-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI EUROPEAN OPEN: Moderating Price Pressure Leaves China Room For Stimulus

EXECUTIVE SUMMARY

- CHINA INFLATION DATA SHOW PRICE PRESSURES MODERATING

- JAPAN MOF, BOJ, FSA OFFICIALS TO DISCUSS FINANCIAL MARKETS AT 4PM (BBG)

- TSY SEC YELLEN: U.S. RECESSION UNLIKELY, BUT NO DROP IN GASOLINE PRICES SOON (RTRS)

- BORIS JOHNSON FACES EUROSCEPTIC REVOLT OVER NORTHERN IRELAND PROTOCOL BILL (FT)

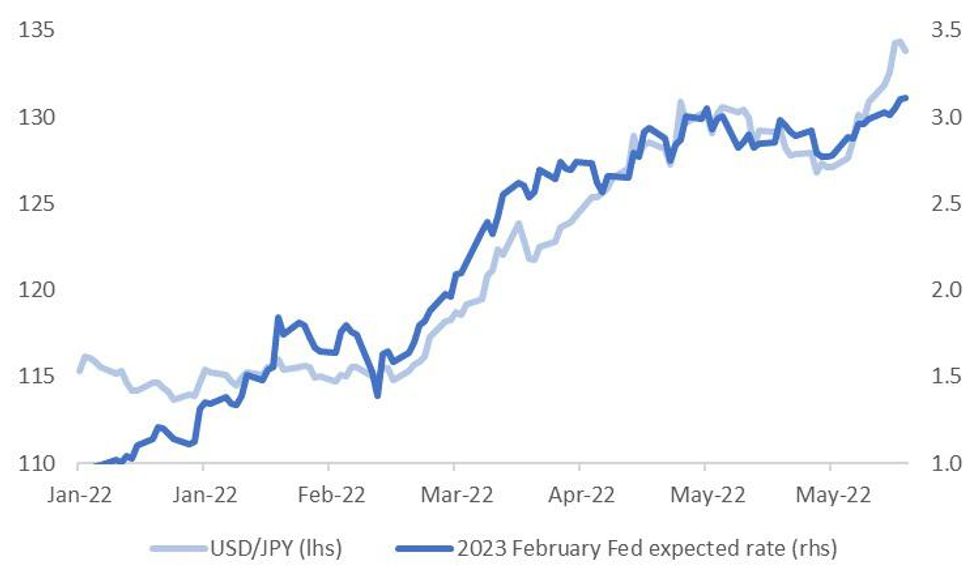

Fig. 1: USD/JPY & '23 Feb Fed Expected Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/BREXIT: Boris Johnson has been warned by Tory Eurosceptics that they will vote down his contentious bill to override the Northern Ireland protocol if it is watered down and does not fully “neutralise” the Brexit text. Liz Truss, UK foreign secretary, agreed to toughen up the bill after last- minute representations by the pro-Brexit European Research Group, leading to a fierce cabinet row on Wednesday. The legislation will be published next week. Johnson, backed by senior cabinet minister Michael Gove, criticised Truss for making the changes, arguing that it would raise tensions with Brussels and make a negotiated settlement with the EU impossible. (FT)

BREXIT: The EU’s position on the row over Northern Ireland Protocol has “hardened” in the face of the UK vow to unilaterally scrap part of the agreement, the Irish government has warned. (Independent)

ECONOMY: Rishi Sunak has been accused of squandering £11bn of taxpayers money by paying too much interest servicing the government’s debt. Calculations by the National Institute of Economic and Social Research, the oldest non-partisan economic research institute in the UK, show the losses stem from the chancellor’s failure to take out insurance against interest rate rises a year ago on almost £900bn of reserves created by the quantitative easing process. (FT)

ECONOMY: Boris Johnson took aim at his own government’s tariffs on imports of food that is not produced domestically, saying their removal could ease the UK’s cost-of-living crisis. But even his officials say otherwise. Yet Johnson’s own government has said cutting tariffs on food imports would have minimal impact on household finances. It’s a “tiny, tiny proportion, 0.4% on the cost of living,” Trade Secretary Anne-Marie Trevelyan said in April. (BBG)

ECONOMY: British employers added staff in May at the slowest pace since early 2021, according to a survey that adds to signs that the labour market is losing some of its heat. A measure of permanent staff hiring by accountants KPMG and the Recruitment and Employment Confederation (REC) fell for a sixth month to 59.2 from 59.8 in April, but remained well above the 50 threshold for growth. (RTRS)

ECONOMY: Proposals to overhaul the law to make it easier to prosecute companies and hold them to account for committing crimes have been put forward to the UK government by the independent agency that reviews legislation. The Law Commission submitted on Friday several possible options to reform the laws governing corporate criminal liability in England and Wales, including widening the scope for attributing criminal liability. (FT)

POLITICS/ECONOMY: Boris Johnson has raised the spectre of a 1970s-style “wage-price spiral” that could force the Bank of England to push up interest rates dramatically if workers demand to be compensated for rocketing prices. Instead the prime minister promised a return to lowering taxes, cutting government spending and slashing regulation, after a renewed push by backbench Conservative MPs. (Guardian)

POLITICS: Jeremy Hunt has warned that Boris Johnson’s policies risk being “overshadowed” by questions over his leadership, insisting it had been his “duty” to speak out against the prime minister. Hunt, one of the most senior Conservatives to turn against Johnson in Monday’s confidence vote, said he did not submit a letter to the 1922 Committee of Conservative backbenchers or encourage others to do so. (Times)

POLITICS: Boris Johnson could face the prospect of another no-confidence vote within a year after Graham Brady, chair of the 1922 Committee, refused to rule out changing the rules. (Guardian)

EUROPE

FRANCE: President Emmanuel Macron’s party and its allies would win 280-320 of the 577 seats in parliament in this month’s French legislative elections, according to poll published on Friday by Elabe for BFM TV, L’Express and SFR. Macron needs 289 seats to retain an absolute majority. Elabe projections show the Nupes grouping of France’s four largest left-wing parties winning 165-190 seats. (BBG)

FINLAND: Finland's government plans to amend border legislation to allow the building of barriers on its eastern frontier with Russia, it said on Thursday, in a move to strengthen preparedness against hybrid threats amid Russia's invasion of Ukraine. (RTRS)

ESTONIA: Estonian Prime Minister Kaja Kallas, who is fighting to stay in office after ending her governing coalition amid squabbling, said she may seek an early election if she fails to assemble a new majority in parliament. Kallas, who has seen her popularity soar in Estonia with her hard line against Russian President Vladimir Putin, is courting the Social Democrats and the conservative Pro Patria party to form a majority. Pro Patria, which hasn’t signaled whether it will be on board, is expected to make a decision on Saturday. (BBG)

UKRAINE: The European Union’s executive arm is expected to recommend next week that Ukraine be granted candidate status, a key step on the long path to EU membership, according to people familiar with the matter. The recommendation, which needs to be debated and adopted by the college of EU commissioners, would come with conditions linked to the rule of law and anti-corruption legislation, said the people who declined to be named on a confidential matter. (BBG)

UKRAINE: NATO Deputy Secretary General Mircea Geoane confirmed that Ukrainian President Volodymyr Zelensky would be invited to the Alliance's summit in Madrid. (European Pravda)

UKRAINE: Ukrainian forces claimed on Thursday to have pushed forward in intense street fighting in the eastern city of Sievierodonetsk, but said their only hope to turn the tide was more artillery to offset Russia's massive firepower. In the south, Ukraine's defence ministry said it had captured new ground in a counter-attack in Kherson province, targeting the biggest swathe of territory Russia has seized since its invasion in February. (RTRS)

U.S.

ECONOMY: U.S. Treasury Secretary Janet Yellen said on Thursday she did not expect the U.S. economy to tip into a recession, but growth would "absolutely" slow down and gasoline prices were unlikely to fall anytime soon. "I don't think we're (going to) have a recession. Consumer spending is very strong. Investment spending is solid," she told a New York Times Dealbook event. "I know people are very upset and rightly so about inflation, but there's nothing to suggest that a ... recession is in the works." (RTRS)

ECONOMY: Treasury Secretary Janet Yellen rejected the idea that corporate greed is causing the US inflation surge, differing with fellow Democrats who have accused big businesses of price gouging. “Demand and supply is largely driving inflation,” Yellen said at a New York Times hosted event on Thursday, when asked about the view that corporate greed is a key cause. She said that it’s true that price-to-cost margins have gone up, but she said that’s not what’s driving inflation. (BBG)

ECONOMY: Friday's consumer price data is likely to reflect the continued impact that Russia's invasion of Ukraine is having on food and energy prices, but U.S. goods and services inflation should moderate in the months ahead, a senior U.S. official said on Thursday. "Despite these disruptions, we continue to believe that the economy can and is transitioning from what has been a historic recovery to stable, steady growth with inflation pressures moderating," the official told reporters. The official said air fares, which were up more than 30% in the last months, were expected to increase quite significantly again, showing the spillover impact of higher energy prices on components of core inflation. (RTRS)

POLITICS: The Jan. 6 committee hearing on Thursday promised to prove former President Trump was responsible for the Jan. 6 Capitol attack. Driving the news: “President Trump summoned the mob, assembled the mob, and lit the flame,” Vice Chair Liz Cheney (R-Wyo.) said, before laying out a seven-point plan for how the panel will publicly show Trump tried to overturn the 2020 election and prevent the transition of power to President-elect Biden. (Axios)

OTHER

GEOPOLITICS: Turkish President Recep Tayyip Erdogan warned Greece against deploying forces on Greek islands in the Aegean Sea, after criticizing what he described as a growing US military presence in the country. “Turkey will not step back from using its rights if necessary and will not give up its rights in the Aegean under the international agreements,” Erdogan said Thursday at an annual military exercise on the Aegean coast. “I am not joking, I am speaking very seriously.” (BBG)

CORONAVIRUS: The World Health Organization said on Thursday its latest investigation into the origins of COVID-19 was inconclusive, largely because data from China is missing, another blow to its years-long effort to determine how the pandemic began. (RTRS)

JAPAN: Officials from Japan’s Finance Ministry, Bank of Japan and Financial Services Agency will meet at 4pm to discuss international financial markets, according to a notice from the ministry. Participants include Vice Finance Minister for International Affairs Masato Kanda, FSA Commissioner Junichi Nakajima and BOJ Executive Director Shinichi Uchida. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki repeats his usual comments on the yen as the currency nears its lowest level since 1998 versus the US dollar. Stability in foreign exchange rates is most important; watching fx moves and their impact on the economy with a sense of urgency. Aware of inflation’s impact on households via media reports. Need to watch downside risks of inflation on the economy such as lower purchasing power and weaker consumption. Suzuki also refrained from commenting on the possibility of currency intervention. (BBG)

JAPAN: Japan's business community issued a joint statement on Friday seeking further relaxation of border controls, as the country begins a gradual easing of COVID-19 travel restrictions. The statement by domestic business lobby Keidanren and foreign chambers of commerce urged further easing to "facilitate an environment where people, goods, money and digital technologies can move freely". (RTRS)

AUSTRALIA: Australia's New South Wales state on Friday said it would invest A$1.2 billion ($850 million) in new transmission lines over 10 years to speed up connections to the grid for new renewable energy projects as the state looks to shift to greener power. (RTRS)

AUSTRALIA: AGL Energy, Australia's top power producer, said on Friday it expects a unit down since April at one of its power stations will restart in late September, more than a month later than earlier flagged, worsening the country's power crisis. (RTRS)

BOK: Bank of Korea Governor Rhee Chang-yong says a rise in interest rates may increase difficulties for the vulnerable class in the short term, but if the timing is missed and inflation rises further, the damage could be even greater. (BBG)

SOUTH KOREA: South Korea's President Yoon Suk-yeol said on Friday labour conflicts should be handled by law and principle as thousands of truckers have been on a strike this week to protest the surge in fuel costs. Yoon told reporters the government should maintain neutrality and that he was not sure if it was appropriate for authorities to get involved in labour conflicts too much. (RTRS)

SOUTH KOREA: Striking South Korean truckers plan to stop shipments of chip raw materials produced in Ulsan, a union official told Reuters. They also plan to tell non-union truckers not to enter a petrochemical production complex in Ulsan, the official said. (RTRS)

HONG KONG: Hong Kong’s quarantine facilities are the fullest in more than three months after officials revived the Covid Zero tactic of mandatory centralized isolation to contain the spread of new sub-variants. More than 50 people -- close contacts of people who test positive for a sub-variant -- are in government-run facilities, with occupancy hitting the highest since February this month. The overall number is likely higher as the government doesn’t release figures for Penny’s Bay, the biggest isolation camp for confirmed Covid cases and close contacts. (BBG)

BOC: Canada unexpectedly canceled an ultra-long bond issuance, potentially terminating the maturity as a surge in revenue reduces the government’s borrowing needs. The Bank of Canada said Thursday that an auction of 2064 bonds on June 16 won’t happen, just as traders were waiting for more information on the sale. The decision reflects “Canada’s declining borrowing needs generally,” the bank said in market notice. (BBG)

BOC: Hot inflation is the Bank of Canada's primary focus as it raises interest rates, a senior central bank official told Reuters on Thursday, making it clear that the bank was willing to accept a housing market correction in order to curb consumer price gains. Senior Deputy Governor Carolyn Rogers, in an interview with Reuters, said higher interest rates will weigh on housing and highly-indepted Canadians, but are needed to curb inflation, which is running at a 31-year high of 6.8%. (RTRS)

BRAZIL: Brazil and the United States should forge closer ties after the two countries drifted apart for ideological reasons, Brazil's far-right President Jair Bolsonaro said on Thursday at a first official meeting with his U.S. counterpart Joe Biden. (RTRS)

BRAZIL: The stock offering for Brazil’s state-owned power company Eletrobras on Thursday raised at least 29.2 billion reais ($6 billion), becoming Latin America’s largest equity deal so far this year, according to people familiar with the matter. (BBG)

RUSSIA: The Kremlin is planning to annex the Donetsk, Luhansk, Kherson, and Zaporizhzhia regions of Ukraine and combine them into a single federal district within Russia, three sources close to the Putin administration told Meduza. “The district should appear after referendums on joining Russia are held in these territories. Ukrainian territories will not accede to existing districts [in Russia],” one of these sources explained. (Meduza)

RUSSIA: Kremlin-controlled authorities have sentenced to death two British citizens and a Moroccan national who all served in Ukraine’s military after a three-day show trial in which no evidence in their favor was presented. (Politico)

RUSSIA: By the end of this year, some Russian regions may face a significant increase in unemployment, according to analysts from the Center for Strategic Research (CSR). First of all, there is a threat to the subjects of the Russian Federation with a pronounced industrial structure of the economy. At the same time, according to experts, employers will more often use other tools to optimize the wage fund (PWF) — transferring employees to idle time or reducing the variable part of salaries. (Kommersant)

RUSSIA: President Vladimir Putin has canceled the requirement for Russian exporters to sell 50% of foreign exchange earnings. Now companies will have to sell foreign currency in the amount that will be determined by the government commission on foreign investment, and the terms of the sale will be set by the Bank of Russia, follows from a decree published on Thursday. (Vedomosti)

RUSSIA: US Treasury Secretary Janet Yellen said a plan to ban European and UK firms from insuring tanker shipments of Russian oil could help limit Moscow’s energy revenues as allied countries seek to curb revenues flowing to Moscow. “The UK is very likely to go along with such a ban and that could have the effect of locking in a good deal of Russian oil,” Yellen said Thursday at an event organized by the New York Times. (BBG)

RUSSIA: Russia may be getting more revenue from its fossil fuels now than shortly before its invasion of Ukraine, as global price increases offset the impact of Western efforts to restrict its sales, U.S. energy security envoy Amos Hochstein told lawmakers during a hearing on Thursday. "I can't deny that," Hochstein told the Senate Subcommittee on Europe and Regional Security Cooperation in response to a question about whether Moscow was making more money now off its crude oil and gas sales than a couple of months before the war started. (RTRS)

TURKEY: Turkey's central bank said on Friday it was increasing the weight of lira fixed assets in the collateral pool, with banks to establish long-term fixed-rate securities in lira in addition to their foreign currency deposits and participation funds. It also said it was increasing the required reserve ratio applied to commercial cash loans in lira to 20% from 10%, in order to support financial stability. (BBG)

TURKEY: Turkey's Treasury said on Thursday it will issue state enterprise income-indexed domestic bonds to encourage Turks to make savings in lira assets, while the banking watchdog announced maturity limits for consumer loans. (BBG)

TURKEY: The Turkish BDDK banking watchdog said on Thursday it had decided to set a maximum 24-month maturity for consumer loans between 50,000 and 100,000 lira and a maximum 12-month maturity for consumer loans over 100,000 lira ($5,814). It said in a statement that among other steps it will direct loans towards productive areas such as investment and exports. (BBG)

AFRICA: The President of Senegal and the African Union (AU), Macky Sall , answered questions from France 24 and RFI. Asked about his trip to Sochi, Russia, to meet Vladimir Putin as President of the AU, Macky Sall explains that he went there "because we are experiencing a shortage of cereals and fertilizers on the African continent". He said he had sent three messages to the Russian president. "Do everything to help free grain from Ukraine through the port of Odessa", "access grain and fertilizer", and "the end of the war, a de-escalation". (France24)

ISRAEL: The floundering government coalition appeared poised to at least survive the weekend, after a meeting between Prime Minister Naftali Bennett and a rumored defector passed uneventfully Thursday evening. Following their meeting, Bennett and Yamina MK Nir Orbach issued a brief joint statement that did not provide any details of their discussion. “The meeting was good, we will meet once again on Sunday,” the statement said. (Times of Israel)

IRAN: Iran on Thursday dealt a near-fatal blow to chances of reviving the 2015 Iran nuclear deal as it began removing essentially all the International Atomic Energy Agency monitoring equipment installed under the deal, IAEA chief Rafael Grossi said. (RTRS)

METALS: A group of indigenous Peruvian communities on Thursday agreed to temporarily lift a protest against MMG Ltd's Las Bambas copper mine that forced the company to halt operations for more than 50 days, the longest in the mine's history. According to meeting minutes signed on Thursday afternoon, the truce will last thirty days and the communities and the mine will engage in talks during that time. (RTRS)

ENERGY: Workers on Shell’s Prelude floating liquefied natural gas production facility in Australia are beginning industrial action after talks failed to resolve a dispute over conditions, a labor union group said Friday. The action, which had been expected, is likely to affect operations and potentially disrupt some cargoes, people with knowledge of the matter said earlier this month Prelude has the capacity to produce 3.6 million tons a year of LNG, but has struggled with ongoing technical issues since it started in 2019. (BBG)

OIL: Saudi Aramco will give full contractual oil supply to at least five buyer in Asia for July, but cut volumes to two others, said refinery officials who asked not to be identified as the information is confidential. One of the buyers that received full-term supply had sought extra volumes and was informed that it will receive what it had asked for. Another customer had some grade adjustment. Of the two that will receive less contractual crude volumes, one had also asked for incremental supply. (BBG)

CHINA

ECONOMY: Banks must achieve the goal of lending to more SMEs at a faster pace this year, and further tilt credit resources to areas severely affected by the epidemic, the China Securities Journal reported citing a meeting by China Banking and Insurance Regulatory Commission. Large state-owned banks should ensure an additional CNY1.6 trillion of inclusive loans to small business throughout the year, the meeting said. Banks are still reluctant to lend to SMEs that lack collateral, guarantees and other data, the newspaper said citing Liang Si, a researcher at Bank of China Research Institute. (MNI)

ECONOMY: Tesla Inc has cancelled three online recruitment events for China scheduled this month, the latest development after Chief Executive Elon Musk threatened job cuts at the electric car maker, saying it was "overstaffed" in some areas. However, Musk had not commented specifically on staffing in China, which made more than half of the vehicles for the automaker globally and contributed a quarter of its revenue in 2021. The company cancelled the three events for positions in sales, R&D and its supply chain originally scheduled for June 16, 23 and 30, notifications on messaging app WeChat showed late on Thursday, without stating a reason. (RTRS)

TRADE: China’s foreign trade will continue to be supported by quickly recovered production amid eased Covid-19 curbs, increased pro-growth policies and a weaker yuan, the China Securities Journal reported citing analysts after May export growth unexpectedly rebounded by 13 percentage points to 16.9% y/y. Overseas demand was still expanding in May, and high commodity prices continued to boost payments, the newspaper said citing Zheng Houcheng, director of Yingda Securities Research Institute, adding that there is a lower comparison base on year. Congestion at the Port of Shanghai has eased rapidly since late April, the newspaper added. (MNI)

CORONAVIRUS: Shanghai will lock down eight city districts this weekend to mass test millions of people as Covid-19 cases continue to emerge, causing more disruption and triggering a renewed run on groceries in areas that just exited a grueling two-month shutdown. The restrictions will apply to roughly 15.3 million residents of Pudong, Huangpu, Jing’an, Xuhui, Hongkou, Baoshan, Yangpu and Minhang districts of Shanghai during the testing, a key tool in China’s Covid Zero arsenal. Renewed scrutiny in the areas that account for more than 60% of Shanghai’s population comes after the number of infections found in the community rebounded to six on Thursday, from zero the day before. (BBG)

ENERGY: Thermal coal in China has climbed above the government’s price caps imposed last month, prompting regulators to dispatch squads to major mining regions to ensure compliance. Cargoes for spot delivery have traded above 1,300 yuan ($195) a ton this week in the northern hub of Qinhuangdao, higher than the 1,155 yuan ceiling set by Beijing, according to people familiar with the transactions. (BBG)

CHINA MARKETS

PBOC INJECTS NET CNY10 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This led to a net injection of CNY10 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8608% at 9:49 am local time from the close of 1.6154% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday vs 42 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6994 FRI VS 6.6811

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6994 on Friday, compared with 6.6811 set on Thursday.

OVERNIGHT DATA

CHINA MAY CPI +2.1% Y/Y; MEDIAN +2.2%; APR +2.1%

CHINA MAY PPI +6.4% Y/Y; MEDIAN +6.4%; APR +8.0%

JAPAN MAY PPI +9.1% Y/Y; MEDIAN +10.0%; APR +9.5%

JAPAN MAY PPI +0.0% M/M; MEDIAN +0.6%; APR +1.1%

SOUTH KOREA APR BOP CURRENT ACCOUNT BALANCE -$79.3MN; MAR $7,057.6MN

SOUTH KOREA APR BOP GOODS BALANCE +$2,947.7MN; MAR $5,637.5MN

SOUTH KOREA MAY BANK LENDING TO HOUSEHOLDS KRW1,060.6TN; APR KRW1,060.2TN

MARKETS

SNAPSHOT: Moderating Price Pressure Leaves China Room For Stimulus

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 399.55 points at 27846.09

- ASX 200 down 84.143 points at 6935.4

- Shanghai Comp. up 18.638 points at 3257.592

- JGB 10-Yr future down 3 ticks at 149.62, yield unch. at 0.251%

- Aussie 10-Yr future down 6.5 ticks at 96.324, yield up 6.6bp at 3.672%

- U.S. 10-Yr future -0-03 at 117-26+, yield up 1.3bp at 3.055%

- WTI crude down $0.7 at $120.81, Gold down $4.33 at $1843.52

- USD/JPY down 15 pips at Y134.21

- CHINA INFLATION DATA SHOW PRICE PRESSURES MODERATING

- JAPAN MOF, BOJ, FSA OFFICIALS TO DISCUSS FINANCIAL MARKETS AT 4PM (BBG)

- TSY SEC YELLEN: U.S. RECESSION UNLIKELY, BUT NO DROP IN GASOLINE PRICES SOON (RTRS)

- BORIS JOHNSON FACES EUROSCEPTIC REVOLT OVER NORTHERN IRELAND PROTOCOL BILL (FT)

BOND SUMMARY: 10-Year JGB Yield Wary Of Testing 0.25% Ceiling, Tsys & ACGBs Slip

Benchmark JGB futures crept higher as T-Notes and Aussie bond futures struggled for momentum. Regional headline flow was fairly light and centred around Chinese inflation figures, as the perceived moderation in price pressures sparked speculation re: PBOC easing prospects.

- T-Notes found support at 117-25+ after its initial downtick and stabilised within a narrow range thereafter. They last trade -0-02 at 117-27+, close to the mid-point of that range. Eurodollar futures run 0.25-1.0 tick lower through the reds. Cash Tsys slipped across the curve, with yields last seen 0.8-2.4bp higher. All eyes will be on U.S. CPI data, with headline inflation expected to have topped 8% in May. Also coming up is the flash reading of June Uni. of Mich. Sentiment, but inflation data will obviously take precedence.

- JGB futures ground higher but buying pressure lacked conviction. They last change hands at 149.58, 7 ticks shy of yesterday's settlement/session high. Cash JGB yields are barely changed across the curve, with 10-year yield operating within touching distance from the 0.25% cap of its permitted trading band. That said, it refrained from testing that level, as participants seem confident about the BoJ determination to enforce its interest-rate peg.

- Cash ACGBs weakened from the off as spillover from the NY session weighed. The curve runs steeper at typing, with yields last seen 2.2-5.0bp higher as 10s underperform. Light steepening impetus materialised in futures space as well, YM now trades -2.6 & XM -5.2. Bills last 2-5 ticks through the reds. The AOFM's issuance slate for next week provided nothing to rock the boat, with local financial markets due to be shut on Monday.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 14 June it plans to sell A$100mn of the 2.50% 20 September 2030 I/L Bond.

- On Thursday 16 June it plans to sell A$1.0bn of the 26 August 2022 Note & A$1.0bn of the 23 September 2022 Note.

- On Friday 17 June it plans to sell A$1.0bn of the 1.25% 21 May 2032 Bond.

EQUITIES: Lower In Asia Ahead of U.S. CPI; China Covid Worry Drives Materials Lower

Most major Asia-Pac equity indices are lower at typing on a negative lead from their U.S. and European counterparts. Energy and commodity-related equities have broadly declined throughout the session, with worry surrounding China’s well-documented, partial re-introduction of pandemic control measures have sent commodity benchmarks a little lower.

- The Hang Seng Index deals 0.2% softer at typing, staging a dramatic recovery from session lows near the open at around -3.1%. The Hang Seng Tech Index sits 0.9% firmer at typing, with broader optimism surrounding an easing in China-based tech re: regulatory crackdowns neutralising growth worry from some quarters following an earnings miss from video streaming giant Bilibili Inc (-14.8%).

- The CSI300 bucked the broader trend of regional peers, trading 0.4% higher and operating around session highs at typing after opening lower. Tech-related names lead the bid, with the ChiNext and STAR50 indices sitting 1.0% firmer apiece. Zooming out, debate re: the “investability” of Chinese equities continues to take focus, with HKEX data pointing to net foreign inflows through the Hong Kong Stock Connect of around CNY26.1bn for the first five days of June - more than that seen in May (CNY16.9bn) and April (CNY6.3bn).

- The ASX200 sits 1.3% worse off at typing, with energy and material names underperforming. Closely-watched Australian financials are on track for a fifth straight day of losses, although the sub-index has remained clear of Thursday’s 14-month lows through Asia-Pac dealing, aided by marginal gains in the ‘Big 4’ banks.

- The Nikkei 225 trades 1.4% lower at typing, on track to snap a five-session streak of gains. Major exporters and large-caps have given up some of their recent gains as the JPY has seen a little strength, with broader appetite for equities sapped by COVID-related growth concerns in China.

- U.S. e-mini equity index futures sit 0.2% to 0.4% better off at writing. The contracts currently operate a little above their respective, recently-made 2-week lows, following a 1.9% - 2.7% lower close on Thursday.

- Looking ahead, U.S. CPI crosses at 1330 BST.

OIL: Lower Amidst Possible Shanghai Lockdown Redux

WTI and Brent deal $0.80 weaker apiece at typing, edging away from session lows after breaking under Thursday’s worst levels earlier despite a lack of obvious headline catalysts. The move lower has mostly unwound gains made following Wednesday’s U.S. EIA oil inventory data release - which had pointed to tightness in crude supplies.

- To recap Thursday’s price action, WTI and Brent extended a pullback from mid-week highs to close ~$0.50 lower, with some downward pressure from an uptick in the USD (DXY) to its own three-week highs. WTI is nonetheless on track to record a seventh straight week of gains (sixth in seven weeks for Brent).

- The outlook for Chinese energy demand has again begun a descent into uncertainty, seeing crude benchmarks operate off recent highs. Shanghai authorities on Thursday announced mass testing to begin on Saturday, with the earmarked ~15mn residents to be under “closed-off management” until testing ends. Fresh COVID cases for the city remains low at 11 reported for Thursday, although six of those cases were found outside of quarantined areas - a key metric that officials have cited in past decisions re: lockdowns.

- A note that Beijing on Thursday closed entertainment venues in the Chaoyang and Dongcheng districts on COVID concerns, with the city today reporting eight cases for June 9.

- Commentary surrounding the EIA’s mid-week report has pointed out that demand for gasoline in the U.S. remains high despite higher pump prices, weighing against earlier expectations for demand destruction amidst the U.S. “summer driving season”.

- An S&P Platts survey released on Thursday has pointed to OPEC+ collectively increasing output by 120K bpd in May, with the group’s shortfall in production from current output quotas topping out at 2.616mn bpd - largely corroborating earlier remarks from the UAE’s energy minister.

- Elsewhere, hope surrounding Iranian nuclear talks have taken a sharp turn southwards as Iran has removed 27 cameras used by the UN’s IAEA to monitor nuclear sites (albeit in supposed retaliation for the agency’s recent resolution condemning the country), with IAEA chief Rafael Grossi calling it a “fatal blow” to a nuclear deal.

GOLD: Edging Lower Ahead Of US CPI Data

Gold has edged lower today. back sub $1846, but we remain above the overnight lows of close to $1840.

- The precious metal is experiencing mixed cross asset drivers at the moment, but we remain very much within recent ranges ahead of key US CPI data tonight.

- In many respects, gold outperformed the USD bounce overnight, although safe haven demand emerged as US equity losses mounted.

- Higher US yields today has likely weighed at the margin as well.

- US real 10yr yields are now at 0.29%, not too far away from recent cyclical highs (0.34%). A move above 0.30% or higher could see gold test lower, although support is evident around $1840 and again around $1830 from the start of the month.

- For the week, gold is still lower, consistent with higher USD levels and the rise in yields.

FOREX: Greenback Loses Shine, Yen Finds Poise

News flow quietened towards the end of the week in Asia, with participants watching mild oscillations in risk appetite. While widening partial lockdown measures in Shanghai provided a source of worry, China's latest inflation figures revived sentiment. Headline CPI coming in at +2.1% Y/Y vs. +2.2% expected and an in-line deceleration in factory-gate price growth suggested that price pressures are moderating, opening some scope for the PBOC to ease policy, even if there have been no concrete announcements on that front as of yet.

- The yen eked out some gains and USD/JPY is on track to snap a five-day winning streak. Technical conditions for the pair remain overbought, with the RSI still above 70. USD/JPY 1-month risk reversal extended its pullback from a one-month high printed earlier this week. FinMin Suzuki stuck to his usual lines on the yen, vowing to watch FX moves with urgency and stressing the importance of yen stability, without citing any specific levels.

- The greenback faltered against all of its G10 peers, even as Tsy yields edged higher, ahead of the key U.S. CPI report which is expected to show that the rate of consumer price growth topped 8%. Despite trimming some gains today, the U.S. dollar remains the best G10 performer this week.

- The Aussie dollar struggled for any topside impetus, diverging from its Antipodean cousin, with AUD/NZD moving sub-NZ$1.1100. Back-end yield spreads continued to move against AUD relative to NZD, but we have seen stability at the 2-year tenor.

- With China inflation data already out, focus turns to the closely watched update on U.S. consumer prices. Also on tap are flash U.S. Uni. of Mich. Sentiment & Canadian unemployment as well as comments from ECB's Villeroy, Holzmann & Nagel.

FOREX OPTIONS: Expiries for Jun10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E905mln), $1.0790-00(E1.8bln), $1.0900(E1.3bln)

- USD/CAD: C$1.2600($525mln), C$1.2735-50($1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/06/2022 | 0130/0930 | *** |  | CN | CPI |

| 10/06/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/06/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/06/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 10/06/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2022 | 0830/0930 | ** |  | UK | Bank of England/TNS Inflation Attitudes Survey |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.