-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tsy Blocks Russia $ Debt Payment At U.S. FIs, RBA No Longer Patient

EXECUTIVE SUMMARY

- TREASURY STOPS RUSSIA FROM PAYING DEBT THROUGH ITS U.S. ACCOUNTS (BBG)

- RBA LOSES ITS ‘PATIENCE', SIGNALS RATE RISES COMING (AFR)

- BOJ'S KURODA CAUTIONS THAT RECENT YEN MOVES HAVE BEEN 'SOMEWHAT RAPID' (RTRS)

- ECB’S KNOT SAYS TIMELY NORMALISATION PREVENTS BOLDER STEPS LATER (BBG)

- DUTCH FINANCE CHIEF BACKS POSTPONING RETURN OF EU’S DEBT LIMITS (BBG)

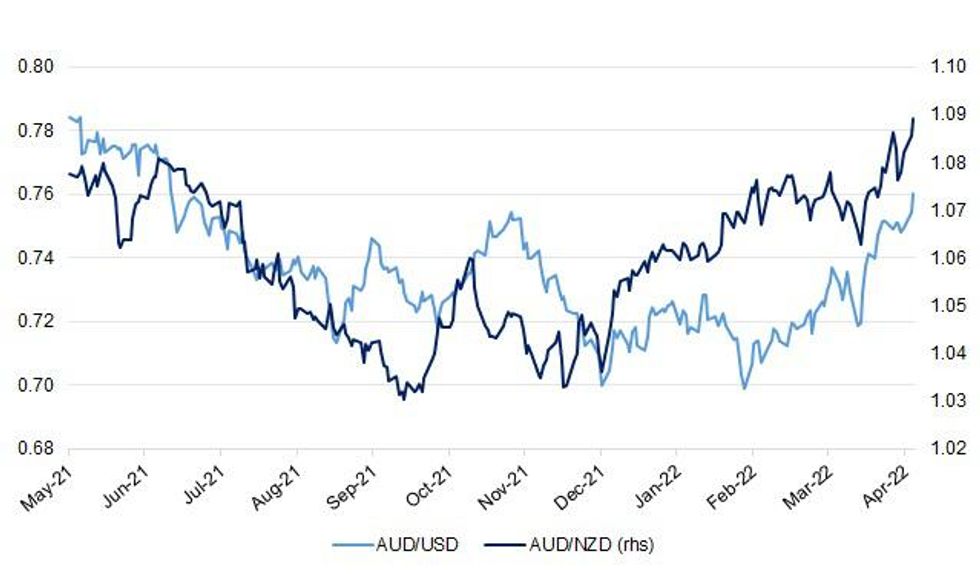

Fig. 1: AUD/USD & AUD/NZD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EUROPE

ECB: “The ECB needs to be clear that its primary mandate is to safeguard medium-term inflation and that it will not hesitate to act to prevent a de-anchoring of expectations,” European Central Bank Governing Council member Klaas Knot says. “A gradual but timely normalization prevents the need for bolder policy interventions in the medium-run”. (BBG)

FISCAL: Dutch Finance Minister Sigrid Kaag said she’d favor prolonging the suspension of the European Union’s fiscal rules, citing the fallout of the war in Ukraine on the bloc’s economy. “One could expect that the Commission would opt for an extension of the general escape clause,” Kaag told reporters on the sidelines of a meeting of euro-area finance chiefs in Luxembourg. “I think that current circumstances would warrant that.” The so-called Stability and Growth Pact, which regulates EU member states’ deficit and debt thresholds, has been suspended since 2020 to cope with the additional spending needed to fight the pandemic. It’s scheduled to kick in again in January, though the European Commission has said it will reassess the reactivation of the pact once its publishes its new economic forecast on May 16. Kaag spoke Monday alongside her Spanish counterpart Nadia Calvino, presenting a joint paper on the reform of the EU’s fiscal rules. (BBG)

GREECE: Greece completed its repayment of its International Monetary Fund (IMF) debt on Monday, Greek Finance Minister Christos Staikouras said. Staikouras added in a statement, "A chapter that opened in May 2010, with Greece's recourse to the Fund for financial support, is now over." Commenting on the event, the FinMin said the completion of the payment was "a very positive relationship, a result of the effective economic policy by the current government," which he said sent a positive message to markets for the state of Greece's fiscal situation. It also boosts the profile of its public debt and adds a savings of 230 million euros in total to the state budget, to the benefit of Greek society, he underlined. Paying off the IMF debt "began, continued, and was completed by the government of New Democracy," Staikouras noted. At the same time, he said, the government continues, despite the great obstacles and external challenges, to move ahead "decisively and with confidence in its economic and social forces, to make Greece stronger all around, with an economy that is more productive, extroverted, and socially more fair." (ANA)

U.S.

MNI INTERVIEW: US Can Handle 4% Wage Gains-Minneapolis Fed Econ

- U.S. workers could ring up wage gains of 4% or more without rattling price stability while inflation may moderate as recent surges in oil and goods prices fade, the Minneapolis Fed's assistant director of the research division and adviser to President Neel Kashkari told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MNI INTERVIEW: Room For More Labor Market Gains– Fed's Rodgers

- A jump in U.S. inflation over the past year coupled with a rockier stock market may be curbing Americans’ appetite for early retirement, suggesting further room for gains in the labor force, St. Louis Fed economist William Rodgers III told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: Floods, drought, wildfires and hurricanes made worse by climate change could cost the U.S. federal budget about $2 trillion each year by the end of the century, the White House said in an assessment on Monday. The analysis by the Office of Management and Budget, which administers the federal budget, found that climate change could hit federal revenues with a 7.1% annual loss by the end of the century. (CNBC)

FISCAL/CORONAVIRUS: Congressional negotiators announced a deal Monday for $10 billion in additional funding for the U.S. coronavirus response but were unable to agree on global aid, stirring warnings from health experts that they would rue the decision if another overseas variant sparked an outbreak in the United States. The bipartisan package, unveiled by Senate Majority Leader Charles E. Schumer (D-N.Y.) and Sen. Mitt Romney (R-Utah), would enable U.S. officials to purchase more therapeutics, tests, vaccines and other supplies, after the White House repeatedly warned that it needed more funding for those priorities. The legislation also calls on federal officials to invest at least $5 billion to develop and procure therapeutics, and at least $750 million in efforts to fight future variants and to build vaccine manufacturing capacity. (The Washington Post)

US TSYS: The Federal Reserve Bank of New York is adding ASL Capital Markets Inc. to the list of trading counterparties it deals with in implementing monetary policy. Primary dealers, as they are known, are required to bid on a pro-rata basis in all Treasury auctions at reasonably competitive prices, as well as make markets for the New York Fed on behalf of its official account holders. The existing list of primary dealers includes units of various major U.S. and international banks such as Goldman Sachs Group Inc., HSBC Holdings Plc and UBS Group AG, as well as firms like Cantor Fitzgerald and Amherst Pierpont Securities. The Stamford, Connecticut-based ASL -- which is not known to be a major entity in financial services -- described itself in a press release as an independent broker-dealer that provides institutional clients with “trading and securities financing solutions in U.S. government securities.” It also flagged that it is a minority-owned business. A website for the firm provided few additional details. The addition of ASL, which was announced in an email from the New York Fed and is listed on the bank’s website, is effective April 4. (BBG)

POLITICS: U.S. Supreme Court nominee Ketanji Brown Jackson secured the support of two more Senate Republicans on Monday, as she cleared a procedural hurdle toward becoming the first Black woman to serve on the nation's top judicial body. Republicans Lisa Murkowski and Mitt Romney joined Susan Collins in saying they would vote to confirm Jackson, 51, to a lifetime seat on the court later this week. They also supported a procedural 53-47 vote to bring her nomination to the Senate floor after the Senate Judiciary Committee deadlocked 11-11 along party lines on whether to advance the nomination. (RTRS)

OTHER

BOJ: Bank of Japan Governor (BOJ) Haruhiko Kuroda said on Tuesday the yen's recent moves were "somewhat rapid," joining a chorus of policymakers who have warned that sharp falls in the currency could hurt the country's import-reliant economy. But Kuroda also repeated his view that a weak yen benefits Japan's economy as a whole, in contrast to some market views that its decline is doing more harm than good to the economy by pushing up import costs. "Recent (yen) moves have been somewhat rapid," Kuroda told parliament, adding that the BOJ was carefully watching currency moves due to their "huge" impact on the economy and prices. "It's extremely important for currency rates to move stably reflecting economic and financial fundamentals," Kuroda said. (RTRS)

BOJ: MNI BRIEF: BOJ's Kuroda: Need To Keep 10-Year JGBs Below 0.25%

- Bank of Japan Governor Haruhiko Kuroda said on Tuesday that if the 10-year Japanese Government Bond (JGB) yield goes above 0.25%, it will reduce the effects of easy policy and corporate appetite to implement capital investments - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: MNI BRIEF: BOJ's Uchida: Core CPI Around 2% In Or After April

- Japan's core consumer price index is expected around 2% in or after April due to higher energy and food costs, and the fading impact of lower mobile phone charges, Shinichi Uchida, the Bank of Japan's executive director in charge of monetary policy said on Tuesday. Uchida told lawmakers that the core inflation rate is likely to increase clearly into positive territory, but indicated that such a price move would not lead to an easy policy change - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBA: The Reserve Bank of Australia has abandoned its language of patience and signalled it could begin raising interest rates within months if wages and inflation data produce strong results. In his usual post-monthly board meeting statement, RBA governor Philip Lowe acknowledged rising inflation was expected to continue, but said labour costs were below where the central bank wanted them to be. "Over coming months, important additional evidence will be available to the board on both inflation and the evolution of labour costs," Dr Lowe said. "The board will assess this and other incoming information as its sets policy to support full employment in Australia and inflation outcomes consistent with the target." Gone from the statement was the usual reference to the board willing to be "patient", though the allusion to upcoming inflation data on April 27 and wages data on May 18, suggest a pre-election rate rise is unlikely. (AFR)

NEW ZEALAND: The Government's books continue to outperform expectations, with New Zealand $4.44 billion closer to surplus than Treasury expected in its most recent forecasts, published in December. The rosier-than-expected fiscals are for the eight months to February, and were published by Treasury on Tuesday. The Government has urged caution with the numbers, warning they do not capture the impact of Omicron, but National reckons the accounts show the Government could afford tax cuts. The result was largely thanks to tax revenue for the first eight months of the financial year coming in at $1.8b higher than expected, and expenses $1.4b lower than expected. Treasury put this down to better-than-expected corporate tax take, and a strong jobs market. (NZ Herald)

NEW ZEALAND: Auckland's largest real estate agency Barfoot & Thompson had a reasonably strong finish to the summer selling season. The agency sold 1180 residential properties in March, which was down by 36% compared to March last year. However the sales levels in March last year were exceptionally high and leaving those aside, March sales this year were the highest they have been for the month of March since 2016. Average and median selling prices remained below last year's peaks but have not shown a dramatic slide. Barfoot's average selling prices in March was $1,234,572, up $38,000 from $1,196,036 in February, but down just over $44,000 from the peak of $1,278,647 set in December 2021. The median March selling price was $1,180,000, up from $1,122,500 in February, but down $60,000 from the peak of $1,240,000 set in November last year. Overall, prices appear to be flattening after coming down from the highs achieved at the beginning of summer. Barfoot's latest figures also suggest buyers will be finding more homes on the market to choose from. (Interest NZ)

SOUTH KOREA: South Korea’s 2022 inflation is likely to be “much higher” than the central bank’s Feb. forecast of 3.1%, according to a Bank of Korea statement. Inflation is likely to remain in the 4% level for some time due to rising oil, grain prices following the Ukraine war. This year’s average oil price is likely to rise far above Bank of Korea’s Feb. forecast of $83/barrel, in Dubai oil. (BBG)

NORTH KOREA: The sister of North Korean leader Kim Jong-un said South Korea is no match for her nuclear-armed country, as she reiterated Pyongyang's position that Seoul is not a "principal enemy," according to state media Tuesday. She was again taking issue with South Korean defense chief's talk in public last week of his troops' "preemptive strike" capabilities. Kim Yo-Jong, vice department director of the Central Committee of the Workers' Party of Korea, described the minister's remarks as an "irretrievable very big mistake." "If anyone does not provoke us, we will never strike it before anything else," she said in her second press statement in a few days carried by the Korean Central News Agency. (Yonhap)

ASIA: The World Bank cut its growth forecast for East Asia and the Pacific for 2022 to reflect the economic impact of Russia's invasion of Ukraine, warning the region could lose further momentum if conditions worsen. The Washington-based lender said in a report on Tuesday it expected 2022 growth in the developing East Asia and Pacific (EAP) region, which includes China, to expand 5.0% percent, lower than its 5.4% forecast in October. But growth could slow to 4.0% if conditions worsened and government policy responses were weaker, World Bank said. (RTRS)

MEXICO: A Mexico opposition party that is key for President Andres Manuel Lopez Obrador’s effort to pass a nationalist electricity bill will vote against the legislation, drastically reducing chances for the constitutional reform to pass. Alejandro Moreno, the president of the Institutional Revolutionary Party, or PRI, said Monday that his party won’t support the bill, and called it “illegal” and “abusive.” The legislation would require that 54% of electricity be generated by the state-owned power utility, reducing the participation of private companies in the market. AMLO, as the president is known, needs the PRI to gain the two-thirds majority necessary to pass the constitutional amendments in the bill. The president’s ruling Morena party wants the official vote to take place in the lower house of congress next week. While some PRI lawmakers had expressed their opposition to the bill, the leadership had remained open to debating it. (BBG)

MEXICO: Credito Real’s default on Swiss-franc bonds doesn’t imply risk for the stability of the Mexican financial system’s operations, according to a Finance Ministry statement. Authorities are closely monitoring Credito Real’s financial situation and its legal process. Mexico doesn’t see contagion to other participants with good performance in the sector. (BBG)

BRAZIL: The Brazilian government’s pick to run Petroleo Brasileiro SA withdrew from the role, risking a power vacuum at Latin America’s biggest oil producer that has become the center of a political dispute over fuel prices. Adriano Pires declined the invite Monday, Energy Minister said in a statement, adding that the decision was taken by personal reasons. The industry veteran was appointed by the Brazilian government, the company’s majority shareholder, to replace Joaquim Silva e Luna, who had been sparring with President Jair Bolsonaro over fuel prices. On Sunday, Bolsonaro’s pick to be the chairman of the board at the state-run giant, Rodolfo Landim, also withdrew his name. (BBG)

RUSSIA: Ukraine President Volodymyr Zelenskiy said he will address the United Nations Security Council on Tuesday, after saying it is in Kyiv's interest to have the most open investigation into the killing of civilians in Ukraine. Speaking on Monday, he said that in Bucha, where mass graves and bodies were found after Ukraine took the town back from Russian forces, at least 300 civilians have been killed, and he expects that in Borodyanka and other towns the number of casualties may be even higher. "I would like to emphasise that we are interested in the most complete, transparent investigation, the results of which will be known and explained to the entire international community," Zelenskiy said in his nightly video address. (RTRS)

RUSSIA: The U.S. believes Russia’s revised war goals include pressing an offensive in the east, with the goal of securing Luhansk and Donetsk, while keeping pressure on Kharkiv, retaining Kherson and conducting aerial attacks on targets across the country, National Security Adviser Jake Sullivan said at the White House. “We assess Russia will focus on defeating the Ukrainian forces” in the Donetsk and Luhansk regions, which would allow Moscow to propagate a narrative of progress and downplay military failures, Sullivan said. “During this renewed ground offensive in eastern Ukraine, Moscow will likely continue to air and missile strikes across the rest of the country to cause military and economic damage, and frankly to cause terror,” he added, noting the new phase could last “months or longer.” (BBG)

RUSSIA: Ukraine’s capital remains at risk of strikes from Russian forces even as Moscow shifts more of its troops toward the eastern parts of the country, a senior U.S. defense official told reporters. About one-third of the approximately 20 battalion tactical groups Russia deployed around Kyiv remain, with the rest in Belarus or heading that way, said the official, who asked not to be identified discussing sensitive issues. Russian jets are flying about 200 sorties a day over Ukraine, even as the share of missile strikes has been declining, the official said. (BBG)

RUSSIA: Russia's defence ministry said Ukrainian forces in Mariupol can leave the area on Tuesday if they lay down their weapons, Interfax news agency reported. There was no immediate Ukrainian comment. (RTRS)

RUSSIA: Russia has backed a self-proclaimed mayor of Ukraine's southeastern port city of Mariupol who is collaborating with Russian forces, the city council said on Monday in an online post. Mariupol has been encircled by Russian forces, who have taken control of some of the city, but as of Monday Russia had not succeeded in taking full control, according to the Ukrainian defence ministry. (RTRS)

RUSSIA: The United States, at the request of Ukraine, is supporting a multi-national team of international prosecutors to the region to help collect and analyze evidence of atrocities with a view toward pursuing accountability, the State Department said on Monday. "We are tracking and documenting atrocities and sharing information with institutions working to hold responsible those accountable," State Department spokesperson Ned Price told reporters. (RTRS)

RUSSIA: Western leaders should examine their own consciences before accusing Russian President Vladimir Putin of war crimes, Foreign Minister Sergei Lavrov said on Monday. He said Moscow would hold a news conference later in the day to demonstrate that Western accusations that its soldiers killed civilians in Northern Ukraine were false. The Kremlin categorically denied any accusations related to the murder of civilians, including in Bucha, where it said the graves and corpses had been staged by Ukraine to tarnish Russia. Asked at a news conference about Biden's comments, Lavrov said the West should first consider its own actions in Iraq and Libya. "Not all is well with the conscience... of American politicians." (RTRS)

RUSSIA: Joe Biden said Putin could face additional sanctions as the U.S. president condemned alleged atrocities committed against civilians in Ukraine. “This guy is brutal and what’s happening in Bucha is outrageous, and everyone’s seen it,” Biden told reporters in his first comments since pictures emerged of dead civilians in mass graves and in the streets of towns newly liberated by Ukrainian forces. “He should be held accountable.” Biden repeated his assertion that the Russian president is a “war criminal,” and said the evidence could lead to him being tried for war crimes. (BBG)

RUSSIA: The U.S. plans to announce new sanctions against Russia this week and is talking to European allies about new ways to put economic pressure on Russia, including those relating to energy. “Yes, this week, we will have additional economic pressure elements to announce,” U.S. National Security Adviser Jake Sullivan said at the White House. (BBG)

RUSSIA: Euro zone finance ministers voiced support for further sanctions against Russia over its invasion of Ukraine but did not discuss any details, the chairman of the ministers Paschal Donohoe said. "Ministers have voiced support for how we can continue... we have not yet gotten into details of what the measures could be," Donohoe told a news conference after a meeting of the ministers. "The discussions will conclude as the week goes on," he said, adding he expected all 27 European Union finance ministers to have a general debate on the possible new sanctions on Tuesday, with decisions only taken later. (RTRS)

RUSSIA: The European Union is working on a new package of sanctions against Russia that is likely to restrict the leasing of airplanes and the import and export of products like jet fuel, steel products and luxury goods, two sources with knowledge of the discussions have told CNBC. However, the bloc remains divided over whether to extend those sanctions to energy imports — despite mounting evidence of war crimes committed by Russian forces in Ukraine. (CNBC)

RUSSIA: Zelenskiy and his top aides pressed for a G-7 foreign ministers meeting this week to ratchet up their sanctions on Russia, including on natural gas and oil sales, citing what appear to be atrocities committed by Russian troops in Bucha, a town near Kyiv. Zelenskiy told Romania’s parliament that he has reasons to believe that the number of victims in Bucha is larger than previously reported and said that more mass graves may be uncovered in the days ahead. The U.K military and police are providing technical assistance and the Metropolitan police war crimes unit have commenced the collection of evidence over the situation in Bucha and elsewhere, U.K. Foreign Minister Liz Truss said. (BBG)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba says some members of the G-7 still have doubts about imposing sanctions on Russian energy. Kuleba, speaking beside U.K. counterpart Liz Truss in Warsaw, says Ukraine demands the “most severe sanctions” be imposed on Russia “this week,” citing what appear to be atrocities committed in Bucha, Ukraine. (BBG)

RUSSIA: Foreign ministers of the Group of Seven nations will gather in Brussels Thurs. to discuss the war in Ukraine, the Japanese government says. Talks to be held on sidelines of NATO ministerial meeting. Japanese Foreign Minister Yoshimasa Hayashi to depart Tokyo Wed. to attend. (BBG)

RUSSIA: The U.S. will press for Russia’s suspension from the UN Human Rights Council amid mounting evidence that its forces are committing war crimes in Ukraine, U.S. Ambassador to the United Nations Linda Thomas-Greenfield told Romanian Prime Minister Nicolae Ciuca, according to a statement from her office. Thomas-Greenfield later said she would raise the issue of atrocities at the UN Security Council on Tuesday. (BBG)

RUSSIA: Germany is expelling 40 staff members of the Russian embassy in Berlin with suspected links to Russian spy agencies as a first response to the alleged killing of Ukrainian civilians by Russian soldiers in Bucha. In a statement, Foreign Minister Annalena Baerbock said the German government decided to declare as persona non grata “a significant number of members of the Russian Embassy who have worked every day against our freedom and against the cohesion of our society here in Germany.” (BBG)

RUSSIA: France has expelled 35 Russian diplomats following alleged atrocities committed against civilians in Bucha, two French foreign ministry officials said. The officials under diplomatic status were holding activities “contrary to our security interests,” according to a statement. Deputy Foreign Minister Alexander Grushko said Russia will respond to the expulsions, Interfax reported. (BBG)

RUSSIA: The U.S. Treasury has halted dollar debt payments from Russian government accounts at U.S. banks, increasing pressure on Moscow to find alternative funding sources to pay bond investors. The move is designed to force Russia into choosing among three unappealing options -- draining dollar reserves held in its own country, spending new revenue, or going into default, said a spokesperson for the Treasury’s Office of Foreign Assets Control who discussed details of the decision on condition of anonymity. The change comes as a payment on the country’s sovereign debt was due Monday and is intended to further ratchet up pressure on Russian President Vladimir Putin to end his invasion of Ukraine. It follows accusations over the weekend that Russian troops massacred civilians in Bucha and other Ukrainian (BBG)

RUSSIA: Russian banking sector liquidity is gradually stabilizing, allowing the central bank to abandon daily fine-tuning repo and deposit auctions and to return to normal weekly auctions from April 6, the central bank said in a statement on its website. Given banks’ continued refinancing needs, Bank of Russia will hold a one-week repo auction on April 5, with the amount offered to be set on the day, it said. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa declared an end to the state of disaster he declared more than two years ago to manage the coronavirus pandemic. Transitional measures, including the wearing of face masks at indoor public and limits on gatherings, will remain in place until new regulations are promulgated next month, Ramaphosa said in a speech broadcast on state radio on Monday. The announcement enables all economic activity to continue as normal. “The end of the state of disaster is a firm commitment to rebuild our economy even while the coronavirus exists among us,” he said. (BBG)

IRAN: The United States still believes there is an opportunity to overcome the remaining differences with Iran in talks over its nuclear program, State Department spokesman Ned Price said on Monday. (RTRS)

METALS: JPMorgan Chase & Co. is reviewing its business with some commodity clients after last month’s nickel short squeeze, a move that threatens to drain more liquidity out of the sector. Senior management at JPMorgan has asked teams around the world to conduct fresh due diligence on some existing clients, including metals traders and oil refiners, according to people familiar with the situation. Risk assessments are also being conducted on certain financing functions, said the people, who asked not to be identified as the information is private. The U.S. bank is one of the largest players in global commodity markets and the biggest in metals by far. It was also a central participant in the nickel price spike that rocked the London Metal Exchange last month, as the biggest counterparty of Tsingshan Holding Group Co., the world’s largest producer of the metal that’s at the center of the squeeze. (BBG)

ENERGY: Italy should wrap up its first deals to get more gas from suppliers to replace flows from Russia in the next week or so, Ecology Transition Minister Roberto Cingolani said on Monday. "A series of talks are under way ... in the next few weeks we will close the first agreements," Cingolani said in an online conference. The minister said Italy expected to get an extra 10 billion cubic metres (bcm) of gas from pipelines to Algeria, Libya and Azerbaijan this year. That number should be more than 20 bcm when these new flows become fully operative in the period to 2024. (RTRS)

OIL: The International Energy Agency (IEA) is still examining details of a planned second round of the coordinated release of oil reserves, Japanese industry minister Koichi Hagiuda said on Tuesday. Japan aims to make a decision on its release plan swiftly after receiving official notification from the IEA to make the cooperative action effective, Hagiuda told a news conference. (RTRS)

OIL: Trafigura offered Urals for April 20-24 at Dated -$34.80 on Platts, according to a trader monitoring the window. That’s a wider discount than when Litasco was offering at -$31.35 last month. (BBG)

OIL: Canadian oil producer Cenovus Energy Inc. became the latest driller to abandon the practice of securing protection against a sudden drop in crude prices, saying it posted a hedging loss in the first quarter. Oil prices have skyrocketed to more than $100 a barrel as inventories around the world drained amid a demand rebound and Russia’s invasion of Ukraine added to supply worries. As balance sheets improve and oil prices surge, the cost to insure against a collapse in prices --known as hedging -- has climbed, prompting many to stay on the sidelines. Those who did hedge find their deals increasingly underwater. Cenovus said its realized losses on all risk management positions for the three months ending March 31 are expected to be about C$970 million ($776 million) and losses for the current quarter to be about C$410 million, according to a statement Monday. “Given the strength of Cenovus’s balance sheet and liquidity position, the company has determined these programs are no longer required to support financial resilience,” Cenovus said. (BBG)

CHINA

CORONAVIRUS: Shanghai reported more than 13,000 daily Covid cases for the first time, as a sweeping lockdown of its 25 million residents and mass testing uncovered extensive spread of the highly infectious omicron variant. The Chinese financial hub registered 13,354 local cases for Monday, up from 9,006 a day earlier and from near zero at the start of March, according to a local government statement. Of the total, 13,086 were asymptomatic infections. More than 12,600 cases were found among people in quarantine while the rest were uncovered during checks on high-risk groups. China reported 16,412 local infections for Monday, including 1,173 symptomatic cases, the National Health Commission said in a statement. That means Shanghai accounted for more than 80% of the nationwide tally. (BBG)

PROPERTY: China Evergrande Group agreed to pay the adviser fees of a bondholder group working with the cash-starved property developer to restructure debt, and to share more information with the creditors, according to people with knowledge of the agreement, who asked not to be named discussing private deal talks. The creditors, advised by Moelis & Co. and Kirkland & Ellis, began to prepare for negotiations in October, after Evergrande delayed interest payments on one of its offshore bonds and reported that certain asset-sale plans had collapsed. A representative for Houlihan Lokey Inc., which is advising the company, declined to comment. Representatives for the bondholder group didn’t return requests for comment. (BBG)

OVERNIGHT DATA

JAPAN FEB LABOUR CASH EARNINGS +1.2% Y/Y; MEDIAN +0.6%; JAN +1.1%

JAPAN FEB REAL CASH EARNINGS +0.0% Y/Y; MEDIAN -0.7%; JAN +0.5%

JAPAN FEB HOUSEHOLD SPENDING +1.1% Y/Y; MEDIAN +2.7%; JAN +6.9%

JAPAN MAR, F JIBUN BANK JAPAN SERVICES PMI 49.4; FLASH 48.7

JAPAN MAR, F JIBUN BANK JAPAN COMPOSITE PMI 50.3; FLASH 49.3

"The Japanese services economy signalled that demand conditions moved back towards expansion territory at the end of the first quarter following the broad easing of COVID-19 restrictions. Latest PMI data indicated the softest fall in business activity in the current three month sequence of decline, while firms noted a renewed rise in new orders. Panel members commented that the lifting of quasi-state of emergency measures had boosted sales."Despite increasing demand, confidence in the year-ahead outlook dampened following the resurgence of the virus in China and the outbreak of war in Ukraine. Firms reported the softest rise in positive sentiment in seven months as a result. "Overall private sector activity returned to growth territory for the first time since last December. A renewed rise in manufacturing output and growth in aggregate new orders contributed to the slight expansion. This was led by domestic demand, as new export orders fell at the sharpest pace for 18 months."Japanese private sector firms pointed to prominent rises in cost pressures in March, with average input prices rising at the fastest pace since August 2008. However, downside risks to the economy rose and dampened the outlook for output in the year-ahead. The degree of optimism reached a seven-month low amid concerns about a return to restrictions if cases rise and the RussiaUkraine war. This is in line with the current projection that the Japanese economy will grow 2.5% this year. (IHS Markit)

AUSTRALIA MAR, F S&P GLOBAL AUSTRALIA SERVICES PMI 55.6; FLASH 57.9

AUSTRALIA MAR, F S&P GLOBAL AUSTRALIA COMPOSITE PMI 55.1; FLASH 57.1

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 93.4; PREV 91.1

Inflation expectations (IE) dropped 0.6ppt last week to 5.8%, as petrol prices dropped sharply. We think this explains much of the lift in sentiment, though the focus on relieving cost of living pressures in the Federal Budget may also have played a part. The fall in petrol prices is likely due to lagged effects of the drop in crude prices since 8 March which have declined by nearly 20% since then. The cut to petrol excise announced in the Budget may, depending on volatile oil prices, see petrol prices drop further in the coming weeks. This could potentially lower IE and lift consumer sentiment further. (ANZ)

SOUTH KOREA MAR CPI +4.1% Y/Y; MEDIAN +4.0%; FEB +3.7%

SOUTH KOREA MAR CPI +0.7% M/M; MEDIAN +0.6%; FEB +0.6%

SOUTH KOREA MAR CORE CPI +3.3% Y/Y; MEDIAN +3.3%; FEB +3.2%

SOUTH KOREA MAR FOREIGN RESERVES $457.81BN; FEB $461.77BN

MARKETS

SNAPSHOT: Tsy Blocks Russia $ Debt Payment At U.S. FIs, RBA No Longer Patient

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 50.76 points at 27787.95

- ASX 200 up 9.968 points at 7523.7

- Shanghai Comp. is closed

- JGB 10-Yr future up 6 ticks at 149.82, yield down 0.8bp at 0.206%

- Aussie 10-Yr future down 1.0 tick at 97.095, yield up 0.7bp at 2.844%

- U.S. 10-Yr future -0-01+ at 122-01+, yield up 1.85bp at 2.416%

- WTI crude up $1.21 at $104.47, Gold down $4.12 at $1928.39

- USD/JPY down 27 pips at Y122.52

- TREASURY STOPS RUSSIA FROM PAYING DEBT THROUGH ITS U.S. ACCOUNTS (BBG)

- RBA LOSES ITS ‘PATIENCE', SIGNALS RATE RISES COMING (AFR)

- BOJ'S KURODA CAUTIONS THAT RECENT YEN MOVES HAVE BEEN 'SOMEWHAT RAPID' (RTRS)

- ECB’S KNOT SAYS TIMELY NORMALISATION PREVENTS BOLDER STEPS LATER (BBG)

- DUTCH FINANCE CHIEF BACKS POSTPONING RETURN OF EU’S DEBT LIMITS (BBG)

US TSYS: A Little Cheaper & Steeper In Asia

Tsys have cheapened a touch overnight, initially on the back of a BBG sources piece which suggested that the U.S. Tsy’s move to block Russia US$-debt payment via U.S. banks doesn’t necessarily mean default (after the initial headlines on the matter provided a very modest bid), although that is listed as one of the potential aims of the move, with other options available to Russia including a drain of US$ reserves held in Russia or spending freshly acquired revenue, per the source report.

- Impetus from a hawkish RBA decision in Australia also played into the weakness ahead of European hours, with the curve steepening in both twist and bear manners during Asia-Pac dealing, as regional participants reacted to Monday’s NY session.

- Also note that WTI & Brent futures are off best levels of the session, but still over a $1/bbl firmer on the day.

- TYM2 is -0-03 at 122-00, 0-02+ off the base of its 0-12+ range, while cash Tsys are 1.0-2.5bp cheaper across the curve, bear flattening (As mentioned).

- Flow was headlined by a screen lift of the of the EDK2 98.3750/.3125 put spreads (+10K over a few clips)

- NY hours will be headlined by the latest ISM services survey, in addition to Fedspeak from Vice Chair Brainard, NY Fed President Williams & San Francisco Fed President Daly (’24 voter).

JGBS: Twisting Steeper, 10-Year Supply Goes Well

A very modest bid in U.S. Tsys provided some early support for most of the JGB curve, as did comments from BoJ Governor Kuroda, as he went to great lengths to reaffirm the Bank’s ultra-loose policy stance, commitment to YCC and warned that recent run of weakness in the JPY had been “somewhat rapid.”

- The pullback from best levels, and eventual weakness, in wider core FI markets saw the space away from best levels in the afternoon.

- 10-Year JGB supply passed smoothly, with the low price matching expectations, tail holding narrow and cover ratio moving to the highest level observed at a 10-Year auction since Nov ’20, aided by the BoJ’s recent actions re: YCC enforcement.

- The latest round of local data (household spending and wages) was mixed, and failed to provide any impetus for the space.

- The curve has twist steepened on the day, with 10s providing the firmest point on the curve, both pre- and post-auction, with the curve perhaps operating in sympathy to the U.S. Tsy twist steepening on Monday, albeit with a longer dated pivot point. 10s are ~1bp richer on the day with 30s & 40s 1.5 & 2.5bp cheaper respectively. Futures are +7 ahead of the bell.

JGBS AUCTION: Japanese MOF sells Y2.1769tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1769tn 10-Year JGBs:

- Average Yield 0.201% (prev. 0.179%)

- Average Price 99.99 (prev. 99.23)

- High Yield: 0.203% (prev. 0.180%)

- Low Price 99.97 (prev. 99.22)

- % Allotted At High Yield: 80.3585% (prev. 57.0000%)

- Bid/Cover: 3.611x (prev. 3.235x)

AUSSIE BONDS: RBA No Longer Patient

The RBA’s removal of the reference to patience in its post-meeting guidance paragraph and focus on upside risks to inflation provided a hawkish read when it came to the post-monetary policy meeting statement. Those matters, coupled with the Bank’s expectations for a continued tightening of the labour market and removal of the phrasing surrounding uncertainty when it comes to the Russia-Ukraine conflict have pressured the ACGB space.

- The Bank’s June meeting is now a very live affair (short-end rate markets had suggested that was the case for some time), with the Bank’s mention of data re: inflation and labour costs in the upcoming months meaning that June is a more probable lift off point than May. May’s (pre-Q122 WPI) SoMP seemingly provided the perfect staging post for guidance re: future action as it comes after the release of Q122 CPI data.

- ~25bp of tightening is priced for the Bank’s June meeting, up a touch vs. pre-RBA levels, but within the realms of what we have seen in recent sessions.

- The degree of futures curve flattening hasn’t really altered, although the move is now bearish in nature, not bullish, with all of the post-settlement gains now reversed and more. YM -6.5 & XM -4.5 at typing. EFPs are comfortably wider on the day, with the 3-/10-Year box flattening, while the IR strip runs 8-14 ticks lower through the reds.

- Pre-RBA trade was dominated by (limited) moves in wider core FI markets.

EQUITIES: Mixed In Asia

Most Asia-Pac equity indices are mixed at writing, with Chinese and Hong Kong markets remaining shut for the Qingming national holiday. Tech-related names across the region outperformed following Wall St’s tech-focused rally on Monday, countering broader weakness seen in other sectors.

- The Australian ASX200 trades 0.1% higher at typing, back from best levels after the RBA provided a hawkish jolt to the market in its monetary policy decision. Materials and healthcare stocks struggled, while energy and utilities sub-indices outperformed as major crude benchmarks have slightly extended gains in Asia. Technology names broadly rallied as well, with the S&P/ASX All Technology Index dealing 2.0% firmer at writing.

- The Nikkei 225 sits 0.1% better off at writing, having oscillated between gains and losses in Asian hours after opening 0.8% higher. Major export-related names such as Rakuten Group (+5.3%) are mostly higher despite the yen catching a bid, while utilities and financials equities underperformed. The overall move lower in the Nikkei comes as household spending data missed expectations earlier in Asia-Pac dealing, representing two straight months of declines and adding to worry from some quarters re: Q1 economic growth.

- U.S. e-mini equity index futures sit 0.1% weaker apiece, operating a touch below Monday’s best levels at typing.

OIL: Higher As Potential Sanctions On Russian Energy In Focus

WTI and Brent deal ~$1.30 firmer at writing apiece, back from session highs, but operating above Monday’s best levels. Major crude benchmarks have caught a bid as well-documented debate re: the potential for European sanctions on Russian energy exports in response to alleged war crimes in Ukraine, continues to do the rounds in Asia,

- Worry re: Chinese energy demand remains elevated as national case counts have reached levels last witnessed in early ‘20. The lockdown in Shanghai has been extended past its initial Tuesday expiry as total infections continue to rise (asymptomatic and symptomatic), with the case count for Apr 4 suggesting that the city now accounts for >80% of the nationwide total (13.3K in Shanghai vs. 16.4K nationwide).

- Keeping within the country, a note that the Chinese transport ministry on Sunday had earlier forecast sharp declines in road traffic and flights over the ongoing Qingming national holiday, due in part to an expansion of pandemic control measures across the country.

- Elsewhere, details on the next coordinated release of crude from the strategic reserves of International Energy Agency (IEA) member countries are due “early this week”, specifically on its “size and timing”.

GOLD: Lower In Asia

Gold deals $4/oz softer to print $1,928/oz at typing, backing away from Monday’s best levels and operating just above session lows as the USD (DXY) continues to hover around one-week highs.

- To recap, the precious metal closed ~$6/oz firmer on Monday despite an uptick in the DXY, with the move higher coming as the west (particularly the EU) has highlighted that they are preparing more sanctions on Russia over alleged war crimes in Ukraine.

- To elaborate, the EU has said it would “significantly tighten” sanctions on Russia. While a full energy product ban still appears unlikely, participants may be watching for progress towards a partial embargo, with German Finance Minister Lindner proposing a more limited ban on Russian coal and oil as “gas cannot be substituted in the short term.”, echoing similar remarks made by French President Macron earlier on Monday.

- Elsewhere, OIS markets now price in a cumulative ~219bp of Fed tightening for the rest of calendar ‘22, with focus turning to Wednesday’s FOMC minutes (1800 GMT).

- From a technical perspective, previously defined resistance levels continue to hold for bullion. Support is located at $1,890.2/oz (Mar 29 low), while resistance is seen at $1,966.1/oz (Mar 24 high).

FOREX: Inflation Tests RBA Patience, Kuroda Calls Yen Moves "Somewhat Rapid"

The yen regained poise in quiet Asia-Pacific trade, with market closures in China, Hong Kong and Taiwan weighing on activity. The choir of Japan's top economic officials pointing to the importance of stability in FX markets was joined by BoJ Governor Kuroda, who called yen moves "somewhat rapid". The first clear indication of the BoJ's discomfort with the yen's recent downswing lent support to the Japanese currency, even as Kuroda-san reiterated that currency weakness is net positive for domestic economy.

- The RBA provided a hawkish surprise in its monetary policy decision, despite keeping the cash rate unchanged this time. The Monetary Board dropped the reference to "patience" in its interest rate outlook, setting the scene for future tightening. The Aussie dollar surged as participants scanned the statement, with the kiwi benefitting from its strength to some extent.

- AUD/USD crossed above key resistance from Oct 28 high of $0.7556, which helped cap gains on Monday. The rate surged as high as to $0.7604 before stabilising near the $0.7600 mark.

- AUD/NZD took out Mar 29 high of NZ$1.0885 on its way to NZ$1.0902, its best level in a year. The pair last operates just shy of the NZ$1.0900 figure.

- Trade data from the U.S. and Canada as well as a slew of services PMI readings from across the globe take focus from here, alongside comments from Fed's Williams, Brainard & Daly.

FOREX OPTIONS: Expiries for Apr05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.0bln), $1.0915-25(E500mln), $1.1050-65(E671mln), $1.1095-10(E1.6bln)

- USD/JPY: Y122.00($656mln)

- GBP/USD: $1.3335-40(Gbp619mln)

- EUR/GBP: Gbp0.8390-00(E661mln), Gbp0.8460(E793mln)

- AUD/USD: $0.7300(A$1.6bln), $0.7500(A$1.1bln)

- USD/CAD: C$1.2510-25($599mln), C$1.2570-80($916mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | 0630/0830 | ** |  | SE | Services PMI |

| 05/04/2022 | 0645/0845 | * |  | FR | industrial production |

| 05/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.