-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Leans Against Market Pricing, Flags 25-50bp Move In July

EXECUTIVE SUMMARY

- FED’S BULLARD EXPECTS ECONOMIC EXPANSION TO CONTINUE THIS YEAR (WSJ)

- LANE: ECB WILL NOT REVISIT DECISION TO LIFT RATES BY 25BP IN JULY (RTRS)

- VILLEROY: NEW ECB TOOL MUST BACKSTOP COMMITMENT TO EURO (RTRS)

- RBA’S LOWE SIGNALS 25-TO-50 BASIS-POINT RATE HIKE IN JULY (BBG)

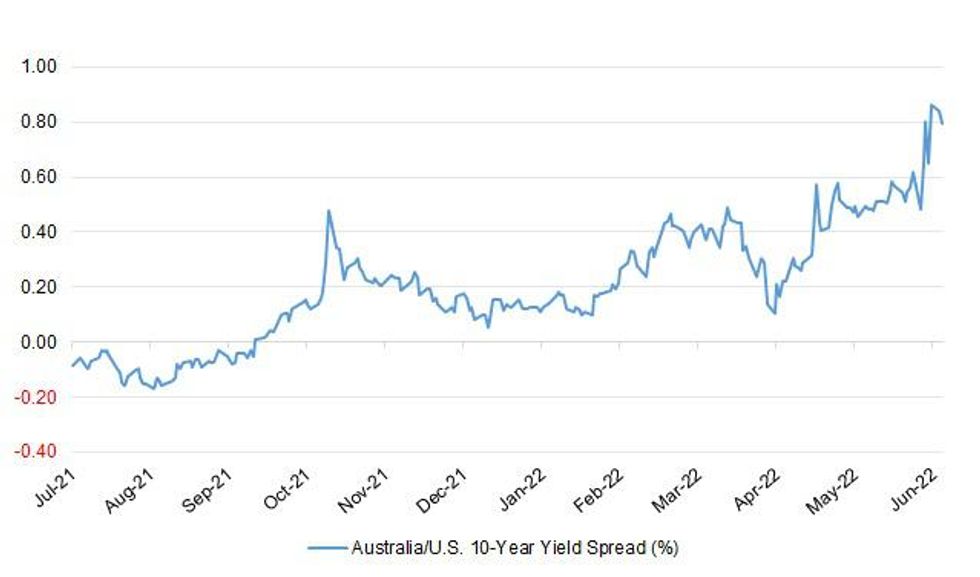

Fig. 1: Australia/U.S. 10-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Annual pay rises agreed at British workplaces steadied last month at a historically high rate but fell further behind soaring inflation, according to another survey on Tuesday that suggested fears of a wage-price spiral may be overdone. XpertHR, a pay and personnel data publisher, said employer pay deals for the three months to May stood at a median 4%, unchanged from the previous month. While jointly the highest reading since 1992, it was a long way behind consumer price inflation of 9% in April. (RTRS)

ECONOMY: An exodus of older workers from the UK labour force is likely to persist, tightening supply side constraints for an economy already facing high inflation and complicating Bank of England monetary policy, associate director at the Institute of Fiscal Studies Jonathan Cribb told MNI. (MNI)

EUROPE

ECB: The European Central Bank will not revisit its decision to raise interest rates by 25 basis points at its July 21 meeting, ECB Chief Economist Philip Lane said on Monday, just days after some of its global peers accelerated the pace of monetary tightening. Negative rates are no longer appropriate for the bloc but the exit will be done in two steps, first by lifting the negative 0.5% deposit rate to minus 0.25% in July and by a possibly larger amount in September, Lane said. (RTRS)

ECB: The European Central Bank's planned instrument against financial fragmentation between euro countries must allow it to back up its commitment to defending the euro, ECB policymaker Francois Villeroy de Galhau said on Monday. At an emergency meeting last week, the ECB asked staff to speed up the design of an "anti-fragmentation" tool after a sharp widening in spreads between southern European bond yields versus safe-haven German debt. (RTRS)

FRANCE: French President Emmanuel Macron will invite all political parties able to form a group in the new parliament for talks on Tuesday and Wednesday after his camp lost its absolute majority, a source close to Macron said on Monday. Macron's centrist coalition is under pressure to secure support from rivals to salvage Macron's reform agenda after weekend elections delivered a hung parliament. If it fails, France could face a long spell of political paralysis. (RTRS)

ITALY/BTPS: Italy sold 3.42 billion euros ($3.60 billion) of its latest 'BTP Italia' inflation-linked bond due in June 2030 to retail investors on Monday, the first day of its offering. Data by Italy's bourse showed it underperformed the May 2020 issue of a similar bond, a 5-year maturity note which raised 4.02 billion euros on the first day it was offered to retail investors. The Rome-based Treasury will offer the new retail linker with an 8-year maturity to small savers until market close on Wednesday. Professional buyers can start making orders on Thursday, from 0800 to 1000 GMT. Italian national consumer price index (NIC index) stood in May at an annual rate of 6.8%, ISTAT data showed last week. (RTRS)

NETHERLANDS: The Netherlands on Monday said it would activate the "early warning" phase of an energy crisis plan and lifted a cap on production by coal-fired power plants as it seeks to reduce reliance on Russian gas in the wake of the war in Ukraine. (RTRS)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said the economy appears on track for more expansion this year, and that the central bank must meet market expectations for rate rises as part of its effort to rein in inflation. “U.S. labor markets remain robust, and output is expected to continue to expand through 2022,” Mr. Bullard said in materials for a presentation in Spain. But he added, “Risks remain substantial and stem from uncertainty around the Russia-Ukraine war and the possibility of a sharp slowdown in China.” (WSJ)

ECONOMY: Former Treasury Secretary Lawrence Summers said the US jobless rate would need to rise above 5% for a sustained period in order to curb inflation that’s running at the hottest pace in four decades. “We need five years of unemployment above 5% to contain inflation -- in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment,” said Summers said in a speech in London Monday. “There are numbers that are remarkably discouraging relative to the Fed Reserve view.” (BBG)

FISCAL: President Biden on Monday told reporters he hoped to make a final decision about whether to support a federal gas tax holiday by the end of the week as high fuel prices continue to pose a problem. “I hope I have a decision … by the end of the week,” Biden said from Rehoboth Beach, Del., where he spent the weekend. Biden did not rule out sending gas rebate cards to Americans, though administration officials have in recent days sounded cool to the idea. Suspending the federal gas tax would require an act of Congress, but a public push by Biden in favor of the policy could help spur action on Capitol Hill. An estimate from the Penn Wharton Budget Model released earlier this year found that suspending the federal gas tax from March to December of this year would reduce average per-capita gasoline spending by between $16 and $47 for that period. (The Hill)

OTHER

EU/CHINA: The European Union and China are planning two high-level meetings in coming weeks, but the talks must tackle real bilateral issues and provide tangible benefits, according to the bloc’s ambassador in Beijing. The two sides will hold the high-level dialogs on the economy and on climate and the environment “in the next few weeks, hopefully,” Nicolas Chapuis, the EU’s ambassador in China, told Bloomberg Television in Beijing on Monday. “We are continuing to press for engagement and solving the issues at hand. Addressing the issues, not sweeping them under the rug.” (BBG)

GEOPOLITICS: Discussions between Turkey, Finland and Sweden about the Nordic countries' NATO membership will continue and an alliance summit in Madrid next week is not a deadline, Turkey said after talks in Brussels on Monday. (RTRS)

JAPAN: Japanese companies look to invest 25% more into equipment, real estate and other physical assets this fiscal year, a Nikkei survey shows, as catching up on delayed plans and a growing interest in decarbonization propel them toward the sharpest jump in nearly half a century. (Nikkei)

JAPAN: Japan’s Finance Minister Shunichi Suzuki repeats recent comments on forex, saying that he will continue to monitor the yen with a high sense of urgency. Will continue to collaborate with the BOJ and take appropriate actions on forex if necessary, Suzuki tells reporters Tuesday. Sudden moves in forex are undesirable. Separately, Suzuki says its important to have responsible fiscal policy management, and that he doesn’t believe the debate on fiscal health has receded. (BBG)

RBA: Australian central bank chief Philip Lowe signaled he will only raise interest rates by 25-to-50 basis points at the July meeting, the same size as debated this month, ahead of the release of significant new economic data. Asked after a speech Tuesday on whether he would follow the Federal Reserve with a 75 basis-point hike next month, Lowe said the board will be “having the same discussion” on the size as it did two weeks ago. Markets responded by scrapping bets on a 75 basis-point hike at the July meeting. “We’re going to look at the data we have each month and the level of interest rates and the inflation rate,” Lowe said. “I expect that next month we’ll be having the same discussion at our board meeting-- 25 or 50 basis points.” (BBG)

RBA: Reserve Bank of Australia, in minutes of its June policy meeting released Tuesday, pointed out that households had built up large financial buffers during the pandemic and the saving rate was very high. “Housing prices had declined in some markets over preceding months, but remained more than 25% higher than prior to the pandemic, thereby supporting household wealth and spending”. On interest rates, says “further steps would need to be taken to normalize monetary conditions in Australia over the months ahead”. (BBG)

RBA: The Reserve Bank’s messy move last year to dump a policy aimed at repressing bond yields to nearly zero led to market dislocation and damaged the central bank’s reputation, a review has found. The central bank on Tuesday released an RBA board review of an experimental policy targeting bond yields, which it introduced to shield the economy during the depths of the COVID-19 pandemic. Some have argued the episode dented the RBA’s credibility, and the central bank on Tuesday said this was an “open question,” arguing other central banks had also underestimated the strength of the economic recovery. In a review of the program, the RBA said the policy had succeeded in driving down funding costs across the economy, pointing to the fall in fixed rates, and a jump in housing and business lending. However, it conceded the exit from the program late last year had tarnished the RBA’s reputation and caused dislocation in the bond market. (The Sydney Morning Herald)

BOK: Bank of Korea Governor Rhee Chang-yong kept the door open for a larger-than-usual interest-rate hike as he emphasized the importance of prioritizing the combat against inflation. Rhee spoke Tuesday just after the central bank released a statement indicating that inflation this year would accelerate beyond a 4.5% annual forecast it gave just last month. Early shipments data for June released separately showed the country’s trade deficit ballooning to a record, fueling concern about the impact of a weaker won that is adding to inflationary pressure at home. “It’s our unchanged forward guidance that monetary policy should be managed with focus on inflation until the rising trend eases,” Rhee told reporters. “There are still three weeks of time left and the board will have to make a decision based on new data.” (BBG)

HONG KONG: Hong Kong's de-facto central bank bought HK$5.22 billion ($664.99 million) from the market in New York trading hours to stop the local currency weakening and breaking its peg to the U.S. dollar. The Hong Kong dollar is pegged to a tight band of between 7.75 and 7.85 versus the U.S. dollar. The aggregate balance - the key gauge of cash in the banking system - will decrease to HK$262.699 billion on June 22, an HKMA spokesperson said on Tuesday. (RTRS)

TURKEY: Turkey's government has submitted a proposal to parliament for a supplementary budget of some 1 trillion lira ($57.74 billion) to cover rising costs of tackling a currency slide, soaring energy prices and rampant inflation, the state-run Anadolu news agency said on Monday. Sources had told Reuters this month that Ankara was mulling pushing a supplemetary budget through parliament before summer recess. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Monday that privatizing state-run oil firm Petrobras via migration to the "Novo Mercado" segment of the Brazilian stock exchange would increase its market cap from 450 billion reais to 750 billion reais ($145 billion). The Novo Mercado is a segment of the B3 exchange with stricter governance rules, including a single class of shares. Speaking at an event hosted by development bank BNDES, Guedes also said Brazil is vital to energy security of the West, which should speed up the country's accession to the Organization for Economic Cooperation and Development (RTRS).

BRAZIL: Brazil Lower House Speaker Arthur Lirasaid that he wants President Jair Bolsonaro’s administration more directly involved in measures to keep Petrobras from raising fuel prices. Lira said higher taxes on Petrobras profits should be proposed via provisional measure, according to remarks made to reporters in Brasilia after meeting with political party leaders. Lira suggested the govt send to Congress a provisional measure changing the law governing state-owned companies so that there is “greater synergy between state-run companies and the government of the moment”. (BBG)

RUSSIA: The European Union’s 27 member states are set to formally grant Ukraine candidate status later this week, following a Monday meeting of EU ambassadors where nobody opposed the decision, according to people familiar with the matter. (BBG)

RUSSIA: The Kremlin said on Monday that Americans captured in Ukraine were "mercenaries" engaged in illegal activities and should take responsibility for their "crimes", RIA news agency reported. Kremlin spokesman Dmitry Peskov was also quoted as saying that the detained men were not covered by the Geneva convention as they were not regular troops. They had shot at at Russian servicemen and put their lives in danger. (RTRS)

RUSSIA: The Russian foreign ministry will summon on Tuesday European Union ambassador to Moscow Markus Ederer over Lithuania's ban of the transit of goods under EU sanctions through Kaliningrad, the governor of Kaliningrad said on Monday. (RTRS)

IRAN: Iran is escalating its uranium enrichment further by preparing to use advanced IR-6 centrifuges at its underground Fordow site that can more easily switch between enrichment levels, a United Nations nuclear watchdog report seen by Reuters on Monday showed. The move is the latest of several steps Iran had long threatened to take but held off carrying out until 30 of the 35 countries on the International Atomic Energy Agency's Board of Governors backed a resolution this month criticizing it for failing to explain uranium traces found at undeclared sites. (RTRS)

METALS: Workers at Chile's state-owned Codelco announced on Monday they will start a nationwide strike early Wednesday in protest of the government and company's decision to close a troubled smelter, the president of the union federation told Reuters. "We are going to start on Wednesday in the first shift," said Amador Pantoja, president of the Federation of Copper Workers (FTC). (RTRS)

METALS: Miners Vale SA and BHP Group said in a joint statement on Monday they are not interested in selling their joint venture Samarco, after reports of the interest of Brazilian steelmaker Companhia Siderurgica Nacional (CSN). "BHP Brasil and Vale say Samarco is not for sale and reaffirm its support for the restructuring plan filed by the employees' unions," the companies said in a joint statement. The statement added the companies are "focused on the mediation hearing in the bankruptcy process" scheduled for Tuesday. (RTRS)

OIL: United States is in talks with Canada and other allies globally to further restrict Moscow's energy revenue by imposing a price cap on Russian oil without causing spillover effects to low-income countries, Treasury Secretary Janet Yellen said on Monday. "We are talking about price caps or a price exception that would enhance and strengthen recent and proposed energy restrictions by Europe, the United States, the UK and others, that would push down the price of Russian oil and depress Putin's revenues, while allowing more oil supply to reach the global market," Yellen told reporters in Toronto. "We think a price exception is also an important way to prevent spillover effects to low income in developing countries that are struggling with high costs food and energy," Yellen said, speaking along side Canadian Finance Minister Chrystia Freeland. (RTRS)

OIL: Europe’s resolve to stop buying Russian crude may be starting to ebb. The continent’s oil refineries took 1.84 million barrels a day of crude from Russia last week, according to tanker tracking data compiled by Bloomberg. That was the the third consecutive weekly increase and took flows from Russia to Europe, including Turkey, to their highest in almost two months. (BBG)

OIL: Ecuador’s state oil company Petroecuador could be forced to suspend exports if protests continue to disrupt production, Chief Executive Officer Italo Cedenosaid in a streamed press conference. “If at some moment our tanks at Lago Agrio, Balao, Amazonas, Punta Gorda no longer have more oil than for just our domestic consumption, we will obviously have to postpone exports,” Cedeno said. (BBG)

CHINA

PBOC: China’s financial regulators are likely to guide down banks’ capital costs to drive down their Loan Prime Rate quotations in H2, thereby reducing the loan interest rates for enterprises and residents, the 21st Century Business Herald reported citing analysts. LPR, based on the rate of PBOC’s Medium-term Lending Facility and quotations submitted by 18 banks, remains at 3.70% for the one-year maturity and 4.45% for five years this month. The PBOC is less likely to cut the MLF rate due to the expected significant monetary tightening by the Fed, analysts said. There is room for a 5-10 bps in one-year LPR, and a 10-15 bps cut in the five-year one, by means of deposit interest rate reform and reserve requirement ratio cuts to lower banks’ costs, the newspaper said citing Ming Ming, chief economist at CITIC Securities. (MNI)

PROPERTY/CREDIT: A record selloff in Fosun International Ltd.’s dollar bonds shows that financial stress among China’s property developers is shifting to the country’s other weaker borrowers. In a sign of contagion, an extended slump in the Shanghai-based conglomerate’s dollar bonds is spreading to several Chinese industrial firms’ offshore debt Tuesday. Fosun’s dollar notes lost 21% last week, the most in a Bloomberg index of Chinese high-yield dollar bond, after Moody’s Investors Service put the firm on review for a downgrade. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9005% at 9:41 am local time from the close of 1.7042% on Monday.

- The CFETS-NEX money-market sentiment index closed at 51 on Monday vs 45 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6851 TUES VS 6.7120

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6851 on Tuesday, compared with 6.7120 set on Monday.

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 81.7; PREV 80.4

Consumer confidence increased 1.6% last week after a 7.6% decline the week before. News about the strength of the labour market may have boosted sentiment, but it remains deeply pessimistic. Household inflation expectations jumped 0.3ppt to 5.9% as average petrol prices increased over the week. The ‘current’ and ‘future economic conditions’ subindices dropped for a third consecutive week, as central banks across the world, including the RBA, became increasingly hawkish about bringing inflation under control, causing uncertainty about economic growth. (ANZ)

NEW ZEALAND Q2 WESTPAC CONSUMER CONFIDENCE 78.7; Q1 92.1

Consumer confidence has fallen sharply in recent months as household budgets have been squeezed by higher mortgage rates and increases in living costs. Weak consumer confidence is weighing on household spending appetites, reinforcing our expectations for a slowdown in economic growth. The drop in confidence has been widespread across all age groups, income brackets and regions. (Westpac)

SOUTH KOREA JUN TRADE BALANCE 20 DAYS -$7,642.0MN; MAY -$4,827.0MN

SOUTH KOREA JUN EXPORTS 20 DAYS -3.4% Y/Y; MAY +24.1%

SOUTH KOREA JUN IMPORTS 20 DAYS +21.1% Y/Y; MAY +37.8%

MARKETS

SNAPSHOT: RBA Leans Against Market Pricing, Flags 25-50bp Move In July

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 633.73 points at 26404.95

- ASX 200 up 93.632 points at 6527

- Shanghai Comp. up 5.812 points at 3321.242

- JGB 10-Yr future down 8 ticks at 147.91, yield down 0.6bp at 0.234%

- Aussie 10-Yr future down 1.5 ticks at 95.840, yield up 1.1bp at 4.080%

- U.S. 10-Yr future -0-10 at 115-28, yield up 5.3bp at 3.279%

- WTI crude up $1.96 at $111.52, Gold down $0.32 at $1838.43

- USD/JPY up 3 pips at Y135.10

- FED’S BULLARD EXPECTS ECONOMIC EXPANSION TO CONTINUE THIS YEAR (WSJ)

- LANE: ECB WILL NOT REVISIT DECISION TO LIFT RATES BY 25BP IN JULY (RTRS)

- VILLEROY: NEW ECB TOOL MUST BACKSTOP COMMITMENT TO EURO (RTRS)

- RBA’S LOWE SIGNALS 25-TO-50 BASIS-POINT RATE HIKE IN JULY (BBG)

US TSYS: Cheaper As Cash Trade Gets Underway For The Week

Asia-Pac hours saw the open of cash Tsy trade for the week, with cash Tsys cheapening on follow through from hawkish Fedspeak observed since Friday’s close (courtesy of Waller & Bullard), Tsy Secretary Yellen’s weekend inflation warning and general weakness in EGBs and Gilts on Monday. That leaves cash Tsys 5-7bp cheaper across the curve, with the long end leading the way lower, resulting in some bear steepening.

- Tsys head into European hours a little off cheapest levels of the session, with TYU2 last dealing 0-05+ off its session base, -0-10 at 115-28.

- Some ACGB-linked moves were witnessed during Asia-Pac dealing on the back of the latest rounds of RBA rhetoric, although the cheapening bias remained intact, aided further by an uptick in e-mini futures and crude oil.

- 3x block buys of TYQ2 115.00 puts (2.5K lots apiece) headlined on the flow side during the overnight session.

- Looking ahead, Tuesday will see the release of existing home sales data and the latest Chicago Fed National Activity Index print. Elsewhere, we will get Fedspeak from Mester & Barkin.

JGBS: Curve Twist Steepens

JGB futures chipped away at their overnight losses during the Tokyo session and now sit 6 ticks below yesterday’s settlement level, over 30 ticks off their overnight low, although trading conditions remain impaired.

- There wasn’t much in the way of local news to digest after the re-open (PM Kishida & Finance Minister Suzuki offered little in the way of meaningful rhetoric), with cross-market impetus helping futures to pare some of its overnight losses during the morning

- Cash JGBs out to 20s are generally within 0.5bp of yesterday’s closing levels, trading on the richer side, although the broader cheapening observed in the global fixed income space on Monday has seemingly facilitated ~1.5bp of cheapening for 30s and 40s, with some twist steepening in play on the curve as a result.

- The exception to rule for paper out to 20s is 5s, with outperformance there (equating to 1.5bp of richening) aided by 5-Year JGB supply, which was absorbed smoothly enough. The low price of the auction matched broader estimates (as proxied by the BBG dealer poll), while the price tail saw a very modest widening, although remained tight in the grander scheme of things. Things were a little softer on the cover ratio side, with the bid/cover moving to the lowest level observed at a 5-Year JGB auction since the COVID-induced vol. of early ’20 (likely on the well-documented market functioning issues).

- Wednesday’s local docket will be headline by the latest round of BoJ Rinban operations.

JGBS AUCTION: Japanese MOF Sells Y2.0207tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0207tn 5-Year JGBs:

- Average Yield: 0.083% (prev. 0.017%)

- Average Price: 100.08 (prev. 99.94)

- High Yield: 0.089% (prev. 0.019%)

- Low Price: 100.05 (prev. 99.93)

- % Allotted At High Yield: 70.9981% (prev. 96.3432%)

- Bid/Cover: 3.165x (prev. 3.402x)

AUSSIE BONDS: Twist Steepening Post-Lowe Pushback

Governor Lowe’s address was at the fore, as he expressed doubt that the Bank would deliver the degree of tightening priced into the STIR space through year end, while explicitly flagging his preference for a discussion of a 25 or 50bp hike in July (the same discussion took place at the Bank’s June meeting). This saw STIR markets unwind a modest some of the tightening that was priced into the space, with a 47bp of tightening now priced into the IB strip when it comes to the July meeting (vs. ~57bp of tightening that was priced earlier in the day). Further out, there is a cumulative ~280bp of tightening priced into IBs through the Bank’s December meeting (vs. ~300bp earlier in the session). Note that Lowe conceded that markets have been a better predictor of the cash rate than the Bank in recent times, while he also tipped his hat to the Bank’s new expectation of 7% inflation in Q422 (a level he had alluded to in a previous address). The bid in the short end allowed ACGBs to move away from worst levels of the day, with the front end leading the bid. That leaves YM +2.5 & XM -2.0, with the cash curve pivoting around the 5- to 6-Year zone. !0s represent the weakest point on the curve.

- Elsewhere, the Bank noted that it would probably prefer to deploy broader bond purchases as opposed to yield targeting if it had the need to do so in the future, with its review of the latter mechanism conceding that the market’s challenge and eventual breaking of the tool resulted in some reputational damage for the RBA.

- Note that ACGBs initially softened in early Sydney dealing, extending on the overnight weakness as markets set up for the deluge of RBA communique.

- Tomorrow’s local docket will be headlined by the latest Westpac leading index print and A$1.0bn of ACGB Apr-25 supply.

EQUITIES: Higher In Asia; Eight-Day Losing Streak Eyed

Virtually all Asia-Pac equity indices are higher at typing, bucking a mixed lead from Wall St. Energy-linked equities caught a bid amongst strength in major energy benchmarks, leading broader gains across the region with the MSCI Asia Pacific Index on track to snap an eight-session streak of losses.

- The Nikkei 225 deals 2.2% firmer at typing, extending a move off of three-month lows made on Monday. Japanese equities outperformed regional peers amidst the latest bout of JPY weakness, with USD/JPY holding a little below multi-decade highs through Asia-Pac dealing.

- The Hang Seng Index trades 1.4% higher at writing, on track for a third straight day of gains on strength in the Financials and Property sub-indices. The Hang Seng Properties Index sits 1.9% better off, with the sector benefitting from lingering tailwinds arising from a slew of Chinese cities signalling supportive policy changes in recent days. The Hang Seng Tech Index outperformed the broader Hang Seng, dealing 2.0% higher at typing.

- The CSI300 lagged major regional peers by comparison, dealing 0.3% firmer at typing, with worry from some quarters re: the country’s ongoing COVID outbreak evident. To elaborate, while daily case counts nationwide have remained low, an outbreak in the South of the country in Macau and nearby tech hub Shenzhen (albeit a more limited outbreak) have prompted fears of stringent pandemic control measures to be taken in those regions, with only relatively shallow gains observed across much of the CSI300’s sub-indices.

- The ASX200 trades 1.5% higher at writing, with a broad bid in mining stocks, tech names, and financials contributing the most to gains in the index. Broader market sentiment received a lift as RBA Governer Lowe signalled intent to debate rate hikes of 25 or 50bp for July, ruling out the potential for a 75bp hike (flagging data-dependence). Mining equities caught a reprieve on Tuesday as various benchmark metals reversed earlier losses, with benchmarks for copper and aluminium on track to break a multi-session streak of losses.

- U.S. e-mini equity index futures sit 1.4% to 1.7% better off, broadly on track to snap a two-day streak of losses at typing.

OIL: Higher In Asia As Stagflation Worry Eases; Supply Picture Shows Potential Improvement

WTI is ~+$2.50 and Brent is ~+$1.40 at writing, operating a little below their respective best levels made on Monday. Both benchmarks have extended a move off of recent lows following the sharp $7 - $8 tumble seen last Friday, with participants focused on worry re: stagflationary risks and the corresponding decline in energy demand.

- To recap, comments from U.S. Pres Biden that a recession is not “inevitable” helped major crude benchmarks rebound from worst levels on Monday, with Brent rising from a one-month low in the process.

- Keeping within the U.S., Biden is expected to announce a decision this week to potentially suspend a federal gasoline tax, following Yellen’s remarks on Sunday that a gasoline tax holiday was an idea “worth considering”. This however comes as U.S. gasoline inventories have declined for over two straight months (EIA data), with stockpiles >10% below their five-year seasonal averages.

- A BBG report has pointed to Russian exports of seaborne crude to Europe hitting two-month highs last week, suggesting that some European resistance to buying Russian crude has ebbed. Crude exports to Asia are continuing to rise (mainly to China and India), with overall Russian crude production reportedly down by 300K bpd against pre-invasion levels (as stated by Russian DPM Novak late last week).

- Elsewhere, Iran has reportedly dropped a major sticking point in stalled indirect nuclear negotiations with the U.S., with source reports from the London-based Middle East Eye stating that Tehran has dropped its requirement that the Iranian Revolutionary Guard Corps (IRGC) should be removed from the U.S.’s list of terror groups - a previously highlighted “red line” for the Iranians. The U.S. was said to have not responded to the offer yet.

GOLD: Holding Steady In Asia; Hugging $1,840/oz Ahead Of Week’s Fedspeak

Gold sits $3/oz better off to print $1,842/oz, trading comfortably within Monday’s range at typing in fairly limited Asia-Pac dealing.

- The precious metal has struggled to make headway above $1,850/oz in recent sessions, with the USD (DXY) remaining range bound a little below recently-made, multi-decade highs, and U.S. real yields continuing to operate around elevated levels as well.

- Earlier remarks from St. Louis Fed Pres Bullard highlighted that the Fed must meet market expectations for rate hikes as part of the process to rein in inflation, noting that July FOMC dated OIS currently price in a ~100% chance of a 75bp hike in that meeting (up from ~80% on Friday), with 205bp now priced in for the remaining four meetings of calendar ‘22.

- Debate re: a Fed-induced recession has likely continued to provide support for bullion despite the prospect of higher rates, with ex-Treasury Secretary Larry Summers on Monday repeating calls for Volcker-style monetary tightening to combat “secular stagflation”.

- Looking ahead, apart from previously-highlighted Fedspeak from the Fed’s Barkin (‘24 voter) and Mester (‘22 voter) later on Tuesday, Fed Chair Powell is due to testify before the Senate Banking Committee on Wednesday, where he is expected to touch on inflation.

- From a technical perspective, gold remains vulnerable in the wake of the steep sell-off seen on Jun 13. Previously flagged support and resistance levels remain intact, at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

FOREX: Risk Sentiment Stays Positive, RBA Speak Moderates AUD Gains

Comments from RBA Gov Lowe tempered AUD gains driven by better risk appetite, as the official said that the Board didn't contemplate a 75bp hike to the cash rate target at its recent meeting, adding that a 25-50bp move seems to be the most likely outcome at the July meeting. Market participants responded by withdrawing hawkish RBA bets, with a 50bp hike in July no longer priced in (down to ~80% implied chance of such a move at typing).

- AUD/USD refreshed session highs later on, as broader risk sentiment remained positive, but the pair struggled to attack its best levels from yesterday. The NOK took over as best performer in G10 FX space.

- AUD/NZD crept higher as a quarterly Westpac Survey showed that consumer confidence in New Zealand tumbled to a record low. The rate tested yesterday's high, even as AU/NZ 2-Year swap spread slipped.

- Safe haven currencies underperformed, with the U.S. dollar leading declines for the second consecutive day. U.S. financial markets are set to re-open after a long weekend.

- Focus turns to U.S. existing home sales, Canadian retail sales and comments from Fed's Mester & Barkin, ECB's Rehn & Kazimir, BoE's Pill & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Jun21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0470-80(E824mln), $1.0575-85(E990mln)

- USD/JPY: Y134.00($1.4bln), Y134.35-50($785mln)

- GBP/USD: $1.2100(Gbp505mln)

- AUD/USD: $0.7000-15(A$1.9bln)

- NZD/USD: $0.6300(N$998mln)

- USD/CNY: Cny6.80($990mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2022 | 0715/0815 |  | UK | BOE Pill at Institute of Accountants Economic Summit | |

| 21/06/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 21/06/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/06/2022 | 1215/1315 |  | UK | BOE Tenreyro Seminar at Goethe University | |

| 21/06/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/06/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/06/2022 | 1500/1100 |  | US | Richmond Fed's Tom Barkin | |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/06/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 21/06/2022 | 1930/1530 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.