-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Ends QE, But Doesn’t Pivot Policy

EXECUTIVE SUMMARY

- FED’S GEORGE WANTS MAJOR BALANCE SHEET REDUCTION (MNI)

- FED'S BOSTIC: HALF-POINT RATE HIKE ISN'T HIS PREFERRED POLICY PATH (MARKETWATCH)

- FED’S BARKIN: BUSINESSES WOULD WELCOME HIGHER INTEREST RATES (CNBC)

- FED'S DALY SUPPORTS RATE LIFTOFF IN MARCH, WANTS OPTIONS OPEN ON RATE PATH (RTRS)

- RBA STAYS FIRM ON CASH RATE VIEW, DROPS QE (MNI)

- NO BOJ INTERVENTION NOW AS 10-YR JGB YIELD RISES (MNI)

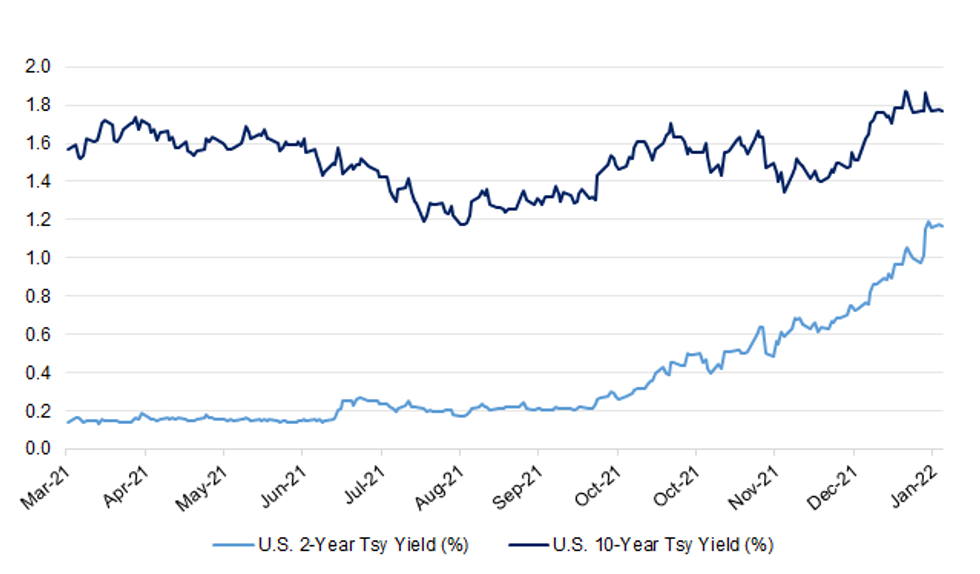

Fig. 1: U.S. 2- & 10-Year Tsy Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Mandatory vaccinations against Covid-19 for frontline National Health Service and social care workers in England are set to be scrapped, the U.K. government announced, after warnings the measure would fuel chronic staff shortages. Health Secretary Sajid Javid told Parliament on Monday a two-week consultation would be launched on reversing the controversial policy, after the “intrinsically less severe” omicron variant eclipsed the predecessor delta strain, changing the balance of risks. (BBG)

EUROPE

SNB: The Swiss National Bank sees inflation near its peak, with no signs that higher wages would fuel demand that would lock in a period of higher prices, SNB Chairman Thomas Jordan told Swiss broadcaster SRF. "In Switzerland we are in a very good environment. We don't see that at all," he said in an interview on the EcoTalk programme when asked about a wage-price spiral. "Wage developments are moderate, price developments so far are very moderate," he said. He also stuck to the SNB's forecast that Swiss inflation would be around 1% this year.

U.S.

FED: MNI: Fed’s George Wants Major Balance Sheet Reduction

- The Federal Reserve should not shy away from a major reduction in its USD8.7 trillion balance sheet as it removes monetary stimulus from the economy, Kansas City Fed President Esther George said Monday. “While it might be tempting to err on the side of caution, the potential costs associated with an excessively large balance sheet should not be ignored,” George said in prepared remarks to the Economic Club of Indiana. These include distortions to the financial system from the Fed’s large presence in the Treasury and MBS markets, reduced policy space for a future downturn and a possible threat to Fed independence - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Atlanta Fed President Raphael Bostic on Monday said he was not advocating for a 50-basis-point rate hike in March. Over the weekend, Bostic’s discussion of a half-point hike with the Financial Times garnered a lot of market attention. In an interview with Yahoo Finance, Bostic clarified that a half-point hike “is not my preferred setting of policy action at the next meeting.” Bostic said he expects three quarter-point rate hikes this year. The discussion about a more aggressive hike was meant to show that he is keeping his options open, he added. “I’m going to let the data and the evidence really guide us,” Bostic said. The Atlanta Fed president said he thought the Fed could start to shrink its balance sheet after the central bank has hiked rates a “few” times. “Let’s get a few of our interest rate moves in order to see how the economy is responding,” he said. Once the reduction has started, Bostic said he thought the Fed could shrink its portfolio at a faster pace than in 2017-2019. (MarketWatch)

FED: The U.S. economy is ready for interest rate increases to control rampant inflation, Richmond Federal Reserve President Thomas Barkin said Monday. With the Fed poised to start hiking rates in March and beyond, Barkin told CNBC in a live interview that tighter monetary policy is appropriate. However, he didn’t commit to how aggressive the central bank might be. “I’d like the Fed to get better positioned. I think we’ve got a good part of the year to get there,” he said on “Closing Bell.” “I think how fast we go just depends on how the economy develops.” (CNBC)

FED: The U.S. Federal Reserve should start raising interest rates from near zero in March, but should keep its options open on how far to raise them after that, San Francisco Federal Reserve Bank President Mary Daly said on Monday. (RTRS)

FED: The top U.S. oil and gas trade group expressed concerns about Sarah Bloom Raskin’s nomination for vice chair for supervision of the Federal Reserve but stopped short of opposing her candidacy, in a break with other industry leaders. American Petroleum Institute senior vice president of policy Frank Macchiarola said Monday that the group has concerns over some of Raskin’s comments on addressing climate-related financial risk. (BBG)

ECONOMY: MNI INTERVIEW: Jan Payrolls Likely Fell - St Louis Fed Economist

- A record surge in Covid-19 infections likely caused U.S. hiring to contract in January for the first time in over a year, according to the St. Louis Fed's employment model, economist Max Dvorkin told MNI, adding that he expects payrolls to make a strong recovery in February. The Fed bank's coincident employment index using high-frequency data from scheduling software company Homebase predicts a seasonally-adjusted decline of 260,000 jobs for January as measured by the BLS's household survey. But that likely overestimates the drop in hiring because Homebase doesn't count workers who are absent due to illness whereas the BLS survey does, Dvorkin said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: The omicron subvariant could delay businesses’ return to office plans “to some degree,” U.S. Labor Secretary Marty Walsh says on Bloomberg TV. “We are working to live with this virus and the different variants,” Walsh says, encouraging people to continue to wear masks and get vaccinated and boosted. Key is to balance keeping Americans safe while also going back to work, Walsh says. (BBG)

ECONOMY: U.S. inflationary pressures should ease in 2022 due to weaker demand for goods, easing supply bottlenecks and a receding coronavirus pandemic, the U.S. Treasury's top economist said on Monday. In a statement released alongside the Treasury's quarterly borrowing estimates, Assistant Secretary for Economic Policy Ben Harris said he expects energy prices to stabilize in 2022, but geopolitical instability could push prices higher. (RTRS)

FISCAL: MNI BRIEF: US Treasury Raises Q1 Borrowing Estimate by USD254B

- The U.S. Treasury Department on Monday announced it expects to borrow USD729 billion in privately-held net marketable debt in the first quarter, USD254 billion more than previously announced in November. Treasury is assuming a cash balance of approximately USD650 billion at the end of March. For the tax-heavy second quarter, Treasury plans to borrow USD66 billion, assuming an end-of-June cash balance of USD700 billion. The Treasury's quarterly refunding, which is expected to show coupon cuts, will be released at 8:30 a.m. February 2. The Treasury's financing estimates do not include any assumptions about the Federal Reserve and potential runoff to the central bank's portfolio of assets and authorities instead await official announcements from the Fed, senior Treasury officials said on a call with reporters - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: New York’s requirement that masks be worn in schools and businesses that don’t screen for vaccination will remain in place while a state court considers a challenge to it. The New York State Supreme Court ruling comes after a brief whipsaw last week that saw the mask mandate upended by a Long Island judge before being temporarily reinstated the next day. Elsewhere, Denver will lift its mask requirement for businesses Feb. 4. Scientific modeling suggests “omicron has run out of fuel in our community,” said Bob McDonald, director of the city’s department of public health and environment. (BBG)

CORONAVIRUS: Coronavirus vaccines for children younger than 5 could be available far sooner than expected — perhaps by the end of February — under a plan that would lead to the potential authorization of a two-shot regimen in the coming weeks, people briefed on the situation said Monday. Pfizer and its partner, BioNTech, the manufacturers of the vaccine, are expected to submit to the Food and Drug Administration as early as Tuesday a request for emergency-use authorization for the vaccine for children 6 months to 5 years old, which would make it the first vaccine available for that age group. Older children already can receive the shot. (Washington Post)

POLITICS: Moderate frontline Democrats, desperate to score a win after months of party failures, are planning to sell the new House competition legislation as a jobs bill that will ease inflation — not a China bill. These members see the rebranding as a life raft ahead of their tough re-election fights. They're urging leadership to make the new competition bill Congress' top legislative priority. (Axios)

BANKS: U.S. banks saw a substantial increase in demand for a key category of business loans in the fourth quarter, with a measure of net demand hitting its highest since 2014, a Federal Reserve survey showed on Monday. Demand for commercial and industrial loans improved across business sizes in the final three months of the year, the Fed reported in its quarterly Senior Loan Officer Opinion Survey. For small firms, the percentage of banks reporting higher demand over those seeing weaker demand rose to 9.3 percentage points from zero in the third quarter, while for medium and large firms it climbed to 21.8 points from 7.5 points. That was the highest for both measures since the third quarter of 2014. (RTRS)

OTHER

U.S./CHINA: “Just to be very candid about it, the conversations are not easy. They are quite difficult,” U.S. Trade Representative Katherine Tai says about what she terms the step-one conversations USTR officials are having around the Phase One agreement with China. “I do expect that we will be advancing the conversations in the next short period of time, and over the course of 2022,” Tai says in a virtual interview hosted by the National Asian Pacific American Bar Association. (BBG)

INFLATION: The OECD expects global inflation to slow in the coming year or two as central banks raise interest rates and pandemic-related supply disruptions wane, Secretary General Mathias Cormann said. “We do believe that over the next 12 to 18 months there will be an easing of inflationary pressures,” Cormann said during a video press conference after the OECD released its Economic Survey of New Zealand Tuesday in Wellington. “There will be monetary policy responses, there will be a gradual withdrawal of crisis-level fiscal support, but furthermore there will be a rebalancing of the global demand and supply equation.” While the spread of the omicron variant of Covid-19 will have an impact on the growth outlook, the global economy is well placed to cope, he said. (BBG)

JAPAN: Japan's top currency diplomat Masato Kanda said a weak yen brings both merits and demerits to the economy due to the country's changing export patterns and increasing reliance on imports. The boost a weak yen gives to Japan's export volumes has declined compared with the past, as manufacturers target shipments to high-end, state-of-the-art products overseas rather than compete with price cuts, said Kanda, the country's vice finance minister for international affairs. A weak yen, however, still inflates the yen-denominated profits Japanese companies earn overseas, he said. "The demerits of a weak yen is that it pushes up the import cost of energy and food, thereby increasing household burdens," he said, acknowledging growing domestic concerns about the potential side-effects of a weak currency. Kanda's remarks underscore how a weak yen is becoming a tricky political issue for Japan's finance ministry, which has historically focused on preventing a strong currency from hurting the country's export sector. (RTRS)

BOJ: MNI INSIGHT: No BOJ Intervention Now As 10-Yr JGB Yield Rises

- The Bank of Japan will not intervene to curb the 10-year Japanese government bond yield after it touched its highest since the yield curve control policy was introduced, except for emergency or crisis situations, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: MNI INTERVIEW: Leave 10-Year JGBs To The Market - Ex-BOJ Aide

- Risks of a surge in long-term interest rates need a step-by-step process from the Bank of Japan to end its commitment to overshoot the 2% sustained inflation target and allow the pricing of benchmark government bonds directly by the market, a former BOJ executive director said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: The Tokyo Metropolitan Government will set guidelines to which it will refer in deciding whether to seek a Covid-19 state of emergency, broadcaster TV Asahi reports, citing an unidentified person. Tokyo will consider the number of patients with moderate and serious symptoms in addition to daily cases and bed occupancy rate. (BBG)

RBA: MNI STATE OF PLAY: RBA Stays Firm On Cash Rate View, Drops QE

- The Reserve Bank of Australia is maintaining its dovish stance relative to other developed market central banks and declined to update its interest rate guidance despite recent bullish data on employment and more importantly inflation. At Tuesday's first board meeting for 2022, the RBA did however announce an end to its bond buying programme, which will continue at the rate of AUD4 billion per week and end on Feb 10, see: MNI BRIEF: RBA Patiently Waits On Inflation As QE Ends - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern is expected to address how the nation will open its borders at a speech Thursday, Deputy Prime Minister Grant Robertson told reporters. Ardern will outline the government’s plans “to reconnect New Zealanders to the world” at the speech after cabinet discussed the issue Tuesday. (BBG)

NEW ZEALAND: Finance Minister Grant Robertson has rejected a warning from the Organisation for Economic Cooperation and Development (OECD) that New Zealand needs to raise the age for superannuation. The OECD said in its 2022 Economic Survey of New Zealand released on Tuesday that the superannuation age needed to rise from 65 to keep the Government’s post-Covid debt levels down to a sustainable level. (Stuff NZ)

CANADA: Finance Minister Chrystia Freeland says making homes more affordable to buy and boosting the country's economic potential will be key considerations in this year's federal budget. Freeland laid out the broad strokes of the spending plan as she launched the government's pre-budget consultations that will run until late February. During a late afternoon news conference, Freeland said she thinks the budget should place a priority on making Canada more competitive and innovative, and fund a transition to a green economy. She also says the Liberals must keep in mind the effects the budget could have on already high inflation rates in an economy that is entering 2022 on strong footing. (Canadian Press)

TURKEY: Turkey central bank to have the authority to determine the maximum interest rate that can be applied on FX-linked lira accounts, according to decree published in official gazette. Turks living abroad will be able to open FX-linked lira time deposit accounts, according to another decree in the gazette. (BBG)

MEXICO: If there are two negative quarters in a row in GDP, it increases the possibility that there is a recession, but it is not enough by itself, Banco de Mexico Deputy Governor Jonathan Heath said in a tweet Monday. The idea that the economy is in recession because there were two consecutive quarters with a negative GDP rate is a simplification of what a recession is. “A recession has to meet three requirements: depth, duration, and spread,” Heath said. “For now, we only meet duration.” (BBG)

RUSSIA: A senior U.S. diplomat accused Russia of trying to destabilize Ukraine, and a Kremlin representative in turn criticized Washington for stoking fears and tensions as the two sides squared off in a fractious debate in the United Nations Security Council. Ambassadors from the U.S., Ukraine and member-nations of the North Atlantic Treaty Organization questioned Russia’s motivations, its troop buildup and what they described as its threat to Ukraine’s and Europe’s security, during Monday’s Security Council meeting. (WSJ)

RUSSIA: The US has drawn up sanctions targeting Vladimir Putin’s inner circle and its ties to the west as Washington broadens the list of financial penalties it and European allies will impose if Russia invades Ukraine. The move comes as the UK vowed on Monday to introduce new legislation strengthening London’s ability to target Kremlin-linked businesses and their owners in the country in case of Russian aggression on Ukraine. Senior US administration officials told the Financial Times that a list of individuals and family members that would be hit with sanctions had been developed in co-ordination with US allies as part of the effort to punish the Russian president in the event of an attack. (FT)

RUSSIA: The State Department ordered the family members of U.S. government staff in Belarus to evacuate on Monday, citing the "unusual and concerning Russian military buildup along Belarus’ border with Ukraine." (Axios)

RUSSIA: European Commission Vice President Valdis Dombrovskis said on Monday the Russia-designed Nord Stream 2 gas pipeline has been put on hold and the Commission is looking into the project's compliance with Europe's energy policy. (RTRS)

RUSSIA: Boris Johnson travels to Kyiv Tuesday for talks with Ukraine's President Volodymyr Zelensky, as tensions with Russia rise and the British prime minister battles the biggest crisis of his premiership. "It is the right of every Ukrainian to determine how they are governed. As a friend and a democratic partner, the UK will continue to uphold Ukraine's sovereignty in the face of those who seek to destroy it," Johnson said in a statement. "We urge Russia to step back and engage in dialogue to find a diplomatic resolution and avoid further bloodshed," he added. (AFP)

RUSSIA: Ukraine’s ambassador to the United Nations said on Monday that Kyiv still hopes for a diplomatic resolution with Russia even as Moscow sends more troops and weapons to its border. “If Russia has any questions to Ukraine, it is better to meet and talk, not to bring troops to the Ukrainian borders and intimidate Ukrainian people,” said Ukrainian Ambassador Sergiy Kyslytsya at a United Nations Security Council meeting. The Ukrainian diplomat is not a member of the council but was invited to participate as the crisis escalates at his country’s border. He pushed back on Russian claims that Kyiv was prepared to mount an attack. (CNBC)

RUSSIA: Russian President Vladimir Putin and his French counterpart Emmanuel Macron on Monday discussed Ukraine tensions and concerns over security in Europe during a phone call, the Kremlin said. "The leaders expressed their views on the situation regarding Ukraine as well as issues related to providing Russia with long-term and legally-binding security guarantees," the Kremlin said in a statement. (Moscow Times)

SOUTH AFRICA: South Africa, where the omicron variant was first identified, has cut the isolation period for those infected with symptomatic Covid-19 to seven days from 10 and dropped the need for asymptomatic cases and contacts of those infected to isolate. The government also said in a statement on Monday that schoolchildren can all now return to their educational facilities full time. Some government schools had been operating learning by rotation to ensure social distancing. The government said the changes were due to the falling number of cases and the high natural immunity in the South African population with between 60% and 80% of people likely to have been infected with the virus. (BBG)

IRAN: The signatories of the Iran nuclear deal only have a “handful of weeks left” to strike a deal and usher in a mutual return to compliance with the agreement, a senior State Department official said Monday. “We are in the final stretch because as we’ve said now for some time this can’t go on forever because of Iran’s nuclear advancement,” explained the official, who spoke on the condition of anonymity in order to share some details of the negotiations. The official said that the U.S. was not imposing an “artificial deadline” or “an ultimatum.” (CNBC)

OIL: OPEC and its allies are largely expected to affirm another 400,000 b/d hike in crude oil production quotas for March when they meet Feb. 2, but sure to be weighing on the virtual discussions will be the elephant in the room -- potential Western sanctions on Russia. Should those sanctions come to pass, the oil market could be suddenly cut off from the world's second largest producer behind the US, at a time when global demand is roaring back from the pandemic. Members with spare output capacity, mainly Saudi Arabia and the UAE, may be asked by their key customers to ease the squeeze with additional production beyond their quotas, which could jeopardize their five-year OPEC+ alliance with Russia. Loath though they are to insert geopolitics into their meetings, ministers may have no choice but to acknowledge the situation and make contingency plans to avoid a globally destabilizing oil price spike. "I'm guessing it will probably come up in discussions," one OPEC source told S&P Global Platts on condition of anonymity, while another added that the group was well aware that its relations with Russia could be on thin ice if other members rush in to claim its market share. (Platts)

OVERNIGHT DATA

JAPAN DEC UNEMPLOYMENT RATE 2.7%; MEDIAN 2.8%; NOV 2.8%

JAPAN DEC JOB-TO-APPLICANT RATIO 1.16; MEDIAN 1.16; NOV 1.15

JAPAN JAN. F JIBUN BANK M’FING PMI 55.4; FLASH 54.6

Japanese manufacturers entered the new year in strong spirits as they reported a stronger improvement in the health of the sector. The latest Manufacturing PMI signalled that firms had begun to shake off the impacts of the pandemic and supply chain disruption to record the sharpest upturn in operating conditions in nearly eight years. Firms recorded quicker rises in both output and new orders, with the former increasing at the sharpest pace since February 2014 and was attributed to rising client confidence and demand. Moreover, the rise in demand was broad-based across both domestic and international markets. Supply chain disruption remained widespread at the start of 2022, however, with a further sharp lengthening of delivery times. While marked, the extent of disruption was the lowest for four months. Delays encouraged firms to raise stockpiles of both inputs and finished items. Stocks of purchases rose at the second-fastest rate in the history of the survey while holdings of finished goods increased at the quickest pace in close to eight-and-a-half years. Confidence regarding the year-ahead outlook also strengthened, underpinned by hopes that an end to the pandemic would induce a broad recovery in demand and supply chains. This is in line with the IHS Markit estimate of 6.3% growth in industrial production in 2022. (IHS MARKIT)

JAPAN JAN VEHICLE SALES -12.5% Y/Y; DEC -10.2%

AUSTRALIA DEC RETAIL SALES -4.4% M/M; MEDIAN -2.0%; NOV +7.3%

AUSTRALIA DEC HOME LOANS VALUE +4.4%; MEDIAN -0.4%; NOV +6.3%

AUSTRALIA DEC HOME OWNER-OCCUPIER LOAN VALUE +5.3%; MEDIAN +7.5%; NOV +7.6%

AUSTRALIA DEC HOME INVESTOR LOAN VALUE +2.4%; NOV +3.8%

AUSTRALIA JAN CORELOGIC HOUSE PRICE INDEX +0.8% M/M; DEC +0.6%

AUSTRALIA JAN, F MARKIT M’FING PMI 55.1; FLASH 55.3

The IHS Markit Australia Manufacturing PMI showed that, while the sector itself remained in expansion, the COVID-19 Omicron wave clearly impacted operations at the start of 2022. Manufacturing output returned to a state of contraction as supply and labour issues ballooned. Suppliers’ delivery times also lengthened at a faster rate amid the spate of COVID-19 disruptions, contributing to a record build up of backlogged work. Any worsening of the demand and output deviation, particularly if pent-up demand is unleashed with improvements in ongoing COVID-19 conditions, carries the potential to aggravate supply constraints. The good news is that price pressures eased at the start of 2022. Meanwhile business optimism declined only slightly despite the surge in COVID-19 cases, reflecting some resilience in sentiment. (IHS Markit)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 101.8; PREV. 100.1

Consumer confidence increased 1.7% last week amid falling COVID cases across most of the country. The rise was mainly driven by a jump in confidence in NSW (6.2%) after three weeks of decline and a 4.3% gain in WA. It was partly offset by declines in Victoria (-2.5%) and Queensland (-0.6%). A more surprising shift was the 0.3ppt fall in inflation expectations (IE) to 4.7%. This came in the same week that the Q4 2021 CPI reported an upward surprise. Retail petrol prices are up 7.0% in January, which would usually elevate inflation expectations. We should not read too much into a single data point, though, as inflation expectations can be quite volatile from week to week. (ANZ)

NEW ZEALAND DEC TRADE BALANCE -NZ$477MN; NOV -NZ$1.060BN

NEW ZEALAND DEC TRADE EXPORTS NZ$6.07BN; NOV NZ$5.69BN

NEW ZEALAND DEC TRADE IMPORTS NZ$6.55BN; NOV NZ$6.75BN

NEW ZEALAND DEC YTD TRADE BALANCE -NZ$6.784BN; NOV -NZ$6.233BN

SOUTH KOREA JAN TRADE BALANCE -$4.889BN; MEDIAN -$2.100BN; DEC -$452MN

SOUTH KOREA JAN EXPORTS +15.2% Y/Y; EST. +15.8%; DEC +18.3%

SOUTH KOREA JAN IMPORTS +35.5% Y/Y; EST. +29.5%; DEC +37.1%

MARKETS

SNAPSHOT: RBA Ends QE, But Doesn’t Pivot Policy

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 79.41 points at 27081.39

- ASX 200 up 34.368 points at 7006

- Shanghai Comp. is closed

- JGB 10-Yr future down 11 ticks at 150.6, yield up 0.2bp at 0.180%

- Aussie 10-Yr future down 0.5 tick at 98.080, yield up 0.8bp at 1.903%

- U.S. 10-Yr future +0-03+ at 128-02+, yield down 0.54bp at 1.771%

- WTI crude up $0.33 at $88.48, Gold up $5.81 at $1802.94

- USD/JPY down 16 pips at Y114.95

- FED’S GEORGE WANTS MAJOR BALANCE SHEET REDUCTION (MNI)

- FED'S BOSTIC: HALF-POINT RATE HIKE ISN'T HIS PREFERRED POLICY PATH (MARKETWATCH)

- FED’S BARKIN: BUSINESSES WOULD WELCOME HIGHER INTEREST RATES (CNBC)

- FED'S DALY SUPPORTS RATE LIFTOFF IN MARCH, WANTS OPTIONS OPEN ON RATE PATH (RTRS)

- RBA STAYS FIRM ON CASH RATE VIEW, DROPS QE (MNI)

- NO BOJ INTERVENTION NOW AS 10-YR JGB YIELD RISES (MNI)

BOND SUMMARY: ACGBs Benefit From Lack Of RBA Policy Pivot, TYH2 Flows Eyed

A modest downtick in e-minis, spill over from the ACGB space, as well as light screen & block buying (+3,310 on block) of TYH2 futures allowed the Tsy space to firm at the margin in Asia. TYH2 last +0-03+ at 128-02+, while cash Tsys run little changed to ~1.5bp richer, with light bull steepening in play. Looking ahead to the NY session, the ISM m’fing survey & JOLTS jobs data headline.

- JGB futures initially benefited from the broader bid in the core global FI space, before that impulse faded ahead of the Tokyo close. The latest round of 10-Year JGB supply was absorbed smoothly, with the cover ratio perhaps hampered by worries re: further cheapening in the international bond space & speculation re: tweaks to the BoJ’s YCC scheme. Still, several relative value plays (identified pre-auction) likely helped when it came to the smooth digestion. There wasn’t a clear catalyst for the modest cheapening witnessed during the latter rounds of Tokyo trade. JGB futures -15 come the bell, with cash JGBs running 0.5-1.0bp cheaper across the curve.

- Aussie bonds firmed in the wake of the RBA decision, with the continued inclusion of the willingness to be patient in the Bank’s forward guidance passage re: interest rates providing a bit of a surprise/dovish tinge to the statement. Note that the Bank marked its expectations higher when it comes to the peak of underlying inflation in the near-term and the underlying inflation profile for ’23, but continues to expect wage growth to be the limiting factor when it comes to inflationary pressures (although it did highlight several well-documented risks/uncertainties surrounding its view). The Bank seemingly failed to make any meaningful adjustment when it comes to GDP growth expectations, while it marked its unemployment forecasts lower in the wake of the recently observed dynamic in that space. YM -1.5 & XM -0.5 at the bell, off the RBA-reaction highs, but comfortably off early Sydney lows. Bills were -1 to +8 through the reds, twisting steeper on the day, with some of the front-end rate hike premium wound out of the strip post-RBA.

JGBS AUCTION: Japanese MOF sells Y2.1080tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1080tn 10-Year JGBs:

- Average Yield 0.175% (prev. 0.096%)

- Average Price 99.27 (prev. 100.03)

- High Yield: 0.176% (prev. 0.097%)

- Low Price 99.26 (prev. 100.02)

- % Allotted At High Yield: 97.0987% (prev. 38.3637%)

- Bid/Cover: 3.269x (prev. 3.458x)

EQUITIES: E-Minis Nudge Lower Overnight

The ASX 200 and Nikkei 225 added ~0.5% apiece, benefitting from Monday’s uptick on Wall St. (which was seemingly a function of month-end rebalancing and less worry re: the prospect of an imminent 50bp rate hike from the Federal Reserve). A reminder that the remainder of the major regional financial centres were closed during Asia-Pac hours, owing to the observance of the Lunar New Year holiday period.

- Elsewhere, U.S. e-minis shed ~0.3% apiece after the impulse from the month-end rebalancing flows faded and continued geopolitical worry surrounding Russia weighed (this limited the bid in the major Asia-Pac equity indices that were open).

OIL: Crude Marginally Higher

WTI & Brent sit ~$0.30 higher on the day at typing. This comes after a more supportive risk environment, geopolitical tension centring on Russia, a bid in U.S. natural gas futures and a softer DXY supported crude on Monday. The weekly API & DoE U.S. crude inventory figures will provide some interest over the next ~36 hours, but it will be Wednesday’s OPEC+ meeting that garners most of the attention (note that consensus looks for the group to press ahead with the pre-prescribed 400K bpd cumulative monthly output lift).

GOLD: $1,800/oz Caps

A softer DXY and a steady to slightly lower U.S. real yield environment (on net) provided some support for bullion on Monday (with the day’s Fedspeak not pointing to any need for an imminent 50bp rate hike), before gold meandered through holiday-impacted Asia-Pac trading. Spot last deals little changed, just below the $1,800/oz mark that has capped price action during early trade this week. Familiar technical parameters remain in play, with the recently observed range intact.

FOREX: AUD Takes Hit As RBA Stays Patient On Rates

The Aussie dollar went offered as the RBA signalled patience as it monitors inflation dynamics. The Bank called quits on its QE programme (as expected), but stressed that "ceasing purchases under the bond purchase programme does not imply a near-term increase in interest rates." The RBA's pushback against market wagers for earlier cash rate hikes provided a bit of a surprise, pulling the rug from under the AUD in otherwise muted Asia-Pac trade.

- AUD/NZD took a nosedive after printing a fresh seven-month high at NZ$1.0758 earlier in the session. The round figure of NZ$1.0700 limited post-RBA losses.

- Apart from post-RBA price swings, G10 currency pairs stuck to tight ranges, as widespread Lunar New Year market closures weighed on activity in Asia.

- Manufacturing PMI readings from across the globe headline the data docket today, with EZ unemployment & Canadian GDP also due.

FOREX OPTIONS: Expiries for Feb01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-70(E2.0bln), $1.1215-25(E2.9bln), $1.1300(E1.5bln), $1.1350-55(E1.2bln)

- USD/JPY: Y112.75($708mln), Y113.20-40($1.3bln), Y114.65($600mln), Y115.00-25($1.1bln), Y116.50-65($1.4bln), Y117.00($940mln)

- USD/CAD: C$1.2705($570mln)

- USD/CNY: Cny6.3600-15($1.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/02/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 01/02/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 01/02/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 01/02/2022 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/02/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 01/02/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 01/02/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 01/02/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (f) |

| 01/02/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2022 | - | *** |  | US | Domestic Made Vehicle Sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (f) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS Jobs Opening Level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS Quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.