-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI EUROPEAN OPEN: Waller Beats Hawkish Drum, Yellen Warns On Inflation Through '22

EXECUTIVE SUMMARY

- FED’S WALLER SUPPORTS 0.75-PERCENTAGE-POINT RATE HIKE IN JULY (WSJ)

- YELLEN SAYS HIGH INFLATION LOCKED IN FOR THE REST OF 2022 (BBG)

- BIDEN DECIDING ON CHINA TARIFFS, SAYS HE WILL SPEAK WITH XI SOON (RTRS)

- ECB’S REHN UNDERSCORES COMMITMENT TO CONTAIN BOND-MARKET PANIC (BBG)

- GERMANY IS TAKING STEPS TO BOLSTER GAS SUPPLIES, HABECK SAYS (BBG)

- MACRON LOSES ABSOLUTE MAJORITY IN PARLIAMENT IN 'DEMOCRATIC SHOCK' (RTRS)

- SPAIN’S CONSERVATIVE OPPOSITION WINS DECISIVE VICTORY IN ANDALUCÍA (FT)

- CHINA MULLS ‘EXTRAORDINARY’ MEASURES FOR MANUFACTURERS (SEC NEWS)

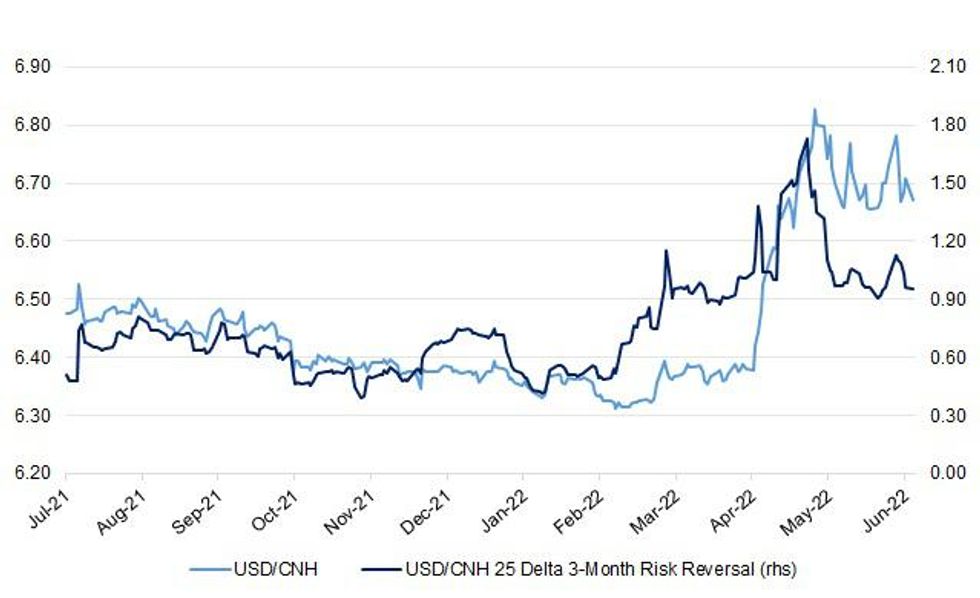

Fig. 1: USD/CNH Vs. USD/CNH 25 Delta 3-Month Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

INFLATION: British consumers are more pessimistic than their peers in major economies about the prospects for inflation and their own personal finances. The findings in a survey of 18 countries by YouGov Plc add to evidence that the UK is being hit harder than most by a surge in consumer prices and shortages after the coronavirus pandemic. The poll, shared exclusively with Bloomberg, showed 71% in the UK expect the cost of living will “increase a lot” over the next 12 months. That’s higher than any other nation and well above the 48% reading in the US. In total, nine-in-10 of those in the UK are bracing for higher costs, also the most in the survey. (BBG)

ECONOMY: Private companies must "come to the party and help" with rising living costs, Boris Johnson's new cost of living tsar has said. David Buttress was appointed earlier this week, and his job is to tackle the problems faced by households amid soaring prices in food, fuel and essentials. The Just Eat co-founder told the BBC he would use his position to encourage "old friends and colleagues... to help the British people". He will have six months in the role, but no budget to increase spending or ministerial powers to cut taxes. (BBC)

ECONOMY: City of London bosses have warned that the UK faces a damaging recession later this year and raised fears that managers lacked experience in dealing with severe economic shocks. The FT’s City Network, a forum of more than 50 senior executives from finance, business and policymaking, said that policymakers faced difficult decisions on how to mitigate the worst effects of an economic downturn. “It’s not pretty,” said Amanda Blanc, chief executive of Aviva, the insurer. “The risk of a recession looks real . . . Even if we miss a technical recession, we see a weak outlook for growth. Stagnation is a clear possibility.” (FT)

ECONOMY: A Treasury minister has warned employees not to expect their wages to rise along with the soaring rate of inflation. Simon Clarke said that big increases in salaries to meet the rising cost of living could end up in a 1970s style "inflationary spiral". This happens when wage rises help push up the cost of living. But unions said that energy prices, not wages, were driving up the cost of living. Mr Clarke said that employers should be "very careful" in setting pay rises that help drive up the cost of living. He warned that inflation could become a "self-fulfilling prophecy". (BBC)

ECONOMY: More than 6.5 million people plan to quit their jobs within the next year as they search for better pay and benefits and an improved work/life balance. Worsening staff shortages have forced companies to pay staff more, as well as to offer improved training and other incentives in the battle for talent. (The Times)

ECONOMY: The dispute at the heart of strikes set to hit Britain's railways this week is resolvable, an industry boss says. Steve Montgomery, chair of the Rail Delivery Group, said more talks were planned for Monday - and that management wanted to work with unions on pay increases and reform. This weekend, the RMT union confirmed three days of strikes would go ahead on Tuesday, Thursday and Saturday. Just 20% of usual services are expected to run - with knock-on disruption. A strike will also take place across the London Underground on Tuesday, with Transport for London advising passengers to walk and cycle instead. (BBC)

ECONOMY: Teachers and doctors are threatening to walk out alongside rail workers if the government fails to meet their demands for a pay rise, as Britain’s most militant union leader raised the prospect of a general strike. With commuters facing a week of chaos on the railways, teachers joined the list of those considering strike ballots, which also includes doctors, nurses, civil service workers, local government staff, barristers, postal workers, BT engineers and traffic wardens. (The Times)

ECONOMY/FISCAL: British manufacturers have called on the Treasury to urgently provide more support amid a poor economic outlook to help “weather the immediate storm”. Make UK, the trade body for manufacturers, and the consultancy BDO found that costs were continuing to rise and output opportunities had been stifled. A survey revealed that two-thirds of companies (67.8%) said rising energy costs were causing catastrophic or major disruption. Meanwhile, 71.9% said increased raw material costs posed a similar threat, and 66.8% had been plagued by rising transport costs. Finding talent has also proved challenging for firms, with vacancies at record levels, at 4.1 vacancies per 100 jobs. (Guardian)

FISCAL: Ministers are backing away from a windfall tax on Britain's electricity generators in favour of a French-inspired consumer price mechanism in a battle to tame inflation. (Telegraph)

BREXIT: Irish Prime Minister Micheal Martin warned Britain on Sunday it would be "very serious" if it enacted a new law to unilaterally change part of a Brexit deal to try to ease trade with Northern Ireland, and urged the government to resume talks. "If this bill is enacted, I think we're in a very serious situation," he told the BBC. "What now needs to happen is really substantive negotiations between the British government and the European Union." (RTRS)

POLITICS: Boris Johnson has been reportedly "airbrushed" from the Conservatives' by-election campaign literature, with leaflets and online advertisements not mentioning the Prime Minister. (Telegraph)

POLITICS: Liberal Democrat leader Sir Ed Davey has appealed to Labour and Green party supporters to vote tactically in Thursday’s crucial West Country byelection – to help deliver a “knockout” blow to Boris Johnson’s premiership. The Lib Dems believe they have a realistic chance of causing one of the biggest byelection shocks of recent times by coming from third place to win in the normally safe Conservative stronghold of Tiverton and Honiton. However, Lib Dem and Tory activists are reporting the race is too close to call, with four days of campaigning to go, despite widespread anger about Partygate and concern in the rural community that the Tories are not doing enough to help farmers or tackle the cost of living crisis. (Observer)

POLITICS: Claims that Boris Johnson missed a conference of Northern MPs for a trip to Ukraine over fears of a bad reception after partygate have been dismissed as "conspiracy b******s". The prime minister unexpectedly pulled out of a conference of northern Conservatives in Doncaster on Friday, just days before a crucial by-election in Wakefield that the Conservatives are widely expected to lose. He instead travelled to Kyiv to meet with Ukrainian president Volodymyr Zelenskyy. Sky News' deputy political editor Sam Coates said organisers of the inaugural Northern Research Group (NRG) conference were "mystified" at the no-show, but had been told there was a "good reason" and that it was of "sufficient significance". However, it did not stop speculation that Mr Johnson may have cancelled in order to miss a rough ride following the partygate scandal and a major revolt by his own MPs. (Sky)

POLITICS: Sir Keir Starmer is planning for his own succession and has told candidates vying to replace him to be ready to fight for the leadership if he is forced to quit over claims that he broke Covid rules. The Labour leader has told allies he wants plans in place to ensure that his work rebuilding the party will not be at risk if he is suddenly forced to resign. He has promised to quit if Durham police find he broke lockdown rules when he had beer and curry with staff after a day campaigning in the local elections on April 30 last year. (The Times)

SCOTLAND: There is no reason why Scotland cannot have a legal independence referendum, the constitution secretary has said. Angus Robertson told the BBC that the SNP would continue to push for a vote based on a section 30 order - as agreed by the Scottish and UK governments. His comments came as The Sunday Times reported that ministers were preparing a consultative referendum next year. It said this could "attempt to bypass the UK government" by phrasing the independence question in another way. The SNP plans to hold a second referendum in October 2023. However, the UK government said now was not the time for another vote. (BBC)

PROPERTY: The number of UK property companies falling into insolvency has soared in the past few months, as investors who were weakened by the pandemic now face being killed off by rising interest rates. In the first three months of the year, 81 property investment companies fell into insolvency, according to tax and advisory firm Mazars. That is the highest quarterly figure in more than a decade and a sharp increase on the 46 companies which went insolvent in the final three months of 2021. (FT)

EUROPE

ECB: The European Central Bank intends to ensure that its monetary policy is transmitted equally across the euro zone’s 19 member-states by preventing undue turbulence on government bond markets, according to Governing Council member Olli Rehn. “We are firmly committed to contain unwarranted fragmentation that would impair monetary-policy transmission,” Rehn told a panel Saturday hosted by the Federal Reserve Bank of Dallas, stressing that he was “speaking as a member of the Governing Council rather than on its behalf.” At the same time, Rehn -- a moderate on the interest-rate- setting panel -- addressed concerns that assisting nations struggling with large debt loads amounts to financing their governments. “We are fully committed to preventing fiscal dominance -- and/or financial dominance, for that matter,” he said. (BBG)

EUROZONE: The eurozone is well placed to ride out recent market volatility and its economy will grow both this year and next, the eurogroup president said, denying that the currency union faces a crisis akin to that which struck a decade ago. Paschal Donohoe, who is Ireland’s finance minister as well as chief of the pan-eurozone group of finance ministers, said the current circumstances were “completely different from the kind of crisis environment we were in” when the bloc was gripped by a spiralling sovereign debt sell-off in the early 2010s. Donohoe said the euro area now had “stronger architecture” and “deeper foundations for our common currency”. (FT)

GERMANY: The German government will step up efforts to bolster gas storage levels after Russia reduced flows in a move Economy Minister Robert Habeck said was intended to unsettle energy markets. The government will make available additional credit lines by state-owned lender KfW to guarantee gas injections at storage sites. It also plans incentives for the industry to reduce consumption and is preparing to fire up more coal plants to keep the use of gas at a minimum. The package of additional measures was announced on Sunday as the government seeks to ensure there will be enough gas available during the winter. (BBG)

FRANCE: French President Emmanuel Macron on Monday lost his parliamentary majority after major election gains by a newly formed left-wing alliance and the far right, in a stunning blow to his plans for major second-term reform. The result from Sunday's second round poll threw French politics into turmoil, raising the prospect of a paralysed legislature or messy coalitions with Macron forced to reach out to new allies. Macron, 44, now also risks being distracted by domestic problems as he seeks to play a prominent role in putting an end to Russia's invasion of Ukraine and as a key statesman in the EU. (RTRS)

FRANCE: Companies should raise wages for their employees by the end of the summer, French Finance Minister Bruno Le Maire said in an interview on France 2 television on Sunday. “For those who can, yes, there’s no doubt,” Le Maire said when asked if company bosses should lift salaries. (BBG)

ITALY: The Italian Treasury has the flexibility and financial firepower needed to overcome market volatility, Italy's head of debt management was quoted as saying on Saturday in an interview with La Repubblica newspaper. "Nobody can be comfortable at a time like this, but it is a manageable situation, considering the whole toolbox at our disposal, including 80.2 billion (euros) in liquidity at the end of May," Davide Iacovoni said. "This means that we can reschedule the auctions, taking into account various timeframes," he added. (RTRS)

ITALY: Russia's Gazprom has said it will only partially meet a request by Italy's Eni for gas supplies on Monday, Italy's state-owned energy exchange (GME) said, signalling a sixth consecutive daily shortfall. Eni is monitoring the issue and will communicate any available update, GME added. (RTRS)

SPAIN: Spain’s conservative People’s party, the Partido Popular, inflicted a resounding defeat on the governing Socialists in a pivotal election in Andalucía on Sunday, securing an absolute majority in the regional government, according to exit polls. The PP’s projected victory surpassed poll forecasts in a vote that was set to secure the party’s main ambition of forming a viable regional administration without having to depend on support from the hard-right Vox party. An exit poll by national public broadcaster RTVE showed the PP winning 58-61 seats, comfortably above the 55 seats needed to secure an absolute majority in the 109-member regional assembly. Prime minister Pedro Sánchez’s Socialists were projected to win 26-30 seats and Vox 13-15. (FT)

IRELAND: Last week was a hectic one for the guardians of the global economy. “To be honest, my office told me the day before,” Gabriel Makhlouf replied when asked how much advance notice he received of an emergency meeting of the European Central Bank (ECB) on Wednesday. As governor of the Central Bank of Ireland, he was joined at the event by counterparts from the 18 other countries that use the euro, where they confirmed crisis measures to help bring down borrowing costs for the currency bloc’s weakest members. This intervention has revived nightmare memories from a decade ago when similar pressures threatened to rip the eurozone apart. One big difference this time around, according to Makhlouf, is that Ireland’s national finances are in much better shape. “The strategy the government is following — it is moving towards a budget surplus next year — has been in the right direction,” he said. “The key thing is to keep this on track.” (The Times)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- S&P affirmed Latvia at A+; Outlook Stable

U.S.

FED: Federal Reserve governor Christopher Waller said that if the economy performs in line with his expectations, he would support raising interest rates by another 0.75 percentage point at the central bank’s meeting next month. “The Fed is ‘all in’ on re-establishing price stability,” Mr. Waller said in remarks prepared for delivery at a conference in Dallas on Saturday. (WSJ)

FED: Cleveland Federal Reserve Bank President Loretta Mester said it will take two years for inflation to come down to the central bank's 2% target. "It isn't going to be immediate that we see 2% inflation. It will take a couple of years but it will be moving down," Mester said in an interview with CBS News on Sunday. (RTRS)

FED: Atlanta Federal Reserve Bank President Raphael Bostic on Friday said he supported the U.S. central bank's 0.75 percentage point interest-rate hike this week, adding that supply chain fixes have been slow in coming. "That means that we're going to have to be more muscular in our policies," Bostic told American Public Media's "Marketplace" radio program, adding that he hopes supply chain logjams will ease up in the summer. "We're attacking inflation and we're going to do all that we can to get it back down to a more normal level, which for us has got to be 2%. We'll do whatever it takes to make that happen," he said. (RTRS)

ECONOMY/INFLATION: The White House and congressional Democrats are in advanced talks on legislation that aims to fight inflation, rein in the deficit and revive parts of President Joe Biden’s stalled economic agenda. The contours of a potential deal remain under negotiation, but the package would likely include capping the price of insulin -- a key medicine for diabetics -- and federal investments in both clean energy and fossil fuels, according to people briefed on the talks. It would also further reduce the budget deficit and boost taxes on the wealthy, corporations or both, they said. An agreement could come together as soon as next week, two people said, though others were more cautious, noting many details remain to be resolved. Climate provisions are a particularly tricky area, and differences could still scotch a deal, one person said. (BBG)

ECONOMY/INFLATION: Treasury Secretary Janet Yellen said that “unacceptably high” prices are likely to stick with consumers through 2022, and that the US economy is likely to slow down. “We’ve had high inflation so far this year, and that locks in higher inflation for the rest of the year,” she said Sunday on ABC’s “This Week.” “I expect the economy to slow,” she said, adding: “But I don’t think a recession at all inevitable.” (BBG)

INFLATION: MNI INTERVIEW: US Shelter CPI Rising to 7% By April -CoreLogic

- Owners' equivalent rent, which makes up a third of U.S. CPI, will likely rise to 7% on the year by next April based on current single-family home rental price trends, Selma Hepp, an economist with real estate data provider CoreLogic, told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL/ENERGY: A federal gas tax holiday to ameliorate the burden of soaring gas prices across the nation is an idea "certainly worth considering," Treasury Secretary Janet Yellen told ABC's "This Week" on Sunday. (Axios)

FISCAL/ENERGY: Energy Secretary Jennifer Granholm warned US drivers against expecting quick relief on gasoline prices amid tight oil supplies worldwide. While the US Energy Information Administration projected in its June short-term outlook that US prices at the pump will average about $4.27 per gallon in the third quarter, the forecast could be “completely upended” by world events, for instance if the European Union were to fully cut off Russian oil, Granholm said on CNN’s “State of the Union. (BBG)

OTHER

GLOBAL TRADE: Ukraine’s harvest may decline to 60 million tons of grain and oilseeds this year, a 43% slump compared with 106 million last year, because of Russia’s invasion and occupation of territories, Deputy Agriculture Minister Markian Dmytrasevych said in a TV interview. Ukraine exported only 4 million tons of grains and oilseeds since Russia started the war in late February and blocked Ukrainian ports, Dmytrasevych said. That’s compared to usual monthly shipments of 5 million tons to 6 million tons via ports, he said. The government sees a chance to accelerate exports by truck if the European Union eases documentation for them. (BBG)

U.S./CHINA: President Joe Biden said on Saturday he was in the process of making up his mind on easing U.S. tariffs on China and planned to speak with Chinese President Xi Jinping soon. (RTRS)

U.S./CHINA: President Joe Biden's administration is reviewing the removal of some tariffs on China and a possible pause on the federal gas tax as the United States struggles to tackle soaring gasoline prices and inflation, two top officials said on Sunday. U.S. Treasury Secretary Janet Yellen said some tariffs on China inherited from the administration of former President Donald Trump served "no strategic purpose" and added that Biden was considering removing them as a way to bring down inflation. (RTRS)

U.S./CHINA/TAIWAN: Biden administration officials have decided to reject a vague new assertion by China that the Taiwan Strait is not “international waters” and are increasingly concerned the stance could result in more frequent challenges at sea for the democratically-governed island, according to people familiar with the matter. (BBG)

U.S./CHINA/TAIWAN: The Global Times tweeted the following on Sunday: “#Comment ’s claim accords with international law. Whether recognizes it or not, China won’t back off. Under the US’s provocation & instigation, it seems tensions in the Taiwan Straits will inevitably escalate. Hopefully it won't lead to war between China and the US.” (MNI)

GEOPOLITICS: China successfully conducted a mid-range anti-ballistic missile test late Sunday, its defense ministry said. The land-based test “achieved its expected objectives” and was defensive in nature and not targeted at any one country, according to the statement. The country conducted a similar test in February 2021 and brings the tally of publicly announced Chinese land-based anti-ballistic missile technical tests to six, state media Global Times reported. (BBG)

BOJ: Prime Minister Fumio Kishida said the Bank of Japan’s policy of monetary easing should remain on track for now, considering the negative impact a change would have on smaller companies. Monetary policy “should be judged comprehensively by taking into account the trends of the economy as a whole,” Kishida said Sunday on a Fuji Television network program. A policy change could increase interest-rate burdens for small and mid-sized businesses, which need to be taken into consideration, he added. While the current easing policy accelerates a weakening yen, which has increased costs for items such as food and energy, Kishida said the government should take measures to stem rising prices. (BBG)

BOJ: Japan’s ruling coalition junior partner expressed support for the Bank of Japan’s decision not to raise interest rates, citing the negative impact that would have on smaller companies, Kyodo News reported. In a speech, Komeito party leader Natsuo Yamaguchi said Saturday that the BOJ’s policy must be accepted even though it is having a variety of impacts on the economy, according to Kyodo. The weak yen can also benefit Japan by attracting more foreign tourists and boosting exports, Kyodo reported Yamaguchi as saying. (BBG)

BOJ: Nearly a majority of the Japanese public thinks the Bank of Japan should cease its ultraloose monetary policy, Nikkei has learned in its latest survey, as 46% wish for the policy to end while 36% favor the BOJ maintaining its approach. (Nikkei)

RBA: Treasurer Jim Chalmers has overridden Reserve Bank of Australia governor Philip Lowe’s wishes and will appoint a panel of independent experts to review the central bank, including a monetary policy expert from overseas. Dr Lowe, who the treasurer has said he has a “mountain of respect for”, has pushed for a joint RBA-Treasury review of the central bank, similar to a model employed by Canada, to ensure the RBA’s independence from politics and to protect its reputation. The RBA has come under scrutiny for its pre-pandemic policies and incorrect forward guidance during COVID-19 that interest rates were not expected to rise until at least 2024. Official interest rates rose in May and June this year, including a super-sized 0.5 of a percentage point rise this month. Dr Chalmers has almost finalised a model for a review into the RBA, including the terms of reference and the small panel of review members, a source close to the process said. (Australian Financial Review)

AUSTRALIA: The Albanese government will cut harder than first flagged when it hands down a budget in October, and then build public support for a second-term agenda of tough revenue and spending measures needed to repair the nation’s finances. In an exclusive interview with AFR Weekend, Treasurer Jim Chalmers said that in the short term, there was a “case for a more substantial look at trimming and cutting back some of this wasteful spending that we’ve inherited”. (Australian Financial Review)

NEW ZEALAND: Prime Minister Jacinda Ardern is sticking with economists' predictions that gross domestic product (GDP) won't fall for the second quarter in a row to trigger a recession. She also ruled out any more support for struggling Kiwis on top of what the Government has already announced. It comes after recent GDP figures for the three months to March fell a seasonally-adjusted 0.2%. The figure was worse than forecasts from most economists of zero growth or a slight increase. It also followed a stronger December quarter, which ended with a 3% rise. (1 News)

SOUTH KOREA: South Korea plans to expand fuel tax cuts in July as part of efforts to ease inflationary pressure from surging energy costs, the finance minister said Sunday. The government will expand tax cuts on fuel consumption to a legal cap of 37 percent from the current 30 percent, according to Finance Minister Choo Kyung-ho. The measure will be effective until the end of this year. (Yonhap)

SOUTH KOREA: South Korea's finance minister reiterated the FX authorities' recent stance on Monday that they would take necessary steps to stabilise the currency market in case of excessive volatility. Finance Minister Choo Kyung-ho declined to comment on a specific USD/KRW exchange rate level when asked by reporters. (RTRS)

HONG KONG: China unveiled on Sunday new top officials in Hong Kong under incoming leader John Lee, who vowed to take the global financial hub to fresh heights, while shrugging off concerns about sanctions the United States has imposed on him. In a sign of continuity for the financial industry, which had watched the appointment closely, Finance Secretary Paul Chan, who is free of U.S. sanctions, is to retain his post in the Chinese-ruled territory. (RTRS)

ASIA: Japanese Prime Minister Fumio Kishida is considering meeting his counterparts from Australia, New Zealand and South Korea in Spain this month while the leaders are there for a NATO summit, Yomiuri reports, without attribution. Leaders are expected to confirm their concerns about China’s “unilateral” acts to change the status quo in the East and South China Seas. Japan has decided not to pursue a bilateral meeting with South Korea given the conditions aren’t right now, Yomiuri reports, citing a unidentified senior Japanese government official. (BBG)

CANADA: Canadian National Railway Co. workers have gone on strike after failing to reach an agreement on Saturday over benefits and wages, according to the International Brotherhood of Electrical Workers lead negotiator. The strike of 750 signals and communications workers began at 11 a.m. on Saturday after negotiations failed, Steve Martin said by phone. The union had given a 72-hour strike notice to the company on June 15. The two sides are still in discussions, he said. An email to CN for comment wasn’t returned. (BBG)

MEXICO: Mexico’s Foreign Affairs Minister Marcelo Ebrard said on Sunday he’s leading in polls among the contenders to succeed President Andres Manuel Lopez Obrador in the country’s 2024 election. Ebrard, one of Lopez Obrador’s top advisers and Mexico’s key diplomatic liaison with the US government, joked at an event in Guadalajara that there was no need for him to officially announce his ambitions since the president had already repeatedly named him as a possible candidate. Ebrard said he would travel around the country ahead of the party’s internal polling while still respecting laws on early campaigning. (BBG)

BRAZIL: Brazil's state-owned oil company Petrobras announced Friday it is raising fuel prices, infuriating President Jair Bolsonaro as he faces an inflationary spike and a re-election bid in October. (AFP)

BRAZIL: Brazilian President Jair Bolsonaro said on Saturday he already has support from congress to start a probe into state-controlled oil giant Petrobras and its pricing policy. Speaking at an event with evangelical supporters, Bolsonaro said there will be enough lawmaker signatures to start the probe and he believes the investigation could make it lose around 30 billion reais ($ 5.8 billion) in market value on Monday. (BBG)

BRAZIL: Brazil’s Energy Ministry is working on a bill to privatize state-owned oil giant Petroleo Brasileiro SA, known as Petrobras, with the same model the government used to privatize Eletrobras earlier this month, O Globo columnist Lauro Jardim said, without detailing how he got the information. (BBG)

RUSSIA: “We will not give away the south to anyone, we will return everything that’s ours,” Zelenskiy said in his daily video address. He also pledged that Ukraine will do all it can to ensure grain supplies leave its ports to help ease a global food crisis caused by Russia’s war, once it receives security guarantees through international mediation. The invasion has triggered what many policymakers warn could be a spiraling food crisis by cutting off shipments of Ukrainian agricultural commodities. United Nations-facilitated negotiations are struggling to make progress, with Ukraine’s Black Sea ports scattered with mines and Russia effectively blocking shipping in the area. The governor in Ukraine’s Odesa said 39 civilian ships under flags of 14 countries are currently unable to leave the region’s ports. (BBG)

RUSSIA: Ukraine's President Volodymyr Zelenskiy predicted Russia will escalate its attacks this week as European Union leaders consider whether to back Kyiv's bid to join the bloc and Moscow presses its campaign to win control of the country's east. "Obviously, this week we should expect from Russia an intensification of its hostile activities," Zelenskiy said in his Sunday nightly video address. "We are preparing. We are ready." (RTRS)

RUSSIA: The Ukrainian negotiator leading the now-stalled talks with Russian officials called on U.S. and NATO allies to quickly supply Kyiv with additional weapons, citing a lack of progress in brokering a peace treaty with Moscow. “Once or two times a week we call each other and they kind of check and ask what’s going on, but both sides clearly realize that right now there is no place for negotiation,” explained David Arakhamia, the majority leader of Ukraine’s parliament and Kyiv’s top negotiator. Arakhamia, who sat down with journalists at the German Marshall Fund in Washington, D.C., to share updates from his discussions with Biden administration officials and lawmakers, including House Speaker Nancy Pelosi, said that Ukraine simply needs more weapons and more sanctions levied against Russia. (CNBC)

RUSSIA: Russian President Vladimir Putin said on Friday at the St Petersburg Economic Forum that Russia anticipates restoring relations with Ukraine after the "special military operation" in that country concludes. During a question-and-answer session with Kazakhstan's President Kassym-Jomart Tokayev, Putin said: "sooner or later, the situation will return to normal". Russia deployed tens of thousands of troops to Ukraine on Feb. 24, in what it calls a "special military operation" to demilitarise and "denazify" Ukraine. Both Ukraine and Western nations say that is a pretext for an unprovoked war of aggression. (RTRS)

RUSSIA: Russia is sending a large number of reserve troops to Sievierodonetsk from other battle zones to try to gain full control of the frontline eastern city, the governor of Ukraine's Luhansk region said on Saturday. "Today, tomorrow, or the day after tomorrow, they will throw in all the reserves they have ... because there are so many of them there already, they're at critical mass," Luhansk regional governor Serhiy Gaidai said on national television. He said Russian forces already controlled most but not all of Sievierodonetsk. (RTRS)

RUSSIA: Delivery of “modern weapons” from the West will enable Ukraine to drive Russian troops out of the Donbas region, Stoltenberg told the German newspaper. At the NATO summit in Madrid this month, the military alliance will declare “that Russia is no longer a partner, but a threat to our security, peace and stability,” he said. “China will also feature in the paper for the first time. Because China’s rise is a challenge to our interests, our values and our security.” (BBG)

RUSSIA: British Prime Minister Boris Johnson on Saturday stressed that the public needs to keep up its support of Ukraine after nearly four months of war. “The worry that we have is that a bit of Ukraine-fatigue is starting to set in around the world,” Johnson told reporters on the back of a trip to Kyiv. “It is very important to show that we are with them for the long haul and we are giving them that strategic resilience that they need.” (CNBC)

RUSSIA: India's purchases of Russian coal have spiked in recent weeks despite global sanctions on Moscow, as traders offer discounts of up to 30%, according to two trade sources and data reviewed by Reuters. (RTRS)

RUSSIA: The Russian economy expanded by 3.5% year-on-year in the first quarter of 2022 after growing 5% in the previous quarter, according to data from federal statistics service Rosstat released on Friday, confirming earlier estimates. The first quarter is expected to have been the last with sound growth before the Russian economy took a hit from sweeping sanctions imposed over Moscow's decision to send forces into Ukraine on Feb. 24. (RTRS)

RUSSIA: Russian imports may drop by 30% this year but will not dwindle to zero, Tass news agency reported Alexei Kudrin, a former finance minister who now heads the state Audit Chamber, as saying on Friday. It did not give more details. Last week a global banking industry lobby group predicted that Western sanctions would cut Russian imports by 28% in 2022. (RTRS)

COLOMBIA: Gustavo Petro, a former guerrilla who wants to transform Colombia’s business-friendly economic model, was elected to the presidency, potentially setting up the most radical change of course in the Andean nation’s recent history. Petro, a former mayor of Bogota, took 50.5% to 47.3% for construction magnate Rodolfo Hernandez in Sunday’s runoff with almost all votes counted, according to Colombia’s electoral authorities. Hernandez conceded in a video message. (BBG)

EQUITIES: The market for share sales hasn’t been this bad in nearly two decades, with few willing to take a chance in a grim investment climate. Just $198 billion worth of initial public offerings and follow-on sales have been priced so far this year, a 70% drop from a year ago. That puts them on track for the lowest first-half haul since 2005, data compiled by Bloomberg show. (BBG)

METALS: Workers at Chilean state-owned miner Codelco, the world's largest copper producer, said on Saturday they will start preparations for a national strike after the firm announced the closure of the troubled Ventanas smelter. (RTRS)

ENERGY: The ‘energy suicide’ that Europe is currently committing, will have long-term effects, with a decline in its economic potential already in place, Chief Executive Officer of Rosneft Igor Sechin said at the St. Petersburg International Economic Forum. "The energy suicide Europe is committing will have long-term effects. We already see a decline in its economic potential, the loss of competitiveness and direct losses for investors. For example, in France the CAC 40 stock index fell by 18%, in Germany the DAX index decreased by 19%, in Italy - by 22%. The total losses of investors of three European countries have already reached around $1.6 trillion," he said. The withdrawal from Russian oil and gas is also disrupting Europe’s competitiveness, Sechin said, adding that this has already turned it into a region with the highest energy cost in the world. (TASS)

ENERGY: Russia cutting gas supplies to Europe has long been one of the EU’s greatest fears. This week it became a reality. Moscow has blamed the decision to restrict volumes on the Nord Stream 1 pipeline to Germany on sanctions imposed after the invasion of Ukraine, specifically those by Canada that left key pumping equipment stranded at a Siemens Energy factory in Montreal. But few in the west are buying Moscow’s line. Russia has access to alternative supply routes to keep export customers supplied, but declined to utilise them. With the cuts coinciding with a visit by the leaders of Germany, Italy and France to Kyiv this week, Germany’s vice-chancellor Robert Habeck said any technical issues were clearly a “pretext” for Russia to squeeze Europe’s economy. (FT)

ENERGY: Throughout the entire Cold War and in the decades since, Russia was a stable supplier of gas to Europe. That changed this week. Russia slashed gas supplies in apparent retaliation over Europe’s support for Kyiv. After its biggest moves yet to use energy as a weapon, gas rationing in the region is now a very real prospect. With European utilities forced to tap reserves intended to cover needs for the winter, government controls of gas distribution could start within months. If Russia completely shuts its main link, the region could run out of supplies by January, according consultant Wood Mackenzie Ltd. (BBG)

ENERGY: Germany’s chemical and pharmaceutical industry called for “using all opportunities” to replace natural gas with other fuels after Russia limited supplies. VCI, the industry national association, singled out switching gas-fired power generation to coal. While the industry is Germany’s single biggest natural-gas consumer with a 15% share nationally, it isn’t facing acute supply problems yet, VCI said in a statement. (BBG)

OIL: The oil pact OPEC+ launched at the outset of the pandemic is finally nearing an end, and where the group goes from here is a politically fraught question. By August, the last of the huge oil-output cuts the group made in 2020 will have been rolled back and delegates from the 23-nation coalition say they are now grappling with what comes next. As President Joe Biden prepares to visit Saudi Arabia -- OPEC’s de facto leader -- US officials are laying the ground for the kingdom and its neighbor, the United Arab Emirates, to move beyond their August production levels and announce further increases to help cool oil prices that are above $110 a barrel, according to people familiar with the matter. (BBG)

OIL: The common objective of the Organization of the Petroleum Exporting Countries and its non-OPEC partners has always been to maintain oil market stability, not to raise prices or bring them down, OPEC Secretary General Mohammad Barkindo said on Saturday. (RTRS)

OIL: Russia expects its oil exports to increase in 2022 despite Western sanctions and a European embargo, the Russian deputy energy minister said on Friday, according to Tass news agency. The European Union has agreed to reduce its purchases of Russian oil by around 90% by the end of 2022 in response to Russia sending troops into Ukraine in what Moscow calls a “special military operation.” (RTRS)

OIL: A 650,000-barrel-cargo of Venezuela's oil chartered by Italy's Eni is about to set sail carrying the first export of crude from the U.S.-sanctioned country to Europe in two years, Refinitiv Eikon data showed on Friday. The U.S. State Department sent letters to Eni and Spain's Repsol in May authorizing them to resume taking Venezuelan crude as a way to settle billions of dollars of unpaid debt and dividends owed by the OPEC-member nation. (RTRS)

OIL: Iraqi Oil Minister Ihsan Abdul Jabbar said on Sunday that the ceiling for exports will reach 3.8 million barrels per day (bpd) in June and 3.85 million bpd in July. He also told reporters that Iraq is 100% committed to its participation in OPEC. The Iraqi oil ministry has said that average crude exports reached 3.3 million bpd in May. (RTRS)

OIL: Libya has little chance of holding elections this year, the parliament-backed prime minister said, raising the prospect of further uncertainty for the OPEC member’s oil industry just as the market is in urgent need of its crude. Fathi Bashagha, who’s engaged in a standoff over the premiership with Abdul Hamid Dbeibah, predicted the political upheaval is likely to continue through 2022, deepening a rift in the North African nation’s fragile institutions. Without a unified government, “there will be no elections and chaos will continue,” Bashagha said in a video interview. The former interior minister, however, downplayed the possibility of civil war re-erupting in the country that’s trying to emerge from a decade of conflict. (BBG)

OIL: Ecuador's state-owned oil company Petroecuador declared force majeure late on Saturday over the impact of protests against the government's social and economic policies in the Andean country, while President Guillermo Lasso tried to clamp down on unrest. (RTRS)

OIL: As gasoline prices soar and the US considers invoking Cold War-era laws to boost production, there’s a massive pool of oil refining capacity on the other side of the Pacific Ocean that’s sitting idle. Around a third of Chinese fuel-processing capacity is currently out of action as Asia’s largest economy struggles to put the coronavirus behind it. If tapped, the extra supply of diesel and gasoline could go a long way to cooling red-hot global fuel markets, but there’s little chance of that happening. That’s because China’s refining sector is set up mainly to serve its mammoth domestic market. The government controls how much fuel can be sent abroad via a quota system that also applies to privately owned companies. And while Beijing has allowed more shipments at times over the years, it doesn’t want to become a major oil-product exporter as that would run counter to its goal of gradually de-carbonizing the economy. (BBG)

POWER: Ukraine is expected to start selling electricity to Slovakia and Hungary this month, a move that could boost revenues for power generators in the country, sources told Reuters. The expansion of power trade with Europe, which is currently curtailed to limited amounts sold to Poland and Moldova, could increase cashflow to Ukrainian utilities hit by a drop in domestic electricity since the Russian invasion, while providing more energy to the 27-country European Union as it grapples with reduced gas supplies from Russia. The EU and Ukraine linked their electricity grids on March 16 in response to Russia’s invasion, enabling Ukraine to receive emergency power from Europe if military attacks caused outages. (RTRS)

CHINA

PBOC: Chinese banks kept their main lending rates unchanged following the central bank’s decision to put policy rate cuts on hold as the economy starts to gradually recover from Covid lockdowns. The one-year loan prime rate was left at 3.7%, according to a statement by the People’s Bank of China Monday. The rate was last lowered in January. Twenty-two of the 25 economists polled by Bloomberg correctly predicted the decision. The five-year rate, a reference for mortgages, was also maintained at 4.45%, following a record 15-basis point cut last month. That was in line with the forecasts of 17 of the 20 economists surveyed by Bloomberg. (BBG)

FISCAL: China E News tweeted the following on Saturday: “China had refunded value-added tax (VAT) credit worth over 1.6 trillion yuan (about 251 billion U.S. dollars) by June 14 to free up much-needed cash for enterprises, official data showed.” (MNI)

ECONOMY: The Chinese economy is expected to grow by around 3% in Q2, and it should strive to achieve the annual target of growing 5.5%, The Paper reported citing Yao Jingyuan, former chief economist and spokesperson of the National Bureau of Statistics. It is not a question of what policy is still lacking, but a matter of implementing the 33 pro-growth measures released by the State Council earlier, the newspaper said citing Yao. Local governments can further reduce the down payment ratio and lower the mortgage rate to boost housing demand, and it is also necessary to offer more support to private and small business to promote employment, Yao was cited as saying. (MNI)

ECONOMY: China is planning to take “extraordinary” measures to address diverging profitability between upstream and downstream manufacturers that risks hampering investment momentum, the Shanghai Securities News reports Monday. The Ministry of Industry and Information Technology has noted the problem caused by Covid-19 outbreak and surging raw material prices, and is doing research to introduce relevant policies, which could involve consumption stimulus, structural supply-side reform and more investment in technological upgrade, the report says. The government needs to stabilize investment confidence of mid and downstream manufacturing firms, and help them improve their rate of capital turnover by solving issues such as overdue receivables, the newspaper quoted Liu Xiangdong, a senior researcher with the government think-tank China Center for International Economic Exchanges. The authorities should also encourage companies to boost investment in technology and equipment upgrade in the second half of the year, Liu says. (BBG)

ECONOMY: China’s retail sales are expected to improve in June and turn positive later amid stimulus including the issuance of consumer coupons and “red envelopes” in the form of e-CNY, the Securities Daily reported. Xiamen city will issue over CNY20 million in digital red envelopes and CNY40 million worth of e-CNY coupons this week, while Wenzhou city is about to issue CNY30 million of e-CNY red envelopes, the newspaper said. Retail sales still fell by 6.7%y/y in May, narrowing from the previous 11.1% decline. (MNI)

ECONOMY: China's car industry is making a full comeback from recent COVID-19 disruptions, with output at some major automakers returning to the normal levels and work resumption at auto parts makers, chip manufacturers and others accelerating, after recent epidemic flare-ups in major Chinese cities were tamed. According to a statement sent to the Global Times by SAIC Motor, one of the largest Chinese automakers based in Shanghai, on Sunday, all of its three major plants in Shanghai have returned to pre-epidemic production levels. SAIC said that the combined daily output of SAIC Motor Passenger Vehicle Co, SAIC Volkswagen Automotive Corp and SAIC General Motors Corp has reached 13,000 units, basically returning to the normal level before the recent COVID-19 outbreak in the city. (Global Times)

CORONAVIRUS: Shanghai’s weekend Covid-testing blitz found the virus seemingly contained, after a spike in cases last week had fanned concern the city would be plunged back into lockdown. The financial hub reported 13 Covid cases for Sunday, with just one found outside government-mandated quarantine for the second day in a row. It was the first weekend of a mass-testing drive designed to stamp out the virus after community cases rose in the days after the city emerged from a punishing two-month lockdown. (BBG)

CORONAVIRUS: Jiangsu, the neighboring province of Shanghai has largely relaxed the quarantine policy for people leaving Shanghai, Yicai.com reported. Nanjing, Suzhou and other cities in Jiangsu have scrapped the requirement of “seven-day collective quarantine + seven-day home quarantine” for people not coming from medium or high risks areas in Shanghai, and only apply “seven-day health monitoring” which suggests not to go to crowded areas or take public transportation during the period, the newspaper said. (MNI)

CORONAVIRUS: China’s Shenzhen city locked down some neighborhoods in the Futian and Luohu districts from 6pm Saturday after two Covid cases were found in mass tests, according to the local health commission website. No new local Covid case was reported in Shenzhen for Sunday. (BBG)

PROPERTY: The city of Zhengzhou will provide home purchase vouchers to residents displaced by urban renewal program, the local housing regulator said in a statement Monday. Residents will need to purchase homes within 12 months after getting the vouchers. (BBG)

PROPERTY: Eastern Chinese city of Wenzhou lowers down-payment ratio for first-time homebuyers to 20% from 30% as part of a policy package to bolster the property market, according to a statement from the municipal government dated late Friday. The city also allows homebuyers to take up higher loan amounts from housing provident fund which carries lower interest rate. First-time buyers of homes in downtown areas are eligible for consumption subsidy equivalent to 0.6% of home purchase price before end-2022. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9792% at 9:39 am local time from the close of 1.6584% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 47 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7120 MON VS 6.6923

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7120 on Monday, compared with 6.6923 set on Friday.

OVERNIGHT DATA

JAPAN MAY TOKYO CONDOMINIUMS FOR SALE -4.3% Y/Y; APR +16.1%

NEW ZEALAND MAY SERVICES PMI 55.2; APR 52.2

The two key sub-indexes of New Orders/Business (62.0) and Activity/Sales (59.6) both experienced a healthy pick-up in activity to lead the way in overall expansion. While Employment (48.5) went back into contraction during May, Supplier Deliveries (45.0) recovered somewhat from earlier lows. With the pick-up in expansion, the proportion of negative and positive comments were exactly even for May, compared with 61.9% of negative comments in April. BNZ Senior Economist Doug Steel said that "while the improvement was far from universal across components, reflecting many ongoing challenges across segments of the service sector, the overall outcome was the first above average result since the outbreak of Delta in August last year.” (BNZ)

UK JUN RIGHTMOVE HOUSE PRICES +9.7% Y/Y; MAY +10.2%

UK JUN RIGHTMOVE HOUSE PRICES +0.3% M/M; MAY +2.1%

MARKETS

SNAPSHOT: Waller Beats Hawkish Drum, Yellen Warns On Inflation Through '22

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 324.06 points at 25638.65

- ASX 200 down 39.399 points at 6435.4

- Shanghai Comp. up 0.903 points at 3317.689

- JGB 10-Yr future up 54 ticks at 147.98, yield up 0.8bp at 0.236%

- Aussie 10-Yr future up 7.5 ticks at 95.870, down 8b.0p at 4.05%

- U.S. 10-Yr future unch. at 116-06, cash Tsys are closed

- WTI crude down $0.27 at $109.29, Gold up $4.04 at $1843.41

- USD/JPY down 6 pips at Y134.96

- FED’S WALLER SUPPORTS 0.75-PERCENTAGE-POINT RATE HIKE IN JULY (WSJ)

- YELLEN SAYS HIGH INFLATION LOCKED IN FOR THE REST OF 2022 (BBG)

- BIDEN DECIDING ON CHINA TARIFFS, SAYS HE WILL SPEAK WITH XI SOON (RTRS)

- ECB’S REHN UNDERSCORES COMMITMENT TO CONTAIN BOND-MARKET PANIC (BBG)

- GERMANY IS TAKING STEPS TO BOLSTER GAS SUPPLIES, HABECK SAYS (BBG)

- MACRON LOSES ABSOLUTE MAJORITY IN PARLIAMENT IN 'DEMOCRATIC SHOCK' (RTRS)

- SPAIN’S CONSERVATIVE OPPOSITION WINS DECISIVE VICTORY IN ANDALUCÍA (FT)

- CHINA MULLS ‘EXTRAORDINARY’ MEASURES FOR MANUFACTURERS (SEC NEWS)

US TSYS: Futures Unwind Early Losses

TYU2 trades 0-04 shy of the peak of its 0-18 Asia range, last dealing +0-00+ at 116-06+, on sub-average volume of ~65K. The modest volume came about on the observance of the Juneteenth holiday in the U.S., with cash Tsys closed until Tuesday’s Asia-Pac session, while Tsy futures will be subjected to curtailed trading hours on Monday.

- Weekend news flow was headlined by Fed Governor Waller’s latest round of hawkish rhetoric (pointing to support for a 75bp rate hike at the July FOMC), confirmation that U.S. President Biden aims to speak with Chinese President Xi “soon,” as well as utterances from U.S. Tsy Sec Yellen re: high inflation being “locked in” for the remainder of ’22 & the likelihood of a roll back of some of the tariffs levied on China by the Trump admin.

- These matters, coupled with an early uptick for e-mini futures, applied pressure to U.S. Tsy futures at the re-open.

- Cross-asset correlations were at the fore thereafter, with broader gyrations in e-minis and Chinese equities in the driving seat. Tsy futures recovered from intraday lows as e-minis briefly moved into negative territory and Chinese equities struggled in early dealing, before working away from best levels as a rebound in Chinese property developer stocks (aided by another round of localised policy support), some upbeat sell-side musings re: Chinese equities and suggestions that China may pursue “extraordinary” measures to combat the divergence in upstream and downstream manufacturers’ profitability came to the fore.

- Note that Monday will see St. Louis Fed President Bullard (’22 voter) comment on inflation and interest rates.

JGBS: Futures Erase Some Of Overnight Gains As Curve Steepens

JGB futures gave back a chunk of their overnight session gains as global core FI markets eased a little in early Tokyo trade, although the contract remained comfortably above neutral levels on the BoJ’s continued ultra-easy policy stance and market mechanism tweaks that look to ensure that the Bank can uphold the boundary located at the upper end of its of permitted 10-Year JGB yield range. The contract then stuck to a very tight range thereafter, looking through swings in wider markets. That leaves the contract +53 as we move towards the Tokyo close.

- Cash JGB trade sees most of the major benchmarks running cheaper on the day (to the tune of 0.5-3.5bp), with 10-Year JGB yields a touch below 0.24% and the curve bear steepening. 7s provide the exception to the trend, with the BoJ’s commitment to its ultra-easy policy settings at the backend of last week (coupled with the market-based policy tweaks we fleshed out earlier) supporting futures, with cash 7s “catching up” early this week.

- Weekend commentary saw both of the political parties that form Japan’s ruling coalition support the BoJ’s monetary policy settings, although the latest Nikkei survey revealed that 46% of the public would prefer a move away from the current ultra-loose monetary settings, while 36% of those surveyed favour the Bank’s current approach.

- Elsewhere, PM Kishida’s cabinet has seen a downtick in support in the latest round of opinion polls.

- Looking ahead, Tuesday will see the release of the outdated minutes from the BoJ’s April meeting, in addition to the latest scheduled round of BoJ Rinban operations (covering 1- to 3-, 5- to 10- & 25+-Year JGBS).

AUSSIE BONDS: Tighter Purse Strings And Global Sentiment at The Fore

The previously outlined cross-asset moves were in the driving seat in early Sydney dealing, which leaves YM +4.5 & XM +7.5 as we move towards the close, with an early blip lower more than reversed. Tightening in EFPs suggest that receive side flows in swaps may have aided the richening.

- Elsewhere, a weekend AFR interview with Australian Treasurer Chalmers may have provided the ACGB space with more of a reason to go bid as e-minis pulled away from best levels of the day and Chinese equities struggled in early dealing. To recap, Chalmers noted that the new government will make deeper cuts than it initially envisaged when its comes to the October Budget. He also suggested that the government will then look to build public support for a “second-term agenda of tough revenue and spending measures needed to repair the nation’s finances.” Nonetheless, bonds are off best levels, aided by a recovery in both e-minis and Chinese equities.

- Elsewhere, AFR sources noted that "Chalmers has overridden Reserve Bank of Australia governor Philip Lowe’s wishes and will appoint a panel of independent experts to review the central bank, including a monetary policy expert from overseas. Dr Lowe, who the treasurer has said he has a “mountain of respect for”, has pushed for a joint RBA-Treasury review of the central bank, similar to a model employed by Canada, to ensure the RBA’s independence from politics and to protect its reputation." This didn’t have anything in the way of tangible impact on the space.

- When it comes to calendar risk, participants were already looking ahead to Tuesday, when we will get the latest address from RBA Governor Lowe, the release of the minutes from the RBA’s June monetary policy meeting and the Bank’s review of its yield targeting mechanism.

EQUITIES: Mostly Lower In Asia; Hong Kong, China Outperform As Commodities Lag

Asia-Pac equity indices are mostly lower at typing following a mixed lead from Wall St. Commodity-linked equities region wide have borne the brunt of the selling pressure amidst broad weakness in major commodity benchmarks (BCOM: - 2.7%), with the MSCI Asia Pacific Index on track to decline for an eighth straight session.

- The CSI300 outperformed peers, trading 0.7% higher and operating a little below session highs at typing. The PBOC’s decision to hold the 1-year and 5-year LPRs steady came largely in line with expectations, with debate re: the possibility of further cuts later in ‘22 doing the rounds in Asia. Richly-valued consumer staples, tech (ChiNext: +2.4%), and healthcare stocks lead gains in the index, easily outpacing losses in energy and materials names amidst aforementioned weakness in commodity benchmarks.

- The Hang Seng Index sits 0.2% better off after reversing earlier losses on strength in real estate, seeing the Hang Seng Properties Index adding 3.5% at writing. China-based tech struggled, with the Hang Seng Tech Index sitting 0.5% weaker, weighed by a steep selloff in NetEase (-7.7%) after the company announced a delay to the Chinese launch of the closely-watched video game Diablo Immortal.

- A Reuters source report last Friday pointing to the PBOC accepting an application from the Ant Group to set up a financial holding company was rebutted by source reports to the contrary from China’s Yicai on Friday as well, effectively negating optimism spurred by the RTRS report (Alibaba’s U.S. ADRs gained as much as ~11% on the open of the NY session before paring most gains). The development thus provided virtually zero tailwind to the space on Monday, against prior expectations from some quarters.

- The ASX200 sits 0.5% worse off at writing, with losses in material stocks contributing the most drag to the index. Major miners such as Rio Tinto (-5.0%), Mineral Resources (-6.0%), and BHP Group (-4.1%) fell on the open amidst a well-documented sell-off in iron ore futures early on Monday, with iron ore on track for an eighth straight day of declines on worry re: China’s COVID-related economic outlook, and signs of weakness in the Chinese property market. The S&P/ASX All Technology Index deals 0.8% higher at writing by comparison, flipping above neutral levels on strength in index large-caps such as Block Inc and Xero Ltd.

- U.S. e-mini equity index futures are flat to 0.5% better off at typing, having pared gains from ~1.0% near the open.

OIL: Lower In Asia; Demand Outlook In Focus As Growth Worries Linger

WTI and Brent are ~$0.30 weaker apiece at typing, operating a little shy of their respective troughs made on Friday.

- To recap, both benchmarks lodged a lower weekly close (first in seven weeks for WTI, four for Brent) last Friday. Attention had coalesced around the possibility of slowing economic growth and weaker fuel demand, in a week that saw the Bank of England, Swiss National Bank, and the Fed raise rates, with the USD (DXY) briefly hitting a 20-year high as well.

- Looking to China, while daily COVID case counts and lockdowns around the country have generally continued easing, domestic fuel demand remains weak, with domestic refiners reportedly operating at around two-thirds capacity in the face of relatively strict export quotas as well (keeping in mind they are generally meant to serve domestic needs). Despite aforementioned improvements, worry re: further domestic COVID-related restrictions are continuing to linger however, with fresh reports pointing to some neighbourhoods in the city of Shenzhen (~12.8mn pop) being placed under lockdown.

- Average gasoline prices in the U.S. have registered their first weekly decline in nine weeks, dipping below the closely-watched $5/gallon mark in the process. U.S. Energy Secretary Granholm has however warned of a persistent “upward pull on demand” in light of the ongoing “summer driving season” and the tight supply outlook globally, driving debate re: the outlook for U.S. fuel demand.

- Libya’s crude production (amidst previously flagged, ongoing political woes) has risen to ~700K bpd, an improvement over the 100K - 150K bpd reported last Tuesday. Looking ahead, the country’s parliament-backed PM over the weekend stated that the country is unlikely to hold elections in ‘22, possibly troubling the crude production outlook for the rest of the year.

GOLD: Holding On To Friday’s Lows; Fedspeak In Focus

Gold sits ~$4/oz weaker at typing to print $1,835/oz, having struggled to make headway above neutral levels in fairly limited Asia-Pac dealing. The precious metal operates a little above Friday’s worst levels, with U.S. Tsy futures and U.S. e-mini equity index futures noted to have unwound their earlier risk-positive moves despite an absence of meaningful macro headline flow.

- To recap Friday’s price action, gold snapped a two-day streak of gains, closing ~$18/oz lower amidst an uptick in U.S. real yields and the USD (DXY), ultimately capping a ~$32 overall lower close for the week.

- July FOMC dated OIS now price in an ~80% chance of a 75bp hike for that meeting, with a cumulative ~196bp of tightening priced in through the remaining four meetings for calendar ‘22. Relatively hawkish comments from the Fed’s Waller (voter) on Saturday supporting a 75bp move in July (flagging data-dependence) helped put a cap on gold, having emphasised tolerance for economic pain to bring down higher prices.

- Keeping within the U.S., debate re: stagflation continues to simmer, with the Fed’s Mester (voter) on Sunday pointing out that recession risks are rising, while Treasury Secretary Yellen said that she expects the economy to slow. A note that both officials were clear in stating that they currently do not predict an impending recession.

- Looking ahead (and keeping in mind the U.S. Juneteenth holiday on Monday), Fed Chair Powell will testify on semi-annual monetary policy before the Senate Banking Committee on Wednesday (1430 BST), with participants likely focusing on firmer clues towards a 50bp or 75bp hike for July.

- From a technical perspective, gold remains vulnerable following the ~$50/oz lower daily close seen on Jun 13. Focus is on a potential move lower towards support at $1,787.0/oz (May 16 low), a break of which would signal a resumption of the downtrend. On the other hand, key resistance holds at around $1,889.1/oz (trendline resistance from Mar 8 high).

FOREX: USD Loses Ground

The USD has tracked lower, with the DXY around -0.30% below NY closing levels from last Friday to 104.40. Firmer equity futures and strong leads from China stocks regionally, appear the main catalysts for this dip.

- EUR/USD was sold early, as French leader Macron lost his outright majority and will have a tougher time pushing through his agenda. Still, we bounced from 1.0460/65 and last track just under 1.0530. This could become a renewed focus point once London/EU markets swing into action.

- USD/JPY tried to breach 135.50 in early trade but once again failed to do so. We slipped underneath 135.00, as equity futures wobbled. However, we have stayed sub this level even as equities turned higher.

- AUD/USD is up close to 0.50% to 0.6965, the best performer within the G10 FX space so far today. The currency market has shrugged off another sharp fall in iron ore prices. Higher China equities, buoyed by stimulus has helped, as has the sharp drop in USD/CNH, back to 6.6700 (-0.60% on the day).

- NZD/USD has broadly tracked AUD higher, but has underperformed by a small margin. We sit +0.30% higher, at 0.6335. The Performance of Services Index rose back to 11th month highs, printing 55.2 versus 52.2 in April.

- Other currencies are stronger against the USD, albeit to varying degrees. NOK is around 0.45% firmer, CAD 0.22%. GBP/USD is only modestly higher.

- A quick reminder that The U.S. will observe the Juneteenth holiday on Monday, which will result in closures/abbreviate trading hours for US markets.

- Note though we will still see St. Louis Fed President Bullard (’22 voter) comment on inflation and interest rates.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/06/2022 | 0100/0900 |  | CN | PBOC LPR announcement | |

| 20/06/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2022 | 0800/0900 |  | UK | BOE Haskel Opening TechUK Policy Leadership Conference | |

| 20/06/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at European Parliament | |

| 20/06/2022 | 1300/1400 |  | UK | BOE Cathy Mann Panels MNI Market News Connect Event | |

| 20/06/2022 | 1500/1700 |  | EU | ECB Lagarde Intro as ESRB Chair at European Parliament | |

| 20/06/2022 | 1645/1245 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2022 | 1700/1900 |  | EU | ECB Panetta Interview with Federico Fubini at Nonfiction Festival | |

| 20/06/2022 | 1930/2130 |  | EU | ECB Lane Speech at Society of Professional Economists |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.