-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: JPY Continues To Weaken As BoJ Defends 10-Year JGB Yield Band

EXECUTIVE SUMMARY

- SHANGHAI ENTERS TWO-STAGE LOCKDOWN

- WHITE HOUSE ROWS BACK BIDEN'S INITIAL COMMENTS WHICH ALLUDED TO RUSSIAN REGIME CHANGE

- UKRAINE RUSSIA SET TO MEET IN TURKEY AGAIN ON MONDAY

- UKRAINIAN PRESIDENT PROVIDES POTENTIAL AREAS OF COMPROMISE, AS RUSSIAN MILITARY TACTICS CHANGE

- BOJ STEPS IN TO DEFEND TOP OF 10-YEAR JGB YIELD TRADING BAND, TWICE

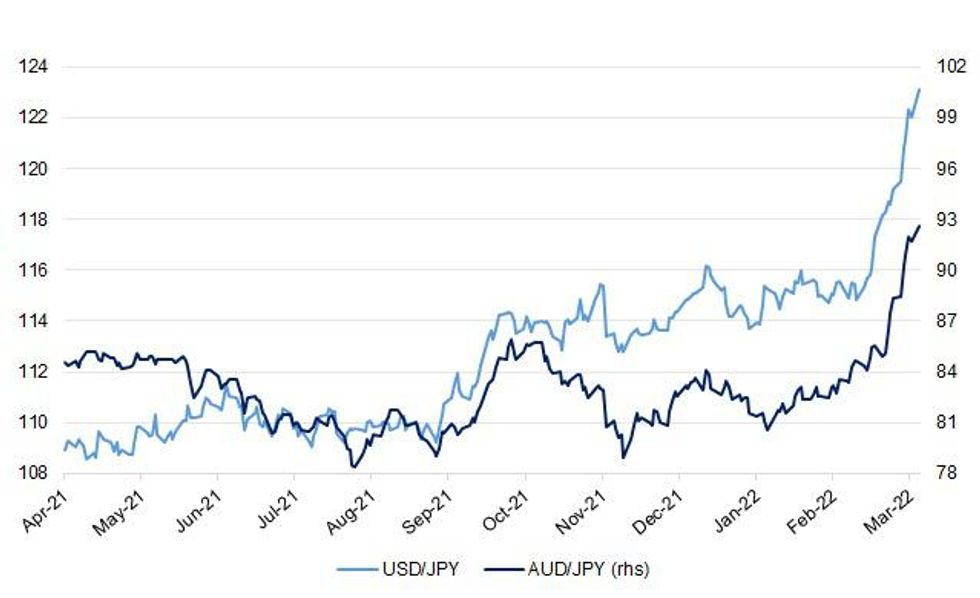

Fig. 1: USD/JPY & AUD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Rishi Sunak has warned critics that the country’s national debt is “ballooning” amid a Tory backlash over the cost of living crisis. The chancellor vowed to tackle the £400 billion hole in the nation’s finances caused by the pandemic as he faced down demands from Tory MPs for more support for families struggling with spiralling inflation. (The Times)

FISCAL: Rishi Sunak faces a grilling from lawmakers on Monday as pressure mounts on the British finance minister to do more to relieve the cost of living crisis. Sunak, regarded as a leading contender to succeed Prime Minister Boris Johnson, has been widely criticized for failing to do enough in his mini-budget last week to help the poorest households cope with soaring energy bills. On Monday afternoon, the chancellor of the exchequer will be forced to defend his 9 billion-pound ($12 billion) package of tax cuts to Parliament’s cross-party Treasury Committee. Hours earlier, officials from his fiscal watchdog, the Office for Budget Responsibility, are due to give evidence to the same panel. (BBG)

FISCAL: Boris Johnson wanted to use Rishi Sunak's Spring Statement to guarantee cheaper energy bills for millions of households next winter, he has told allies – but he failed to get the plan past the Chancellor. (Telegraph)

FISCAL: HMRC has been accused of lacking a “clear plan” to claw back £39bn in unpaid taxes after the debt mountain grew considerably during the pandemic. MPs on the Public Accounts Committee said the taxman must urgently ramp up plans to recover the missing cash, which is particularly crucial at a time when the public finances and household living standards are under strain. They said: “We are not satisfied that HMRC has a clear plan to tackle the mountain of tax debt which has built up during the pandemic.” The MPs called for a detailed plan within the next six months to show targets, decisions on write-offs and contingency arrangements for future problems collecting funds. The pile of unpaid taxes climbed from £16bn pre-Covid to a peak of £67bn in August 2020, after the first lockdown. (Telegraph)

ENERGY/FISCAL: The chancellor is considering proposals for a new council tax rebate after his spring statement failed to allay panic in No 10 over the spiralling cost-of-living crisis. Rishi Sunak is already weighing up another multibillion-pound package to help shield households from a further surge in fuel bills this autumn. The energy price cap will jump from about £1,300 to nearly £2,000 on Friday and could rise again to £3,000 in October. It is only days since Sunak announced a package of tax and duty cuts that was widely dismissed as too limited and underestimating the scale of the problem facing households. No 10 is becoming increasingly alarmed about the effects of inflation, particularly with the May local elections looming. (Sunday Times)

ENERGY: Boris Johnson is expected to hold crunch talks with senior cabinet ministers this week to resolve fractious talks over plans to tackle rising bills and boost the country’s energy security. The government’s energy strategy has been delayed by cabinet splits over onshore wind, funding for nuclear energy and the role fracking should play given spiralling energy prices and the Ukraine invasion. It is understood that major disagreements still remain between the prime minister, chancellor Rishi Sunak and Kwasi Kwarteng, the business secretary. The cabinet tensions have only grown since the chancellor’s spring statement last week, which drew criticism for failing to do enough on the cost of living. Sunak now faces pressure from Number 10 to sanction spending on new nuclear power and renewables projects. (Observer)

BREXIT: The Attorney General has been among senior Tories privately pushing for the Government to trigger Article 16 without delay, The Telegraph can disclose, as a Conservative election expert said Sinn Fein was on course to win control of the Northern Ireland executive within weeks. (Telegraph)

BREXIT: Russell Antram, the head of EU trade at the CBI, the industry group, said the multiplicity of rules across 27 countries was “a real challenge for the largest of HR departments, let alone small businesses”. “As the virus restrictions are removed the complexity firms are facing is becoming clearer,” he said. “It is essential the UK and individual EU member states make progress in bilateral talks to ease restrictions.” William Bain, head of trade policy at the British Chambers of Commerce, said the EU-UK Trade and Cooperation Agreement (TCA) contained more than 1,000 restrictions on cross-border trade in services. He said there was a need for bilateral agreements with individual EU member states but also for EU-level flexibility to remove the ambiguities facing employers, staff and contractors on short-stay business travel in the EU. “Businesses can’t afford to wait until the TCA review in 2026,” Bain added. (FT)

EUROPE

ECB: The European Central Bank does not expect the war in Ukraine to push the euro zone into stagflation even if it does push up inflation due to higher energy prices and push down growth, President Christine Lagarde was quoted as saying on Saturday. "Incoming data don’t point to a material risk of stagflation," Lagarde said in an interview with Phileleftheros published by the ECB on its website. Lagarde said growth in the euro area could be as low as 2.3% in a severe scenario due to the war in 2022, however in all scenarios inflation is expected to decrease and settle at levels around the bank's 2% target in 2024. (RTRS)

ECB: European Central Bank Governing Council member Ignazio Visco said that since the beginning of Russia’s war in Ukraine market integration has become more “uncertain.” The invasion “is putting at risk the international economic and financial set-up,” Visco said at an event on Sunday. Key pillars of “markets integration and multilateral cooperation are clearly more uncertain now.” Also on Sunday, ECB President Christine Lagarde told the Cypriot newspaper Phileleftheros that the euro area isn’t seeing a “material risk” of stagflation tied to the war and the resultant jump in energy prices. Growth is continuing and the labor market is strong, she said. (BBG)

GERMANY: Germany's Social Democrats (SPD) scored a clear victory in a regional election in the state of Saarland on Sunday (Mar 27), according to preliminary results, helping Chancellor Olaf Scholz consolidate his power ahead of other regional votes this year. The centre-left party will have enough seats for an absolute majority in the small western state, the first regional vote since the SPD unexpectedly beat the conservatives in a national election last year after 16 years of rule by Angela Merkel. "Saarland was a first test of the mood after the federal election," said SPD leader Lars Klingbeil, describing the win as a "sensational victory". (RTRS)

GERMANY: Germany's ruling coalition will stick with agreements on complying with its debt brake again and not raising taxes, Chancellor Olaf Scholz said on Sunday. "We found an agreement between the three parties about the questions of debt brake and tax hikes, and all three will stick with it," he told broadcaster ARD. From 2023, Germany's ruling coalition of Scholz's Social Democrats (SPD), the Free Democrats (FDP) and Greens aims to return to the debt brake rule of the constitution that limits new borrowing to a tiny fraction of economic output. (RTRS)

ITALY/BTPS: Italy plans to sell up to EU3 billion ($3.3 billion) of 1.1% bonds due April 1, 2027 in an auction on March 30. Italy plans to sell up to EU3.5 billion ($3.85 billion) of 0.95% bonds due June 1, 2032 in an auction on March 30. (BBG)

ITALY/BTPS: The Italian Treasury plans to launch three new government bonds, or BTPs, in the second quarter of the year, it said in its quarterly guidance on Friday. The new bonds will have maturity dates of August 2025, June 2029 and December 2032, respectively, the treasury said. The treasury targets a minimum final outstanding of 9 billion euros ($9.90 billion) for the 2025-dated BTP and EUR10 billion for each of the two other BTPs, it said. The minimum final outstanding is the overall issuance volume a bond has to reach before it is replaced by a new benchmark. Other bonds, in addition to the new ones, could also be issued during the quarter, subject to market conditions, the treasury said. (Dow Jones)

SNB: The Swiss National Bank believes the Swiss franc's rise above parity versus the euro is unlikely to have a significant impact economically, Chairman Thomas Jordan said in an interview broadcast on Saturday. (RTRS)

ENERGY: The European Commission will look into the question of energy price caps after an extensive debate on the topic pushed by Spain at the EU summit, German Chancellor Olaf Scholz said on Friday. Germany and many other countries are sceptical about market interventions against high energy prices, he told a news conference at the end of the two day EU summit. Earlier, a European Union source said Germany and the Netherlands had opposed the southern countries in a “tough” debate on the issue of price caps. European countries had agreed however to cooperate on the joint purchase of gas on a voluntary basis, Scholz said. (RTRS)

ENERGY: The European Commission will discuss with all the involved parties options to ease the energy market crunch worsened by Russia's invasion of Ukraine, Italian Prime Minister Mario Draghi said on Friday, including a proposal to cap gas prices. "The European Commission will discuss with stakeholders, the large oil and electricity companies, distribution companies and others," Draghi told a news conference after a summit of the EU leaders in Brussels. (RTRS)

RATINGS: Rating reviews of note from after hours on Friday included:

- Fitch affirmed the Netherlands at AAA; Outlook Stable

- Moody's affirmed Sweden at Aaa; Outlook Stable

- S&P affirmed Germany At AAA; Outlook Stable

- DBRS Morningstar confirmed the European Union at AAA, Stable Trend

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

U.S.

FED: Russia’s invasion of Ukraine has put “additional pressure on inflation, which is too high,” Federal Reserve Bank of San Francisco President Mary Daly says. “In the United States, we’re at a 40-year high. People are thinking about inflation when they go to bed at night and when they wake up in the morning, and that’s far from our target for price stability”. (BBG)

FED: MNI INTERVIEW: Fed’s Athreya-Upside Risks To 4% Inflation View

- The surge in energy prices could mean inflation more than doubles the Fed's target this year, Richmond Fed Research Director Kartik Athreya told MNI, adding that it would still make sense to await further clarity on the war in Ukraine before tilting towards more aggressive rate hikes - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden is expected to propose a new minimum tax that would largely target billionaires when he unveils his 2023 budget, according to a document obtained by CNBC. Called the “Billionaire Minimum Income Tax,” it would assess a 20% minimum tax rate on U.S. households worth more than $100 million. Over half the revenue could come from those worth more than $1 billion. (CNBC)

CORONAVIRUS: The Biden administration is planning to give Americans age 50 or older the option of a second booster of the Pfizer-BioNTech or Moderna coronavirus vaccine without recommending outright that they get one, according to several people familiar with the plan. Major uncertainties have complicated the decision, including how long the protection from a second booster would last, how to explain the plan to the public and even whether the overall goal is to shield Americans from severe disease or from less serious infections as well, since they could lead to long Covid. (NYT)

POLITICS: President Biden's job approval rating dropped to 40% in a NBC News Poll out Sunday. The figure marks Biden's lowest approval rating since coming into office. (Axios)

EQUITIES: US companies are rushing to repurchase large volumes of shares to take advantage of recent stock market volatility and reassure investors as growth slows. A record $319bn of new share buybacks have been authorised so far this year, according to Goldman Sachs data, with rising numbers of companies using “accelerated” deals to buy large volumes as quickly as possible while their share prices are depressed. There were $267bn in share buybacks at the same point in 2021. Even recently listed companies, that traditionally spend cash to fuel growth rather than return excess to shareholders, have joined the trend after sharp drops in their stock prices make repurchases more attractive. (FT)

OTHER

U.S./CHINA: China and U.S. regulators are working “in the same direction” to meet the U.S. side’s audit requirement on overseas-listed Chinese companies, the China Securities Journal said citing people close to the Chinese securities regulator. The China Securities Regulatory Commission on Sunday held a video meeting with some U.S.-listed Chinese companies and investors to seek their input, the newspaper said. The regulator denied some previous media reports on the issue as “subjective speculation,” the newspaper said without identifying the reports. (MNI)

BOJ: MNI BRIEF: BOJ Ready To Conduct Consecutive Days Of JGB Buying

- The Bank of Japan stands ready to conduct fixed-rate bond buying operations for consecutive days, depending on developments of bond yields overseas, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: MNI INSIGHT: Coordinating BOJ, Govt Policy Aims Under Review

- Tweaks to monetary policy that could include a focus on the five-year government bond tenor, but not change easy policy, are under discussion to keep the Bank of Japan in step with the government's efforts to ease the impact of high energy prices, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Support for Japanese Prime Minister Fumio Kishida jumped six percentage points from last month to 61% in a new poll, with about two-thirds of respondents saying they approved of his government’s response to Russia’s invasion of Ukraine. Japan has acted with unprecedented speed to clamp down on Russia, including by freezing the assets of individuals and entities, as well as stripping the country of its most-favored nation trade status. In response, Russia halted negotiations on a peace treaty that would bring a formal end to World War II. (BBG)

AUSTRALIA: Australia will cut fuel excise, extend support to first-home buyers and boost road and railway funding in a budget Prime Minister Scott Morrison aims to use as a springboard to a come-from-behind election win. The government, which hands down its budget at 7:30 p.m. on Tuesday, will expand a program that allows first-home buyers to enter the market with only a 5% deposit and without having to pay mortgage insurance, according to a statement Monday. The program will be boosted to cover 50,000 buyers a year. (BBG)

NORTH KOREA: North Korea will continue to develop "formidable striking capabilities" that cannot be bartered or sold for anything, leader Kim Jong Un said, according to state media on Monday, as he visited workers involved with the country's biggest missile test. Kim was meeting with officials, scientists, technicians and workers who contributed to a missile launch on Thursday, which North Korea said was its largest intercontinental ballistic missile (ICBM), state news agency KCNA reported. "Only when one is equipped with the formidable striking capabilities, overwhelming military power that cannot be stopped by anyone, one can prevent a war, guarantee the security of the country and contain and put under control all threats and blackmails by the imperialists," Kim said, according to the report. (RTRS)

BOC: The Bank of Canada is prepared to act “forcefully” with rate hikes to return inflation to target, particularly as price pressures broaden amid tight labor markets and booming demand, a deputy governor said on Friday. Sharon Kozicki, in her first speech since joining governing council last year, also said the pace and magnitude of interest rate increases, along with the start of quantitative tightening, would be actively discussed at the central bank’s April meeting. “Inflation in Canada is too high, labor markets are tight and there is considerable momentum in demand,” Kozicki said, speaking via webcast to the Federal Reserve Bank of San Francisco. (RTRS)

MEXICO: The Bank of Mexico’s unanimous half-point interest rate hike at its meeting this week was aimed specifically at anchoring inflation expectations, which have been hit harder than expected by supply chain problems, Governor Victoria Rodriguez Ceja said Friday. The decision was the board’s first unanimous vote since the central bank began its current tightening cycle in June. By voting together, the five board members wanted to send a message that they were moving fast to get expectations under control, Rodriguez said in an interview with El Financiero Bloomberg TV. Inflation expectations are a factor “that we’re very interested in taking care of, anchoring” them, she said on the sidelines of Mexico’s annual banking convention in Acapulco, where she is participating in Mexico’s annual banking convention. (BBG)

BRAZIL: Brazil’s central bank chief, Roberto Campos Neto, reiterated that a Selic benchmark rate of 12.75% should be enough to bring inflation expectations to target within a relevant horizon, according to a TV interview broadcast on Sunday. Policy makers have added 975 basis points to borrowing costs since last March, the world’s most aggressive tightening cycle in the wake of the pandemic, to 11.75% and pledged to further increase the Selic rate to 12.75% by May. “We understand that we have made quite a big adjustment that, in our view, is enough to bring inflation to target,” Campos Neto told Band News network, stressing that the effects of monetary tightening through rate hikes are usually felt after 12-18 months. Yet, given uncertainties stemming from Russia’s invasion of Ukraine, the central bank signaled further increases could take place if needed. (BBG)

BRAZIL: Brazil President Jair Bolsonaro lashed out at recent polls showing him trailing leftist Luiz Inacio Lula da Silva in the run-up to October’s elections as he kicked off his bid for re-election on Sunday. “A deceiving poll published a thousand times will not turn someone into the President of the Republic,” he told supporters during an event hosted by the Liberal Party in Brasilia, recasting the 2018 messianic discourse that drove him to power. The right-wing leader, who’s seeking a second term amid growing economic challenges that will potentially determine the outcome of this year’s election, framed the upcoming runoff as a fight against an internal enemy. (BBG)

RUSSIA: President Biden said Sunday that he is not advocating regime change in Moscow, echoing aides who have scrambled to clarify Biden’s unscripted comment a day earlier that Russian President Vladimir Putin “cannot remain in power.” A reporter asked Biden on Sunday outside a church whether he wanted Putin removed and was calling for regime change. “No,” Biden responded. Biden’s comment about Putin during a visit to Poland drew international scrutiny and a rebuke from Moscow as the president met with European leaders and sought to bolster the NATO alliance. (The Washington Post)

RUSSIA: U.S. President Biden tweeted the following on Sunday: "My message to the people of Ukraine: We stand with you. Period." (MNI)

RUSSIA: Peskov, the Kremlin spokesman, told the Tass news agency on Saturday that Biden’s reference to Putin as a “butcher” further diminishes the possibility for future relations between the U.S. and Russia. “The state leader should remain sober,” Peskov said. (BBG)

RUSSIA: German Chancellor Olaf Scholz said NATO allies aren’t pursuing regime change in Russia. Asked whether Biden’s comment that Vladimir Putin “cannot remain in power” was a mistake, Scholz replied: “As far as I’m concerned, he said what he said.” That’s not the goal of NATO, and also not of the U.S. president,” Scholz said in an interview with German broadcaster ARD on Sunday. We both agree that regime change cannot be the goal of our policies.” (BBG)

RUSSIA: French President Emmanuel Macron warned Sunday against the use of escalating "words or actions" if a ceasefire or withdrawal of Russian troops in the war in Ukraine is to be achieved. Macron's comments, during an interview with France 3, come a day after Biden said in a speech in Poland that Russian President Vladimir Putin "cannot remain in power," calling Putin a "butcher." U.S. officials quickly walked back the comment, telling reporters the U.S. isn't seeking regime change in Russia. (Axios)

RUSSIA: Ukraine said a second round of conflict talks between negotiators from Kyiv and Moscow will take place in Turkey from Monday (March 28), just over one month into Russia's invasion of Ukraine. "Today, during another round of video negotiations, it was decided to hold the next in-person round of the two delegations in Turkey on March 28-30," Mr David Arakhamia, a Ukraine negotiator and politician wrote on Facebook. Mr Vladimir Medinsky, Russia's lead negotiator in the conflict, confirmed the upcoming talks with Ukraine, but gave a slightly different time frame, saying they would start on Tuesday and end on Wednesday. (AFP)

RUSSIA: Ukraine’s priorities at the Ukrainian-Russian talks in Turkey this week will be “sovereignty and territorial integrity,” President Volodymyr Zelenskyy told his nation Sunday in his nightly address. “We are looking for peace, really, without delay,” he said. “There is an opportunity and a need for a face-to-face meeting in Turkey. This is not bad. Let’s see the outcome.” This week, he said, “I will continue to appeal to the parliaments of other countries” to remind them of the dire situation in besieged cities like Mariupol. (AP)

RUSSIA: President Volodymyr Zelenskiy said Ukraine’s military defense is forcing Russia’s leadership to realize that “talks are necessary,” after earlier bemoaning a stalemate amid ultimatums and demands he cede territory. “The conversation must be meaningful. Ukrainian sovereignty must be guaranteed, Ukraine’s territorial integrity must be ensured,” Zelenskiy said in a video address late Friday. The Russian Defense Ministry said earlier that its forces, which have failed to take several major cities, would focus on taking control of the full eastern Donbas region. (BBG)

RUSSIA: President Volodymyr Zelenskyy has said that Ukraine is prepared to discuss adopting a neutral status as part of a peace deal with Russia, but the move would have to be guaranteed by third parties and put to a referendum. Zelenskyy said a peace deal would not be possible without a ceasefire and troop withdrawals. He ruled out trying to recapture all Russian-held territory by force, saying it would lead to a third world war, and said he wanted to reach a “compromise” over the eastern Donbas region, held by Russian-backed forces since 2014. (Al Jazeera)

RUSSIA: Speaking with independent Russian journalists on Sunday, Zelensky said Ukraine is not discussing the terms "denazification" and "demilitarization" at all during talks with Russia. "We won't sit down at the table at all if all we talk about is some 'demilitarization,' or some 'denazification.' For me, these are absolutely incomprehensible things," Zelensky said. (CNN)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba said on Friday peace negotiations with Russia were difficult, and denied reports that progress had been made in resolving four out of six key issues. "There is no consensus with Russia on the four points," Kuleba said in a post on Facebook. "The negotiation process is very difficult. The Ukrainian delegation has taken a strong position and does not relinquish its demands. We insist, first of all, on a ceasefire, security guarantees and territorial integrity of Ukraine." Kuleba later tweeted that there was "no consensus in negotiations yet", complaining "Russia sticks to ultimatums". (RTRS)

RUSSIA: The U.K. has created a special diplomatic unit to help support Ukraine “when the Russians are serious about negotiations,” British Foreign Secretary Liz Truss said in an interview with The Telegraph. “I don’t believe they are serious at present and that’s why I’ve said we need to be tough to get peace,” Truss told the newspaper. “We need to double down on sanctions. We need to double down on the weapons that we’re sending Ukraine.” (BBG)

RUSSIA: Mayor Andriy Sadovyi of Lviv said Russian missiles had struck the city in a second strike on Saturday. “One more missile attack,” he wrote on his Facebook page. Sadovyi said earlier that the first assault had hit “industrial facilities where fuel was stored.” Officials said five people were injured in that attack. (BBG)

RUSSIA: Ukraine will seek a new “structure of security guarantees” after the war, presidential aide Andriy Yermak told the Atlantic Council in a video interview. “Give the world the model that will prevent Russia from conducting an aggressive policy for many years, not only after the end of fighting on Ukraine territory,” he said. (BBG)

RUSSIA: Ukrainian forces still control the besieged port city of Mariupol and no one will surrender it, Ukraine's top security official Oleksiy Danilov said on Friday. "Mariupol is holding on, and no one is going to surrender Mariupol," Danilov said in televised comments. Thousands of Russian troops are stationed at military outposts from Georgia to Syria to Tajikistan, many of them assigned to motorized rifle brigades that experts consider combat-capable and ready to deploy immediately. (The Washington Post)

RUSSIA: Ukraine has started “small tactical counteroffensives” in the northern Sumy, Kharkiv and Kyiv regions, and in the Kherson area in the south, according to presidential spokesman Oleksiy Arestovych. He said that Russian troops want to encircle the Ukrainian army in eastern Donbas, seize the city of Mariupol, which has been under siege for almost a month, and keep control of the Kherson region. “We now have hope” to retake territories in the north and near the capital Kyiv, Arestovych said. “It also means potentially a sharp worsening of the situation near Mariupol and in Donbas. (BBG)

RUSSIA: A separatist leader backed off an earlier statement that his region may hold a vote soon to become part of Russia, saying that no such preparations are under way and that any referendum would only come after fighting ends, Tass reported. Leonid Pasechnik, leader of the Russian-backed Luhansk People’s Republic in the eastern Ukrainian region of Donbas, said earlier comments were his “personal, private opinion.” “In the future, having gotten their freedom, the residents of our republics will have the absolute right to determine their future,” he said. Pasechnik’s earlier statement about an imminent vote drew denunciations from officials in Kyiv, who called it an illegitimate step aimed at partitioning Ukraine. In Moscow, a senior Russian legislator was also cool to the idea, saying now isn’t the time for a vote, Tass reported. (BBG)

RUSSIA: Even as the southern port city of Mariupol remains under siege, Chernihiv in Ukraine’s north, close to the Belarus border, is also encircled by Russian troops, Mayor Vladyslav Atroshenko said in a televised briefing where he warned of an expanding humanitarian crisis. (BBG)

RUSSIA: Russian shelling caused additional damage to a nuclear research facility in Kharkiv, although on-site radiation levels remain within standard limits. Saturday’s attack seriously damaged thermal insulation lining of the facility’s “Neutron Source” building, while also causing partial shedding of lining materials in the installation’s experimental hall, the State Nuclear Regulatory Inspectorate of Ukraine said on its website. Ongoing shelling risks more damage and could lead to radiation contamination of surrounding areas, according to the statement. The installation has been in long-term shutdown mode since Feb. 24. (BBG)

RUSSIA: The International Atomic Energy Agency said it was “monitoring developments” after being told by Ukrainian officials that Russian troops had taken control of Slavutych, a town near the defunct Chernobyl nuclear power plant in northern Ukraine. The IAEA said in a tweet on Saturday that many of the plant’s staff live in Slavutych and that there had been “no staff rotation” at Chernobyl, the site of the 1986 nuclear accident, since Monday. (BBG)

U.S./CHINA/RUSSIA: The Federal Communications Commission (FCC) on Friday added Russia's AO Kaspersky Lab, China Telecom (Americas) Corp and China Mobile International USA to its list of communications equipment and service providers deemed threats to U.S. national security. The regulator last year designated five Chinese companies including Huawei Technologies Co and ZTE Corp as the first firms on the list, which was mandated under a 2019 law. Kaspersky is the first Russian company listed. FCC Commissioner Brendan Carr said the new designations "will help secure our networks from threats posed by Chinese and Russian state-backed entities seeking to engage in espionage and otherwise harm America’s interests." (RTRS)

RUSSIA: Leaders of European Union countries agreed at their two-day summit in Brussels to focus on enforcing sanctions against Russia in cooperation with global partners, the head of the bloc’s executive arm told reporters. “We agreed now to really look deep into the loopholes we discover now, or the circumventions that some try to take, and to do everything within their own respective system to close the loopholes and make the circumventions impossible,” Ursula von der Leyen, head of the European Commission, said after the meeting. (BBG)

RUSSIA: Sanctions on Russia are a "hard lever" that should only be removed following a "full ceasefire and withdrawal" from Ukraine, the foreign secretary says. Liz Truss told the Sunday Telegraph that Moscow would also have to commit to "no further aggression" or face the prospect of them being reimposed. The West had to remain "tough to get peace", she said. (BBC)

RUSSIA: Vladimir Putin and his henchmen face a "day of reckoning" with evidence of war crimes having been committed in Ukraine, a cabinet minister has said. It was also "absolutely right" that strict sanctions against Russia should remain in place until the Kremlin withdraws its forces following the "illegal invasion", Nadhim Zahawi told Sky News. (Sky)

RUSSIA: Russia’s government said it will limit access to Russian sea ports and internal waterways for ships from countries that have banned Russian shipping from their ports. The ministry of transport is due to fill in the details of the restrictions, and the countries involved, within five working days. (BBG)

RUSSIA: Russian agents seized millions of dollars worth of Audemars Piguet watches in Moscow in an apparent retaliation for Swiss sanctions banning luxury goods exports, Swiss newspaper NZZ am Sonntag reported. The pricey watches were seized from the firm’s local premises by special agents from Russia’s FSB, the newspaper said, citing people familiar with a confidential Swiss Federal Department of Foreign Affairs memo. (BBG)

RUSSIA: Russia will expand limited trading to all shares listed on the Moscow Exchange in another shortened session on Monday. The Moscow Exchange will trade Russian shares, in addition to corporate and municipal bonds, in a shortened four-hour session, according to the Russian central bank’s website statement. The ban on short selling these securities will apply, it said. Russia resumed trading in 33 local stocks, including Gazprom PJSC and Sberbank PJSC, on Thursday and took measures, including preventing foreigners from exiting local equities and banning short selling, to avoid a repeat of the 33% slump seen on the first day of the Ukraine invasion last month. The MOEX Index rose 4.4% on Thursday, but reversed most gains on Friday. Russian equities are this year’s worst performers globally. The bourse will also resume trading in foreign shares on Monday, which will be traded in a so-called negotiated regime, the Bank of Russia said. (BBG)

IRAN: The issue of a “terror” designation on Iran’s Islamic Revolutionary Guard Corps has taken centre stage during the ongoing efforts to revive the country’s 2015 nuclear deal with world powers. In an interview with state television on Saturday, Amirabdollahian had confirmed that the FTO designation, in addition to sanctions imposed on IRGC subsidiaries and entities, is the main remaining obstacle to an agreement. The diplomat said senior IRGC commanders have told him the talks should not be stalled by the issue of the designation if an agreement is within reach, but he vowed that in spite of this “self-sacrifice”, he would not grant concessions on this issue. (Al Jazeera)

IRAN: The U.S. said the revival of a nuclear deal with Iran may not happen soon following recent requests from Tehran, including that Washington removes the Islamic Revolutionary Guard Corps from its list of terrorist organizations. Iran said it had agreed with France, Germany and the U.K. on a draft text to restore the nuclear accord, but that a deal hinged on what happened with the IRGC. (BBG)

IRAN: Top EU diplomat Josep Borrell said on Saturday Iran and world powers were "very close" to agreement on reviving their 2015 nuclear deal, which would curb Tehran's nuclear programme in exchange for lifting tough sanctions. (RTRS)

IRAN: US Secretary of State Antony Blinken committed Sunday to countering hostile actions from Iran regardless of whether the US can reestablish a nuclear agreement with the country, hours after the US special envoy to Iran stressed that a deal "is not inevitable." "Deal or no deal, we will continue to work together and with other partners to counter Iran's destabilizing behavior in the region," Blinken said during a meeting with in Israel with Prime Minister Naftali Bennett. (CNN)

EQUITIES: Hong Kong stock investors are bracing for a key earnings deadline on Thursday, with dozens of firms unable to file annual results facing a possible trading halt. At least 73 listed firms said they will postpone their annual earnings filings past the March 31 deadline due to the Covid outbreak or auditor changes, according to exchange statements as of 6 p.m. local time Saturday. That includes distressed builders China Evergrande Group and Kaisa Group Holdings Ltd. ahead of what’s expected to be one of the worst earnings seasons in over a decade for developers. The list also includes a large amount of energy and materials firms. The suspensions risk could hit trading sentiment in the city’s equities market, which remains fragile following bouts of volatility in recent weeks as Beijing vowed to end a yearlong regulatory crackdown after a historic selloff. (BBG)

EQUITIES: Initial public offerings worldwide have plummeted in the first quarter after a record showing in 2021, as volatility stoked by the war in Ukraine and soaring inflation sets investors on edge and scuppers deals. About $65 billion has been raised via IPOs around the world in 2022, down 70% from $219 billion in the first three months of last year, according to data compiled by Bloomberg. That puts the global market on track for the lowest quarterly proceeds since the onset of the coronavirus pandemic in 2020. Still, companies such as renewable-energy provider Plenitude and skin-care business Galderma are lining up to test investors’ appetite for new shares in the coming months. (BBG)

ENERGY: Russia expects Western buyers of its natural gas to adapt to Moscow’s decision to switch payments for its supplies to Russian roubles, Finance Minister Anton Siluanov said on Friday. “Settlements in roubles as now more reliable than in foreign currencies,” Siluanov said on state TV, adding that the move will have no impact on oil and gas revenues of the budget. (RTRS)

ENERGY: French President Emmanuel Macron on Friday dismissed Russian President Vladimir Putin's demand for Europe to pay for gas in roubles as he accused Moscow of trying to sidestep sanctions over its war on Ukraine. Macron told journalists after an EU summit in Brussels that the Russian move "is not in line with what was signed, and I do not see why we would apply it". Macron said that "we are continuing our analysis work" following the Kremlin's manoeuvre. But he insisted "all the texts signed are clear: it is prohibited. So European players who buy gas and who are on European soil must do so in euros". "It is therefore not possible today to do what is requested, and it is not contractual," he said. (AFP)

ENERGY: Russian tankers carrying oil chemicals and products are increasingly concealing their movements, a phenomenon that some maritime experts warn could signal attempts to evade unprecedented sanctions prompted by the invasion of Ukraine. In the week ended March 25, there were at least 33 occurrences of so-called “dark activity” -- operating while on-board systems to transmit their locations are turned off -- by Russian tankers, said Windward Ltd., an Israeli consultancy that specializes in maritime risk. That’s more than double the weekly average of 14 in the past year. The dark operations occurred mainly in or around Russia’s exclusive economic zone, according to Windward, which conducted the research at Bloomberg’s request. (BBG)

OIL: Yemen's Houthis said they launched attacks on Saudi energy facilities on Friday and the Saudi-led coalition said oil giant Aramco's petroleum products distribution station in Jeddah was hit, causing a fire in two storage tanks but no casualties. A huge plume of black smoke could be seen rising over the Red Sea city where the Saudi Arabian Grand Prix is taking place this weekend, an eyewitness said. The Iran-aligned Houthis have escalated attacks on the kingdom's oil facilities in recent weeks and ahead of a temporary truce for the Muslim holy month of Ramadan. (RTRS)

OIL: Yemen's Houthi rebels announced a three-day truce with the Saudi-led coalition and dangled the prospect of a "permanent" ceasefire on Saturday, the seventh anniversary of a brutal conflict that has left millions on the brink of famine. (AFP)

OIL: Qatar’s foreign minister has said the conflict in Ukraine, and its geopolitical ramifications, is pushing some countries to explore new ways of pricing oil — not in the dollar. The comments, made Saturday by Mohammed bin Abdulrahman Al-Thani, come after a Wall Street Journal report that Saudi Arabia is in accelerated talks with China to accept yuan instead of dollars for oil that Beijing buys. (CNBC)

OIL: The Chairman of the National Oil Corporation (NOC), Mustafa Sanallah, has warned that the current oil production could fall at any moment due to the lack of funding, which led to a lack of maintenance and the deterioration of the oil sector's infrastructure. Sanallah added in a press statement that the NOC faced major problems in obtaining the required budgets, although the current government has obtained the highest numbers of revenues since 2013, as it received 26 billion dollars in 2021. However, the NOC received only 11% of the required budget, according to him. (Libya Observer)

ENERGY: French President Emmanuel Macron rejected Putin’s demand that purchases of Russian gas must be paid in rubles. “All the texts signed are very clear: it is forbidden,” Macron said at a press conference in Brussels. He said contracts signed with European buyers stipulate a payment in euros and must be respected. (BBG)

CHINA

YUAN: China should urgently introduce policies to stabilize market expectations and increase control over cross-border capital flow, the Securities Times said in a front-page editorial. The spread between 10-year China and U.S. treasury yields have rapidly narrowed to 31 bps, below the 40-bps "comfort zone," as the market expects more rate hikes by the Federal Reserve to control inflation. A narrower spread pressures the yuan and causes capital outflow, the newspaper said. China should nonetheless stick to its own policies and introduce a loosening monetary environment to promote economic growth, it said. Foreign holdings of Chinese stocks and bonds are limited and not enough to impact the overall market, it said. (MNI)

CORONAVIRUS: The Chinese city of Shanghai is to be divided in half for a two-part lockdown which will see authorities roll out an experimental COVID testing regime. Shanghai has been battling a new coronavirus surge for nearly a month, and on Saturday reported its highest daily number of cases since the initial outbreak in China receded. Authorities have decided to use the Huangpu River that passes through the city as a dividing point, as it locks down in two stages over a nine-day period. Districts on one side will be locked down and tested between 28 March and 1 April, the other between 1 April and 5 April. (Sky)

CORONAVIRUS: Tianjin, which neighbors Beijing and has a population of 13 million, began citywide nucleic acid testing Sunday morning, according to local authorities. All the residents are advised not to leave their communities. The sample collection and testing is expected to be completed within 24 hours, said a notice issued by the authority. Those who don't take the tests will see their health code turn "orange." (China Daily)

EQUITIES/CORONAVIRUS: Shanghai’s stock exchange will provide online services over IPO approval meetings, consultations and road shows as half of the city faces a lockdown in turns to stanch a spiraling outbreak in the Chinese financial hub. The exchange will extend the time window for listed companies’ statement releases to 11 p.m., according to a bourse statement. Companies that had reserved an earlier time slot to release 2021 full year earnings can apply to postpone the April 30 deadline, which remains the latest date for a release. The measures are similar to the steps taken in February 2020 amid the initial Covid outbreak to limit in-person meetings and cut paperwork. Policies then also included encouraging telephone and online roadshows and board meetings, as well as postponement of certain releases. (BBG)

OVERNIGHT DATA

CHINA FEB INDUSTRIAL PROFITS YTD +5.0% Y/Y; JAN +178.9%

CHINA MARKETS

PBOC NET INJECTS CNY120 BLN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY150 billion via 7-day reverse repos with the rates unchanged at 2.10% on Monday. The operation has led to a net injection of CNY120 billion after offsetting the maturity of CNY30 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1404% at 09:24 am local time from the close of 2.2160% on Friday.

- The CFETS-NEX money-market sentiment index closed at 46 on Friday vs 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3732 MON VS 6.3739

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3732 on Monday, compared with 6.3739 set on Friday.

MARKETS

SNAPSHOT: JPY Continues To Weaken As BoJ Defends 10-Year JGB Yield Band

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 147.89 points at 27996.1

- ASX 200 up 17.854 points at 7424.1

- Shanghai Comp. down 4.116 points at 3208.124

- JGB 10-Yr future down 19 ticks at 149.29, yield up 1.3bp at 0.251%

- Aussie 10-Yr future down 11.0 ticks at 97.050, yield up 11bp at 2.885%

- U.S. 10-Yr future down 0-08+ at 121-09, yield up 4.81bp at 2.5212%

- WTI crude down $3.48 at $110.43, Gold down $14.38 at $1944.11

- USD/JPY up 96 pips at Y123.01

- SHANGHAI ENTERS TWO-STAGE LOCKDOWN

- WHITE HOUSE ROWS BACK BIDEN’S INITIAL COMMENTS WHICH ALLUDED TO RUSSIAN REGIME CHANGE

- UKRAINE RUSSIA SET TO MEET IN TURKEY AGAIN ON MONDAY

- UKRAINIAN PRESIDENT PROVIDES POTENTIAL AREAS OF COMPROMISE, AS RUSSIAN MILITARY TACTICS CHANGE

- BOJ STEPS IN TO DEFEND TOP OF 10-YEAR JGB YIELD TRADING BAND, TWICE

BOND SUMMARY: U.S. 5-/30-Year Yield Spread Inverts, BoJ Defends 10-Year Band, Twice

Asia-Pac dealing saw core fixed income markets move lower, although there was some brief, limited respite for bulls during early Asia trade (perhaps on some worry surrounding U.S. President Biden’s apparent weekend faux pas, as some of his comments alluded to a desire for regime change in Russia. Note this idea was quickly rowed back by the White House).

- Ultimately, U.S. Tsys continued to cheapen, with TYM2 through Friday’s low, last dealing -0-10+ at 121-07 (next support is seen at the Jan 18 ’19 low, 121-02), with the contract 0-03 off the base of its 0-24+ range, operating on nearly 190K lots. Cash Tsys are 5-10bp cheaper on the session, with 2s leading the way lower. Note that the 5-/30-Year yield spread has inverted for the first time since ’06. Factors helping the cheapening included a move lower in crude oil prices (owing to a two-stage lockdown in China’s Shanghai), some “decent sized” payside flows in U.S. swaps (per market contacts), spill over from JGBs, a truncated U.S. Tsy supply schedule and regional reaction to Friday’s cheapening. Looking ahead, NY hours will bring advance goods trade data, inventory readings and the latest Dallas Fed m’fing activity print. Meanwhile, 2- & 5-Year Tsy auctions headline on the supply front. Elsewhere, the latest Russia-Ukraine summit in Turkey will garner interest, although there is little in the way of expectations re: a meaningful breakthrough between the two nations.

- The move higher in core global fixed income markets has resulted in the BoJ having to defend the upper end of its permitted 10-Year JGB yield trading band. Note that 10-Year JGB yields have had an incremental look above the upper limit of the BoJ’s permitted trading band, resulting in a second round of BoJ buying interest via fixed rate operations after the initial fixed rate operations drew no offers to sell from market participants (we await results of the second round of operations). JGB futures are -24 on the day, after registering another fresh cycle low. Meanwhile, the curve has bear steepened, with 40s running nearly 5bp cheaper on the day (some concession ahead of tomorrow’s 40-Year JGB auction is apparent).

- It was another session of tracking the wider impetus for the Aussie bond space. That leaves YM -18.0 and XM -13.5, with the former shunting lower into the close. Bills run 5-24 ticks lower through the reds. Note that the ruling Australian coalition will cut the fuel excise duty and support first time buyers re: the housing market when it hands down the latest Federal Budget on Tuesday.

EQUITIES: Mixed As China Ramps Up COVID Fight

Asia-Pac equity indices are mixed, mirroring Wall St.’s performance on Friday.

- The Hang Seng outperformed, reversing earlier losses to sit 1.1% higher at typing. Losses observed in the utilities and real estate developer sub-indices were countered by gains in China-based technology large-caps, with the Hang Seng Technology Index sitting 3.0% better off at typing. To elaborate, sentiment in Chinese technology giants received a lift from Meituan’s Q4 earnings delivered last Friday, with the latter rallying 14.4% come the lunch bell.

- The CSI300 is 0.8% worse off at typing, underperforming major regional equity index peers despite recovering from declines of up to ~2% earlier in the session. The benchmark has come under pressure as authorities in the Chinese city of Shanghai announced a two-phase lockdown despite earlier assurances to the contrary, raising worry re: slower economic growth for ’22, with downside economic risks set to grow if more Chinese cities adopt similar measures to contain the spread of COVID-19. Steep losses were observed in the consumer staples sub-index, while energy and utilities outperformed.

- The Nikkei sits 0.5% lower at typing after opening lower, on track to end a nine-session streak of gains. The move lower comes despite a weakening in the JPY, with the impulse from a weaker currency failing to counter heavy losses observed in materials and industrial names.

- U.S. e-mini equity index futures sit 0.3% weaker across the board at typing.

OIL: Lower As Shanghai Enters Lockdown

WTI and Brent are ~-$3.30 at typing, operating a touch above Friday’s worst levels. The benchmarks have come under pressure in Asian hours owing to the declaration of a two-phase lockdown in the Chinese city of Shanghai (even after local authorities pushed back on the idea of a lockdown in the runup to the move), raising worry re: lower fuel demand in China.

- Elsewhere, major crude benchmarks have unwound some of last Friday’s gains as the Houthi rebel group declared a unilateral temporary ceasefire over the weekend (technically due to end later Monday) on a range of offensive actions towards Saudi Arabia. To recap, WTI and Brent reversed earlier losses to close higher on Friday after the Houthi rebels claimed responsibility over an attack on oil storage facilities in Jeddah.

- Turning to the U.S., RTRS source reports have pointed to the Biden administration considering a possible 30mn bbl release of crude from the country’s Strategic Petroleum Reserves, adding to 60mn bbls released earlier this month by IEA member countries.

- Looking at the week ahead, OPEC+ meets on Thursday. International pressure on the group to raise production has so far yielded little by way of concrete commitment, with heavyweights Saudi Arabia and the UAE continuing to emphasise “balance” and “stability” instead.

GOLD: Lower In Asia As Dollar Rallies

Gold is $12/oz softer printing ~$1,946/oz at writing, operating a touch above Friday’s trough. The precious metal has come under pressure on the back of a firmer USD, with higher U.S. Tsy yields and Fed/BoJ policy divergence allowing the DXY to hit the highest level observed in ~2 weeks.

- To recap, bullion recovered from worst levels on Friday to close virtually unchanged, finishing the week ~$30/oz better off. The rebound was facilitated by rising tensions between Russia and the west amidst a flurry of announcements from Russia-focused meetings between leaders of the G7, NATO, and the European Council, neutralising an uptick in U.S. real yields.

- May FOMC dated OIS now prices in ~45bp of tightening, pointing to an 80% chance of a 50bp rate hike at that particular meeting. The expectation for the May FOMC is a little lower than levels witnessed early last week (after Fed Chair Powell’s hawkish comments on Monday), while OIS markets now show a cumulative ~200bp of Fed tightening priced in for the rest of calendar ’22.

- Looking to technical levels, the short-term outlook for gold is still bearish, providing space for the recent overbought conditions to unwind. Resistance is situated at $1,966.1/oz (Mar 24 high), while support is located at $1,903.7/oz (50-day EMA).

FOREX: USD Gains, JPY Tumbles On BoJ Policy Divergence

The greenback has benefitted from an uptick in U.S. Tsy yields and JPY weakness during Asia-Pac dealing, trading higher against most of its G10 FX counterparts as a result.

- JPY has tumbled to the bottom of the same rankings on the back of the latest enforcement attempts re: the top end of the BoJ’s permitted 10-Year JGB yield trading band, as USD/JPY surged to fresh multi-year highs on continued BoJ policy divergence vs. DM central bank peers, printing as high as Y123.16, before easing back to trade around Y123.00. Note that 10-Year JGB yields have had an incremental look above the upper limit of the BoJ’s permitted trading band, resulting in a second round of BoJ buying interest via fixed rate operations after the initial fixed rate operations drew no offers to sell from market participants.

- Elsewhere, there is a bit of defensive tone, with a downtick in oil markets & pressure on Chinese mainland equities amid a two-stage lockdown in the Chinese city of Shanghai garnering most of the attention on the headline front.

- The likes of the NOK & CAD are struggling with lower oil prices, although the AUD is the top performer within the G10 sphere, benefitting from commodity FX cross- & AUD/JPY related flows, with AUD/NZD moving to the highest level observed since April ’21. Note that the ruling Australian coalition will cut the fuel excise duty and support first time buyers re: the housing market when it hands down the latest Federal Budget on Tuesday.

- Looking ahead, Monday’s focus will fall on central bank speak from ECB’s Rehn & BoE Governor Bailey, with lower tier economic data due from across the globe. Elsewhere, the latest Russia-Ukraine summit in Turkey will garner interest, although there is little in the way of expectations re: a meaningful breakthrough between the two nations.

FOREX OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-60(E1.0bln), $1.1000(E532mln)

- USD/JPY: Y120.50-70($649mln)

- USD/CAD: C$1.2535-50($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2022 | 1100/1200 |  | UK | BOE Bailey in Conversation w. Guntram Wolff | |

| 28/03/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/03/2022 | 1430/1530 |  | UK | DMO Consultation Gilt Issuance 2022/23 | |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 28/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.