-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: The Lone Dove

EXECUTIVE SUMMARY

- U.S. PRESIDENT BIDEN: A RECESSION IS “NOT UNAVOIDABLE” (AP)

- LAGARDE TELLS MINISTERS ECB PLANS FOR LIMIT ON BOND SPREADS (BBG)

- GERMAN FINMIN CHALLENGES ECB OVER BOND MARKET FRAGMENTATION RISKS

- BOJ KEEPS ULTRA-LOOSE MONPOL SETTINGS UNCHANGED, ADDS RARE COMMENT ON FX

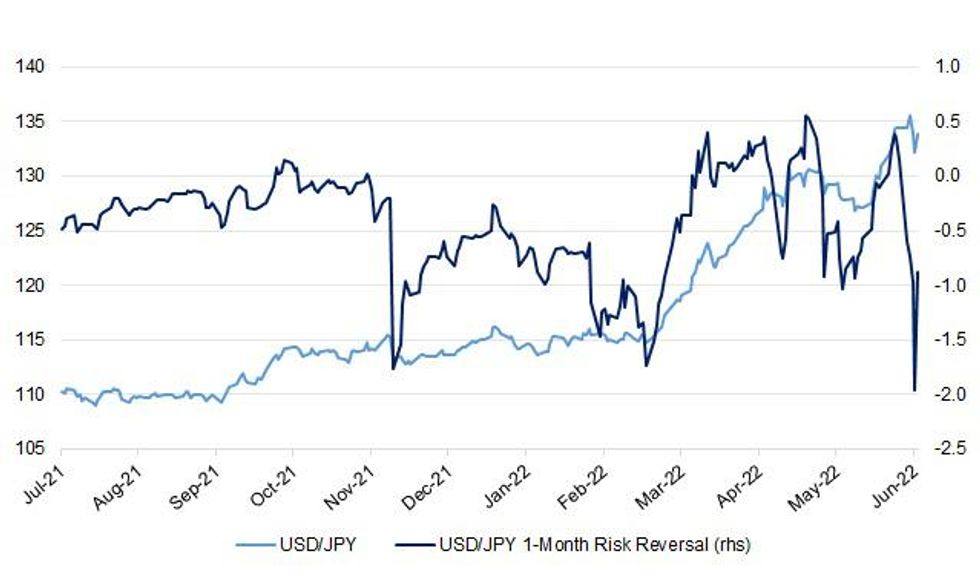

Fig. 1: USD/JPY & USD/JPY 1-Month Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

TRANSPORT: UK airlines will be forced to cancel hundred of flights this summer after London’s Gatwick airport announced plans to limit its operations because of continuing staff shortages plaguing the transport sector. The UK’s second-busiest airport said on Friday it would cut the number of flights airlines can run to 825 per day in July and 850 in August, down from the 900 that Gatwick was planning to operate on peak days in August. (FT)

TRANSPORT: An investigation is under way following the death of a passenger at Gatwick Airport. EasyJet confirmed the death in a statement, adding members of its cabin crew gave medical assistance to the unnamed passenger while waiting for help from paramedics. (Sky)

POLITICS: Boris Johnson is considering scrapping the role of ethics adviser after the resignation of Lord Geidt, who accused him of making a mockery of his position overseeing standards in government. The prime minister’s official spokesperson said Johnson would not immediately start looking for a replacement for Geidt, but would instead review the system of enforcing the ministerial code. (Guardian)

EUROPE

ECB: European Central Bank President Christine Lagarde told euro-area finance ministers that the ECB’s new anti-crisis tool will kick in if the borrowing costs for weaker nations rise too far or too fast, according to people briefed on their discussions. At a meeting in Luxembourg Thursday, Lagarde explained to ministers that the new mechanism that central bank officials are devising is intended to prevent irrational market movements from putting pressure on individual euro nations as ECB embarks on its first interest-rate hikes in more than a decade, the people said, asking not to be identified discussing private conversations. (BBG)

EU: Eurozone finance ministers mothballed plans on Thursday to complete the banking union — a decade-long project born out of the financial and the sovereign debt crises — settling for narrower improvements to the bloc’s rules for handling bank failures. Eurogroup chief and Irish Finance Minister Paschal Donohoe had hoped to reach consensus on a workplan sketching out a way forward on four parallel "workstreams," including a common deposit insurance scheme, dubbed EDIS, to cover savers' losses in case of bank failures. It also contained measures reducing banks' exposure to sovereign debt; creating a single market for banking; and agreeing on common rules on how to deal with failing banks. But the Irishman's plan didn't fly with capitals, with the main sticking point being Berlin's opposition to EDIS. "For Germany, a full European deposit guarantee is not up for debate," said Finance Minister Christian Lindner as he entered the meeting. (Politico)

EU: The European Commission plans to recommend that Ukraine and Moldova be granted candidate status in a symbolic step forward in the lengthy process to become members of the European Union. The EU’s executive arm is set to issue its opinion on Friday and will impose conditions that the countries will have to meet in the future on the rule of law, justice and anti-corruption, according to people familiar with the matter. The commission is also expected to recommend granting candidate status to Georgia once it meets specific conditions. (BBG)

EU/UK: The European Union will keep all options on the table in terms of its response to Britain's move to override some post-Brexit rules for Northern Ireland, Maros Sefcovic said on Thursday, when asked about the possibility of a trade war. (RTRS)

GERMANY/ECB: Germany’s finance minister has challenged the European Central Bank over the spectre of bond market fragmentation in the eurozone, saying he did not see particular hazards in current market conditions. Christian Lindner told the ECB’s president in a closed-door session that he was not worried by recent moves in spreads between bond yields in the euro area, and that talking about fragmentation in the bloc’s financial markets could damage confidence, according to people familiar with the discussion. (FT)

SPAIN: Where Andalusia goes, the rest of Spain follows. The southern region holds an election on Sunday and the conservative Popular Party (PP), buoyed by a change in its national leadership, is well ahead in the polls. If the polls are borne out, it will be an unprecedented victory for the party, marking the start of an electoral cycle that is expected to culminate in a general election next year. (Politico)

SPAIN: Spanish power plants bought more natural gas to generate electricity on Wednesday than on any other day since records began, transmission system operator Enagas said on Thursday. Extreme early summer heat is raising demand for electric air conditioning just as cheaper, renewable sources of power are contributing less to the system, meaning more expensive gas-fired plants are making up the shortfall. (RTRS)

HUNGARY: Hungary threatened to stall the European Union’s efforts to agree on a global minimum tax, just as the bloc was on the verge of a breakthrough after negotiating tweaks to get Poland’s backing. Hungary told EU ambassadors on Wednesday it is no longer in a position to back a compromise deal due to changed economic conditions, including the war in Ukraine, according to people with knowledge of the matter. The country has requested the item be removed from the agenda of a meeting on Friday in Luxembourg that was expected to give a green light to the plans. “Europe is in deep enough trouble without the global minimum tax,” Hungarian Foreign Minister Peter Szijjarto said in a video posted on Facebook Thursday. “We’re not supporting a hike in taxes for Hungarian companies and we’re not willing to put jobs in danger.” (BBG)

HUNGARY: Hungary has “a lot of work” to do before the European Union’s executive body will agree to release its pandemic recovery money, the country’s minister in charge of EU talks told Inforadio. The nation is still aiming to secure an agreement on both the pandemic funds as well the multi-year EU budget by year’s end, Tibor Navracsics told Inforadio in an interview on Thursday after talks with EU officials in Brussels. In a separate interview with Euronews, Navracsics said Hungary was ready to come to a compromise with the EU. (BBG)

UKRAINE: Temporary silos on Ukraine's border would be intended to prevent Russia from stealing Ukrainian grain and make sure the country's winter harvest is not lost due to a lack of storage, U.S. Agriculture Secretary Tom Vilsack said on Thursday. But, during a visit to the United Nations, Vilsack stressed that reviving shipments from Ukraine's Black Sea ports was the most effective and efficient way to export grain and urged Russia to take U.N.-led talks on the issue "seriously." (RTRS)

UKRAINE: Russia said on Thursday it was facilitating the export of grain and oilseeds from Ukraine through Russian-held transit points on the Azov Sea, without explaining who was providing the foodstuffs for export. Ukraine, like Russia one of the world's biggest exporters of grains and oilseeds, has accused Russia of stealing grain from territories in Ukraine that its forces have seized. Russian Deputy Prime Minister Viktoria Abramchenko rejected the allegation in an interview with Reuters, saying: "Russia does not ship grains from Ukraine." She continued: "Russia is securing a 'green [safe] corridor' for grains and any other foodstuff such as oilseeds ... so it can be exported from Ukraine without hurdles. [Via] Melitopol or Berdiansk." (RTRS)

UKRAINE: Ukraine alone should decide whether or not to accept any territorial concessions towards Russia in view of ending the war, French President Emmanuel Macron told TF1 television in an interview as he visited Kyiv. (RTRS)

UKRAINE: Britain will welcome representatives from Ukraine and business leaders on Friday to discuss how UK companies can help rebuild key infrastructure in Kyiv. Trade Secretary Anne-Marie Trevelyan will seek to promote collaboration between British companies in infrastructure, energy and transport, and Ukrainian public and private organisations to help repair damaged and destroyed infrastructure. Trevelyan will also announce changes to trade remedy measures, including reallocating ring-fenced market access for steel imports from Russia and Belarus to other countries including Ukraine. (RTRS)

UKRAINE: Russian-flagged ships have been carrying grain harvested in Ukraine last season and transported it to Syria, U.S. satellite imagery company Maxar said on Thursday. (RTRS)

U.S.

ECONOMY: President Joe Biden told The Associated Press on Thursday that the American people are “really, really down” after a tumultuous two years with the coronavirus pandemic, volatility in the economy and now surging gasoline prices that are slamming family budgets. He said a recession is not inevitable and bristled at claims by Republican lawmakers that last year’s COVID-19 aid plan was fully to blame for inflation reaching a 40-year high, calling that argument “bizarre.” As for the overall American mindset, Biden said, “People are really, really down.” (AP)

ECONOMY: President Joe Biden on Thursday signed legislation to improve oversight of ocean shipping, which lawmakers say will help curb inflation and ease export backlogs. The new law boosts the investigatory authority of the Federal Maritime Commission (FMC), the U.S. agency that oversees ocean shipping, and increases transparency of industry practices. (RTRS)

ECONOMY: U.S. housing finance giant Freddie Mac said on Thursday the average contract rate on a 30-year fixed-rate mortgage rose by more than half a percentage point to 5.78%, the greatest one-week jump in 35 years. Rates on the most popular type of U.S. home loan surged after the Federal Reserve announced it was raising interest rates by 75 basis points in an attempt to slow the economy and quell inflation, which is at 40-year-highs. (RTRS)

BANKING: An indicator of credit risk in the U.S. banking system may be showing signs of stress, as the Federal Reserve’s aggressive rate hike path ratchets up expectations of economic pain. The so-called FRA-OIS spread , which measures the gap between the U.S. three-month forward rate agreement and the overnight index swap rate, increased to 29.50 basis points on Thursday, its widest since May 23, according to data from Refinitiv. The measure was at -11.66 bps earlier in the week. (RTRS)

BONDS: Spreads on US junk-rated corporate bonds, an important gauge of risk that signals higher defaults when it increases, surpassed 500 basis points for the first time since November 2020. The figure, which measures the extra yield investors demand to hold the debt instead of US Treasuries, increased 31 basis points on Thursday to 508 basis points, according to the Bloomberg US Corporate High Yield index. (BBG)

EQUITIES: The number of Russell 3000 companies, excluding financial firms, trading below cash has surpassed the month-end record set during the global financial crisis. As of Wednesday’s close, the market capitalizations of 167 Russell 3000 companies, including three major airlines, were below the firms’ cash holdings. The monthly record was 165 in February 2009. (BBG)

ENERGY: U.S. Energy Secretary Jennifer Granholm called an emergency meeting with refining executives for next week, a department spokesperson said on Thursday, as tensions between the Biden administration and Big Oil mount over soaring gasoline prices. (RTRS)

OIL: Top Biden administration officials are weighing limits on exports of fuel as the White House struggles to contain gasoline prices that have topped $5 per gallon. Discussions around capping gasoline and diesel exports have picked up in recent days, as President Joe Biden intensified his criticism of soaring oil company profits, said people familiar with the matter who asked for anonymity to describe private conversations. Limits under consideration would fall short of a complete ban on foreign sales of petroleum products, with gasoline exports averaging 755,000 barrels a day so far this year, according to the US Energy Information Administration. That’s up from 681,000 barrels a day during the same period in 2021. (BBG)

OIL: Robust demand from Latin America is set to lift US Gulf Coast fuel exports to new heights this month, hampering efforts to build up national inventories amid soaring prices. At the current pace, exports of products -- which typically go to where prices are highest -- are up 27% from what they were in June 2019. Massive exports are hindering restocking efforts in the US, where gasoline inventories have languished to their lowest seasonal level since 2014, while stockpiles of distillates, which include diesel, have tumbled to the lowest for this time of year since 2005, according to government data. (BBG)

OTHER

WTO: Major members of the World Trade Organization reached an initial deal on Thursday, winning over India which said it was confident more global accords could be achieved as negotiations on fishing, vaccines and food security entered their final hours. The body's 164 members must all agree for new rules to pass, meaning that one member alone can block deals. During the June 12-15 meeting, extended into the evening of a fifth day on Thursday, that member has been India. However, a provisional agreement to extend a moratorium on applying duties to electronic transmissions until at least 2023 was reached despite earlier opposition from New Delhi. (RTRS)

NATO: Australian Prime Minister Anthony Albanese on Friday said he would attend "an important" NATO meeting in Madrid at the end of the month as the United States-led alliance looks to further strengthen its ties in the wake of Russia's war in Ukraine. (RTRS)

U.S./CHINA: The United States' ambassador to China, Nicholas Burns, said on Thursday he expects Beijing's "zero COVID" policy to persist into early 2023, and that U.S. businesses were reluctant to invest in the country until restrictions ease. (RTRS)

U.S./TAIWAN: A duo of U.S. senators introduced a bill on Thursday to significantly enhance support for Taiwan, including provisions for billions of dollars in U.S. security assistance and changes to the decades old law undergirding Washington's unofficial ties with the Chinese-claimed democratic island. (RTRS)

BOJ: MNI BRIEF: BOJ On Hold, Keeps Policy Forward Guidance

- The Bank of Japan board Friday held easy policy as expected as the economy largely continued moving in line with the baseline scenario despite lingering downside risks and uncertainties - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Finance Minister Shunichi Suzuki said on Friday there has been a "rapid" weakening of the yen recently, adding that Tokyo was closely watching market moves with a stronger sense of urgency. In a news conference, Suzuki also said he hoped the BOJ continues to make efforts to achieve its 2 per cent inflation target in a stable and sustainable manner. (RTRS)

JAPAN: Japan has reappointed Masato Kanda as vice finance minister for international affairs, serving as the country's top currency diplomat, as part of a mid-year personnel reshuffle, the Ministry of Finance said on Friday. (RTRS)

SOUTH KOREA: The South Korean economy is at the risk of losing steam as deteriorating external economic conditions are feared to dent investment and export growth amid high inflation, the finance ministry said Friday. Market volatility and global economic downside risks further expanded due to the Federal Reserve's accelerating monetary tightening and global supply chain disruptions, the ministry said in its monthly economic assessment report, called the Green Book. (Yonhap)

SOUTH KOREA: The government will extend the current seven-day quarantine mandate for COVID-19 patients for four more weeks because rolling back the obligation could accelerate a resurgence of the virus, Prime Minister Han Duck-soo said Friday. (Yonhap)

NORTH KOREA: South Korea's President Yoon Suk-yeol said the United Nations Security Council should respond in a coordinated manner against North Korea's missile provocations, South Korea's Newsis reported on Friday. (RTRS)

CANADA: Canadian Finance Minister Chrystia Freeland expressed confidence on Thursday in the Bank of Canada's ability to rein in surging inflation and keep price gains from becoming entrenched, but said there was no guarantee the economy would avoid a recession. "The Bank has begun the work of bringing inflation back within target, and it has the tools and the expertise it needs to keep inflation from becoming entrenched," Freeland told a business audience in Toronto. (RTRS)

CANADA: Canadian Imperial Bank of Commerce (CM.TO)is "comfortable" with the quality of its mortgage book, but is on the lookout for signs of stress, its chief risk officer said on Thursday."We're very comfortable with where things are currently," Shawn Beber said at the fifth-largest Canadian bank's investor day in Toronto. If "things get more stressed, then you could see higher losses than (anticipated) but that's not the base case scenario that we are looking at." (RTRS)

BRAZIL: Brazilian state-run oil company Petrobras is set to announce a fuel price increase on Friday, local media reported on Thursday, raising alarm bells within the country's top political ranks. According to O Globo, the company's board has approved diesel and gasoline price increases that will come into effect next week. Petrobras said it could not "preemptively discuss decisions on price preservation or price adjustments due to competition issues." (RTRS)

ARGENTINA: Argentina's central bank raised its benchmark interest rate by the most in three years on Thursday, hot on the heels of amajor hike by the U.S.Federal Reserveand as the South American country firefights sky-high inflation running at over 60%. (RTRS)

RUSSIA: Law enforcement in the United States, Germany, the Netherlands and Britain dismantled a global network of internet-connected devices that had been hacked by Russian cyber criminals and used for malicious purposes, the U.S. Justice Department said on Thursday. The network, known as the "RSOCKS" botnet, comprised millions of hacked computers and devices worldwide, including "Internet of Things" gadgets like routers and smart garage openers, the department said in a statement. (RTRS)

RUSSIA: The Dutch intelligence service said on Thursday it had uncovered a Russian military agent attempting to use a false identity to infiltrate the International Criminal Court (ICC) which is investigating accusations of war crimes in Ukraine. (RTRS)

RUSSIA: The Ministry of Finance does not exclude the possibility of entering the domestic borrowing market this year, Finance Minister Anton Siluanov told reporters on the sidelines of the St. Petersburg International Economic Forum. But first we need to decide on the budget policy, which is still being discussed in the government, the minister added. In the spring, Siluanov announced that the Ministry of Finance was not planning new placements of government bonds in 2022 and would resume borrowing in 2023 if the market situation stabilizes. (Vedomosti)

RUSSIA: Russian authorities are discussing the idea of giving foreign investors who are willing to cut exposure to Russia a chance to ditch their Russian stocks and bonds later this year despite capital controls, a finance ministry official said on Thursday. (RTRS)

IRAN: Israeli and American intelligence officials have been watching each day as Iran digs a vast tunnel network just south of the Natanz nuclear production site, in what they believe is Tehran’s biggest effort yet to construct new nuclear facilities so deep in the mountains that they can withstand bunker-busting bombs and cyberattacks. Though the construction is evident on satellite photographs and has been monitored by groups that track the proliferation of new nuclear facilities, Biden administration officials have never talked about it in public and Israel’s defense minister has mentioned it just once, in a single sentence in a speech last month. In interviews with national security officials in both nations, there clearly were differing interpretations of exactly how the Iranians may intend to use the site, and even how urgent a threat it poses. (NYT)

IRAN: The United States on Thursday imposed sanctions on Chinese and Emirati companies and a network of Iranian firms that help export Iran's petrochemicals, a step that may aim to raise pressure on Tehran to revive the 2015 Iran nuclear deal. The U.S. Treasury department said it had imposed penalties on two companies based in Hong Kong, three in Iran, and four in the United Arab Emirates, as well as on Chinese citizen Jinfeng Gao and Indian national Mohammed Shaheed Ruknooddin Bhore. (RTRS)

METALS: Workers at Chile's state-owned Codelco, the world's largest copper producer, will go on strike if they do not receive a favorable answer from the company's board of directors Friday, the union said on Thursday. (RTRS)

METALS: Russia is experiencing problems with the supply of iron ore products to Europe, although sanctions do not prohibit this. The reason for the drop in exports was the destruction of supply chains due to hostilities in Ukraine. Iron ore producers are reorienting deliveries to China and are talking about the need to build deep-water ports in the south of the Russian Federation, which would make exports to Asia more profitable. (Kommersant)

ENERGY: Canada said on Thursday it was in talks with Germany to resolve an issue with a Siemens Energy turbine for Russia's Nord Stream 1 pipeline that was sent to Canada for maintenance, reducing gas supply to Europe. The capacity of Gazprom's Nord Stream 1 pipeline to supply gas to Europe is partly constrained as sanctions on Russia make it impossible for German equipment supplier Siemens to return the turbine being maintained in Canada, the companies said earlier this week. (RTRS)

ENERGY: A breakneck rally in Asian natural gas spot prices is forcing some importers to halt plans to buy additional shipments of the power plant fuel. North Asia spot liquefied natural gas prices are surging toward $40 per million British thermal units, the highest in over three months, on fears of a global supply squeeze, according to traders with knowledge of the matter. The benchmark is up nearly 70% so far this week and is at a seasonal high. Some Asian buyers are now unwilling or unable to procure LNG at current spot rates, instead choosing to wait for prices to come down before refilling inventories, according to traders. That risks leaving buyers short in the event of extreme weather or other major disruptions. (BBG)

CHINA

PBOC: China doesn’t need to follow US and European central banks to hike interest rates because its economy is in a different cycle and its inflation is far lower than other major economies, Economic Daily says in a front-page commentary Friday. China’s consumer price inflation is holding steady, while decline in producer price is accelerating, and that means China’s inflation is under control; China is expected to achieve its goal of keeping its CPI at around 3% for the whole year. Although geopolitical conflicts are still disrupting the international energy and food markets, China has sufficient food and coal supply. Given its moderate and controllable inflationary outlook, China has enough room to tweak monetary policy and doesn’t need to follow other countries to increase interest rates. China should accelerate implementation of measures to stabilize the economy, taking advantage of a relatively small window of time when inflation is at relatively low levels and when there are fewer impediments to diverge with the monetary tightening in developed countries. (BBG)

ECONOMY: China’s No. 2 online retailer sees worrying signs that shoppers are reluctant to reopen their wallets even as major cities emerge from bruising Covid lockdowns, suggesting consumer spending may take months to recover. The months-long closure of cities like Shanghai has caused a fundamental shift in how people spend their money, with a pullback in discretionary spending continuing even after the lockdown of the financial hub ended a few weeks ago, according to Xin Lijun, chief executive officer of JD Retail. (BBG)

FISCAL: China should use the next six months to intensify fiscal policy and pay more attention to price tools of monetary policy to stabilise economic growth, in order to prepare for the arrival of global stagflation, according to a working paper published by researchers at China Finance 40 Forum. China should maintain the flexibility of the yuan while closely monitoring capital flow anomalies, the paper said. Also, China should participate more in multilateral debt restructuring mechanisms, as major central banks tighten policy. Along with the sharp rise in global energy and grain prices, it is very likely to trigger debt crises in some emerging markets and developing countries, the paper said. (MNI)

FISCAL: China’s local governments are caught in an unexpectedly severe budget squeeze, creating a dilemma for officials over whether to boost debt or tolerate weaker economic growth. Maintaining the Covid Zero policy is both slowing the economy and also adding huge extra costs to government budgets, which have to pay for regular mass testing, quarantine hospitals, as well as food provision and other services during lockdowns in places like Jilin or Shanghai. The mass-testing for Covid alone will add hundreds of billions of yuan, if not more, onto local authorities’ spending responsibilities beyond what was budgeted in early March. (BBG)

REAL ESTATE: China’s real estate market is still hovering at the bottom despite over 200 cities having loosened regulations by mid-June, as home prices nationwide are still slowly declining, Caixin reported. Second-hand home prices in 70 key cities decreased by 0.4% m/m, or 2.2% y/y in May, Caixin cited data by Shanghai E-House Real Estate Research Institute. New housing declined by 0.2% m/m, or 0.8% y/y, said Caixin. The current relaxations aim at fine-tuning the qualifications of home buyers, and first-tier cities have not changed policies markedly, Caixin said citing Zhang Dawei, chief analyst of Centaline Property. (MNI)

MILITARY: China launched its third and most advanced aircraft carrier on Friday, bringing it a step closer to its goal of building a blue-water navy with at least six aircraft carrier battle groups by 2035. (SCMP)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8885% at 9:33 am local time from the close of 1.6148% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 47 on Thursday vs 48 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6923 FRI VS 6.7099

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6923 on Friday, compared with 6.7099 set on Thursday.

OVERNIGHT DATA

NEW ZEALAND MAY BUSINESSNZ MANUFACTURING PMI 52.9; APR 51.2

While both Production (52.8) and Delivery of Raw Materials (55.4) both managed to return to expansion for May, the other key sub-index of New Orders (53.0) recorded its lowest level of activity since the August lockdown in 2021. Overall, any sustained move towards historical levels of expansion requires a healthy level of new orders, which has averaged 55.0 since the survey began. Manufacturers continue to have a more negative mindset during May, with the proportion of negative comments at 72.7%, compared with 70.3 in April and 64.2% in March. While COVID and related issues remain a key influence, skill/labour shortages are also regularly mentioned. (BusinessNZ)

NEW ZEALAND MAY NON RESIDENT BOND HOLDINGS 58.3%; APR 58.6%

MARKETS

SNAPSHOT: The Lone Dove

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 374.45 points at 26056.75

- ASX 200 down 120.198 points at 6470.9

- Shanghai Comp. down 0.649 points at 3284.736

- JGB 10-Yr future up 41 ticks at 147.62, yield down 2.8bp at 0.231%

- Aussie 10-Yr future down 12 ticks at 95.81, yield up 12.2bp at 4.115%

- U.S. 10-Yr future +0-15 at 116-10, yield up 3.77bp at 3.233%

- WTI crude down $0.68 at $116.91, Gold down $10.88 at $1846.43

- USD/JPY up 164 pips at Y133.85

- U.S. PRESIDENT BIDEN: A RECESSION IS “NOT UNAVOIDABLE” (AP)

- LAGARDE TELLS MINISTERS ECB PLANS FOR LIMIT ON BOND SPREADS (BBG)

- GERMAN FINMIN CHALLENGES ECB OVER BOND MARKET FRAGMENTATION RISKS

- BOJ KEEPS ULTRA-LOOSE MONPOL SETTINGS UNCHANGED, ADDS RARE COMMENT ON FX

US TSYS: T-Notes Stay On Softer Footing Even As BoJ Comes To Rescue

Selling pressure hit T-Notes as trading got underway in Asia, with the contract extending its pullback from Thursday's peak (116-21). Recovery in U.S. e-mini futures was deemed risk-supportive, sapping strength the Treasuries.

- The slide in T-Notes was stopped by the BoJ, who announced their monetary policy decision. Despite the market testing the resolve of Japan's central bank over the past week, officials stood the course and stuck with their super-loose policy settings, familiar forward guidance and assessment of the economy, although they tipped hat to the need to watch financial and FX markets. Resultant bounce in JGB futures supported T-Notes, which moved away from their session low of 115-28+.

- TYU2 last trades +0-13 at 116-07, while Eurodollar futures run 1.5-5.0 ticks higher through the reds. Cash curve bear flattened in Tokyo trade, with yields last 4.4-6.2bp higher. The spread between 5-/30-Year Tsy yields moved towards zero, but lacked the impetus to turn positive.

- Looking ahead, Fed Chair Powell will speak at the Dollar Conference today, while local data highlights are limited to industrial output.

AUSSIE BONDS: Cheapening Pressure Prevails Despite Strong ACGB Auction, BoJ's Dovish Resolve

Selling pressure spilled over from U.S. Tsys into ACGBs, although a solid ACGB May '32 auction & fallout from the BoJ's policy meeting helped reduce losses for Aussie bonds.

- U.S. Tsys were dumped from the off, correcting Thursday's rally, as upticks in U.S. e-mini futures indicated that the local equity space may get some reprieve. Aussie bonds clung to the coattails of Tsys, trading with a heavier bias through the session.

- A strong auction for A$1.0bn of ACGB May '32 prompted ACGBs to briefly pop higher, as one successful bidder took the whole amount on offer, reducing the price tail to zero. Based on our quick calculations, the last time when a single buyer snapped all of ACGBs on offer was in Sep 2020. Excluding two 2020 sales, when single buyers managed to purchase A$2.0bn of auctioned bonds each time, today's was the largest amount bought by a lone bidder on record.

- ACGBs resumed losses but took another brief breather as the BoJ announced its monetary policy decision, keeping all ultra-loose settings and broader rhetoric unchanged. Resultant bid in JGBs spilled over into the broader core FI space.

- When this is being typed, YM trade -10.5 & XM -13.5, with bills sitting 4-10 ticks lower through the reds. Cash curve runs steeper, with yields last 9.5-16.5bp higher.

JGBS: JGBs Extend Rally After BoJ Reaffirms YCC Parameters, 10-Year Yield Returns To Target

JGB futures re-opened sharply higher after the Tokyo lunch break, during which the BoJ demonstrated its steadfast commitment to persistent powerful monetary easing. The contract returned from the trading pause at a new session high of 147.78 before trimming gains.

- The past week saw a tug-of-war between the BoJ and market participants questioning the sustainability of its firm grip on the yield curve, even as local analysts expected the Bank to stand pat today.

- JGB futures crept higher in the lead-up to the policy announcement, with the upswing possibly facilitated by comments from FinMin Suzuki, who said he hopes the BoJ will persist in efforts towards achieving its inflation target.

- The Policy Board indeed maintained its YCC settings, forward guidance and overall assessment of the economy despite recent yen weakness and growing pressure on the 0.25% cap on 10-Year yield.

- The yield on 10-Year JGBs rose to the highest level since 2016 this morning, with the Bank conducting another round of unlimited fixed-rate debt purchases in the afternoon.

- But the decision to stick with ultra-loose monetary policy stance dragged benchmark 10-Year yield back into the target range and it last sits at 0.22%.

- The 7-10-Year sector covered by the Bank's daily bond-purchase operations outperforms on the cash curve, with yields mostly lower as we type, save for the super-long end. JGB futures have stabilised trade at 147.45, 24 ticks above previous settlement.

- All eyes are on the press conference with BoJ Gov Kuroda this afternoon.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

- Average Yield: 4.1150% (prev. 3.3588%)

- High Yield: 4.1150% (prev. 3.3600%)

- Bid/Cover: 2.7670x (prev. 2.3200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 100.0% (prev. 66.9%)

- Bidders 48 (prev. 39), successful 1 (prev. 13), allocated in full 1 (prev. 5)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 22 June it plans to sell A$1.0bn of the 3.25% 21 April 2025 Bonds.

- On Thursday 23 June it plans to sell A$500mn of the 26 August 2022 Note & A$1.5bn of the 7 October 2022 Note.

EQUITIES: Asia Follows Wall St. Lower; Hong Kong, Chinese Equities Outperform

Most Asia-Pac equity indices are worse off at typing, largely tracking a negative lead from Wall St. Hong Kong and Chinese equities bucked the broader trend of losses, continuing their recent outperformance against peers globally.

- The Hang Seng Index outperformed, sitting 0.8% better off after paring opening gains of as much as 1.2%. China-based tech names lead gains (HSTECH: +1.5%), with analysts pointing to an easing in regulatory crackdowns by the Chinese authorities, rising bets for policy support for the COVID-hit Chinese economy (keeping in mind that China May new home price data released yesterday pointed to a decline for a second consecutive month), and rate divergence between the U.S. and China to support optimism in the space.

- The CSI300 trades 0.3% higher, having flipped between gains and losses throughout Asia-Pac dealing. Broad gains in consumer staples and industrials countered relatively shallower losses in healthcare and financials, with large-caps such as Kweichow Moutai (+2.9%) and CATL (+4.2%) leading gains.

- The Nikkei 225 sits 1.6% worse off at typing, with tech-based names and large-caps underperforming amidst evident spillover from weak sentiment in high-beta equities during Thursday’s NY session. Large losses were observed in favoured names such as Softbank Group (-3.4%), Tokyo Electron (-5.1%), and Fujitsu Ltd (-3.9%).

- The ASX200 deals 2.2% lower at writing after plunging to as low as -2.5% after the open, with losses observed across virtually every sub-index. Commodity and tech-based names lead losses, with focus on worry re: economic stagnation evident.

- U.S. e-mini equity index futures sit 0.5% to 0.7% better off at typing, with NASDAQ contracts leading gains. Zooming out, e-minis operate a little above their respective cycle lows made on Thursday (18-month low for S&P500 contracts).

OIL: On Track To Break Weekly Streak Of Gains Despite Lingering Supply Worry

WTI and Brent are ~$0.60 worse off apiece, operating a little under Thursday’s best levels at typing.

- Both benchmarks are nonetheless on track to end the week lower, snapping a streak of consecutive higher weekly closes (seven weeks for WTI, four weeks for Brent), as a slew of ultimately hawkish central bank decisions from Europe to the Americas this week has brought debate re: recessionary risks (and thus reduced energy demand) to the fore.

- Looking to the Middle East, U.S. Treasury officials on Thursday announced sanctions on Chinese, UAE, and Iranian companies for breach of crude-related sanctions on Iran. The move cratered earlier, scant hopes for the U.S. to ease sanctions on Iranian crude in the face of tight global supplies, seeing WTI and Brent flip to session highs after hitting two-week lows.

- Elsewhere, RTRS source reports have pointed to OPEC+ producing 2.7mn bpd below quotas in May, mainly on well-documented production issues faced by some members, as well as ongoing sanctions on Russian crude.

- Libyan crude production in particular is expected to continue facing issues in June, with the country declaring on Tuesday that output is around 100K - 150K bpd (output in 2021 was ~1.2mn bpd) in the face of the country’s previously-flagged political woes.

- BBG source reports have also pointed to the likelihood of the U.S. introducing a partial ban on fuel exports (currently estimated at ~755K bpd), possibly exacerbating well-documented supply worries in Europe as the Biden administration continues to explore ways to tamp down surging gasoline prices at home.

GOLD: Back Towards The 200 Day MA

Golds recent volatility continues, with the precious metal back towards its 200 day MA ($1844). This around 0.70% weaker from NY closing levels.

- The firmer USD trend, with the DXY rebounding 0.65% today to 104.30, is the main driver of gold weakness.

- Whilst much of this is concentrated in terms of the USD/JPY bounce (+1.5% to +134.15), all major currencies are weaker against the USD so far today.

- US yields are also higher following sharp drops in the previous two sessions. The 2yr is back up to 3.15%, around 5bps firmer on the day.

- Gold got close to $1858 late in the NY session. USD weakness, plus sharp falls in US equities were the main drivers.

- US equity futures are higher today, while regional Asia Pacific equity market sentiment remains downbeat for the most part.

- At this stage, gold is tracking 1.5% down for the week, although we are comfortably above the weekly lows of sub $1810.

FOREX: Yen Tumbles As BoJ Chooses To Remain World's Dovish Dissenter

The BoJ dispelled the doubts and reaffirmed its ironclad commitment to ultra-loose monetary policy, keeping all YCC parameters, overall assessment of the economy and forward guidance unchanged. In an unusual move, the Bank underlined the need to "pay due attention to developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices." Yet this laconic commentary on FX matters fell well short of some of the more aggressive remarks issued by Japanese financial officials in the recent weeks.

- The yen began tumbling ahead of the BoJ's announcement amid continued assessment of the sustainability of the Bank's dovish stance. FinMin Suzuki's remark that he hopes policymaker would continue to work towards their inflation target appeared to have cooled the enthusiasm of some yen bulls.

- Spot USD/JPY whip-sawed after the announcement, running as high as to Y134.63, before retracing to its current levels. The pair last deals +186 pips at Y134.07 (and climbing), with the yen still comfortably underperforming all of its major peers.

- Looking into the options space, as might have been expected, USD/JPY implied volatilities pulled back sharply across the curve, while 1-month risk reversal soared off its lowest levels since March 2020.

- Demand for USD/JPY boosted the greenback, allowing it to take a breather after Thursday's sell-off and land atop the G10 scoreboard. Firmer U.S. Tsy yields amplified buying pressure.

- The Antipodeans struggled for any topside impetus as most regional equity benchmarks slipped on a negative lead from Wall Street, while crude oil traded on a softer footing.

- The focus now shifts to Gov Kuroda's press conference, where he is likely to be quizzed on any potential policy tweaks at the July policy meeting and FX intervention risks.

- Outside of Japan, final EZ CPI, U.S. industrial output & comments from Fed's Powell, ECB's Simkus as well as BoE's Pill & Tenreyro are eyed today.

FOREX OPTIONS: Expiries for Jun17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0425(E561mln), $1.0490-00(E1.7bln), $1.0650(E764mln), $1.0700(E650mln)

- USD/JPY: Y133.00($681mln), Y133.85-00($564mln)

- GBP/USD: $1.2110(Gbp1.3bln)

- EUR/GBP: Gbp0.8630-50(E1.9bln)

- AUD/USD: $0.7000-05(A$638mln)

- USD/CAD: C$1.2885($585mln)

- USD/CNY: Cny6.7000($1.5bln), Cny6.75($2.7bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/06/2022 | 0830/0930 |  | UK | BOE Tenreyro Opens BOE Household Finance Workshop | |

| 17/06/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 17/06/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/06/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 17/06/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/06/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/06/2022 | 1430/1530 |  | UK | BOE Pill Panels BOE Household Finance Workshop |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.