-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI EUROPEAN OPEN: Familiar Themes Move To Background On Fed Decision Day

EXECUTIVE SUMMARY

- ECB FORECASTS SHOW INFLATION BELOW 2% TARGET AFTER NEXT YEAR (BBG)

- IMF TELLS BANK OF ENGLAND TO RAISE INTEREST RATES (FT)

- JOHNSON SUFFERS BIGGEST REBELLION OF PREMIERSHIP (Times)

- U.S. HOUSE PASSES $2.5TN DEBT CEILING HIKE, UYGHUR FORCED LABOUR BILL

- WHO: VACCINES SLIGHTLY LESS EFFECTIVE AGAINST SEVERE COVID, DEATHS (RTRS)

- STUDY SUGGESTS OMICRON IS LESS SEVERE THAN DELTA AND TWO VACCINE JABS GIVE GOOD PROTECTION (Telegraph)

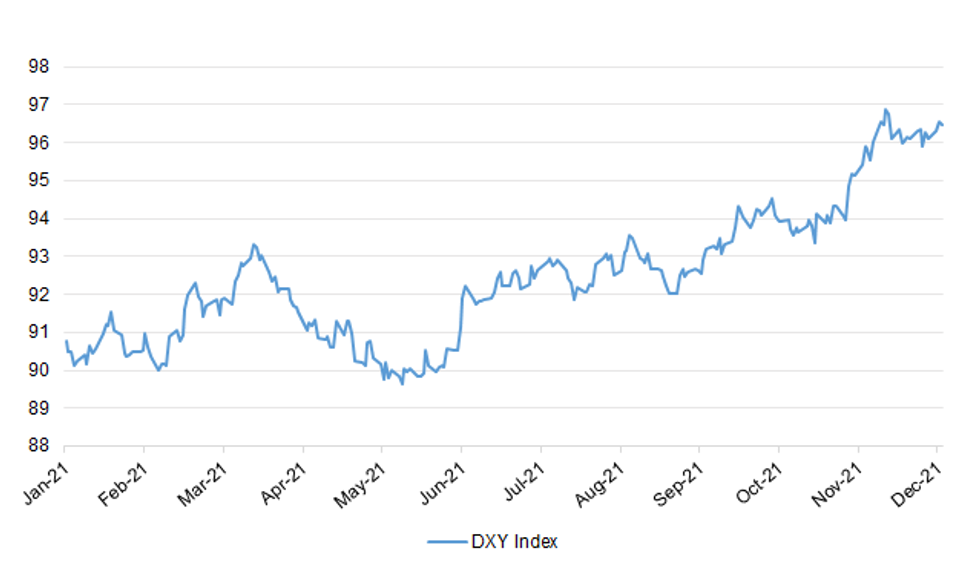

Fig. 1: DXY Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE/IMF: The IMF has urged the Bank of England to raise interest rates, warning that demand was too strong in the economy and UK inflation would rise to about 5.5 per cent early next year. Two days ahead of the central bank’s next Monetary Policy Committee meeting, Kristalina Georgieva, the IMF’s managing director, said the UK’s monetary policy needed to “withdraw the exceptional support provided during 2020”. In its annual health check on the British economy, the fund accused the BoE’s interest rate setters of allowing inflation to spiral in the UK economy by finding excuses to do nothing at its regular meetings. “It would be important to avoid inaction bias, in view of costs associated with containing second-round impacts [of inflation],” the IMF said. (FT)

POLITICS: Boris Johnson suffered the biggest rebellion of his premiership last night as nearly 100 Conservative MPs voted against plans for Covid passes and some of them openly questioned his future. Almost half of Tory backbenchers voted against new curbs that will require people to show proof of vaccination or a negative test at large indoor venues across England, leaving the prime minister reliant on Labour’s support. The rebellion — which was far bigger than No 10 and the whips expected — came from all wings of the party, including 13 former cabinet ministers and 26 MPs who were elected in 2019. (Times)

CORONAVIRUS: Britain’s wave of Omicron infections could reach 1m a day by the end of December, the government’s most senior public health adviser has warned amid growing calls to limit Christmas gatherings. Dr Susan Hopkins told MPs on Tuesday the Omicron Covid variant was initially doubling every two to three days in the UK but the pace appeared to have speeded up, driving a surge of disease that risked putting “significant” pressure on the NHS. (Guardian)

SCOTLAND: People in Scotland should limit socialising to just three households amid rising cases of the Omicron variant, Nicola Sturgeon has said. Setting out the guidance ahead of the festive season, Ms Sturgeon said: "We are not asking you to cancel or change your plans, and we are not proposing limits on the size of household gatherings." She added: "My key request today is this: before and immediately after Christmas, please minimise your social mixing with other households as much as you can. (Sky)

EUROPE

ECB: The European Central Bank’s new projections show inflation below the 2% target in both 2023 and 2024, according to officials familiar with the matter, giving President Christine Lagarde ammunition to argue against a swift increase in interest rates. While consumer-price growth for next year will be stronger than the 2.2% predicted in September, it will then slow over the forecast horizon, the officials said. They asked not to be identified because such numbers are confidential. The projections, which extend to 2024 for the first time, are a key input in formulating the ECB’s post-pandemic policy path. The outlook isn’t official until published by the Governing Council after its decision on Thursday. An ECB spokesman declined to comment. (BBG)

EU: European authorities are planning to make it easier for individual investors to put their money in private equity by loosening rules around an investment structure that buyout firms see as a gateway for billions of dollars in fresh capital. The proposed changes affect the European Long-Term Investment Fund, or ELTIF, which began in 2015 to encourage investment into infrastructure and companies seeking long-term capital. But only 57 products with estimated assets under management of about 2.4 billion euros ($2.7 billion) have been launched as of October, with managers put off by restrictions on how the fund could be used. The new rules, under review by the European Council and European Parliament, will remove minimum investment and wealth requirements for individuals while also broadening the type of assets fund managers can hold. (BBG)

EU: European Union governments reaffirmed on Tuesday their promise to allow six Balkan countries to one day join the bloc, nudging the EU towards finally opening talks with North Macedonia and Albania. For over a year, the EU's plan to build a "ring of friends" from Ukraine to Tunisia by offering closer ties, trade and aid has been paralysed, in part because European politicians fear a backlash over migration. The Balkan states include Serbia, Kosovo, Bosnia-Herzegovina, Montenegro, Albania and North Macedonia. "The Council reaffirms its commitment to enlargement, which remains a key policy of the European Union," the bloc's 27 European affairs ministers said in a policy statement. "The Council reiterates the EU's unequivocal support to the European perspective of the Western Balkans," the bloc added. (RTRS)

GERMANY/RUSSIA: German Foreign Office tweeted the following on Tuesday: "FM @ABaerbock in phone call with FM Sergey Lavrov @mfa_russia: we want honest & open talks w/ #Russia. Territorial integrity of #Ukraine must not be violated. Need progress in the Normandy format. FMs also discussed a visa-free regime for young Russians & cooperation on hydrogen." (MNI)

FRANCE: French voters who have moved have to contact authorities to register on local polling lists because registration is not automatic – an exception in Europe. More than 7 million people, many of them young adults, are in this group of "poorly registered" voters. To address the issue of abstention, authorities extended the registration deadline to March 4, 2022, for the April elections. (France24)

ITALY: Lower House Speaker Roberto Fico told reporters on Tuesday that he will send the letter summoning Italy's parliamentarians and representatives of the regions to elect a new president on January 4. (Ansa)

SPAIN: In the wake of the financial crisis a decade ago Spain agonised over how to cut spending to meet Brussels’ demands. Today Madrid has the opposite dilemma: can it ramp up spending enough to use up vast quantities of EU coronavirus aid? With the vast majority of €70bn in EU recovery fund grants scheduled for 2021-2023, the resources are without precedent for Spain, the programme’s second biggest beneficiary after Italy. “This is the absolute priority; this is an opportunity for the whole country,” Gonzalo García Andrés, minister of state for the economy, said in an interview. “When the money starts coming into the economy, it is not going to stop.” (FT)

NETHERLANDS: The Netherlands will extend COVID-19 restrictions through the Christmas holidays, including the early closure of schools, Dutch Prime Minister Mark Rutte said on Tuesday. The rapid spread of the Omicron variant of the coronavirus, which is making up roughly 1% of new infections in the country, "is a reason to be concerned and to be cautious," Rutte said in a televised comments. Elementary schools will close a week early to try to prevent children from infecting older family members during Christmas as hospitals struggle with a wave of COVID-19 patients. Rutte said a second Christmas "during which grandparents couldn't hug their grandkids under the tree" was a painful necessity. (RTRS)

US

FISCAL: The House voted early Wednesday 221-209 to raise the debt ceiling by $2.5 trillion, which will extend it beyond the 2022 midterms. Driving the news: The measure, advanced by Senate Democrats earlier on Tuesday, now heads to the president's desk for a signature. (Axios)

POLITICS: Senate Majority Leader Charles Schumer (D-N.Y.) is threatening to keep the Senate in session and voting over the weekend and into the week of Christmas to break a Republican blockade of President Biden’s nominees. Schumer noted that the backlog of Biden nominees awaiting action in the Senate has grown to 158 because of holds placed by conservatives including Sens. Ted Cruz (R-Texas) and Josh Hawley (R-Mo.). “The Republican obstruction of President Biden’s nominees this year has reached a new low. We’ve had to file cloture on twice as many nominees at this point in the Biden administration than Republicans had to do under President Trump,” Schumer told reporters Tuesday afternoon. (Hill)

POLITICS: The Democratic-controlled House voted Tuesday night to recommend that the Department of Justice pursue criminal charges against former White House chief of staff Mark Meadows for failing to appear for a deposition with the select committee investigating the January 6 attack on the US Capitol. (CNN)

CORONAVIRUS: The omicron Covid-19 variant first detected in southern Africa about a month ago now makes up about 3% of cases sequenced in the U.S., according to data from the Centers for Disease Control and Prevention. While the delta variant still dominates the U.S. at about 97% of all Covid cases analyzed, omicron is quickly gaining ground. The new variant represented an estimated 2.9% of all cases sequenced last week, up from 0.4% the previous week, according to the CDC. (CNBC)

OTHER

CORONAVIRUS: COVID-19 vaccines appear to have become slightly less effective in preventing severe disease and death but do provide "significant protection", the World Health Organization (WHO) said on Tuesday. The Omicron variant first detected in South Africa and Hong Kong last month has now been reported by 77 countries and is probably present in most worldwide, but should not be dismissed as "mild", WHO Director-General Tedros Adhanom Ghebreyesus said. "Omicron is spreading at a rate we have not seen with any previous variant," Tedros told an online briefing. "Even if Omicron does cause less severe disease, the sheer number of cases could once again overwhelm unprepared health systems." (RTRS)

CORONAVIRUS: Omicron is likely to be 23 per cent less severe than delta with vaccines still offering good protection, the first major real-world study into the new variant has shown. A study of more than 78,000 omicron cases in South Africa recorded between Nov 15 and Dec 7 also found that the Pfizer jab still offers 70 per cent protection against hospitalisation after two doses. The research showed that, compared with the first Wuhan strain, the virus led to 29 per cent fewer admissions to hospital, with 23 per cent fewer hospital admissions compared with delta. Far fewer people also needed intensive care from omicron, with just five per cent of cases admitted to ICU compared with 22 per cent of delta patients. (Telegraph)

CORONAVIRUS: The vaccine made by Sinovac Biotech Ltd., one of the most widely used in the world, does not provide sufficient antibodies to neutralize the omicron variant, said Hong Kong researchers in initial lab findings that may have sweeping consequences for the millions of people relying on the Chinese shot to protect them against Covid-19. Among a group of 25 people fully vaccinated with Sinovac’s shot, which is called Coronavac, none showed sufficient antibodies in their blood serum to neutralize the omicron variant, said a statement from a team of researchers at the University of Hong Kong released late Tuesday night. In a separate group of 25 fully vaccinated with the messenger RNA shot developed by Pfizer Inc. and BioNTech SE, five of them had neutralizing ability against the new variant, the scientists said. That’s in line with findings released last week by the companies, who said a third shot would be sufficient to protect against omicron. (BBG)

CORONAVIRUS: Pfizer’s Covid-19 antiviral pill cuts the risk of hospitalisation or death by up to 89 per cent in high-risk patients, according to final trial results that confirm earlier data. The positive results come after a rival antiviral from Merck proved less effective than initially hoped and at a time when the new Omicron variant surges in several countries. Although the trial was held while Delta was the dominant coronavirus variant, Pfizer believes the antiviral, known as Paxlovid, is likely to work against Omicron. An early lab study showed it continued to work against Omicron, and other studies are under way. (FT)

U.S./CHINA: The U.S. House of Representatives passed legislation on Tuesday to ban imports from China's Xinjiang region over concerns about forced labor, part of Washington's continued pushback against Beijing's treatment of its Uyghur Muslim minority. The measure passed by unanimous voice vote, after lawmakers agreed on a compromise that eliminated differences between bills introduced in the House and Senate. (RTRS)

U.S./CHINA: The Biden administration is considering imposing tougher sanctions on China’s largest chipmaker, according to people familiar with the situation, building on an effort to limit the country’s access to advanced technology. The National Security Council is set to hold a meeting on Thursday to discuss the potential changes, said the people, who asked not to be identified because the deliberations are private. Agencies represented through their deputies will include the Commerce, Defense, State and Energy departments. The proposal that’s being examined would tighten the rules on exports to Shanghai-based Semiconductor Manufacturing International Corp. If one proposal is adopted, companies such as Applied Materials Inc., KLA Corp. and Lam Research Corp. may find their ability to supply gear to SMIC severely limited. (BBG)

UK/CHINA: Britain has scolded China for its broadening use of a national security law in Hong Kong, detailing attacks on the city's vaunted judiciary, civil society groups and foreign diplomats. "The erosion of liberty in Hong Kong is an affront to freedom and democracy," Foreign Secretary Liz Truss said in the publication on Tuesday of her government's latest six-monthly report on Hong Kong. (RTRS)

CANADA: The federal government will announce new and expanded travel measures on Wednesday in a bid to limit the spread of the omicron coronavirus variant. Multiple sources told CBC News and Radio-Canada that the government is expected to renew an advisory against non-essential international travel, which had been in place for most of the COVID-19 pandemic but was quietly lifted in October. Sources say much stronger measures were discussed with premiers and Prime Minister Justin Trudeau during a Tuesday evening call. The proposed measures included whether to implement a ban on all non-essential foreign travellers into Canada, including from the United States, and stricter quarantine and testing measures for travellers who are allowed into Canada, including returning Canadians and permanent residents. But no decision was reached. (CBC)

CANADA: Finance Minister Chrystia Freeland tabled a fiscal and economic update today that commits billions of dollars in new spending to help Canada ride out a relentless health crisis. While the government made a number of big-ticket promises during the last election campaign, this relatively short 96-page document is focused on the fight against COVID-19 — something Freeland described as "our most important national project." Major Liberal campaign commitments — such as new housing supports, health transfer hikes and climate change initiatives — have been put off until the spring budget as the government adopts an "omicron-centric" approach to governing in the short term, a senior government official told reporters at a briefing. (CBC)

BOJ: Bank of Japan Governor Haruhiko Kuroda says he doesn’t expect stagflation to take place in Japan. Domestic corporate goods prices are rising significantly led by energy prices, Kuroda says in response to questions from a lawmaker in parliament. Don’t expect those high prices to be reflected in consumer prices soon. Want to achieve inflation backed by wage growth and a virtuous economic cycle so the bank will continue persistently with its monetary stimulus. (BBG)

JAPAN: The Japanese government overstated monthly data on construction orders for about eight years, officials said Wednesday, raising the possibility that the practice may have led to miscalculating the country's gross domestic product figures. The Ministry of Land, Infrastructure, Transport and Tourism had double counted some of the data it received from the same businesses when compiling its monthly construction orders data since fiscal 2013, according to the officials. Prime Minister Fumio Kishida said at a parliamentary session Wednesday that misrepresentation of the data does not have an impact on GDP figures for fiscal 2020 and 2021, which will end next March. "It was extremely regrettable. We must do everything we can to prevent a similar incident from happening again," Kishida said. Land minister Tetsuo Saito also offered an apology during the session. (Kyodo)

JAPAN: The Japanese government expects tax revenue to exceed 60 trillion yen in fiscal 2022, according to a draft budget plan, Sankei reports, without attribution. (BBG)

AUSTRALIA: Australia on Wednesday reopened borders to vaccinated skilled migrants and foreign students after a near two-year ban on their entry, in a bid to boost an economy hit by stop-start COVID-19 lockdowns and restart international travel.(RTRS)

AUSTRALIA: Australia’s government won’t seek mandate to freeze compulsory employer pension contributions at next year’s election, Minister for Superannuation Jane Hume says in webinar Wednesday. (BBG)

RBNZ: Reserve Bank of New Zealand Gov. Adrian Orr said the central bank will continue to increase its cash rate, eventually raising it above the level considered neutral for the economy. The comments by Mr. Orr at the New Zealand parliament's annual review of the central bank reiterate RBNZ's statements in November, when it raised the cash rate for the second time in two months. "It is our expectation that the OCR (Official Cash Rate) would eventually need to be raised above its neutral rate, conditional on the economy evolving as expected," Mr. Orr said. (WSJ)

RBNZ: New Zealand Finance Minister Grant Robertson expressed confidence in central bank Governor Adrian Orr after a number of senior officials announced they are leaving the bank. Asked Wednesday in Wellington if he has confidence in Orr, Robertson told reporters: “Yes I do. I think Adrian Orr has done a great job under a very, very challenging time as the governor of the Reserve Bank.” (BBG)

NEW ZEALAND: New Zealand’s government expects to achieve a budget surplus three years earlier than previously projected as the economy rebounds from the Covid-19 pandemic. Treasury Department forecasts show a NZ$2.1 billion surplus in the year ending June 2024, Finance Minister Grant Robertson said Wednesday in Wellington when presenting the half-year fiscal and economic update. In May’s budget, the balance was projected to stay in deficit until 2027. The projected surplus is a dividend of Robertson’s strategy of immediate, aggressive fiscal support when the pandemic hit in early 2020. As well as allowing more rapid debt reduction, the increase in revenue will enable the government to raise spending in health and other areas leading into the 2023 election. “The strong economic position gives us options,” Robertson said. “There are major challenges and opportunities that need to be met. Now is the time to tackle major long-term issues.” (BBG)

SOUTH KOREA: South Korea is considering further reducing the maximum private gathering size and restoring curfews on business hours to tackle the fast spread of COVID-19 infections, Prime Minister Kim Boo-kyum said Wednesday. Kim made the announcement during a government meeting following sharp increases in case numbers and deaths, including an all-time high of 94 COVID-19 fatalities the previous day. The plan marks a reversal of the government's phased program for a return to normal that began last month with the loosening of virus restrictions. (Yonhap)

INDIA: The government is considering changes to the proposed cryptocurrency framework, a senior government official said. This means that it may not be introduced in the winter session of parliament as planned. The issues being debated include the need for wider consultation and seeking comments from the public as well as whether the Central Bank Digital Currency (CBDC) to be introduced by the Reserve Bank of India needs to be a part of this bill or should be dealt with under the RBI Act. (Economic Times)

PHILIPPINES: The Philippines slightly raised its economic growth outlook for 2021 and forecast narrowing fiscal deficits in the next years, as it expects to sustain the recovery momentum amid easing mobility curbs. The Development Budget Coordination Committee, which sets the government’s economic assumptions for fiscal purposes, adjusted the 2021 gross domestic product growth estimate to a range of 5%-5.5% from a previous projection of 4%-5% in August, Budget Assistant Secretary Rolando Toledo said in a virtual briefing. It kept the projection of a faster 7%-9% expansion for 2022. “Our accelerated vaccination drive has enabled the safe and targeted reopening of the economy,” Toledo said, adding that the output will return to its pre-pandemic level next year. Over a third of the population has been fully vaccinated. (BBG)

UAE: The United Arab Emirates has suspended talks with the US over its $23bn deal to buy up to 50 F-35 fighter jets and other weapons in a sign of friction in the Gulf state’s relations with Washington. An Emirati official said Abu Dhabi had informed the US that “technical requirements, sovereign operational restrictions and cost-benefit analysis led to the reassessment”. (FT)

IRAN: The head of the United Nations nuclear watchdog warned Tuesday that the restrictions faced by his inspectors in Iran threaten to give the world only a “very blurred image” of Tehran's program as it enriches uranium closer than ever to weapons-grade levels. Speaking in a wide-ranging interview to The Associated Press, Rafael Mariano Grossi said he wanted to tell Iran that there was “no way around” his inspectors at the International Atomic Energy Agency if the Islamic Republic wanted to be “a respected country in the community of nations.” (AP)

IRAN: Saudi Arabia's foreign minister said on Tuesday that Iran appeared to be "stalling" in talks with global powers to salvage a nuclear pact and hoped progress would be made soon. Prince Faisal bin Farhan al-Saud, speaking at a press conference following a Gulf Arab summit in Riyadh, said the kingdom was in constant contact with parties to the talks in Vienna and the feedback "does not lead to optimism". (RTRS)

ISRAEL: A group of U.S. lawmakers is asking the Treasury Department and State Department to sanction Israeli spyware firm NSO Group and three other foreign surveillance companies they say helped authoritarian governments commit human rights abuses. Their letter sent late Tuesday and seen by Reuters also asks for sanctions on top executives at NSO, the United Arab Emirates cybersecurity company DarkMatter, and European online bulk surveillance companies Nexa Technologies and Trovicor. The lawmakers asked for Global Magnitsky sanctions, which punishes those who are accused of enabling human rights abuses by freezing bank accounts and banning travel to the United States. (RTRS)

PALESTINE: U.S. and Palestinian officials met virtually on Tuesday to renew the U.S.-Palestinian Economic Dialogue, the first such meeting in five years, the U.S. State Department said. They discussed infrastructure development, renewable energy and environmental initiatives, connecting Palestinian and American businesses, addressing obstacles to Palestinian economic development and other topics, it said. (RTRS)

ARGENTINA: Argentina’s central bank is weighing its first interest rate increase in over a year as it seeks to bring borrowing costs closer to inflation amid talks with the International Monetary Fund over a new financial program. The monetary authority is considering the hike to narrow the gap in real interest rates -- the rate after adjusting for inflation -- in coming weeks, according to a person with direct knowledge of the matter, who asked not to be named commenting on internal policy discussions. Argentina’s benchmark rate currently stands at 38%, well below the country’s annual inflation of 51%, leaving the South American nation with a negative real rate of about 13 percentage points, one of the world’s biggest. (BBG)

CHINA

PBOC: The People’s Bank of China will keep liquidity reasonable and ample next year while making monetary policy more “forward-looking and targeted” through both short and long-term measures, so as to help promote stable growth demanded by last week’s top leadership meeting on the economy, the CEWC, according to a statement on its website. The central bank will also strengthen the flexibility of the yuan exchange rate and promote lower costs of capital raising through further reforming interbank market rates, the statement read. (MNI)

FISCAL: China’s fiscal policies may play a bigger role in stabilizing growth next year, while monetary policies are likely to lean toward limited loosening to coordinate with fiscal stimulus, Yicai.com reported. China may further lower banks’ reserve requirement ratios and moderately lower policy rate if necessary, it said. Monetary policies will also need to be designed to boost financial support to small businesses, which face weak demand, insufficient cash, and impact from government policies, the news site said. China is likely to maintain tight controls over real estate while taking measures to ensure the sector’s “soft landing,” it said. (MNI)

ECONOMY: China is expected to stimulate growth by promoting the sales of green home appliances and new energy vehicles and increasing investment in high-tech and infrastructure that support decarbonization, Yicai.com reported citing analysts. Measures may include issuing vouchers and encouraging car sales in rural areas, the newspaper said. Boosting investment will be the key to preventing a slowdown, with infrastructure mainly focusing on supporting digital and green transform, as well as technology upgrade to ensure a stable supply chain, the newspaper said citing analysts. (MNI)

CORONAVIRUS: The southern Chinese city of Dongguan, home to 10.5 million people, launched mass testing for Covid-19 on Wednesday after four infections were identified a day earlier. Local authorities said the move was intended to stop the further spread of the coronavirus and those who did not comply would face legal consequences. (SCMP)

OVERNIGHT DATA

CHINA NOV INDUSTRIAL OUTPUT +3.8% Y/Y; MEDIAN +3.7%; OCT +3.5%

CHINA NOV INDUSTRIAL OUTPUT YTD +10.1% Y/Y; MEDIAN +10.4%; OCT +10.9%

CHINA NOV RETAIL SALES +3.9% Y/Y; MEDIAN +4.7%; OCT +4.9%

CHINA NOV RETAIL SALES YTD +13.7% Y/Y; MEDIAN +13.8%; OCT +14.9%

CHINA NOV FIXED ASSETS EX RURAL YTD +5.2% Y/Y; MEDIAN +5.4%; OCT +6.1%

CHINA NOV PROPERTY INVESTMENT YTD +6.0% Y/Y; MEDIAN +6.1%; OCT +7.2%

CHINA NOV UNEMPLOYMENT 5.0%; MEDIAN 4.9%; OCT 4.9%

CHINA NOV NEW HOME PRICES -0.33% M/M; OCT -0.25%

JAPAN OCT TERTIARY INDUSTRY INDEX +1.5% M/M; MEDIAN +1.2%; OCT +0.5%

AUSTRALIA DEC WESTPAC CONSUMER CONFIDENCE 104.3; NOV 105.3

AUSTRALIA DEC WESTPAC CONSUMER CONFIDENCE -1.0% M/M; NOV +0.6%

The index remains comfortably in positive territory where optimists outnumber pessimists. There was a clear difference in responses between the states hit hardest by recent Delta outbreaks and the rest of Australia. Both NSW and Victoria posted significant falls (down 3.6% and 3.5% respectively) while sentiment was up in Queensland (3.4%), WA (3.2%) and SA (7.1%). While high vaccination rates have allowed the ‘Delta states’ to reopen, there appears to be a heightened sensitivity to virus developments in those states where there is likely more concern about the newly emerging Omicron strain and the continued circulation of COVID locally. (Westpac)

NEW ZEALAND Q3 BOP CURRENT ACCOUNT BALANCE -NZ$8.300BN; MEDIAN -NZ$7.825BN; Q2 -NZ$1.536BN

NEW ZEALAND Q3 CURRENT ACCOUNT GDP RATIO YTD -4.6%; MEDIAN -4.5%; Q2 -3.3%

SOUTH KOREA NOV UNEMPLOYMENT 3.1%; MEDIAN 3.3%; OCT 3.2%

SOUTH KOREA OCT MONEY SUPPLY L +0.7% M/M; SEP +0.2%

SOUTH KOREA OCT MONEY SUPPLY M2 +1.1% M/M; SEP +0.5%

CHINA MARKETS

PBOC NET DRAINED CNY450BN VIA OMOS WEDS; MLF RATE FLAT

The People's Bank of China (PBOC) injected CNY500 billion via a 1-year medium-term lending facility and CNY10 billion via 7-day reverse repos with the rates unchanged at 2.95% and 2.2%, respectively, on Wednesday. The operation has led to a net drain of CNY450 billion after offsetting the maturity of CNY950 billion MLF and CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, and the cut of the reserved requirement ratio by 0.5% for financial institutions effective today has released around CNY1.2 trillion long-term funds into the market, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2002% at 09:30 am local time from the close of 2.2071% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 56 on Tuesday, compared with the close of 50 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3716 WEDS VS 6.3675

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3716 on Wednesday, compared with 6.3675 set on Tuesday.

MARKETS

SNAPSHOT: Familiar Themes Move To Background On Fed Decision Day

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 29.06 points at 28461.57

- ASX 200 down 51.283 points at 7327.1

- Shanghai Comp. down 4.597 points at 3656.928

- JGB 10-Yr future up 5 ticks at 152.07, yield down 0.6bp at 0.046%

- Aussie 10-Yr future down 2.3 ticks at 98.425, yield up 1.9bp at 1.56%

- U.S. 10-Yr future +0-03 at 130-23+, yield down 1.02bp at 1.431%

- WTI crude down $1 at $69.73, Gold down $1.2 at $1769.59

- USD/JPY up 2 pips at Y113.72

- ECB FORECASTS SHOW INFLATION BELOW 2% TARGET AFTER NEXT YEAR (BBG)

- IMF TELLS BANK OF ENGLAND TO RAISE INTEREST RATES (FT)

- JOHNSON SUFFERS BIGGEST REBELLION OF PREMIERSHIP (Times)

- U.S. HOUSE PASSES $2.5TN DEBT CEILING HIKE, UYGHUR FORCED LABOUR BILL

- WHO: VACCINES SLIGHTLY LESS EFFECTIVE AGAINST SEVERE COVID, DEATHS (RTRS)

- STUDY SUGGESTS OMICRON IS LESS SEVERE THAN DELTA AND TWO VACCINE JABS GIVE GOOD PROTECTION (Telegraph)

BOND SUMMARY: Tsys Post Marginal Gains Pre-FOMC, Flattening Hits Cash ACGB Curve

All eyes were on the impending announcement of the monetary policy decision from U.S. Fed, with continued assessment of Omicron risks and simmering Sino-U.S. tensions in the background.

- T-Notes ground higher, albeit very reluctantly. They last change hands +0-02 at 130-22+. Cash Tsy yields sit 0.2-0.9bp lower across the curve, with belly outperforming at the margin. Eurodollar futures last trade unch. to +1.0 tick through the reds. Note that U.S. retail sales & Empire M'fing Survey will hit the wires today, albeit they will be overshadowed by the latest showing from FOMC members.

- JGB futures went bid, topping out at 152.09 after the Tokyo lunch break. They last trade at 152.07, 5 ticks above previous settlement. Cash JGB yields sit slightly lower across the curve. The final reading of Japan's Oct industrial output was revised higher, while the BoJ conducted Rinban ops covering 1-10 & 25+ Year JGBs, but the JGB space was unfazed. BoJ Gov Kuroda told lawmakers that policymakers intend to continue persistently with its monetary stimulus.

- Overnight impetus weighed on cash ACGBs in early trade, with the short-end extending losses later on, which was paralleled by a recovery in the longer-end. This flattening dynamic leaves us with yields sitting 1.3-6.3bp higher across the curve. YM last trades -3.8 & XM -2.3, while bills run 2-6 ticks through the reds. Aussie bonds shrugged off a marginal deterioration in Westpac Consumer Confidence, as headline index remained in positive territory. Across the Tasman, NZGBs went bid after New Zealand slashed planned debt issuance over the next four years, but there was no real follow-through in ACGBs.

JGBS AUCTION: Japanese MOF sells Y2.8574tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8574tn 1-Year Bills:

- Average Yield -0.1088% (prev. -0.1261%)

- Average Price 100.109 (prev. 100.126)

- High Yield: -0.1068% (prev. -0.1241%)

- Low Price 100.107 (prev. 100.124)

- % Allotted At High Yield: 31.6769% (prev. 33.2848%)

- Bid/Cover: 3.682x (prev. 3.774x)

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.375tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+ Years until maturity

FOREX: Major FX Pairs Rangebound, All Eyes On Fed

Most G10 crosses were happy to hold narrow ranges ahead of today's monetary policy announcement from the Fed, who are expected to take a more hawkish stance, which should be reflected in a faster asset purchase taper, a more aggressive rate dot lot and tweaks to the language. The DXY wavered in close proximity to yesterday's high.

- The kiwi has underperformed at the margin as New Zealand's quarterly BoP current account deficit expanded more than forecast in the three months through the end of September. RBNZ Gov Orr did not offer any fresh insights in his latest address, noting that the OCR will likely move above its neutral level at some point. The Treasury's HYEFU showed improvement in debt outlook, with the Debt Management Office slashing their bond issuance plans for the next four years.

- The yuan showed little interest in China's economic activity data, which were (on balance) slightly weaker than expected. Industrial output rose marginally faster than expected but retail sales growth slowed more than forecast. Fixed assets and property investment missed expectations by a narrow margin, while the unemployment rate unexpectedly edged higher to 5.0% from 4.9%.

- Inflation reports from the UK, France, Italy and Canada as well as U.S. retail sales & Empire M'fing will take focus on the data front later in the day.

FOREX OPTIONS: Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.0bln), $1.1300(E670mln), $1.1350(E529mln), $1.1400(E2.2bln)

- USD/JPY: Y112.95-05($1.1bln), Y113.75-80($1.5bln), Y113.90-05($1.1bln), Y114.20($1.1bln)

- GBP/USD: $1.3235-50(Gbp705mln)

- EUR/GBP: Gbp0.8575-80(E811mln)

- AUD/USD: $0.7275(A$544mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.