-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Growth Matters Continue To Dominate In Asia

EXECUTIVE SUMMARY

- CHINA ACCELERATES SPECIAL BOND ISSUE TO BOOST GROWTH (SEC. DAILY)

- US PLANS ECONOMIC TALKS WITH TAIWAN IN LATEST CHALLENGE TO CHINA (BBG)

- RUSSIA FACES BIGGEST DEBT TEST YET AS US PAYMENT BAN CLOUDS PATH (BBG)

- WEST MULLS HAVING RUSSIAN OLIGARCHS BUY WAY OUT OF SANCTIONS (AP)

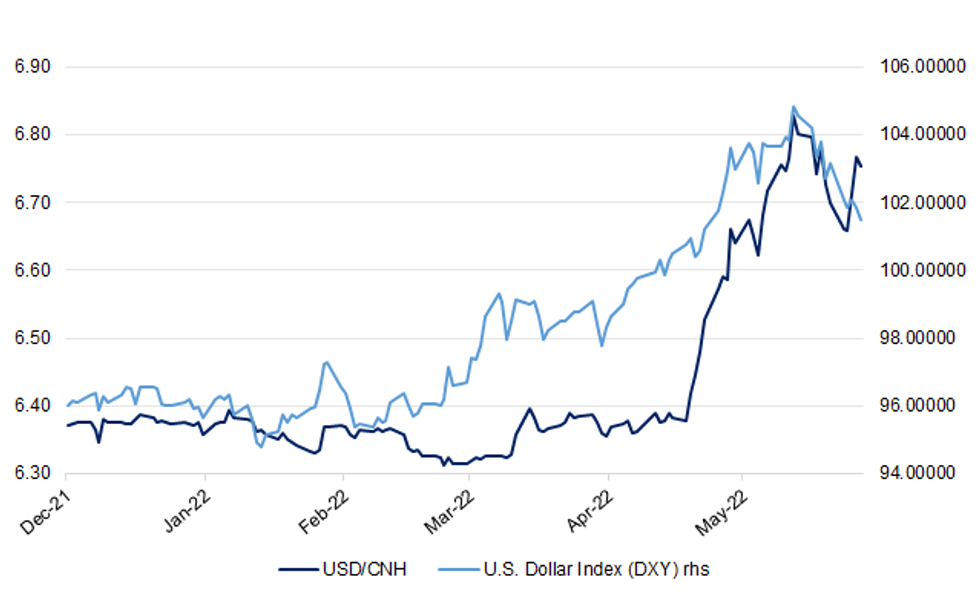

Fig. 1: USD/CNH Vs. U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The government will continue to come under pressure to help people facing high energy bills into next year, the Institute of Fiscal Studies has warned. The IFS said calls for help were likely to continue for "at least" another year if oil and gas prices do not fall. It comes after Chancellor Rishi Sunak announced on Thursday that every UK household would get an energy bill discount of £400 this October. The government has insisted the support announced by Mr Sunak was "temporary". But analysts have forecast that energy bills will be even higher in spring 2023 than predicted for October. (BBC)

NORTHERN IRELAND: Northern Island’s Stormont assembly will be recalled next week in an effort to end political paralysis over post-Brexit trading arrangements for the region. Legislators will meet on Monday after nationalist party Sinn Féin, which won this month’s elections, lodged the petition to vote for a new speaker at the regional assembly. But Sir Jeffrey Donaldson, whose Democratic Unionist party is boycotting the legislature and power-sharing executive until its Brexit demands are met, dismissed the move as a “stunt”. (FT)

EUROPE

ITALY/BTPS: Italy plans to sell up to EU3 billion ($3.22 billion) of 1.1% bonds due April 1, 2027 in an auction on May 31. Italy plans to sell up to EU2.5 billion ($2.68 billion) of 2.5% bonds due Dec. 1, 2032 in an auction on May 31. Italy plans to sell up to EU1.25 billion ($1.34 billion) of floating bonds due Oct. 15, 2030 in an auction on May 31. (BBG)

RATINGS: Potential sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Fitch on Italy (current rating: BBB; Outlook Stable) & Sweden (current rating: AAA; Outlook Stable).

- Moody’s on Switzerland (current rating: AAA; Outlook Stable)

- DBRS Morningstar on Poland (current rating: A, Stable Trend)

OTHER

GLOBAL TRADE: The White House said on Thursday there were no talks being held about relaxing sanctions on Russia in order to get grain exports. Russian President Vladimir Putin and Italy's Prime Minister Mario Draghi on Thursday discussed ways to help ease the international food crisis, with the Kremlin saying this could be done only if the West lifts sanctions. (RTRS)

GLOBAL TRADE: Civil vessels may safely use the Azov Sea port of Mariupol in Ukraine as the danger from mines has been eliminated, the Russian defence ministry said on Thursday. It said a maritime humanitarian corridor was opened on Wednesday in the Azov Sea. Russia took full control of Mariupol last week when more than 2,400 Ukrainian fighters surrendered at the besieged Azovstal steelworks. (RTRS)

GLOBAL TRADE: Samsung Electronics notified part suppliers of 10% cut in smartphone production target for this year, Maeil Business Newspapers reports, citing an unidentified official at one of suppliers. Samsung to adjust the volume to 280m from initial target of 310m units. Samsung to reduce production target after demand weakened on high inflation and the ongoing war in Ukraine. (BBG)

GEOPOLITICS: China and the Solomon Islands reached a series of important consensuses after friendly, in-depth and productive communication on deepening bilateral mutually-beneficial cooperation, visiting Chinese State Councilor and Foreign Minister Wang Yi said Thursday. Wang expounded on the eight-point consensus at a joint press conference with Solomon Islands Foreign Minister Jeremiah Manele. Both sides agreed to jointly cement the political foundation of China-Solomon Islands relations, build the Belt and Road Initiative, implement the China-proposed Global Development Initiative, foster a secure and stable environment, promote connectivity, address climate change, enhance sub-national exchanges and safeguard the interests of developing countries. Wang stressed that China-Solomon Islands relations, which grow with the trend of the times in compliance with people's wishes, will surely flourish and embrace an even brighter future. (China News)

BOJ: Bank of Japan (BOJ) Governor Haruhiko Kuroda said on Friday the country's core consumer inflation will likely remain around the central bank's 2% target for 12 months unless energy prices drop sharply. But he told parliament that prices likely would not rise "sustainably and stably" unless accompanied by wage hikes, suggesting the recent increase in inflation alone would not lead to an immediate withdrawal of monetary stimulus. (RTRS)

JAPAN: Japan’s government is considering funding a planned increase in defense spending with so-called “bridge bonds,” Jiji reports, citing an unidentified official. While the bonds are effectively the same as regular debt, the government wants to make the maturity date shorter and clearly stipulate how they will be paid for to assuage concerns about the fiscal burden. (BBG)

JAPAN: Japan will assemble related cabinet ministers next week to discuss power crunches as some regions face the tightest energy supply in a decade this winter, public broadcaster NHK reported Thurs., without saying where it obtained the information. Expected to draw up steps including restarting idled thermal power plants, which will be a major constraint on the Tokyo area this summer

NEW ZEALAND: New Zealand's house prices are forecast to sink 9.0% this year as aggressive interest rate hikes take some heat out of the blazing housing market amid a worsening cost of living crisis, keeping potential buyers on the sidelines, a Reuters poll found. House prices have nearly doubled in the last seven years as investors have cashed in on near-zero interest rates and access to cheap loans. That has led to increased homelessness and fuelled inequality, making New Zealand's the most unaffordable housing market among developed nations. Although house prices have already started to come off their highs, they are still very far from returning to their pre-pandemic levels. The 9% decline predicted for this year in the latest Reuters poll of 11 property market analysts taken May 11-26 is much larger than the 0.8% fall predicted in a February poll. House prices are forecast to decline a further 2.0% in 2023. (RTRS)

NORTH KOREA: China and Russia vetoed on Thursday a U.S.-led push to impose more United Nations sanctions on North Korea over its renewed ballistic missile launches, publicly splitting the U.N. Security Council for the first time since it started punishing Pyongyang in 2006. The remaining 13 council members all voted in favor of the U.S.-drafted resolution that proposed banning tobacco and oil exports to North Korea, whose leader Kim Jong Un is a chain smoker. It would also blacklist the Lazarus hacking group which the United States says is tied to North Korea. (RTRS)

HONG KONG: Chief Executive-elect John Lee will depart for Beijing Saturday and return Tuesday, according to a Hong Kong government statement. Lee will receive the instrument of appointment from China’s central government. (BBG)

CANADA: MNI INTERVIEW: Used Car Quality Also Matters In Canada CPI Fix

- Statistics Canada will act much like any used car buyer next month when adding that product to the Consumer Price Index, looking not just at sticker prices but traits like mileage and models to ensure the inflation rate isn't thrown off by swings in the quality of vehicles on the market - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

TURKEY: Turkish military operations being carried out now and in the future on its southern borders do not target neighbours' sovereignty but are necessary for Turkey's security, the country's National Security Council said on Thursday. The statement, after a three-hour meeting, followed President Tayyip Erdogan's declaration on Monday that Ankara would soon launch new military operations on its southern borders to combat terrorist threats there. (RTRS)

TURKEY/RATINGS: Potential sovereign credit rating reviews of note scheduled for after hours on Friday include:

- Moody’s on Turkey (current rating: B2; Outlook Negative)

BRAZIL: Former Brazilian President Luiz Inacio Lula da Silva has seen his approval in the presidential race grow to 48% since March, according to a new survey by pollster Datafolha released on Thursday, putting him ahead of incumbent Jair Bolsonaro's 27%. (RTRS)

RUSSIA: The military situation in eastern Ukraine is even worse than people say it is and the country needs heavy weapons now to effectively fight Russia, Foreign Minister Dmytro Kuleba said on Thursday. Kuleba, taking part in a live question and answer session with Twitter users, also said peace talks with Russia were not really taking place. (RTRS)

RUSSIA: Russian Foreign Minister Sergei Lavrov has warned the West that supplying weapons to Ukraine capable of hitting Russian territory would be "a serious step towards unacceptable escalation", Tass news agency said on Thursday. Lavrov told the RT Arabic channel that he hoped sane people in the West would understand this, adding "There are still a few left there", RIA quoted him as saying. (RTRS)

RUSSIA: The Biden administration is preparing to step up the kind of weaponry it is offering Ukraine by sending advanced, long-range rocket systems that are now the top request from Ukrainian officials, multiple officials say. The administration is leaning toward sending the systems as part of a larger package of military and security assistance to Ukraine, which could be announced as soon as next week. Senior Ukrainian officials, including President Volodymyr Zelensky, have pleaded in recent weeks for the US and its allies to provide the Multiple Launch Rocket System, or MLRS. The US-made weapon systems can fire a barrage of rockets hundreds of kilometers — much farther than any of the systems Ukraine already has — which the Ukrainians argue could be a gamechanger in their war against Russia. (CNN)

RUSSIA: The path for Russia to keep sidestepping its first foreign default in a century is turning more onerous as another coupon comes due on the warring nation’s debt. Investors are supposed to receive about $100 million worth of interest on Russian foreign debt in their accounts by Friday, payments that President Vladimir Putin’s government says it has already made. That’s unlikely to satiate concerned bondholders who are itching to see the cash after the US Treasury closed a loophole that previously allowed US banks and individuals to accept such payments. It’s the latest twist in a debt saga that has dragged on for months as the war in Ukraine and sanctions complicate the flow of cash from Russia to holders of its foreign debt. If Russia’s obligations aren’t fulfilled, a 30-day grace period ensues. “We are in uncharted waters,” said Ehsan Khoman, head of emerging market research at MUFG Bank Ltd. in Dubai. “All eyes are now on May 27.” (BBG)

RUSSIA: The White House said on Thursday it expects minimal impact on the U.S. and global economy from a Russia debt default. "We expect the impact on the U.S. and the global economy to be minimal, given Russia has already been isolated financially," White House spokesperson Karine Jean-Pierre said in a press briefing on Thursday. The United States pushed Russia closer to the brink of a historic debt default on Wednesday by not extending its license to pay bondholders, as Washington ramps up pressure following Russia's actions in Ukraine. (RTRS)

RUSSIA: Western allies are considering whether to allow Russian oligarchs to buy their way out of sanctions and using the money to rebuild Ukraine, according to government officials familiar with the matter. Canadian Deputy Prime Minister and Finance Minister Chrystia Freeland proposed the idea at a G-7 finance ministers' meeting in Germany last week. Freeland raised the issue after oligarchs spoke to her about it, one official said. The Canadian minister knows some Russian oligarchs from her time as a journalist in Moscow. The official said the Ukrainians were aware of the discussions. The official said it's also in the West’s interests to have prominent oligarchs dissociate themselves from Russian President Vladimir Putin while at the same time providing funding for Ukraine. (AP)

RUSSIA: Russia's central bank said on Thursday it has extended the timeframe of mandatory foreign currency sales for export-focused companies to 120 working days. It also said the currency did not have to be sold if it was used to settle import contracts. (RTRS)

MIDDLE EAST: No meeting between Saudi and Iranian foreign ministers has been scheduled in the foreseeable future, an official from the Saudi foreign ministry said on Thursday, adding that some progress has been made in talks with Teheran but "it's not enough". Iran foreign minister Hossein Amir-Abdollahian said earlier on Thursday that he may meet his Saudi counterpart soon in a third country. "Iran must build confidence for future cooperation, and there are several issues that can be discussed with Teheran if it has the desire to de-escalate tensions in the region," the official told Reuters. (RTRS)

ENERGY: Europe is hitting roadblocks as it tries to find alternatives to Russian gas in the Middle East and North Africa, as talks with big producers like Qatar, Algeria and Libya have become complicated. The issues that have snarled negotiations range from the pricing of Qatari gas to stability in Libya and the politics of Western Sahara, a disputed North African territory. The challenges mark another indication that Europe will struggle to fully replace energy from Russia, which supplies 38% of the continent’s natural gas. (WSJ)

ENERGY: Italian Premier Mario Draghi on Thursday called Russian President Vladimir Putin over the Ukraine war, the Kremlin said, according to TASS. Putin told Draghi that Russia will ensure an uninterrupted supply of gas to Italy, the Kremlin said. (ANSA)

OIL: Hungary needs 3-1/2 to 4 years to shift away from Russian crude and make huge investments to adjust its economy and until there is a deal on all issues, it cannot back the EU’s proposed oil embargo, a top Hungarian aide said on Thursday. Prime Minister Viktor Orban’s chief of staff, Gergely Gulyas told Reuters it was not the transition period which was the biggest problem standing in the way of an agreement. The European Commission this month proposed new sanctions against Russia for invading Ukraine but they require the unanimous support of all 27 EU member states and landlocked Hungary, which is heavily reliant on Russian oil imports via a pipeline, has been blocking them. (RTRS)

OIL: A record volume of Russian oil is on board tankers, with most of that heading to India or China as other nations restrict imports because of the war in Ukraine. Between 74 million and 79 million barrels from the OPEC+ producer were in transit and floating storage over the past week, more than double the 27 million barrels just before the February invasion of Ukraine, according to Kpler. Asia overtook Europe as the largest buyer for the first time last month, and that gap is set to widen in May, according to the data and analytics company. (BBG)

OIL: The Biden administration is reaching out to the oil industry to inquire about restarting shuttered refineries, as the White House scrambles to address record high- gasoline prices that are setting off political alarm bells ahead of the midterm elections. Members of the National Economic Council and other officials have inquired within the industry about factors that led some refining operations to be curtailed and if plans are underway to restart capacity, a person familiar with the matter said. The person, who wasn’t authorized to speak on the record, added no direct ask to restart operations was made. The White House didn’t immediately respond to a request for comment. (BBG)

OIL: The U.S. Treasury Department is expected to renew as soon as Friday Chevron Corp's license to operate in Venezuela under similarly, restricted terms of its existing authorization, according to two people familiar with the matter. Chevron existing license will expire on June 1 if not renewed earlier. The document allows it to preserve its oil and gas assets in the U.S.-sanctioned country. (RTRS)

CHINA

POLICY: China should widen its level of support to more groups because those who are able to benefit from the current tax cuts and car purchase subsidies are not the groups most in need of a bailout, Yicai.com reported citing Huang Yiping, a former adviser to the People’s Bank of China. China may consider issuing special treasury bonds to support the economic activities of the difficult groups, Huang was cited as saying. Some analysts expect Q3 may be an important window for launching the issuance of these bonds with an expected scale between CNY1-2 trillion, the newspaper said. (MNI)

FISCAL: Local governments in China are accelerating special bond issuance to boost infrastructure investment and shore up the economy, with new issues in May expected to reach the highest this year, according to a Securities Daily report Friday. Special bonds issued by local governments had reached 1.82 trillion yuan as of May 26 this year, including 418.2 billion yuan offered this month, the report said, citing data from Choice data platform. Based on bond issuing plans released by local governments, total special bond offer by local governments is expected to reach 2.03 trillion yuan in the first five months, including 632 billion yuan in May. An acceleration in issuance of special bonds sends a strong signal that the authorities are seeking to stabilize investment and growth, Zhang Yiqun, an official at China Fiscal Policy Society, was quoted as saying. (BBG)

CREDIT: Banks are under great pressure to increase loans to small businesses amid weak demand despite regulators’ repeated calls to boost credit support to SMEs, the 21st Century Business Herald reported. Big banks have cut SME loan interest rates to around 3.5%, much lower than the average 5% released by the central bank, the newspaper said citing a bank worker in Shanghai. Companies have reduced borrowing and production sizes amid the economic downturn, while unsustainable businesses in need of loans fail to get approval from banks’ risk control department, the newspaper cited another bank worker. (MNI)

PROPERTY: Shanghai plans to resume trading in its land market from June 1, and the proportion of funds that developers must seal up in supervised accounts has been reduced to lure buyers, the Shanghai Securities News reported. The restart of the land market is an important signal as the city is actively promoting the resumption of work after near two-month lockdown to curb the spread of Covid-19, the newspaper said. Some local state-owned developers have shown enthusiasm towards the land auction and targeted several plots, the newspaper added. (MNI)

PROPERTY/CREDIT: Greenland Holdings Corp., China’s 11th- largest builder, is seeking investor approval for a possible bond-repayment extension, triggering fresh concerns about its financial health. The Shanghai-based real estate firm has asked holders of a $488 million dollar note due June 25 to approve certain amendments and waivers that include a maturity extension, according to a filing to the Hong Kong stock exchange Friday. Fears over a possible extension had triggered record drops in the firm’s imminently maturing notes the previous day. Greenland, which has a presence in 30 countries, is the latest property firm to show signs of rising stress as developers deal with a record wave of defaults. The company was previously seen as relatively immune to the clampdown on China’s debt-saddled real estate sector, in part because it’s viewed as a quasi state-owned enterprise. Builders have been scrambling to extend deadlines or exchange maturing notes to avoid an outright default as key channels of funding remain closed off to many builders. (BBG)

CORONAVIRUS: Shanghai stepped up mass tests across the city, ordering more residents to undergo nucleic acid screening for the Omicron variant of Covid-19, as the city begins a countdown to end the two-month citywide lockdown on June 1. Daily new infections fell 21.9 per cent to 264 cases in the past 24 hours, the sixth day of declines, according to data released on Friday. Cases showing symptoms dipped 6.2 per cent to 45, the third day that the number stayed below 50. One patient died, unchanged from a day earlier. Local authorities are not letting up their vigilance, with Pudong’s district government ordering all 5.7 million residents within their jurisdiction to test for Covid-19 on Friday. The 1,200-square kilometre area east of the Huangpu River is home to the Shanghai Stock Exchange, Walt Disney’s Shanghai Disneyland resort, Tesla’s Gigafactory3 and the treasury operation of almost every bank in China. (SCMP)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7650% at 10:32 am local time from the close of 1.6686% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday, flat from the close of Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7387 FRI VS 6.6766

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7387 on Friday, compared with 6.6766 set on Thursday.

OVERNIGHT DATA

CHINA APR INDUSTRIAL PROFITS -8.5% Y/Y

CHINA APR INDUSTRIAL PROFITS YTD +3.5% Y/Y; MAR +8.5%

JAPAN MAY TOKYO CPI +2.4% Y/Y; MEDIAN +2.5%; APR +2.4%

JAPAN MAY TOKYO CORE CPI +1.9% Y/Y; MEDIAN +2.0%; APR +1.9%

JAPAN MAY TOKYO CORE-CORE CPI +0.9% Y/Y; MEDIAN +0.9%; APR +0.8%

AUSTRALIA APR RETAIL SALES +0.9% M/M; MEDIAN +1.0%; MAR +1.6%

NEW ZEALAND MAY ANZ CONSUMER CONFIDENCE 82.3; APR 84.4

NEW ZEALAND MAY ANZ CONSUMER CONFIDENCE -2.5% M/M; APR +8.3%

Consumer confidence fell 2 points in May to 82.3, above its record low of 77.9 in March, but still dire. The proportion of people who believe it is a good time to buy a major household item, the best indicator for spending, fell 7 points to -30. In welcome news for the RBNZ, inflation expectations fell from 5.6% to 5.1%. (ANZ)

MARKETS

SNAPSHOT: China Growth Matters Continue To Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 184.06 points at 26788.9

- ASX 200 up 76.221 points at 7182.1

- Shanghai Comp. up 16.334 points at 3139.442

- JGB 10-Yr future up 3 ticks at 149.95, yield down 1bp at 0.230%

- Aussie 10-Yr future down 6.0 ticks at 96.720, yield up 6.2bp at 3.265%

- U.S. 10-Yr future +0-01 at 120-08, yield up 0.18bp at 2.749%

- WTI crude up $0.08 at $114.17, Gold up $3.06 at $1853.69

- USD/JPY down 26 pips at Y126.86

- CHINA ACCELERATES SPECIAL BOND ISSUE TO BOOST GROWTH (SEC. DAILY)

- US PLANS ECONOMIC TALKS WITH TAIWAN IN LATEST CHALLENGE TO CHINA (BBG)

- RUSSIA FACES BIGGEST DEBT TEST YET AS US PAYMENT BAN CLOUDS PATH (BBG)

- WEST MULLS HAVING RUSSIAN OLIGARCHS BUY WAY OUT OF SANCTIONS (AP)

US TSYS: Tight Asia Trade

Friday provided a very limited round of Asia-Pac Tsy trade as participants assessed bid in Hong Kong equities, the latest round of credit stress in the Chinese property developer sphere and Sino-U.S. tensions after a BBG source report noted that “the US and Taiwan are planning to announce negotiations to deepen economic ties, people familiar with the matter said, in a fresh challenge to Beijing, which has cautioned Washington on its relationship with the island.”

- Ultimately, Tsys are little changed on the day, with TYU2 +0-01 at 120-08, sticking to a tight 0-07 range on light volume of 80K (~20K of which is roll related). Cash Tsys are flat to 1.5bp richer across the curve, with 2s outperforming.

- PCE & the final UoM survey reading headline the NY docket on Friday, with the Dallas Fed m’fing activity print also due.

- A quick reminder that the U.S. will observe the Memorial Day holiday on Monday, which will result in curtailed cash Tsy trade on Friday, in addition to a cash Tsy closure and shortened futures trade on Monday.

JGBS: Curve Bull Flattens On Touted Shorter-Dated “Bridge Bond” Focus

Marginally weaker than expected Tokyo CPI data, BoJ Governor Kuroda’s continued focus on generating sustainable wage growth and the aforementioned Sino-U.S. tensions re: Taiwan provided a modest bid for the JGB space during the Tokyo morning.

- The contract sits a touch off of best levels ahead of the close, +4, with a lack of meaningful catalysts apparent during afternoon trade.

- Still, the contract has more than reversed overnight session losses, while the wider cash curve bull flattened as the major benchmarks richened by 0.5-3.0bp. 20s outperformed after the sector led yesterday’s cheapening.

- The outperformance in the super long end was aided by reports that Japan is looking to finance its planned increase in defence spending via “bridge bonds,” with a focus on relatively short-term debt and clear stipulations re: financing methods in an effort to play down fiscal worries.

- Looking ahead, the latest round of BoJ Rinban operations headline the domestic docket on Monday.

JGBS AUCTION: Japanese MOF sells Y4.7714tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.7714tn 3-Month Bills:

- Average Yield -0.1050% (prev. -0.1210%)

- Average Price 100.0262 (prev. 100.0302)

- High Yield: -0.0982% (prev. -0.1162%)

- Low Price 100.0245 (prev. 100.0290)

- % Allotted At High Yield: 41.3273% (prev. 54.1000%)

- Bid/Cover: 2.589x (prev. 2.818x)

AUSSIE BONDS: Cheaper Ahead Of The Weekend

Aussie bonds drifted cheaper in early Sydney dealing and never looked like recovering, as futures added to overnight session losses, albeit while remaining in confined ranges. YM trades -4.0 & XM is -5.5 as we work towards the Sydney close. Super-long ACGBs are ~7bp cheaper on the day. EFPs are a touch wider, with a parallel shift in 3s and 10. Bills un 2-7bp cheaper through the reds.

- Retail sales growth slowed a touch in April when compared to March, although a virtually in line with expected headline M/M reading, coupled with the fact the print represented another record level of turnover, allowed some to focus on the relative strength of the Australian economy (which the RBA is relying on after recently embarking on a tightening cycle).

- The recent stabilisation in wider core FI markets, still elevated (in terms of recent history) outright yield levels & potential for cross-market demand vs. the likes of the U.S. Tsys seemingly combined to result in a firm round of ACGB Jun-31 supply. The weighted average yield printed 1.14bp through prevailing mids (per Yieldbroker), with the cover ratio printing at a very healthy level, just shy of 3.50x.

- The AOFM’s weekly issuance slate revealed a step up in note issuance, albeit to “only” A$2.0bn, while there will only be one ACGB auction next week, for an easily digestible A$1.0bn of ACGB Apr-25.

- GDP data (Wednesday) headlines the domestic docket next week, with the final round of partials due on Tuesday. We will also get private sector credit readings (Tuesday), CoreLogic house price data (Wednesday), the monthly trade balance print (Thursday) & housing finance data (Friday).

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 1 June it plans to sell A$1.0bn of the 3.25% 21 April 2025 Bond.

- On Thursday 2 June it plans to sell A$1.0bn of the 8 July 2022 Note & A$1.0bn of the 26 August 2022 Note.

EQUITIES: Hang Seng Outperforms On Tech Giant Beats

A positive start for Chinese & Hong Kong equities provided the highlight of Asia-Pac dealing.

The space benefitted from hope re: fresh policymaker support for the Chinese economy, news of accelerated special bond issuance from local Chinese governments during May and stronger than expected quarterly earnings data from a couple of the tech giants (Alibaba & Baidu). This allowed the Hang Seng to outperform on the day (last +2.8%), although Chinese & Hong Kong equities have ticked away from best levels, perhaps on the back of the latest round of credit stress surrounding the Chinese property developer space.

- The move higher in Chinese & Hong Kong equities allowed e-minis to find a bit of a base after they took a hit in the wake of a BBG source report noted that “the US and Taiwan are planning to announce negotiations to deepen economic ties, people familiar with the matter said, in a fresh challenge to Beijing, which has cautioned Washington on its relationship with the island.” Note that losses were modest, even at their extremes, with the 3 major contracts last 0.1% softer on the session.

- Friday’s bid in Asia-Pac equities came on the back of a positive Wall St. lead, with Thursday seeing the U.S. indices benefit from a better than expected quarterly earnings report from Macy’s, among other retailers (bucking the recent trend of disappointing reports out of the sector), and speculation surrounding a Fed tightening pause at some point in Q4.

OIL: Flat In Asia, U.S. Refined Product Demand/Scarcity & Russia Front & Centre

WTI and Brent crude futures are little changed on the day, with buoyant regional equity indices providing some cushion for crude during Asia-Pac dealing. This has allowed crude futures to consolidate Thursday’s $3.00+ gains, with continued worry surrounding tight U.S. refined product markets ahead of driving season and the bid in equity markets cited as the major drivers behind yesterday’s gains. Note that WTI is on course to lodge a fifth straight round of weekly gains based on current price levels.

- When it comes to tight U.S. product markets, BBG sources have reported that “the Biden administration is reaching out to the oil industry to inquire about restarting shuttered refineries, as the White House scrambles to address record high- gasoline prices that are setting off political alarm bells ahead of the midterm elections.”

- Elsewhere, the elongated EU discussions re: the next round of Russian sanctions continue to drag on. Thursday saw Hungary note that it needs 3 to 4 years to move away from Russian oil, with such a move requiring huge investment. A Hungarian official used an interview with RTRS to stress that any deal with the EU re: a Russian crude embargo must address all of the country’s concerns.

- When it comes to wider demand for Russian oil, Kpler has flagged a record level of Russian oil aboard tankers, with most of that cargo bound for India & China.

GOLD: Recovers Modestly

Gold is up slightly today, +0.20%, to be back close to $1854, but we remain comfortably within recent ranges.

- For the most part, Gold has followed broader USD sentiment today. The early dip below $1850 coincided with some USD strength but the DXY is now -0.30% below the NY closing level, hence the precious metal's recovery.

- Equity sentiment in the region has been strong, with HK and China related markets leading the move higher. This has likely capped Gold's rebound to degree from a risk sentiment standpoint. US equity futures are lower, but only slightly.

- US yields have edged down in the 2yr, but the 10yr has remained steady. The real US 10yr continued to ease overnight, down to 0.13%. This is likely to help keep a floor under gold demand. Dips back to $1840 are generating support.

FOREX: Greenback Offered Amid Better Sentiment, Aussie Rises Post-Retail Sales

Positive risk sentiment lingered on after a solid session on Wall Street, supported by an early bid in Chinese equities. Offshore yuan garnered some strength, which radiated across G10 FX space. The redback shrugged off a plunge in Chinese industrial profits amid hopes for more policymaker support, as local governments are accelerating special bond issuance to stabilise investment and growth.

- The greenback fell prey to better risk appetite and landed at the bottom of the G10 pile, as the dollar index (DXY) pulled back from a one-week high, even as U.S. e-mini futures slipped. Traditional safe havens JPY and CHF also faced headwinds.

- On recent yen moves, Japan PM Kishida said they have been driven by different factors and the government is focusing on easing the impact on households and businesses. He added that FX moves are expected to stabilise on the back of steps to avoid the outflow of funds from Japan.

- The Antipodeans set the pace for gainers in G10 FX space. AUD/USD climbed to a three-week high after Australia's retail sales rose 0.9% M/M (vs. BBG est. +1.0% M/M) to a fresh record in April, suggesting that household spending remains healthy despite rising costs of living.

- U.S. PCE, wholesale inventories and U. of Mich. Sentiment as well as comments from ECB's Lane take focus from here.

FX OPTIONS: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E2.9bln), $1.0525(E1.2bln), $1.0550(E1.5bln), $1.0570-75(E1.0bln), $1.0625-35(E2.4bln), $1.0650-60(E3.6bln), $1.0690-00(E1.5bln), $1.0750-65(E1.9bln)

- AUD/USD: $0.7165(A$804mln)

- USD/JPY: Y125.70-75($550mln), Y126.98-05($1.8bln), Y127.75($1.2bln)

- EUR/GBP: Gbp0.8450-60(E680mln), Gbp0.8650(E588mln)

- NZD/USD: $0.6475(N$553mln)

- USD/CAD: C$1.2750-70($1.1bln), C$1.2900-10($705mln)

- USD/CNY: Cny6.7250($780mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/05/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/05/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.