-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsys Twist Flatten, DXY Nudges Lower

- Cash Tsys extend twist flattening in Asia.

- Localised COVID restrictions in China continue to draw interest, while markets looked through the latest North Korea missile launch.

- Central bank speak dominates on Tuesday.

BOND SUMMARY: Flow Dominates Limited Tsy Session, JGB Futures Push Lower In Afternoon

U.S. Tsys stuck to a narrow range in Asia-Pac hours, with a lack of notable headline flow evident. TYH2 +0-02+ at 128-07 ahead of European trade, with cash Tsys running 1.5bp cheaper to 1.0bp richer across the curve, twist flattening in the process. Flow was headlined by a block buy of the TYH2 127.00 puts (+15.0K), with a mis-weighted FV/WN block flattener (-5,275/+750) also observed. Fed Chair Powell’s latest testimony will draw most of the event interest on Tuesday. The pre-release of the initial address saw Powell note that he stands ready to prevent elevated inflation from becoming entrenched. "The economy is expanding at its fastest pace in many years, and the labour market is strong," he added. Fedspeak from George and Mester will supplement Powell during NY hours. 3-Year Tsy supply is also due on Tuesday. Meanwhile, NFIB small biz optimism headlines a thin NY economic data docket.

- JGB futures struggled in afternoon trade, after the space saw a bid develop during the Tokyo morning, as participants returned from the elongated Tokyo weekend. The contract finished -21. There wasn't much in the way of obvious catalysts to trigger such a move. A warning from Nomura re: the potential for further futures selling from foreign CTA-like accounts owing to long positioning, inflation breakeven dynamics & speculation that the BoJ may lift its immediate inflation forecasts did the rounds and may explain the weakness. 10-Year JGB yields hit the highest level since early ’21 on the back of the move. A multi-tranche JPY offering from Berkshire Hathaway headlined on the issuance front.

- Aussie bonds followed the broader ebb and flow, leaving YM +2.0 and XM +2.5 at the close. Local data had no impact on the space, with firmer than expected retail sales for November likely driven by the re-opening from COVID lockdowns/supply crunch fears. Remember that real-time data pointing to a slowdown in retail activity in recent weeks has been widely disseminated. A$ IG issuance continued to tick over.

FOREX: Yen Loses Ground Amid Reduced Demand For Safety

The yen snapped its four-day winning streak against the greenback as Japanese markets re-opened after a public holiday amid reduced demand for safe haven currencies. The continued reassessment of risks from the spreading Omicron coronavirus variant took centre stage, as broader headline flow failed to provide any notable catalysts, with North Korea's apparent missile test virtually ignored by the FX space.

- The AUD was among the best performers in G10 FX space. It may have drawn some support from a solid beat in Australian retail sales and an uptick in BBG Commodity Index. Other high-beta currencies such as NOK and CAD also firmed but NZD struggled.

- Offshore yuan garnered some strength, with spot USD/CNH testing yesterday's low, as the DXY traded on a heavier footing. The redback was resilient in light of targeted lockdowns imposed by some Chinese cities.

- The global data docket is fairly light today, with comments coming up from Fed's Powell, Mester & George as well as ECB's Kazaks. Joachim Nagel will take over Bundesbank presidency from Jens Weidmann in the presence of ECB Pres Lagarde.

ASIA FX: Won Leads Regional Currencies Higher Amid Greenback Weakness

Emerging Asian FX outperformed the greenback amid continued reassessment of risks from the Omicron variant, with regional headline flow offering little in the way of outright drivers of price action within the space.

- CNH: Spot USD/CNH tested yesterday's low, with offshore yuan shrugging off localised lockdowns imposed by some Chinese cities. Beijing's pledge to boost investment to stabilise growth & a stronger than expected PBOC fix may have lent some support to the redback, while the DXY lost some altitude.

- KRW: Geopolitical matters failed to rattle the Korean won, which outperformed all regional peers. The KRW stayed strong even as North Korea test-launched an apparent ballistic missile for the second time this year. Recall that FinMin Hong told his ministry to closely monitor FX markets yesterday.

- IDR: Spot USD/IDR extended its recent sell-off, even as Bank Indonesia noted that retail sales growth slowed into the end of 2021. Worth noting that Indonesia suggested it might relax restrictions in Java and Bali, while the Investment Ministry allowed some coal vessels to set sail and vowed to review the current export ban on Wednesday.

- MYR: Spot USD/MYR went offered. Malaysia's overall wholesale & retail sales rose to a fresh record in November, according to data from the Department of Statistics.

- PHP: The peso garnered some strength, even as the Philippines' trade deficit widened more than expect, while Health Sec Duque warned against the rapid surge in new Covid-19 infections.

- THB: The baht was the second-best performer in the region, despite concerns over the local Omicron outbreak. BoT Gov Sethaput judged that the economic recovery might be fragile, albeit the central bank is prepared for worst-case scenarios.

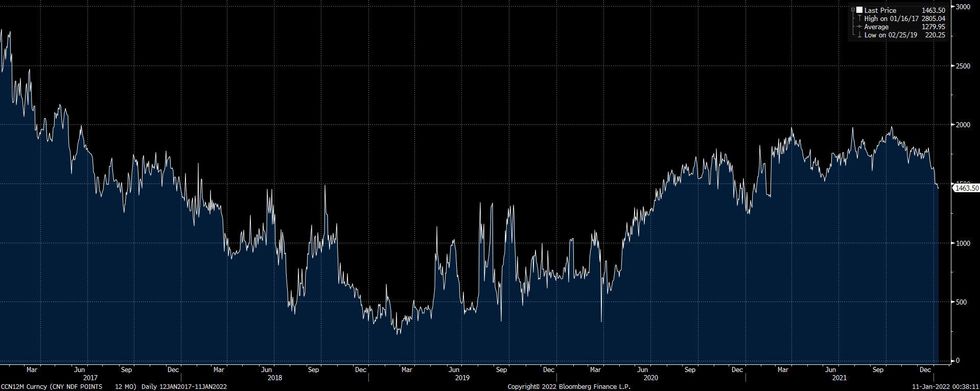

CNY: Commerzbank Look For Continuation Of Move Lower In USD/CNY Forward Points

12-month USD/CNY forward points have pulled back sharply in recent weeks.

- Commerzbank point to the market pricing in monetary easing in China vs. a more hawkish Fed. They suggest that “as the Chinese economy looks to be weakening over the foreseeable future and the Fed sounds more hawkish, for now, USD/CNY forward points are likely to fall further.”

Fig. 1: USD/CNY 12-Month Forward Points

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

OIL: Crude Lodges Uptick In Asia

Crude oil futures have managed to reverse some of Monday’s losses, with WTI & Brent adding ~$0.50 & ~$0.30 to their respective settlement levels during overnight dealing. This comes after risk aversion (which faded into the NY close) and an uptick in both Libyan & Kazakh crude production applied some modest pressure to the space on Monday. API inventory estimates provide the focal point for participants on Tuesday.

EQUITIES: Flat To Lower In Asia

Most of the major regional equity indices edged lower during Asia-Pac hours, given the negative lead from Wall St. and worry re: Fed tightening. The Hang Seng was the outlier, dealing little changed in early afternoon trade. Still, none of the major regional equity indices shed 1%. E-minis traded either side of unchanged in Asia, after the major indices pared losses into Monday’s Wall St. close, with broader focus already moving to Wednesday’s U.S. CPI release (and implications for Fed policy). The latest North Korean missile launch failed to impact broader sentiment.

GOLD: Technicals Continue To Dominate

Monday’s pullback from session highs in U.S. real yields, coupled with a similar pullback in the DXY index, allowed spot gold to tick away from technical support, with familiar lines in the sand remaining in place. Spot hovers around $1,805/oz, adding a handful of dollars during Asia Pac hours. Broader focus is on Wednesday’s U.S. CPI print, with Fed Chair Powell’s Tuesday testimony set to provide a point of interest in the interim.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2022 | 0800/0900 | * |  | ES | Industrial Orders |

| 11/01/2022 | 0900/1000 | * |  | IT | Retail Sales |

| 11/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/01/2022 | 1020/1120 |  | EU | ECB Lagarde At Bundesbank Ceremony | |

| 11/01/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/01/2022 | 1430/0930 |  | US | Kansas City Fed's Esther George | |

| 11/01/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/01/2022 | 1500/1000 |  | US | Fed Chair Powell's Senate Nomination Hearing | |

| 11/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 11/01/2022 | 1800/1300 | *** |  | US | US 3 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.