-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN MARKETS ANALYSIS: BoK Hikes, Riksbank Decision Due

- Australian data failed to move the needle.

- The BoK delivered the expected 25bp rate hike, pointed to further tightening, but stayed away from providing a firm timeline re: the next hike.

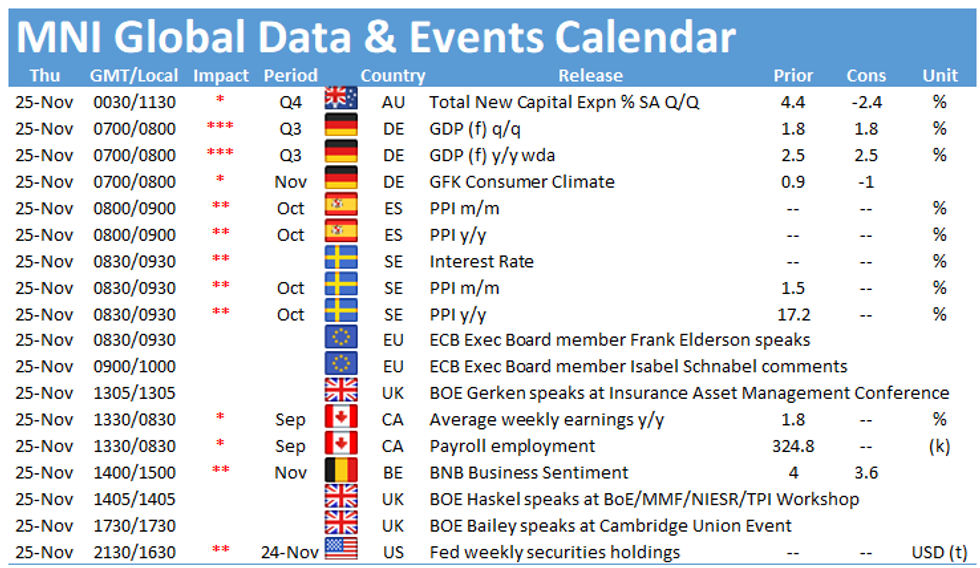

- The Riksbank will deliver their monetary policy decision today, while the ECB will publish the minutes of their most recent policy meeting. Speeches are due from a raft of ECB & BoE members.

BOND SUMMARY: Tight Asia Session For Core FI

The lack of macro headline flow and the Thanksgiving holiday-hampered nature of the session (when it comes to both liquidity and a shortened trading day for futures/closure for cash Tsys) has resulted in a narrow round of trade for TYZ1 thus far. The contract last deals -0-01 at 129-25+, operating within the confines of a 0-03+ range.

- JGB futures trade 3 ticks below settlement levels, in a limited Tokyo session. Yields out to 20s are ultimately within 0.5bp of yesterday's closing levels, mostly biased lower on the day, with 30s and 40s richening by ~1.0-1.5bp as the market shrugged off the apparent relatively tame issuance requirements surrounding the fiscal support package if press reports are to be believed. Mixed demand metrics were observed in the latest 40-Year JGB auction, which produced a high yield that was below wider expectations. Elsewhere, the cover ratio was a little softer vs. what was seen at the previous 40-Year auction, printing at the lowest level witnessed at a 40-Year auction since Aug '15. Still, 40s outperformed on the curve on the aforementioned issuance expectations.

- Aussie bond futures experienced a lacklustre session with YM -4.5 and XM -1.0 at the bell, looking through local data releases (a marginally softer than exp. private capex print for Q3, accompanied with negative revisions for Q2 and an uptick in 21/22 capex exp., as well as another uptick in ABS payrolls). The cash curve bear flattened after the U.S. Tsy-linked bid (from Wednesday trade) in the long end faded as we moved through the day. Swap spreads & EFPs tightened again after yesterday's aggressive narrowing from extremes. The initial tightening of spreads was seemingly facilitated by a combination of spill over from post-RBNZ rate market dynamics across the Tasman and a slight moderation in the usage of the RBA's SLF, with the latter pointing to slightly less worry re: collateral shortage in the ACGB space.

US: Thanksgiving Holiday Exchange Schedules

A reminder that the U.S. will observe the Thanksgiving holiday on Thursday. This will impact trading hours in the latter part of the week. Trading schedules for the major U.S. exchanges can be found below.

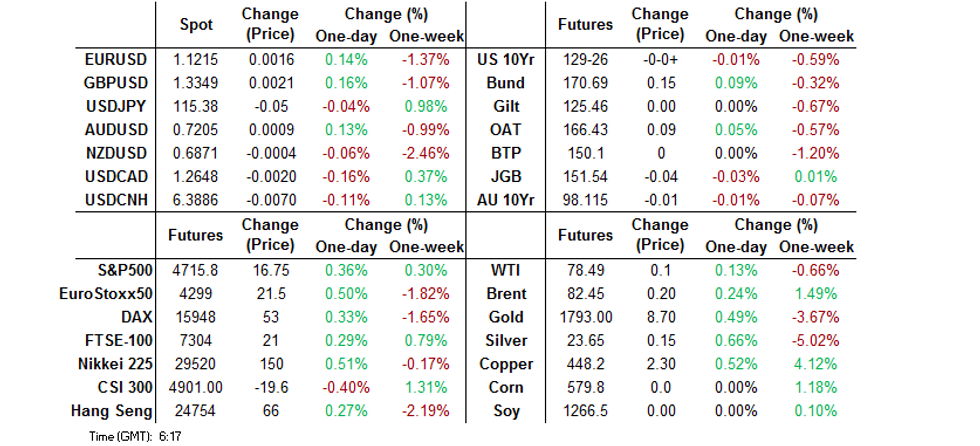

FOREX: USD Falters On Thanksgiving Day, NZD Remains Under Pressure

The DXY moved away from a 16-month high as the greenback underperformed at the margin during a fairly slow Asia-Pac session. Participants assessed familiar themes, with activity limited the Thanksgiving holiday in the U.S.

- The initial bid in NZD evaporated later in the session. The kiwi had a firmer start and extended recovery from yesterday's lows, but these gains proved short-lived. The kiwi lags the G10 pack alongside the USD as we type.

- AUD/NZD extended gains after charting a double bottom pattern, consolidating above its 100-DMA. The aforementioned bullish structure was completed on Wednesday, when the pair closed above its 100-DMA for the first time since mid-Oct.

- The Riksbank will deliver their monetary policy decision today, while their colleagues from the ECB will publish the minutes of their most recent policy meeting. Speeches are due from a raft of ECB & BoE members. The final reading of German GDP headlines the data docket.

FOREX OPTIONS: Expiries for Nov25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1350(E545mln)

- USD/JPY: Y114.15-25($1.0bln), Y114.95-00($1.0bln), Y115.50($745mln)

ASIA FX: Yuan Shows Some Modest Strength, Won Slips After BoK Deliver MonPol Decision

Most USD/Asia crosses crept higher, even as the DXY pulled back from yesterday's multi-month high. BoK monetary policy decision headlined the regional economic docket.

- CNH: Offshore yuan traded on a firmer footing, but the leg lower in USD/CNH seemed driven by broader dollar weakness. China's State Council asked local governments to use proceeds from special bond sales to boost investment and expand domestic demand, while the city of Chengdu extended support to local developers.

- KRW: The won weakened a tad after the BoK raised the 7-Day Repo Rate by 25bp, in line with expectations, and lifted their inflation outlook. Governor Lee revealed that the decision was not unanimous (Joo Sangyong provided the expected dovish dissenting vote) and refused to rule out another hike in 1Q22, albeit he did not commit to such a move.

- IDR: The rupiah traded on a slightly softer footing. Bank Indonesia Governor Warjiyo told lawmakers the the central bank see the current account deficit widening to about 1.5% of GDP next year.

- MYR: The ringgit tumbled to a three-month low amid continued stock outflows. Local headline flow was relatively light and lacked notable market catalysts.

- PHP: Spot USD/PHP bounced after rejecting its 100-DMA in the wake of Wednesday's sell-off. Overnight greenback strength may have aided the move.

- THB: Spot USD/THB consolidated above its 50-DMA, as participants assessed yesterday's portion of BoT rhetoric.

EQUITIES: E-Minis Nudge Higher, Asia Mixed

There was a lack of notable movement in the major regional equity indices during Thursday's Asia-Pac session, with some modest outperformance for the Nikkei 225 as it regained some of yesterday's losses. U.S. e-mini futures added 0.2-0.3% overnight, which came in the wake of the major Wall St. indices finishing flat to a touch higher on Wednesday. There was distinct lack of notable macro headline flow, with the U.S. Thanksgiving holiday set to crimp broader liquidity into the weekend. The only real point of note came via a 300mn block sale of shares in embattled property developer China Evergrande, which crossed before the Hong Kong open and was conducted at a 20% discount to yesterday's closing price, pointing to an institutional investor dumping their holdings.

GOLD: Holding Below $1,800/oz

Gold has stuck to a narrow range in Asia, with spot last dealing little changed, just above $1,790/oz. Wednesday saw an incremental breach of Tuesday's low, but gold never threatened to test key support in the form of the Nov 3 low ($1,759.0/oz), with our weighted U.S. real yield monitor pulling back from best levels of the day (as the cash Tsy curve twist flattened), allowing bullion to recover from worst levels, while consolidating below the $1,800/oz marker. A quick reminder that broader markets will be thinned out for the remainder of the week, owing to the Thanksgiving holiday in the U.S.

OIL: Crude Flat In Asia

WTI & Brent crude futures sit at virtually unchanged levels after essentially finishing flat on Wednesday.

- The European COVID situation continues to cloud the demand side, while the question of what will OPEC+ do to counter the recently outlined coordinated stockpile release from some of the major oil consuming nations? lingers on the supply side.

- On the latter, some source reports have suggested that the OPEC+ group will choose not to implement the previously outlined 400K bpd uptick in production when it convenes next week. However, it would seem not all of the participating nations are onboard with such a move, with separate source reports pointing to no plan to deviate from the previously prescribed plan re: upping production. We also saw OPEC's advisory body (the Economic Commission Board) suggest that the aforementioned and well-documented stockpile release from the major consuming nations could result in a notable swelling of surplus in global oil markets.

- Elsewhere, the latest weekly DoE inventory dataset, released Wednesday, revealed a "surprise" headline crude build, akin to what was seen in the API estimate the evening before.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.