disease Control and Prevention authorized the shots for the general public Friday. The move allows an extra dose of protection for tens of millions of fully vaccinated Americans as cases climb and public officials worry the nation could face another surge during the winter. (CNBC)

CORONAVIRUS: White House Vaccinations Coordinator Bechara Choucair is leaving the administration to return to the private sector, he said in a message Sunday to Bloomberg News. Choucair's last day will be Monday. He joined President Joe Biden's team during the transition last year and was charged with accelerating the nascent Covid-19 vaccination effort Biden inherited upon taking office in January. Choucair, a former Chicago health commissioner and senior executive at Kaiser Permanente, is departing after the U.S. expanded access to vaccines for all people over age 5 and widely approved booster doses for adults. (BBG)

POLITICS: President Biden and members of his inner circle have reassured allies in recent days that he plans to run for reelection in 2024, as they take steps to deflect concern about the 79-year-old president's commitment to another campaign and growing Democratic fears of a coming Republican return to power. The efforts come as the broader Democratic community has become increasingly anxious after a bruising six-month stretch that has seen Biden's national approval rating plummet more than a dozen points, into the low 40s, amid growing concerns about inflation, Democratic infighting in Washington and faltering public health efforts to move beyond the covid-19 pandemic. (Washington Post)

POLITICS: President Joe Biden "remains fit for duty" after his first physical exam while in office, his doctor Kevin O'Connor said Friday. O'Connor, however, noted in a health report that a "single, 3mm, benign appearing polyp" was removed from Biden's colon during a routine colonoscopy conducted during Friday's exam, which required that he be placed under anesthesia. (CNBC)

OTHER

GLOBAL TRADE: Global supply-chain woes are beginning to recede, but shipping, manufacturing and retail executives say that they don't expect a return to more-normal operations until next year and that cargo will continue to be delayed if Covid-19 outbreaks disrupt key distribution hubs. (WSJ)

U.S./CHINA/TAIWAN: The United States and Taiwan next week will hold a second session of an economic dialogue launched last year in the face of increasing pressure on the island from China, the State Department said on Friday. (RTRS)

JAPAN/CHINA: China has asked Japan's top diplomat to visit the country, Foreign Minister Yoshimasa Hayashi revealed Sunday, in what would be the first such trip since December 2019. (Nikkei)

GEOPOLITICS: Chinese State Councillor and Foreign Minister Wang Yi on Saturday (Nov 20) stressed the need for unity and cooperation for all countries, calling for dialogue to manage differences. Mr Wang made the remarks when delivering the speech "Opposing Division Through Solidarity, Promoting Development Through Cooperation", via video link at the Global Town Hall themed "Managing Competition, Conflict, and Cooperation in a Pandemic World". Noting that the world is still in the middle of a raging pandemic, Mr Wang said countries must join hands to build consensus and form synergy due to the current situation. (Xinhua)

GEOPOLITICS: Europe faces a "synchronized" series of crises around Belarus, from the political to energy and security, Polish Prime Minister Mateusz Morawiecki said Sunday as he again blamed Russia for being behind the migrant crisis on its border. Speaking during his tour of three Baltic states on Sunday, Morawiecki voiced alarm over tensions flaring from Belarus to Ukraine, and warned of Moscow's "appetite to rebuild the empire" at a press conference with his Lithuanian counterpart Ingrida Simonyte. (BBG)

GEOPOLITICS: Belarus's authoritarian leader has told the BBC it is "absolutely possible" his forces helped migrants cross into Poland but denies they were invited. Thousands of migrants, mainly from the Middle East, have been trying to get into the EU via Belarus for months. In an exclusive interview, Alexander Lukashenko told me: "We're Slavs. We have hearts. Our troops know the migrants are going to Germany." "Maybe someone helped them. I won't even look into this," he added. The EU, Nato and the US have accused the Belarus leader of luring migrants to the border with the false promise of easy entry to the EU. Something he has denied. (BBC)

GEOPOLITICS: China downgraded diplomatic relations with Lithuania on Sunday over the opening of a Taiwanese office in Vilnius last week. The Chinese Foreign Ministry said in a statement that the new Taiwanese Representative Office in Lithuania "openly creates the false impression of 'one China, one Taiwan' in the world, renounces the political commitment made by Lithuania … on the establishment of diplomatic relations with the People's Republic of China, undermines China's sovereignty and territorial integrity, and grossly interferes in China's internal affairs." (POLITICO)

AUSTRALIA: The Australian government expects 200,000 vaccinated foreign students and skilled workers will soon return without quarantining when the country further relaxes pandemic restrictions next week. From Dec. 1, students, skilled workers and travelers on working vacations will be allowed to land at Sydney and Melbourne airports without needing to seek exemptions from a travel ban, Prime Minister Scott Morrison said Monday. "The return of skilled workers and students to Australia is a major milestone in our pathway back, it's a major milestone about what Australians have been able to achieve and enable us to do," Morrison said. The government expects 200,000 arrivals in the two categories by January, he said. Vaccinated citizens of Japan and South Korea will also be allowed in without quarantining, as well as people on humanitarian visas. But the government has yet to decide when general tourists will be allowed to return. (AP)

AUSTRALIA: International students arriving in Australia's Victoria state will no longer be required to quarantine, the state government announced Friday. As in New South Wales, which updated its rules last week, arrivals must be fully vaccinated and have tested negative for Covid-19 within 72 hours of departure. (BBG)

AUSTRALIA: Australia's Northern Territory will stop admitting unvaccinated travellers from other parts of the country from Monday. Currently people who have not been inoculated can enter from anywhere other than a designated Covid hotspot. Exemptions to the new measure will be made for "returning Territorians, extremely limited essential personnel and some compassionate grounds," an NT government press release said. (BBG)

NEW ZEALAND: The whole of NZ will move into the traffic light framework at 11.59pm on Thursday, December 2, Prime Minister Jacinda Ardern says. "This date provides the certainty for businesses in particular to plan." She urged people to download the vaccination certificate, which will become critical under the framework for people to get out and about. Cabinet has also decided to undertake a trial by allowing hairdressers and barbers in Auckland to open from Thursday to vaccinated people, Ardern said at today's post-Cabinet press briefing. (NZ Herald)

ASIA: Chinese President Xi Jinping on Monday said the valuable experience of China-ASEAN cooperation over the past 30 years should be cherished and upheld over the long term. Xi made the remarks while addressing the ASEAN-China Special Summit to Commemorate the 30th Anniversary of ASEAN-China Dialogue Relations via video link. (Xinhua)

CANADA: British Columbia imposed temporary restrictions on fuel and non-essential travel on Friday to ease supply chain disruptions and support recovery work after floods and mudslides destroyed roads, houses and left thousands stranded in the western Canadian province. (RTRS)

BRAZIL: Brazil's central bank President Roberto Campos Neto said on Friday that inflation expectations for 2022 are rising and shifting "a bit" away from the bank's target, noting that the bank has been trying to control it by raising interest rates. (RTRS)

BRAZIL: Brazilian central bank understands that floating FX rate is important because it absorbs shocks, president Roberto Campos Neto said at an event in Sao Paulo. Volatility tends to decline as credibility is generated, greater sustainable growth and long-term fiscal visibility. Campos Neto said that he hears a lot about the topic of making more or less intervention in FX rate, and added that "this government has made a lot of intervention." (BBG)

BRAZIL: The Brazilian Social Democratic Party (PSDB) was unable on Sunday to nominate its presidential candidate for next year's election because of a voting app failure, delaying a decision between the main contenders, Joao Doria and Eduardo Leite. (RTRS)

RUSSIA: The U.S. has shared intelligence including maps with European allies that shows a buildup of Russian troops and artillery to prepare for a rapid, large-scale push into Ukraine from multiple locations if President Vladimir Putin decided to invade, according to people familiar with the conversations. That intelligence has been conveyed to some NATO members over the past week to back up U.S. concerns about Putin's possible intentions and an increasingly frantic diplomatic effort to deter him from any incursion, with European leaders engaging directly with the Russian president. The diplomacy is informed by an American assessment that Putin could be weighing an invasion early next year as his troops again mass near the border. (BBG)

RUSSIA: France is concerned about a buildup of Russian forces along the border of Ukraine, said Foreign Minister Jean-Yves Le Drian, who warned the Kremlin against incursions. "Any violation of the border, any intrusion would lead to extremely grave consequences," Le Drian said in an interview on RTL radio on Sunday. (BBG)

SOUTH AFRICA: South Africa's Mineral Resources and Energy Minister Gwede Mantashe said Eskom Holdings SOC Ltd. is delaying emergency power projects that would have started generating 1,996 megawatts of electricity by next August, City Press reported. The state-owned utility hasn't approved 11 generation projects that are intended to provide power supplies when the national grid is vulnerable, the newspaper reported, citing the minister. Mantashe said Eskom informed him in writing that it "would not sign the agreement with these emergency electricity suppliers." Eskom Chief Executive Officer Andre de Ruyter denied stalling the projects, saying that a final agreement hasn't been presented to the utility, according to the newspaper. (BBG)

IRAN: Iran's naval forces seized a vessel carrying smuggled fuel off the shores of the country's southern Hormozgan province early Saturday, the state-run Young Journalists' Club reported. The unidentified ship had a cargo of more than 150,000 liters (943 barrels) of diesel fuel and its 11 crew members were presented to judicial authorities, according to the report. (BBG)

OIL: The White House on Friday pressed the OPEC producer group again to maintain adequate global supply, days after U.S. discussions with some of the world's biggest economies over potentially releasing oil from strategic reserves to quell high energy prices. The Biden administration has asked a wide range of countries, including China for the first time, to consider releasing stocks of crude. President Joe Biden faces slipping approval figures as Americans cite inflation as a growing problem. White House spokeswoman Jen Psaki said the administration wants to "ensure that the OPEC member countries and OPEC as an organization meets the demand needs that are out there with the adequate supply. That is something we've pressed them on in the past." (RTRS)

OIL: Japan is considering releasing oil from its reserves for the first time to curb surging oil prices, Kyodo news agency reported on Saturday, as Prime Minister Fumio Kishida signalled his readiness to counter oil price hikes following a request from the United States. However, Japan may struggle to justify such a move, as under its own laws the country can release reserves only at a time of supply constraints or natural disasters, but not to lower prices. (RTRS)

OIL: Japan is preparing to release crude oil from its strategic stockpiles as part of a joint effort with the U.S. to rein in soaring prices, according to a report by TV Asahi. The Japanese government determined it can do so legally as long as it taps surplus supply, TV Asahi reported Monday, citing an unnamed government official. It didn't provide further details on exactly how much oil would be released. The move comes as the U.S. and other major crude consumers grapple with a surge in oil prices after the Organization of Petroleum Exporting Countries and its allies resisted calls to return more supply to the market. Japanese Prime Minister Fumio Kishida had previously said his government was considering a release from reserves in coordination with countries such as the U.S. (BBG)

OIL: The Trans Mountain crude oil and products pipeline in Western Canada likely will remain closed for another week after record rainfall triggered severe flooding and landslides in British Columbia, resulting in the longest shutdown in the pipeline's nearly 70-year history, officials said Nov. 19. (Platts)

CHINA

YUAN: An organization formed by key participants in China's currency market urged banks to limit speculative foreign-exchange trading after the yuan climbed to a six-year high versus peers. The China Foreign Exchange Committee -- founded under guidance from the central bank -- encouraged lenders to be risk-neutral when trading foreign exchange for themselves and for clients, according to people familiar with the matter. Banks were advised to better track their proprietary trading and improve risk management, the people said, citing a proposal made by core members of the organization that was circulated to members. (BBG)

YUAN: The yuan is likely to maintain its recent strength in the near term supported by China's strong exports, businesses' demand for converting their forex holdings and the easing of relations with the U.S. after the video summit between the two presidents, the official Economic Daily said in its frontpage citing analyst Wang Qing of Golden Credit Rating. The Chinese currency broke the 6.37 resistance and now trades the highest since June 1, while the dollar index also strengthened. However, the yuan may not be on an appreciation path given China is likely to pursue a degree of structural loosening to support its growth while the U.S. begins tapering, said the newspaper. (MNI)

PBOC: China's economy could enter a period of "quasi-stagflation" with relatively slow growth and excessively high producer-price inflation, said Liu Shijin, an adviser to the nation's central bank. Such a scenario is "very likely" if demand remains weak, producer prices stay high, corporate profits are squeezed, and existing risks in the economy are "released too quickly," he told an online forum, the China Macroeconomy Forum, Sunday. Such a possibility needs close attention as once it happens, it will last into next year, he said. China's economic growth has slowed noticeably after September, and judging from the current situation, especially the two-year average growth rate, economic growth "is very likely to come in below 4% in the fourth quarter," he said. (BBG)

PBOC: The People's Bank of China may be more active in boosting social financing and ensuring liquidity, the Economic Information Daily said commenting the central bank's Q3 monetary report. The PBOC removed its oft-repeated phrases in the Q3 report, including "not engaging in flooding-style" credit stimulus and "controlling overall monetary floodgate," said the newspaper owned by Xinhua News Agency. The central bank also showed structural loosening policy intention, it said. While developed economies have started peripheral tightening, China won't follow but will instead shift to more pro-growth given its worsening slowdown and expected fall in inflation, said the daily. (MNI)

INFLATION: China's consumer price inflation is mostly under control, and it won't see wide-scale price increases, the National Development and Reform Commission said in a WeChat blogpost. Food prices can be contained given China's increased grain harvest and rising pork supply, Guo Liyan, a researcher at a research body affiliated with the NDRC, said in the blogpost. China's current logistics are functioning well, so transportation snags are unlikely despite snow and outbreaks of animal diseases in some regions, Guo said. While the prices of raw materials such as coal may continue rising in the near term, China has released some production capacities and reserves to guide the market, which limited industrial price gains, the blogpost said. (MNI)

POLICY: The possible imposition of a so-called 'data tax' on platform developers including giant internet companies has emerged as another facet of President's Xi Jinping's 'common prosperity' drive to share wealth more equitably throughout the nation. (Nikkei)

POLICY: China's market regulator on Saturday fined relevant firms including tech giants Alibaba, Baidu, Tencent and e-commerce platform JD.com Inc and Suning for violating the country's anti-monopoly rules in 34 mergers and acquisitions (M&A) deals which they failed to declare illegal implementation of operating concentration, marking the latest move in the nation's fight against monopoly. (Global Times)

ENERGY: China's daily coal output has now stabilized after reaching over 12 million tons and the price of coal futures has declined to 800 yuan ($125.25) per ton, a fall of nearly 60 percent from the peak reached in October, the National Development and Reform Commission (NDRC) of China announced on Saturday on its website. Analysts believed that the adjusted measurement revealed by the country's top economic planner will quickly cool down the surging coal price before winter comes this year. According to news outlet China Reform Daily, China's nationwide coal output reached 12.05 million tons on November 10, a new historic height, and now has stabilized after reaching a daily output of over 12 million tons. (Global Times)

ENERGY: China's top economic planner together with National Energy Administration have sent teams to supervise construction and operation of natural gas storage facilities in nine regions, NDRC says in a statement. China is capable of ensuring gas demand with current gas storage, statement says. Coal stockpile at power plants is expected to top 150m tons at end-Nov., according to a separate NDRC statement. (BBG)

OVERNIGHT DATA

SOUTH KOREA NOV 1-20 EXPORTS +27.6% Y/Y; OCT +36.1%

SOUTH KOREA NOV 1-20 IMPORTS +41.9% Y/Y; OCT +48.0%

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rates unchanged at 2.2% on Monday. The operation has led to a net injection of CNY40 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:28 am local time from the close of 2.1369% on Friday.

- The CFETS-NEX money-market sentiment index closed at 44 on Friday vs 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3952 MON VS 6.3825

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3952 on Monday, compared with 6.3825 set on Friday.

MARKETS

SNAPSHOT: European COVID Worries Linger

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 28.24 points at 29774.11

- ASX 200 down 43.443 points at 7353.1

- Shanghai Comp. up 21.139 points at 3581.43

- JGB 10-Yr future up 7 ticks at 151.69, yield down 0.5bp at 0.075%

- Aussie 10-Yr future up 2.0 ticks at 98.190, yield down 1.7bp at 1.793%

- U.S. 10-Yr future -0-05+ at 130-22+, yield up 0.69bp at 1.553%

- WTI crude down $0.20 at $75.76, Gold up $0.20 at $1845.69

- USD/JPY up 15 pips at Y114.14

- CHINA FX PANEL URGES BANKS TO CAP SPECULATION AS YUAN SURGES (BBG)

- PBOC ADVISER WARNS ABOUT 'QUASI-STAGFLATION' RISK (BBG)

- BOE GOVERNOR WARNS RISKS TO INFLATION FORECASTS 'TWO-SIDED' (FT)

- ANTI LOCKDOWN PROTESTS OBSERVED IN SEVERAL EUROPEAN CAPITALS

- U.S. INTELLIGENCE SHOWS MASS RUSSIA TROOP BUILDUP NEAR UKRAINE (BBG)

- JAPAN PREPARES TO RELEASE OIL RESERVES IN JOINT PLAN (TV ASAHI)

BOND SUMMARY: Two-Way flows In Tight Ranges In Asia

TYZ1 drifted lower early on, with a recovery from lows in oil futures and a ~0.3% uptick for e-minis applying some light pressure, in addition to the regional reaction Friday's comments from Fed Vice Chair Clarida & Governor Waller, as they flagged the potential for more aggressive tapering from the central bank. The truncated Tsy supply schedule owing to the Thanksgiving holiday provided another likely source of pressure (2- & 5-Year Tsy supply is due on Monday). Still, the space recovered from lows, with the lack of a wider bid in Asia-Pac equities (ex. China, which benefitted from increased speculation re: the prospect of targeted easing from the PBoC) and continued worry re: the COVID situation in Europe providing some interest as we moved through the session. TYZ1 last -0-05 at 130-23, 0-04+ off lows. Cash Tsys run 0.5-1.0bp cheaper across the curve, with 2s and 3s leading the way lower ahead of the aforementioned supply. Existing home sales data & the latest Chicago Fed national activity index reading hit later today.

- JGB futures initially eased back from their overnight highs, aided by the aforementioned cheapening in the U.S. Tsy space, although Tokyo morning trade was relatively limited. The contract then recovered alongside Tsys, to last deal +11 on the day. Cash JGB trade sees the major benchmarks running 0.5-1.5 richer vs. Friday's close. 7s provided the strongest point on the curve throughout the day, pointing to a futures-driven round of outperformance, while the long end lagged, perhaps on carry over worry re: JGB issuance to facilitate the well-documented round of incoming fiscal stimulus. A liquidity enhancement auction covering off the run 1- to 5-Year JGBs provided solid results. Elsewhere, a reminder that Japan will observe a market holiday on Tuesday, which may have limited afternoon trade.

- Aussie bond futures softened a little vs. early Sydney levels as crude oil futures moved off lows and U.S. Tsys came under some modest cheapening pressure, leaving YM -0.5. and XM +2.0 at the bell. The long end of the cash ACGB curve sits ~2.5bp richer on the day, with no direct impact from the slide in the cover ratio at today's ACGB Jun-51 auction (pricing at the auction was still comfortably through prevailing mids at the time of supply). A sizeable round of ACGB coupon payments and the latest round of scheduled ACGB purchases from the RBA did little to support the space.

JGBS AUCTION: Japanese MOF sells Y400.0bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y400.0bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.007% (prev. -0.007%)

- High Spread: -0.007% (prev. -0.005%)

- % Allotted At High Spread: 100.0000% (prev. 3.7158%)

- Bid/Cover: 5.539x (prev. 4.064x)

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 2.4794% (prev. 2.3718%)

- High Yield: 2.4825% (prev. 2.3750%)

- Bid/Cover: 1.9400x (prev. 3.5233x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 80.0% (prev. 44.8%)

- Bidders 44 (prev. 56), successful 25 (prev. 12), allocated in full 18 (prev. 7)

EQUITIES: Mixed, China Benefits From Increased Odds Re: Targeted PBoC Easing

U.S. e-mini futures added ~0.3% in the first Asia-Pac session of the week, while the major regional equity indices lacked a sense of coherence, dealing either side of unchanged at typing. The latter generally struggled to lodge anything in the way of sustained upward pressure in the wake of the COVID-related headwinds that hampered European equities on Friday. Meanwhile, some pointed to increased odds of targeted PBoC easing in the early part of '22 (on the back of language tweaks in the latest PBoC quarterly monetary policy report, released at the tail end of last week) as the supportive factor for mainland Chinese equities, which bucked the broader negative regional trend, recording modest gains in the process.

OIL: Crude Futures Pare Early Asia Losses

Oil unwound the early losses experienced in Asia-Pac trade, with WTI & Brent futures trading a handful of cents softer on the day into European hours. The initial pressure came on the back of increased prospects of Japan joining the likes of the U.S. & China in planning a coordinated inventory release from its national oil reserves. However, questions re: the scale of such a release from Japan, given the focus of national law on addressing inventories, not prices, coupled with the lack of an immediate decision (officials pointed to no decision being made as of yet) and a sizeable release arguably being priced into markets already, made for a relatively quick snapback. The major futures benchmarks currently trade a little over $1.00 above their respective session lows as a result. Note that WTI futures failed to challenge key support in the form of the Oct 7 low ($74.25).

GOLD: Asia Sees Consolidation Of Friday's Downtick

Gold has consolidated in Asia, after recording 2 consecutive daily losses at the backend of last week. Spot last deals little changed, hovering around $1,845/oz. A quick reminder that Friday saw an uptick from all-time lows in our weighted U.S. real yield monitor (owing to two permanent FOMC voters pointing to the potential for a quicker pace of tapering re: the central bank's bond buying schemes), with an uptick in the broader DXY also helping gold bears. Still, the bullish technical theme remains intact for gold, with bears needing to force a break through the Nov 10 low ($1,822.4/oz) to start turning the tide in their favour. Meanwhile, bulls continue to eye the Jun 14 high ($1,877.7/oz), which forms the initial resistance point.

FOREX: Antipodean Divergence Unfolds, Yuan Unfazed By PBOC Talk

The kiwi dollar traded on a slightly softer footing as participants reassessed RBNZ policy outlook ahead of this week's monetary policy meeting. That the Committee will raise the OCR on Wednesday seems like a done deal, but the debate on whether a 50bp remains on the table is ongoing. Separately, PM Ardern announced that New Zealand will shift away from lockdowns and into the traffic light system of managing Covid-19 on December 3.

- The Aussie topped the G10 scoreboard, diverging from its Antipodean cousin, as U.S. e-mini futures crept higher. AUD/NZD bounced off a fresh two-month low in early trade.

- The DXY advanced alongside U.S. Tsy yields, but struggled to threaten the prior trading day's high amid light macro headline flow.

- The yuan showed little interest in the latest round of chatter surrounding the PBOC's thinking on the current exchange rate. The yuan fixing was 21 pips softer than expected, while a PBOC-sponsored FX panel urged banks to limit speculative trading and ramp up risk management.

- EZ consumer confidence & U.S. existing home sales take focus on the data front. Elsewhere, ECB's de Guindos, de Cos, Holzmann, Kazaks & Kazimir are set to speak.

FOREX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1350(E774mln), $1.1380-90(E677mln), $1.1450(E1.5bln), $1.1580(E1.3bln)

- GBP/USD: $1.3360-70(Gbp811mln)

- EUR/GBP: Gbp0.8360(E507mln)

- AUD/USD: $0.7400-15(A$604mln)

- USD/CAD: C$1.2485-95($1.0bln), C$1.2685($1.1bln)

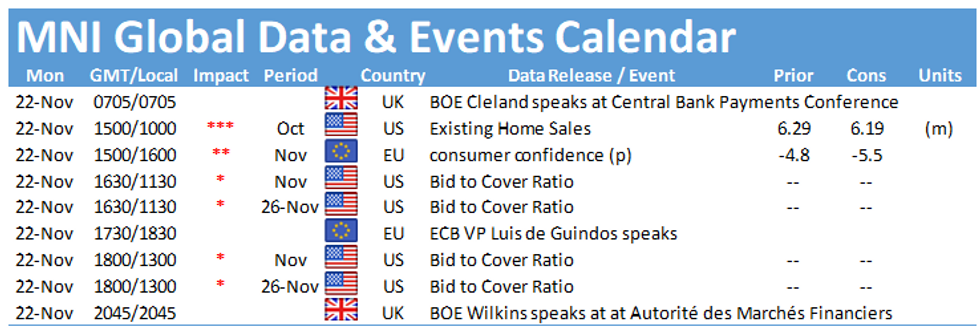

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.